Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Trinseo S.A. | d796166d8k.htm |

™

Trademark

Deutsche Bank

Leveraged Finance

Conference

September 30, 2014

Exhibit 99.1 |

2

Introductions & Disclosure Rules

Disclosure Rules

The forward looking statements contained in this presentation involve risks and

uncertainties that may affect the Company's operations, markets, products,

services, prices and other factors. These risks and uncertainties include,

but are not limited to, economic, competitive, legal, governmental and technological

factors. Accordingly, there is no assurance that the Company's expectations

expressed in such forward looking statements will be realized. The Company

assumes no obligation to provide revisions to any forward looking statements

in this presentation should circumstances change. This presentation contains

financial measures that are not in accordance with generally accepted

accounting principles in the US (“GAAP”) including Adjusted EBITDA.

We believe these measures provide relevant and meaningful information to

investors and lenders about the ongoing operating results of the Company.

Such measures when referenced herein should not be viewed as an alternative to GAAP

measures of performance. We have provided a reconciliation of Adjusted EBITDA

in the Appendix section of this presentation.

Introductions

Chris Pappas, President & CEO

David Stasse, Vice President, Treasury & Investor Relations

|

3

Business Overview

Engineered Polymers

Revenue: $1,046MM

Adj EBITDA: $7MM

Styrenics

Revenue: $2,290MM

Adj EBITDA: $188MM

Emulsion Polymers

Revenue: $1,918MM

Adj EBITDA: $239MM

Plastics

Revenue: $3,336MM

Adj EBITDA: $195MM

#3 Polystyrene Globally

Leading Player

Synthetic Rubber

Revenue: $631MM

Adj EBITDA: $135MM

Top 3 SSBR Globally

Q2’14 LTM Revenue: $5,254MM

Q2’14

LTM

Adj

EBITDA:

$333MM

Latex

Revenue: $1,287MM

Adj EBITDA: $104MM

#1 Globally in SB Latex

End

markets

Market

position

Performance tires

Standard tires

Polymer modification

Technical rubber goods

Coated paper and packaging

board

Carpet and artificial turf

backings

Tape saturation

Cement modification

Building products

Trinseo -

$5+ billion in annual revenue, world leader in the production of latex, rubber and

plastics Americas

Styrenics

-

$2

billion

leader

in

styrene

/

polystyrene

Appliances

Consumer goods

Construction/sheet

Packaging

Automotive

Consumer electronics

Automotive

Consumer electronics

Construction/sheet

Electrical and lighting

Medical devices

Note: Division and Segment EBITDA excludes Corporate unallocated Q2 ‘14 LTM Adjusted EBITDA of

$(101)MM. Totals may not sum due to rounding. |

4

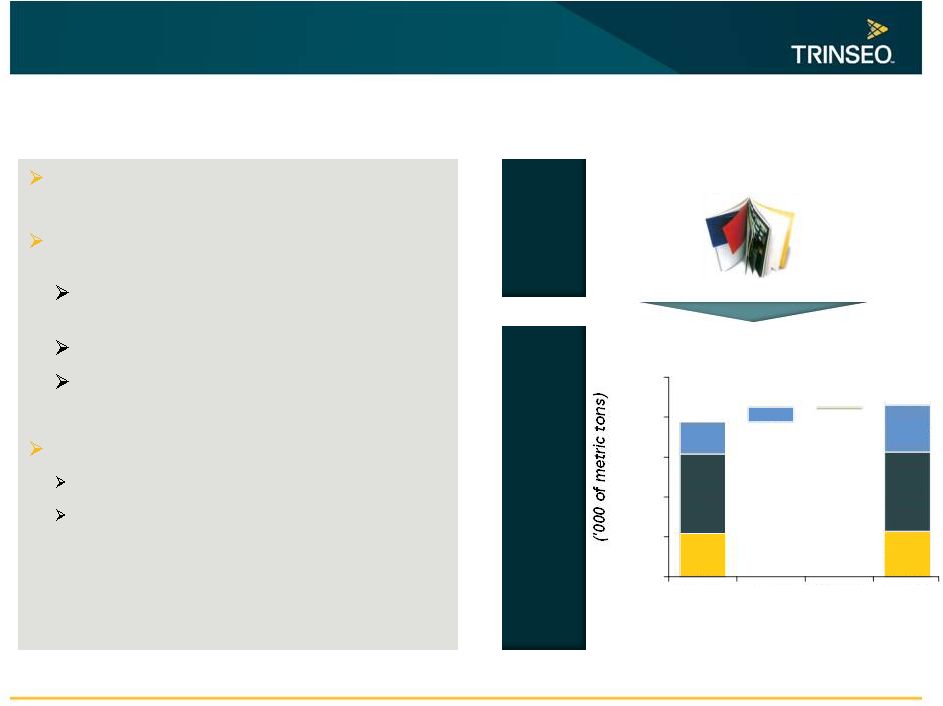

Latex

Key Trends

End Market

Demand

Source: IHS

Improving living

standards

in emerging economies

Chinese SB Latex

Demand

Number 1 globally in SB Latex

Three areas of focus: paper & board, carpet,

and performance latex

Growth in carpet, paper board, Asia paper,

performance latex

Challenged paper markets in NA and Europe

Additional capacity in China in Q2 ‘15

Improving industry structure

Significant consolidation

20% capacity reduction in NA / Europe

1,554

1,722

0

400

800

1,200

1,600

2,000

2010A

China

W.E. and

N.A.

2016E

North

America

Western

Europe

Western

Europe

China

China

China

North

America |

5

Synthetic Rubber

Fuel efficiency and safety

Key Trends

End Market

Demand

Source: Michelin, Trinseo estimates

$600

-

$700mm business focused on

performance tire market

Technology leader in SSBR

Provides superior tread properties such as wet

grip, low rolling resistance

Doubled capacity since 2012

–

H1 ’14 volume run rate up 75% from 2012

Investing in growth

Purchased 25kMT of capacity rights from JSR

Converting Ni-PBR train to Nd-PBR to address

demand for high performance tire walls

Global Premium

Passenger Car Tires

SSBR

target

end-

market

–

To be sold over next six quarters

–

Expected to be completed by Q4’15

–

Trialing Generation 4 enhanced SSBR |

6

Engineered Polymers

Key Trends

End Market

Demand

Source: ICIS

Growing demand for high-tech plastics focused

on automotive and other growth markets

Polycarbonate

Automotive

Lightweighting

Plastic Used

in

Passenger Vehicles

5.5

9.1

0

2

4

6

8

10

12

2012E

2017E

Sustainable, long-standing relationships with

automotive industry leaders

Highly engineered compounded blends

Restructuring and rising operating rates

should lead to significant EBITDA lift in 2015

–

Serves consumer electronics, medical, and

electrical / lighting markets

H1 ’14 global demand growth up 5%

–

–

Focused on weight reduction, improving

interior aesthetic trends

Manufacturing facilities across 4

continents |

7

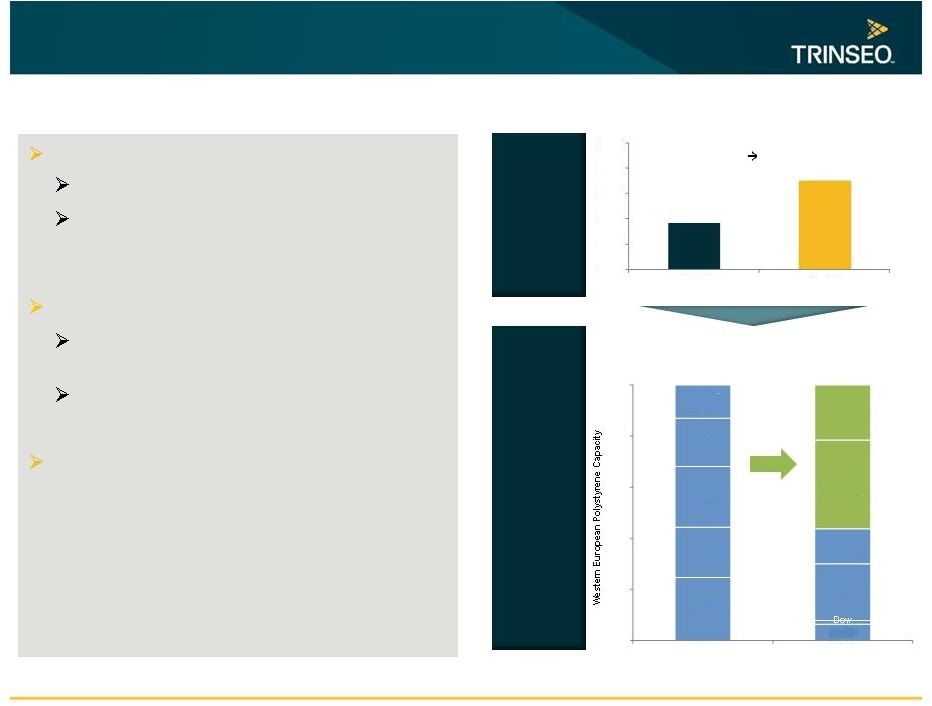

Styrenics

Evolving industry structure

New players focused on SM and PS margins

Capacity rationalization and cyclical recovery

will increase operating rates

Styrenic polymers business with global scale

Focused on appliances, packaging, and

constructions

Number 3 polystyrene globally

Americas Styrenics provided $35mm in LTM

dividends

Tightening

Polystyrene

Operating

Rates

~20%

Reduction in

Production

Capacity

Increasing Focused

Suppliers

1%

2%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

Supply

Demand

2013E -2018E CAGR

2013E -

2018E CAGR

2013E -

2018E Operating Rate:

70% 73%

Styrolution

Trinseo

0%

20%

60%

80%

100%

2006

2014

Versalis

Total

BASF

BASF

Dow

NOVA

Total

Polimeri

Europa

40% |

8

Financial Overview

Source: see appendix for reconciliation to nearest GAAP metric

Historical Quarterly Adjusted EBITDA

Strong earnings momentum driven by growth in Synthetic Rubber,

stable Latex business, and improved supply/demand dynamics in Styrenics

Quarterly LTM Adjusted EBITDA (Q4 ‘12 to Q2 ‘14)

Styrenics

Synthetic

Rubber

Latex

Corporate

Engineered

Polymers

$255

$214

$211

$225

$278

$297

$333 |

9

Balance Sheet

Deleveraging Over Time with Significant Liquidity

Net Debt

$1,209MM

$1,140MM

$1,023MM

Strong balance sheet with no long-term

debt maturities until 2019

IPO proceeds used for de-leveraging

–

Target net debt of 2-3X Adj. EBITDA

–

Growth opportunities to be pursued selectively

Ability to refinance up to $1.193 billion of

Senior Notes

–

Potential to significantly lower interest costs

(currently 8.75% coupon)

$675 million liquidity

(a)

–

Cash ($182MM), Revolver ($293MM), AR Facility

($200MM)

(a)

As of Q2 2014 proforma for $132.5mm debt paydown on July 14

4.7x

4.1x

3.1x

0.0x

0.5x

1.0x

1.5x

2.0x

2.5x

3.0x

3.5x

4.0x

4.5x

5.0x

FY2012

FY2013

2QLTM

(a)

Note: see appendix for reconciliation to nearest GAAP metric

|

Summary

Structural

•

Polycarbonate restructuring

•

Deleveraging and refinancing

•

Consolidation and capacity rationalization

Profitable Growth

•

Additional SSBR capacity

•

New SSBR and neodymium-PBR technology

•

China latex expansion

•

Automotive and CEM compounding

Cyclical

•

Rising operating rates in styrene, polystyrene, polycarbonate

•

Recovering tire markets

10 |

™

Trademark

Appendix |

12

US GAAP to Non-GAAP Reconciliation

(in $millions, unless noted)

Q4'12 LTM

Q1'13 LTM

Q2'13 LTM

Q3'13 LTM

Q4'13 LTM

Q1'14 LTM

Q2'14 LTM

Net Income (Loss)

30.3

(9.4)

(39.5)

(33.3)

(22.2)

4.5

(12.0)

Interest expense, net

110.0

116.6

123.7

128.0

132.0

132.5

131.4

Provision for (benefit from) income taxes

17.5

(7.7)

0.6

(3.7)

21.9

34.7

38.0

Depreciation and amortization

85.6

88.5

90.6

93.8

95.3

95.1

98.3

EBITDA

243.4

187.9

175.3

184.7

226.9

266.8

255.7

Loss on extinguishment of long-term debt

-

20.7

20.7

20.7

20.7

-

-

Other non-recurring items

(0.7)

0.5

0.5

1.1

0.7

(0.4)

32.1

Restructuring and other charges

7.4

(0.4)

6.0

9.0

10.8

11.3

7.0

Net (gains) / losses on dispositions of businesses and assets

-

-

3.2

4.2

4.2

4.2

1.0

Fees paid pursuent to advisory agreement

4.6

4.7

4.7

4.8

4.7

4.7

27.8

Asset impairment charges or write-offs

-

-

0.7

0.7

9.9

9.9

9.2

Adjusted EBITDA

254.8

213.5

211.2

225.3

278.1

296.8

332.8

Note: totals may not sum due to rounding |