Attached files

| file | filename |

|---|---|

| 8-K - TIMBER & WOOD PRODUCTS FORUM PRESENTATION - CatchMark Timber Trust, Inc. | a8-ktimberandfoodforum.htm |

w w w . c a t c h m a r k . c o m CatchMark Timber Trust NYSE: CTT S e p t e m b e r 2 0 1 4

F O R WA R D - L O O K I N G S TAT E M E N T S 2 This presentation contains certain forward-looking statements within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (as set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended) that are subject to risks and uncertainties. Such forward-looking statements can generally be identified by use of forward-looking terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. These forward-looking statements are based on certain assumptions, discuss future expectations, describe future plans and strategies, contain financial and operating projections or state other forward-looking information. The Company's ability to predict results or the actual effect of future events, actions, plans or strategies is inherently uncertain. Although the Company believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, the Company's actual results and performance could differ materially from those set forth in, or implied by, the forward-looking statements. You should be aware that there are various factors that could cause actual results to differ materially from any forward-looking statements made in this presentation. Factors that could cause or contribute to such differences include, but are not limited to, changes in general economic and business conditions in Alabama, Georgia, Florida, and Texas where the Company's timberlands are located, changes in timber prices and the impact on the Company's revenues, limitations on the Company's ability to harvest timber, changes in the supply of timberlands available for acquisition that meet the Company's investment criteria, the Company's ability to access external sources of capital and the impact that potential increases in interest rates could have on the Company's business, and industry trends. You are cautioned not to place undue reliance on any of these forward-looking statements, which reflect the Company's views only as of this date. Furthermore, except as required by law, the Company is under no duty to, and does not intend to, update any of our forward-looking statements after this date, whether as a result of new information, future events or otherwise. This presentation does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not permitted by law or in which the person making the offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. COMPANY UPDATE | SEPTEMBER 2014

36% Q U A L I T Y T I M B E R L A N D H O L D I N G S 3 FROM YEAR-TO-DATE CLOSED AND ANNOUNCED ACQUISITIONS UP R E C E N T C AT C H M A R K G A I N S – P O S I T I O N E D F O R G R O W T H COMPANY UPDATE | SEPTEMBER 2014 3 29% R E V E N U E S 1 UP 220% A D J U S T E D E B I T D A 1 UP nearly 14% D I V I D E N D 2 UP 42% S U S T A I N A B L E H A R V E S T V O L U M E UP O V E R 2 0 1 3 POST ANNOUNCED ACQUISITIONS AND FOLLOW-ON OFFERING 1 2Q 2014 compared to 2Q 2013 2 3Q 2014 compared to 2Q 2014 3 Measured by acreage as compared to 12/31/2013 <15% R E D U C E D L E V E R A G E N E T D E B T / E N T E R P R I S E V A L U E

AT T E N T I O N T O Q U A L I T Y — A S S E T S , P R O D U C T I O N , E A R N I N G S • Growth Maximize shareholder returns from: – Recurring dividends, derived from sustainable harvests in existing timberland holdings – Acquisitions strategy concentrating on high-demand Southeast “fiber baskets” to increase future harvest volume and cash flow – Participation in the ongoing U.S. housing recovery as well as feeding into growing offshore log and lumber demand • Lower Volatility Exclusively own and manage timberland (“Pure Play”) — unlike most competitors, the company does not engage in higher-risk forest products manufacturing operations • Inflation Protection Invest in a non-correlated asset class 4 COMPANY UPDATE | SEPTEMBER 2014

E X I S T I N G P O R T F O L I O Key Facts • 320,400 acres of commercial timberlands1 – 290,800 fee acres – 29,600 leased acres • Approximately 12.1 mm tons of merchantable timber2 • Well-diversified species and product mix – 73% pine / 27% hardwood by acreage2 – 20% sawtimber / 23% chip-n-saw / 57% pulpwood by volume2 • Sustainable Forestry Initiative-certified 5 Counties with Ownership and Leasehold Interests (As of June 30, 2014) 1. As of June 30, 2014 2. As of December 31, 2013 and closed acquisitions as of June 30, 2014. COMPANY UPDATE | SEPTEMBER 2014

2 0 1 4 O P E R AT I N G H I G H L I G H T S 6 • Increased targeted 2014 adjusted EBITDA to $16 million to $17 million from $13 million to $14 million based on sustainable harvest volumes and scheduled land sales. Adjusted EBITDA increased almost 220% for second quarter 2014 over second quarter 2013. • Increased revenues by 29% in second quarter 2014 over second quarter 2013. • Declared a $0.125 per share dividend to stockholders of record on August 29, payable on September 15, 2014, a 14% increase over previously declared $0.11 per share dividend payable during the first/second quarters of 2014. • Increased expected volumes on Legacy Properties to 1.1 million tons of timber, a 20% increase in production volume from approximately 920,000 tons in 2013. • Completed or entered into pending purchases of $197 million of high quality timberlands, comprising approximately 100,000 acres in Georgia, Texas, and Florida — improving future harvest mix and enhancing company cash flow by adding 450,000 to 490,000 tons of sustainable annual harvest volume. • Purchaser exercised option to buy 3,000 acres for $9 million, or $3,000 per acre (transaction scheduled to close in fourth quarter). • Multi-draw term facility increased by $65 million to $215 million; revolving credit facility increased by $10 million to $25 million; $240 million total capacity. • Raised $160 million (net of fees) for ongoing timberland purchases. Improved Earnings Growth Forecast Generated Sharply Higher Revenues Increased Dividend Boosted Annual Harvest Target Executed Major Acquisitions Advanced Profitable Land Sale Expanded Credit Facilities Completed Follow-on Offering COMPANY UPDATE | SEPTEMBER 2014

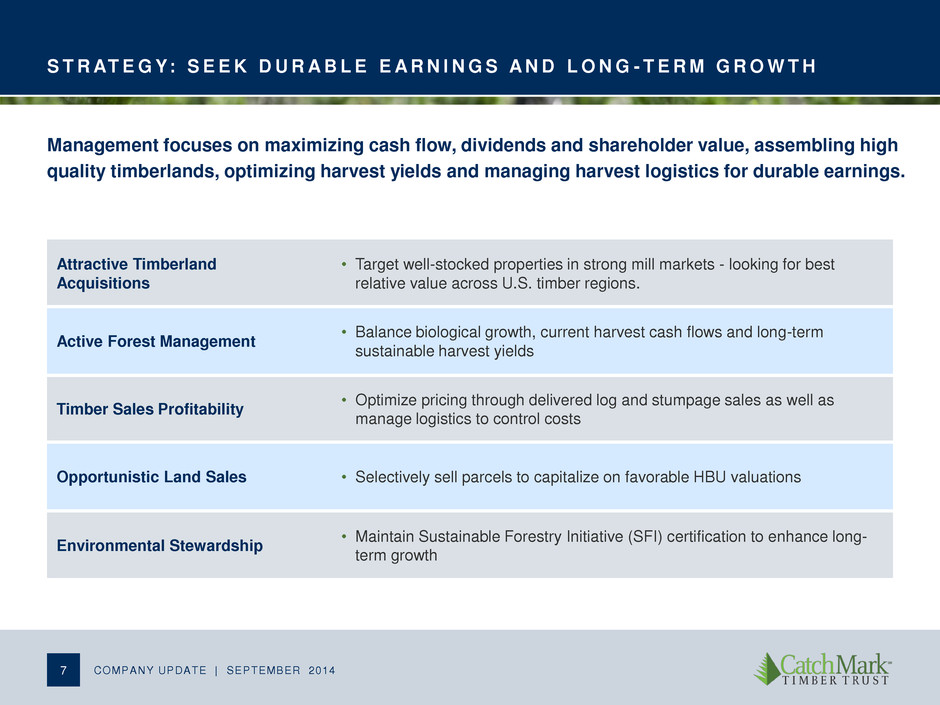

S T R AT E G Y: S E E K D U R A B L E E A R N I N G S A N D L O N G - T E R M G R O W T H Management focuses on maximizing cash flow, dividends and shareholder value, assembling high quality timberlands, optimizing harvest yields and managing harvest logistics for durable earnings. 7 Attractive Timberland Acquisitions • Target well-stocked properties in strong mill markets - looking for best relative value across U.S. timber regions. Active Forest Management • Balance biological growth, current harvest cash flows and long-term sustainable harvest yields Timber Sales Profitability • Optimize pricing through delivered log and stumpage sales as well as manage logistics to control costs Opportunistic Land Sales • Selectively sell parcels to capitalize on favorable HBU valuations Environmental Stewardship • Maintain Sustainable Forestry Initiative (SFI) certification to enhance long- term growth COMPANY UPDATE | SEPTEMBER 2014

$680 $1,634 $2,032 $3,767 $3,074 $6,130 $8,458 $8,391 $4,901 $1,949 $1,060 $1,337 $3,404 $5,036 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 $35 billion 75%+ TIMOs T I M B E R L A N D M & A A C T I V I T Y I S P I C K I N G U P 8 Source: Forest Economic Advisors Historical Timberland Transaction Volume ($ in millions) COMPANY UPDATE | SEPTEMBER 2014 Timberland transaction volume totaled over $35 billion between 2003 and 2008, the majority of which was acquired by TIMOs and will likely be coming back to the market over the next five years.

Targeted Areas Targeted states R O B U S T A N D AT T R A C T I V E A C Q U I S I T I O N P I P E L I N E • Robust Pipeline: $500 million of identified transaction opportunities, including TIMO-owned properties in expiring funds • Key Metrics/Criteria: – Local market dynamics (supply/demand balance) – Sustainable productivity (tons/acre/year) – Merchantable inventory/mix (tons/acre) – Target cash yield (near-term/long-term) • Current Geographic Focus: Southern Pine Belt where best relative value exists today • Average Deal Size: 10,000-40,000 acres CatchMark seeks well-stocked, high quality timberlands with near-term income potential to increase its harvest volumes and cash flow as well as characteristics to sustain long-term growth. 9 COMPANY UPDATE | SEPTEMBER 2014

M I C R O M A R K E T S M A K E A D I F F E R E N C E 10 COMPANY UPDATE | SEPTEMBER 2014 CatchMark targets markets with favorable current and long-term supply/demand fundamentals. • Timber prices driven by local supply and demand. • Prices can vary greatly from market to market. Source: Timber Mart South Region PST $29 $27 $25 $30 PCNS 15 18 16 21 PPW 10 11 9 15

M A J O R 2 0 1 4 T R A N S A C T I O N S Waycross/Panola • $74 million • Texas and Georgia • 36,300 acres • 180,000-200,000 tons of annual harvest volume (5.0 – 5.5 tons/acre/year) • 1.45 million tons of merchantable timber (40 tons/acre) Oglethorpe/Satilla River* • $111 million • Georgia and Florida • 55,600 acres • 240,000-260,000 tons of annual harvest volume (4.3 – 4.7 tons/acre/year) • 2.7 million tons of merchantable timber (49 tons/acre) 11 Counties with Ownership and Leasehold Interests (Projected Q4 2014) Legacy timberland YTD acquisitions (closed and announced) YTD new acquisitions (closed and announced) in same counties as legacy timberland CatchMark has closed on or agreed to acquire approximately 100,000 acres of high quality timberlands YTD, expanding its holdings by 36%, which will increase sustainable harvest volumes, improve product mix, and enhance long-term earnings. * Expected to close Q4 2014 COMPANY UPDATE | SEPTEMBER 2014

A C Q U I S I T I O N S D R I V E I N C R E A S E D S U S TA I N A B L E H A R V E S T P R O D U C T I O N 12 COMPANY UPDATE | SEPTEMBER 2014 3.3 3.4 3.1 2.4 3.3 5.5 4.7 5.0 4.2 0.0 1.0 2.0 3.0 4.0 5.0 6.0 Note: Public company data represents 10-year historical average. Acquisition property data represents 10-year projected average. * Expected to close Q4 2014 Drivers of Cash Yield: ─ Sustainable harvest: 80% - 90% ─ Recreational leases: 5% - 10% ─ Land sales: 5% - 10% +28% versus Comparable Company Historical Average Comparable Company Data (10-year Historical Average) CTT Acquisitions (10-year Projected Average) WY PCL RYN DEL Weighted Average Waycross/ Panola Oglethorpe/ Satilla* Weighted Average CTT Pro Forma CatchMark’s recent acquisitions exhibit strong productivity characteristics, which enhanced its overall portfolio productivity. Harvest Volume per Acre (tons)

S U S TA I N A B L E H A R V E S T P R O D U C T I O N D R I V E S C A S H F L O W A N D VA L U E 13 COMPANY UPDATE | SEPTEMBER 2014 *: Pricing as of 6/30/14 from Timber Mart South: Southwide averages. (1) Leasing / Ancillary Revenue estimated to be approximately $10 per acre on average. (2) Forest Management / Taxes estimated to be approximately $15 per acre on average. Harvest Assumptions % Pine (tons) 87.5% % Hardwood (tons) 12.5% 3.25 Tons per Acre 5.00 Tons per Acre Pricing Pricing Product Tons / Revenue Revenue Tons / Revenue Revenue Product Category (6/30/2014) (Trendline) Mix Acre (Current) (Trendline) Acre (Current) (Trendline) Pine Pulpwood $10.54 $10.00 50.0% 1.42 $14.99 $14.22 2.19 $23.06 $21.88 Pine CNS $17.14 $26.00 25.0% 0.71 12.19 18.48 1.09 18.75 28.44 Pine Sawtimber $25.23 $41.00 25.0% 0.71 17.94 29.15 1.09 27.60 44.84 Subtotal Pine 100.0% 2.84 $45.11 $61.85 4.38 $69.40 $95.16 Hardwood Pulpwood $10.74 $10.00 66.7% 0.27 $2.91 $2.71 0.42 $4.48 $4.17 Hardwood Sawtimber $29.93 $29.00 33.3% 0.14 4.05 3.93 0.21 6.24 6.04 Subtotal Hardwood 100.0% 0.41 $6.96 $6.64 0.63 $10.71 $10.21 Total Revenues 3.25 $52.07 $68.49 5.00 $80.11 $105.36 (+) Leasing / Ancillary Revenue (1) 10.00 10.00 10.00 10.00 (–) Forest Management / Taxes (2) (15.00) (15.00) (15.00) (15.00) Implied EBITDA $47.07 $63.49 $75.11 $100.36 % r versus 3.25 Tons per Acre @ Current Pricing – 34.9% 59.6% 113.2% Higher sustainable harvest production can yield significantly increased cash flow, particularly when factoring in a price recovery. Illustrative per Acre Example:

N E W A C Q U I S I T I O N S : S I G N I F I C A N T P O R T F O L I O E N H A N C E M E N T S 14 278,100 377,000 100,200 Legacy Portfolio YTD Acquisitions Pro Forma Portfolio Acreage (acres) 1.1 1.6 0.5 Legacy Portfolio YTD Acquisitions Pro Forma Portfolio Sustainable Harvest (tons in millions) 37 45 40 Legacy Portfolio YTD Acquisitions Pro Forma Portfolio Merchantable Inventory (tons per acre) 41% 50% 44% Legacy Portfolio YTD Acquisitions Pro Forma Portfolio % Sawtimber Inventory Comparison2 (%) CatchMark's YTD announced acquisitions improve the quality of its timberland portfolio and enhance future earnings capacity. 1. Net of lease expirations and land sales 2. Represents percentage of inventory comprised of sawtimber/chip-n-saw products COMPANY UPDATE | SEPTEMBER 2014 1 1 N E W A C Q U I S I T I O N S : S I G N I F I C A N T P O R T F O L I O E N H A N C E M E N T S

T I M B E R M A R K E T I S AT A N I N F L E C T I O N P O I N T I N T H E C Y C L E 15 0.8 0.9 1.0 1.2 1.4 1.8 0.0 0.5 1.0 1.5 2.0 12 13 14 15 16 17 Projected U.S. Housing Starts 125% S tart s i n m ill io n s 45.0 47.6 51.6 55.8 60.1 64.9 30 40 50 60 70 80 12 13 14 15 16 17 Projected North America Lumber Consumption 44% B B F Annual Housing Starts vs. Real Sawtimber Prices Sources: Timber Mart-South South-wide Average Sawtimber Prices, U.S. Census Bureau Note: Prices are adjusted for inflation and converted to 2013 dollars based on the Producer Price Index (PPI) (starts in 000s / US$ per ton) COMPANY UPDATE | SEPTEMBER 2014 $20 $30 $40 $50 $60 500 1,000 1,500 2,000 2,500 2000 2002 2004 2006 2008 2010 2012 2014 Total Housing Starts Sawtimber Price Source: Forest Economic Advisors Housing starts drive sawtimber prices: 1.5mm starts = $40+ sawtimber (vs. $25 today).

Annual Demand Impact (Housing Start Equivalents) Annual Supply Impact (Housing Start Equivalents) Recent Upturn in U.S. Residential Construction +820,000 Significant Increase in Lumber and Log Exports to China +490,000 Mountain Pine Beetle Epidemic in British Columbia (260,000) Major Timber Supply Contractions in Eastern Canada (166,000) Aggregate Impact on Lumber Supply- Demand Balance (2017) +1.74 million Versus 2013 Starts of ~930k 16 O T H E R M A C R O FA C T O R S W I L L I N T E N S I F Y T H E R E C O V E R Y COMPANY UPDATE | SEPTEMBER 2014 Source: Forest Economic Advisors These supply-demand factors equate to +1.74 million housing start equivalents.

(starts in millions) “ SUPER -CYCLE ” CREATES NEW PEAK 17 2.07 0.93 1.75 0.49 0.49 0.43 0.0 0.5 1.0 1.5 2.0 2.5 3.0 2005 2013 2017 Housing Start Equivalents Fundamental Demand China Demand Canada Capacity Constraints 1.42 2.67 COMPANY UPDATE | SEPTEMBER 2014 Source: Forest Economic Advisors New “super-cycle” peak (+29% vs. 2005) should drive significantly higher sawtimber prices.

$0 $10 $20 $30 $40 $50 $60 $70 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 2010 2012 2014 Pine Sawtimber Pine Chip-n-Saw Pine Pulpwood Trendline Pine Sawtimber Trendline Pine Chip-n-Saw Trendline Pine Pulpwood U.S. South Stumpage Prices (Real) Current Pricing (6/30/14) Trendline Pricing Deviation from Trendline Required Annual Growth Rate to Reach Trendline 5-Year 10-Year Southern US; Sawtimber $25.23 / Ton $41.00 / Ton (39%) 10% 5% Southern US; Chip-n-saw $17.14 / Ton $26.00 / Ton (39%) 9% 4% Southern US; Pulpwood $10.54 / Ton $10.00 / Ton 5% 0% 0% Source: Timber-Mart South Note: Prices are adjusted for inflation and converted to 2013 dollars based on the Producer Price Index (PPI) T R E N D I N G S I G N I F I C A N T P R I C E R E C O V E R Y 18 $4 1 ($ per ton) $10 $26 $41 COMPANY UPDATE | SEPTEMBER 2014

E X P E R I E N C E D M A N A G E M E N T T E A M 19 CatchMark’s seasoned leadership provides significant industry experience and capability to help realize company objectives and growth plan. Jerry Barag, President and CEO (30 years of industry experience) •Managing Director and Founder TimberStar Advisors and TimberStar •Chief Investment Officer at Lend Lease Real Estate Investments •Executive Vice President, Equitable Real Estate Brian Davis, Chief Financial Officer (20 years) • Senior Vice President and Chief Financial Officer of Wells TIMO • Positions at SunTrust Bank, focusing on capital needs for middle-market and large-cap corporate clients John Rasor, Chief Operating Officer (45 years) • Managing Director and Founder TimberStar Advisors and TimberStar • Executive Vice President of Georgia Pacific, responsible for timber and timberlands, building product businesses, and wood and fiber procurement for wood products, pulp and paper CEO Barag and COO Rasor have worked together since 2004, completing $1.4 billion in timberland acquisitions and $1.9 billion dispositions; generated investor returns of 2.0x equity and 1.4x total capital in the first and only timberland securitization (TimberStar). COMPANY UPDATE | SEPTEMBER 2014

S U M M A R Y CatchMark’s focus on quality—timberland assets, operational excellence, and sustainable earnings—helps the company grow cash flow, dividends and shareholder value. S t r a t e g y • Expand holdings of prime, well- stocked timberlands; manage for durable earnings and increase value through sustainable environmental practices; grow cash flow and dividends per share P e r f o r m a n c e • Completed or announced nearly $200 million of timberland acquisitions in 2014 • Increased harvest volumes on legacy portfolio by 20% over 2013 • Increased earnings guidance for year by 20% • Announced 14% dividend increase for 3rd Quarter O p p o r t u n i t y • Invest in a company well- positioned to take advantage of the improving housing market with an experienced and proven management team implementing a clear strategy, buoyed by a strong balance sheet 20 COMPANY UPDATE | SEPTEMBER 2014