Attached files

| file | filename |

|---|---|

| 10-Q - QUARTERLY REPORT - MobileBits Holdings Corp | f10q0714_mobilebitsholdings.htm |

| EX-31.1 - CERTIFICATION - MobileBits Holdings Corp | f10q0714ex31i_mobile.htm |

| EX-31.2 - CERTIFICATION - MobileBits Holdings Corp | f10q0714ex31ii_mobile.htm |

| EX-10.2 - REVISED EMPLOYMENT AGREEMENT - MobileBits Holdings Corp | f10q0714ex10ii_mobile.htm |

| EXCEL - IDEA: XBRL DOCUMENT - MobileBits Holdings Corp | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - MobileBits Holdings Corp | f10q0714ex32i_mobile.htm |

| EX-32.2 - CERTIFICATION - MobileBits Holdings Corp | f10q0714ex32ii_mobile.htm |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement ("Agreement") is made and entered into as of the 21st day of April, 2014, by and between MobileBits Corporation, a Florida corporation (the "Employer" or the Company"), and Hussein Abu Hassan (the "Employee").

WITNESSETH:

1. Employment. The Employer hereby employs the Employee, and the Employee hereby accepts such employment, upon the terms and subject to the conditions set forth in this Agreement.

2. Term. Subject to the provisions of termination as hereinafter provided, the term of employment under this Agreement shall commence April 21, 2014 (the "Commencement Date") and shall continue through the end of the business day, April 21, 2017; provided, however, that beginning on April 21, 2017 and on the first calendar day after the conclusion of any term of this Agreement (each a "Renewal Date") thereafter, the term of this Agreement shall automatically be extended for one additional years, unless either party gives the other written notice of non-renewal at least ten (10) days prior to any such Renewal Date. The "term of this Agreement" shall mean period of time beginning as of the Commencement Date and ending as of the last date that the Employee is employed by the Company.

3. Compensation; Reimbursement, Etc.

(a) Basic Salary. The Employer shall pay to the Employee as compensation for all services rendered by the Employee during the term of this Agreement a basic annualized salary of $120,000.00 per year (the "Basic Salary"), or such greater sum as the parties may agree on from time to time, payable monthly on the first day of each month during the term of this Agreement. The Board of Directors of the Employer and the Employee shall review and discuss the Basic Salary of the Employee and the Employee shall be entitled to an increase to such Basic Salary as mutually agreed between them. In addition, the Board of Directors of the Employer, in its discretion, may, with respect to any year during the term hereof, award a bonus or bonuses to the Employee in addition to the bonuses provided for in Section 3(b). The compensation provided for in this Section 3(a) shall be in addition to any pension or profit sharing payments set aside or allocated for the benefit of the Employee.

(b) Bonus. In addition to the Basic Salary paid pursuant to Section 3(a), the Employer shall pay as incentive compensation an annual bonus based upon the Employee's performance and computed in accordance with an incentive management bonus plan that is each year recommended and/or approved by the Board of Directors of the Employer. The Employee's participation in such incentive management bonus plan shall be on the basis and terms as recommended and/or approved by the Board of Directors of the Employer. For each bonus period during the term of this Agreement the minimum bonus shall be equal to 100% of the Employee's Basic Salary during such bonus period. In no event shall the bonus paid to the Employee for any twelve (12) month period under this Agreement in which Employee remains employed during the entire twelve (12) month period be less than $120,000 and the Employee shall be entitled to a guaranteed bonus of such amount.

| 1 | Page |

(c) Stock Options. Effective as of the Commencement Date, the Employee shall receive one or more nonqualified stock options to purchase an aggregate of Twelve Million (12,000,000) shares of the Employer's common stock. The right to purchase such stock shall be nontransferable and shall vest immediately upon the Commencement Date. The options shall have a term of seven (7) years and the exercise price of the options shall be equal to the fair market value of the stock on the date of grant which the parties mutually agree is $0.05. The Employer may grant said stock options either under the Employer's currently existing stock option plans ("Plans"), or in such other manner as may be determined by the Employer; provided, however, that the terms pursuant to which the stock option is granted, if granted outside of the Plans, shall be substantially similar to the terms of grant contained in the Plans, and further provided, that in any case, the shares of common stock underlying the options shall be registered on Form S-8 (or an equivalent registration statement). During the Employment Term, the Employee shall also be eligible to receive additional stock options as determined by the Board in accordance with the Employer's practices applicable to senior employees of the Employer.

(d) Tax-Gross Up Payments. In addition to such other amounts as are due and payable under this Agreement, the Company shall make such additional payments to Employee as are necessary to provide Employee with enough funds to pay any and all taxes attributable to or resulting from the payment of the Basic Salary, the bonus and any other compensation paid to Employee under this Agreement, including without limitation to any and all income tax arising under the Internal Revenue Code, and state, Canadian and provincial laws with the end result that Employee shall receive the Basic Salary and Bonuses as if no such tax was applicable to the Employee. The Company shall make any payments required by this paragraph no later than 105 days after the last day of Employee's taxable year following the Employee's taxable year in which the applicable Basic Salary and Bonuses are paid to the Employee.

(e) Benefits and Perquisites. During the term of this Agreement, Employee shall be provided with the standard health insurance, disability insurance and such other benefits as may be offered by the Company to executive level employees.

(f) Reimbursements. The Employer shall reimburse the Employee for all reasonable expenses incurred by the Employee in the performance of his duties under this Agreement including without limitation all travel expenses related to his duties on behalf of the Company; provided, however, that the Employee must furnish to the Employer an itemized account, satisfactory to the Employer, in substantiation of such expenditures. In addition, Employer shall pay, or reimburse Employee for, all membership fees and related costs in connection with Employee's membership in professional and civic organizations which are approved in advance by the Employer.

4. Duties. The Employee is engaged as President. Subject to the direction and supervision of the Employer's Board of Directors, the Employee shall perform such duties as are customarily associated with a President of a Florida corporation.

| 2 | Page |

5. Extent of Services; Vacations and Days Off.

(a) During the term of his employment under this Agreement, the Employee shall devote such time, energy and attention during regular business hours to the benefit and business of the Employer as may be reasonably necessary in performing his duties pursuant to this Agreement.

(b) The Employee shall be entitled to at least six weeks of vacation per year with pay and to such personal and sick leave with pay in accordance with the policy of the Employer as may be established from time to time by the Employer and applied to other senior employees of the Employer. In addition, the Employee shall be entitled to such fringe benefits as may be provided from time to time by the Employer to other executives of the Employer or its affiliates.

6. Indemnification. The Employer shall indemnify the Employee to the fullest extent that would be permitted by law as in effect at the time of the subject act or omission, or by the Articles of Incorporation and Bylaws of the Employer as in effect at such time, or by the terms of any indemnification agreement between the Employer and the Employee, whichever affords greatest protection to the Employee, and the Employee shall be entitled to the protection of any insurance policies the Employer may elect to maintain generally for the benefit of its employees (and to the extent the Employer maintains such an insurance policy or policies, in accordance with its or their terms to the maximum extent of the coverage available for any company employee), against any and all loss, claim, damage, liability, deficiencies, actions, suits, proceedings, claims, costs and legal expenses or expense whatsoever (including, but not limited to, reasonable legal fees and other expenses and reasonable disbursements incurred in connection with investigating, preparing to defend or defending any action, suit or proceeding, including any inquiry or investigation, commenced or threatened, or any claim whatsoever, or in appearing or preparing for appearance as witness in any proceeding, including any pretrial proceeding such as a deposition) at the time such costs, charges and expenses are incurred or sustained, in connection with any action, claim, suit or proceeding to which the Employee may be made a party by reason of his being or having been an employee of the Employer, or serving as an employee of an Affiliate of the Employer, other than any action, suit or proceeding brought against the Employee by or on account of his breach of the provisions of any employment agreement with a third party that has not been disclosed by the Employee to the Employer. Notwithstanding the foregoing, Employee shall not be entitled to indemnification pursuant to this paragraph 6 to the extent that any such liability is found in a final judgment by a court of competent jurisdiction to have resulted primarily and directly from the Employee's fraud, gross negligence or willful misconduct. The Company shall advance all Expenses incurred by the Employee in connection with the investigation, defense, settlement or appeal of any Proceeding to which the Employee is a party or is threatened to be made a party by reason of the fact that the Employee is or was an Agent of the Company (including services as an Agent of an Affiliate). The Employee hereby undertakes to repay such amounts advanced only if, and to the extent that, it shall be determined ultimately that the Employee is not entitled to be indemnified by the Company as authorized hereby. The advances to be made hereunder shall be paid by the Company to the Employee within twenty (20) days following delivery of a written request therefor by the Employee to the Company. In the event that the Company takes the position that Employee is not entitled to indemnification in connection with the proposed settlement of any Proceeding, Employee shall have the right at his own expense to undertake defense of any such claim, insofar as such Proceeding involves claims against the Employee, by written notice given to the Company within 10 days after the Company has notified Employee in writing of its contention that Employee is not entitled to indemnification; provided, however, that the failure to give such notice within such 10-day period shall not affect or limit the Company's obligations with respect to advancement and indemnification under this Agreement. For purposes of this Agreement, "Expenses" shall mean all out-of-pocket costs of any type or nature whatsoever (including, without limitation, all attorneys' fees and related disbursements), actually and reasonably incurred by the Employee in connection with either the investigation, defense or appeal of a Proceeding or establishing or enforcing a right to indemnification under this Agreement or otherwise. Any payments to be made to Employee pursuant to this Section 6 shall first be made under insurance policies that the Employer may maintain generally for the benefit of its employees, if any. An "Affiliate" shall mean any entity controlling, controlled by or under common control with Employer. The provisions of this Section 6 shall specifically survive the expiration or earlier termination of this Agreement. Shall any portion of this Section 6 be held to be invalid, unreasonable, and arbitrary or against public policy, then such portion of the paragraph shall be modified to provide Employee with the fullest protection that would be permitted by law.

| 3 | Page |

7. Terminations.

(a) Voluntary Termination by Employee. The Employee may terminate his employment hereunder upon giving at least ten (10) business days' prior written notice. If the Employee gives notice pursuant to Section 7(a) above, the Employer shall have the right to relieve the Employee, in whole or in part, of his duties under this Agreement (without reduction in compensation through the termination date).

(b) Termination By Employee for Good Reason. The Employee may terminate his employment hereunder for Good Reason and upon written notice. As used herein, "Good Reason" shall include the following:

(i) Should the Company materially breach its duties as specified in this Agreement; or

(ii) Mobile Bits Holding Corporation fails to elect Employee to its Board of Directors or Mobile Bits Holding Corporation relieves Employee of his position as the member of the Board of Directors of the Company for reasons other than for "Good Cause" (as such term is defined in Section 7(c) of this Agreement).

If the Employee shall terminate this Agreement with Good Reason, effective on a date earlier than a Renewal Date as provided for in Section 2 (with the effective date of termination as so identified by the Employer's Board of Directors upon receipt of written notice from Employee of his termination with Good Reason being referred to herein as the "Accelerated Termination Date"), the Employee, until the date which is twelve (12) month(s) after the Accelerated Termination Date, shall continue to receive the Basic Salary and other compensation and employee benefits (including without limitation the bonus that would otherwise have been payable during such compensation continuation period under the bonus plan in effect immediately before the Accelerated Termination Date) that the Employer has heretofore in Section 3 agreed to pay and to provide for the Employee, in each case in the amount and kind and at the time provided for in Section 3; provided that, notwithstanding such termination of employment, the Employee's covenants set forth in Section 9 and Section 10 are intended to and shall remain in full force and effect. The parties agree that, because there can be no exact measure of the damage that would occur to the Employee as a result of terminating his employment for Good Reason, the payments and benefits paid and provided pursuant to this Section 9(b) shall be deemed to constitute liquidated damages and not a penalty for the termination of the Employee's employment with Good Reason, and the Employer agrees that the Employee shall not be required to mitigate his damages,

| 4 | Page |

(c) Termination by Employer. Except as otherwise provided in this Agreement, the Employer may terminate the employment of the Employee hereunder only for Good Cause upon written notice; provided, however, that no breach or default by the Employee shall be deemed to occur hereunder unless the Employee shall have failed to cure the breach or default within thirty (30) days after Employee received written notice thereof indicating that it is a notice of termination pursuant to this Section of this Agreement. As used herein, "Good Cause" shall include:

(i) the Employee's conviction of either a felony involving moral turpitude or any crime in connection with his employment by the Employer which causes the Employer a substantial detriment, but specifically shall not include traffic offenses;

(ii) willful or material wrongdoing by the Employee, including, but not limited to, acts of fraud, which could be expected to have a materially adverse effect, monetarily or otherwise, on the Employer or its subsidiaries or affiliates, as determined by the Employer and its Board of Directors;

(iii) material breach by the Employee of a material obligation under this Agreement or of his duty to the Employer; or

(iv) any condition which either resulted from the Employee's substantial dependence, as reasonably determined by the Board of Directors of the Employer, on alcohol, or any narcotic drug or other controlled or illegal substance. If any determination of substantial dependence is disputed by the Employee, the parties hereto agree to abide by the decision of a panel of three physicians appointed in the manner and subject to the same penalties for noncompliance as specified in Section 7(c) of this Agreement.

Termination of the employment of the Employee for reasons other than those expressly specified in this Agreement as good cause shall be deemed to be a termination of employment "without Good Cause." If the Employer shall terminate the employment of the Employee without good cause, effective on a date earlier than a Renewal Date as provided for in Section 2 (with the effective date of termination as so identified by the Employer being referred to herein as the "Accelerated Termination Date"), the Employee, shall continue to receive the Basic Salary and other compensation and employee benefits for three months (including without limitation the bonus that would otherwise have been payable during such compensation continuation period under the bonus plan in effect immediately before the Accelerated Termination Date) that the Employer has heretofore in Section 3 agreed to pay and to provide for the Employee, in each case in the amount and kind and at the time provided for in Section 3; provided that, notwithstanding such termination of employment, the Employee's covenants set forth in Section 9 and Section 10 are intended to and shall remain in full force and effect. The parties agree that, because there can be no exact measure of the damage that would occur• to the Employee as a result of a termination by the Employer of the Employee's employment without good cause, the payments and benefits paid and provided pursuant to this Section 9(d) shall be deemed to constitute liquidated damages and not a penalty for the Employer's termination of the Employee's employment without good cause, and the Employer agrees that the Employee shall not be required to mitigate his damages.

| 5 | Page |

(d) Termination on Death. If the Employee dies during the term of his employment, the Employer shall pay to the estate of the Employee such compensation, including any bonus compensation earned but not yet paid, as would otherwise have been payable to the Employee up to the end of the month in which his death occurs including all of the Employee's stock options.

(e) Disability, Illness and Incapacity. During any period of disability, illness or incapacity during the term of this Agreement which renders the Employee at least temporarily unable to perform the services required under this Agreement for a period which shall not equal or exceed (1) a period of 120 consecutive days or (2) shorter periods aggregating 180 days during any twelve-month period, the Employee shall receive the compensation payable under Section 3 of this Agreement plus any bonus compensation earned but not yet paid, less any benefits received by him/her under any disability insurance carried by or provided by the Employer. All rights of the Employee under this Agreement (other than rights already accrued) shall terminate as provided below upon the Employee's permanent disability (as defined below), although the Employee shall continue to receive any disability benefits to which he may be entitled under any disability income insurance which may be carried by or provided by the Employer from time to time. The term "permanent disability" as used in this Agreement shall mean the inability of the Employee, as determined by the Board of Directors of the Employer, by reason of physical or mental disability to perform the duties required of him under this Agreement for (1) a period of 120 consecutive days or (2) shorter periods aggregating 180 days during any twelve-month period. Successive periods of disability, illness or incapacity will be considered separate periods unless the later period of disability, illness or incapacity is clue to the same or related cause and commences less than six months from the ending of the previous period of disability. Upon such determination, the Board of Directors may terminate the Employee's employment under this Agreement upon ten (10) days' prior written notice. If any determination of the Board of Directors with respect to permanent disability is disputed by the Employee, the parties hereto agree to abide by the decision of a panel of three physicians. The Employee and Employer shall each appoint one member, and the third member of the panel shall be appointed by the other two members. The Employee agrees to make himself available for and submit to examinations by such physicians as may be directed by the Employer. Failure to submit to any such examination shall constitute a breach of a material part of this Agreement.

| 6 | Page |

8. Disclosure. The Employee agrees that during the term of Employee's employment by the Employer, Employee will disclose and disclose only to the Employer, in writing, all ideas, methods, plans, developments or improvements known by his which relate directly or indirectly to the business of the Employer, whether acquired by the Employee before or during Employee's employment by the Employer. Nothing in this Section 8 shall be construed as requiring any such communication where the idea, plan, method or development is lawfully protected from disclosure as a trade secret of a third party or by any other lawful prohibition against such communication.

9. Confidentiality and Ownership Rights.

(a) Nondisclosure of Information. The Employee acknowledges that in the course of Employee's employment by the Employer Employee will receive certain trade secrets, which may include, but are not limited to, programs, lists of acquisition or disposition prospects and knowledge of acquisition strategy, financial information and reports, lists of customers or potential customers and other proprietary information, confidential information and knowledge concerning the business of the Employer (hereinafter collectively referred to as "Information") which the Employer desires to protect. The Employee understands that the Information is confidential and agrees not to reveal the Information to anyone outside the Employer, unless compelled to do so by any federal or state regulatory agency or by a court order. If Employee becomes aware that disclosure of any Information is being sought by such an agency or through a court order, Employee will immediately notify the Employer. The Employee further agrees that she will at no time use the Information in competing with the Employer. Upon termination of Employee's employment with the Employer, regardless of the reason for such termination, the Employee shall surrender to the Employer all papers, documents, writings and other property produced by Employee or coming into Employee's possession by or through Employee's employment or relating to the Information, and the Employee agrees that all such materials are and will at all times remain the property of the Employer and to the extent the Employee has any rights therein, Employee hereby irrevocably assigns such rights to the Employer.

(b) Ownership of Information, Ideas, Concepts, Improvements, Discoveries and Inventions.

(i) All information, ideas, concepts, improvements, discoveries and inventions, whether patentable or not, which are conceived, made, developed or acquired by Employee or which are disclosed or made known to Employee, individually or in conjunction with others, during Employee's employment by the Employer and which relate to the Employer's business, products or services (including but not limited to all such information relating to corporate opportunities, research, financial and sales data, pricing and trading terms, evaluations, opinions, interpretations, acquisition prospects, the identity of customers or their requirements, the identity of key contacts within the customer's organization or within the organization of acquisition prospects, or marketing and merchandising techniques, prospective names and marks), are and shall be the sole and exclusive property of the Employer. Moreover, all drawings, memoranda, notes, records, files, correspondence, manuals, models, specifications, computer programs, maps and all other writings or materials of any type embodying any of such information, ideas, concepts, improvements, discoveries and inventions are and shall be the sole and exclusive property of the Employer.

| 7 | Page |

(ii) In particular, Employee hereby specifically sells, assigns and transfers to the Employer all of Employee's worldwide right, title and interest in and to all such information, ideas, concepts, improvements, discoveries or inventions described in Section 9(b)(i) above, and any United States or foreign applications for patents, inventor's certificates or other industrial rights that may be filed thereon, including divisions, continuations, continuations-in-part, reissues and/or extensions thereof, and applications for registration of such names and marks. Both during the period of Employee's employment by the Employer and thereafter, Employee shall assist the Employer and its nominees at all times in the protection of such information, ideas, concepts, improvements, discoveries or inventions both in the United States and all foreign countries, including but not limited to the execution of all lawful oaths and all assignment documents requested by the Employer or its nominee in connection with the preparation, prosecution, issuance or enforcement of any applications for United States or foreign letters patent, including divisions, continuations, continuations-in-part, reissues, and/or extensions thereof, and any application for the registration of such names and marks.

(c) The provisions of this Section 9 shall specifically survive the expiration or earlier termination of this Agreement.

10. Expenses. Employer shall pay or reimburse Employee for all reasonable out-of-pocket costs and expenses (including reasonable fees and disbursements of legal counsel, appraisers, accountants and other experts employed or retained by Employee) incurred by Employee in connection with, arising out of, or in any way related to the negotiation, preparation, execution and delivery of this Agreement.

11. Specific Performance. The Employee agrees that damages at law will be an insufficient remedy to the Employer if the Employee violates the terms of Sections 8 and 9 of this Agreement and that the Employer would suffer irreparable damage as a result of such violation. Accordingly, it is agreed that the Employer shall be entitled, upon application to a court of competent jurisdiction, to obtain injunctive relief to enforce the provisions of such Sections, which injunctive relief shall be in addition to any other rights or remedies available to the Employer. The provisions of this Section 11 shall specifically survive the expiration or earlier termination of this Agreement.

12. Compliance with Other Agreements. The Employee represents and warrants that the execution of this Agreement by Employee and Employee's performance of Employee's obligations hereunder will not conflict with, result in the breach of any provision of or the termination of or constitute a default under any Agreement to which the Employee is a party or by which the Employee is or may be bound.

13. Compliance with Tax Laws.

(a) If any payment or benefit provided by Company to or for the benefit of the Employee, whether paid or payable or distributed or distributable pursuant to the terms of this Agreement or otherwise, including, by example and not by way of limitation, acceleration by the Company or otherwise of the date of payment under any plan, program, arrangement or agreement of Company (a “Payment") is subject to the excise tax imposed by Code section 4999 or any interest or penalties with respect to such excise tax (the "Excise Tax"), then Company shall make such additional payments to Employee (the "Excise Tax Gross Up Payments") as are necessary to provide Employee with enough funds to pay the Excise Tax, as well as any additional taxes (other than the 409A Tax, as defined below), including but not limited to additional Excise Tax, attributable to or resulting from the payment of the Excise Tax Gross Up Payments, with the end result that Employee shall be in the same position with respect to his tax liability (other than the 409A Tax) as he would have been in if no Excise Tax had ever been imposed. The Company shall make any payments required by this paragraph no later than the last day of Employee's taxable year next following the Employee's taxable year in which the Excise Tax is remitted to the taxing authority.

| 8 | Page |

(b) If any Payment provided to Employee is subject to adverse tax consequences under Code section 409A, then Company shall make such additional payments to Employee (the "409A Gross Up Payments") as are necessary to provide Employee with enough funds to pay the additional taxes, interest, and penalties imposed by Code section 409A (collectively, the "409A Tax"), as well as any additional taxes, including but not limited to additional 409A Tax, attributable to or resulting from the payment of the 409A Gross Up Payments, with the end result that Employee shall be in the same position with respect to his tax liability as he would have been in if no 409A Tax had ever been imposed. The Company shall make any payments required by this paragraph no later than the last day of Employee's taxable year next following the Employee's taxable year in which the 409A Tax is remitted to the taxing authority.

13. Waiver of Breach. The waiver by the Employer of a breach of any of the provisions of this Agreement by the Employee shall not be construed as a waiver of any subsequent breach by the Employee.

14. Binding Effect; Assignment. The rights and obligations of the Employer under this Agreement shall inure to the benefit of and shall be binding upon the successors and assigns of the Employer. This Agreement is a personal employment contract and the rights, obligations and interests of the Employee hereunder may not be sold, assigned, transferred, pledged or hypothecated.

15. Entire Agreement. This Agreement contains the entire agreement and supersedes all prior agreements and understandings, oral or written, with respect to the subject matter hereof. This Agreement may be changed only by an agreement in writing signed by the party against whom any waiver, change, amendment, modification or discharge is sought.

16. Headings. The headings contained in this Agreement are for reference purposes only and shall not affect the meaning or interpretation of this Agreement.

17. Governing Law. This Agreement shall be construed and enforced in accordance with the laws of the Federal District and State of Florida. Venue for all legal proceedings arising out of this Agreement shall be located only in the state or federal court with competent jurisdiction in Sarasota County, Florida.

| 9 | Page |

18. Notice. All notices which are required or may be given under this Agreement shall be in writing and shall be deemed to have been duly given when received if personally delivered; when transmitted if transmitted by telecopy or similar electronic transmission method; one working day after it is sent, if sent by recognized expedited delivery service; and five days after it is sent, if mailed, first class mail, certified mail, return receipt requested, with postage prepaid. In each case notice shall be sent to:

If to the Employee:

Hussein Abu Hassan, Individually

371 front St. West suite 220

Toronto, Ontario M5v-3S8

If to the Employer:

Walter J. Kostiuk, as Employer's CEO,

Director and Chairman of the Board of

Directors

5901 N. Honore Ave. Ste. 110

Sarasota, FL 34243

[Remainder of Page Intentionally Left Blank; Signature Page Follows]

| 10 | Page |

IN WITNESS WHEREOF, the parties hereto have executed this Agreement the day and year first above written.

EMPLOYER:

| /s/ Walter J. Kostiuk |  |

MobileBits Corporation

| BY: Walter J. Kostiuk , as Employer’s CEO, Director and Chairman of the Board Of Directors | ||

| STATE OF Florida | ) | |

| ) ss. | ||

| COUNTY OF Sarasota | ) | |

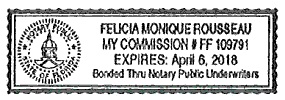

On this 21st day of April, 2014, before me personally came Walter Kostiuk, to me known, who being duly sworn, did depose and say, that he is the Chief Executive officer of Mobilebits Corporation, the corporation described in and which executed the foregoing instrument; and that he signed his name thereto by order of the Board of Directors of said corporation.

|

||

| Felicia Monique Rousseau | ||

| Notary Public | ||

| EMPLOYEE: _____________________ Hussein Abu Hassan, Individually |

|

|

11 | Page