Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - VERSAR INC | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - VERSAR INC | v388278_ex21.htm |

| EX-23 - EXHIBIT 23 - VERSAR INC | v388278_ex23.htm |

| EX-3.1 - EXHIBIT 3.1 - VERSAR INC | v388278_ex3-1.htm |

| EX-31.1 - EXHIBIT 31.1 - VERSAR INC | v388278_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - VERSAR INC | v388278_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - VERSAR INC | v388278_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - VERSAR INC | v388278_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

| For the fiscal year ended | Commission File |

| June 27, 2014 | No. 1-9309 |

(Exact name of registrant as specified in its charter)

| DELAWARE | 54-0852979 |

| (State or other jurisdiction of Incorporation or organization) | (I.R.S. employer identification no.) |

| 6850 Versar Center, Springfield, Virginia | 22151 |

| (Address of principal executive offices) | (Zip code) |

(703) 750-3000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Common Stock, $.01 par value

(Title of Class)

NYSE MKT

(Name of each exchange on which registered)

Securities registered pursuant to Section 12(g) of Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the Exchange Act).

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant as of December 27, 2013 was approximately $34,331,460 The number of shares of Common Stock outstanding as of September 2, 2014 was 9,715,844.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement to be filed with the Securities and Exchange Commission with respect to the 2014 Annual Meeting of Stockholders are incorporated by reference into Part III hereof.

PART I

Item 1. Business

Unless this report indicates otherwise the terms ”Versar,” the “Company,” “we,” “us,” and “our” refer to Versar, Inc. and its consolidated subsidiaries. Versar’s fiscal year end is based upon a 52 or 53 week year ending on the last Friday of the fiscal period and therefore does not close on a calendar month end. The Company’s fiscal years 2014 and 2012 included 52 weeks, while fiscal 2013 included 53 weeks.

Cautionary Statement Regarding Forward-Looking Statements

This report contains certain forward-looking statements that are based on current expectations. Actual results may differ materially. The forward-looking statements include, without limitation, those regarding the continued award of future work or task orders from government and private clients, cost controls and reductions, the expected resolution of delays in billing of certain projects, and the possible impact of current and future claims against the Company based upon negligence and other theories of liability. Forward-looking statements involve numerous risks and uncertainties that could cause actual results to differ materially, including, but not limited to, the possibility that the demand for the Company's services may decline as a result of possible changes in general and industry specific economic conditions and the effects of competitive services and pricing; the possibility that the Company will not be able to perform work within budget or contractual limitations; one or more current or future claims made against the Company may result in substantial liabilities; the possibility that the Company will not be able to attract and retain key professional employees; failure to recover at-risk contract costs; changes to or failure of the Federal, State, or local governments to fund certain programs in which the Company participates; changes in customer procurement policies and practices; delays in project funding; effects of U.S Government conflict of interest policies; loss of anticipated new contract vehicles either due to funding changes or competitive factors, and such other risks and uncertainties set forth in this report and in other reports and other documents filed by the Company from time to time with the Securities and Exchange Commission.

Business Overview

Versar, Inc. is a Delaware corporation incorporated in 1969. We are a global project management company providing sustainable value oriented solutions to government and commercial clients. We also provide tailored and secure engineering solutions in extreme environments and offer specialized abilities in staff augmentation, performance based remediation, and hazardous material management.

Fiscal year 2014 proved to be a challenging year for Versar. Although we saw an increase in revenue and successfully completed the acquisition and integration of Geo-Marine, Inc. (“GMI”) we experienced a decline in net income compared to fiscal year 2013. GMI was a strategic acquisition for Versar as its design, construction, and environmental expertise and customer base will allow the Company to expand its reach in terms of clients, technical capabilities, and geography in the near term. In addition, our balance sheet remains strong and is a reflection of our ability to continue to improve liquidity and manage working capital. Ongoing macro-economic issues, such as delays in finalizing the federal budget during calendar year 2013, resulted in slower and fewer contract awards across the federal government. However, this has caused an increased focus by our customers on the value of services provided. Both the commercial and government sectors are adjusting their needs to the new economic environment of constrained budgets and staffing and as a result are demanding greater productivity and value-oriented solutions from service providers.

Selling into this new economic environment has required increased emphasis on managing customer risk, whether that risk is related to construction oversight, as is the case with our work in Afghanistan and Iraq, or sustainability risk, as is the case with our commercial and U.S.-based government work. This economic environment has also driven significant investment in business development activities designed to provide customized responses to a customer’s value solution and sustainability needs. We have invested in new technologies to streamline processes and increase productivity and have realized economic and performance benefits from continued cost reduction efforts directed at our fixed and controllable expenses.

As a service-based company, our revenue is primarily derived through the provision of labor-based services, rather than capital-intensive product offerings. Our revenue opportunities are driven by our ability to retain existing clients as well as attract new ones, providing quality and responsive value-oriented project management at competitive rates, and identifying and retaining a qualified team of employees.

| 2 |

Business Segments

The company is aligned into three reportable segments: Engineering and Construction Management, Environmental Services, and Professional Services, all of which are described below.

Engineering and Construction Management (“ECM”)

This business segment performs Title I Design Services, Title II Construction Management Services, and Title III Construction Services, all of which are discussed further in the initial bullet below. This business segment also provides other related engineering and construction type services both in the United States and internationally. It provides national security solutions in several markets that have received funding priority and require ongoing services and support. Our services in this segment include the following:

| · | Title I Design Services entails a broad-range of expertise including master planning; land use planning; space utilization studies; requirements definition and scoping; programming; cost estimates; infrastructure and traffic planning; privatization studies, and other feasibility studies. Title II Construction Management Services involve construction oversight, inspection, job site evaluations, and construction documentation among other areas. Other related services include system optimization and commissioning, scheduling, and quality assurance/control. Title III Construction Services are actual construction services. Certain staff members in this business segment hold security clearances enabling Versar to provide services for classified construction efforts. |

| · | This segment consists of federal, state, local, international, and commercial clients. Examples of federal work include construction and construction management services for the U.S. Air Force (“USAF”) and U.S. Army, construction management and personal services including engineering, construction inspection, operations and maintenance and administrative support to the U.S. Army Corps of Engineers (“USACE”) and project and construction management services for the District of Columbia Courts and commercial customers. |

| · | Through ECM we continue to pursue the development of opportunities in energy/green initiatives in conjunction with the Environmental Services business segment. Our acquisition of GMI has expanded our capacity to provide energy related services. |

| Environmental Services (“ESG”) |

This business segment provides full service environmental solutions and includes our remediation and compliance, exposure and risk assessment, natural resources, unexploded ordnance (“UXO”)/military munitions response program (“MMRP”), air, greenhouse gas, energy, and cultural resources services. Clients include a wide-range of federal, state, and commercial agencies. Some examples include the following:

| · | We provide support to USACE, USAF, the U.S. Navy, and many local municipal entities assisting with environmental compliance, remediation, biological assessments, and natural resource management. This work includes performance-based remediation (“PBR”) contracts for United States Air Force Civil Engineer Center (“AFCEC”). |

| · | For more than 30 years, Versar has supported the states of Virginia, Maryland, New York, Pennsylvania and Delaware on a variety of different environmental projects. For example, we have supported the State of Maryland in the assessment of the ecological health and natural resources risk of the Chesapeake Bay. Versar continues to assess how the Delaware River is affected by dredging programs. We assist several counties in Maryland and Virginia with their watershed programs, identifying impaired watersheds and providing cost-effective solutions for their restoration programs. We provide energy feasibility review, measurement and verification to the State of New York. |

| · | ESG provides munitions response services at two of the world’s largest ranges including the National Training Center at Fort Irwin, California and one of the largest U.S. Air Force testing and training ranges. Our services include operational range clearance, operations and maintenance, and range sustainment services at both locations. |

| 3 |

| · | ESG is the prime contractor on three PBR Task Orders under Versar’s 2009 United States Air Force Worldwide Environmental Restoration and Construction (“WERC”) contract for AFCEC. Each of the three contracts provide multi-year environmental remediation programs focused on achieving site-specific performance objectives (outcomes) for numerous project sites on USAF facilities in the Southwest, Midwest and Northeast. We are also a key team member on a fourth PBR program for AFCEC providing similar services at Western USAF facilities. With the acquisition of GMI, this business segment has expanded its portfolio of clients to include the U.S. Navy and increased our Cultural Resources staff by more than five times and doubled our Natural Resources capabilities. |

| · | We have supported the U.S. Environmental Protection Agency for the past 30 years providing a wide-range of regulatory mandated services involving exposure assessment and regulatory review. |

Professional Services (“PSG”)

This business segment provides onsite environmental management, planning and engineering services to the U.S Department of Defense (“DoD”) and to the U.S. Department of Commerce. Versar’s provision of on-site services, or staff augmentation, serves to enhance the mission of the customer with subject matter experts fully dedicated to mission objectives. This segment serves government business by realigning two or more facilities management functions to establish a single entity and by supporting customers in areas where their capabilities and capacities are lacking.

| · | We provide expert services for the U.S. Army’s Net Zero energy, water, and solid waste program for certain U.S. Army installations. Net Zero energy means the installation produces as much energy/water/solid waste onsite as it uses. Our professionals facilitate strategic initiatives, develop implementation plans, conduct outreach, and apply technologies to deliver progress towards site-specific goals and objectives. |

| · | We have fielded installation restoration managers under the Defense Environmental Restoration Program to clean-up landfill and disposal sites throughout the nation. |

| · | Versar serves the DoD Joint Base communities with facility and utilities integration, National Environmental Policy Act considerations, water program management and wildlife program management. |

| · | We manage hazardous materials and waste for large quantity generator sites through application of green procurement philosophies and hazardous material control program concepts. |

| · | We provide staff augmentation ranging from field support of archaeological investigations to senior level advisors. Our archaeological and historic preservation professionals advise government officials regarding the protection of our nation’s cultural resources. |

| · | We provide biological and physical sciences support to the National Oceanic Atmospheric Administration to ensure efficiencies and accuracies in the lab environment. |

Revenue Earned by Geographic Location

Our consolidated gross revenue from continuing operations for fiscal year 2014 was $110.3 million, of which approximately $107.6 million was funded with U.S. currency and approximately $2.7 million of the remainder was derived from our subsidiary in the United Kingdom, Professional Protection Systems, Ltd. (“PPS”), and funded in pounds sterling. Approximately 30% of our fiscal year 2014 business was conducted in international locations.

Our consolidated gross revenue from continuing operations for fiscal year 2013 was $102.6 million, of which approximately $100.0 million was funded with U.S. currency and approximately $2.6 million of the remainder was derived from our PPS subsidiary in the United Kingdom and funded in pounds sterling. Approximately 39% of our fiscal year 2013 business was conducted in international locations.

Our Strategy

For several years, we have noted that ongoing macro issues have resulted in slower and fewer contract awards across the federal government. However, our increased focus and investment in business development and talent acquisition has allowed Versar to significantly increase both new orders and backlog. We continue to strongly believe that the Company’s capabilities and strengths align well with the future needs and demands of our clients. The federal government continues to fund areas that clearly align with Versar’s program management services – environmental remediation, sustainable firing range utilization/management, ongoing investments in military base efficiencies and renovation, and continued embracing of energy and environmental sustainability at US facilities around the world. The same is true at the state and local levels, where we are seeing increased levels of expenditure on infrastructure and environmental remediation. Internationally and commercially, we also see very strong alignment with our capabilities – increased awareness of the environment in lesser developed countries, renewed domestic construction and its associated project issues, increased natural resource extraction infrastructure demands in hazardous regions, as well as the United States’ continued presence in Afghanistan and other parts of the Middle East and South East Asia.

| 4 |

Specifically, the following four elements are driving our strategy:

| · | Pursuit of larger contract opportunities. Our move to large-business status, coincident with development of a stronger internal infrastructure and associated technologies, allows us to focus on pursuing larger prime contract opportunities. Strategic partnering, joint-ventures, and long-lead positioning coupled with Versar branding has the potential to provide increased growth and services. |

| · | Leveraging of our services. This will allow us to work efficiently in the new economic environment, whether through selling sustainable risk management services, utilizing our energy and environmental skill-sets or via effective use of our project and construction management skills in relation to complex project oversight. Expansion of our existing core capabilities in a broader and more comprehensive manner provides us with the understanding and insight necessary to reduce client risk. |

| · | Expanding our international footprint. While we are strong internationally specifically in the construction management business, incorporation of our construction and non-construction services into our overseas offerings should enable the transition of our proven domestic skills into the international market and will help us meet growing overseas client needs. |

| · | Geographic and client expansion through acquisition. We have an active acquisition strategy which is focused on expanding our ability to offer our technical services to both new geographic areas and new clients, such as the U.S. Navy and the U.S. Department of State. |

Competition

We face substantial competition in each line of business in which we operate as these areas become more crowded and price sensitive. Our competitors are often larger and have greater financial resources, requiring Versar to be selective in our marketing and sales efforts and more adept in developing strategic partnerships to enhance our competitive advantage. We also believe that our present size and diversified service offerings relative to the smaller, niche companies with which we also compete provide us with a competitive advantage.

Our business segments, consisting of ECM, ESG, and PSG, reflect a mix of business that we continue to believe will provide stability, while continuing to represent our core capabilities. Additionally, the combination of our core capabilities is an important selling feature as customers look for one source to meet their needs. We believe that we are competitive among the firms that combine environmental health and safety/risk assessment and engineering design and construction capability in one package because we have established relationships with a broad spectrum of teaming partners. Our acquisition of GMI and their technical capabilities has expanded our ability to deliver targeted capabilities in a full range of situations and we believe our recent contract wins demonstrate marketplace recognition of our unique portfolio of solutions. We are actively pursuing customers that require these combined services as we leverage our capabilities into the changing economic environment.

We continue to adjust our pricing structure to ensure that we remain competitive across all business segments, while remaining conscious of the need to drive overall corporate profitability. Similarly, we are concentrating our marketing efforts on maximizing our return on investment through expanding support for existing customers, developing tasks under existing contracts, and collaborating with firms that need our specialized expertise.

| 5 |

Backlog

We report “funded” backlog, which represents orders for goods and services for which we have received firm contractual commitments. Based on past experience, the Company believes that approximately 90% of funded backlog will be performed in the succeeding twelve-month period. However, no assurance can be given that we will ultimately realize our full backlog. Additionally, other companies with similar types of contracts to ours may not calculate backlog in the same manner we do, because their calculations are based on different subjective factors or because they use a different methodology. Therefore, information presented by us regarding funded backlog may not necessarily be comparable to similar presentations by others.

As of June 27, 2014, funded backlog was approximately $114 million, an increase of approximately 5% compared to approximately $108 million of funded backlog at the end of the fiscal year 2013. This increase reflects the award of several large long-term contracts and backlog contributed by GMI, and is indicative of the high quality proposals that were developed as a result of proposal preparation staff training and business development investments over the past several years.

Our proposal pipeline is strong with multiple large long-term contract proposals awaiting award results that hold the possibility for further increasing our backlog. We believe we will be able to further increase our backlog as a result of our continued strong proposal efforts and pipeline.

Employees

At June 27, 2014, we had approximately 450 full-time employees, of which seventy-five percent are engineers, scientists, and other professionals. 71% of our professional employees have a bachelor’s degree, 33% have a master’s degree, and 3% have a doctorate degree.

Item 1A. Risk Factors

Our line of credit contains, and our future debt agreements may contain, covenants that may restrict our ability to engage in activities that may be in our long-term best interest, including financing future operations or capital needs or engaging in other business activities, and that require us to maintain specific financial ratios or levels.

Our line of credit restricts, among other things, our ability and the ability of our subsidiaries to:

| · | incur additional debt; |

| · | pay dividends or distributions on our capital stock; |

| · | purchase, redeem or retire capital stock; |

| · | make acquisitions and investments; |

| · | create liens on our assets; |

| · | enter into certain transactions with affiliates; |

| · | merge or consolidate with another company; or |

| · | transfer or sell assets outside the ordinary course of business. |

In addition, our line of credit requires that we maintain compliance with certain financial ratios and levels, such as a minimum tangible net worth and a minimum current ratio. It is possible that these covenants may adversely impact our ability to finance our future operations or capital needs to pursue available business opportunities. Additionally, a failure to comply with any of these covenants could lead to a default under our line of credit which could result in an acceleration of indebtedness and prevent us from having access to the line of credit for future borrowings to fund our cash and working capital needs.

| 6 |

We are dependent on government contracts for the majority of our revenue, and a reduction or delay in spending by government agencies could adversely affect our business and operating results.

Contracts with agencies of the United States government and various state and local governments represented approximately 95% of our revenue in fiscal year 2014, with 5% of our revenue coming from commercial sources. Therefore, the majority of our revenue and the success of our business are materially dependent on contracts with governmental agencies. Companies engaged in government contracting are subject to certain unique business risks not shared by the general commercial sector. Among these risks are:

| · | a competitive procurement process with no firm schedule or guarantee of contracts being awarded; |

| · | competitive pricing pressure that may require reductions in costs in order to realize revenue under contracts; |

| · | award of work to competitors and not to us due to policy reasons; |

| · | dependence on congressional and state appropriations and administrative allotment of funds; |

| · | policies and regulations that can be changed at any time by governing bodies; |

| · | competing political priorities and changes in the political climate regarding funding and operations of the services; |

| · | shifts in buying practices and policy changes regarding the use of private contractors; |

| · | changes in and delays or cancellations of government programs or requirements; |

| · | government contracts that are usually awarded for relatively short periods of time and are subject to renewal options in favor of the government; and |

| · | many contracts with U.S. government agencies require annual funding and may be terminated at the agency’s discretion. |

The U.S. government contracting laws provide that the U.S. government can do business only with responsible contractors. Accordingly, U.S. government agencies have the authority under certain circumstances to suspend or debar a contractor from bidding on government contracts.

A reduction or shift in spending priorities by U.S. government agencies could limit or eliminate the continued funding of our existing government contracts or awards of new contracts or new task orders under existing contracts. These reductions or shifts in spending, if significant, could have a material adverse effect on our business.

Continued inability of the legislative and executive branches of the federal government to agree on a budget for key agencies or to enact appropriations in a timely manner has in past years delayed, and may in the future delay, the award of contracts. These delays, if significant, could have a material adverse effect on our operating results.

Our government contracts are subject to audit and potential reduction of costs and fees.

Contracts with the U.S. government and many other state and local governmental agencies are subject to audit by governmental agencies, which could result in the disallowance of certain costs and expenses. These audits can result in the disallowance of significant costs and expenses if the auditing agency determines, in its discretion, that certain costs and expenses were not warranted, allowable, or were excessive. Disallowance of costs and expenses, if pervasive or significant, could have a material adverse effect on our business.

As a government contractor, we are subject to a number of procurement laws and regulations; a violation of any such law or regulation could result in sanctions, contract termination, forfeiture of profit, harm to our reputation or loss of our status as an eligible government contractor.

We must comply with, and are affected by, federal, state and local laws and regulations regarding the formation, administration and performance of government contracts. These laws and regulations affect how we transact business with our government clients and, in some instances, impose additional costs on our business operations. Even though we take precautions to prevent and deter fraud, misconduct and non-compliance, we face the risk that our personnel or outside partners may engage in misconduct, fraud or improper activities. Government contract violations could result in the imposition of civil and criminal penalties or sanctions, contract termination, forfeiture of profit and/or suspension of payment, any of which could make us lose our status as an eligible government contractor and could cause our reputation to suffer serious harm. Loss of our status as an eligible government contractor would have a material adverse effect on our operations and financial condition.

| 7 |

Actual or perceived conflicts of interest may prevent us from being able to bid on or perform contracts.

U.S. government agencies have conflict of interest policies that may prevent us from bidding on or performing certain contracts. When dealing with U.S. government agencies that have such policies, we must decide, at times with insufficient information, whether to participate in the procurement process in light of the fact that such performance could preclude us from participating in a related procurement. We have, on occasion, declined to bid on particular projects because of actual or perceived conflicts of interest. We are likely to continue encountering such conflicts of interest in the future. Future conflicts of interest could cause us to be unable to secure key contracts with U.S. government customers.

Robust enforcement of environmental regulations is important to our financial success.

Our business is materially dependent on the continued enforcement by local, state and federal governments of various environmental regulations. From time to time, depending on political pressures, local, state and federal agencies relax environmental clean-up standards to promote economic growth and to discourage industrial businesses from relocating. Any relaxation in environmental and compliance standards could impact our ability to secure additional contracting work with such agencies or with other federal agencies that operate or manage contaminated property. Further, in a period of relaxed environmental standards, private industry may be less willing to allocate funds to consulting services designed to prevent or remediate environmental problems.

Many of our U.S. government customers procure goods and services through indefinite delivery / indefinite quantity (“ID/IQ”), government wide acquisition contract (“GWAC”) or GSA Schedule contracts under which we must compete for post-award orders.

Budgetary pressures and reforms in the procurement process have caused many U.S. government customers to purchase goods and services through ID/IQ, GSA Schedule contracts and other multiple award and/or GWAC contract vehicles. These contract vehicles increase competition and pricing pressure requiring us to make sustained efforts following the initial contract award to obtain ongoing awards and realize revenue. There can be no assurance that we will increase revenue or otherwise sell successfully under these contract vehicles. Our failure to compete effectively in this procurement environment could harm our business, financial condition, operating results and cash flows and our ability to meet our financial obligations.

If we fail to recover at-risk contract costs, we may have reduced fees or losses.

We are at risk for any costs we incur before a contract is executed, modified or renewed. A customer may choose not to pay us for these costs. While such costs are typically associated with specific anticipated contracts and funding modifications, we cannot be certain that our customers will execute these contracts or contract renewals or that they will pay us for all our related at-risk costs. If unrecovered at-risk costs are significant, we may experience a decline in contract margins or experience losses on certain contracts or in certain periods, resulting in reduced profitability.

We could face potential liability for failure to properly design remediation.

A part of our business involves the design and implementation of remediation at environmental clean-up sites. If we fail to properly design and build a remediation system or if someone claims that we did, we could face expensive litigation and potential settlement costs. If we failed to successfully defend against such a lawsuit, it could have a materially adverse effect on our business.

Environmental laws and regulations and our use of hazardous materials may subject us to significant liabilities.

Our operations are subject to U.S. federal, state and local environmental laws and regulations, as well as environmental laws and regulations in the various countries in which we operate. We are also subject to environmental laws and regulations relating to the discharge, storage, treatment, handling, disposal and remediation of regulated substances and waste products, such as radioactive, biochemical or other hazardous materials and explosives. We may incur substantial costs in the future because of: modifications to current laws and regulations; new laws and regulations; new guidance or new interpretation of existing laws or regulations; violations of environmental laws or required operating permits; or discovery of previously unknown contamination.

| 8 |

Our failure to properly manage projects may result in additional costs or claims.

Our engagements regularly involve complex and lengthy projects. The quality of our performance on such projects depends in large part upon our ability to manage the relationship with our clients, and to effectively manage the projects and deploy appropriate resources in a timely manner. If we miscalculate the resources or time required to complete a project with capped or fixed fees our operating results could be adversely affected. Further, any defects or errors, or failures to meet our client’s expectations, could result in claims for damages against us.

Our services expose us to significant risks of liability and it may be difficult to obtain or maintain adequate insurance coverage.

Our services involve significant risks of professional and other liabilities that may exceed the fees we derive from performance. Our business activities could expose us to potential liability under various laws and regulations and under workplace health and safety regulations. In addition, we sometimes may assume liability by contract under indemnification agreements. We are not able to predict the magnitude of any such liabilities.

We obtain insurance from third parties to cover our potential risks and liabilities. However, it is possible that we may not be able to obtain adequate insurance to meet our needs, may have to pay an excessive amount for the insurance coverage we want, or may not be able to acquire any insurance for certain types of business risks.

We are exposed to risks associated with operating internationally.

A large and increasing portion of our business is conducted internationally. Consequently, we are subject to a variety of risks that are specific to international operations, including the following:

| · | export regulations that could erode profit margins or restrict exports; |

| · | compliance with the U.S. Foreign Corrupt Practices Act; |

| · | compliance with the U.K Bribery Act; |

| · | the burden and cost of compliance with foreign laws, treaties and technical standards and changes in those regulations; |

| · | contract award and funding delays; |

| · | potential restrictions on transfers of funds; |

| · | foreign currency fluctuations; |

| · | import and export duties and value added taxes; |

| · | transportation delays and interruptions; |

| · | uncertainties arising from foreign local business practices and cultural considerations; and |

| · | potential military conflicts, civil strife and political risks. |

While we have and will continue to adopt measures to reduce the potential impact of losses resulting from the risks of our foreign business, we cannot ensure that such measures will be adequate.

Political destabilization or insurgency in the regions in which we operate may have a material adverse effect on our operating performance.

Certain regions in which we operate are highly politically unstable. Insurgent activities in the areas in which we operate may cause further destabilization in these regions. There can be no assurance that the regions in which we operate will continue to be stable enough to allow us to operate profitably or at all. During fiscal years 2014, 2013, and 2012, revenue generated from our operations in international locations, which included our reconstruction work in Iraq and Afghanistan, contributed 33%, 39%, and 36% of our revenue, respectively. We have been required to increase compensation to our personnel as an incentive to deploy them to many of these regions. To date, we have been able to recover this added cost under our contracts, but we may not be able to secure increases in contract payments to continue to recover all such costs in the future. To the extent that we are unable to transfer such increased compensation costs to our customers, our operating margins would be adversely impacted, which could adversely affect our operating performance. In addition, increased insurgent activities or destabilization, including civil unrest or a civil war in Iraq or Afghanistan, may lead to a determination by the U.S. government to halt our operations in a particular location, country or region and to perform the services we provide using military personnel.

| 9 |

Shifts in governmental priorities could potentially impact our contracts in certain regions.

In extreme circumstances, the U.S. government may decide to terminate all U.S. government activities, including our operations under U.S. government contracts in a particular location, country or region and to withdraw all military personnel. Any of the foregoing could severely affect our operating performance and may result in additional costs and expenses and loss of revenue.

If our partners fail to perform their contractual obligations on a project, we could be exposed to legal liability, loss of reputation or reduced profits.

From time to time, we enter joint venture agreements and other contractual arrangements with partners to jointly bid on and execute a particular project. The success of these joint projects depends in part on the satisfactory performance of the contractual obligations by our partners. If any of our partners fail to satisfactorily perform their contractual obligations, we may be required to make additional investments and provide additional services to complete projects, increasing our cost on those projects. If we are unable to adequately address a partner’s performance issues, then our client could terminate the joint project, exposing us to legal liability, loss of reputation or reduced profits.

We operate in highly competitive industries.

The markets for many of our services are highly competitive. There are numerous professional architectural, engineering, construction management, and environmental consulting firms, and other organizations that offer many of the same services offered by us. We compete with many companies that have greater resources than us and we cannot provide assurance that such competitors will not substantially increase the resources devoted to their business in a manner competitive with the services provided by us. Competitive factors include reputation, performance, price, geographic location and availability of technically skilled personnel. In addition, we face competition from the use by our clients of in-house environmental, engineering and other staff.

Our growth strategy includes acquisitions of other businesses, which may require us to incur costs and liabilities or have other unexpected consequences which may adversely affect our operating results and financial condition.

In addition to internal or organic growth, our current strategy involves growth through acquisitions of complementary businesses, as well as growth from acquisitions that would diversify our current service offerings. Like other companies with similar growth strategies, we may be unable to successfully implement our growth strategy, as we may not be able to identify suitable acquisition candidates, obtain acceptable financing, or consummate any future acquisitions. We frequently engage in evaluations of potential acquisitions and negotiations for possible acquisitions, certain of which, if consummated, could be significant to us. Although it is our general objective only to acquire those companies which will be accretive to both earnings and cash flow, any potential acquisitions may result in material transaction expenses, increased interest and amortization expense, increased depreciation expense and increased operating expense, any of which could have a material adverse effect on our operating results. Acquisitions may entail integration and management of the acquired businesses to realize economies of scale and control costs. In addition, acquisitions may involve other risks, including diversion of management resources otherwise available for ongoing development of our business and risks associated with entering new markets. Future acquisitions may also result in potentially dilutive issuances of securities. As a result of the consummation of acquisitions of other businesses, we may be subject to the risk of unanticipated business uncertainties or legal liabilities relating to those acquired businesses for which the sellers of the acquired businesses may not indemnify us. We may not realize the full anticipated benefit of any acquired business that has operated as a small business (as determined by the Small Business Administration based upon the North American Industry Classification Systems) if following their acquisition by us certain of their contracts are revoked or not renewed because they fail to continue to maintain small business status.

| 10 |

An economic downturn may have a material adverse effect on our business.

In an economic recession, or under other adverse economic conditions that may arise from natural or man-made events, customers and vendors may be less likely to meet contractual terms and payment or delivery obligations. In particular, if the U.S. government changes its operational priorities in Iraq and/or Afghanistan, reduces the DOD Operations and Maintenance budget, or reduces funding for Department of State initiatives in which we participate, our business, financial condition and results of operations could be severely affected.

Our quarterly and annual revenue, expenses and operating results may fluctuate significantly, which could have a negative effect on the price of our common stock.

Our quarterly and annual revenues, expenses and operating results have and may continue to fluctuate significantly because of a number of factors, including:

| • | the seasonality of the spending cycle of our public sector clients, notably the U.S. government, and the spending patterns of our private sector clients; |

| • | the hiring and utilization rates of employees in the United States and internationally; |

| • | the number and significance of client engagements commenced and completed during the period; |

| • | the delays incurred in connection with an engagement because of weather or other factors; |

| • | the ability to work within foreign countries’ regulations, tax requirements and obligations; |

| • | the business, financial, and security risks related to working in foreign countries; |

| • | the ability of clients to terminate engagements without penalties; |

| • | the creditworthiness and solvency of clients; |

| • | the size and scope of engagements; |

| • | the delay in federal, state and local government procurements; |

| • | the ability to perform contracts within budget or contractual limitations; |

| • | the timing of expenses incurred for corporate initiatives; |

| • | any threatened or pending litigation matters; |

| • | periodic reductions in the prices of services offered by our competitors; |

| • | the likelihood of winning the re-bids of our existing large government contracts; |

| • | the general economic and political conditions; |

| • | the loss of a major contract or the shutdown of a major program; |

| • | the volatility of currencies in foreign countries; and |

| • | the integration of any acquisition or the ability of an acquired business to continue to perform as in the past. |

Variations in any of these factors could cause significant fluctuations in our operating results from quarter to quarter and could result in net losses and have a material adverse effect on our stock price.

We are highly dependent on key personnel and our business could suffer if we fail to continue to attract, train and retain skilled employees.

Our business is managed by a number of key management and operating professional personnel. The loss of key personnel could have a material adverse effect on the Company.

Availability of highly trained and skilled professional, administrative and technical personnel is critical to our future growth and profitability. Even in the current economic climate, competition in our industry for scientists, engineers, technicians, management and professional personnel is intense and competitors aggressively recruit key employees. Competition for experienced personnel, particularly in highly specialized areas, has occasionally made it more difficult for us to timely meet all our staffing needs. We cannot be certain we will be able to continue to attract and retain required staff. Any failure to do so could have a material adverse effect on our business, financial condition, operating results and our ability to meet our financial obligations. Failure to recruit and retain a sufficient number of these employees could adversely affect our ability to maintain or grow our business. Some of our contracts require us to staff a program with personnel the customer considers key to successful performance. If we cannot provide these key personnel or acceptable substitutes, the customer may terminate the contract, and we may not be able to recover our costs.

| 11 |

In order to succeed, we will have to keep up with a variety of rapidly changing technologies. Various factors could affect our ability to keep pace with these changes.

Our success will depend on our ability to keep pace with changing technologies which can occur rapidly in our core business segments. We may incur significant expense in order to update our technologies, which could have a material adverse effect on our margins and results of operations. Even if we keep up with the latest developments and available technology, newer services or technologies could negatively affect our business.

Our employees may engage in misconduct or other improper activities, which could harm our business.

Like all companies, we are exposed to the risk of employee fraud or other misconduct. Employee misconduct could include intentional failures to comply with U.S. government procurement regulations, unauthorized activities, attempts to obtain reimbursement for improper expenses, or submission of falsified time records. Employee misconduct could also involve improper use of our customers’ sensitive or classified information, which could result in regulatory sanctions against us. Negative press reports regarding employee misconduct could harm our reputation with the government agencies with which we work. If our reputation with these agencies is negatively affected, or if we are suspended or debarred from contracting with government agencies for any reason, our future revenues and growth prospects would be adversely affected. It is not always possible to deter employee misconduct, and the precautions we take to prevent and detect this activity may not be effective in controlling unknown or unmanaged risks or losses, which could harm our business, financial condition, operating results and our ability to meet our financial obligations.

Internal system or service failures could disrupt our business and impair our ability to effectively provide our services and products to our customers, which could damage our reputation and adversely affect our revenue, profitability and operating results.

Our information technology systems are subject to systems failures, including network, software or hardware failures, whether caused by us, third-party service providers, intruders or hackers, computer viruses, natural disasters, power shortages or terrorist attacks. Any such failures could cause loss of data and interruptions or delays in our business, cause us to incur remediation costs, subject us to claims and damage our reputation. Failure or disruption of our communications or utilities could cause us to interrupt or suspend our operations or otherwise adversely affect our business. Any system or service disruptions if not anticipated and appropriately mitigated could have a material adverse effect on our business including, among other things, an adverse effect on our ability to bill our customers for work performed on our contracts, collect the amounts that have been billed and produce accurate financial statements in a timely manner. Our property and business interruption insurance may be inadequate to compensate us for all losses that may occur as a result of any system or operational failure or disruption and, as a result, our results of operations could be materially and adversely affected. Versar is investing in systems that will allow it to achieve and remain in compliance with the regulations governing its business; however, there can be no assurance that such systems will be effective at achieving and maintaining compliance or that we will not incur additional costs in order to make such systems effective.

Item 2. Properties

Our corporate executive office is located in Springfield, Virginia, which is a suburb of Washington, D.C. Versar currently leases 40,507 square feet from Springfield Realty Investors, LLC. The rent is subject to two percent escalation per year through December 31, 2021.

As of June 27, 2014, we had under lease an aggregate of approximately 175,000 square feet of office and manufacturing space in the following locations (parenthetical reference of business segments using space): Dulles (ECM), Springfield (all segments), Hampton (ESG) and Virginia Beach (PSG), VA; Chandler, AZ (ESG); Sacramento, CA (ESG); Westminster, CO (all segments); Aiea, HI (ECM); Louisville, KY (ESG); Columbia (ESG), and Germantown, MD (ESG); Charleston, SC (ESG); Knoxville, TN (ECM), Plano. San Antonio (ESG) and El Paso, TX (ESG); Clark Air Force Base (ECM), Makati City (ECM), the Republic of Philippines; Milton Keynes, U.K. (ECM and ESG); and Abu Dhabi (ECM and ESG), United Arab Emirates. The lease terms primarily range from two to six years.

| 12 |

Item 3. Legal Proceedings

Versar and its subsidiaries are parties from time to time to various legal actions arising in the normal course of business. We believe that any ultimate unfavorable resolution of any current ongoing legal actions will not have a material adverse effect on its consolidated financial condition and results of operations.

EXECUTIVE OFFICERS OF THE REGISTRANT

The current executive officers of Versar, their ages as of August 29, 2014, their current offices or positions and their business experience for at least the past five years are set forth below.

| NAME | AGE | POSITION(S) WITH THE COMPANY | ||

| Anthony L. Otten | 58 | Chief Executive Officer | ||

| Jeffrey A. Wagonhurst | 66 | President and Chief Operating Officer | ||

| Cynthia A. Downes | 53 | Executive Vice President, Chief Financial Officer, Treasurer and Principal Accounting Officer | ||

| James D. Villa | 51 | Senior Vice President, General Counsel, Secretary and Corporate Compliance Officer | ||

| Linda McKnight | 65 | Senior Vice President of Business Development | ||

| Jeffrey M. Moran | 51 | Senior Vice President, Environmental Services Group | ||

| Rob Biedermann | 53 | Senior Vice President of Engineering and Construction Management | ||

| Wendell Newton | 56 | Senior Vice President of Professional Services |

Anthony L. Otten, BS, MPP, joined Versar as Chief Executive Officer (“CEO”) in February of 2010. Prior to becoming CEO, he had served on Versar's Board of Directors for two years as an independent board member. Mr. Otten served as Managing Member of Stillwater, LLC from July 2009 to February 2011, as an Operating Partner of New Stream Asset Funding, LLC from 2007 to June 2009 and Managing Member of Stillwater, LLC from 2004 to 2007. Mr. Otten has a Bachelor of Science degree from the Massachusetts Institute of Technology and a Masters in Public Policy from Harvard’s Kennedy School of Government.

Jeffrey A. Wagonhurst, MBC, MBA, joined Versar in February 1999 as an Army Program Manager. In 2001, he was elected Vice President of Human Resources and Facilities. In September 2006, he was elected Senior Vice President to lead our former Program Management business unit (now ECM). In May 2009, Mr. Wagonhurst was promoted to Executive Vice President, Program Management Group. In February 2010, Mr. Wagonhurst was promoted to President and Chief Operating Officer of Versar. Mr. Wagonhurst concluded his 30 year career with the U.S. Army and retired in May 1997 as a Colonel. He commanded a Combat Engineer Brigade and Battalion during his service as well as previously serving as a Deputy District Commander of the Mobile District, U.S. Army Corps of Engineers.

Cynthia A. Downes, BS, MBA, CPA, joined Versar in April 2011 as Executive Vice President, Chief Financial Officer, Treasurer, and Principal Accounting Officer. From April 2009 to April 2011 Ms. Downes was Vice President and Chief Financial Officer of Environmental Design International, an engineering firm, based in Chicago, specializing in environmental and civil engineering. From January 2007 to April 2009, she was Vice President of Finance of GDI Advanced Protection Solutions and from 2005 to 2007, she was a consultant at Huron Consulting Group, Inc. Ms. Downes also spent 15 years at Tetra Tech, ultimately serving as Vice-President and Chief Financial Officer of Tetra Tech, EM Inc.

| 13 |

James D. Villa, B.A. J.D., joined Versar in March 2014 as Senior Vice President, General Counsel, Secretary, and Corporate Compliance Officer. From 2011 to 2014, he served as Vice President and General Counsel of Colonial Parking, Inc. From 2006 to 2010, he served as Vice President and Chief Counsel of AOL, Inc., where he had responsibility for litigation and regulatory matters. Prior to joining AOL, Mr. Villa was a Trial Attorney in the Antitrust Division of the United States Department of Justice and also served as a Special Assistant United States Attorney in the Eastern District of Virginia. Mr. Villa was in private practice with several different law firms in Washington, D.C. prior to joining the Department of Justice. Mr. Villa served as a Captain in the United States Army Reserve and served in Saudi Arabia and Kuwait in support of Operations Desert Shield and Desert Storm. He has a Bachelor of Arts degree from the University of Michigan and a Juris Doctor degree from the University of Michigan Law School.

Linda M. McKnight, AA, joined Versar in April 2013 as Director of Business Development. In May of 2013, she was elected as Senior Vice President in charge of business development and strategy. Ms. McKnight has more than 29 years' of experience in sales and marketing for environmental, engineering, construction, and logistics services in both domestic and international markets. She has held senior management sales positions with Tetra Tech and Kellogg Brown & Root (KBR) over the past 24 years. From 2010 to 2013, she provided business development consulting to firms focused on enhancing internal sales processes to grow environmental and engineering services to federal clients. Ms. McKnight is a Fellow and active member in the Society of American Military Engineers and serves on the Board of the Society's Academy of Fellows. She is the Immediate Past President of Women in Defense, Capital Chapter.

Jeffrey M. Moran, BS, PE, joined Versar in May 2009 as a Senior Vice President for Versar’s Environmental Services Group (previously Compliance and Environmental Programs business segment). Mr. Moran brings more than 25 years of experience to Versar that includes management and technical positions as an engineering consultant. He is a Civil Engineer registered in the states of Maryland and Virginia and the District of Columbia. Mr. Moran is also active in the Society of American Military Engineers where he has held various executive posts with the Northern Virginia Chapter and the Mid-Atlantic Region. He also completed a management program at Harvard Business School in 2012.

Rob A. Biedermann, BS, MS, joined Versar in May of 2010 serving as the Afghanistan In-Country Program Manager. In July 2011, he was assigned as the Program Manager for Versar’s Tooele Chemical Demilitarization Project completing the project and demobilization in June 2012. In July 2012, Mr. Biedermann was appointed Vice President and assumed responsibility for Domestic Operations of the Engineering and Construction Management Group. Mr. Biedermann was elected to Senior Vice President in August 2013. He served in the US Army for 12 years departing in 1997 as a Corps of Engineers Major having served in Operations Desert Shield and Storm while assigned to the 249th Engineer Combat Battalion (Heavy), the 101st Airborne Division (Air Assault), the 555th Combat Engineer Group and Mobile District, US Army Corps of Engineers. He served as the Construction Operations Manager and General Manager for JB Rodgers | Kinetics from June of 1997 to March of 2003 managing revenues up to $210 million. From 2003 to 2010, Mr. Biedermann served as the Chief Operating Officer and President of JB Henderson Construction, Inc. of Albuquerque, NM managing operations with revenues of up to $100 million. From October 1998 to March 2010, he was a Labor Arbitrator for the Sheet Metal and Air Conditioning Contractor’s National Association and elected as an Executive Board Member in October, 2008.

Wendell Newton, BS, joined Versar in July 2014 as Senior Vice President of the Professional Services Group. From February 1999 to July 2014, Mr. Newton was the Executive Vice President, Chief Operating Officer and one of the three shareholders of J.M. Waller Associates, Inc. Mr. Newton brings more than twenty-five years of experience in leadership and management in the areas of contracts, operations, finance, project management, human resources, and business development. During his 15 year tenure with J.M. Waller, Mr. Newton was responsible for the executive leadership of the national environmental, facilities and logistics consulting and management groups. He served as senior-level management and provided oversight of environmental and compliance projects as well as projects involving development of facility requirements, master plans, land use and infrastructure plans. He developed and executed capital resource management plans including division and group annual budgets and the management of the technical services support staff. Mr. Newton also served as Vice President for J.M. Waller's Operations Division managing the company's professional services resources world-wide and providing oversight to nearly 300 engineering, scientific, management and professional support staff who serve J. M. Waller's federal client base.

| 14 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Common Stock

Our common stock is traded on the NYSE MKT (formerly NYSE Amex) under the symbol VSR. At August 18, 2014, the Company had 889 stockholders of record, excluding stockholders whose shares were held in nominee name. The quarterly high and low sales prices as reported on the NYSE MKT during fiscal years 2014 and 2013 are presented below.

| Fiscal Year 2014 | High | Low | ||||||

| 4th Quarter | 4.08 | 3.13 | ||||||

| 3rd Quarter | 5.10 | 3.60 | ||||||

| 2nd Quarter | 5.17 | 4.08 | ||||||

| 1st Quarter | 5.65 | 4.03 | ||||||

| Fiscal Year 2013 | High | Low | ||||||

| 4th Quarter | $ | 4.64 | $ | 4.06 | ||||

| 3rd Quarter | 4.77 | 3.85 | ||||||

| 2nd Quarter | 4.24 | 3.38 | ||||||

| 1st Quarter | 3.64 | 2.95 |

No cash dividends have been paid by Versar since it began public trading of its stock in 1986. The Board of Directors intends to retain any future earnings for use in our business and does not anticipate paying cash dividends in the foreseeable future. Under the terms of our revolving line of credit, approval would be required from our primary bank for the payment of any dividends. We have established equity compensation plans to attract, motivate and reward good performance of high caliber employees, directors and service providers serving Versar and its affiliates. Currently, there are four stock option plans under which options remain outstanding, which were previously approved by the stockholders: the 2010 Stock Incentive Plan, the 2005 Stock Incentive Plan, the 2002 Stock Incentive Plan and the 1996 Stock Option Plan. We do not maintain any equity compensation plans not approved by our stockholders.

Equity Compensation Plan Information

| Plan Category | Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans, excluding securities reflected in column (a) (c) | |||||||||

| Equity compensation plans approved by security holders | 22,000 | $ | 4.20 | 619,115 | ||||||||

| 15 |

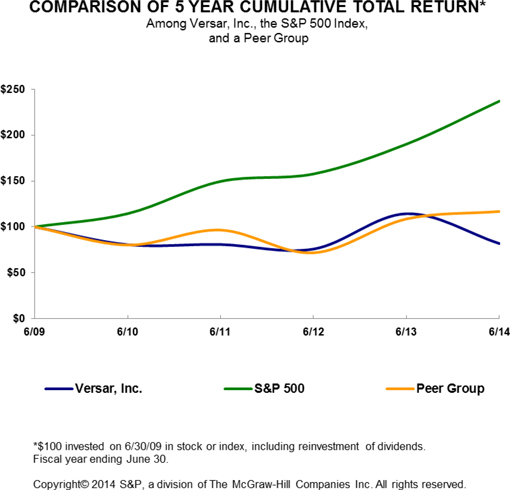

The graph below matches Versar, Inc.'s cumulative 5-Year total shareholder return on common stock with the cumulative total returns of (i) the S&P 500 index and (ii) a customized peer group of five companies comprised of Aecom Technology Corp., Arcadis, NV, Ecology & Environment Inc., TRC Companies Inc. and URS Corp. The graph tracks the performance of a $100 investment in our common stock, in each of the peer groups, and the index (with the reinvestment of all dividends) from 6/30/2009 to 6/30/2014.

The stock price performance included in this graph is not necessarily indicative of future stock price performance.

| 16 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations is provided to enhance the understanding of, and should be read together with, our consolidated financial statements and the notes to those statements that appear elsewhere in this Annual Report on Form 10-K. This discussion contains forward-looking statements that involve risks and uncertainties. Unless otherwise specifically noted, all years refer to our fiscal years which ended on June 27, 2014, June 28, 2013 and June 29, 2012.

Financial Trends

On October 1, 2013, the beginning of our second quarter of fiscal year 2014, non-essential functions of the U.S. Government temporarily shut down because Congress failed to pass legislation providing appropriations authority for the government to continue to operate for the U.S. Government’s fiscal year 2014. Between October 1 and October 16, 2013, there was no funding of federal agencies or programs, either by discretionary funding through annual appropriations acts or interim continuing resolutions (CRs). Subsequently, on October 16, 2013, Congress passed a CR funding measure to finance all U.S. Government activities through January 15, 2014 and raised the debt ceiling through February 7, 2014. Under this continuing resolution, partial-year funding was available at prior year levels, subject to certain restrictions, but new spending initiatives were not authorized.

On December 10, 2013, the U.S. Government reached a two-year budget agreement known as the Bipartisan Budget Agreement of 2013 (“BBA”). The BBA provides budget guidance through the U.S. Government’s fiscal year 2015, restores certain projected reductions, and eliminates sequestration for two years. The BBA does not address core fiscal issues, long-term debt issues, or deficit issues, and it does not appropriate funds. It appears that the U.S. Government will continue to face substantial fiscal and economic challenges that affect funding for certain projects, and as a result, we expect the U.S. government services market will continue to contract from historic annual levels.

Despite the appropriations resolution resulting from the BBA, the Company has not yet seen the expected increase in project funding, although we do expect more money will be provided by the end of September. During fiscal year 2014, we continued to enhance our positioning to identify and win more contracts, through the combination of leveraging the capabilities that GMI has brought the Company and improving our contract bidding strategies. However, although GMI contributed significant revenue during the fiscal year, it was not enough to counter the influence that delayed funding has had on contract activity in other parts of our business. The contribution from GMI and other company efforts have resulted in enhanced backlog and a healthy pipeline. We have managed costs to counter some of the margin pressure associated with the slowdown, such as shutting down the Company’s office in Knoxville, TN. While we have been very proactive in managing costs in the business, there is a level of costs, much of it fixed, that must be maintained and that will be covered as revenues increase with an improved funding environment.

Our business performance is affected by the overall level of U.S. Government spending and the alignment of our offerings and capabilities with the budget priorities of the U.S. Government. The U.S. Government budget deficit and the national U.S. debt have created pressure to examine and reduce spending across all federal agencies. Baseline spending for the DoD for the next 10 years has been reduced and there may be further reductions. Adverse changes in fiscal and economic conditions, such as the manner in which spending reductions are implemented, including sequestration, future government shutdowns, and issues related to the nation’s debt ceiling, could materially impact our business.

In this challenging economic environment, we focus on those opportunities where the U.S. Government continues funding and which clearly align with Versar’s customers, such as sustainable range management, UXO, PBR, and construction contract management. We also continue to focus on areas that we believe offer attractive enough returns to our clients that they will continue to fund efforts, such as construction type services both in the U. S. and internationally, improvements in energy efficiency, and facility upgrades.

| 17 |

Specifically, we see the following four elements driving our strategy going forward:

| · | Pursuit of larger contract opportunities. Our move to a large business, coincident with continued development of a strong internal infrastructure and associated technologies, allows us to focus on pursuing larger prime contracts and expand our pool of opportunities. We continue to strengthen our relationships with other contractors to create teaming arrangements that better serve our clients. Where we have seen a shift in focus to contracts for qualified small businesses, we are strengthening and developing relationships with such businesses so we can enhance our opportunity to capture some of this work. |

| · | Leveraging of our services. The combination of our multiple skill sets and broad service offerings will allow us to work efficiently in the new economic environment whether selling sustainable risk management services utilizing our energy and environmental skill-sets, or via effective use of our project and construction management skills in relation to complex project oversight. |

| · | Expanding our international footprint. While the Company is strong internationally in the construction management business, incorporation of our non-construction services into our overseas client base will allow for replication of our proven domestic skills into the international market and will help us meet growing overseas client needs. |

| · | Geographic and client expansion through acquisition. We have an active acquisition strategy and are focused on expanding our ability to offer our technical services to both new geographic areas and new clients, such as the U.S. Navy and the U.S. Department of State, through the acquisition of complementary businesses. |

We believe that Versar’s business segments have the expertise to identify and respond to the challenges raised by the global economic issues we face and that we are positioned in the coming year to address these concerns. However, we expect to continue to sub-contract a greater percentage of our services to expand our ability to offer a broader set of capabilities to the market. As a result, we anticipate that we will continue to experience a compression of our gross margins due to sub-contracting costs over the near term.

On July 1, 2014, we announced our acquisition of J.M. Waller Associates, Inc, (“JMWA”), a Service Disabled Veteran Owned Small Business (SDVOSB) with more than $30 million in annual revenues. The acquisition price of $13 million will be satisfied with cash and a seller note. JMWA, which is expected to be accretive to earnings in year one and adds contracted backlog of over $25 million, represents another step in our efforts to expand our growth opportunities and complement of service offerings. Key long-term clients include the U.S. Army Corps of Engineers, U.S. Air Force, U.S. Navy, Environmental Protection Agency, and the General Services Administration.

Our business operates through the following three business segments: ECM, ESG, and PSG. These segments are segregated based on the nature of the work, business processes, customer bases and the business environment in which each of the segments operates.

There are risk factors or uncertainties that could significantly impact our future financial performance. A sample of these risks is listed below. For a complete discussion of these risk factors and uncertainties refer to Item 1A. Risk Factors, herein.

| • | We operate in highly competitive industries; |

| • | A reduction or delay in pending awards by government agencies could adversely affect us; |

| • | Our inability to win or renew government contracts could adversely affect us; |

| • | We are exposed to risks associated with operating internationally; |

| • | Our failure to properly manage projects may result in additional costs or claims; |

| • | An economic downturn may adversely affect our business; |

| • | In order to succeed we need to keep up with a variety of rapidly changing technologies; |

| • | We are highly dependent on key personnel; |

| • | Future acquisitions may not go as expected and may have unexpected costs and consequences; and |

| • | The government may adopt new contract laws or regulations at any time. |

| 18 |

Consolidated Results of Operations

The table below sets forth our consolidated results of continuing operations for the fiscal years ended June 27, 2014, June 28, 2013, and June 29, 2012.

| For the Fiscal Year Ended | ||||||||||||

| June 27, 2014 | June 28, 2013 | June 29, 2012 | ||||||||||

| (dollars in thousands) | ||||||||||||

| GROSS REVENUE | $ | 110,280 | $ | 102,622 | $ | 114,970 | ||||||

| Purchased services and materials, at cost | 55,108 | 44,070 | 51,531 | |||||||||

| Direct costs of services and overhead | 48,438 | 44,865 | 46,988 | |||||||||

| GROSS PROFIT | $ | 6,734 | $ | 13,687 | $ | 16,451 | ||||||

| Gross Profit percentage | 6 | % | 13 | % | 14 | % | ||||||

| Selling general and administrative expenses | 8,390 | 7,603 | 8,083 | |||||||||

| Other operating income | (1,596 | ) | (182 | ) | 199 | |||||||

| Goodwill Impairment | 1,381 | - | - | |||||||||

| OPERATING (LOSS) INCOME, FROM CONTINUING OPERATIONS | (1,441 | ) | 6,266 | 8,169 | ||||||||

| OTHER (INCOME) EXPENSE | ||||||||||||

| Write-offs of uncollectible financing receivable | - | - | 694 | |||||||||

| Interest income | (15 | ) | (28 | ) | (70 | ) | ||||||

| Interest expense | 133 | 86 | 182 | |||||||||

| (LOSS) INCOME BEFORE INCOME TAXES, FROM CONTINUING OPERATIONS | $ | (1,559 | ) | $ | 6,208 | $ | 7,363 | |||||

| Income (Loss) from discontinued operations before income taxes | 317 | (2,751 | ) | (463 | ) | |||||||

| (LOSS) INCOME BEFORE INCOME TAXES | $ | (1,242 | ) | $ | 3,457 | $ | 6,900 | |||||

Fiscal Year 2014 Compared to Fiscal Year 2013

Gross revenue for fiscal year 2014 was $110.3 million, an increase of 7% compared to $102.6 million during the 2013 fiscal year. Additional revenue of $13.5 million contributed by GMI was partially off-set by decreases in revenue associated with our Title II work in Afghanistan and the completion of several programs within PSG. We have seen a decline in our contract positions within PSG largely due to the continued shift to more contract solicitations being targeted at businesses that qualify for small business programs. As a result, we continue to seek new ways to develop our relationships with firms qualified for these programs to increase our ability to capture more of this work and maintain current projects. Additionally, while JMWA acquired on July 1, 2014 will contribute revenue to all three of our reporting segments, we expect it to significantly contribute to the revenues of the PSG segment.

Purchased services and materials for fiscal year 2014 was $55.1 million, an increase of 25% compared to $44.0 million during the 2013 fiscal year. We continue to sub-contract a greater percentage of our services to expand our ability to offer a broader set of capabilities to market.

| 19 |

Direct costs of services and overhead for fiscal year 2014 were $48.4 million, an increase of 8% compared to $44.9 million during the 2013 fiscal year. This increase was primarily due to additional costs associated with GMI.

Gross profit from continuing operations for fiscal year 2014 was $6.7 million, a decrease of 51% compared to $13.7 million during the 2013 fiscal year. The majority of this decrease was due to the reduction in gross profit related to our Title II work in Afghanistan, which is anticipated to terminate during fiscal year 2015. In addition, purchased services, as a percentage of contract revenue, increased to 50%, compared to 43% during fiscal year 2013. As we continue to sub-contract a greater percentage of our services to expand our ability to offer a broader set of capabilities to market, we continue to see a compression of our gross margins. In the current business environment we expect a continued need to market a broader set of services, and thus expect to continue to experience compressed gross margins in the near term.

Selling, general and administrative expenses for fiscal year 2014 were $8.4 million, an increase of 10% compared to $7.6 million during the 2013 fiscal year. This increase was due to approximately $0.1 million related to integration costs associated with the acquisition of GMI, $0.4 million in reserves related to the shutdown of our Knoxville office, $0.3 million expense as a result of a change in California’s workers compensation classification code, an additional $0.1 million in fourth quarter reserves for doubtful accounts, and $0.1 million related to the acquisition of JMWA shortly after the end of the fiscal year. These increases were partially offset by $0.2 million from management’s continued efforts to control costs, such as rent reductions, updating paid time off policies, and temporary furloughs during fiscal 2014.

Other operating income for fiscal year 2014 was $1.6 million, compared to $0.2 million during the 2013 fiscal year. Fiscal year 2014 other operating income resulted from the reversal of certain liabilities that were previously recorded relating to the two contingent notes payable as additional consideration for the GMI acquisition. In accordance with ASC 805 Business Combinations, as we continued to examine the historical and forecasted revenues and operations attributable to GMI during the fourth quarter, we concluded that there was a less than probable likelihood that GMI would, within the measurement period, win the proposal that was a condition to earn the first of the two contingent notes and a less than probable likelihood that operations would achieve the revenue targets required to earn the second of the two contingent notes.