Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MERCER INTERNATIONAL INC. | d786371d8k.htm |

RBC Capital

Markets’ Global Industrials Conference

September 10, 2014

Exhibit 99.1 |

2

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Forward Looking Statements

The

Private

Securities

Litigation

Reform

Act

of

1995

provides

a

“safe

harbor”

for

forward-looking

statements.

Certain

information

included

in

this

presentation

contains

statements

that

are

forward-looking,

such

as

statements

relating

to

results

of

operations

and

financial

conditions

and

business

development

activities,

as

well

as

capital

spending

and

financing

sources.

Such

forward-looking

information

involves

important

risks

and

uncertainties

that

could

significantly

affect

anticipated

results

in

the

future

and,

accordingly,

such

results

may

differ

materially

from

those

expressed

in

any

forward-looking

statements

made

by

or

on

behalf

of

Mercer.

For

more

information

regarding

these

risks

and

uncertainties,

review

Mercer’s

filings

with

the

United

States

Securities

and

Exchange

Commission.

Unless

required

by

law,

we

do

not

assume

any

obligation

to

update

forward-looking

statements

based

on

unanticipated

events

or

changed

expectations. |

3

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Mercer International Inc. |

4

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

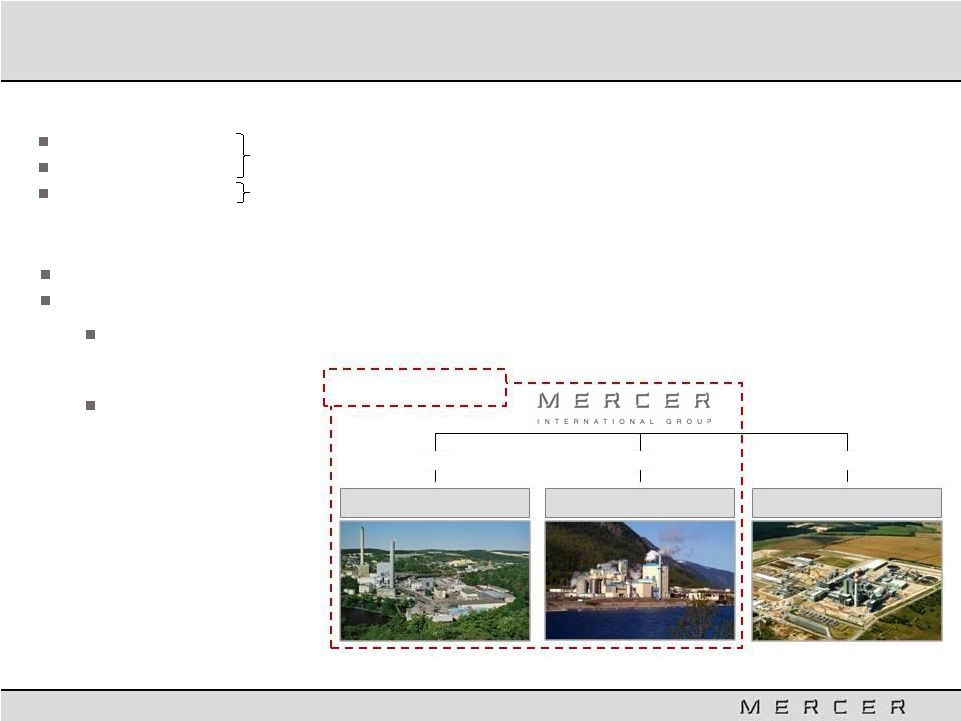

Corporate Structure

(1)

Pursuant to the terms of its 2017 Senior Notes

Mercer conducts operations through three subsidiaries:

100%

Celgar -

BC, Canada

100%

Rosenthal -

Germany

83%

Stendal

-

Germany

Restricted Group

520,000 ADMT + 100 MW

360,000 ADMT + 57 MW

660,000 ADMT + 148 MW

the only two NBSK market pulp mills in Germany, which is Europe’s largest market for

NBSK pulp one of the largest, most modern pulp mills in North America

Debt is 80%

guaranteed by the

German government

Non-recourse to the

Restricted Group

Rosenthal –

Germany

Stendal –

Germany

Celgar –

BC, Canada

The Restricted Group is supported by the Celgar and Rosenthal operations

The Unrestricted Group is supported by the Stendal operation

The Corporation is divided into the “Restricted Group” and the “Unrestricted

Group” – a structure created to facilitate

the

acquisition

of

Celgar

through

the

issue

of

senior

notes

(1) |

5

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

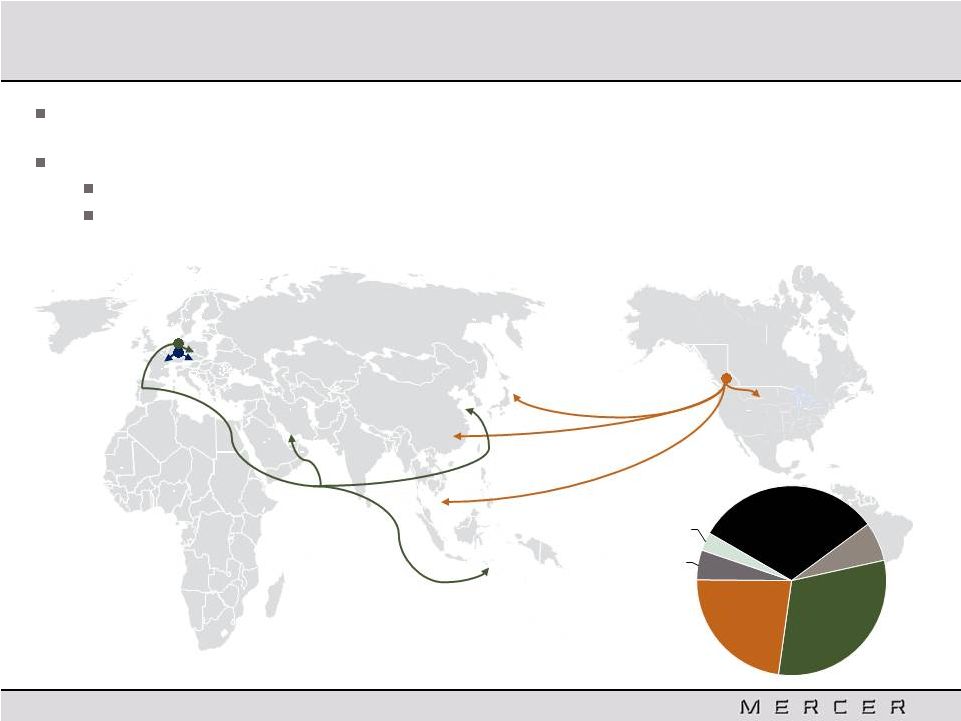

Strategically Located Mills with Access to Global Markets

Celgar

(B.C., Canada)

520,000 ADMT

United

States

Stendal

(Germany)

660,000 ADMT

Rosenthal

(Germany)

360,000 ADMT

Indonesia

China

Thailand

Middle

East

Europe

Japan

Mercer’s three mills have a combined annual capacity of 1.54 million air dried metric

tonnes (“ADMT”) of NBSK pulp production

and 305 MW of electrical generation

The mills’

strategic locations position the company well to serve customers in Europe, North America and

Asia China

–

the

world’s

largest

and

fastest

growing

pulp

import

market

Germany

–

the

largest

European

pulp

import

market

Germany

31%

Italy

7%

China

31%

Other

European

Union

23%

Other Asia

5%

North

America

3%

Mercer 2013 Pulp Sales by Region |

6

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

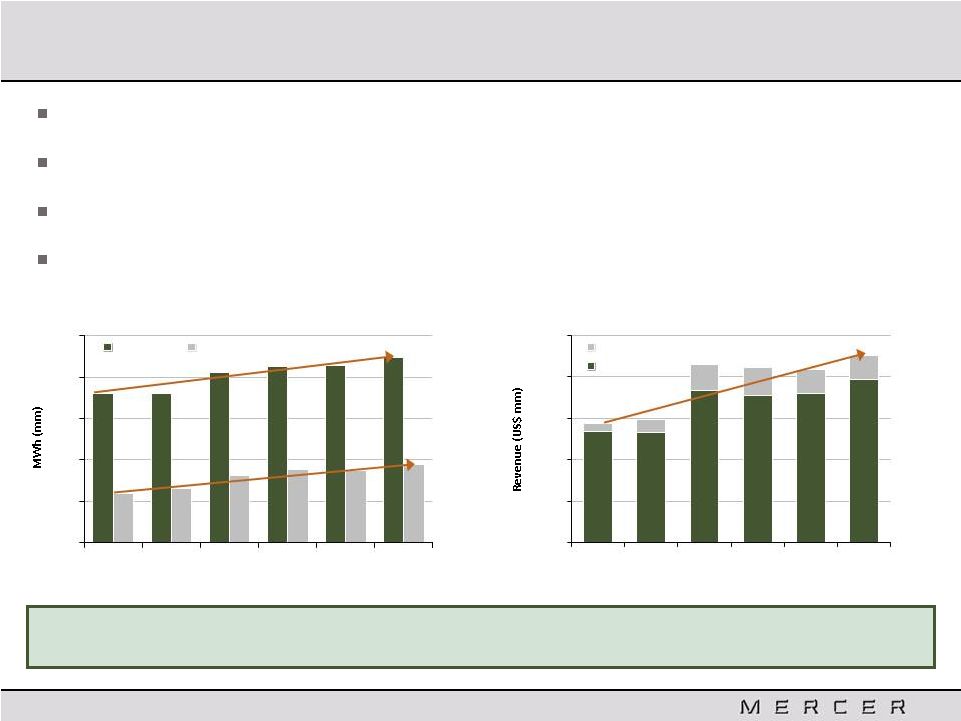

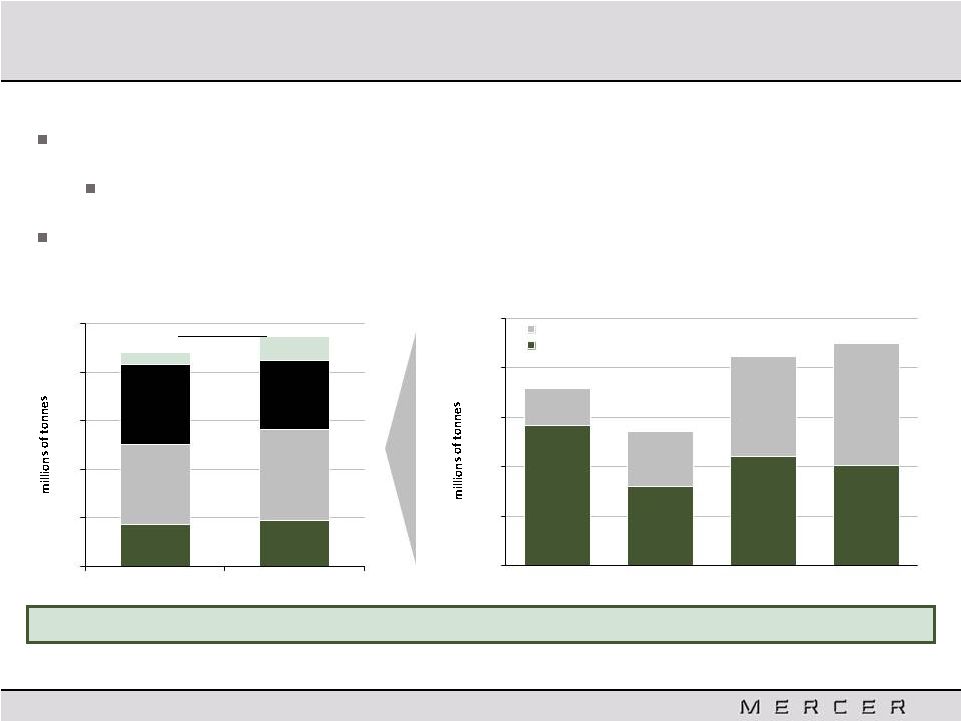

Growing Energy and Chemical By-Product Revenues

Mercer

has

been

a

leader

among

paper

and

forest

products

companies

in

embracing

the

“bio-economy”

and

in

harnessing significant value from the generation of surplus power, as well as its production

of bio-chemicals Mercer recognized the opportunity to secure new revenue streams

from its operations, as the marketplace turned to biomass for carbon-neutral power

and renewable chemical by-products Since

energy

and

chemicals

are

by-products

of

our

pulping

process,

production

is

highly

efficient

and

sales

of

these products are highly profitable

Stendal’s Project Blue Mill was completed in Q4 2013 (46 MW capacity addition)

Green electricity and chemical by-product revenue…

a significant and growing part of Mercer’s business

CAGR:

4.9%

CAGR:

10.7%

CAGR:

10.5%

1.45

1.44

1.64

1.70

1.71

1.79

0.48

0.52

0.65

0.71

0.70

0.76

-

0.4

0.8

1.2

1.6

2.0

2009

2010

2011

2012

2013

Q2-2014

LTM

Mercer’s Electricity Production and Sales

Production

Exports

$63.5

$65.4

$94.8

$93.0

$92.2

$99.6

-

$22.0

$44.0

$66.0

$88.0

$110.0

2009

2010

2011

2012

2013

Q2-2014

LTM

Mercer’s Energy and Chemical Revenue

Chemical

Energy |

7

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

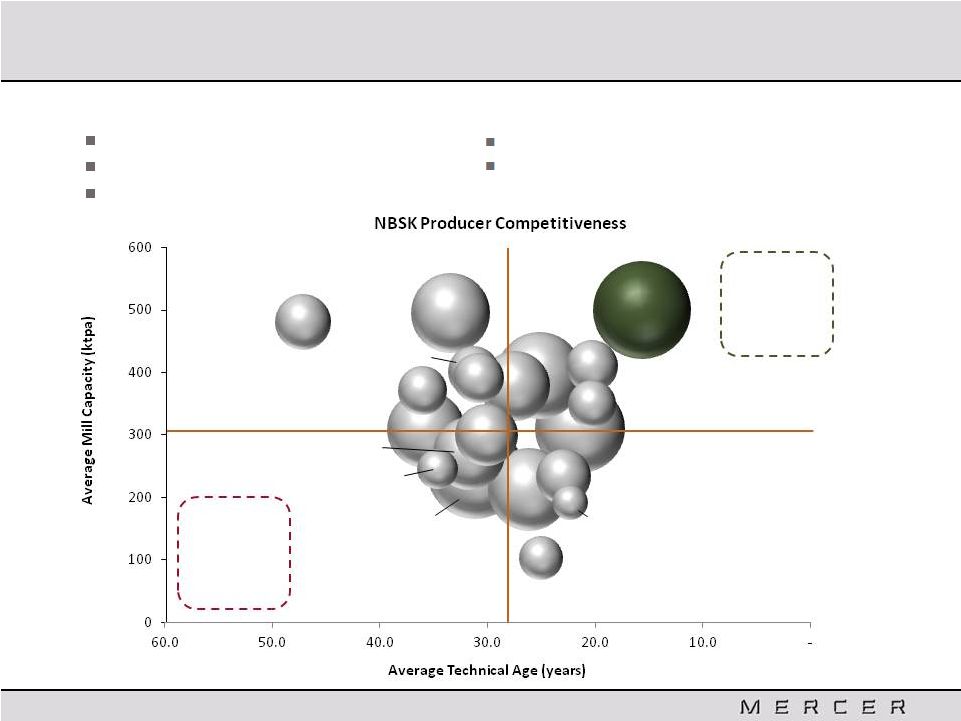

Mercer’s operations are some of the largest and most modern NBSK facilities in the

world Low production costs

Low maintenance capital requirements

High runability / efficiency

Globally Cost Competitive, Modern Mill Operations

Source: FisherSolve Q1 2014 data

Note: NBSK market pulp only

Mercer

Metsä

Fibre

International

Paper

(Ilim)

Stora

Enso

Södra

Cell

Catalyst

West

Fraser

SCA

Canfor

Resolute

UPM

Domtar

Aditya Birla

Weyer-

haeuser

Average Market Pulp

Capacity per Mill:

306,559 tpa

Average Technical Age:

28.4 years

Metsä

Board

Older,

Smaller

NBSK

Pulp Mills

Nanaimo

Daishowa-

Marubeni

Billerud-

Korsnas

Heinzel

Asia Pulp and Paper

(Paper Excellence)

Newer,

Larger

NBSK Pulp

Mills

Strong record of environmental performance

All facilities are net energy producers |

8

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

The NBSK Market |

9

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Introduction to the Major Themes in NBSK

The impact of digital media on paper demand

Current themes surrounding the NBSK market include:

The

effect

of

China

and

other

emerging

economies’

continuing

growth

The

net

supply

impact

of

mill

closures,

starts

/

restarts,

and

facility conversions

The

potential

supply

impact

of

integrated

players

selling

their

pulp

on

the

market

The impact of additional hardwood capacity coming online |

10

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

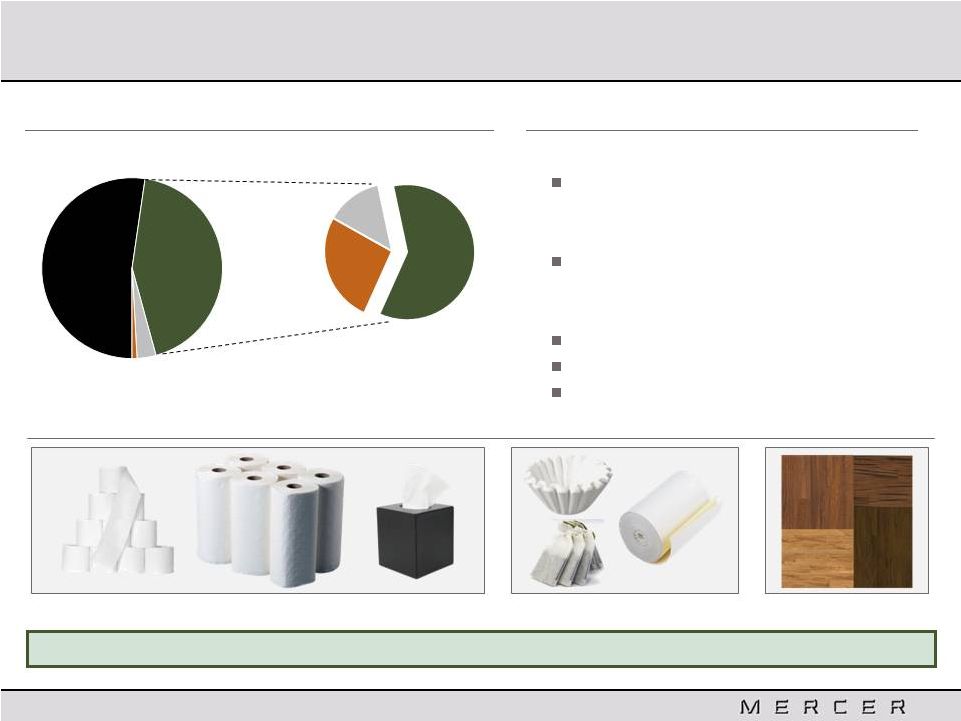

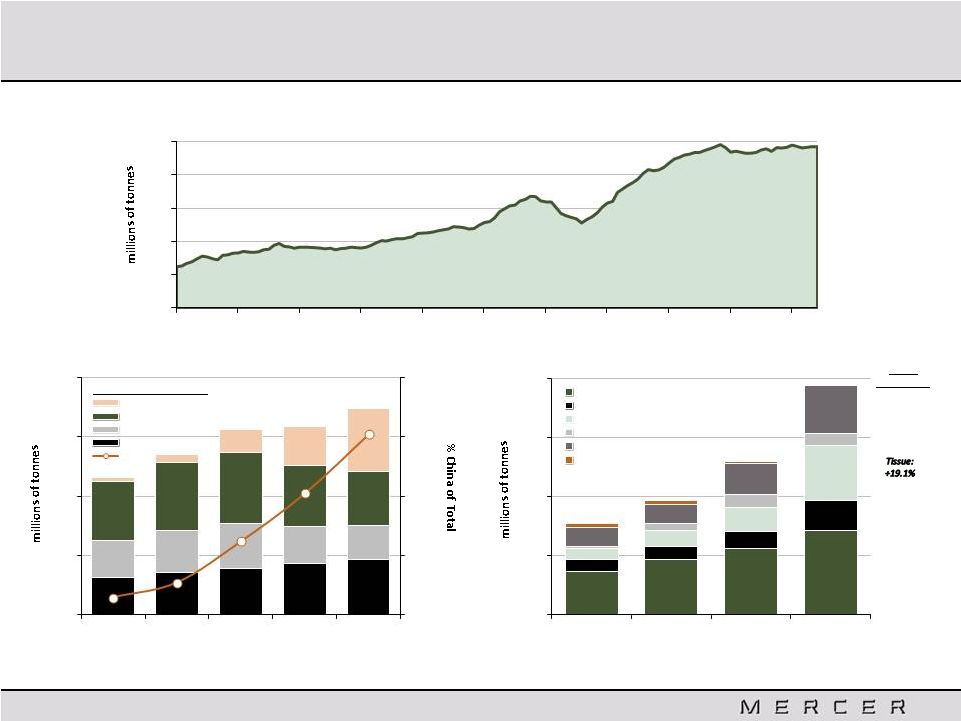

Global Pulp Market

Components of the Pulp Market

(1)

Major Uses for Softwood Pulp

NBSK commands a higher premium relative to other kraft pulps

(1) Source: PPPC (2013A)

Chemical Pulp Demand

Bleached Softwood Kraft

Pulp Demand

Northern Bleached Softwood Kraft (NBSK)

Produced From:

Spruce / Pine / Fir / Cedar

Core Production Areas:

North America, Northern Europe

Characteristics:

Long, slender, thin-walled fibers

Better softness and strength

Better structure

Specialty Paper

Laminates

Tissue

Bleached

Hardwood

Kraft

52%

Bleached

Softwood

Kraft

44%

Unbleached

Kraft

3%

Sulphite

1%

NBSK

60%

SBSK

26%

Other

14% |

11

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Demand Fundamentals –

Changes to NBSK End Use Markets

37.3%

19.5%

37.3%

30.2%

19.9%

39.7%

P&W:

(5%)

Tissue:

+5%

Specialty:

+3%

CAGR 2010 -

2013

Total:

+2%

NBSK’s strength attributes make it a necessary input for tissue and specialty

products Changes

to

Papermakers’

Demand

for

NBSK

The

increased

NBSK

demand

for

use

in

tissue

/

specialty

products

has

outpaced

the

decreased

NBSK

demand

for

printing & writing grades

From

2003

to

2013,

a

period

very

affected

by

“digital

substitution”

of

traditional

paper

grades,

total

NBSK

demand

grew

by

13.8%

(1)

Significant growth in tissue capacity is a major contributing factor and is expected to

continue globally, though some projects have been delayed versus previous tissue

producer announcements (1)

Source: PPPC (2014)

(2)

Source: Brian McClay (June 2014)

Specialty

Specialty

Tissue

Tissue

Printing &

Writing

Printing &

Writing

Others

Others

-

3.0

6.0

9.0

12.0

15.0

2010

2013

NBSK Demand by End Use

(1)

1.4

0.8

1.1

1.0

0.4

0.6

1.0

1.2

1.8

1.4

2.1

2.2

-

0.5

1.0

1.5

2.0

2.5

2012

2013

2014

2015

Annual Tissue Capacity Growth by Region

(2)

Rest of World

China |

12

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Demand Fundamentals –

China’s Growing Demand

(1) Source: PPPC (2014)

P&W Woodfree:

+7.7%

Paper Board:

+11.4%

Kraft & Spec.:

+11.2%

CAGR:

2004 –

2013

Region: 1995-2015E CAGR

-

1.2

2.4

3.6

4.8

6.0

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

BSK Deliveries to China

(1)

12 Month Rolling (2001 –

Present)

-

10%

20%

30%

40%

-

7.0

14.0

21.0

28.0

1995

2000

2005

2010

2015E

Global BSK Demand by Region

(1)

China: 14.9%

W. Europe: (0.4%)

N. America: (0.4%)

Other: 2.0%

% China

-

4.0

8.0

12.0

16.0

2004

2007

2010

2013

China’s Chemical Pulp Demand

(1)

P&W: Woodfree

Paper Board

Tissue

Fluff

Kraft & Specialty

P&W: Mechanical |

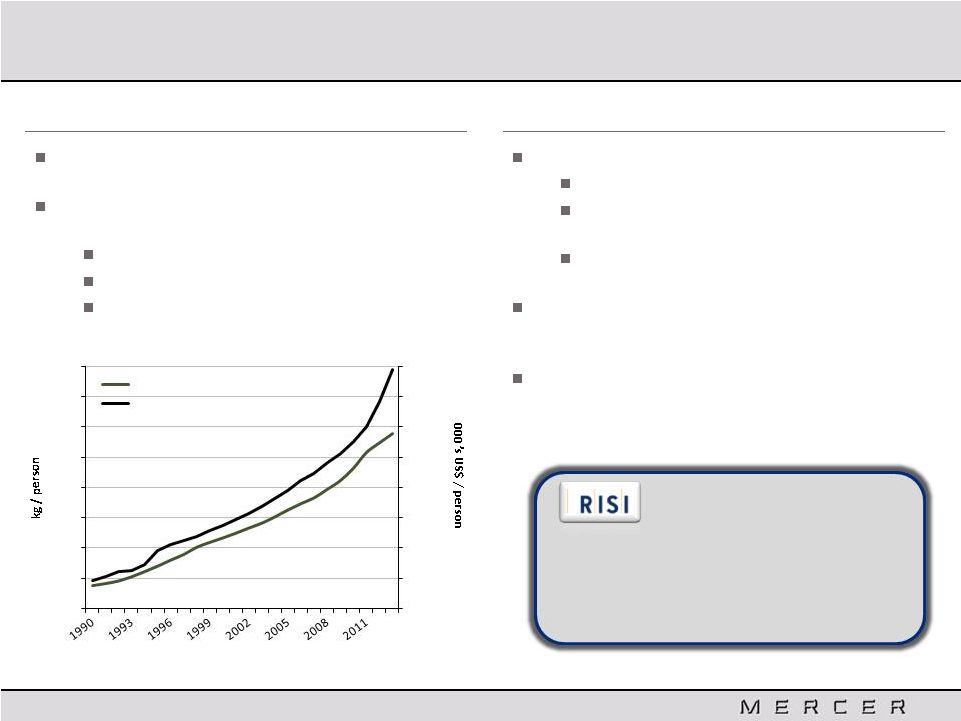

13

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Demand Fundamentals –

China’s Growing Demand (Cont'd)

(1)

Source: PPPC

(2014); note: income measured at purchasing power parity in constant 2005 US dollars

(2)

China’s demand is growing rapidly…

…

and its pulp supply isn’t currently keeping pace

Over time, the market will easily

absorb new tissue capacity

10 Year

CAGR: +7.4%

10 Year

CAGR: +8.8%

China’s 12

Five-Year Plan should increase

demand for NBSK

Growth in Chinese per capita tissue, wood-free,

and specialty paper grade consumption is due to:

Rising living standards

Growing disposable income

Increased demand for hygiene products

Shutting of “Old China”

pulp / paper capacity

Significant closures to date, and to come

Implementing pollution and water / energy

constraints to stay operating

Modern assets require greater volumes of

NBSK to run machines at optimal rates

Focus on wood-based pulps, but limited domestic

wood fiber supply, means large pulp import

volumes

We believe that there is healthy demand for virgin

fiber as paper recovery is nearing feasible

maximums in most markets

th

-

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

-

0.75

1.50

2.25

3.00

3.75

4.50

5.25

6.00

Tissue Demand & Income in China

(1)

Tissue Demand per Capita

Income per Capita

Chinese Government Mandated

Closure of “Old China”

Capacity

(2)

2005-2009:

6.5 mm tonnes per year over 5 years

2011:

8.31 mm tonnes

2012A:

10.57 mm tonnes

2013E:

7.42 mm tonnes (not yet finalized)

2014E:

4.63 mm tonnes

Source: RISI (August 22, 2014 press release; July 24, 2014 press release; May 9, 2014 PPI Asia

Report; and other disclosures) |

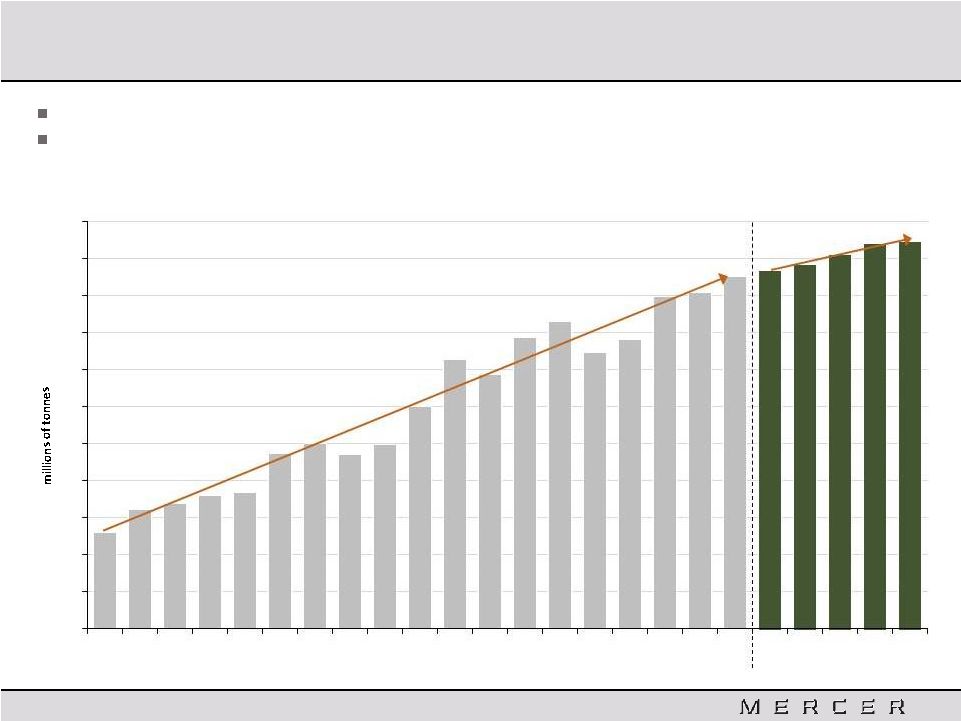

14

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

(1) Source: PPPC (May 2014)

Supply Fundamentals –

Slowing BSK Capacity Growth

Forecast

2014E-2018E

CAGR: +0.8%

1995-2013

CAGR: +1.8%

From 1995 to 2013, BSK capacity grew at a steady rate, experiencing a few dips along the

way Capacity is forecasted to increase at a more moderate rate in the coming five

years 16

17

18

19

20

21

22

23

24

25

26

27

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

Bleached Softwood Kraft

Global Market Pulp Capacity

(1) |

15

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Supply Fundamentals –

Net Capacity Change Analysis

2012–2013 BSK Closures and Conversions

Mill

Closure

Name

Location

Company

Grade

Date

kt

Hunan

China

Yueyang Paper

BSK

Q2 2012

(400)

Uimaharju

Finland

Stora Enso

NBSK

Q2 2012

(200)

Ngodwana

South Africa

Ngodwana

BSK

Q4 2012

(215)

Fort Frances

Canada

Resolute

NBSK

Q4 2012

(115)

Kamloops

Canada

Domtar

NBSK

Q1 2013

(120)

Perry

USA

Georgia-Pacific (Buckeye)

Fluff-BSK

Q1 2013

(40)

Jesup

USA

Rayonier

Fluff-BSK

Q2 2013

(260)

Tofte

Norway

Södra Cell

NBSK

Q3 2013

(400)

Total

(1,750)

Recent History

Future Expectations

There have been some

announcements for new

BSK capacity coming

online; however, these

(3)

(1)

In the last few years, there

have been several notable

BSK mill closures

During this time, the Ilim

Bratsk mill expanded

(490,000 tpa) and Terrace

Bay mill restarted (350,000

tpa)

projects are at least 2 or 3 years away from being realized

These

new

capacities,

if

realized,

will

be

somewhat

offset

by

mill

conversions

to

dissolving

pulp

(2)

and

future

integration of current market volumes

(1) For example: an expansion at UPM Kymi of 170,000 tpa in late 2015 / early

2016; an expansion at Södra Cell Värö (Sweden) of 275,000 tpa by 2016; a rebuild of MetsäFibre Äänekoski (Finland)

which would add ~700,000 tpa to the market BSK pulp supply in 2017; and a start-up of

Svetlogorsky (Belarus) swing mill (NBSK, NBHK and DP) with some integrated production (BSK market pulp

supply impact unknown)

(2) For example: conversion of Aditya Birla Terrace Bay (Canada) from NBSK to

dissolving pulp in 2016 to reduce BSK market pulp supply by 350,000 tpa

(3) For example: addition of a new paper machine at Mondi Štetí (Czech

Republic) to reduce BSK market pulp supply as it integrates some of its production (BSK market pulp supply impact unknown) |

16

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Strong Long-Term NBSK Fundamentals

Demand Fundamentals

Supply Fundamentals

Supply growth potential for NBSK is limited

Minimal NBSK new capacity increases

Only one new mill added globally from 2011 to 2014

Limited new capacity expected in the near-term

Some capacity additions have recently been announced

for 2016 and 2017

Meaningful capacity shutdowns of old, uneconomical mills

With strong demand growth outpacing modest supply increases,

we believe that the NBSK market will be very attractive in the coming years

(1) Source: Hawkins Wright – Defining the China Market (December 2013)

Demand for NBSK is still growing globally

Improving economic conditions for emerging countries

Tissue in China: 10% p.a. growth through 2017

(1)

Printing & writing paper in China: 4% p.a. growth

Strengthening agent

Digital substitution

through 2017

(1) |

17

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Financial Performance and Recent Developments |

18

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

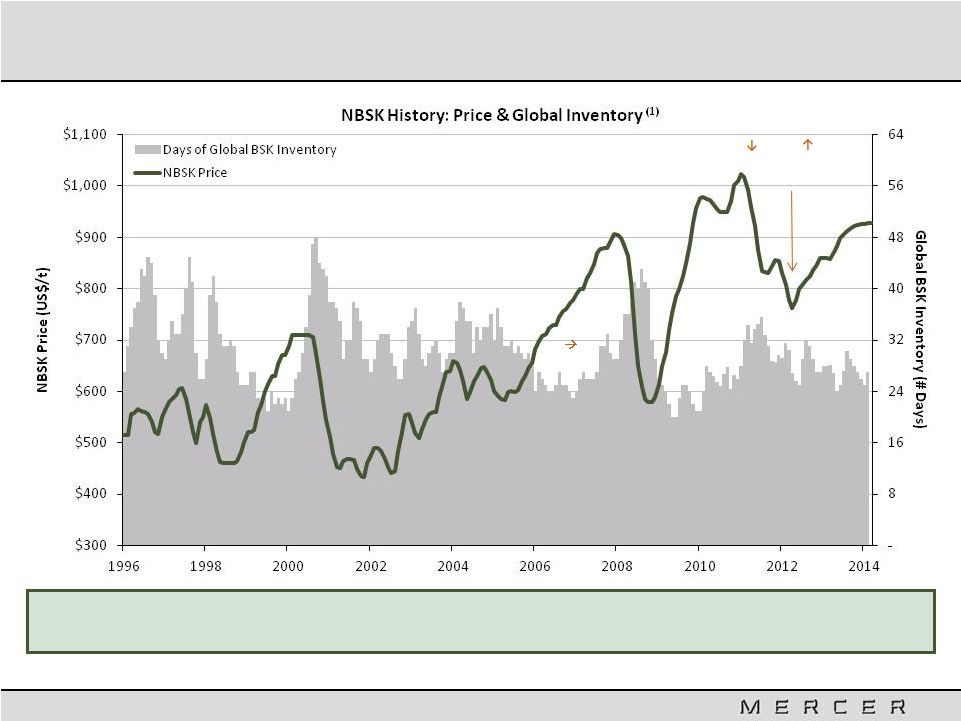

After undergoing significant changes over the past 20+ years, the market for NBSK is trending

from balanced to tight, with the meaningful substitution of NBSK for other pulps largely

completed Putting NBSK’s History into Perspective

Shortage!

price

surge

(1) Sources: Factset FOEX PIX Pulp NBSK for prices; PPPC for inventories

Supply, Prices:

Stocks are low,

prices increasing |

19

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

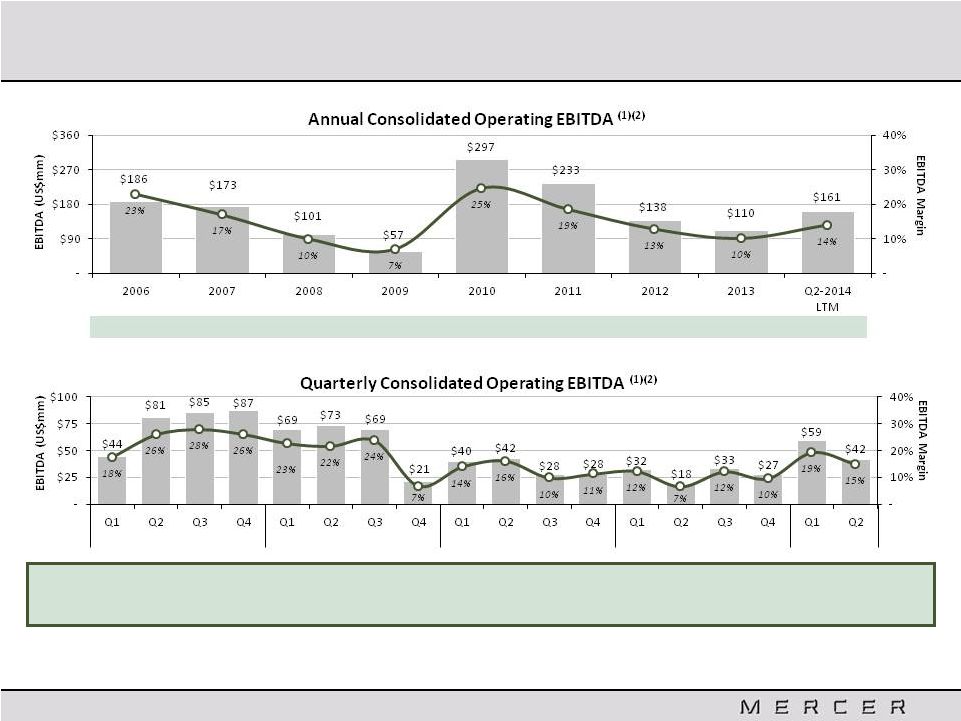

Significant Earnings Potential

Pulp pricing recently rising –

currently under some pressure in China due to market uncertainty

regarding new hardwood capacity but is expected to further improve in 2014

2010

2011

2012

2013

Energy & Chemical

Revenue (US$mm)

$63

$65

$95

$93

$100

$51

2014

$92

$35

$33

(1)

For

a

reconciliation

of

Net

Income

to

Operating

EBITDA,

please

refer

to

Appendix

C.

(2)

The company’s reporting currency was the Euro up until October 1, 2013. Figures prior to

this date have been converted to US dollars at the average foreign exchange rates in effect during the period

Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and

non-recurring capital asset impairment charges. It does not reflect the

impact of a number of items that affect net income. It is not a measure of financial performance under GAAP, and should not be considered as an alternative

to net income or income from operations as a measure of performance, nor as an alternative to

net cash from operating activities as a measure of liquidity |

20

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

We

believe

there

is

significant

room

for

further

price

increases

in

the

current

cycle

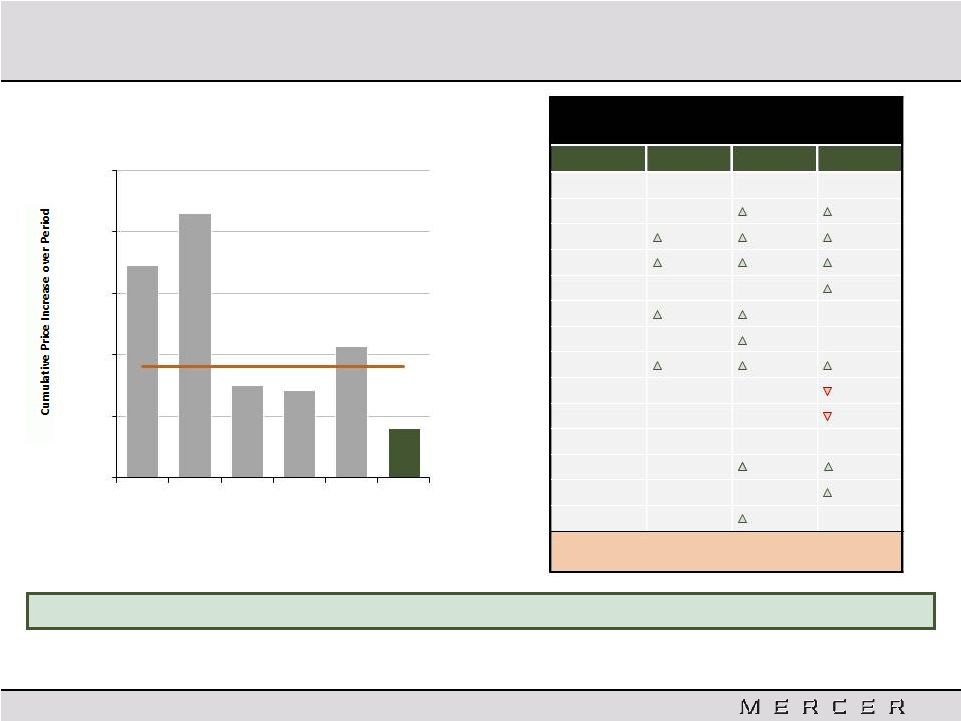

NBSK List Price Increases since Q3 2013

(US$/tonne)

Date

US

Europe

China

Aug-13

$945

$860

$680

Sep-13

$945

$880

$695

Oct-13

$970

$895

$720

Nov-13

$990

$905

$740

Dec-13

$990

$905

$750

Jan-14

$1,010

$915

$750

Feb-14

$1,010

$920

$750

Mar-14

$1,030

$925

$770

Apr-14

$1,030

$925

$750

May-14

$1,030

$925

$720

Jun-14

$1,030

$925

$720

Jul-14

$1,030

$930

$725

Aug-14

$1,030

$930

$730

Sept-14

(2)

n/a

$950

n/a

Change since

Aug-13

+$85

+9%

+$90

+10%

+$50

+7%

Recent NBSK Pricing Momentum

Source: RISI, unless otherwise noted

104%

129%

45%

43%

64%

24%

Median 54%

60%

90%

120%

150%

Mar-99

to

Jan-01

Sep-05

to

Aug-08

-

May-09

to

Jul-11

Sep-12

to

Aug 14

(Current)

Historical “Upcycle”

NBSK Price

Increase Trends

(1)

30%

-

Jan-86

to

Jun-90

Dec-93

to

Oct-95

Note: Producer realized prices are net of discounts, rebates and commissions

(1)

Calculations based on North American NBSK list prices (2)

Based on announced list price as of September 1, 2014 |

21

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Mercer’s Recent Developments

Capital Projects

Enhanced pulp production capacity (30,000 ADMT per year)

and added new electrical generating capacity (46 MW)

Celgar Workforce Reduction

Stendal Credit Facilities

The credit facilities were amended in August 2014 to provide

greater flexibility by reducing scheduled principal payments

by 50% and improving covenants

Stendal received a waiver under its credit facility in March

2014

US$20 million of the proceeds from the 2014 equity

offering (described next) will be contributed to Stendal

Completed Stendal’s Project Blue Mill on schedule and on budget

Expected annual cost savings of US$8 to US$10 million; 80% of which

are expected to be realized in 2014

Incurred pre-tax charges of ~US$5 million for severance and other

personnel related expenses in 2013

Amortizing loan, supported by guarantees from the German

Federal and State governments

EBITDA based covenants pinch at the bottom of the pulp cycle |

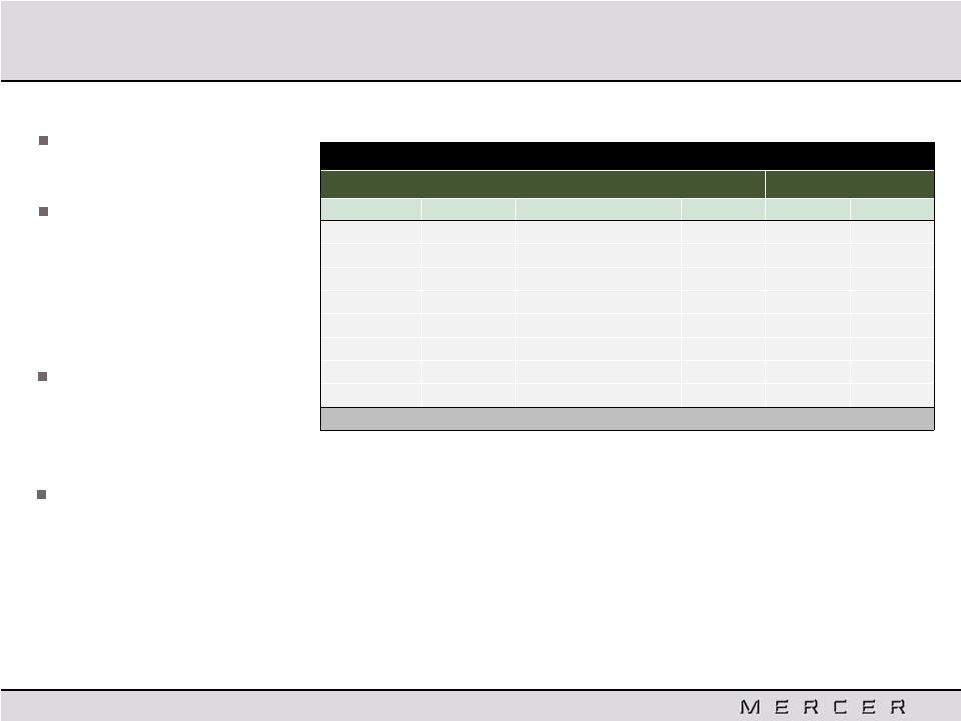

22

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

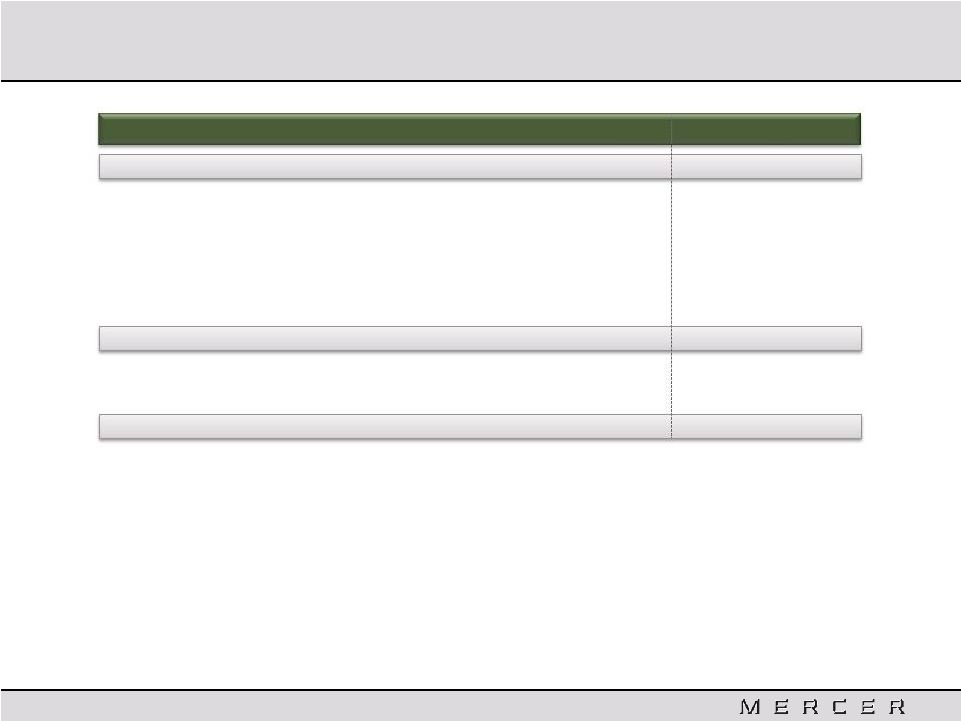

Mercer Debt Summary

At 31-Dec-13

At 30-Jun-14

Term

Characteristics

US$mm

US$mm

Month-Year

Long-Term Debt Facilities

Stendal Loan Facility

$568.9

$537.9

Sept-17

Amortizing bank facility, 80% German government guaranteed and

non-recourse to Mercer, floating rate but partially hedged to 5.28%

Senior Notes

$336.4

$336.1

Dec-17

9.5% senior unsecured, redeemable beginning Dec 1, 2014 at 104.75%

Project Facilities

$21.9

$18.8

Sept-17

Various floating rate amortizing bank project facilities

Short-Term Debt Facilities

Celgar Revolver

-

-

May-16

Floating rate, revolving credit facility, ~US$36 million available

Rosenthal Revolver

-

-

Oct-16

Floating rate, revolving credit facility, ~US$39 million available

Total Debt

$927.3

$892.8

Less: Cash

($147.7)

($241.0)

Net Debt

$779.5

$651.8

LTM EBITDA

$110.3

$160.9

Net Debt to EBITDA

7.1x

4.1x

Mercer’s Recent Developments (Cont’d)

Capital Raises

Issued US$50 million in “tack-on”

Senior Notes at a 104.5% premium to face value in July 2013

Equity offering of 8.05 million shares at US$7.15/share for net proceeds of ~US$53.6 million

in April 2014 The over-allotment was exercised in full

Note: Excludes loans payable to the noncontrolling shareholder of the Stendal mill

Note: Some numbers may not add due to rounding |

23

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Mercer’s Recent Developments (Cont’d)

Annual Maintenance Shuts

In

June

2014,

Mercer

and

Resolute

Forest

Products

launched

a

new

50/50

joint venture company called Performance BioFilaments

The joint venture is set to commercialize novel product applications for

cellulose

filaments,

an

innovative

biomaterial

derived

from

wood

fiber

Completed the most extensive of our 2014 scheduled annual maintenance shuts during Q2 at

Celgar

While the shut was completed largely as planned, difficulties were encountered in returning to

full production Q2 shuts (including a short 2-day shut at Stendal), along with delays in reaching

full production at Celgar, impacted EBITDA during the quarter by about US$18 million

Performance BioFilaments |

24

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Mercer –

Summary

Globally cost competitive, modern mill operations

Strategically located mills with excellent access to key markets

Stable and growing revenue from high-margin energy & bio-chemical by-product

sales Strong long-term NBSK fundamentals

Significant leverage to the NBSK pulp cycle

Experienced management team

The largest “pure-play”

NBSK market pulp producer |

25

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Appendix A

Additional Information on Mercer International Inc. |

26

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Mercer Balance Sheet –

June 30, 2014

Note: Restricted Group consists of Celgar and Rosenthal; Unrestricted Group consists of

Stendal (see Corporate Structure slide for more details) Note: Some numbers may not add

due to rounding in US$ millions

Restricted

Unrestricted

Adjustments

Consolidated

ASSETS

Cash,

Cash

Equivalents

$157.4

$83.6

-

$241.0

Receivables

$69.8

$64.9

-

$134.7

Inventories

$104.1

$60.9

-

$165.1

Other

Current

Assets

$11.4

$5.7

-

$17.1

Total

Current

Assets

$342.8

$215.2

-

$558.0

Property,

Plant

and

Equipment

$410.1

$596.8

-

$1,006.9

Due

from

Unrestricted

Group

$155.5

-

($155.5)

-

Other

Long-Term

Assets

$27.7

$16.3

-

$44.0

Total

Long-Term

Assets

$593.2

$613.1

($155.5)

$1,050.9

TOTAL

ASSETS

$936.0

$828.3

($155.5)

$1,608.8

LIABILITIES

&

EQUITY

Payables

$63.5

$52.2

-

$115.7

Current

Debt

-

$62.2

-

$62.2

Other

Current

Liabilities

$1.3

-

-

$1.3

Total

Current

Liabilities

$64.8

$114.4

-

$179.2

Debt

$336.1

$546.3

-

$882.4

Due

to

Restricted

Group

-

$155.5

($155.5)

-

Other

Liabilities

$70.5

$51.1

-

$121.6

Total

Long-Term

Liabilities

$406.7

$752.9

($155.5)

$1,004.1

Total

Shareholders'

Equity

(Deficit)

$464.5

($32.5)

-

$432.0

Non-Controlling

Interest

(Deficit)

-

($6.4)

-

($6.4)

Total

Equity

$464.5

($38.9)

-

$425.6

TOTAL

LIABILITIES

AND

EQUITY

$936.0

$828.3

($155.5)

$1,608.8 |

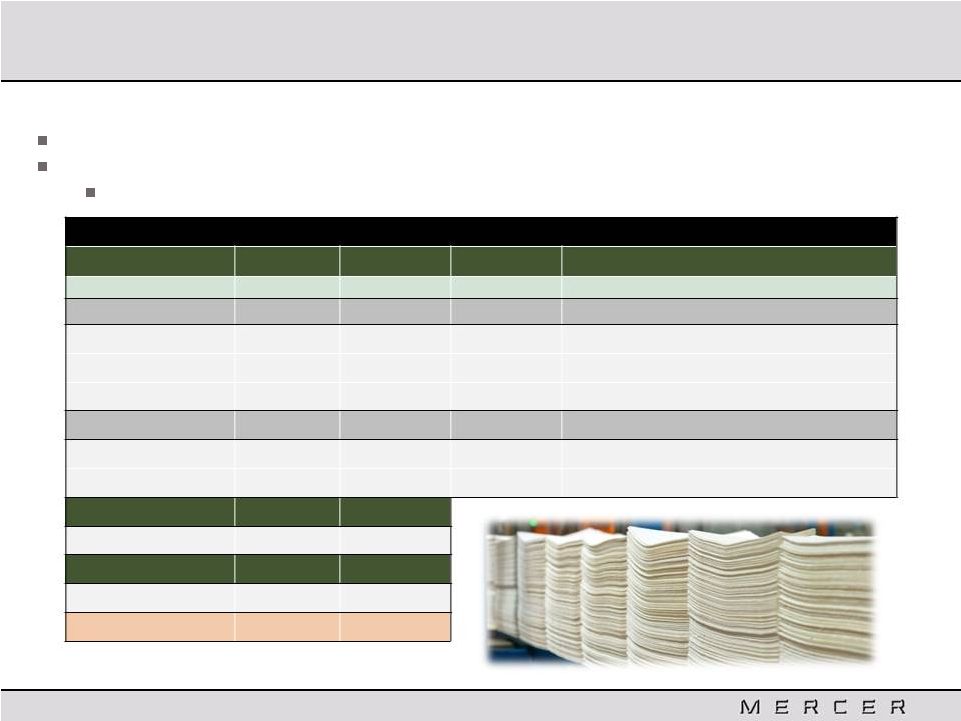

27

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Mercer Selected Historical Financial Data (Consolidated)

in US$ millions, except for per share data

2011

2012

2013

Q2 2013

Q2 2014

Pulp Revenue

$1,157.2

$979.8

$996.2

$491.0

$538.0

Energy and Chemical Revenue

$94.8

$93.0

$92.2

$45.5

$52.9

Total Revenue

$1,252.0

$1,072.7

$1,088.4

$536.5

$590.9

Operating Income (Loss)

$154.7

$63.0

$31.7

$11.4

$61.3

Interest Expense

$82.1

$71.8

$69.2

$34.5

$34.6

Gain

(Loss)

on

Derivative

Instruments

(1)

($2.0)

$4.8

$19.7

$13.3

$5.8

Other Income (Expense)

$3.6

($0.2)

$1.2

($0.1)

($0.1)

Net Income (Loss) Attributable to Common

Shareholders

$69.7

($15.7)

($26.4)

($13.6)

$21.6

Operating EBITDA

(2)

$232.6

$137.7

$110.3

$50.3

$100.9

Earnings Per Share (Basic)

$1.39

($0.28)

($0.47)

($0.24)

$0.36

Note: Quarterly data represents 6 months ended June 30

Note: Some numbers may not add due to rounding

(1) Gains (losses) on Stendal’s interest rate swap and pulp price swaps (subject to

quarterly non-cash mark-to-market valuation adjustments)

(2) Refer to Appendix C for Reconciliation of Net Income to Operating EBITDA.

Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and non-recurring capital asset

impairment charges. It does not reflect the impact of a number of items that affect net

income. It is not a measure of financial performance under GAAP, and should not be considered as an alternative to

net income or income from operations as a measure of performance, nor as an alternative to net

cash from operating activities as a measure of liquidity |

28

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Appendix B

Detailed Overview of Operations |

29

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Rosenthal Mill

Mercer

International

Group:

Restricted

Group

Location:

Blankenstein,

Germany

(~300

km

south

of

Berlin)

Pulp

Production

Capacity:

360,000

ADMT

per

year

Electricity

Generating

Capacity:

57

MW

Certification:

ISO

9001,

14001,

and

50001

2013

Green

Electricity

Sales:

US$21.5

million

Key Features:

Built

in

1999

–

modern

and

efficient

Strategically located in central Europe

Close proximity to stable fiber supply and nearby

sawmills

Allows customers to operate using just in time inventory

process, lowering their costs and making Rosenthal a

preferred supplier

In 2013, the mill sold nearly 180,000 MWh of green electricity

One of the largest biomass power plants in Germany

Regularly setting new pulp and energy production records

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

29 |

30

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Celgar Mill

Mercer

International

Group:

Restricted

Group

Location:

Castlegar,

BC,

Canada

(~600

km

east

of

Vancouver)

Pulp

Production

Capacity:

520,000

ADMT

per

year

Electricity

Generating

Capacity:

100

MW

Certification:

ISO

9001

and

ISO

14001

2013

Green

Electricity

Sales:

US$12.3

million

Key Features:

Modern and efficient

Abundant and low fiber costs by global standards

Green Energy Project was completed in September 2010

In 2013, the mill sold over 127,000 MWh of green electricity

Secured C$57.7 million in non-repayable capital funding from

government of Canada for green capital investments

Majority used to fund Green Energy Project

Continues to demonstrate significant upside potential

Regularly setting production records and increasing the

amount of bio-energy generated

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

30 |

31

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Stendal Mill

Mercer

International

Group:

Unrestricted

Group

Location:

Stendal,

Germany

(~130

km

west

of

Berlin)

Pulp

Production

Capacity:

660,000

ADMT

per

year

Electricity

Generating

Capacity:

148

MW

Certification:

ISO

9001

and

ISO

14001

certified

2013

Green

Electricity

Sales:

US$45.6

million

2013

Chemical

Sales:

US$12.8

million

Key Features:

Completed in 2004, it’s one of the newest and largest pulp

mills in the world

83% Mercer owned

Debt is 80% government guaranteed, low interest and

non-recourse to Mercer

One of the largest biomass power plants in Germany

In 2013, exported over 390,000 MWh

Project Blue Mill was completed in Q4 2013 (on time and on

budget) and has increased this mill’s annual pulp production

capacity by 30,000 ADMT and electricity generation by

109,000 MWh

Regularly setting new performance records

31

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com |

32

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Appendix C

Reconciliation of Net Income to Operating EBITDA |

33

NASDAQ:MERC | TSX:MRI.U | www.mercerint.com

Reconciling Net Income (Loss) to Operating EBITDA

Note: For other reconciliations of Net Income (Loss) to Operating EBITDA in periods not shown

here, please refer to that period’s respective Form 10-Q or 10-K, which can be found on our

website (www.mercerint.com)

Note: Some numbers may not add due to rounding

in US $ millions

2012

2013

Q2 2013

Q2 2014

Net Income (Loss) Attributable to Common Shareholders

($15.7)

($26.4)

($13.6)

$21.6

Add: Net Income Attributable to Non-Controlling Interest

$2.2

$0.6

$1.7

$4.3

Add: Income Tax Provision (Benefit)

$9.4

$9.2

$2.0

$6.4

Add: Interest Expense

$71.8

$69.2

$34.5

$34.6

Add: Loss (Gain) on Derivative Instruments

($4.8)

($19.7)

($13.3)

($5.8)

Add: Other Expense (Income)

$0.2

($1.2)

$0.1

$0.1

Operating Income (Loss)

$63.0

$31.7

$11.4

$61.3

Add: Depreciation and Amortization

$74.7

$78.6

$38.9

$39.6

Operating EBITDA

$137.7

$110.3

$50.3

$100.9

Operating EBITDA is defined as operating income (loss) plus depreciation and amortization and

non-recurring capital asset impairment charges. Management uses Operating EBITDA as a benchmark measurement of

its own operating results, and as a benchmark relative to its competitors. Management

considers it to be a meaningful supplement to operating income (loss) as a performance measure primarily because depreciation

expense and non-recurring capital asset impairment charges are not an actual cash cost,

and depreciation expense varies widely from company to company in a manner that management considers largely

independent of the underlying cost efficiency of their operating facilities. In addition, we

believe Operating EBITDA is commonly used by securities analysts, investors and other interested parties to evaluate our

financial performance.

Operating EBITDA does not reflect the impact of a number of items that affect our net income

(loss) attributable to common shareholders, including financing costs and the effect of derivative instruments. Operating

EBITDA is not a measure of financial performance under the accounting principles generally

accepted in the United States of America (“GAAP”), and should not be considered as an alternative to net income (loss) or

income (loss) from operations as a measure of performance, nor as an alternative to net cash

from operating activities as a measure of liquidity. Operating EBITDA has significant limitations as an analytical tool, and should not be

considered in isolation, or as a substitute for analysis of our results as reported under GAAP. Operating EBITDA should only be

considered as a supplemental performance measure and should not be considered as a measure of

liquidity or cash available to us to invest in the growth of our business. Because all companies do not calculate

Operating EBITDA in the same manner, Operating EBITDA as calculated by us may differ from

Operating EBITDA or EBITDA as calculated by other companies. We compensate for these limitations by using Operating

EBITDA as a supplemental measure of our performance and by relying primarily on our GAAP

financial statements. |