Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VEREIT, Inc. | v388447_8k.htm |

Exhibit 99.1

FOR IMMEDIATE RELEASE

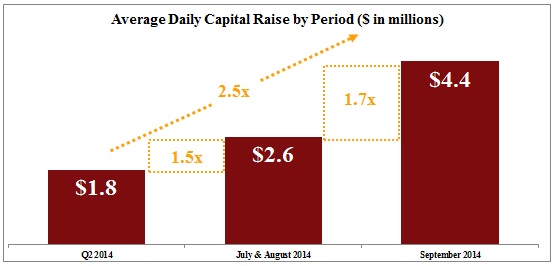

American Realty Capital Properties Experiences Upward Trajectory in Equity Raise for Cole Capital®, as Expected

New York, New York, September 5, 2014 - American Realty Capital Properties, Inc. (NASDAQ: ARCP) (“ARCP” or the “Company”) announced today the most recent equity raise amounts for Cole Capital®, ARCP’s private capital management business:

| · | Actual August 2014: Raised $85.3 million or $2.8 million per day |

| · | Year-to-date 2014: Raised $1.2 billion (as of 8/31/2014) |

As expected, in the weeks following the execution of a number of major selling agreements with leading broker-dealers and the recently announced merger of Cole Corporate Income Trust, Inc. (“CCIT”) with Select Income REIT (NYSE: SIR), daily capital raising and investor interest has increased substantially. More importantly, since our recent earnings call, there has been a significant increase, as expected, prior to the announced sale of CCIT to SIR, pending the liquidity event.

“I have been on the road the past few months personally meeting with financial advisors and I can attest to the high level of interest and increased demand for Cole Capital’s product offerings,” said David S. Kay, President of ARCP. “As the industry’s premier sponsor of net lease non-listed REIT offerings, we have seen a dramatic increase in requests for offering materials and in-person meetings, as well as a significant upsurge in in-bound call volume to our sales desk. Even with August and the summertime typically the slowest time of the year historically, as seen in Stanger’s monthly report, we are currently averaging approximately $5 million a day. Despite slow summer months, we enter September with higher daily capital raise levels and expect further significant increases due to the CCIT merger with SIR. With the momentum we’ve built in the marketplace, we expect these efforts and activity to drive the balance of the year’s capital raising as planned.”

Note about Capital Raise Figures

All capital raise figures presented herein are inclusive of proceeds received from each of the REIT’s distribution reinvestment programs, excluding the September 2014 numbers in the graph above.

About ARCP

ARCP is a leading, self-managed commercial real estate investment trust (“REIT”) focused on investing in single tenant freestanding commercial properties subject to net leases with high credit quality tenants. ARCP owns approximately 4,400 properties totaling 99.1 million square feet of leasable space. Additionally, ARCP sponsors non-traded REITs through its wholly owned private capital management business and direct investment wholesale broker dealer, Cole Capital®. In total, ARCP manages nearly $30 billion of high-quality real estate located in 49 states, as well Washington D.C., Puerto Rico and Canada. ARCP is a publicly traded Maryland corporation listed on The NASDAQ Global Select Market. Additional information about ARCP can be found on its website at www.arcpreit.com. ARCP may disseminate important information regarding it and its operations, including financial information, through social media platforms such as Twitter, Facebook and LinkedIn.

Forward-Looking Statements

Information set forth herein (including information included or incorporated by reference herein) contains “forward-looking statements” (as defined in Section 21E of the Securities Exchange Act of 1934, as amended), which reflect ARCP's expectations regarding future events. The forward-looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements include, but are not limited to, market and other expectations, objectives, intentions, our inability to meet our 2014 capital raise targets for Cole Capital and any expectations with respect to estimates of growth. Additional factors that may affect future results are contained in ARCP's filings with the U.S. Securities and Exchange Commission (“SEC”), which are available at the SEC's website at www.sec.gov. ARCP disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise.

|

Contacts |

||||

| Jamie Moser/Jonathan Keehner | Brian S. Block, CFO, Treasurer, Secretary and EVP | |||

| Joele Frank, Wilkinson Brimmer Katcher | American Realty Capital Properties, Inc. | |||

| Ph: 212-355-4449 | Ph: 212-415-6500 | |||