Attached files

| file | filename |

|---|---|

| 8-K - WEC FORM 8-K - WEC ENERGY GROUP, INC. | wec8-k09022014.htm |

September 2014 Exhibit 99.1

2 Cautionary Statement Regarding Forward-Looking Information Much of the information contained in this presentation is forward-looking information based upon management’s current expectations and projections that involve risks and uncertainties. Forward-looking information includes, among other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow, dividend growth and dividend payout ratios, debt redemptions, construction costs and capital expenditures, investment opportunities, corporate initiatives, rate base, and future electric sales. Readers are cautioned not to place undue reliance on this forward-looking information. Forward-looking information is not a guarantee of future performance and actual results may differ materially from those set forth in the forward-looking information. In addition to the assumptions and other factors referred to in connection with the forward-looking information, factors that could cause Wisconsin Energy's actual results to differ materially from those contemplated in any forward-looking information or otherwise affect our future results of operations and financial condition include, among others, the following: general economic conditions, including business and competitive conditions in the company’s service territories; timing, resolution and impact of future rate cases and other regulatory decisions; availability of the company’s generating facilities and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes; varying weather conditions; continued industry consolidation; our ability to continue to mitigate the impact of Michigan customers switching to an alternative electric supplier; cyber- security threats; construction risks; equity and bond market fluctuations; the impact of any legislative and regulatory changes; current and future litigation and regulatory investigations; changes in accounting standards; and other factors described under the heading “Factors Affecting Results, Liquidity and Capital Resources” in Management’s Discussion and Analysis of Financial Condition and Results of Operations and under the headings “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors” contained in Wisconsin Energy's Form 10-K for the year ended December 31, 2013 and in subsequent reports filed with the Securities and Exchange Commission. On June 22, 2014, Wisconsin Energy entered into an agreement to acquire Integrys Energy Group for stock and cash consideration valued at $71.47 per share of Integrys stock. The transaction is subject to the receipt of several state and federal regulatory approvals, as well as approvals from the shareholders of both companies. The information contained in this presentation characterizes Wisconsin Energy on a stand-alone basis, and does not reflect any assumptions or expectations with respect to the acquisition or combined company. Wisconsin Energy expressly disclaims any obligation to publicly update or revise any forward-looking information.

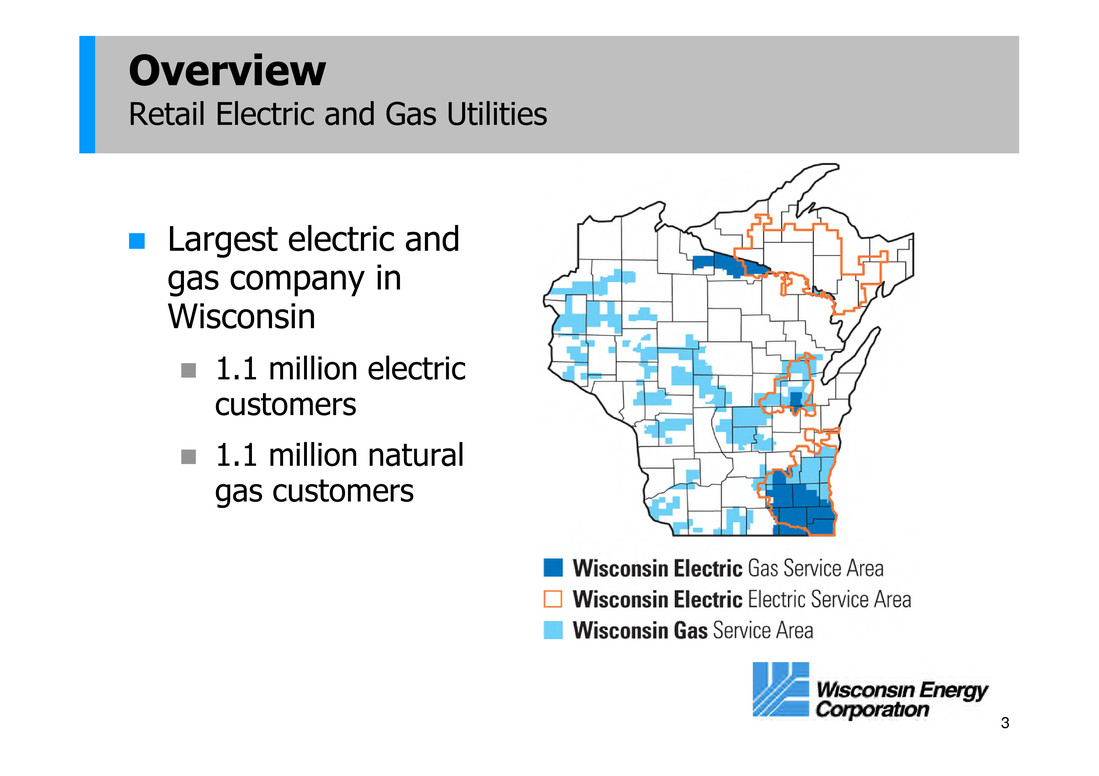

3 Largest electric and gas company in Wisconsin 1.1 million electric customers 1.1 million natural gas customers Overview Retail Electric and Gas Utilities

4 Investment Thesis An “Earn and Return” Company with a Low Risk Profile Positive free cash flow Targeted EPS growth of 4%-6% Best in class dividend growth - targeting a dividend payout ratio of 65%-70% of earnings in 2017 Implies 7%-8% dividend growth annually 2015-2017 Proven management team that has delivered strong financial results and operational excellence Balanced regulatory climate

5 Wisconsin Energy is the only company in the S&P Electric Index S&P Utilities Index Philadelphia Utility Index Dow Jones Utilities Average that has grown earnings per share and dividends per share every year since 2003 A Track Record of Performance Consistent Earnings and Dividend Growth

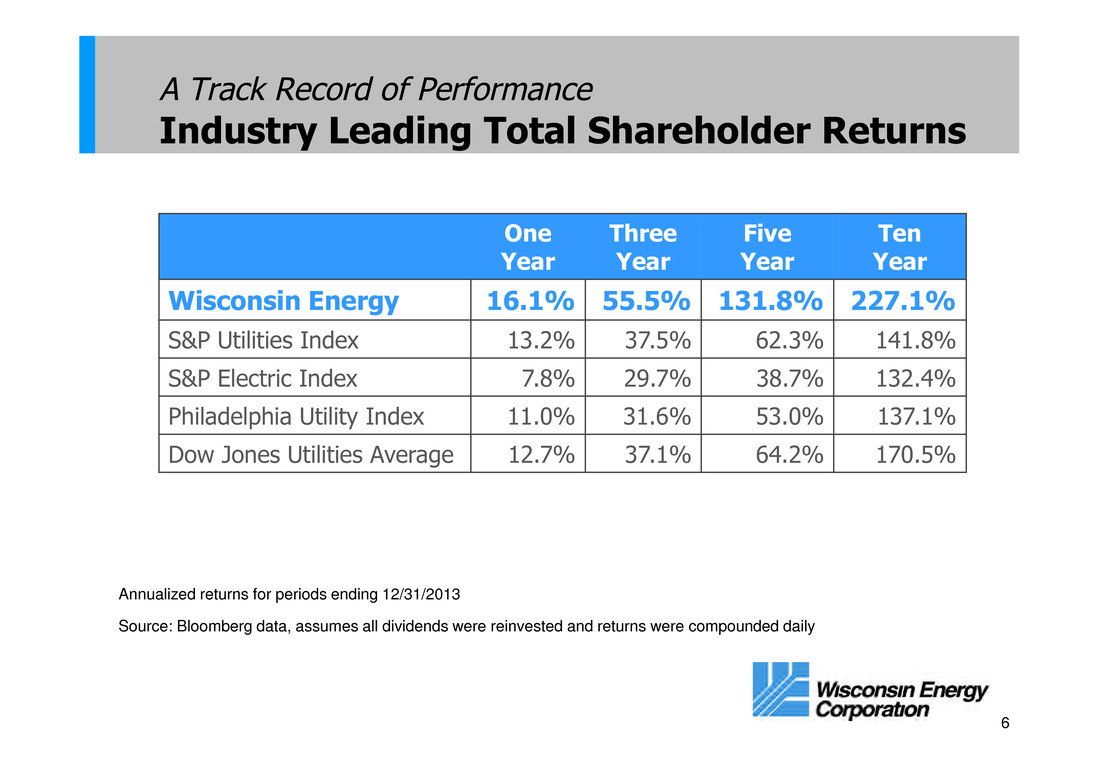

6 A Track Record of Performance Industry Leading Total Shareholder Returns One Year Three Year Five Year Ten Year Wisconsin Energy 16.1% 55.5% 131.8% 227.1% S&P Utilities Index 13.2% 37.5% 62.3% 141.8% S&P Electric Index 7.8% 29.7% 38.7% 132.4% Philadelphia Utility Index 11.0% 31.6% 53.0% 137.1% Dow Jones Utilities Average 12.7% 37.1% 64.2% 170.5% Annualized returns for periods ending 12/31/2013 Source: Bloomberg data, assumes all dividends were reinvested and returns were compounded daily

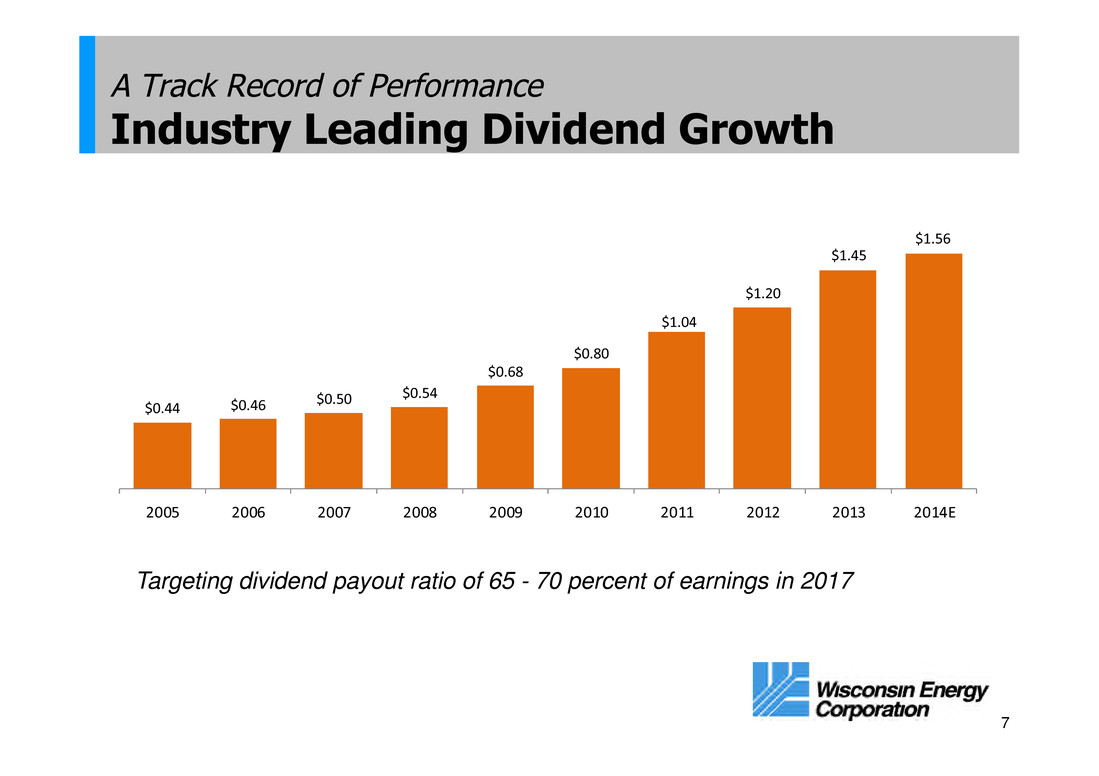

7 Targeting dividend payout ratio of 65 - 70 percent of earnings in 2017 A Track Record of Performance Industry Leading Dividend Growth $0.44 $0.46 $0.50 $0.54 $0.68 $0.80 $1.04 $1.20 $1.45 $1.56 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E

8 A Track Record of Performance Leading Reliability and Customer Satisfaction Named the most reliable utility … In the U.S. in 2013 In the Midwest nine of the past 12 years During 2013, achieved highest customer satisfaction ratings in past decade … likely best ever

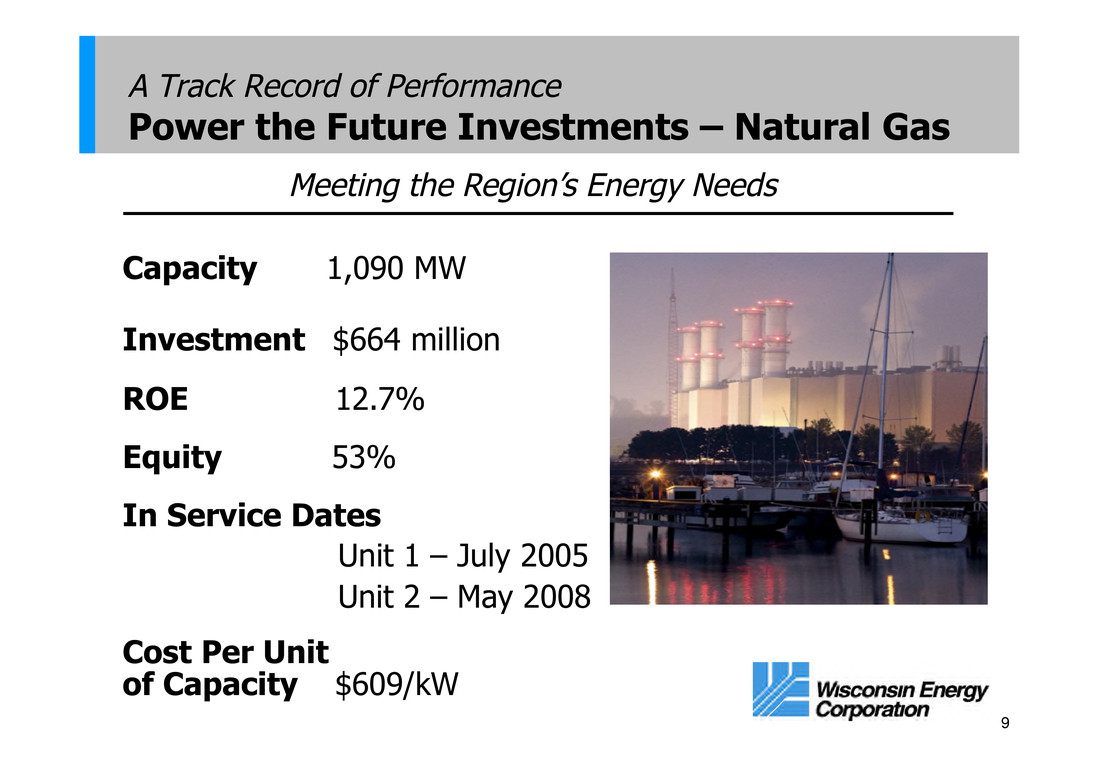

9 A Track Record of Performance Power the Future Investments – Natural Gas Capacity 1,090 MW Investment $664 million ROE 12.7% Equity 53% In Service Dates Unit 1 – July 2005 Unit 2 – May 2008 Cost Per Unit of Capacity $609/kW Meeting the Region’s Energy Needs

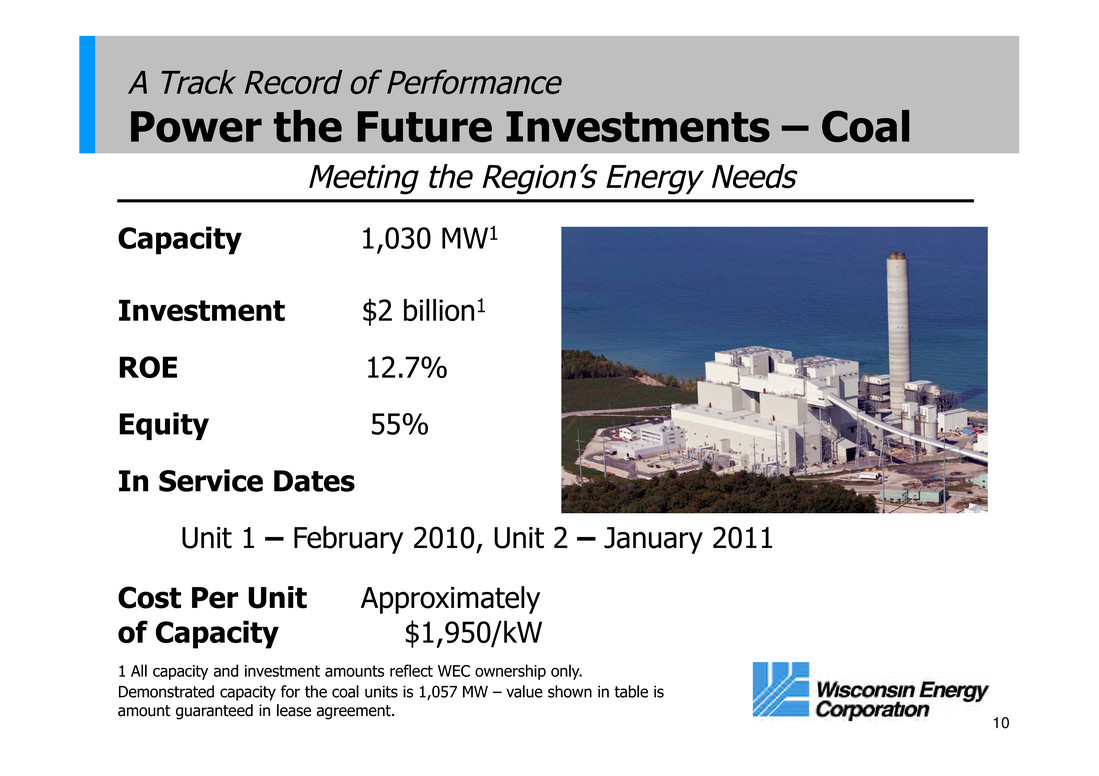

10 Capacity 1,030 MW1 Investment $2 billion1 ROE 12.7% Equity 55% In Service Dates Unit 1 – February 2010, Unit 2 – January 2011 Cost Per Unit Approximately of Capacity $1,950/kW 1 All capacity and investment amounts reflect WEC ownership only. Demonstrated capacity for the coal units is 1,057 MW – value shown in table is amount guaranteed in lease agreement. Meeting the Region’s Energy Needs A Track Record of Performance Power the Future Investments – Coal

11 A Track Record of Performance Dramatic Change in Environmental Performance From 2000 to 2014... Power plant capacity up 50% Emissions of nitrogen oxide sulfur dioxide down 80% mercury particulate matter

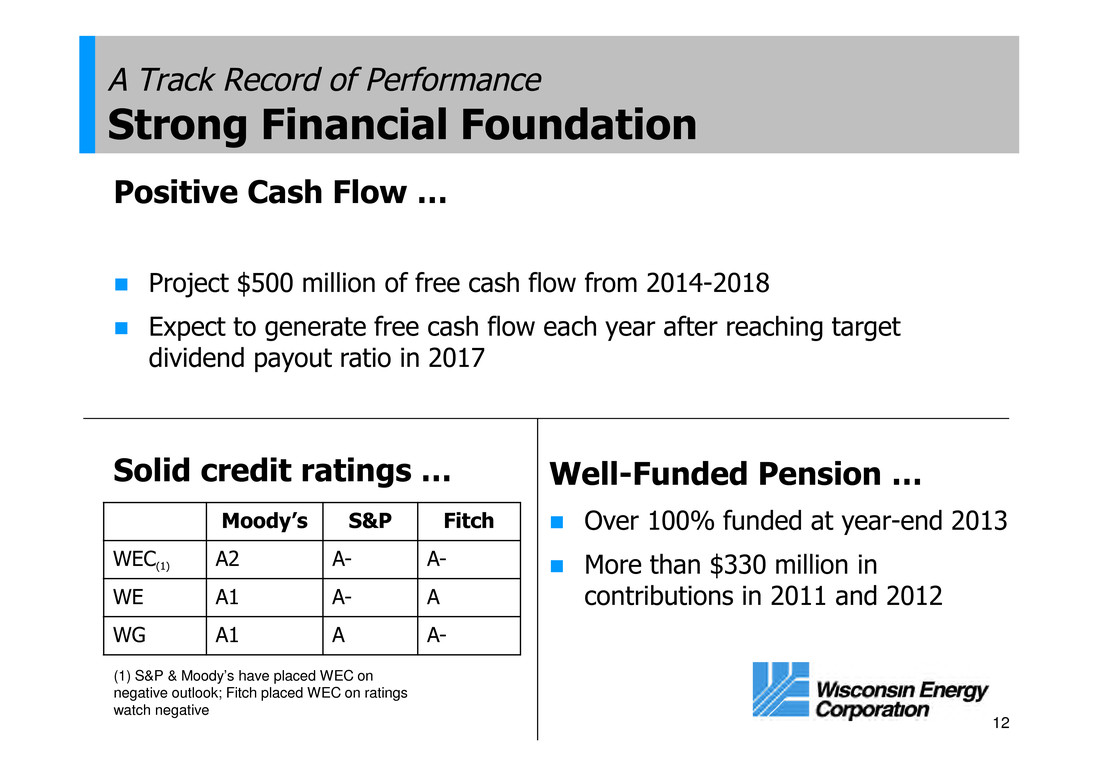

12 A Track Record of Performance Strong Financial Foundation Moody’s S&P Fitch WEC(1) A2 A- A- WE A1 A- A WG A1 A A- Well-Funded Pension … Over 100% funded at year-end 2013 More than $330 million in contributions in 2011 and 2012 Solid credit ratings … Positive Cash Flow … Project $500 million of free cash flow from 2014-2018 Expect to generate free cash flow each year after reaching target dividend payout ratio in 2017 (1) S&P & Moody’s have placed WEC on negative outlook; Fitch placed WEC on ratings watch negative

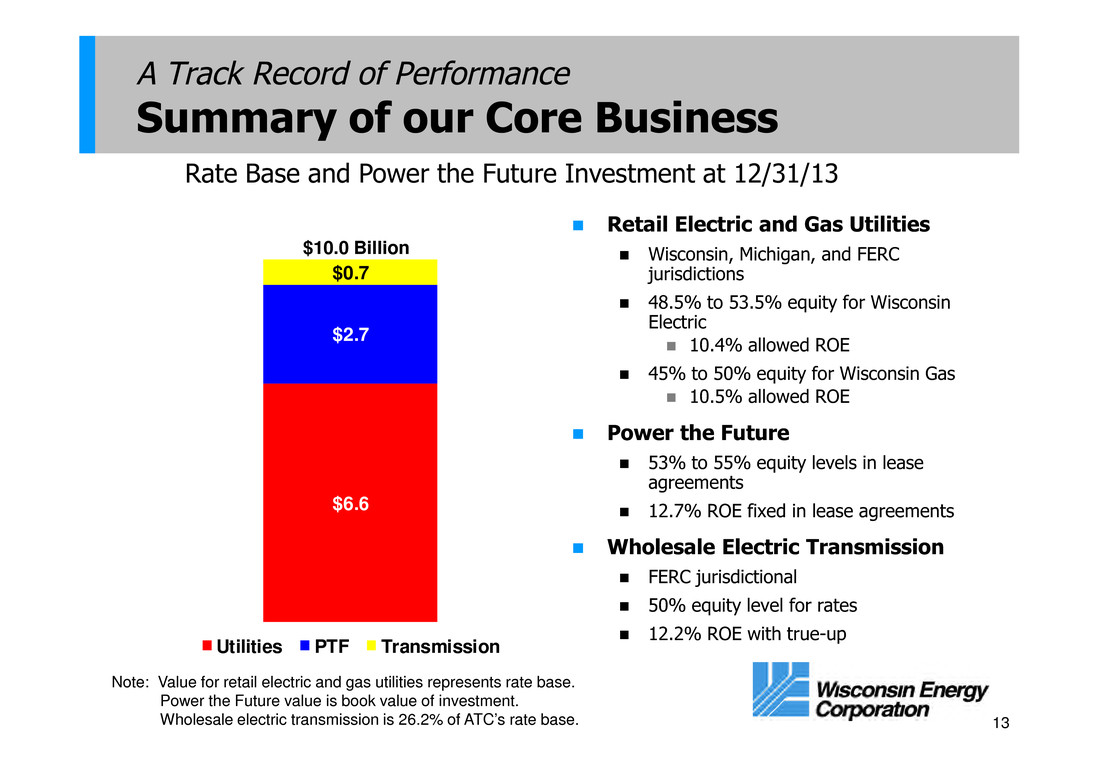

13 A Track Record of Performance Summary of our Core Business Retail Electric and Gas Utilities Wisconsin, Michigan, and FERC jurisdictions 48.5% to 53.5% equity for Wisconsin Electric 10.4% allowed ROE 45% to 50% equity for Wisconsin Gas 10.5% allowed ROE Power the Future 53% to 55% equity levels in lease agreements 12.7% ROE fixed in lease agreements Wholesale Electric Transmission FERC jurisdictional 50% equity level for rates 12.2% ROE with true-up $2.7 $5.7 Note: Value for retail electric and gas utilities represents rate base. Power the Future value is book value of investment. Wholesale electric transmission is 26.2% of ATC’s rate base. $10.0 Billion Rate Base and Power the Future Investment at 12/31/13 $6.6 $2.7 $0.7 Utilities PTF Transmission

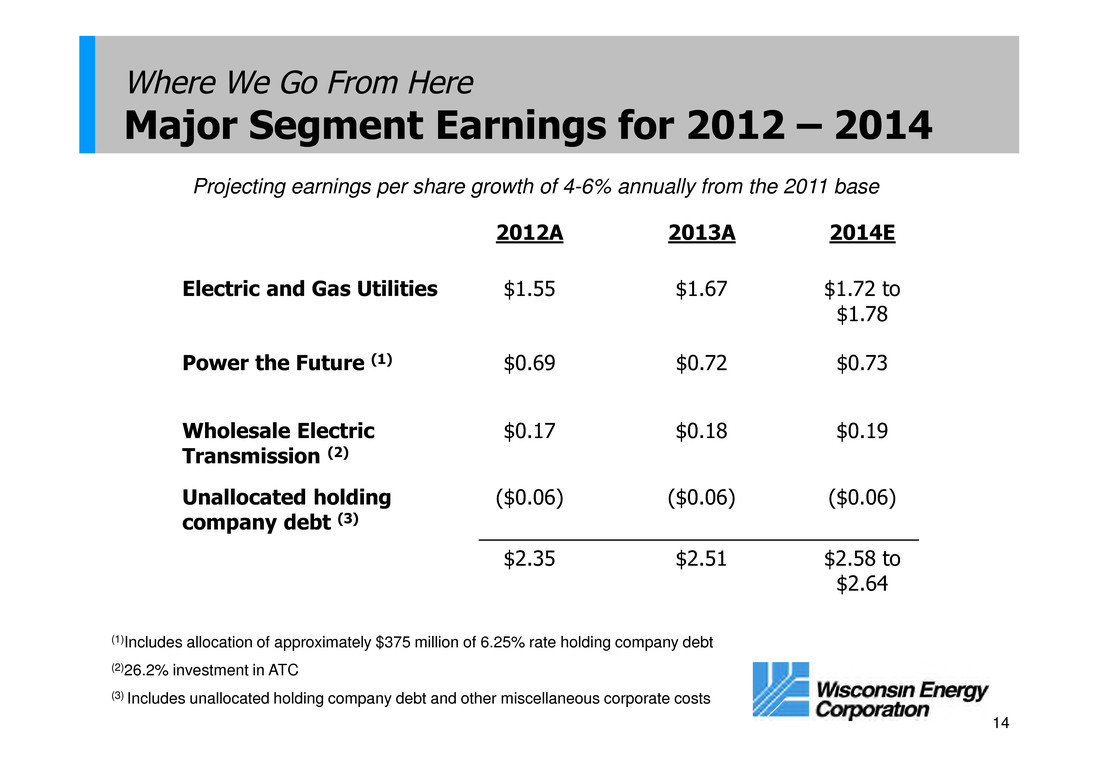

14 Where We Go From Here Major Segment Earnings for 2012 – 2014 2012A 2013A 2014E Electric and Gas Utilities $1.55 $1.67 $1.72 to $1.78 Power the Future (1) $0.69 $0.72 $0.73 Wholesale Electric Transmission (2) $0.17 $0.18 $0.19 Unallocated holding company debt (3) ($0.06) ($0.06) ($0.06) $2.35 $2.51 $2.58 to $2.64 (1)Includes allocation of approximately $375 million of 6.25% rate holding company debt (2)26.2% investment in ATC (3) Includes unallocated holding company debt and other miscellaneous corporate costs Projecting earnings per share growth of 4-6% annually from the 2011 base

15 Where We Go From Here Delivering the Future From 2014 through 2018, our plan is to invest $3.2 to $3.5 billion in needed infrastructure projects that will: Renew and modernize our grid Meet new environmental standards Reduce our operating costs for customers From 2014 through 2023, our plan is to invest $6.5 to $7.1 billion in needed infrastructure

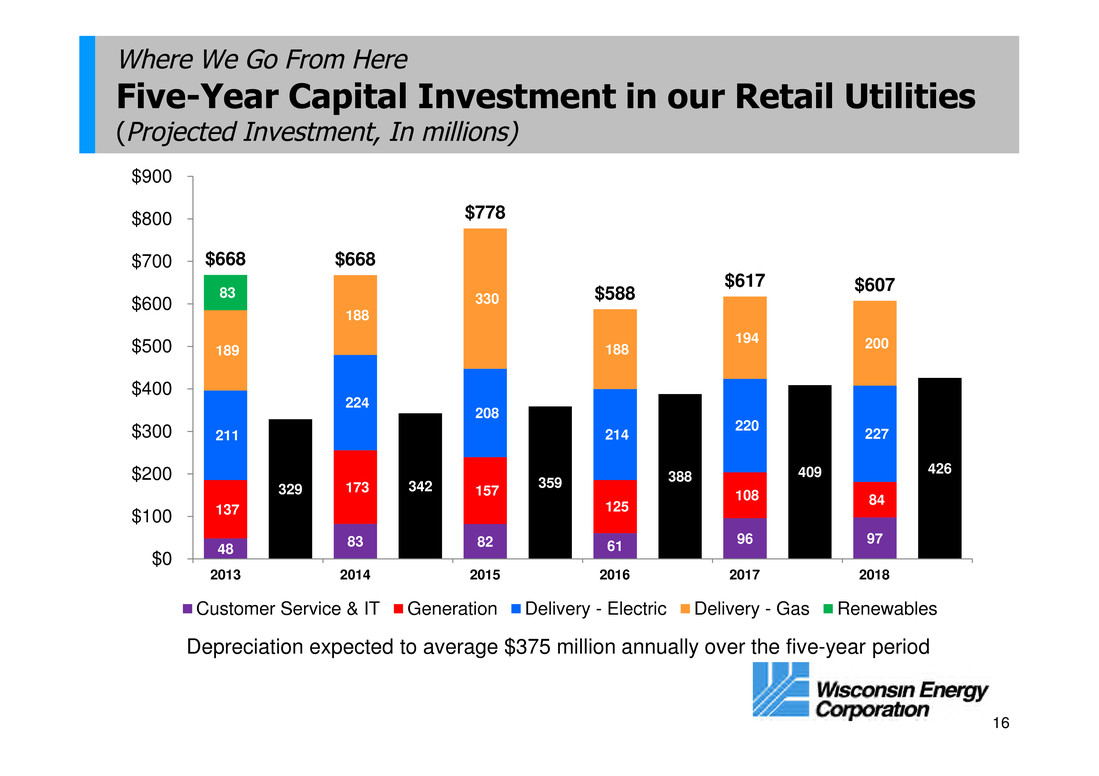

16 Where We Go From Here Five-Year Capital Investment in our Retail Utilities (Projected Investment, In millions) 48 83 82 61 96 97 137 173 157 125 108 84 211 224 208 214 220 227 189 188 330 188 194 200 83 $668 329 $668 342 $778 359 $588 388 $617 409 $607 426 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2013 2014 2015 2016 2017 2018 Customer Service & IT Generation Delivery - Electric Delivery - Gas Renewables Depreciation expected to average $375 million annually over the five-year period

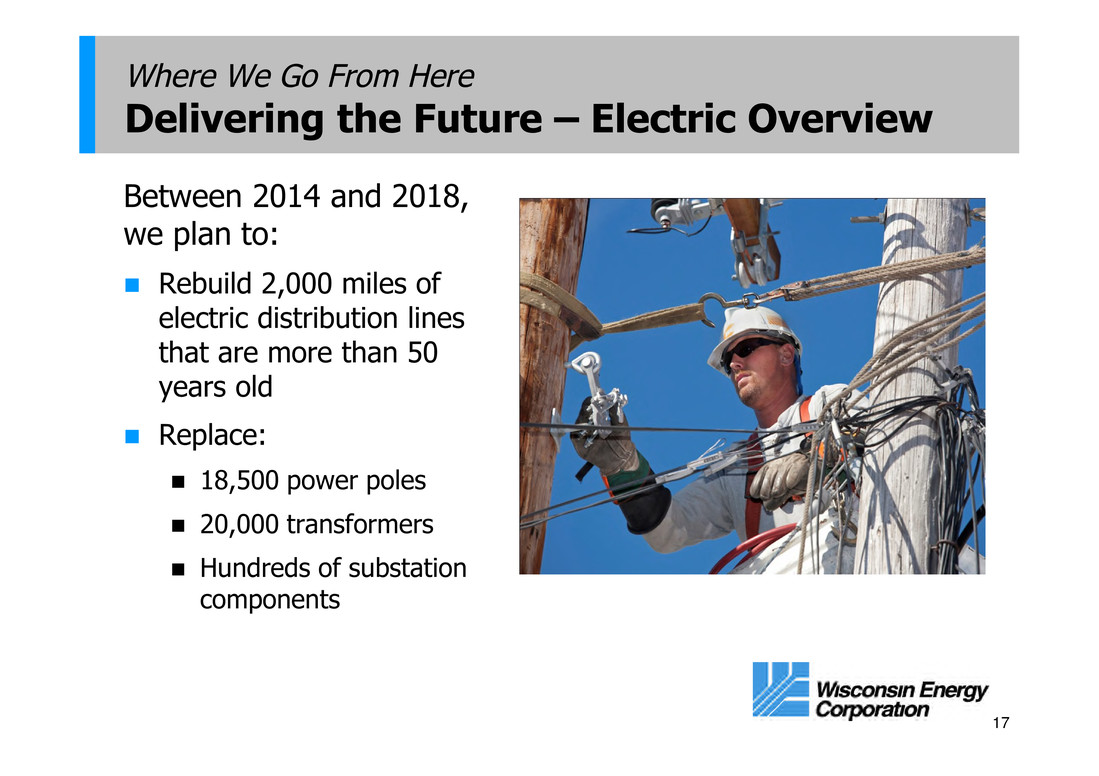

17 Between 2014 and 2018, we plan to: Rebuild 2,000 miles of electric distribution lines that are more than 50 years old Replace: 18,500 power poles 20,000 transformers Hundreds of substation components Where We Go From Here Delivering the Future – Electric Overview

18 Between 2014 and 2018, we also plan to: Replace: 1,100 miles of vintage plastic and steel gas mains 83,000 individual gas distribution lines 233,000 meter sets Where We Go From Here Delivering the Future – Gas Overview

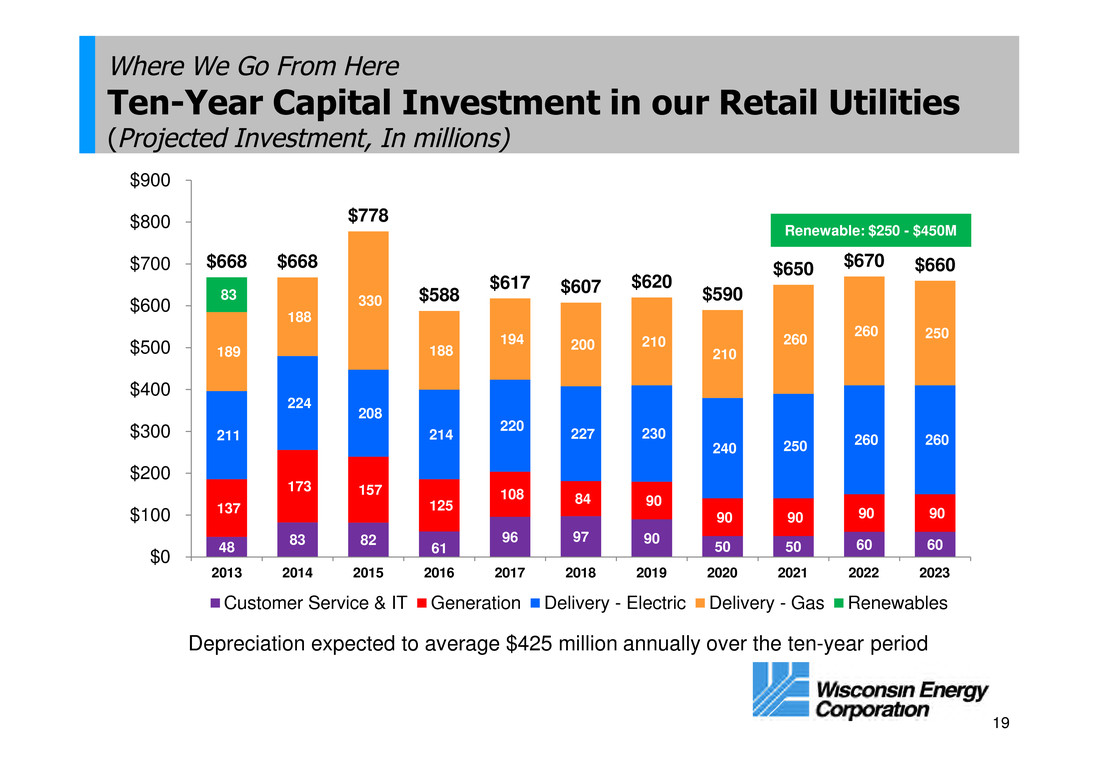

19 Where We Go From Here Ten-Year Capital Investment in our Retail Utilities (Projected Investment, In millions) 48 83 82 61 96 97 90 50 50 60 60 137 173 157 125 108 84 90 90 90 90 90 211 224 208 214 220 227 230 240 250 260 260 189 188 330 188 194 200 210 210 260 260 250 83 $668 $668 $778 $588 $617 $607 $620 $590 $650 $670 $660 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Customer Service & IT Generation Delivery - Electric Delivery - Gas Renewables Renewable: $250 - $450M Depreciation expected to average $425 million annually over the ten-year period

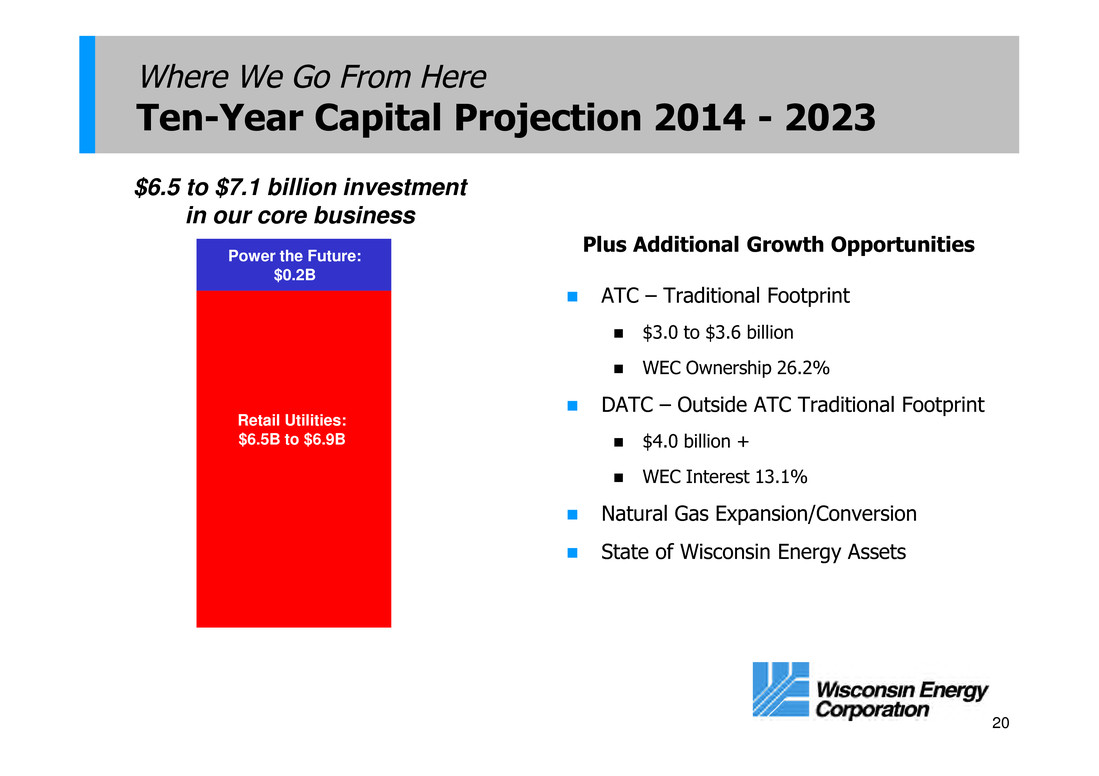

20 Where We Go From Here Ten-Year Capital Projection 2014 - 2023 Plus Additional Growth Opportunities ATC – Traditional Footprint $3.0 to $3.6 billion WEC Ownership 26.2% DATC – Outside ATC Traditional Footprint $4.0 billion + WEC Interest 13.1% Natural Gas Expansion/Conversion State of Wisconsin Energy Assets $2.7 $5.7 Retail Utilities: $6.5B to $6.9B Power the Future: $0.2B $6.5 to $7.1 billion investment in our core business

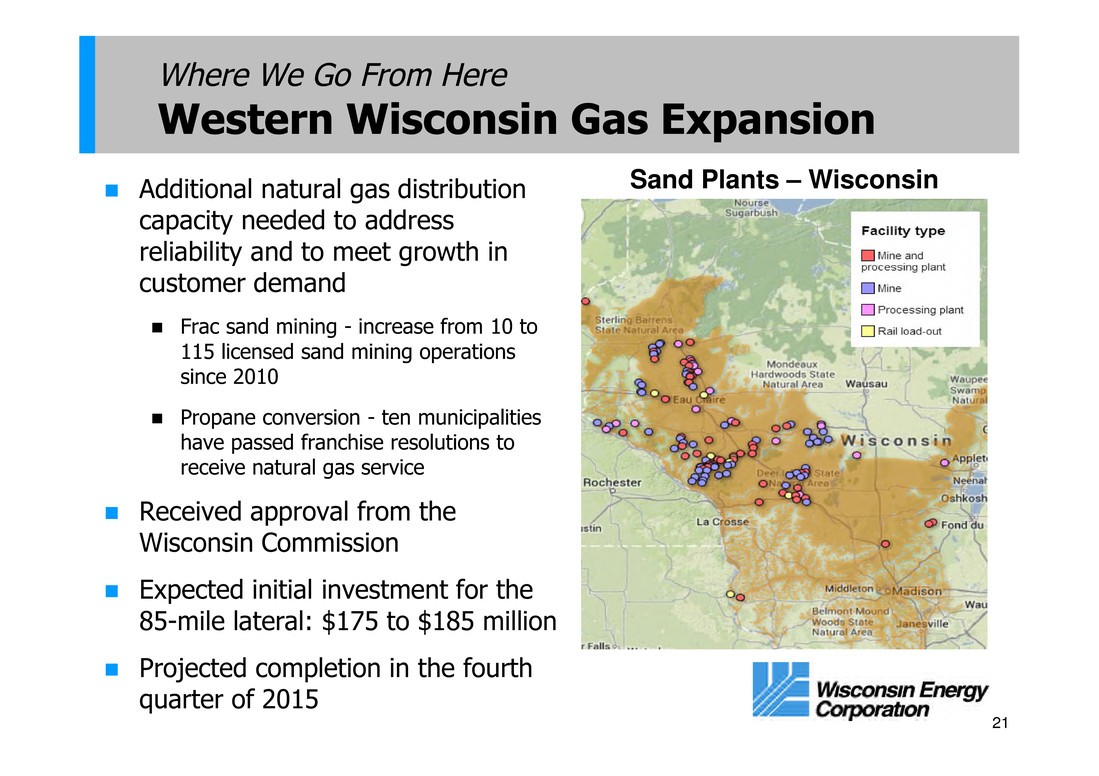

21 Where We Go From Here Western Wisconsin Gas Expansion Additional natural gas distribution capacity needed to address reliability and to meet growth in customer demand Frac sand mining - increase from 10 to 115 licensed sand mining operations since 2010 Propane conversion - ten municipalities have passed franchise resolutions to receive natural gas service Received approval from the Wisconsin Commission Expected initial investment for the 85-mile lateral: $175 to $185 million Projected completion in the fourth quarter of 2015 Sand Plants – Wisconsin

22 Where We Go From Here Renewable Energy Investments Biomass plant completed 50MW Investment of $269 million Commercial operation began in November of 2013 Renewable fleet in place Glacier Hills Wind Park (162 MW, in service since 2011) Blue Sky Green Field Wind Park (145 MW, in service since 2008) Montfort Wind Energy Center (30 MW, purchased in 2012) We expect to be in compliance with the Wisconsin renewable portfolio standard through 2023

23 Converting Valley from coal to natural gas Unit 1 conversion underway Targeting completion for both Units 1 and 2 in late 2015 Follows construction of a gas pipeline upgrade with expected in-service in 2014 Where We Go From Here Valley Power Plant Projected conversion cost for Valley: $65 to $70 million

24 Building a new powerhouse at Twin Falls as existing powerhouse is in need of repair Construction began in the fall of 2013 with scheduled completion in 2016 Expected cost: $60 to $65 million Where We Go From Here Twin Falls Hydroelectric Powerhouse

25 Where We Go From Here Fuel Flexibility Project To Date: have achieved sustained operation on 20% PRB coal blend In July, asked the Wisconsin Commission to approve $25 million of additional capital for plant modifications that will enable testing of up to 100% PRB coal Further investment may be needed for fuel handling and storage Objective is to have the flexibility to burn up to 100% PRB coal on a sustained basis Goal: enable our Oak Creek expansion units to burn both Powder River Basin (PRB) and bituminous coal

26 Where We Go From Here Wisconsin Rate Case Summary Wisconsin has biennial rate cycle Two year forward looking test years Apply in 2014 for 2015 and 2016 rates Settlement for ROE, capital structure, and base rate changes reached in May Wisconsin Electric ROE of 10.2%, Wisconsin Gas ROE of 10.3% Wisconsin Electric capital structure unchanged (at 51% equity midpoint), Wisconsin Gas equity component increased to 49.5% (from 47.5%) Non-fuel electric rate increase of $41.5 million or 1.4% in 2015 Remainder of the case will focus on rate design and 2015 fuel recovery Expect final order this fall

27 Where We Go From Here Presque Isle Power Plant Entered into ‘System Support Resource’ (SSR) agreement with MISO in January 2014 for payments to support operation of Presque Isle power plant Filed for next SSR effective October of 2014 Several recent FERC orders may impact the SSR payments Allocation of costs across MISO Re-examination of the fixed costs to run Presque Isle Return on-and-of embedded investment can be submitted for potential recovery No significant impact expected on 2014 or 2015 earnings Assessing long-term alternatives to maintain electric reliability in the Upper Peninsula of Michigan

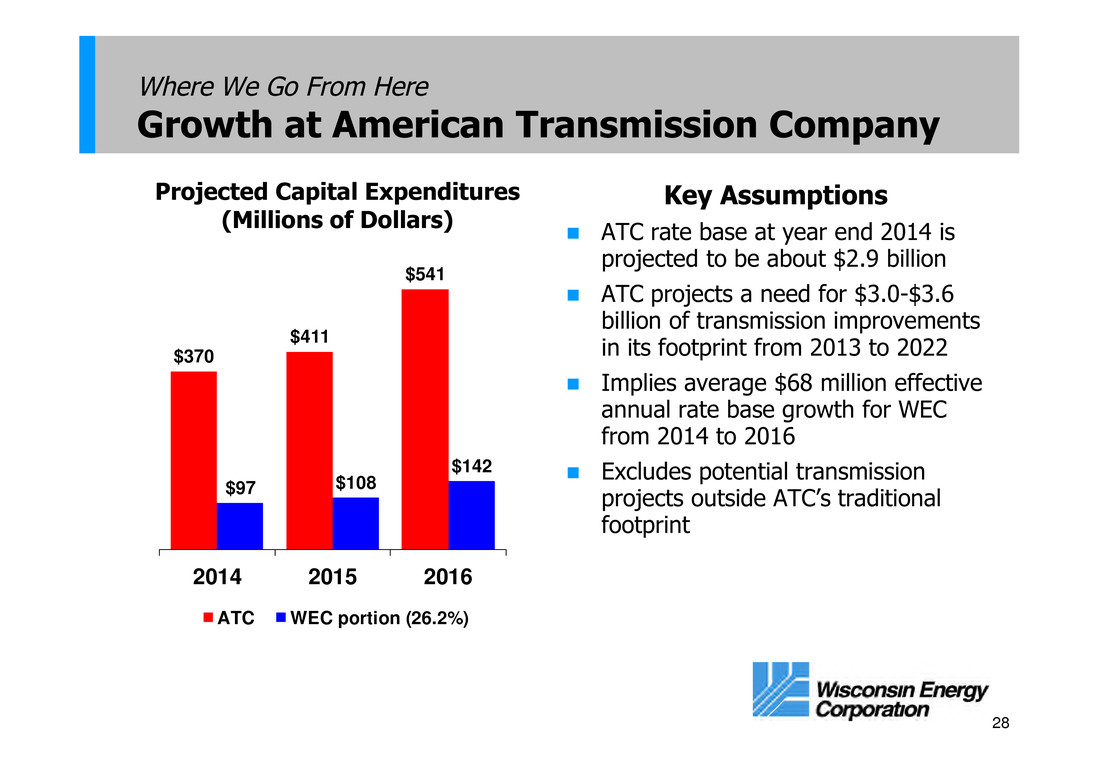

28 Where We Go From Here Growth at American Transmission Company $370 $411 $541 $97 $108 $142 2014 2015 2016 ATC WEC portion (26.2%) Key Assumptions ATC rate base at year end 2014 is projected to be about $2.9 billion ATC projects a need for $3.0-$3.6 billion of transmission improvements in its footprint from 2013 to 2022 Implies average $68 million effective annual rate base growth for WEC from 2014 to 2016 Excludes potential transmission projects outside ATC’s traditional footprint Projected Capital Expenditures (Millions of Dollars)

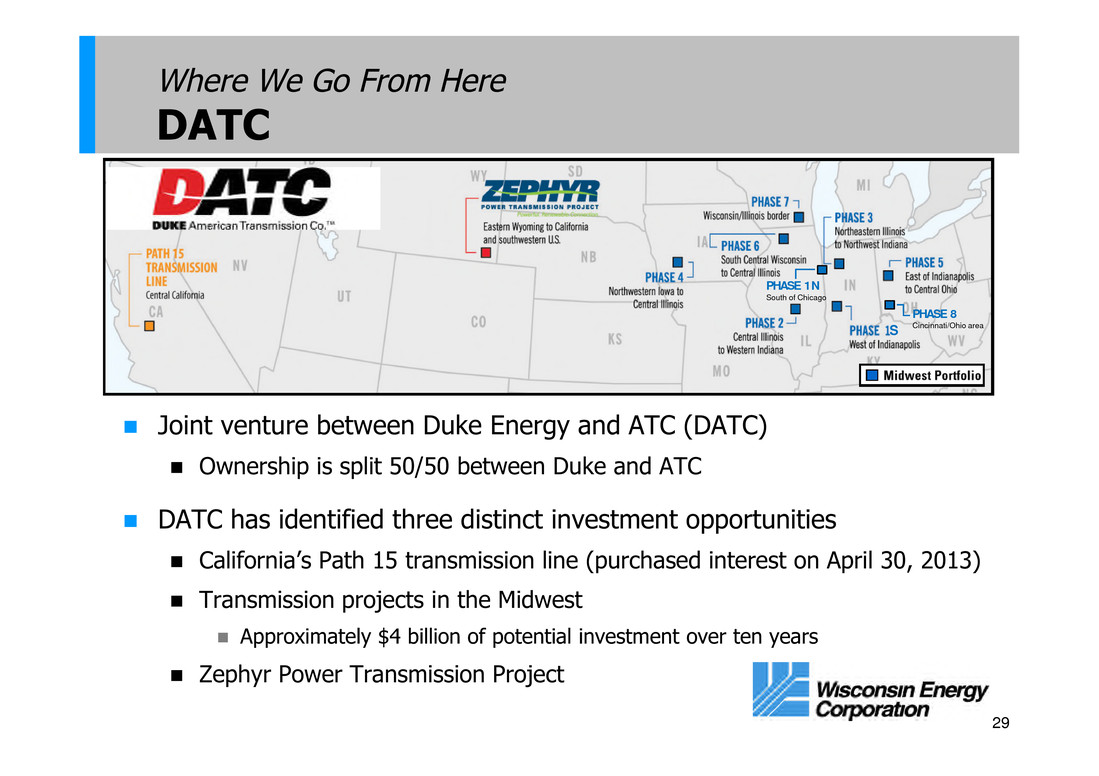

29 Where We Go From Here DATC Joint venture between Duke Energy and ATC (DATC) Ownership is split 50/50 between Duke and ATC DATC has identified three distinct investment opportunities California’s Path 15 transmission line (purchased interest on April 30, 2013) Transmission projects in the Midwest Approximately $4 billion of potential investment over ten years Zephyr Power Transmission Project PHASE 1N South of Chicago PHASE 8 Cincinnati/Ohio area S

30 Where We Go From Here Industry Leading Dividend Growth The board of directors raised the quarterly dividend in January to 39 cents a share – equivalent to an annual rate of $1.56 a share Represents a 30% increase over the rate in effect during 2012 The board of directors also affirmed a target payout ratio of 65-70 percent of earnings in 2017 Supports 7-8 percent dividend increases from 2015-2017

31 Key Takeaways on Wisconsin Energy An “Earn and Return” Company with a Low Risk Profile Power the Future program now complete Highly visible earnings and strong cash flow Well-managed utility franchises with rate base growth Investment in American Transmission Company provides an additional regulated growth opportunity Positioned to deliver among the best risk-adjusted returns in the industry Positive free cash flow Best in class dividend growth story

Appendix

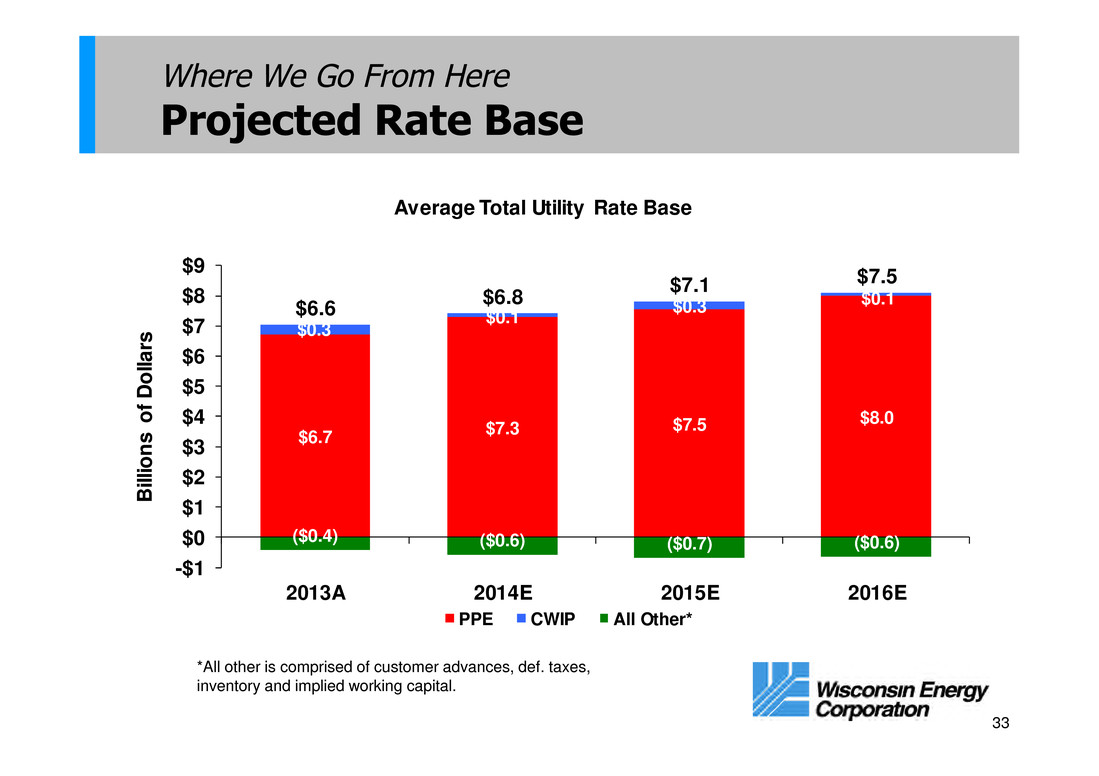

33 Where We Go From Here Projected Rate Base $6.7 $7.3 $7.5 $8.0 $0.3 $0.1 $0.3 $0.1 ($0.4) ($0.6) ($0.7) ($0.6) $6.6 $6.8 $7.1 $7.5 -$1 $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 2013A 2014E 2015E 2016E B ill io n s o f D o lla rs Average Total Utility Rate Base PPE CWIP All Other* *All other is comprised of customer advances, def. taxes, inventory and implied working capital.

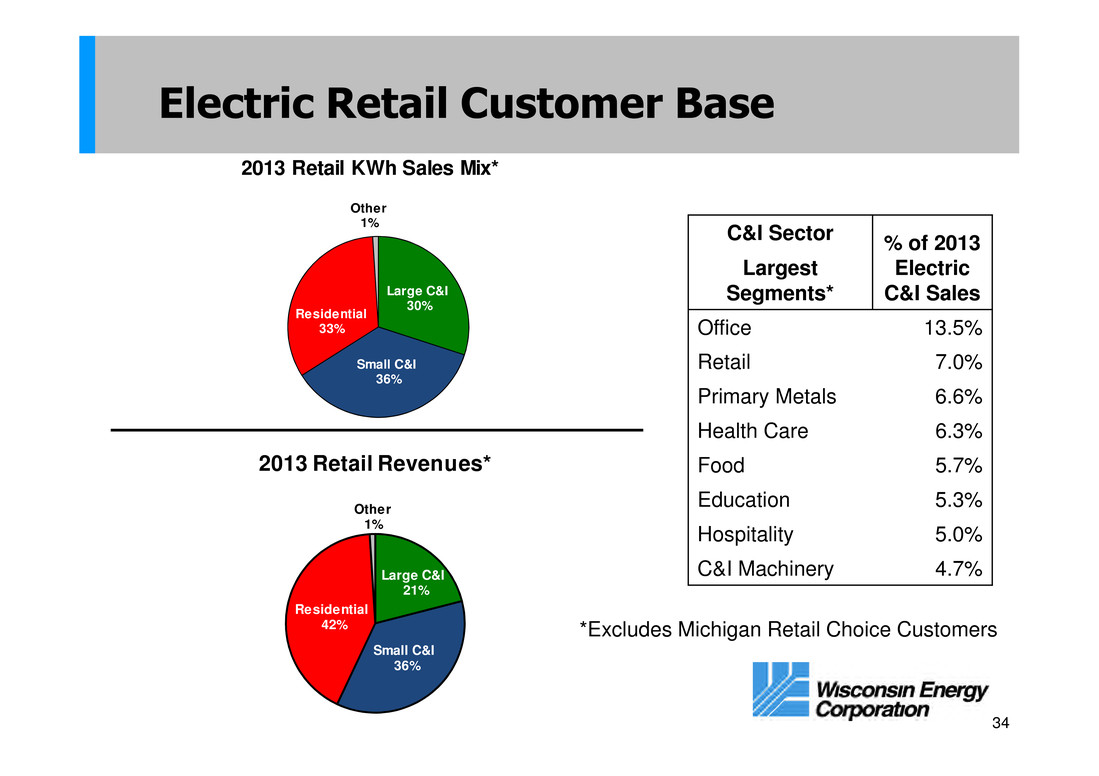

34 Electric Retail Customer Base Large C&I 30% Small C&I 36% Residential 33% Other 1% 2013 Retail KWh Sales Mix* C&I Sector Largest Segments* % of 2013 Electric C&I Sales Office 13.5% Retail 7.0% Primary Metals 6.6% Health Care 6.3% Food 5.7% Education 5.3% Hospitality 5.0% C&I Machinery 4.7%Large C&I 21% Small C&I 36% Residential 42% Other 1% 2013 Retail Revenues* *Excludes Michigan Retail Choice Customers

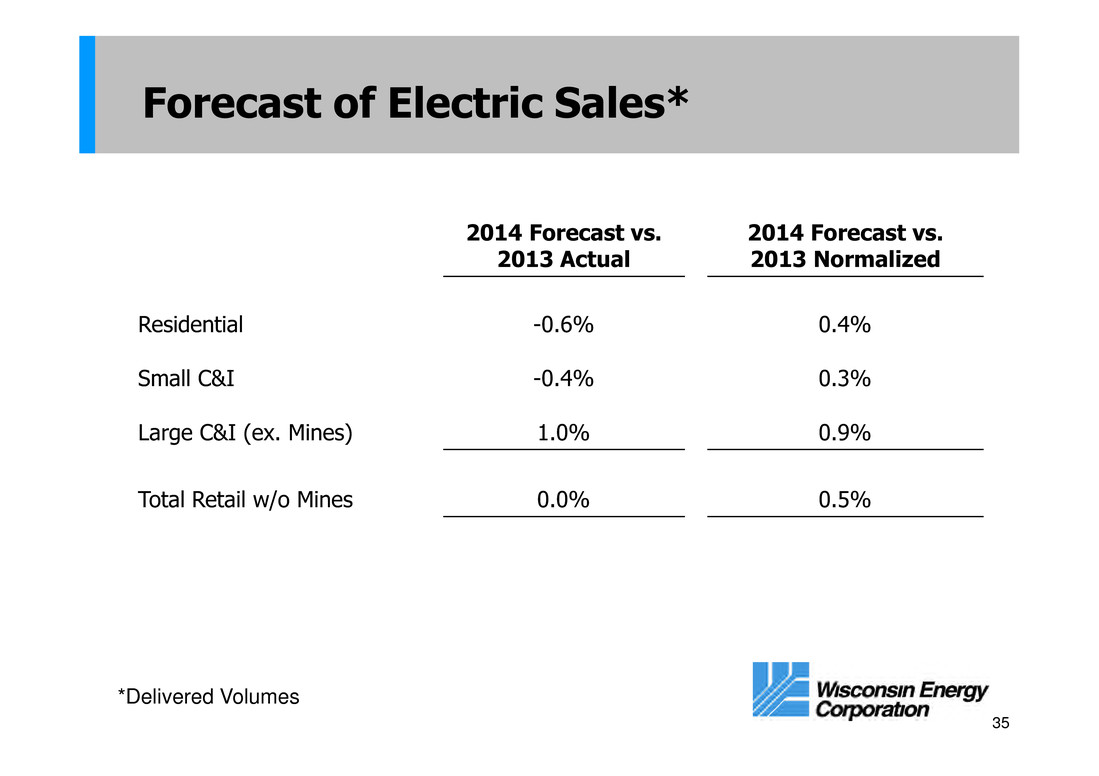

35 Forecast of Electric Sales* 2014 Forecast vs. 2013 Actual 2014 Forecast vs. 2013 Normalized Residential -0.6% 0.4% Small C&I -0.4% 0.3% Large C&I (ex. Mines) 1.0% 0.9% Total Retail w/o Mines 0.0% 0.5% *Delivered Volumes

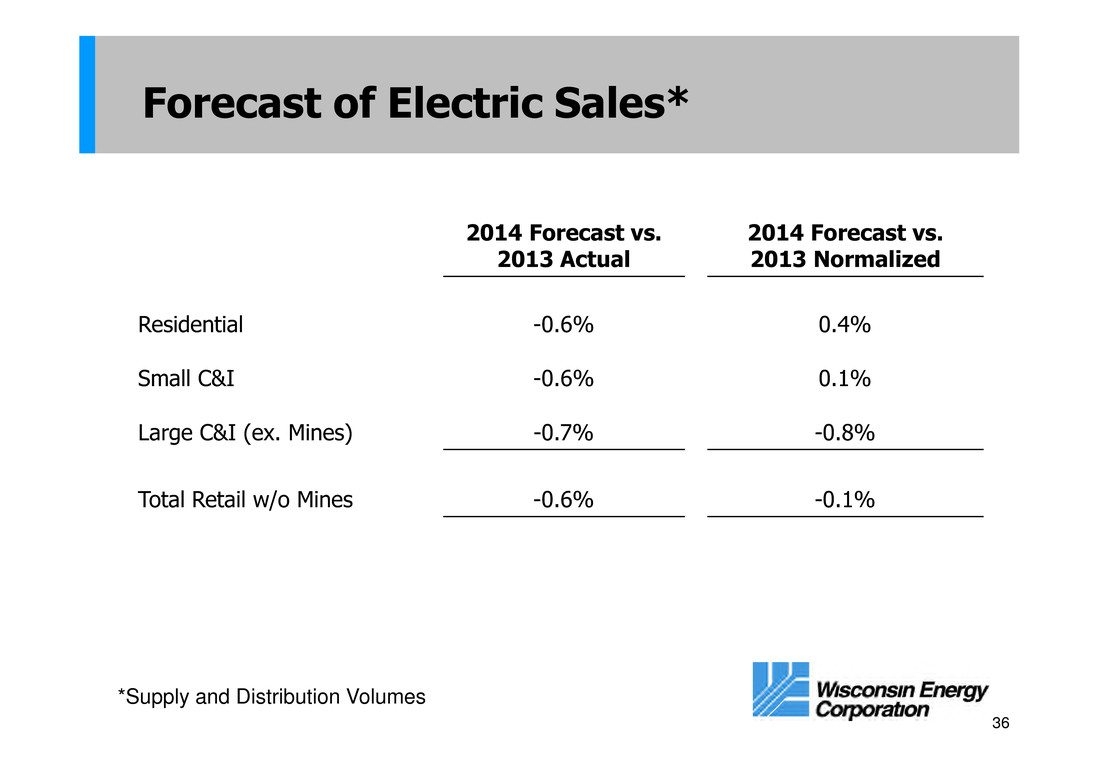

36 Forecast of Electric Sales* 2014 Forecast vs. 2013 Actual 2014 Forecast vs. 2013 Normalized Residential -0.6% 0.4% Small C&I -0.6% 0.1% Large C&I (ex. Mines) -0.7% -0.8% Total Retail w/o Mines -0.6% -0.1% *Supply and Distribution Volumes

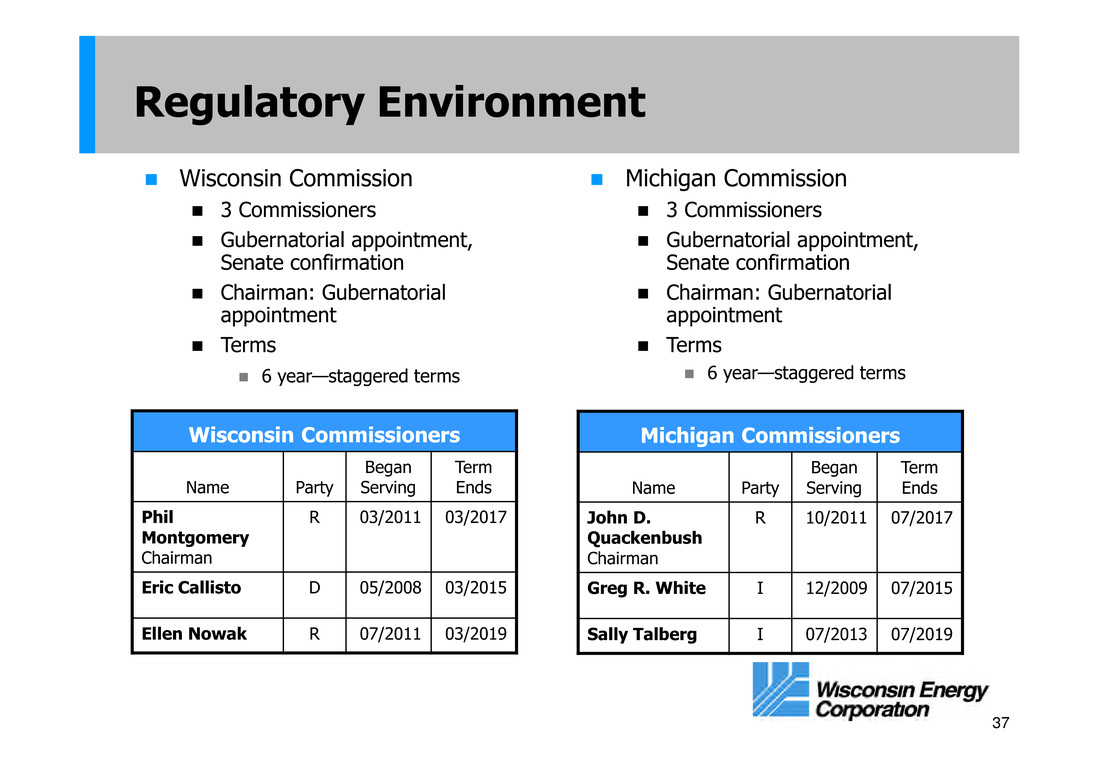

37 Regulatory Environment Wisconsin Commissioners Name Party Began Serving Term Ends Phil Montgomery Chairman R 03/2011 03/2017 Eric Callisto D 05/2008 03/2015 Ellen Nowak R 07/2011 03/2019 Wisconsin Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Michigan Commission 3 Commissioners Gubernatorial appointment, Senate confirmation Chairman: Gubernatorial appointment Terms 6 year—staggered terms Michigan Commissioners Name Party Began Serving Term Ends John D. Quackenbush Chairman R 10/2011 07/2017 Greg R. White I 12/2009 07/2015 Sally Talberg I 07/2013 07/2019