Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SELECT INCOME REIT | a2221303z8-k.htm |

| EX-2.1 - EX-2.1 - SELECT INCOME REIT | a2221303zex-2_1.htm |

| EX-2.2 - EX-2.2 - SELECT INCOME REIT | a2221303zex-2_2.htm |

| EX-10.1 - EX-10.1 - SELECT INCOME REIT | a2221303zex-10_1.htm |

| EX-99.3 - EX-99.3 - SELECT INCOME REIT | a2221303zex-99_3.htm |

| EX-99.2 - EX-99.2 - SELECT INCOME REIT | a2221303zex-99_2.htm |

| EX-99.4 - EX-99.4 - SELECT INCOME REIT | a2221303zex-99_4.htm |

Exhibit 99.1

|

|

Select Income REIT to Acquire Cole Corporate Income Trust September 2, 2014 F5 Networks Corporate Headquarters Seattle, WA 299,643 sq. ft. |

|

|

Disclaimer. 2 THIS PRESENTATION CONTAINS FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER SIR USES WORDS SUCH AS "BELIEVE," "EXPECT," "ANTICIPATE," "INTEND," "PLAN," "ESTIMATE," OR SIMILAR EXPRESSIONS, IT IS MAKING FORWARD LOOKING STATEMENTS. THESE FORWARD LOOKING STATEMENTS ARE BASED UPON SIR’S PRESENT INTENT, BELIEFS OR EXPECTATIONS. FORWARD LOOKING STATEMENTS ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY SIR’S FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS, WHICH INCLUDE THOSE THAT ARE DETAILED IN OUR ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2013 AND SUBSEQUENT FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. YOU SHOULD NOT PLACE UNDUE RELIANCE UPON ANY FORWARD LOOKING STATEMENT. EXCEPT AS REQUIRED BY APPLICABLE LAW, SIR UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD LOOKING STATEMENT AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. |

|

|

Disclaimer. 3 ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION AND WHERE TO FIND IT In connection with the merger, Select Income REIT (NYSE: SIR) expects to file with the SEC a registration statement on Form S-4 containing a joint proxy statement/prospectus and other documents with respect to the merger with respect to both SIR and Cole Corporate Income Trust, Inc. (CCIT). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) IF AND WHEN THEY BECOME AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. After the registration statement has been declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to the SIR shareholders and CCIT stockholders. Investors will be able to obtain a free copy of documents filed with the SEC at the SEC’s website at www.sec.gov. In addition, investors may obtain free copies of SIR’s filings with the SEC from SIR’s website at www.sirreit.com and free copies of CCIT’s filings with the SEC from its website at www.colecapital.com. PARTICIPANTS IN THE SOLICITATION RELATING TO THE MERGER SIR, its Trustees and certain of its executive officers, CCIT, its directors and certain of its executive officers and Reit Management & Research LLC, SIR’s manager, and Cole Corporate Income Advisors, LLC, CCIT’s advisor, and certain of their directors, officers and employees may be deemed participants in the solicitation of proxies from SIR’s shareholders in respect of the approval of the issuance of SIR common shares in the merger and from CCIT’s stockholders in respect of the approval of the merger. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of SIR shareholders and CCIT’s stockholders in connection with the proposed merger will be set forth in the joint proxy statement/prospectus and the other relevant documents to be filed with the SEC. You can find information about SIR’s Trustees and executive officers in its definitive proxy statement for SIR’s 2014 Annual Meeting of Shareholders. You can find information about CCIT’s directors and executive officers in its definitive proxy statement filed with the SEC on Schedule 14A on April 8, 2014. These documents are available free of charge on the SEC’s website and from SIR or CCIT, as applicable, using the sources indicated above. |

|

|

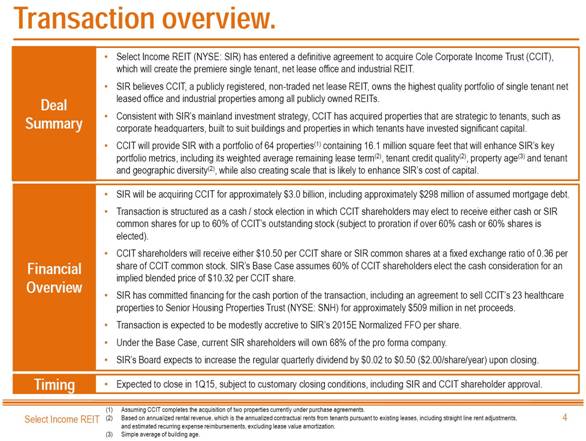

Transaction overview. 4 Select Income REIT (NYSE: SIR) has entered a definitive agreement to acquire Cole Corporate Income Trust (CCIT), which will create the premiere single tenant, net lease office and industrial REIT. SIR believes CCIT, a publicly registered, non-traded net lease REIT, owns the highest quality portfolio of single tenant net leased office and industrial properties among all publicly owned REITs. Consistent with SIR’s mainland investment strategy, CCIT has acquired properties that are strategic to tenants, such as corporate headquarters, built to suit buildings and properties in which tenants have invested significant capital. CCIT will provide SIR with a portfolio of 64 properties(1) containing 16.1 million square feet that will enhance SIR’s key portfolio metrics, including its weighted average remaining lease term(2), tenant credit quality(2), property age(3) and tenant and geographic diversity(2), while also creating scale that is likely to enhance SIR’s cost of capital. Deal Summary SIR will be acquiring CCIT for approximately $3.0 billion, including approximately $298 million of assumed mortgage debt. Transaction is structured as a cash / stock election in which CCIT shareholders may elect to receive either cash or SIR common shares for up to 60% of CCIT’s outstanding stock (subject to proration if over 60% cash or 60% shares is elected). CCIT shareholders will receive either $10.50 per CCIT share or SIR common shares at a fixed exchange ratio of 0.36 per share of CCIT common stock. SIR’s Base Case assumes 60% of CCIT shareholders elect the cash consideration for an implied blended price of $10.32 per CCIT share. SIR has committed financing for the cash portion of the transaction, including an agreement to sell CCIT’s 23 healthcare properties to Senior Housing Properties Trust (NYSE: SNH) for approximately $509 million in net proceeds. Transaction is expected to be modestly accretive to SIR’s 2015E Normalized FFO per share. Under the Base Case, current SIR shareholders will own 68% of the pro forma company. SIR’s Board expects to increase the regular quarterly dividend by $0.02 to $0.50 ($2.00/share/year) upon closing. Financial Overview Expected to close in 1Q15, subject to customary closing conditions, including SIR and CCIT shareholder approval. Timing Assuming CCIT completes the acquisition of two properties currently under purchase agreements. Based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. Simple average of building age. |

|

|

5 Base Case financing detail. SIR will use a combination of equity, debt and cash to fund the CCIT acquisition: $795 million equity issuance to CCIT shareholders. Sale of 23 healthcare properties to occur simultaneously and generate $539 million in gross proceeds; or $509 million net of $30 million of assumed mortgage debt. SIR expects to draw on its existing unsecured revolving credit facility for up to $500 million and has received $1 billion in financing commitments from Citigroup and UBS Investment Bank for a bridge loan to finance the remaining cash portion of the transaction. SIR will seek investment grade credit ratings. SIR expects to issue laddered maturities of senior unsecured notes to refinance the bridge loan and borrowings under its revolving credit facility on a long term basis. |

|

|

Summary of key benefits. 6 PNC Bank Philadelphia, PA 441,000 sq. ft. Allstate Irving, TX 458,338 sq. ft. Church & Dwight Ewing, NJ 250,086 sq. ft Based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. Simple average. The greater scale and enhancements to key portfolio metrics will benefit shareholders by reducing risk and likely lowering SIR’s cost of capital. Lengthens SIR’s weighted average lease term(1). Increases SIR’s percentage of investment grade rated tenants(1). Expands SIR’s portfolio of high quality buildings that are strategic to tenants. Reduces the average age of SIR’s buildings(2). Enhances SIR’s geographic, industry and tenant diversity(1). Provides incremental scale/size for the SIR platform. |

|

|

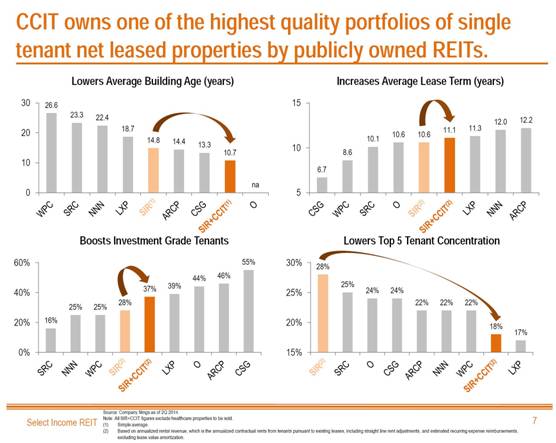

CCIT owns one of the highest quality portfolios of single tenant net leased properties by publicly owned REITs. 7 SIR(1) SIR+CCIT(1) SIR(2) SIR(2) SIR+CCIT SIR+CCIT(2) Source: Company filings as of 2Q 2014. Note: All SIR+CCIT figures exclude healthcare properties to be sold. Simple average. Based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. SIR(2) SIR+CCIT(2) SIR+CCIT(2) |

|

|

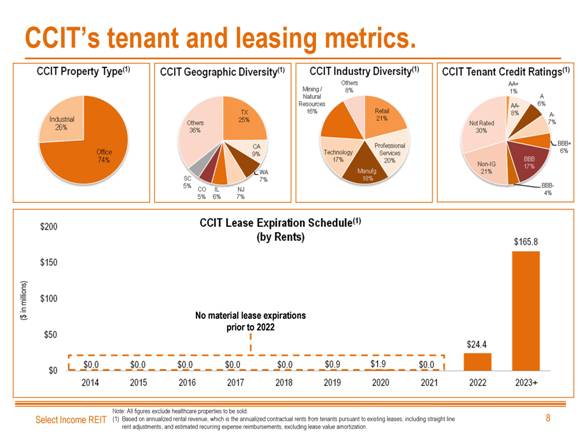

CCIT’s tenant and leasing metrics. 8 ($ in millions) No material lease expirations prior to 2022 Note: All figures exclude healthcare properties to be sold. Based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. |

|

|

$4,556 114 43.1 35 98% 11.1 37% 10.7 18% SIR + Pro Forma CCIT(1) Significantly strengthening the SIR platform. 9 $2,475 64 16.1 30 100% 11.8 49% 8.1 35% Pro Forma CCIT(1) Enterprise Value ($mm)(2) Properties Square Feet (mm) Number of States Weighted Average Occupancy(3) Remaining Lease Term (years)(4) % Investment Grade Tenants(4) Average Building Age (years)(5) Top 5 Tenant Concentration(4) $2,081 50 27.0 21 96% 10.6 28% 14.8 28% SIR (1) Excludes healthcare properties to be sold. (2) Assumes a blended purchase price of $10.32 per CCIT share. (3) Based on square footage pursuant to existing leases, and includes (i) space being fitted out for occupancy, and (ii) space which is leased but is not occupied or is being offered for sublease, if any. (4) Based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. (5) Simple average. |

|

|

Increases tenant credit worthiness. 10 Note: Pro forma information excludes healthcare properties to be sold. Charts are based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. Top Investment Grade Tenants Top 20 Tenants All Tenants SIR Today Pro Forma Investment Grade Non-Investment Grade Not Rated |

|

|

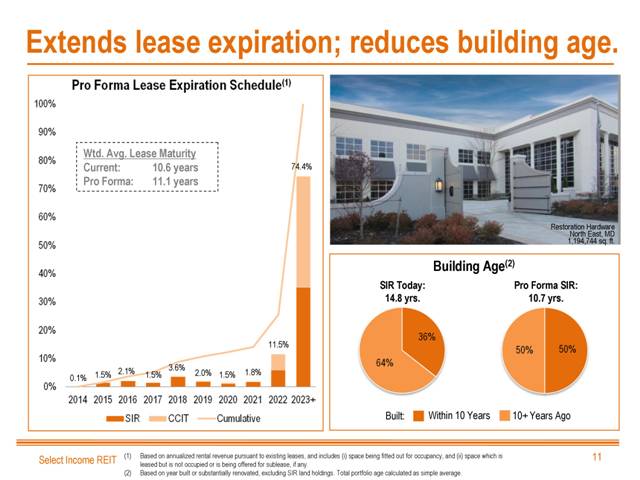

Building Age(2) Extends lease expiration; reduces building age. 11 0.1% 1.5% 2.1% 1.5% 3.6% 2.0% 1.5% 1.8% 11.5% 74.4% Wtd. Avg. Lease Maturity Current: 10.6 years Pro Forma: 11.1 years Based on annualized rental revenue pursuant to existing leases, and includes (i) space being fitted out for occupancy, and (ii) space which is leased but is not occupied or is being offered for sublease, if any. Based on year built or substantially renovated, excluding SIR land holdings. Total portfolio age calculated as simple average. Restoration Hardware North East, MD 1,194,744 sq. ft. SIR Today: 14.8 yrs. Pro Forma SIR: 10.7 yrs. Within 10 Years 10+ Years Ago Built: |

|

|

Diversifies tenant mix and income streams. 12 Tenant Industry Diversity(1) Tenant Geographic Diversity SIR Today Pro forma Rental Income Diversity(1) SIR Today Pro forma Top 10 Tenants Other Tenants SIR Today Pro Forma High Tech, Communications Manufacturing, Energy, Transportation Real Estate, Financial Industrial Retail, Food Mining, Natural Resources Other Based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. SIR Today Pro forma SIR Market Today New SIR Market |

|

|

13 Noble Energy (NYSE: NBL) Corporate Headquarters Houston, TX 497,477 sq. ft. |

|

|

14 United Launch Alliance Corporate Headquarters Centennial, CO 167,917 sq. ft. |

|

|

15 Compass Group (LON: CPG) U.S. Headquarters Charlotte, NC 284,039 sq. ft. |

|

|

16 F5 Networks (Nasdaq: FFIV) Corporate Headquarters Seattle, WA 299,643 sq. ft. |

|

|

17 Tesoro Corp. (NYSE: TSO) Corporate Headquarters San Antonio, TX 618,017 sq. ft. |

|

|

18 Amazon.com (Nasdaq: AMZN) Distribution Center Spartansburg, SC 1,016,110 sq. ft. |

|

|

Successful execution of SIR’s business strategy. 19 SIR's 3Q12 distribution of $0.49 per common share reflects SIR's initial distribution rate of $0.40 plus an additional $0.09 reflecting SIR's first 20 days as a public company. Source: SNL from 3/6/2012 to 8/29/2014. Current distribution yield of 6.9% as of August 29, 2014. Average total return since IPO exceeds 20% per annum. Quarterly Distributions Paid Per Share Total Return (2) $0.40(1) $0.42 $0.42 $0.44 $0.44 $0.46 $0.46 $0.48 $0.50e |

|

|

20 Valuation benefits of scale and improved portfolio quality. Based on RMZ Index as of 8/29/2014. REIT Sector Avg. Equity Market Cap (1) ($mm) 15,694 4,132 2,363 1,128 Pro Forma SIR SIR Larger REITs generally trade at better multiples than smaller REITs(1). |

|

|

Summary of key benefits. 21 AON plc Lincolnshire, IL 222,717 sq. ft. FedEx Colorado Springs, CO 155,808 sq. ft. DuPont/Pioneer Johnston, IA 198,554 sq. ft. Based on annualized rental revenue, which is the annualized contractual rents from tenants pursuant to existing leases, including straight line rent adjustments, and estimated recurring expense reimbursements, excluding lease value amortization. Simple average. The greater scale and enhancements to key portfolio metrics will benefit shareholders by reducing risk and likely lowering SIR’s cost of capital. Lengthens SIR’s weighted average lease term(1). Increases SIR’s percentage of investment grade rated tenants(1). Expands SIR’s portfolio of high quality buildings that are strategic to tenants. Reduces the average age of SIR’s buildings(2). Enhances SIR’s geographic, industry and tenant diversity(1). Provides incremental scale/size for the SIR platform. |

|

|

Select Income REIT to Acquire Cole Corporate Income Trust September 2, 2014 F5 Networks Corporate Headquarters Seattle, WA 299,643 sq. ft. |