Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - REDtone Asia Inc | ex322.htm |

| EX-31.2 - EXHIBIT 31.2 - REDtone Asia Inc | ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - REDtone Asia Inc | ex311.htm |

| EX-32.1 - EXHIBIT 32.1 - REDtone Asia Inc | ex321.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

(MARK ONE)

|

||

|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

||

|

For the fiscal year ended May 31, 2014

|

||

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

|

||

|

For the transition period from ______ to______

|

||

|

Commission file number 333-129388

|

||

|

REDTONE ASIA, INC

|

||

|

(Exact Name of registrant as specified in its charter)

|

||

|

Nevada

|

71-098116

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Unit 15A, Plaza Sanhe, No. 121,Yanping Road, JingAn District, 200042 Shanghai, PRC

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

||

Registrant’s telephone number, including area code (86) 6103 2230

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, $0.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (of for such shorter period that the registrant was required to submit and post such files). Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

1

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The issuer’s revenues for its most recent fiscal year were $6,176,820.

The aggregate market value of voting and non-voting stock held by non-affiliates of the registrant as of May 31, 2014 was $-0-. Although listed on the OTCBB under the symbol RTAS, there is currently no active trading for the registrant’s common stock. Therefore, the aggregate market value of the stock is deemed to be $-0-.

At the date of this report, there were 282,315,356 outstanding shares of Redtone Asia, Inc. Common Stock, $0.0001 par value.

Documents Incorporated by Reference: None

Transitional Small Business Disclosure Format (check one) Yes o No x

2

Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believe”, “project”, “expect”, “anticipate”, “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” “possible,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in the section entitled “Risk Factors” (refer to Part I, Item 1A). We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Historical Overview

As of May 31, 2014, details of the Company and its subsidiaries are as follows:

|

Name

|

Domicile and date of incorporation

|

Effective ownership

|

Principal activities

|

|||

|

Redtone Telecommunication (China) Limited (“Redtone China”)

|

Hong Kong

May 26, 2005

|

100%

|

Investment holdings

|

|||

|

Redtone Telecommunications (Shanghai) Limited (“Redtone Shanghai”)

|

The PRC

July, 26, 2005

|

100%

|

Provides technical support services to group companies

|

|||

|

Shanghai Hongsheng Net Telecommunication Company Limited (“Hongsheng”)

|

The PRC

November 29, 2006

|

100% (1)

|

Marketing and distribution of discounted call services to PRC consumer market

|

|||

|

Shanghai Huitong Telecommunication Company Limited (“Huitong”)

|

The PRC

March, 26, 2007

|

100% (1)

|

Marketing and distribution of IP call and discounted call services in the PRC

|

|||

|

Shanghai Jiamao E-Commerce Company Limited (“Jiamao”)

|

The PRC

March 21, 2008

|

100% (1)

|

Marketing and distribution of products on the Internet

|

|||

|

Nantong Jiatong Investment Consultant Co., Ltd (“Nanjing Jiatong”)

|

The PRC

May 17, 2011

|

100% (1)

|

Investment holdings

|

|||

|

Shanghai QianYue Business Administration Co., Ltd. ("QBA")

|

The PRC

December 12, 2008

|

100% (1)

|

Provision of prepaid shopping-card services in the PRC

|

|||

|

Shanghai Xin Chang Information Technology Company Limited (“Xin Chang”)

|

The PRC

January 13, 2006

|

56% (1)

|

Marketing and distribution of IP call and discounted call services in the PRC

|

(1) - Variable interest entities. See also Footnote 16 in the Notes to the audited financials.

Business of the Issuer

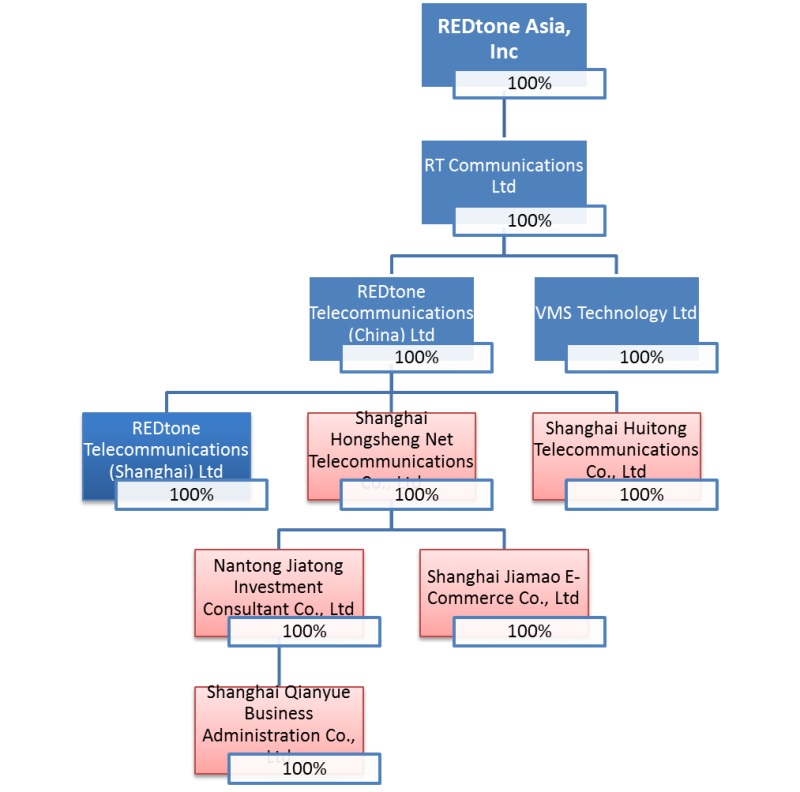

Corporate Structure

Control through equity ownership

Control through equity ownership Control through contractual binding (“VIE”)

Control through contractual binding (“VIE”)On November 30, 2006, the Company entered into loan agreements with Huang Bin (“HB”) and Mao Hong (“MH”) for the establishment of Shanghai Hongsheng Net Telecommunications Co., Ltd (“Hongsheng”). On November 30, 2006, the Company entered into an equity pledge agreement which provides that HB and MH will pledge all their equities in Hongsheng to the Company and REDtone Telecommunications (Shanghai) Limited (“REDtone Shanghai”). The agreement also provides that control of Hongsheng by the Company shall take effect from June 1, 2007.

On April 30, 2007, the Company entered into loan agreements with Mao Junbao (“MJ”) and MH for the establishment of Shanghai Huitong Telecommunications Co., Ltd (“Huitong”). On April 30, 2007, the Company entered into an equity pledge agreement, which provides that MJ and MH would pledge all their equities in Huitong to the Company and REDtone Shanghai.

On May 24, 2011, Hongsheng entered into a nominee agreement between Wang Jianping and Xu Lanying. The nominee agreement provided that Hongsheng would commission Wang Jianping and Xu Lanying to establish Nantong Jiatong Investment Consultant Co., Ltd (“Nantong Jiatong”). The nominee shareholders of Nantong Jiatong are Wang Jianping and Xu Lanying.

On May 24, 2011, the Company entered into a loan Agreement with Nantong Jiatong to extend a loan of RMB22,000,000 (RMB22 million) for the additional capital injection into Hongsheng for the establishment of Shanghai Qianyue Business Administration Co., Ltd (“QBA”). An equity pledge agreement entered into by and amongst the Company, Nantong Jiatong and Hongsheng, provided that Nantong Jiatong would pledge all its equities in Hongsheng to the Company

Although the Company is not the shareholder of Hongsheng, Huitong, Nantong Jiatong and QBA, the Company has determined that it is the primary beneficiary of these four entities, as the Company has 100% voting powers and is entitled to receive all the benefits from the operations of these four entities. Hence, Hongsheng, Huitong, Nantong Jiatong and QBA are identified as VIEs and are consolidated as if wholly-owned subsidiaries of the Company.

Mr Mao Hong, the newly appointed Chief Operating Officer, is also a shareholder of Hongsheng and HuiTong.

On January 22, 2014, Hongsheng completed the acquisition of a 56% equity interest in Xin Chang from Diao Xi Rui (“DXR”), a non-affiliated person. The consideration of $245,655 was paid upon signing of the Acquisition Agreement; while another $489,900 to be paid to Xin Chang as an operating fund in batches based on Xin Chang’s financial needs as determined by the Company. Pursuant to the agreement, the assets and liabilities of Xin Chang immediate before the acquisition was transferred to DXR. Therefore, the acquisition is in fact the purchase of operating concession.

Subsequent to the year-end date, on July 25, 2014, the Company entered into an agreement to dispose of its entire equity interest in Hongsheng, a VIE subsidiary, to Guotai Investment Holdings Limited at a total cash consideration of approximately $4.54 million.

Pursuant to the agreement, Hongsheng shall transfer all its operations, assets and liabilities other than investment in QBA prior to the completion of the above transaction. Therefore, the entire arrangement is to dispose of the shell of Hongsheng together with the entire interest in QBA.

The completion of disposal is subject to the transfer of the aforementioned operations, assets and liabilities, and also statutory approval by PRC local government.

Business Overview

We are principally involved in the business of offering discounted call services for end users and corporate segment and paperless reload services for prepaid mobile air-time reload for end user in Shanghai covering all three major telecommunication operators namely China Mobile, China Unicom and China Telecom.

Redtone China had on 25 July 2014 entered into a Share Sale Agreement (“SSA”) with Guotai Investment Holdings Limited (“GUOTAI”) for the divestment of Hongsheng for a total cash consideration of RMB28,000,000 for the purpose of GUOTAI acquiring the 3rd party payment license, held by its wholly owned subsidiary, QBA.

Hongsheng has been conducting all the telco related services in Shanghai. These telco related businesses shall be transferred to Huitong, a subsidiary of Redtone China from the Completion date. Therefore, all existing telco businesses of Hongsheng shall remain with the REDtone Group.

Upon completion of the Divestment, Hongsheng shall cease to be a subsidiary of Redtone China.

Products and Services

REDtone China offer the following services to customers:

1. Discounted call services for consumers (“EMS”)

2. Discounted call services for corporate customers

3. Reload services for prepaid mobile

4. Discontinued prepaid shopping-card services – revenue recognized is the commission earned.

Competition

The telecommunications industry in China is dominated by three state-run corporations: China Telecom Corporation Limited, China Mobile Communications Corporation and China United Network Communications Group Co., Ltd, all of whom have 3G licenses and engaged fixed-line and mobile business in China.

(i) Direct Telecommunication Operators namely China Telecom Corporation Limited, China Mobile Communications Corporation and China United Network Communications Group Co., Ltd. These companies may adopt a more aggressive pricing on their local and international calls and have direct impact on our discounted call services for corporate segment. Likewise, if these operators offer very competitive rates for domestic, long distance and international calls, it could pose a substitution threat to our EMS services.

(ii) Other Discounted Service Providers

The discounted service providers such as Super E-Secretary operate domestic calls and the tool to compete is to provide discount on long distance calls. This company, despite being a small player (less than 15% market share) in the Shanghai discounted consumer call market, may cause the price disruption when they compete on price aggressively.

(iii) Other Mobile air-time reload service providers

Other competitors like Smartpay, Defeng and YiQiao offers similar mobile air-time reload services in Shanghai. They entered into this reload services earlier than us but we command slightly better price advantage and better system support for paperless mobile reload in comparison with conventional paper-based reload model.

We believe our competitive advantage is derived from the following strengths:

|

(a)

|

Competitive Pricing

|

We, being one of the leading alternative voice service providers in Shanghai in terms of market share, could command the economies of scale to achieve lower minutes cost and lower operating cost per minute. Additional cost advantage is the low capital investment with self-developed technology.

By having advantage of longer market presence, credibility and dominant market share, we can afford to price its products and services competitively while maintaining healthy gross margins.

|

(b)

|

Superior Technology and Competent Technical Support

|

|

(c)

|

Innovation

|

Innovation embodied in all the products and services is the key to the competitive advantage of our operations. In addition, innovation also helps us to truly serve the needs of the customers and to provide value-added services and products to the customers.

Close communication with our front line resellers will enable us to gather market intelligence and assist us in strategy formulation that is relevant to market needs.

|

(d)

|

Value Added Services

|

For the telecommunications services we provide, customers would also benefit from value added services in our convenient reload, customer care services and support, and e-billings.

Regulatory Matters

REDtone China does not provide direct telecommunication services in PRC. REDtone China acts as a distributor for CTT. REDtone China has a business licence issued by PRC’s State Administration for Industry and Commerce to carry out the distribution services. REDtone China does not require a telecommunication licence to carry out its distribution activities.

We do not anticipate having to expend significant resources to comply with any governmental regulations applicable to our operations. We are subject to the laws and regulations which are generally applicable to business operations, such as business licensing requirements, income taxes and payroll taxes.

However, the telecommunications industry is highly regulated in China. PRC laws and regulations will be modified and updated from time to time by the China government. In addition, many PRC laws and regulations are subject to extensive interpretive power of governmental agencies and commissions, and there is substantial uncertainty regarding the future interpretation and application of these laws or regulations.

Shanghai Hongsheng Net Telecommunication Co., Ltd. (“Hongsheng”), the subsidiary that carries out the telecommunication distribution services currently has a business license in connection with these services. The business license is valid until November 28, 2026, and the Telecommunication Value-Adding Business Operating Permit is valid until October 7, 2018. Both are subject to annual filings; however, the Company does not foresee any issue regarding renewal or material fees involved in the renewal.

Costs of Compliance with Environmental Laws

We are not presently affected by and do not have any costs associated with compliance with environmental laws.

Customers and Suppliers

Our major customers are end users and corporate clients in Shanghai. Our suppliers are mainly termination partners and telecommunication players such as CTT, China Mobile and China Unicom and China Telecom.

Intellectual Property and Research and Development

The Company has no registered patents, trademarks or copyrights and no applications for patents, trademarks or copyrights are pending.

The Company utilized intellectual property pursuant to an agreement signed between REDtone Technology Sdn. Bhd, and REDtone Telecommunications (China) Ltd on 11 August 2005 in respect of the acquisition of the software with regards to the Customer billing, commission management, top-up management, traffic management, cardless system and gateway interface system suite.

The “REDtone” logo in Chinese is registered trademarks in China valid until October 13, 2020.

The Company did not incur any research and development expenses in the fiscal year ended May 31, 2014.

Number of Employees

Currently, we have our Chief Executive Officer to manage the Company. With the acquisition of REDtone China, as of May 31, 2014, we had thirty nine (39) employees including eleven (11) in the Management team, twenty (20) in Research & Development, Customer Care, Sales and Marketing as well as Finance and Administrative, and balance of eight (8) in Technical supports. None of our employees are represented by labor unions or subject to collective bargaining agreements. We believe our employee relations are good and have no employee related dispute recorded over the years.

Risks Related to Our Business

Operational/Business Risk

We are principally involved in the provision of telecommunications services and solutions and office communication solutions. As such, we are subject to certain operational and business risk factors inherent in the telecommunications industry. The operational risks include, inter alia, changes in conditions such as deterioration in prevailing market conditions, changes in labor, increase in labor cost and raw material costs and continued supply of electricity which is essential for the smooth operations of its telecommunications network(s). The business risks include, inter alia, network disruption in respect of the provision of the telecommunications services and Although we seek to mitigate these operational and business risks through, inter-alia, efficient cost control, maintaining a diversified range of customers and suppliers, having good relationships with the customers, suppliers and employees of the Company and having contractual agreements for projects undertaken, there can be no assurance that any change to these factors will not have a material adverse effect on our business and financial performance.

We are in a very competitive and rapidly changing telecommunications industry and its future success will depend on its ability to increase its market share in its markets. As we are competing against well-established telecommunications companies that offer related services which including China Telecom, China Unicom and China Mobile on their pricing strategies, technological advances, advertising campaigns, strategic partnerships and other initiatives. The increasing competition in this telecommunications industry has had, and is expected to continue to have, a significant impact on our business and financial performance. Competition is expected to increase with the emergence of new entrants into its markets. We believe that the provision of telecommunications services complemented with our innovative will provide the group with a competitive edge and differentiate us from its competitors.

Although we seek to mitigate these risks, there can be no assurance that our competitors will not develop technologies and products that are more effective than those developed by us. We have a very clear strategy to replicate the business in other provinces in China.

Dependence on key personnel

The technology industry is a growing and fast-changing sector and management and operation of the business requires the employment of highly-skilled knowledge workers, whether in technology or non-technology related fields. Our management recognizes and believes that our continuing success depends to a significant extent on the abilities and continuing efforts of its existing Executive Directors, Chief Executive Officers and key personnel. The labor market for skilled personnel in this field is highly competitive. We recognize that our success depends to a significant extent upon, amongst others, our ability to attract new personnel and retain its existing skilled personnel. We seek to mitigate this risk factor by offering its employees competitive salary/remuneration and benefits packages. There can be no assurance that the measures taken will be successful and that any change in our existing skilled personnel will not have a material effect on our business and operations.

Adverse Changes to the terms of business collaboration agreement with China TieTong

We currently have business collaboration agreements with China TieTong. The agreement provides for renewability and is subject to changes in the terms of the agreements on renewal. We will endeavour to seek and renew the agreement on terms favourable to us. There can be no assurance that any adverse changes to the terms of the agreement (for example, from failure to reach commercially acceptable terms) would not result in higher interconnection expenses. However, as we have emerged as a significant service provider, China TieTong may views this as a business opportunity to continue and further strengthen their working relationship with us.

Although individual members of our management team have experience as officers of publicly-traded companies, much of that experience came prior to the adoption of the Sarbanes-Oxley Act.

It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with the Sarbanes-Oxley Act’s internal controls requirements, we may not be able to obtain the independent auditor certifications that Sarbanes-Oxley Act requires publicly-traded companies to obtain.

If we need additional financing, the funding may not be available on satisfactory terms or at all.

We may seek to raise additional capital through public or private equity offerings, debt financings or additional corporate collaboration and licensing arrangements. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we would incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to your interest in bankruptcy or liquidation. To the extent we raise additional funds through collaboration and licensing arrangements, it may be necessary to relinquish some rights to our technologies or product candidates, or grant licenses on unfavorable terms.

If the market does not accept our other new products or upgrades to existing products that we launch from time to time, our operating results and financial condition would be materially adversely affected.

From time to time, we plan on launching new products and upgrades to existing products. Our future success with our next generation product offerings will depend on our ability to accurately determine the functionality and features required by our customers, as well as the ability to enhance our products and deliver them in a timely manner. We cannot predict the present and future size of the potential market for our next generation of products, and we may incur substantial costs to enhance and modify our products and services in order to meet the demands of this potential market.

If we experience delays in product development or the introduction of new products or new versions of existing products, our business and sales will be negatively affected.

There can be no assurance that we will not experience delays in connection with our current product development or future development activities. If we are unable to develop and introduce new products, or enhancements to existing products in a timely manner in response to changing market conditions or customer requirements, it may materially and adversely affect our operating results and financial condition. Because we have limited resources, we must effectively manage and properly allocate and prioritize our product development efforts. There can be no assurance that these efforts will be successful or, even if successful, that any resulting products will achieve customer acceptance.

We have only limited protection of our proprietary rights and technology.

Our success is heavily dependent upon our proprietary technology. We rely on a combination of the protections provided under applicable copyright, trademark and trade secret laws, confidentiality procedures and licensing arrangements, to establish and protect our proprietary rights. As part of our confidentiality procedures, we generally enter into non-disclosure agreements with our developers, distributors and marketers. Despite these precautions, it may be possible for unauthorized third parties to copy certain portions of our products or to reverse engineer or obtain and use information that we regard as proprietary, to use our products or technology without authorization, or to develop similar technology independently. Moreover, the laws of some other countries do not protect our proprietary rights to the same extent as do the laws of the United States. Furthermore, we have no patents and existing copyright laws afford only limited protection. There can be no assurance that we will be able to protect our proprietary software against unauthorized third party copying or use, which could adversely affect our competitive position.

We have never paid cash dividends and are not likely to do so in the foreseeable future.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate.

Risks Associated With Doing Business in China and Asia

There are substantial risks associated with doing business in China and Asia, as set forth in the following risk factors.

Our operations and assets in China are subject to significant political and economic uncertainties.

Changes in PRC laws and regulations, their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business, results from operations and financial condition. Under current leadership of the PRC, the Chinese government has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

Our business is largely subject to the uncertain legal environment in China and your legal protection could be limited.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, the Chinese legal system is a system in which precedents set in earlier legal cases are not generally used. The overall effect of legislation enacted over the past 20 years has been to enhance the protections afforded to foreign invested enterprises in China. However, these laws, regulations and legal requirements are relatively recent and evolving rapidly, and their interpretation and enforcement involve various uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign invested enterprises to hold business licenses and permits. In addition, all of our executive officers and directors are not residents of the U.S., and most of the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to serve process on these individuals in the U.S., or to enforce a judgment obtained in the U.S. against the Company or any of these persons.

The Chinese governments exert substantial influence over the manner in which we must conduct our business activities which could have an adverse effect on our ability to operate in China

China has only recently permitted provincial and local economic autonomy and private economic activities. The Chinese governments continue to exercise substantial control over virtually every sector of the economy through regulation and state ownership. Our ability to operate may be harmed by changes in laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy could have a significant effect on economic conditions in China. Additionally, regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in particular regions of China, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.

The substantial portion of our revenues will be settled in RMB, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside China or to pay dividends or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including the restriction that foreign-invested enterprises may only buy, sell or remit foreign currencies after providing valid commercial documents at banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, is subject to governmental approval in China, and companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

The value of our securities will be affected by the foreign exchange rate between U.S. dollars and RMB and other local currencies.

The value of our common stock will be affected by the foreign exchange rate between U.S. dollars and RMB, and between those currencies and other currencies in which our sales may be denominated. For example, to the extent that we need to convert U.S. dollars into RMB for our operational needs and should the RMB appreciate against the U.S. dollar at that time, our financial position, the business of the company, and the price of our common stock may be harmed. Conversely, if we decide to convert our RMB into U.S. dollars for the purpose of declaring dividends on our common stock or for other business purposes and the U.S. dollar appreciates against the RMB, then the U.S. dollar equivalent of our earnings from our subsidiaries in China would be reduced.

The Company relies on contractual agreements (VIE structure) for all of its revenues; further, the Company has no equity interest in these subsidiaries and there are risks associated with this type of arrangement in light of the legal structure in the PRC.

Redtone China has placed tremendous reliance on contractual arrangements (VIE structure) for asserting management and controls in its wholly owned subsidiaries without equity interest. The existence of such VIE structure is due to the fact that the PRC government limits the foreign investment in the value-added telecommunication industry. These subsidiaries account for all of the Company’s revenue.

The VIE structure, while effective, does involve some associated risks, which may include:

|

(i)

|

While each agreement under the Contractual Arrangements as governed by PRC laws is valid, biding, and enforceable, there is the possibility that these Contractual Arrangements will not be deemed by the relevant government authorities to be in compliance with PRC laws and regulation; or, that other government authorities will not in the future interpret existing laws, regulations or policies, or issue new laws, regulations or policies, with the result that all or some of these Contractual Arrangements would be deemed to be in violation of PRC laws.

|

|

(ii)

|

The PRC laws referred to herein are laws currently in force. There is the possibility that any of such laws, or the interpretation thereof or enforcement thereof, will be changed, amended or replaced in the immediate future or in the long-term with or without retrospective effect.

|

|

(iii)

|

Under the current Contractual Arrangements, if the PRC Entities, and/or any of their individual shareholders fails to perform its/his/her respective obligations under these Contractual Arrangements, the Company may have to incur substantial costs and resources to enforce such arrangements, and rely on legal remedies under PRC laws, including, but not limited to, seeking specific performance or injunctive relief, and claiming damages, which we cannot assure the Company would achieve the full remedy therefrom.

|

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

The Company’s principal executive offices are located at Suites 15A, E,F, Plaza Sanhe, No. 121 Yanping Road, Jing An District, Shanghai, PRC. The Company’s management believes that all facilities occupied by the Company are adequate for present requirements, and that the Company’s current equipment is in good condition and is suitable for the operations involved.

We are not a party to and none of our property is subject to any material pending or threatened legal, governmental, administrative or judicial proceedings.

No matter was submitted to a vote of the Company’s security holders during the fourth quarter of the fiscal year covered by this Annual Report.

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s Articles of Incorporation provide that the Company has the authority to issue 300,000,000 shares of common stock at par value of $0.0001 per share. As of May 31, 2014, we had 282,315,356 outstanding shares of Common Stock.

On March 25, 2011, our common stock began being quoted on the OTCBB under the symbol “RTAS”. We have not had any active trading in our stock as of the date of this report.

The Company has never paid any cash dividends on its stock and does not plan to pay any cash dividends in the foreseeable future.

As of May 31, 2014, we had approximately 49 shareholders of record.

Equity Compensation Plans

The Company does not have any equity compensation plans in place as of the date of this report, and had no options, warrants or other convertible securities outstanding as of that date.

Sales of Unregistered Securities

For the period from June 1, 2013 to the date of this report, there is no sale of unregistered securities.

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

Overview

We are principally involved in the business of offering discounted call services for end users and corporate segment and paperless reload services for prepaid mobile air-time reload for end user in Shanghai covering all three major telecommunication operators namely China Mobile, China Unicom and China Telecom. We also are venturing into e-business, or an internet business as third party payment solution for e-commerce industry in China.

Results of Operations

Financial Presentation

The following sets forth a discussion and analysis of the Company’s financial condition and results of operations for the two years ended May 31, 2014 and 2013. This discussion and analysis should be read in conjunction with our consolidated financial statements appearing elsewhere in this Annual Report on Form 10-K. The following discussion contains forward-looking statements. Our actual results may differ significantly from the results discussed in such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in “Item 1A — Risk Factors” of this Annual Report on Form 10-K.

Continuing operations

Results of continuing operations for year ended May 31, 2014 compared to year ended May 31, 2013

|

Year ended

|

||||||||||||||||

|

May 31, 2014

|

May 31, 2013

|

Increase/(Decrease) from previous year

|

||||||||||||||

|

Revenue

|

6,176,820 | 6,487,707 | (310,887 | ) | -5 | % | ||||||||||

|

Other income and gains

|

149,588 | 97,588 | 52,000 | 53 | % | |||||||||||

|

Service costs

|

(2,955,367 | ) | (4,030,075 | ) | 1,074,708 | -27 | % | |||||||||

|

Personnel cost

|

(752,868 | ) | (619,800 | ) | (133,068 | ) | 21 | % | ||||||||

|

Depreciation expense

|

(484,432 | ) | (459,122 | ) | (25,310 | ) | 6 | % | ||||||||

|

Amortization expense

|

(137,452 | ) | (121,632 | ) | (15,820 | ) | 13 | % | ||||||||

|

Administrative and other expenses

|

(806,221 | ) | (669,568 | ) | (136,653 | ) | 20 | % | ||||||||

|

Income before provision for income taxes

|

1,190,068 | 685,098 | 504,970 | 74 | % | |||||||||||

|

Provision for income taxes

|

104,362 | (284,680 | ) | 389,042 | 137 | % | ||||||||||

|

Net income before non-controlling interest

|

1,294,430 | 400,418 | 894,012 | 223 | % | |||||||||||

Revenues. The Company generated revenue of $6,176,820 in the fiscal year ended May 31, 2014, representing a 5% decrease as compared with the fiscal year ended May 31, 2013. The decrease in revenues was mainly due to the decrease in call traffics in consumer voice business by $0.31 million, an intense price competition in telecommunication market.

Other income and gains. During the fiscal year ended May 31, 2014, the Company recorded other income and gains of $149,588, an increase of $52,000 or 53% compared with last year. The increase was due to an increase in interest income from time deposits.

Service cost. Service costs from operations for the year ended May 31, 2014 of $2,955,367 reflected a decrease of $1,074,708 over the fiscal year ended May 31, 2013. The decrease was mainly due to improvement in operating efficiency by reducing the use of unnecessary data..

Personnel expenses. The personnel expenses have increased 21% or $133,068 to $752,868 for the year ended May 31, 2014. This is mainly contributed by annual increment in payroll and additional headcount due to the inclusion of the newly acquired Xin Chang operation.

Depreciation and amortization expenses. Depreciation is generally comparable to last year. The increase in amortization expense was mainly attributable to the amortization of the newly acquired customer base and the operating concession during the year.

Administrative and other operating expenses. The general and administrative expenses have increased $136,653 or 20% to $806,221. This is mainly due to the inclusion of the newly acquired Xin Chang operation.

Income before provision for income taxes. For the financial year under review, the dropped in service costs has caused the net income before provision for income taxes stood at $1,190,068 as compared to $685,098 over the financial year 2013.

Provision for income taxes. For the financial year under review, there is a income tax income of $104,362 compared to income tax expense of $284,680 over the financial year 2013. This was mainly due to a reversal of overprovided tax expense in last financial year as Redtone Shanghai has obtained its 2 years full-tax exemption, starting from January 1, 2013, and 3 years 50%-tax exemption from the local tax authority.

Net income before non-controlling interest. For the financial year under review, the dropped in service costs and income tax income has caused the net income before non-controlling interest stood at $1,294,430 as compared to $400,418 over the financial year 2013.

Liquidity and Capital Resources.

Cash

Our cash balance at May 31, 2014, was $2,991,276, representing a reduction of $2,487,815, from previous cash balance of $5,479,091 as of May 31, 2013.

Cash Flow (before effect of exchange rate changes).

|

May 31, 2014

|

May 31, 2013

|

+/- |

% Changes

|

|||||||||||||

|

Net cash provided by/ (used in) operating activities

|

$ | (196,758 | ) | $ | 1,782,442 | (1,979,200 | ) | -111 | % | |||||||

|

Net cash provided by/(used in) investing activities

|

$ | (518,807 | ) | $ | 151,079 | (669,886 | ) | -443 | % | |||||||

|

Net cash provided by financing activities

|

$ | 32,473 | $ | 39,190 | (6,717 | ) | -17 | % | ||||||||

|

Net (decrease)/increase in cash and cash equivalents

|

(683,092 | ) | 1,972,711 | (2,655,803 | ) | -135 | % | |||||||||

Net cash used in operations during the fiscal year ended May 31, 2014 amounted to $196,758 as compared to net cash provided by operations of $1,782,442 in the same period of FY2013, the change was mainly due to more settlement of account payable during the year.

Net cash flow used in investing activities for the fiscal year ended May 31, 2014 amounted to $518,807 mainly represents consideration paid for the acquisition of Xinchang during the year, and also cash paid in purchase of new property, plant and equipment.

There was net cash provided in financing activities for the year ended May 31, 2014 total $32,473 aroused from intercompany advances.

Working Capital

Our working capital was a positive of $3,712,695 at May 31, 2014, an increase of 56% year on year. The increased in working capital is mainly due to non-inclusion of the cash and cash equivalent in our discontinued operation, i.e. QBA.

At May 31, 2014, we had stockholders’ equity of $7,546,038; total assets of $12,715,771 and total current liabilities of $5,005,963.

We do not currently anticipate any material capital expenditures for our existing operations. We do not currently anticipate purchasing or leasing any plant and equipment during approximately the next twelve (12) months.

We do not believe that inflation has had a material effect on our results of operations. However, there can be no assurances that our business will not be affected by inflation in the future.

We have no off balance sheet arrangements.

Discontinued Operations

Results of discontinued operations for year ended May 31, 2014 compared to year ended May 31, 2013

|

Year ended

|

||||||||||||||||

|

May 31, 2014

|

May 31, 2013

|

Increase/(Decrease) from previous year

|

||||||||||||||

|

Revenue

|

63,849 | 733,133 | (669,284 | ) | -91 | % | ||||||||||

|

Other income and gains

|

97,390 | 43,972 | 53,418 | 121 | % | |||||||||||

|

Service costs

|

14,354 | 699,846 | (685,492 | ) | -98 | % | ||||||||||

|

Personnel cost

|

157,777 | 198,913 | (41,136 | ) | -21 | % | ||||||||||

|

Depreciation expense

|

182,797 | 192,409 | (9,612 | ) | -5 | % | ||||||||||

|

Administrative and other expenses

|

50,548 | 36,950 | 13,598 | 37 | % | |||||||||||

|

Loss before provision for income taxes

|

(244,237 | ) | (351,013 | ) | 106,776 | 30 | % | |||||||||

|

Provision for income taxes

|

- | - | - | N/A | ||||||||||||

|

Net loss before non-controlling interest

|

(244,237 | ) | (351,013 | ) | 106,776 | 30 | % | |||||||||

Revenues. The Company generated revenue of $63,849 in the fiscal year ended May 31, 2014, representing a 91% decrease as compared with the fiscal year ended May 31, 2013. The decrease was mainly due to one-off project in previous year which have not recurring in this financial year.

Other income and gains. During the fiscal year ended May 31, 2014, the Company recorded other income and gains of $97,390, an increase of $53,418 or 121% compared with last year. The increase was due to an increase in interest income from time deposits.

Service cost. Service costs from operations for the year ended May 31, 2014 of $14,354 reflected a decrease of $685,492 over the fiscal year ended May 31, 2013. The decrease was consistent with the lower revenue generated during the year.

Personnel expenses. The personnel expenses have decreased 21% or $41,136 to $157,777 for the year ended May 31, 2014. This is mainly due to lay-off some of the manpower to optimize the cost of the company.

Loss before provision for income taxes. The net loss before provision for income taxes stood at $244,237 as compared to $351,013 over the financial year 2013 mainly due to lower personnel expenses compared to last year.

Liquidity and Capital Resources.

Cash

Our discontinued cash balance at May 31, 2014 (included in asset held for sale in the Consolidated Balance Sheets) was $1,687,392 as compared to previous cash balance of $1,797,240 as of May 31, 2013.

Cash Flow from Discontinued Operations (before effect of exchange rate changes).

|

May 31, 2014

|

May 31, 2013

|

+/- |

% Changes

|

|||||||||||||

|

Net cash provided by/ (used in) operating activities

|

$ | (114,149 | ) | $ | (99,105 | ) | (15,044 | ) | -15 | % | ||||||

|

Net (decrease)/increase in cash and cash equivalents

|

(114,149 | ) | (99,105 | ) | (15,044 | ) | -15 | % | ||||||||

Net cash used in operations during the fiscal year ended May 31, 2014 amounted to $114,149 as compared to net cash provided by operations of $99,105 in the same period of FY2013, an reduction of 15% as a result of a decrease in operating expenses.

Critical Accounting Policies and Estimates

Revenue Recognition

The Company assesses appropriate revenue recognition policy for each type of operation according to ASC 605-45

Revenue represents the invoiced value of services rendered and receivable during the year. Revenue is recognized when all of the following criteria are met:

|

·

|

Persuasive evidence of an arrangement exists,

|

|

|

·

|

Delivery has occurred or services have been rendered,

|

|

·

|

The seller’s price to the buyer is fixed or determinable, and

|

|

|

·

|

Collectability is reasonably assured

|

Revenue Recognition policy for each of the major products and services:

| 1. Discounted call services for consumer (EMS) as follow: |

|

|

· Collaboration with CTT – Redtone China is appointed as the sole distributor for EMS and we will recognize the revenue when airtime is utilize by the consumer and it is on net basis which is computed based on a fixed sharing ratio of the total airtime utilize by consumers after netting of direct traffic termination cost and incidental expenses as per the collaboration agreement with CTT. Redtone China’s role for Business Collaboration with China TieTong Telecommunications (CTT) would be as “Agent” as Redtone China is the sole distributor for EMS brand owned and controlled by CTT; and

· Collaboration with other telecommunication providers – Redtone China will act as discounted consumer call Reseller whereby Redtone China will decide on service and package specification, pricing policy while China Unicom merely acts as passive termination partner for call traffic. Redtone China will pay China Unicom solely based on call traffic termination by China Unicom at prescribed rate (defined as traffic termination cost in the book of Redtone China). In this regard, Redtone China will recognize the revenue when airtime is utilized by the consumer and the value recognize is the call charges gross value. Redtone China role for Business Collaboration with China Unicom would be as “Principal” as China Unicom is playing passive role as traffic termination partner while Redtone China is fully responsible for the entire management of discounted call services.

As this is a prepaid product, there is an expiry date for the product sold. If the airtime is not utilize by the expiry date, which is currently one year from the activation date, it will be deemed expired and recognize as revenue based on the remaining gross value of the expired prepaid product

|

|

.

|

· Collaboration with CTT – the revenue recognize is the commission earn from distributing the discounted call services to corporate customer; and

· Collaboration with other telecommunication providers –the revenue recognize is the commission earn from distributing the discounted call services to corporate customer.

|

|

3.

|

Reload services for prepaid mobile – revenue recognize is the commission earn.

|

|

4.

|

Discontinued prepaid shopping-card services – revenue recognized is the commission earned.

|

Recent Accounting Pronouncements.

The Company does not expect the adoption of any recent accounting pronouncements which are further elaborated in Note 3 (o) of Notes to Consolidated Financial Statements will have any material impact on its financial statements.

As a smaller reporting company, the Company is not required to provide disclosure required by this item.

The Company’s audited financial statements and the notes thereto appear in Part IV, Item 15, of this report.

(a) Evaluation of Disclosure Controls and Procedures. Under the supervision and with the participation of our management, including our chief executive officer and chief financial officer, we evaluated the effectiveness of our disclosure controls and procedures, as such term is defined under Rule 13a-15(e) promulgated under the Securities Exchange Act of 1934, as amended. Based upon that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls were effective as of the end of the period covered by this annual report.

(b) Changes in Internal Controls. There have been no changes in our internal controls over financial reporting during the fiscal year ended May 31, 2014 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

(c) Management’s Report on Internal Control over Financial Reporting. Management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rule 13a-15(f) under the Exchange Act, as amended. The Company’s internal control over financial reporting is designed to provide reasonable assurance as to the reliability of the Company’s financial reporting and the preparation of financial statements in accordance with GAAP. Our internal control over financial reporting includes those policies and procedures that:

|

·

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the Company;

|

|

·

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP, and that receipts and expenditures of the Company are being made only in accordance with authorizations of management and directors of the Company; and

|

|

·

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the Company’s consolidated financial statements.

|

Internal control over financial reporting, no matter how well designed, has inherent limitations. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Therefore, internal control over financial reporting determined to be effective can provide only reasonable assurance with respect to financial statement preparation and may not prevent or detect all misstatements. Moreover, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management has assessed the effectiveness of the Company’s internal control over financial reporting as of May 31, 2014. In making this assessment, management used the criteria established by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control — Integrated Framework (1992).

Based on the Company’s processes and assessment, as described above, management has concluded that, as of May 31, 2014, the Company’s internal control over financial reporting was effective.

This Annual Report on Form 10-K does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation requirements by the Company’s registered public accounting firm pursuant to rules of the SEC that permit the Company to provide only management’s report in this Annual Report on Form 10-K for the year ended May 31, 2014.

There were no items required to be disclosed in a report on Form 8-K during the fourth quarter of the fiscal year ended May 31, 2014 that have not been already disclosed on a Form 8-K filed with the SEC.

The following table sets forth as of the date hereof, except as otherwise noted, the names, ages and positions held with respect to each director, executive officer, and significant employee expected to make a significant contribution to the Company:

|

Name

|

Age

|

Position

|

Period

|

|

Chuan Beng Wei

|

49

|

Director

CEO

|

July 2008 - Present

October 2010- Present

|

|

Lau Bik Soon

|

44

|

Director

|

October 2010-Present

|

|

Ng Hui Nooi

|

41

|

CFO

|

March 2012-Present

|

Mr Chuan Beng Wei, age 49, is now the Chief Executive Officer of the Company. Mr Wei has been and will continue serving on the Board of Directors of the Company. He obtained his Bachelor’s Degree in Electrical Engineering from University of Technology Malaysia in 1989 and Diploma in Management (Gold Medalist Award Winner) from the Malaysian Institute of Management, Kuala Lumpur in 1995. He also completed an Entrepreneur Development Program from the renowned MIT Sloan School of Management in USA in January 2006.

He began his career with Hewlett Packard Sales Malaysia Sdn Bhd in 1989 as a Systems Engineer responsible for information technology (“IT”) technical and customer relations, and was subsequently promoted to Major Account Manager. Having gained wide exposure in IT, electronics and the telecommunications industry, he began his entrepreneur pursuit. He started Redtone Telecommunications Sdn Bhd in 1996 with two other partners. As one of the founding members of the Redtone Group, he is instrumental in shaping the Group’s business relations and policies. His main responsibilities include management of the Group’s overall business, expanding its overseas markets and financial-related matters. Mr Wei also serves as the Managing Director of the Redtone Group, which was listed in January 2004 in the ACE Market of Bursa Malaysia. In addition, in 2007, Mr Wei started Redtone China where he played a significant role in developing business strategy in China. He was the past Chairman for The Association of Computer and Multimedia Malaysia and the past Deputy Chapter Chairperson for the exclusive Young Presidents’ Organization (YPO).

Mr. Bik Soon Lau, age 44, obtained his first-class honors degree in electrical engineering from the University of Technology in Malaysia. He joined REDtone in 2008, as an executive director responsible for expanding the Group’s Malaysia business which includes data, broadband, Wifi and discounted call services. Prior to joining REDtone, he was the Country Manager for Hitachi Data Systems Malaysia from year 2005 to 2008. Under his leadership in Hitachi, he strengthened the organisation and company’s channel partner, and helped the company grow its business in Malaysia.

Mr. Lau’s 16 years of experience as Sales Director in the ICT and telecommunications industry provides expertise in corporate leadership and strategic marketing planning. In his career, he has held numerous other positions, including sales director, partner sales manager, enterprise division account manager, business development manager, systems engineer, and research and design engineer. He has held these positions with organizations such as Cisco Systems, Sun Microsystems, Compaq Computer, TQC Consultant (IT Division) Sdn Bhd, and Motorola Penang. During his tenure with these organizations, he received various Partner Management Excellence awards as well as many accolades as a high achiever in sales.

Ms. Hui Nooi Ng, age 41, a Malaysian Chartered Accountant, obtained her Professional Degree from The Association of Chartered Certified Accountants in 2004. Ms. Ng has more than eighteen years of working experience in accountancy and has held various positions from accountant to finance manager with companies in Malaysia and Vietnam. In 1999, she joined ChemQuest Sdn Bhd, as an accountant, fully responsible for the finance and accounting operations for the company. In 2010, she joined Poh Huat Furniture Ind. Vietnam Joint Stock Co, a Malaysian manufacturing company based in Vietnam as the Finance Manager. In this position, her main responsibilities included financial review and reporting, budgeting, business planning and risk management and treasury functions.

Number and Terms of Office of Directors

A Board of Directors, consisting of at least one (1) person shall be chosen annually by the Stockholders at their meeting to manage the affairs of the company. The Directors' term of office shall be one year, and Directors may be re-elected for successive annual terms. There is no family relationship between any of our executive officers and directors.

Code of Ethics

The Company has not yet adopted a Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, comprising written standards that are reasonably designed to deter wrongdoing and to promote the behavior described in Item 406 of Regulation S-K promulgated by the Securities and Exchange Commission. Due to the small size of the Company, management does not believe such a code is needed at this time.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who own more than 10% of the Company’s stock (collectively, “Reporting Persons”) to file with the SEC initial reports of ownership and changes in ownership of the Company’s Common Stock. Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) reports they file. To the Company’s knowledge, based solely on its review of the copies of such reports received or written representations from certain Reporting Persons that no other reports were required, the Company believes that during its fiscal year ended May 31, 2014, all Reporting Persons complied with all applicable filing requirements.

The following table sets forth, for the fiscal years ended May 31, 2014 and 2013, certain information regarding the compensation earned by the Company’s named executive officers. Where columns have been omitted from the Summary Compensation Table below, it is because no such compensation was paid to the named executive officer during the 2014 or 2013 fiscal years.

|

SUMMARY COMPENSATION TABLE

|

|||||||||||||||||

|

Annual Compensation

|

|||||||||||||||||

|

Other

|

All Other

|

||||||||||||||||

|

Name and

|

Year

|

Annual

|

Compen-

|

||||||||||||||

|

Principal

|

Ended

|

Salary

|

Bonus

|

Compen-

|

Sation

|

||||||||||||

|

Position

|

May 31

|

($)

|

($)

|

sation ($)

|

($)

|

||||||||||||

|

Chuan Beng Wei,

|

2014

|

-0-

|

-0-

|

-0-

|

-0-

|

||||||||||||

|

Director, CEO

|

2013

|

-0-

|

-0-

|

-0-

|

-0-

|

||||||||||||

|

Bik Soon, Lau

|

2014

|

-0-

|

-0-

|

-0-

|

-0-

|

||||||||||||

|

Director

|

2013

|

-0-

|

-0-

|

-0-

|

-0-

|

||||||||||||

|

Hui Nooi, Ng

|

2014

|

15,638

|

-0-

|

-0-

|

-0-

|

||||||||||||

|

CFO

|

2013

|

17,649

|

-0-

|

-0-

|

-0-

|

||||||||||||

Director Compensation

Members of the Board of Directors did not receive any cash or non-cash compensation for their service as Directors during our 2014 and 2013 fiscal years.

Compensation Committee Interlocks and Insider Participation

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

Compensation Committee Report

As a smaller reporting company, the Company is not required to provide the disclosure required by this item.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth beneficial ownership information as of May 31, 2014: (i) each of the Company’s officers and directors, (ii) each person who is known by the Company to own beneficially more than 5% of the outstanding shares of common stock, and (iii) all of the Company’s officers and directors as a group. As of the date of this report, the Company had 282,315,356 shares of common stock outstanding.

|

(i)

|

Security Ownership of directors and executive officers: None

|

|

(ii)

|

Security ownership of certain beneficial owners:

|

|

Title of Class

|

Name and Address

|

Amount &

Nature of

Beneficial

Ownership

|

Percentage

of Class

|

|

Common shares

|

REDtone International Bhd,

Suites 22-28, 5th Floor,

IOI Business Park, 47100 Puchong,

Malaysia.

|

260,619,364 | 92.3% |

|

(iii)

|

Security ownership of officers and directors as a group: None.

|

During the fiscal year ended May 31, 2014 and 2013, there were no related transactions between the Company and the directors except the followings:

Amount due from a related company

|

2014

|

2013

|

|||||||

|

Fellow subsidiary:

|

||||||||

|

REDtone Technology Sdn. Bhd.

|

$ | 3,272,950 | $ | 3,302,301 | ||||

Amount due to a related company

|

2014

|

2013

|

|||||||

|

Fellow subsidiary:

|

||||||||

|

Redtone Telecommunications Sdn Bhd

|

$ | 148,791 | $ | 116,318 | ||||

Albert Wong & Co, has served as the Company’s principal accountant since April 5, 2013. Their fees billed to the Company for the past two fiscal years are set forth below:

|

Fiscal Year ended May 31,

|

||||||||

|

2014

|

2013

|

|||||||

|

Audit Fees

|

$

|

48,000

|

42,000

|

|||||

|

Audit Related Fees

|

-

|

-

|

||||||

|

All Other Fees

|

0

|

0

|

||||||

|

Total Fees

|

48,000

|

42,000

|

||||||

|

•

|

Audit Fees.

|

||||||||

|

-Including fees for professional services for the audit of our annual financial statements and for the reviews of the financial statements included in each of our quarterly reports on Form 10-Q.

|

|||||||||

|

•

|

Audit Related Fees

|

||||||||

|

-Consists of assurance related services by the independent auditors that are reasonably related to the performance of the audit and review of our financial statements and are not included under audit fees.

|

|||||||||

|

•

|

Tax Fees

|

||||||||

|

- These services included assistance regarding federal, state and local tax compliance and return preparation.

|

|||||||||

|

•

|

All Other Fees

|

||||||||

|

-Includes time and procedures related to change in independent accountants and research and assistance provided to the Company.

|

|||||||||

During its fiscal year ended May 31, 2014, the Company did not have an Audit Committee and the Company’s director pre-approved all fees of the principal accountant.

(a) The following documents are filed as a part of this Report:

|

1. FINANCIAL STATEMENTS - beginning on page F-1 of this Report:

|

|

CERTIFIED PUBLIC ACCOUNTANTS

7th Floor, Nan Dao Commercial Building

359-361 Queen’s Road Central

Hong Kong

Tel : 2851 7954

Fax: 2545 4086

|

ALBERT WONG

|

|

|

B.Soc., Sc., ACA., LL.B.,

|

|

|

C.P.A.(Practising)

|

|

|

To:

|

The board of directors and stockholders of

|

REDtone Asia, Inc.

Report of Independent Registered Public Accounting Firm

We have audited the accompanying consolidated balance sheets of REDtone Asia, Inc. and its subsidiaries (“the Group”) as of May 31, 2014 and 2013 and the related consolidated statements of income and comprehensive income, stockholders' equity and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Group's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

We were not engaged to examine management’s assertion about the effectiveness of the Group’s internal control over financial reporting as of May 31, 2014 and 2013 included in the Group’s Item 9A “Controls and Procedures” in the Annual Report on Form 10-K and, accordingly, we do not express an opinion thereon.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of REDtone Asia, Inc. and its subsidiaries as of May 31, 2014 and 2013 and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ Albert Wong & Co.

Albert Wong & Co.

Hong Kong, China

August 29, 2014

CONSOLIDATED BALANCE SHEETS

At May 31, 2014 and 2013

|

2014

|

2013

|

|||||||

|

Assets

|

||||||||

|

Current assets

|

||||||||

|

Cash and cash equivalents

|

$ | 2,991,276 | $ | 5,479,091 | ||||

|

Inventories

|

3,974 | 10,621 | ||||||

|

Accounts receivable

|

2,898,976 | 2,398,488 | ||||||

|

Tax recoverable

|

23,372 | 23,323 | ||||||

|

Other receivables and deposits

|

1,083,269 | 434,606 | ||||||

|

Assets held for sale

|

1,713,011 | - | ||||||

|

Total current assets

|

8,713,878 | 8,346,129 | ||||||

|

Property, plant and equipment, net

|

1,451,894 | 1,900,561 | ||||||

|

Intangible assets, net

|

1,939,613 | 1,559,471 | ||||||

|

Goodwill

|

610,386 | 610,386 | ||||||

|

Amount due from a related company

|

- | 3,302,301 | ||||||

|

Total assets

|

12,715,771 | 15,718,848 | ||||||

|

Liabilities and stockholders’ equity

|

||||||||

|

Liabilities

|

||||||||

|

Current liabilities

|

||||||||

|

Deferred income

|

743,793 | 840,740 | ||||||

|

Accounts payable

|

2,798,373 | 3,751,360 | ||||||

|

Accrued expenses and other payables

|

582,240 | 534,375 | ||||||

|

Amount due to a related company

|

148,791 | 116,318 | ||||||

|

Taxes payable

|

671,125 | 718,042 | ||||||

|

Liabilities related to assets held for sale

|

56,861 | - | ||||||

|

Total current liabilities

|

5,001,183 | 5,960,835 | ||||||

|

Deferred tax liabilities

|

4,780 | 19,739 | ||||||

|

Total liabilities

|

5,005,963 | 5,980,574 | ||||||

|

Equity

|

||||||||

|

Common stock, US$0.0001 par value , 300,000,000 shares authorized; 282,315,356 shares issued and outstanding, respectively

|

28,232 | 28,232 | ||||||

|

Additional paid in capital

|

7,726,893 | 7,726,893 | ||||||

|

Less: Amount due from a related company

|

(3,272,950 | ) | - | |||||

|

Retained earnings

|

2,172,842 | 1,095,216 | ||||||

|

Accumulated other comprehensive income

|

891,021 | 887,933 | ||||||

|

Total stockholders’ equity

|

7,546,038 | 9,738,274 | ||||||

|

Non-controlling interests

|

163,770 | - | ||||||

|

Total equity

|

7,709,808 | 9,738,274 | ||||||

|

Total liabilities and stockholders’ equity

|

12,715,771 | 15,718,848 | ||||||

See accompanying notes to the consolidated financial statements.

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

Years ended May 31, 2014 and 2013

|

2014

|

2013

|

|||||||

|

Continuing operations

|

||||||||

|

Revenue

|

6,176,820 | 6,487,707 | ||||||

|

Other income and gains

|

149,588 | 97,588 | ||||||

|

Service costs

|

(2,955,367 | ) | (4,030,075 | ) | ||||

|

Personnel cost

|

(752,868 | ) | (619,800 | ) | ||||

|

Depreciation expense

|

(484,432 | ) | (459,122 | ) | ||||

|

Amortization expense

|

(137,452 | ) | (121,632 | ) | ||||

|

Administrative and other expenses

|

(806,221 | ) | (669,568 | ) | ||||

|

Income before provision for income taxes

|

1,190,068 | 685,098 | ||||||

|

Income tax income/(Provision for income taxes)

|

104,362 | (284,680 | ) | |||||

|

Net income before non-controlling interest

|

1,294,430 | 400,418 | ||||||

|

Share of loss by non-controlling interest

|

27,435 | - | ||||||

|

Net income from continuing operations

|

1,321,865 | 400,418 | ||||||

|

Discontinued operations

|

||||||||

|

Net loss

|

(244,237 | ) | (351,013 | ) | ||||

|

Net loss from discontinued operations

|

(244,237 | ) | (351,013 | ) | ||||

|

Net income for the year

|

||||||||

|

Net income before non-controlling interest

|

1,050,193 | 49,405 | ||||||

|

Share of loss by non-controlling interest

|

27,435 | - | ||||||

|

Net income for the year

|

1,077,628 | 49,405 | ||||||

|

Other comprehensive income

|

||||||||

|

Gain/(loss) on foreign currency translation of continuing operations

|

(4,876 | ) | 72,312 | |||||

|

Share of other comprehensive income by non-controlling interest

|

(1,810 | ) | - | |||||

|

Other comprehensive income attributable to shareholders of the Company

|

(6,686 | ) | 72,312 | |||||

|

Gain/(loss) on foreign currency translation of discontinued operations

|

7,962 | 79,602 | ||||||

|

Total other comprehensive income

|

1,276 | 151,914 | ||||||

|

Total comprehensive income

|

||||||||

|

- Attributable to continuing operations

|

1,315,179 | 472,730 | ||||||

|

- Attributable to discontinued operations

|

(236,275 | ) | (271,411 | ) | ||||

|

Total comprehensive income

|

1,078,904 | 201,319 | ||||||

|

Earnings per share, basic and diluted

|

||||||||

|

– continuing operations

|