Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEWFIELD EXPLORATION CO /DE/ | d783528d8k.htm |

Lee

K. Boothby Chairman, President and CEO

September 2014

Exhibit 99.1 |

Executing Our Vision

1.

Focus the asset base

2.

Expand our inventory (liquids)

3.

Execute our three-year plan

4.

Grow oil / liquids production

5.

Strengthen the balance sheet |

3

Repositioned asset portfolio to

U.S. onshore, liquids-rich plays

Added liquids assets in SCOOP/STACK and

Uinta Central Basin

Focused people, capital on “plays of

the future”

Monetizing non-core assets |

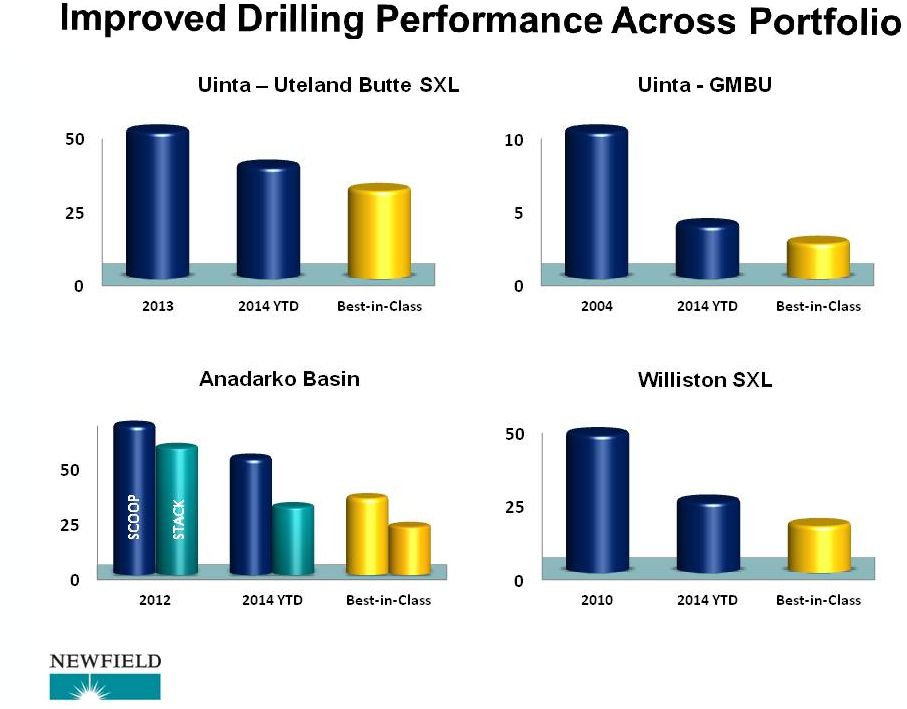

4

Multiple, stacked geologic pays

Liquids-focused portfolio, deep inventory

Common play attributes allow transfer of

technology, people and capital

Operational efficiencies unlocking

additional inventory

Drilling efficiencies in all focus areas

Completion optimizations enhance returns;

expand economic development windows |

5

Key objectives:

Production / reserve growth

Inventory expansion

Improve cost structure

Strengthen the balance sheet

Delivered 2013 plan (year 1)

On track with 2014e-16e plan

Double-digit production & cash flow growth |

6

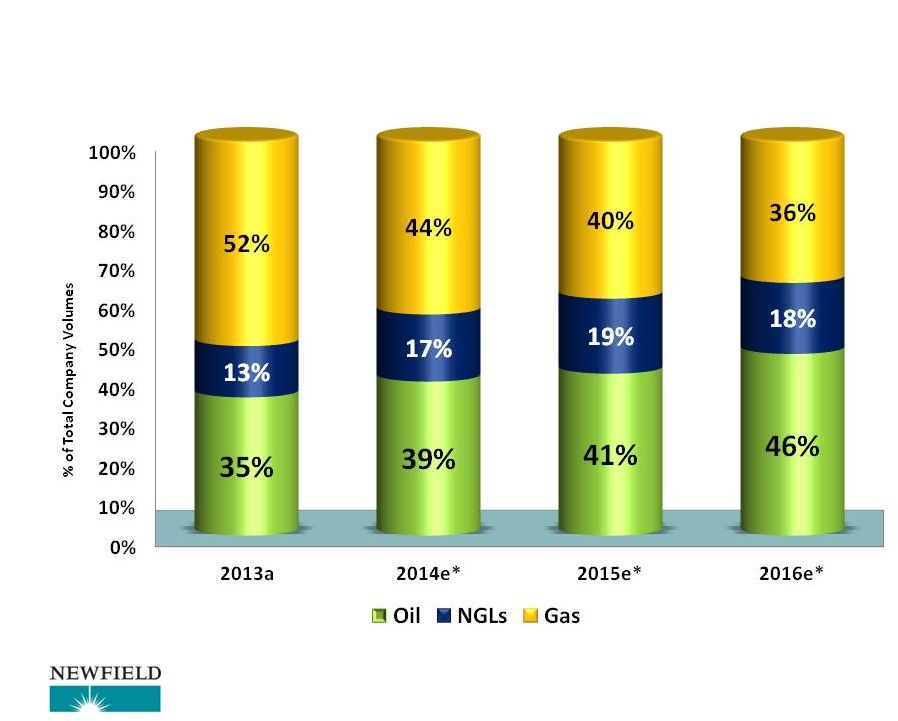

Shifted investments to liquids

Added assets in the Anadarko and Uinta

basins

Focused people, capital on “plays

of the future”

SCOOP/STACK, Central Basin

Accelerated liquids growth

Three-year cash flow CAGR: ~25%

2014 oil production to grow 30% YOY |

7

Oil Drives Our Future Growth

*Assumes guidance mid-points for 2014-16 |

8

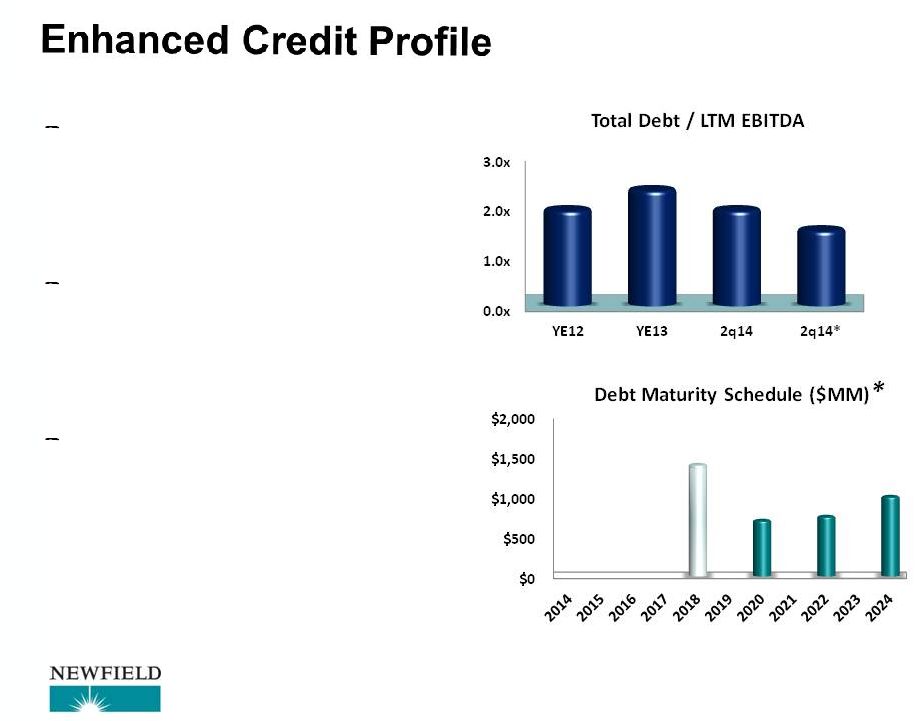

Non-core asset sales funded

transition of the asset base

Sold ~$2.5 billion in non-strategic assets

Proceeds from Granite Wash sale to reduce

long-term debt

Maintained strong credit profile

throughout transition |

9

*Pro-forma for Call on $600 MM Sr. Sub Notes Due 2018

Improved credit

metrics

Staggered debt

maturities

Increased cash flow

generation and

reducing long-term

debt

Credit Facility

$0 drawn @6/30/14

Bonds |

2014

Goals 1.

Anadarko Basin: 100% production growth

a)

SCOOP area in active development

2.

STACK: “Production delineate,”

HBP

3.

Central Basin: Assess and deliver SXL results

4.

Williston Basin & Eagle Ford: Grow >35%

5.

Post efficiency gains in drilling, completions

6.

Exit International |

11

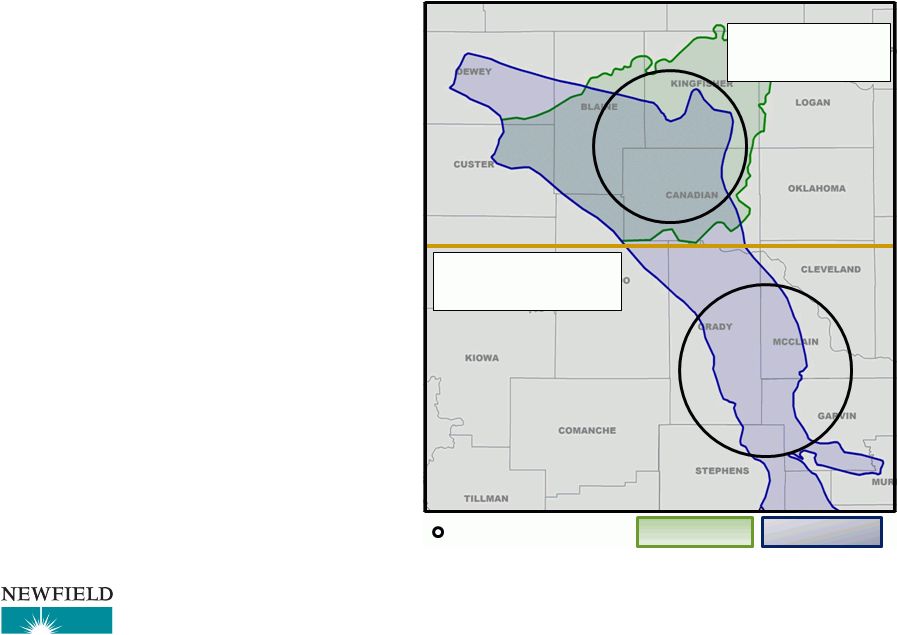

STACK

165,000 net acres

SCOOP

85,000 net acres

Newfield acreage position

Meramec Play

Woodford Play

Anadarko Basin

>250,000 Total Net Acres:

—

Added 25,000 net acres YTD

—

Multiple prospective horizons

—

SCOOP South in development

—

Assessing “SCOOP North”

—

Newfield operated rig running

—

Benefitting through “Operated By Others”

(OBO) activity

—

2014 program will production

delineate ~70% of STACK

(~50% currently) |

12

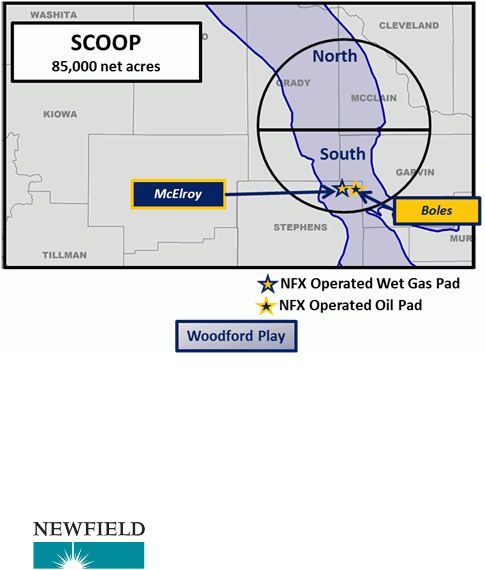

Anadarko Basin—SCOOP

85,000 Net Acres:

—

North SCOOP ~42,000 net acres

—

Six industry rigs running in N. SCOOP

—

Active assessment underway

—

Newfield operated rig running

—

South SCOOP ~43,000 net acres

“NEW”

McElroy Wet Gas Pad (4 XL

wells)

–

(17% oil in IP and 30-day)

—

Avg. lateral length: 4,978’

—

Avg. 24-hr IP per well: 1,811 BOEPD

—

Avg. 30-day per well: 1,395 BOEPD

—

“NEW”

Boles Oil Pad (5 SXL wells)

—

Avg. lateral length: ~7,754’

—

Current pad rate: ~10,365 BOEPD (41% oil)

—

Continuing to clean-up and achieve max rate |

13

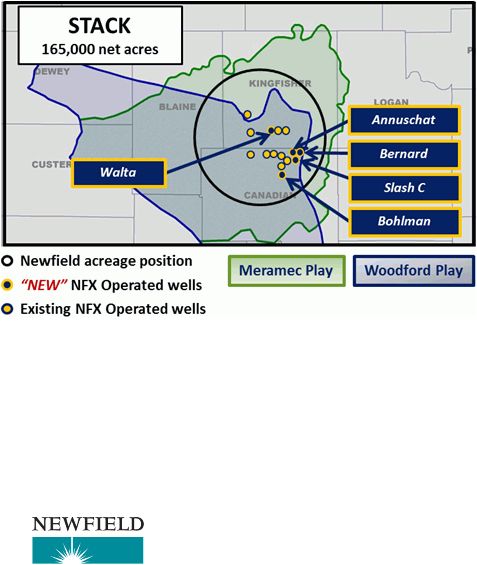

Anadarko Basin—STACK

*Includes 4 wells

>165,000 Total Net Acres:

—

~50% of acreage now “production

delineated”

—

RORs improving through lower

completed well costs

—

“Best-in-Class”

well: $~10 MM

—

Five

“NEW”

STACK wells:

Walta, Annuschat, Bernard,

Slash C and Bohlman wells

—

Avg. lateral length: ~10,000’

—

Avg. 24-hr IP: 845 BOEPD (87% oil)

—

Avg. 30-day rate*: 530 BOEPD (85% oil) |

14

Well Type

# Wells

Avg.

Gross IP

(24-Hours)

Avg.

Gross

30-Day Rate

Avg.

Gross

60-Day Rate

Avg.

Gross

90-Day Rate

SCOOP Wet Gas SXL (1)

15

2,106 BOEPD

1,669 BOEPD

1,689 BOEPD

1,626 BOEPD

SCOOP Wet Gas XL (2)

17

1,468 BOEPD

1,105 BOEPD

966 BOEPD

965 BOEPD

SCOOP Oil* (3)

15

1,435 BOEPD

1,068 BOEPD

1,071 BOEPD

1,056 BOEPD

STACK (4)

15

888 BOEPD

599 BOEPD

606 BOEPD

566 BOEPD

(1) All 15 wells have 90-day rates

(2) 60 and 90-day rates include 13 wells

(3) All 15 wells have 90-day rates

(4) 60-day rate includes 12 wells and 90-day rate includes 11 wells (data

excludes 2 STACK wells drilled in single-well extension areas) All rates

reported as wellhead volumes Anadarko Basin—'13–'14 Wells Driving

Growth Shallower decline rates and higher oil cuts in STACK providing

attractive returns

*Excludes New Boles pad currently cleaning-up

69 operated wells

South SCOOP in “full field”

development

–

–

– |

15

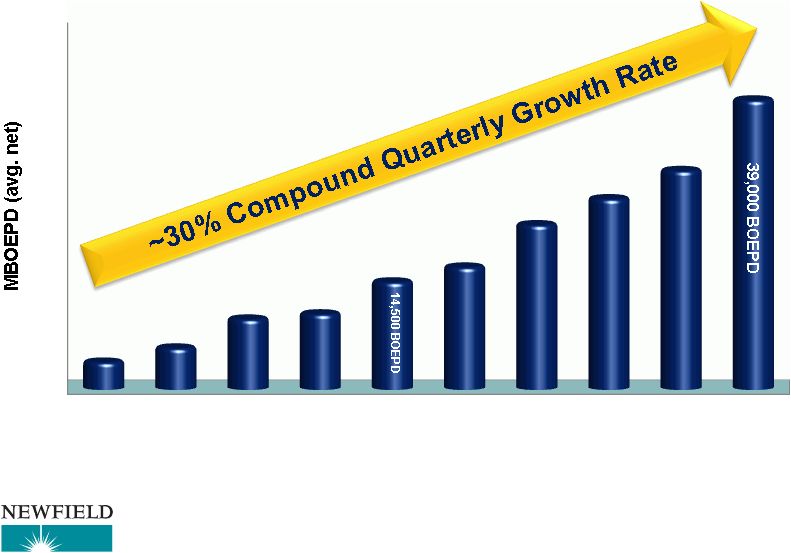

Anadarko Basin—SCOOP & STACK Production

3,700 BOEPD

0

10

20

30

40

50

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14 |

16

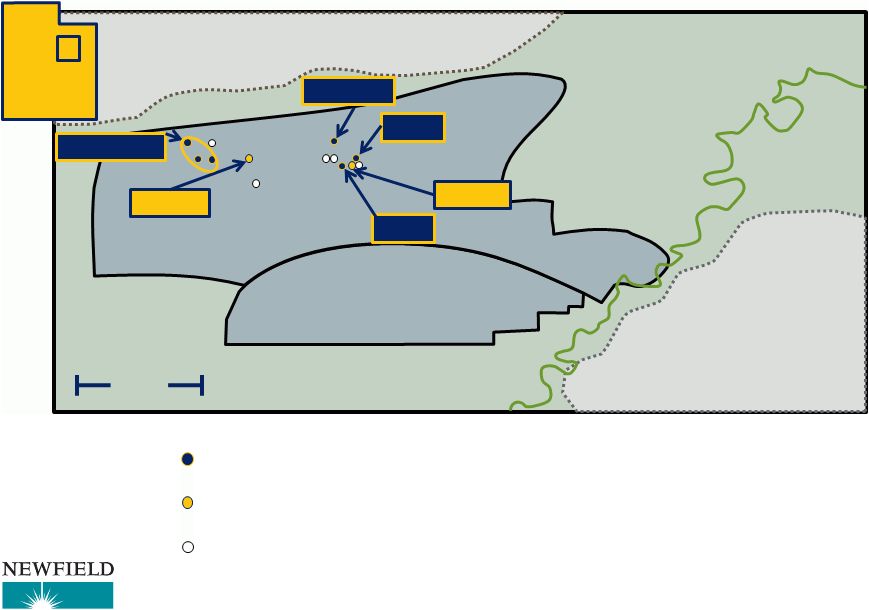

Perank

Jorgensen

Aubrey 2

Close

Uteland Butte SXL Wells: Producing (6)

Wasatch SXL Wells: Producing (2)

SXL Horizontal Wells: Drilling/Completing (5)

Ranch

Existing Wells

Uinta Basin—Recent SXL Wells

UTAH

Altamont / Bluebell

Greater

Monument Butte Unit

(GMBU)

Natural Buttes

Green River

Central Basin

~10 Miles |

17

Well Type

# Wells

Avg.

Gross IP

(24-Hours)

Avg.

Gross

30-Day Rate

Avg.

Gross

60-Day Rate

Avg.

Gross

90-Day Rate

Recent Uteland Butte SXLs (1)

3

2,157 BOEPD

1,532 BOEPD

1,323 BOEPD

1,154 BOEPD

Wasatch SXLs (2)

2

2,068 BOEPD

1,428 BOEPD

1,479 BOEPD

1,583 BOEPD

Existing Uteland Butte SXLs

3

1,543 BOEPD

997 BOEPD

818 BOEPD

753 BOEPD

Central Basin Avg. SXL (3) (4)

8

1,905 BOEPD

1,273 BOEPD

1,151 BOEPD

1,025 BOEPD

(1) 30-day, 60-day and 90-day rates include 2 wells

(2) 90-day rates include 1 well

(3) 30-day rate includes 7 wells

(4) 60-day and 90-day rates include 6 wells

All rates reported as wellhead volumes

—

Five SXLs have average IP of >2,100 BOEPD gross

—

Strong 30, 60 & 90-day rates

—

Current “Best-in-Class”

Uteland Butte SXL wells: ~$11.2 MM (drill

& complete)

—

Production performance supporting projected type curves

Uinta Basin—Recent SXL Wells |

18

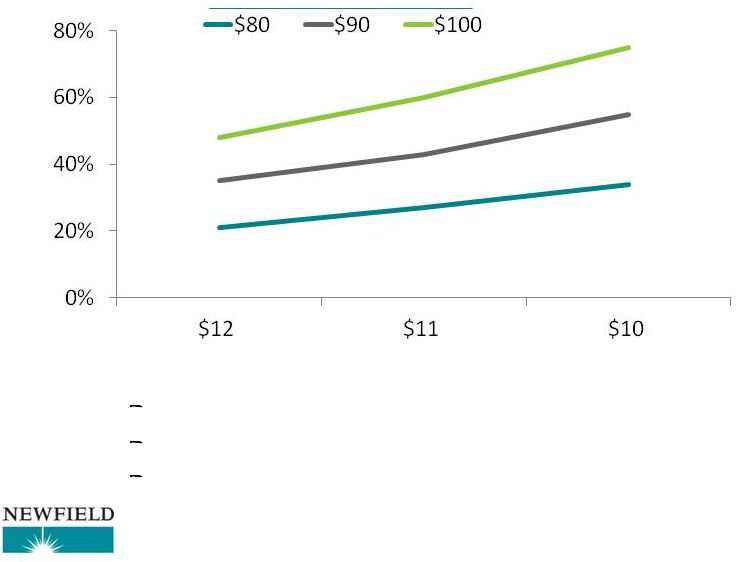

Uteland Butte—Significant Resource Potential and

Returns

ROR%

D&C cost ($ MM)

“Days to depth”

decreasing

Completed well costs per lateral foot improving

Recent wells outperforming type curve

Price deck*

*Flat pricing, assumes indicated oil price and $4/Mmbtu gas price

|

19

Newfield is a proven operator:

Demonstrated execution in field

Moved multiple plays from HBP

mode to full-field development

Applying “lessons learned”

across

the portfolio

Today’s developments benefitting from

common attributes across portfolio |

20

*Days to depth, spud to rig-release |

21

Pearl Topsides

installed in August

2014!

First oil: 4Q14

Working with

potential bidders

Goal: monetize the

business

China Update |

To

Do List 1.

Deliver the three-year plan

2.

Provide visibility, unlock potential (‘14-’16)

3.

Continued efficiencies (always)

4.

Monetize China business

5.

Update three-year Plan (Feb. ‘15) |

23

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

The

words

“will”,

“believe”,

“intend”,

“plan”,

“expect”

or

other

similar

expressions are intended to identify forward-looking statements. Other than

historical facts included in this presentation, all information and

statements, such as information regarding planned capital expenditures, estimated

reserves, estimated production targets, drilling and development

plans,

the

timing

of

production,

planned

capital

expenditures,

and

other

plans

and

objectives

for

future

operations,

are

forward-

looking

statements.

Although

as

of

the

date

of

this

presentation

Newfield

believes

that

these

expectations

are

reasonable,

this

information

is

based upon assumptions and anticipated results that are subject to numerous

uncertainties and risks. Actual results may vary significantly from those

anticipated due to many factors, including drilling results, commodity prices, industry conditions, the prices of goods and

services, the availability of drilling rigs and other support services, the

availability of refining capacity for the crude oil Newfield produces in the

Uinta Basin in Utah, the availability of capital resources, labor conditions, severe weather conditions, governmental regulations and other

operating risks. Please see Newfield’s 2013 Annual Report on Form 10-K

and subsequent Quarterly Reports on Form 10-Q filed with the U.S.

Securities and Exchange Commission (SEC) for a discussion of other factors that may

cause actual results to vary. Unpredictable or unknown factors not discussed

herein or in Newfield’s SEC filings could also have material adverse effects on forward-looking statements.

Readers are cautioned not to place undo reliance on forward-looking statements,

which speak only as of the date of this presentation. Unless legally

required, Newfield undertakes no obligation to publicly update or revise any forward-looking statements.

Cautionary

Note

to

Investors

–

Effective

January

1,

2010,

the

SEC

permits

oil

and

gas

companies,

in

their

filings

with

the

SEC,

to

disclose

only proved, probable and possible reserves that meet the SEC’s definitions for

such terms. Newfield may use terms in this presentation, such as

“resources”, “net resources”, “net discovered resources”, “net risked resources”, “net lower-risked captured resources”, “net risked

captured resources”, “gross resources”, “gross resource

potential”, “gross unrisked resource potential”, “gross unrisked resources”, and

similar terms that the SEC’s guidelines strictly prohibit in SEC filings.

Investors are urged to consider closely the oil and gas disclosures in

Newfield’s

2013

Annual

Report

on

Form

10-K,

available

at

www.newfield.com,

www.sec.gov

or

by

writing

Newfield

at

4

Waterway

Square

Place,

Suite

100,

The

Woodlands,

Texas

77380

Attn:

Investor

Relations.

Forward Looking Statements and Related Matters |

Lee

K. Boothby Chairman, President and CEO

September 2014 |