Attached files

| file | filename |

|---|---|

| 8-K - DNB FINANCIAL CORPORATION FORM 8-K - DNB FINANCIAL CORP /PA/ | dnb8k.htm |

DNB Financial Corporation

Investor Overview Presentation

Summer 2014

Forward-looking statements:

Certain statements contained in this presentation are forward-looking in nature. These include all

Certain statements contained in this presentation are forward-looking in nature. These include all

statements about DNB's plans, objectives, expectations and other statements that are not historical

facts, and usually use words such as "expect," "anticipate," "believe" and similar expressions. Such

statements represent management's current beliefs, based upon information available at the time

the statements are made, with regard to the matters addressed. All forward-looking statements

are subject to risks and uncertainties that could cause DNB's actual results or financial condition to

differ materially from those expressed in or implied by such statements. Factors of particular

importance to DNB include, but are not limited to: (1) changes in general, national or regional economic

conditions; (2) changes in interest rates; (3) changes in loan default and charge-off rates; (4) changes in

deposit levels; (5) changes in levels of income and expense in non-interest income and expense related

activities; (6) residential mortgage and secondary market activity; (7) changes in accounting and

activities; (6) residential mortgage and secondary market activity; (7) changes in accounting and

regulatory guidance applicable to banks; (8) price levels and conditions in the public securities markets

generally; (9) competition and its effect on pricing, spending, third-party relationships and revenues;

and (10) changes in regulation resulting from or relating to financial reform legislation. DNB does not

undertake any obligation to update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

new information, future events or otherwise.

Non-GAAP Financial Measures:

This presentation includes non-GAAP financial measures. Information about any such non-GAAP

This presentation includes non-GAAP financial measures. Information about any such non-GAAP

financial measures, including a reconciliation of those measures to GAAP, can be found in the

presentation and/or in our SEC reports available on our website at http://investors.dnbfirst.com/.

FORWARD-LOOKING STATEMENTS & ADDITIONAL

INFORMATION

2

I. Corporate Overview/Compelling Investment Opportunity (Pages 4-7)

II. Strong Market Drives Opportunity (Pages 8-19)

III. Consistent Performance, Stable Growth & Financial Trends (Pages 20-31)

IV. Experienced Management and Board Leadership (Pages 32-38)

V. Invest in DNBF (Pages 39-42)

TABLE OF CONTENTS

3

CORPORATE OVERVIEW

Founded: 1860, The oldest National Bank in the greater

Philadelphia Region

Philadelphia Region

Headquarters: Downingtown, Chester County, Pennsylvania

NASDAQ Ticker: DNBF

Total Assets: $685 million

Deposits: $576 million

Total Equity: $62 million

Branch Offices: 13

Share Price: $21.25 ($22.00 as of August 25, 2014)

Market Cap: $59 million

Shares Outstanding: 2.8 million

Snapshot June 30, 2014

4

COMPELLING INVESTMENT OPPORTUNITY

Snapshot June 30, 2014

• High quality footprint, serving growing, diversified and affluent markets in

Chester and Delaware Counties, Pennsylvania

Chester and Delaware Counties, Pennsylvania

• Book value per share has grown from $16.18 in 2Q 2013 to $17.62 in 2Q

2014

2014

• High level of low cost core deposits: Cost of Deposits - .25% YTD or .23% QTD

and Composite Cost of Funds - .40% YTD or .38% QTD

and Composite Cost of Funds - .40% YTD or .38% QTD

• Increasing momentum in non-Interest income has grown and now generates

$1 million per quarter with about 29% coming from wealth management

$1 million per quarter with about 29% coming from wealth management

• Strong liquidity combined with the ability to shift earning assets from

investments to loans will contribute to higher margins over time

investments to loans will contribute to higher margins over time

• Superior asset quality - NPL/Gross Loans of 1.18%

5

COMPELLING INVESTMENT OPPORTUNITY

• Well capitalized, highly liquid, with clean, conservative balance sheet

• Well positioned to grow to $1 billion-plus in assets

• Strong Market Demographics

• Favorable loan and low cost deposit trends

• Proven management team generating results since 2007

• Historic quarterly cash dividend

• Focus on Relationship Banking

6

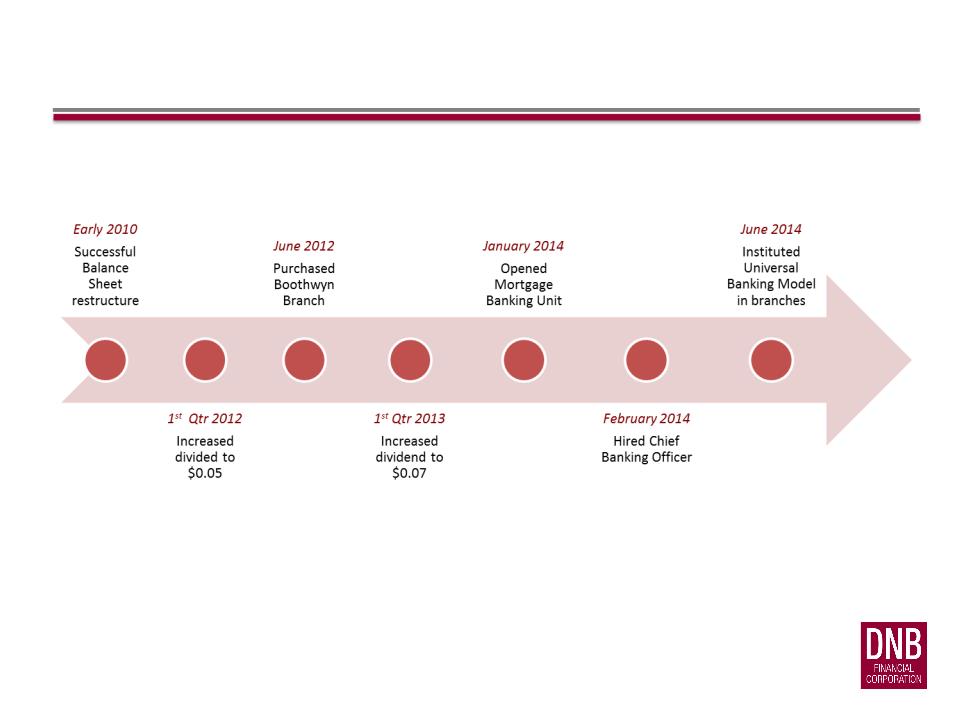

KEY INITIATIVES & MILESTONES

7

Strong Market Drives Opportunity

8

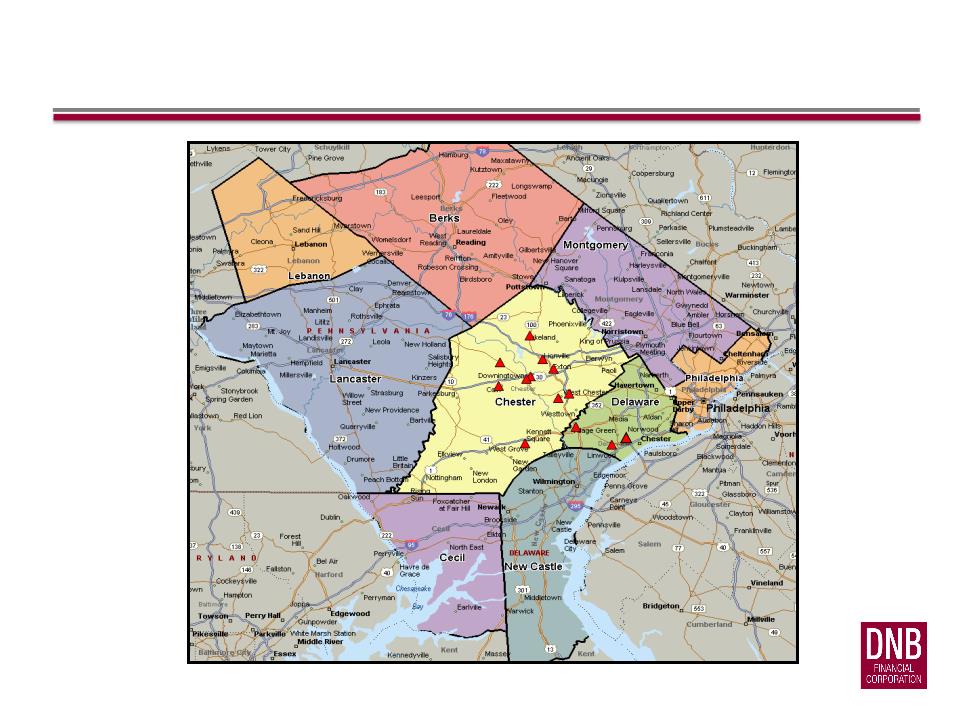

ESTABLISHED PRESENCE IN ATTRACTIVE

SOUTHEASTERN PENNSYLVANIA MARKET

9

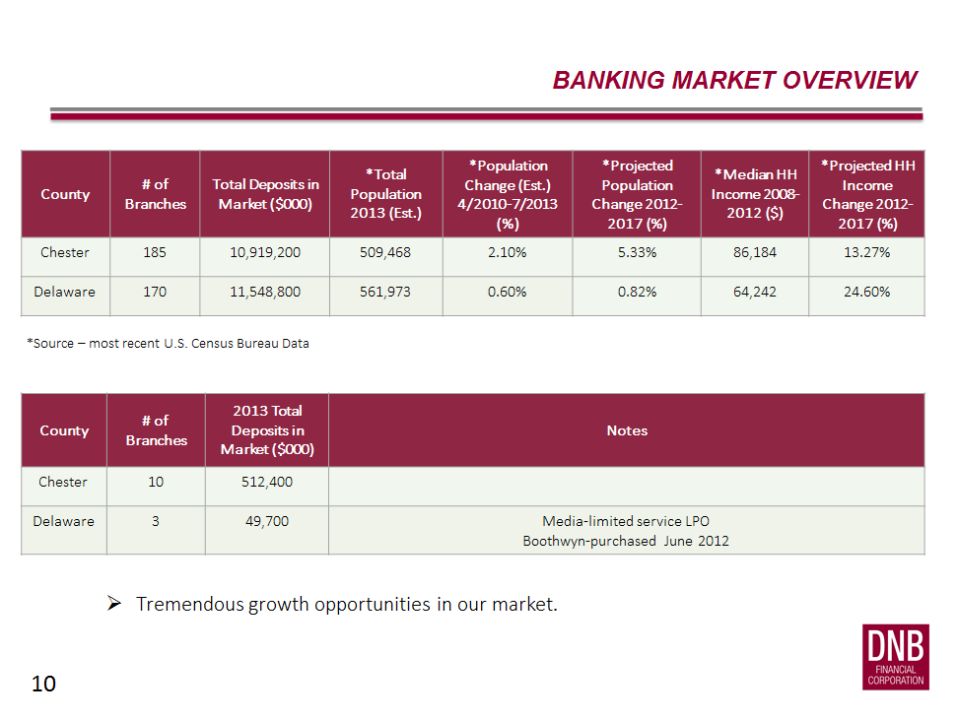

MARKET OVERVIEW AND DEMOGRAPHICS

Largest Market: Chester County, PA

• Fast Growing: Population (est.) 509,468 in 2013, representing an increase of

10,582 from the 2010 Census (2014 data not available)

10,582 from the 2010 Census (2014 data not available)

• Most Affluent County in PA: Median Household Income is $86,184,

significantly above U.S. average of $51,371, and the county ranks 14th

nationally in disposable income (highest income county in the state)

significantly above U.S. average of $51,371, and the county ranks 14th

nationally in disposable income (highest income county in the state)

• Diverse Economy: the largest industry is manufacturing which represents

23.1% of the workforce, retail trade is the major employer making up 13.8%

23.1% of the workforce, retail trade is the major employer making up 13.8%

of the employment and the North East portion of the county is a booming

corridor of high tech pharmaceutical companies (Chester County Chamber of

Commerce)

corridor of high tech pharmaceutical companies (Chester County Chamber of

Commerce)

11

Growing Banking Presence: Delaware County, PA

• Population (est.) 561,098 in 2013, representing an increase of 2,994 from the

2010 Census (2014 data not available)

2010 Census (2014 data not available)

• Median Household Income is $64,242, above U.S. average of $51,371

• Fifth most populous county in the state of PA, conducive for expanded

banking services growth

banking services growth

• In excess of 7,200 businesses (over $500,000 in sales)

MARKET OVERVIEW AND DEMOGRAPHICS

12

• Continue to attract low cost core deposits

• Grow fee revenue as a percentage of total revenues by investing in new

business lines, building full client relationships and maximizing significant

untapped cross-sell potential

business lines, building full client relationships and maximizing significant

untapped cross-sell potential

• Build relationship banking in retail and commercial while providing a

consistent DNB First customer experience

consistent DNB First customer experience

• Maximize the potential of technology, social media and mobile delivery

• Capture additional business with wealth management, insurance and

Mortgage Banking

Mortgage Banking

• Explore accretive Bank & non-Bank acquisition opportunities in Delaware

and Chester counties, as well as in contiguous markets

and Chester counties, as well as in contiguous markets

STRATEGY TO SERVE OUR MARKETS

AND GROW

AND GROW

13

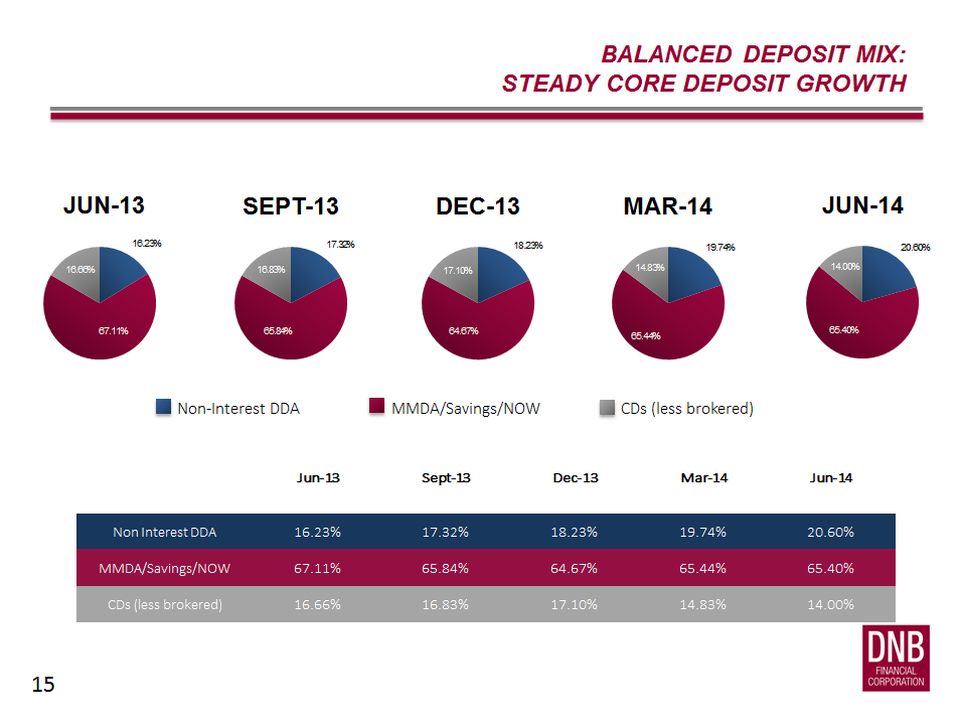

HIGH LEVEL OF LOW

COST CORE DEPOSITS

16

Core Deposits includes: Demand Deposit, NOW , MMDA & Savings

(excludes CD’s)

(excludes CD’s)

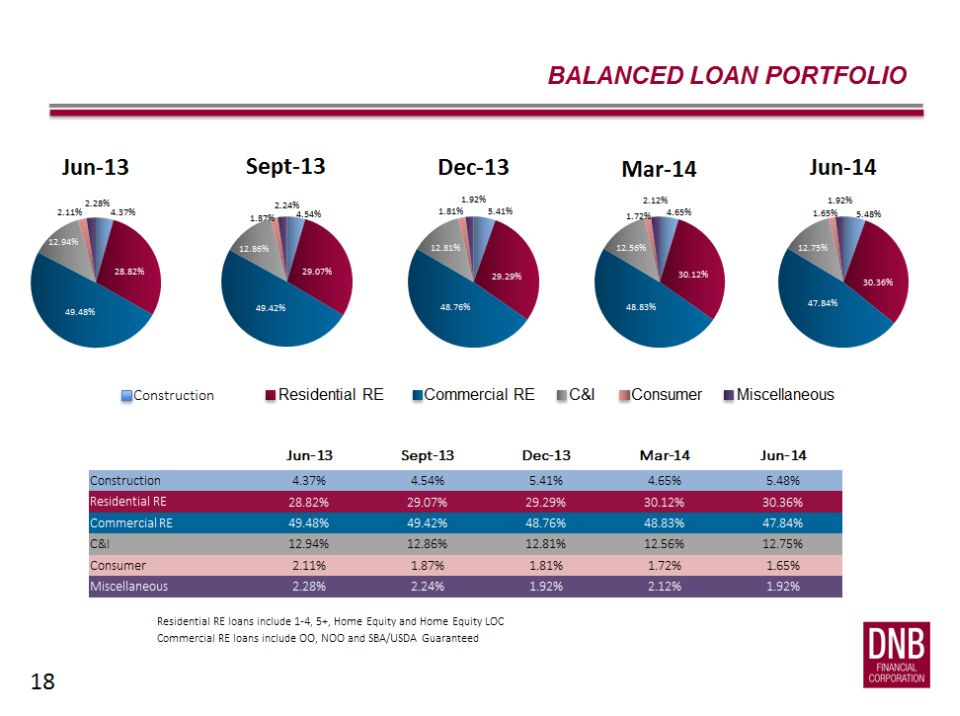

DETAILED LOAN PORTFOLIO COMPOSITION

|

Loan Type

|

$ Balance

|

Percent

|

|

Commercial RE OO

|

87,740

|

19.99%

|

|

Commercial RE NOO

|

90,025

|

20.51%

|

|

Residential 1-4

|

67,265

|

15.32%

|

|

Commercial & Industrial

|

55,987

|

12.75%

|

|

Residential 5+

|

33,213

|

7.57%

|

|

SBA/USDA Guaranteed

|

32,281

|

7.35%

|

|

Construction

|

24,051

|

5.48%

|

|

Home Equity LOC

|

25,614

|

5.83%

|

|

Municipal/Govt/Non-Profit

|

6,539

|

1.49%

|

|

Home Equity

|

7,184

|

1.64%

|

|

Consumer

|

7,257

|

1.65%

|

|

Farmland

|

1,864

|

0.42%

|

|

Total

|

439,022

|

100.00%

|

Snapshot June 30, 2014

17

LOAN PORTFOLIO

19

DNB’s Financial Strength, Consistent

Performance, Stable Growth and Financial

Trends

Trends

20

EXECUTIVE SUMMARY

21

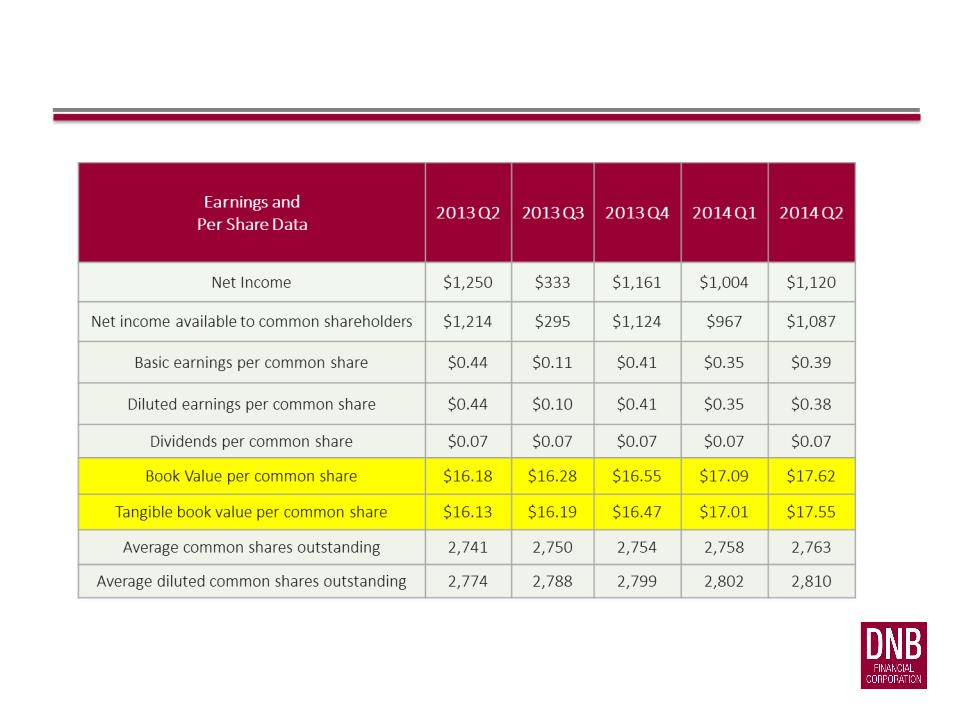

EARNINGS & PER SHARE DATA

22

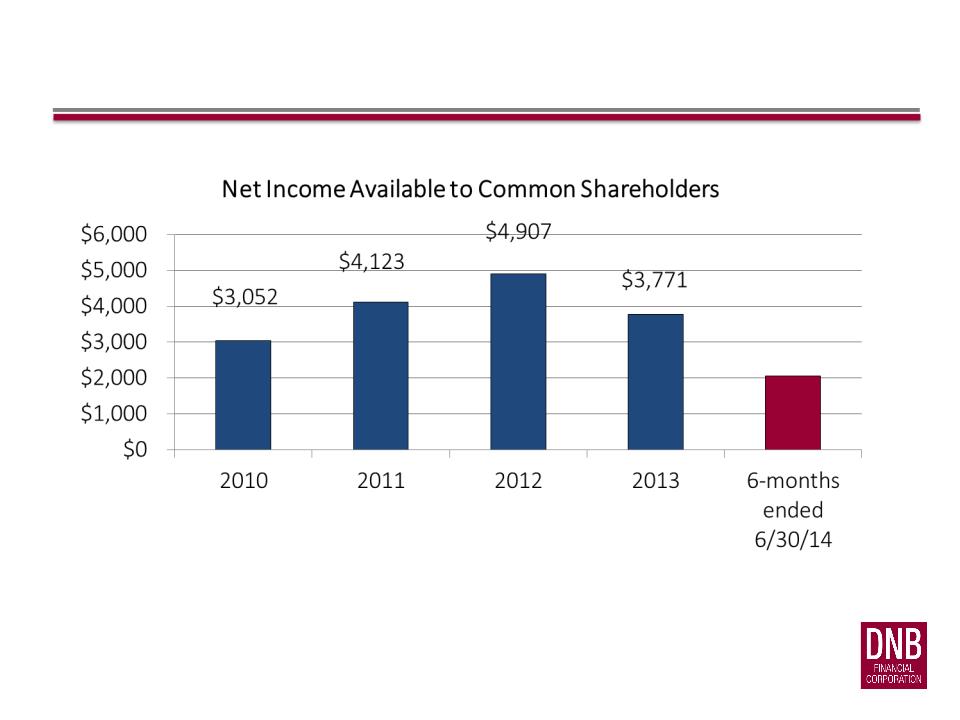

$2,054

EARNINGS & PER SHARE DATA

23

EARNINGS & PER SHARE DATA

24

EXECUTIVE SUMMARY

|

Performance Ratios

|

2013 Q2

|

2013 Q3

|

2013 Q4

|

2014 Q1

|

2014 Q2

|

|

Return on average assets

|

0.76%

|

0.20%

|

0.70%

|

0.62%

|

0.67%

|

|

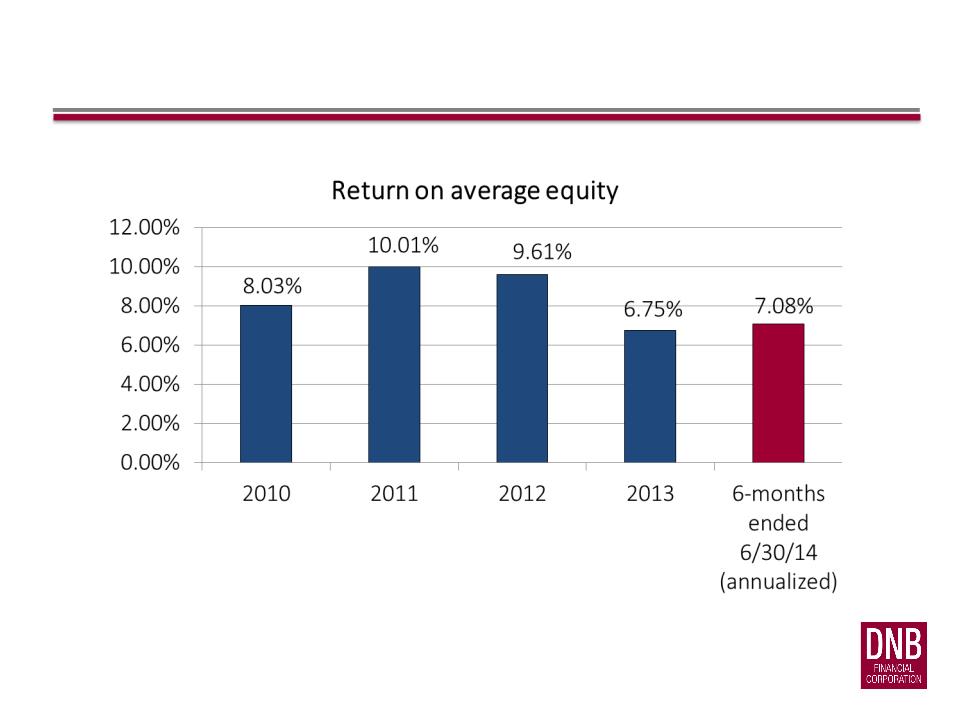

Return on average equity

|

8.60%

|

2.28%

|

7.86%

|

6.78%

|

7.35%

|

|

Return on average tangible

equity |

8.65%

|

2.29%

|

7.89%

|

6.81%

|

7.38%

|

|

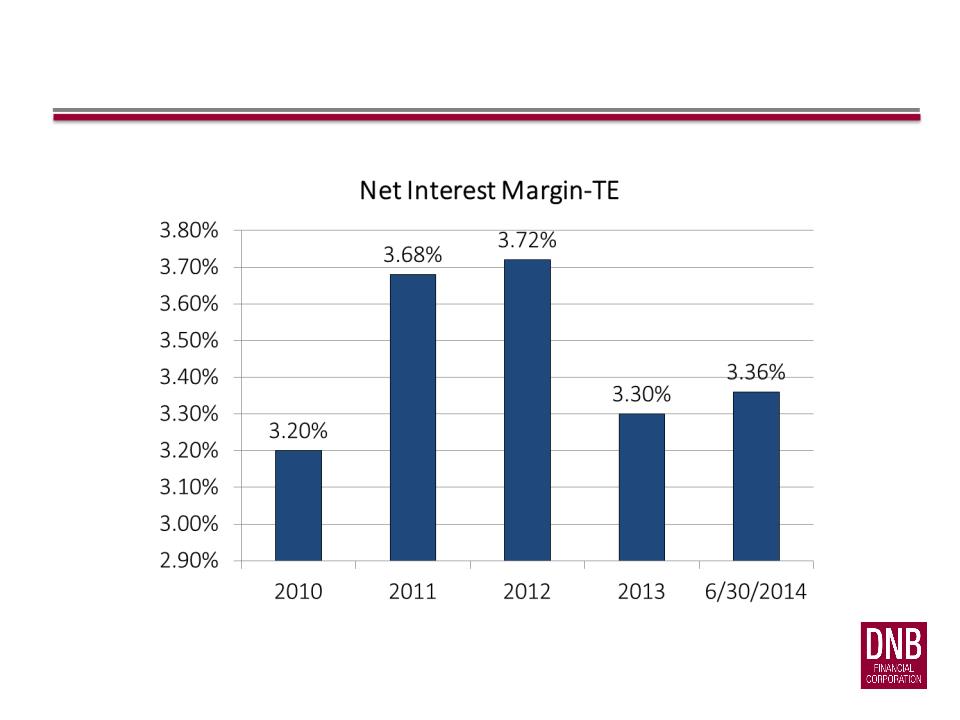

Net interest margin

|

3.35%

|

3.21%

|

3.31%

|

3.36%

|

3.36%

|

|

Efficiency ratio

|

66.98%

|

70.84%

|

70.15%

|

73.63%

|

71.97%

|

25

PERFORMANCE RATIOS

26

PERFORMANCE RATIOS

27

PERFORMANCE RATIOS

28

EXECUTIVE SUMMARY

|

Asset Quality Ratios

|

2013

Q2 |

2013

Q3 |

2013

Q4 |

2014

Q1 |

2014

Q2 |

|

Net Charge-offs to average loans

|

0.20%

|

1.02%

|

0.01%

|

0.06%

|

0.03%

|

|

Non-performing loans/Total loans

|

2.60%

|

1.40%

|

1.38%

|

1.26%

|

1.18%

|

|

Allowance for credit loss/Total loans

|

1.72%

|

1.08%

|

1.11%

|

1.10%

|

1.11%

|

|

Allowance for credit loss/Non-

performing loans |

65.94%

|

77.04%

|

80.73%

|

87.59%

|

94.62%

|

29

ASSET QUALITY RATIOS

30

EXECUTIVE SUMMARY

|

Capital Ratios

|

2013

Q2 |

2013

Q3 |

2013

Q4 |

2014

Q1 |

2014

Q2 |

|

Total equity/Total assets

|

8.60%

|

8.89%

|

8.86%

|

8.83%

|

9.00%

|

|

Tangible equity/Tangible assets

|

8.58%

|

8.87%

|

8.84%

|

8.78%

|

8.95%

|

|

Tangible common equity/Tangible assets

|

6.63%

|

6.87%

|

6.87%

|

6.88%

|

7.06%

|

|

Tier 1 leverage ratio

|

10.42%

|

10.39%

|

10.61%

|

10.72%

|

10.76%

|

|

Tier 1 risk-based capital ratio

|

15.22%

|

15.18%

|

15.35%

|

15.00%

|

14.88%

|

|

Total risk-based capital ratio

|

16.47%

|

16.16%

|

16.40%

|

16.04%

|

15.92%

|

31

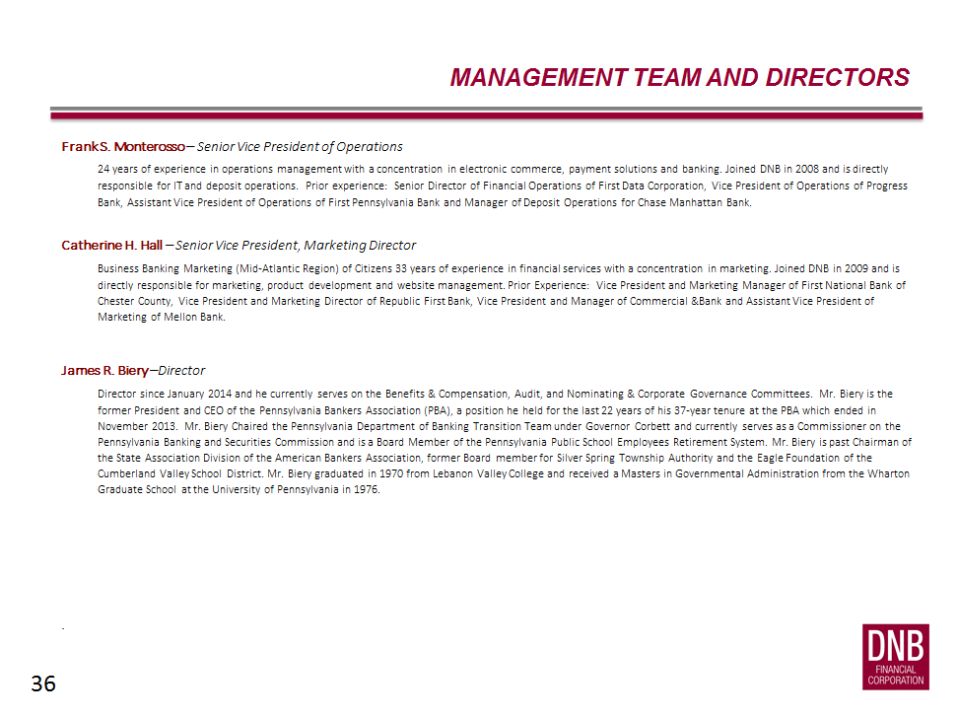

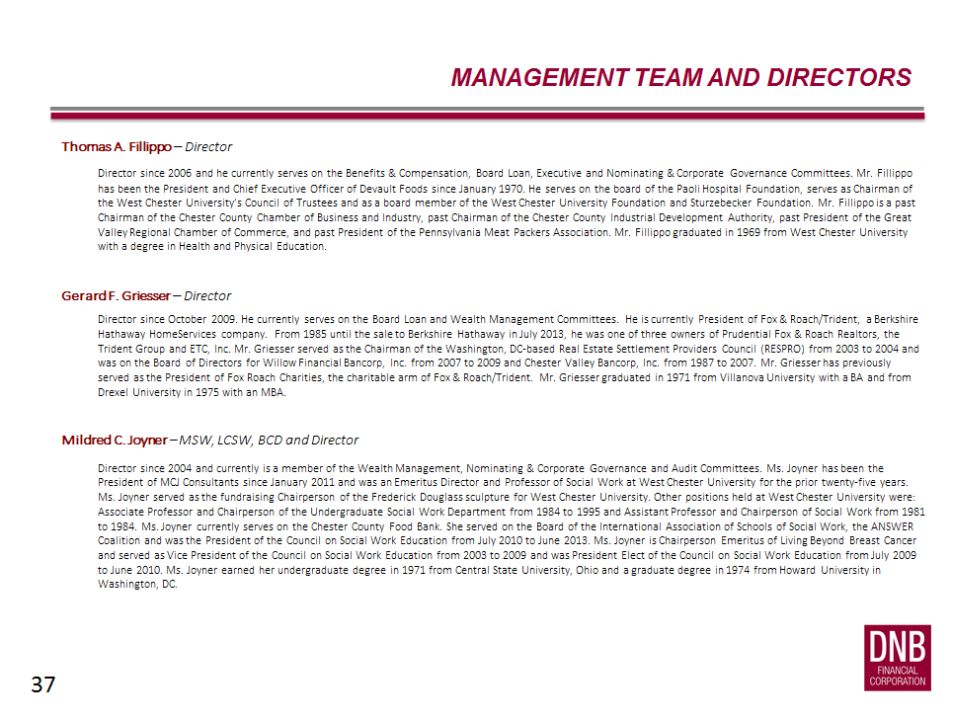

Experienced Management and Board

Leadership

Leadership

32

Invest in DNB Financial

39

DNBF STOCK PERFORMANCE

|

Security or Index

|

2013 Return

|

|

DNBF*

|

33.87%

|

|

NASDAQ Bank Index*

|

39.33%

|

|

KBW Bank Index*

|

34.71%

|

Closing price on Dec 27, 2013: $20.75

Closing price on August 25, 2014: $22.00

*Source: Bloomberg

40

INVESTOR RELATIONS CONTACT

Gerald F. Sopp

484.359.3138

gsopp@dnbfirst.com

http://investors.dnbfirst.com/

41

For more information, Investors may

contact:

contact:

THANK YOU

42