Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BUCKEYE PARTNERS, L.P. | a14-20366_18k.htm |

| EX-2.1 - EX-2.1 - BUCKEYE PARTNERS, L.P. | a14-20366_1ex2d1.htm |

| EX-99.1 - EX-99.1 - BUCKEYE PARTNERS, L.P. | a14-20366_1ex99d1.htm |

Exhibit 99.2

|

|

Investor Presentation South Texas Infrastructure Acquisition September 2, 2014 |

|

|

LEGAL NOTICE/FORWARD-LOOKING STATEMENTS The presentation contains "forward-looking statements" that we believe to be reasonable as of the date of this presentation. These statements, which may include any statement that does not relate strictly to historical facts, use terms such as "anticipate," "assume," "believe," "estimate," "expect," "forecast," "intend," "plan," "position," "predict," "project," or "strategy" or the negative connotation or other variations of such terms or other similar terminology. In particular, statements, express or implied, regarding future results of operations or ability to generate sales, income or cash flow, to make acquisitions, or to make distributions to unitholder are forward-looking statements. These forward-looking statements are based on management's current plans, expectations, estimates, assumptions and beliefs concerning future events impacting Buckeye Partners, L.P. (the "Partnership" or "BPL") and therefore involve a number of risks and uncertainties, many of which are beyond management's control. Although the Partnership believes that its expectations stated in this presentation are based on reasonable assumptions, actual results may differ materially from those expressed or implied in the forward-looking statements. The factors listed in the "Risk Factors" sections of, as well as any other cautionary language in, the Partnership's public filings with the Securities and Exchange Commission, provide examples of risks, uncertainties and events that may cause the Partnership's actual results to differ materially from the expectations it describes in its forward-looking statements. Each forward-looking statement speaks only as of the date of this presentation, and the Partnership undertakes no obligation to update or revise any forward-looking statement. Our pending South Texas Infrastructure Acquisition may not be consummated. The South Texas Infrastructure Acquisition is subject to closing conditions and regulatory approvals. If these conditions are not satisfied or waived, the South Texas Infrastructure Acquisition will not be consummated. If the closing of the South Texas Infrastructure Acquisition is substantially delayed or does not occur at all, or if the terms of the South Texas Infrastructure Acquisition are required to be modified substantially due to regulatory concerns, we may not realize the anticipated benefits of the South Texas Infrastructure Acquisition fully or at all. Certain of the conditions remaining to be satisfied include the absence of a law or order prohibiting the transactions contemplated by the contribution agreement and the expiration of any waiting periods under the Hart-Scott-Rodino Act, as amended, with respect to the South Texas Infrastructure Acquisition. We have filed a registration statement (including a preliminary prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the preliminary prospectus in that registration statement and other documents we have filed with the SEC for more complete information about us and the offering. You may get these documents for free by visiting EDGAR on the SEC web site at www.sec.gov. Alternatively, the Partnership, any underwriter or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling (888) 603-5847. © Copyright 2014 Buckeye Partners, L.P. 2 |

|

|

Transaction Overview Buckeye has entered into a definitive agreement to acquire 80% of the interests of a newly formed company, Buckeye Texas Partners (“BTP”), with Trafigura AG for $860 million The assets of BTP will include a vertically integrated system of midstream assets strategically located in Corpus Christi, Texas and the Eagle Ford Shale Deep water, high volume marine petroleum products terminal Condensate splitter and LPG storage complex Eagle Ford crude/condensate gathering facilities All assets are fully supported by 7-10 year minimum volume commitments and storage contracts with Trafigura Significant opportunity for additional infrastructure build-out to support expected growth in the Eagle Ford and Corpus Christi markets Transaction expected to close mid to late September 2014 Buckeye will be operator of the assets © Copyright 2014 Buckeye Partners, L.P. 3 Texas Hub – Corpus Christi, TX Financial Benefits 100% fee-based take-or-pay cash flows Revenues are fully contracted for 7 to 10 year terms Acquisition Adjusted EBITDA investment multiple forecast to be approximately 8.5x in 2016 (1) Highly accretive to distributable cash flow per unit; forecast to be approximately 8% in 2016 (1) Positions Buckeye for acceleration of distribution growth SOUTH TEXAS INFRASTRUCTURE ACQUISITION OVERVIEW After including estimated capex to complete existing growth capital projects; Please see non-GAAP disclosures on slide 15. |

|

|

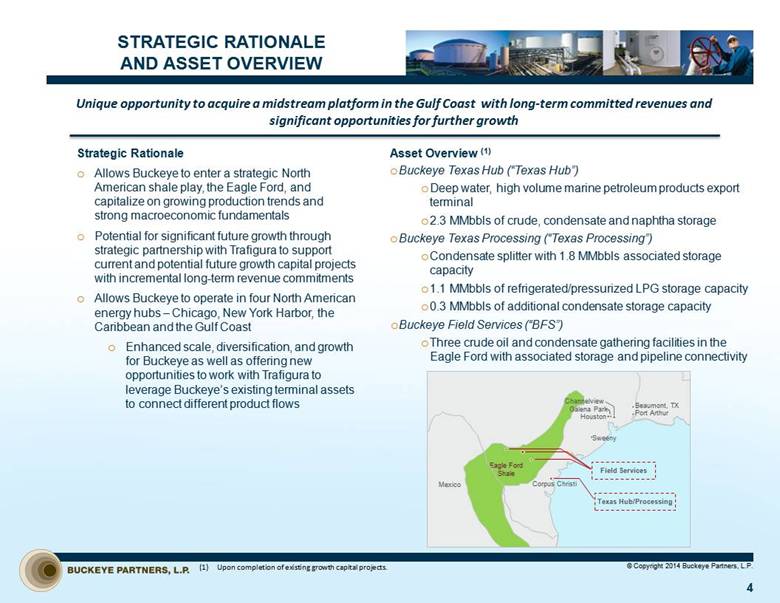

STRATEGIC RATIONALE AND ASSET OVERVIEW © Copyright 2014 Buckeye Partners, L.P. 4 Unique opportunity to acquire a midstream platform in the Gulf Coast with long-term committed revenues and significant opportunities for further growth Strategic Rationale Allows Buckeye to enter a strategic North American shale play, the Eagle Ford, and capitalize on growing production trends and strong macroeconomic fundamentals Potential for significant future growth through strategic partnership with Trafigura to support current and potential future growth capital projects with incremental long-term revenue commitments Allows Buckeye to operate in four North American energy hubs – Chicago, New York Harbor, the Caribbean and the Gulf Coast Enhanced scale, diversification, and growth for Buckeye as well as offering new opportunities to work with Trafigura to leverage Buckeye’s existing terminal assets to connect different product flows Asset Overview (1) Buckeye Texas Hub (“Texas Hub”) Deep water, high volume marine petroleum products export terminal 2.3 MMbbls of crude, condensate and naphtha storage Buckeye Texas Processing (“Texas Processing”) Condensate splitter with 1.8 MMbbls associated storage capacity 1.1 MMbbls of refrigerated/pressurized LPG storage capacity 0.3 MMbbls of additional condensate storage capacity Buckeye Field Services (“BFS”) Three crude oil and condensate gathering facilities in the Eagle Ford with associated storage and pipeline connectivity Upon completion of existing growth capital projects. Mexico Eagle Ford Shale Corpus Christi Houston Port Arthur Texas Hub/Processing Sweeny Galena Park Channelview Beaumont, TX Field Services |

|

|

© Copyright 2014 Buckeye Partners, L.P. 5 OUR PARTNER – TRAFIGURA Benefits of Partnership Trafigura as a global trading firm has the ability to fully utilize a variety of products exported from the Corpus Christi terminal to serve end markets they supply around the world Ongoing partnership incentivizes Trafigura to identify future opportunities with Buckeye and for Buckeye to provide the logistics solutions to make those opportunities materialize Buckeye has the ability to help Trafigura facilitate product and condensate movements out of Corpus with its other marine terminal assets About Trafigura Trafigura is a global leader in international commodities trading and logistics $42 billion in assets $133 billion in revenue in 2013 167 offices in 59 countries on six continents Trafigura physical activities involve sourcing, storing, blending and delivering energy products and raw materials to customers around the world Traded approximately 1 billion barrels of oil and petroleum products in 2013 2nd largest independent, non-ferrous metals trader in the world Strong North American and Gulf Coast presence One of largest crude oil blenders in the Gulf Coast Substantial exporter of refined products out of North America |

|

|

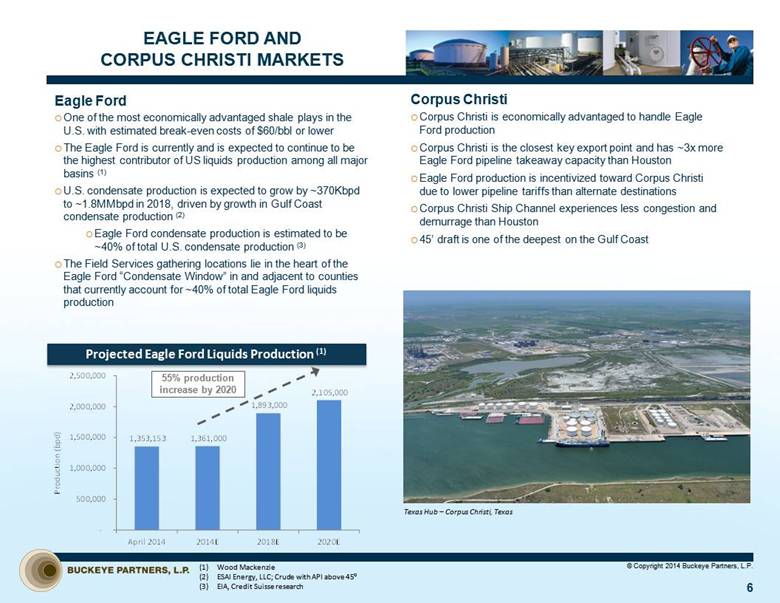

EAGLE FORD AND CORPUS CHRISTI MARKETS Eagle Ford One of the most economically advantaged shale plays in the U.S. with estimated break-even costs of $60/bbl or lower The Eagle Ford is currently and is expected to continue to be the highest contributor of US liquids production among all major basins (1) U.S. condensate production is expected to grow by ~370Kbpd to ~1.8MMbpd in 2018, driven by growth in Gulf Coast condensate production (2) Eagle Ford condensate production is estimated to be ~40% of total U.S. condensate production (3) The Field Services gathering locations lie in the heart of the Eagle Ford “Condensate Window” in and adjacent to counties that currently account for ~40% of total Eagle Ford liquids production © Copyright 2014 Buckeye Partners, L.P. 6 Corpus Christi Corpus Christi is economically advantaged to handle Eagle Ford production Corpus Christi is the closest key export point and has ~3x more Eagle Ford pipeline takeaway capacity than Houston Eagle Ford production is incentivized toward Corpus Christi due to lower pipeline tariffs than alternate destinations Corpus Christi Ship Channel experiences less congestion and demurrage than Houston 45’ draft is one of the deepest on the Gulf Coast Wood Mackenzie ESAI Energy, LLC; Crude with API above 45 EIA, Credit Suisse research Projected Eagle Ford Liquids Production (1) 55% production increase by 2020 Texas Hub – Corpus Christi, Texas 1,353,153 1,361,000 1,893,000 2,105,000 - 500,000 1,000,000 1,500,000 2,000,000 2,500,000 April 2014 2014E 2018E 2020E Production (bpd) |

|

|

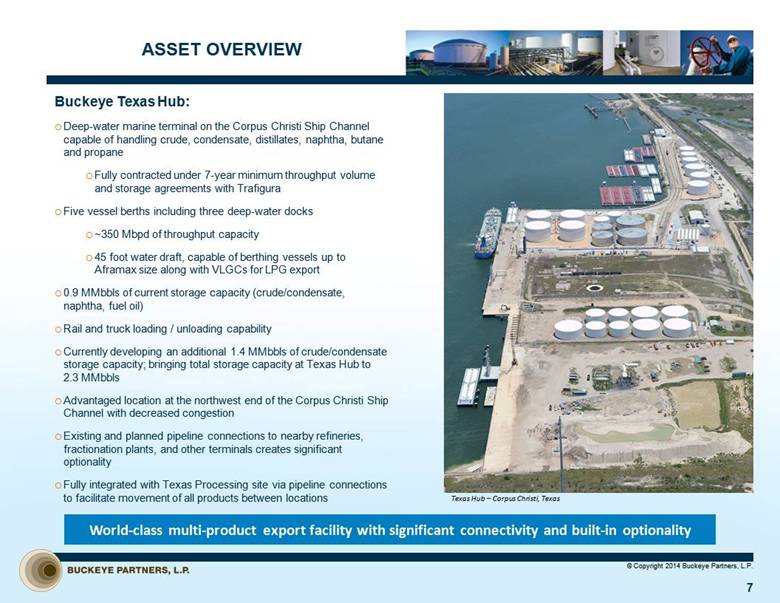

ASSET OVERVIEW Buckeye Texas Hub: Deep-water marine terminal on the Corpus Christi Ship Channel capable of handling crude, condensate, distillates, naphtha, butane and propane Fully contracted under 7-year minimum throughput volume and storage agreements with Trafigura Five vessel berths including three deep-water docks ~350 Mbpd of throughput capacity 45 foot water draft, capable of berthing vessels up to Aframax size along with VLGCs for LPG export 0.9 MMbbls of current storage capacity (crude/condensate, naphtha, fuel oil) Rail and truck loading / unloading capability Currently developing an additional 1.4 MMbbls of crude/condensate storage capacity; bringing total storage capacity at Texas Hub to 2.3 MMbbls Advantaged location at the northwest end of the Corpus Christi Ship Channel with decreased congestion Existing and planned pipeline connections to nearby refineries, fractionation plants, and other terminals creates significant optionality Fully integrated with Texas Processing site via pipeline connections to facilitate movement of all products between locations © Copyright 2014 Buckeye Partners, L.P. 7 World-class multi-product export facility with significant connectivity and built-in optionality Texas Hub – Corpus Christi, Texas |

|

|

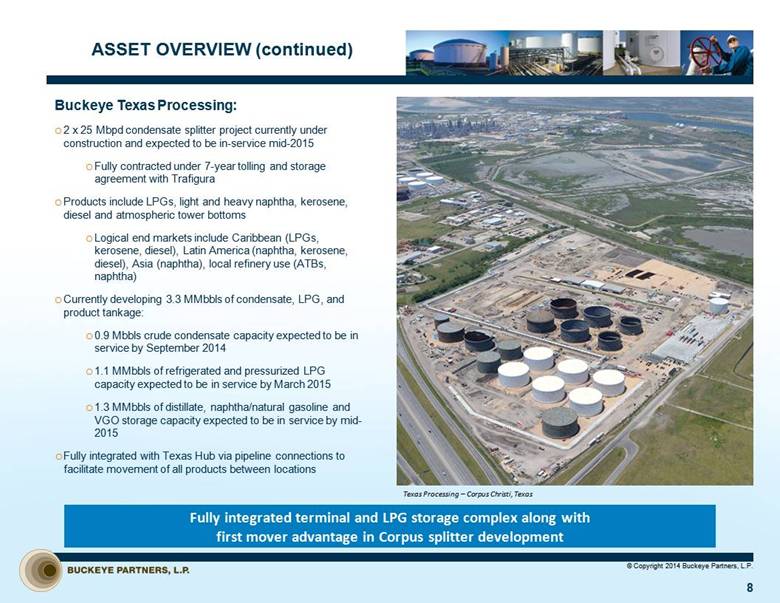

ASSET OVERVIEW (continued) Buckeye Texas Processing: 2 x 25 Mbpd condensate splitter project currently under construction and expected to be in-service mid-2015 Fully contracted under 7-year tolling and storage agreement with Trafigura Products include LPGs, light and heavy naphtha, kerosene, diesel and atmospheric tower bottoms Logical end markets include Caribbean (LPGs, kerosene, diesel), Latin America (naphtha, kerosene, diesel), Asia (naphtha), local refinery use (ATBs, naphtha) Currently developing 3.3 MMbbls of condensate, LPG, and product tankage: 0.9 Mbbls crude condensate capacity expected to be in service by September 2014 1.1 MMbbls of refrigerated and pressurized LPG capacity expected to be in service by March 2015 1.3 MMbbls of distillate, naphtha/natural gasoline and VGO storage capacity expected to be in service by mid-2015 Fully integrated with Texas Hub via pipeline connections to facilitate movement of all products between locations © Copyright 2014 Buckeye Partners, L.P. 8 Fully integrated terminal and LPG storage complex along with first mover advantage in Corpus splitter development Texas Processing – Corpus Christi, Texas |

|

|

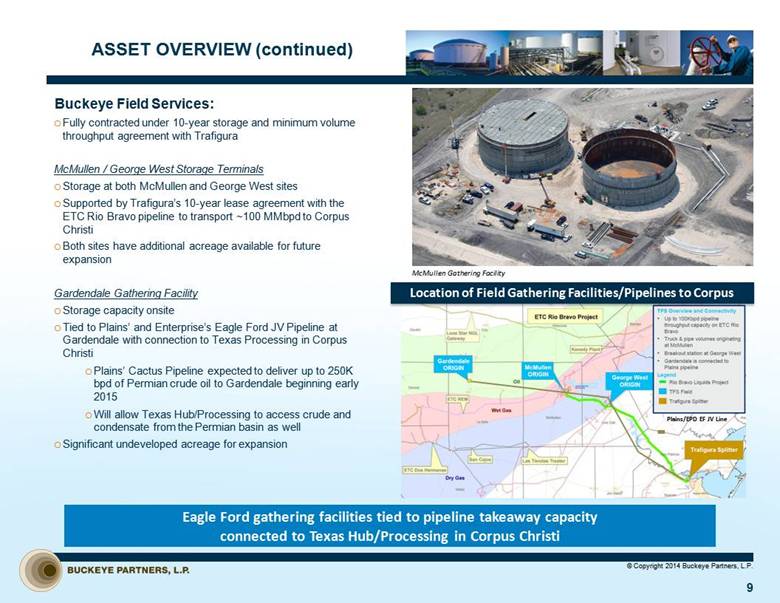

ASSET OVERVIEW (continued) 9 Buckeye Field Services: Fully contracted under 10-year storage and minimum volume throughput agreement with Trafigura McMullen / George West Storage Terminals Storage at both McMullen and George West sites Supported by Trafigura’s 10-year lease agreement with the ETC Rio Bravo pipeline to transport ~100 MMbpd to Corpus Christi Both sites have additional acreage available for future expansion Gardendale Gathering Facility Storage capacity onsite Tied to Plains’ and Enterprise’s Eagle Ford JV Pipeline at Gardendale with connection to Texas Processing in Corpus Christi Plains’ Cactus Pipeline expected to deliver up to 250K bpd of Permian crude oil to Gardendale beginning early 2015 Will allow Texas Hub/Processing to access crude and condensate from the Permian basin as well Significant undeveloped acreage for expansion Plains/EPD EF JV Line Location of Field Gathering Facilities/Pipelines to Corpus Eagle Ford gathering facilities tied to pipeline takeaway capacity connected to Texas Hub/Processing in Corpus Christi © Copyright 2014 Buckeye Partners, L.P. McMullen Gathering Facility |

|

|

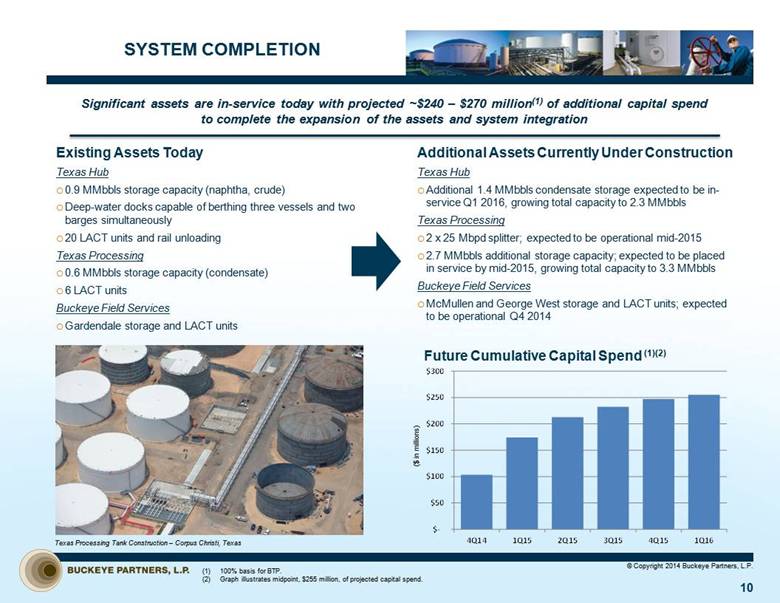

SYSTEM COMPLETION © Copyright 2014 Buckeye Partners, L.P. 10 Future Cumulative Capital Spend (1)(2) ($ in millions) Texas Processing Tank Construction – Corpus Christi, Texas Existing Assets Today Texas Hub 0.9 MMbbls storage capacity (naphtha, crude) Deep-water docks capable of berthing three vessels and two barges simultaneously 20 LACT units and rail unloading Texas Processing 0.6 MMbbls storage capacity (condensate) 6 LACT units Buckeye Field Services Gardendale storage and LACT units Additional Assets Currently Under Construction Texas Hub Additional 1.4 MMbbls condensate storage expected to be in-service Q1 2016, growing total capacity to 2.3 MMbbls Texas Processing 2 x 25 Mbpd splitter; expected to be operational mid-2015 2.7 MMbbls additional storage capacity; expected to be placed in service by mid-2015, growing total capacity to 3.3 MMbbls Buckeye Field Services McMullen and George West storage and LACT units; expected to be operational Q4 2014 Significant assets are in-service today with projected ~$240 – $270 million(1) of additional capital spend to complete the expansion of the assets and system integration 100% basis for BTP. Graph illustrates midpoint, $255 million, of projected capital spend. $- $50 $100 $150 $200 $250 $300 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 |

|

|

© Copyright 2014 Buckeye Partners, L.P. 11 KEY EXPORT FACILITY The integrated system of assets is a world-class multi-product export facility with built-in flexibility and optionality Condensate, Crude and LPG Exports Five vessel berths including three deep-water docks enable large volumes to be exported on the water Over 5 MMbbls of tankage exist between Texas Hub and Texas Processing to aggregate from the Eagle Ford and pipelines connected to refineries and fractionation plants Sites have bulk condensate, crude and LPG storage for aggregation, along with splitter product tankage for export Ability to further expand dock capabilities Splitter Product Exports Anticipated completion date makes the splitter at Texas Processing one of the first to market, and the first in Corpus, enabling the asset to lock up key long-term take-or-pay commercial agreements Tolling agreement with Trafigura provides optimal utilization as Trafigura trades in markets around the world, providing them visibility to capture higher value chain netbacks from splitter-produced products Local price-advantaged natural gas and limited amount of un-contracted splitting capacity in Asian markets creates supply/demand fundamentals that favor long-term economics of splitting condensate in the Gulf Coast Ability to meet local demand for atmospheric tower bottoms (ATBs) also drives economics to split locally before exporting Texas Hub – Corpus Christi, Texas |

|

|

POTENTIAL FUTURE GROWTH PROJECTS © Copyright 2014 Buckeye Partners, L.P. 12 Current identified potential growth opportunities in excess of $500 million Unit Train Transloading Unit train loading and off-loading capability via the development of a loop track at nearby site owned by BTP Opportunity to rail heavy Canadian crude to the Gulf Coast and send naphtha as diluent on Canada backhaul Dock Opportunities Texas Hub – ability to construct new deep-water dock on existing waterfront Port of Corpus Christi – opportunity to build pipeline connections to a public dock owned by the Port of Corpus Christi Pipeline Connections Construct additional gathering lines into BFS locations Establish new pipeline connections between Texas Hub/Processing and other third-party assets Additional Splitting Capacity Ability to add a third 25 Mbpd train to the splitter at Texas Processing Option to develop an additional 2 x 25 Mbpd splitter on vacant property currently owned by BTP Growth projects are all incremental to the forecast and provide a path to additional growth and accretion Proposed fleeting area docks capital project Proposed unit train transloading capital project |

|

|

SUMMARY OF ACQUISITION BENEFITS Fee-based take-or-pay cash flows that are 100% contracted with 7 to 10 year terms Attractive acquisition adjusted EBITDA investment multiple of ~8.5x (1) Highly accretive to distributable cash flow per unit; forecast to be approximately 8% in 2016 (1) Positions Buckeye for acceleration of distribution growth Establishes a new growth platform for Buckeye in a key North American basin, the Eagle Ford Shale Provides product diversification into crude oil, LPG and refined products markets in the Gulf Coast Vertically integrated system of midstream assets links Eagle Ford field production to marine terminal infrastructure in a key hub location Attractive growth opportunities with Trafigura to further utilize and expand our integrated network of marine terminals © Copyright 2014 Buckeye Partners, L.P. 13 After including estimated capex to complete project; See non-GAAP disclosure on slide 15. |

|

|

NON-GAAP FINANCIAL MEASURES Adjusted EBITDA and distributable cash flow are measures not defined by GAAP. Adjusted EBITDA is the primary measure used by our senior management, including our Chief Executive Officer, to (i) evaluate our consolidated operating performance and the operating performance of our business segments, (ii) allocate resources and capital to business segments, (iii) evaluate the viability of proposed projects, and (iv) determine overall rates of return on alternative investment opportunities. Distributable cash flow is another measure used by our senior management to provide a clearer picture of Buckeye’s cash available for distribution to its unitholders. Adjusted EBITDA and distributable cash flow eliminate (i) non-cash expenses, including, but not limited to, depreciation and amortization expense resulting from the significant capital investments we make in our businesses and from intangible assets recognized in business combinations, (ii) charges for obligations expected to be settled with the issuance of equity instruments, and (iii) items that are not indicative of our core operating performance results and business outlook. Buckeye believes that investors benefit from having access to the same financial measures used by senior management and that these measures are useful to investors because they aid in comparing Buckeye’s operating performance with that of other companies with similar operations. Adjusted EBITDA and distributable cash flow data presented by Buckeye may not be comparable to similarly titled measures at other companies because these items may be defined differently by other companies. This presentation references forward-looking estimates of Adjusted EBITDA investment multiples projected, as well as the accretion to distributable cash flow per unit, to be generated by the investment in Buckeye Texas Partners. A reconciliation of estimated Adjusted EBITDA or distributable cash flow to GAAP net income is not provided because GAAP net income generated by the investment for the applicable periods is not accessible. Buckeye has not yet completed the necessary valuation of the various assets to be acquired, a determination of the useful lives of these assets for accounting purposes, or an allocation of the purchase price among the various types of assets. In addition, interest and debt expense is a corporate-level expense that is not allocated among Buckeye’s segments and could not be allocated to the operations of the partnership with Trafigura without unreasonable effort. Accordingly, the amount of depreciation and amortization and interest and debt expense that will be included in the additional net income generated as a result of the acquisition of the 80 percent interest in the partnership with Trafigura is not accessible or estimable at this time. The amount of such additional resulting depreciation and amortization and applicable interest and debt expense could be significant, such that the amount of additional net income would vary substantially from the amount of projected Adjusted EBITDA and distributable cash flow. © Copyright 2014 Buckeye Partners, L.P. 14 |