Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE, DATED AUGUST 28, 2014 (FURNISHED PURSUANT TO ITEM 2.02) - PALL CORP | exhibit991_q4fy14.htm |

| 8-K - CURRENT REPORT - PALL CORP | pallcorp_8kxq4fy2014.htm |

Better Lives. Better Planet.SM © 2014 Pall Corporation Q4 and Full Year FY 2014 Financial Results August 28, 2014 Exhibit 99.2

2 The matters discussed in this presentation contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Results for the fourth quarter of fiscal year 2014 are preliminary until our Form 10-K is filed with the Securities and Exchange Commission on or before September 29, 2014. Forward-looking statements are those that address activities, events or developments that the Company or management intends, expects, projects, believes or anticipates will or may occur in the future. All statements regarding future performance, earnings projections, earnings guidance, management’s expectations about its future cash needs, dilution from the disposition or future allocation of capital and effective tax rate, and other future events or developments are forward- looking statements. Forward-looking statements are those that use terms such as “may,” “will,” “expect,” “believe,” “intend,” “should,” “could,” “anticipate,” “estimate,” “forecast,” “project,” “plan,” “predict,” “potential,” and similar expressions. Forward-looking statements contained in this and other written and oral reports are based on management’s assumptions and assessments in light of past experience and trends, current conditions, expected future developments and other relevant factors. The Company’s forward-looking statements are subject to risks and uncertainties and are not guarantees of future performance, and actual results, developments and business decisions may differ materially from those envisaged by the Company’s forward-looking statements. Such risks and uncertainties include, but are not limited to, those discussed in Part I, Item 1A, “Risk Factors” in the 2013 Form 10-K, and other reports the Company files with the Securities and Exchange Commission, including: the impact of disruptions in the supply of raw materials and key components from suppliers, including limited or single source suppliers; the impact of terrorist acts, conflicts and wars or natural disasters; the extent to which special U.S. and foreign government laws and regulations may expose the Company to liability or impair its ability to compete in international markets; the impact of economic, political, social and regulatory instability in emerging markets, and other risks characteristic of doing business in emerging markets; fluctuations in foreign currency exchange rates and interest rates; the impact of a significant disruption in, or breach in security of, the Company’s information technology systems, or the failure to implement, manage or integrate new systems, software or technologies successfully; the Company’s ability to successfully complete or integrate acquisitions; the Company’s ability to develop innovative and competitive new products; the impact of global and regional economic conditions and legislative, regulatory and political developments; the Company’s ability to comply with a broad array of regulatory requirements; the loss of one or more members of the Company’s senior management team and its ability to recruit and retain qualified management personnel; changes in the demand for the Company’s products and the maintenance of business relationships with key customers; changes in product mix and product pricing, particularly with respect to systems products and associated hardware and devices for the Company’s consumable filtration products; product defects and unanticipated use or inadequate disclosure with respect to the Company’s products; the Company’s ability to deliver its backlog on time; increases in manufacturing and operating costs and/or the Company’s ability to achieve the savings anticipated from its structural cost improvement initiatives; the impact of environmental, health and safety laws and regulations and violations; the Company’s ability to enforce patents or protect proprietary products and manufacturing techniques; costs and outcomes of pending or future litigation and the availability of insurance or indemnification rights; changes in the Company’s effective tax rate; the Company’s ability to compete effectively in domestic and global markets; and the effect of the restrictive covenants in the Company’s debt facilities. Factors or events that could cause the Company’s actual results to differ may emerge from time to time, and it is not possible for the Company to predict all of them. The Company makes these statements as of the date of this disclosure and undertakes no obligation to update them, whether as a result of new information, future developments or otherwise. Management uses certain non-GAAP measurements to assess the Company’s current and future financial performance. The non-GAAP measurements do not replace the presentation of the Company’s GAAP financial results. These measurements provide supplemental information to assist management in analyzing the Company’s financial position and results of operations. The Company has chosen to provide this information to facilitate meaningful comparisons of past, present and future operating results and as a means to emphasize the results of ongoing operations. Reconciliations of the non-GAAP financial measures used throughout this presentation to the most directly comparable GAAP measures appear at the end of this presentation in the Appendix and are also available on Pall’s website at www.pall.com/investor Forward-Looking Statements

3 Conference Call Information Dial-In Toll-Free: 855.356.7268 International: 706.634.1981 Replay Toll-Free: 855.859.2056 International: 404.537.3406 Conference ID: 84648660 Internet: www.pall.com/investor

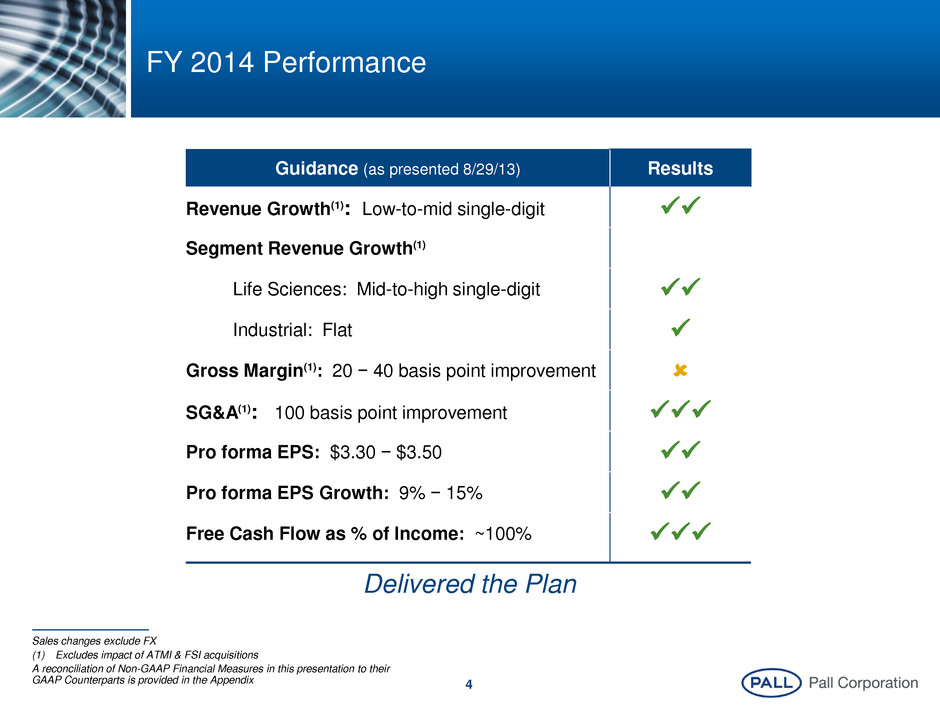

4 FY 2014 Performance Guidance (as presented 8/29/13) Results Revenue Growth(1): Low-to-mid single-digit Segment Revenue Growth(1) Life Sciences: Mid-to-high single-digit Industrial: Flat Gross Margin(1): 20 − 40 basis point improvement SG&A(1): 100 basis point improvement Pro forma EPS: $3.30 − $3.50 Pro forma EPS Growth: 9% − 15% Free Cash Flow as % of Income: ~100% Sales changes exclude FX (1) Excludes impact of ATMI & FSI acquisitions A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Delivered the Plan

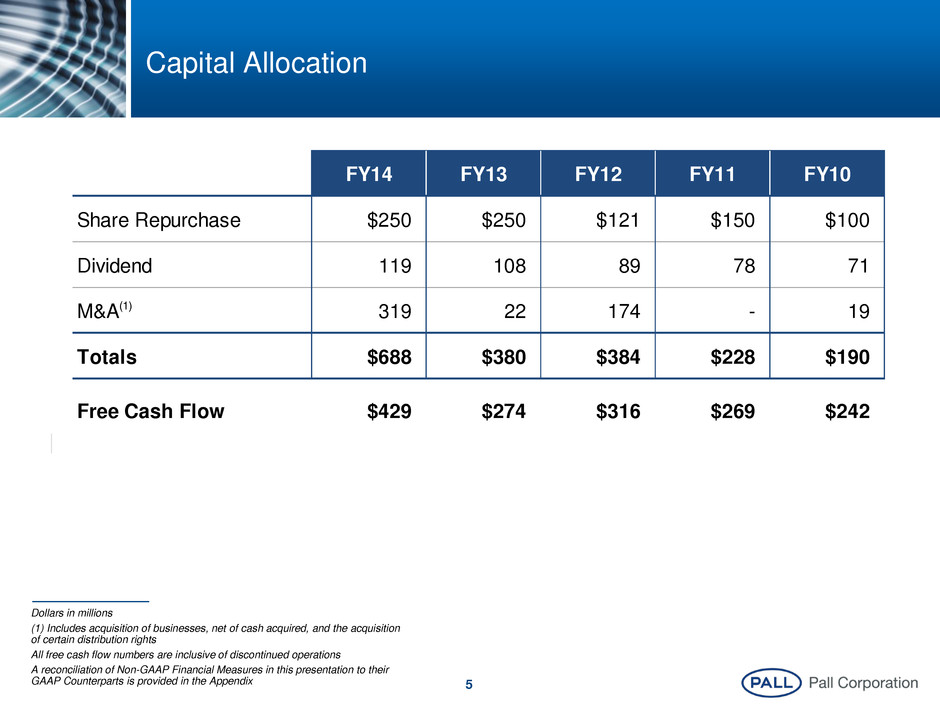

5 FY14 FY13 FY12 FY11 FY10 Share Repurchase $250 $250 $121 $150 $100 Dividend 119 108 89 78 71 M&A(1) 319 22 174 - 19 Totals $688 $380 $384 $228 $190 Free Cash Flow $429 $274 $316 $269 $242 Capital Allocation Dollars in millions (1) Includes acquisition of businesses, net of cash acquired, and the acquisition of certain distribution rights All free cash flow numbers are inclusive of discontinued operations A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix

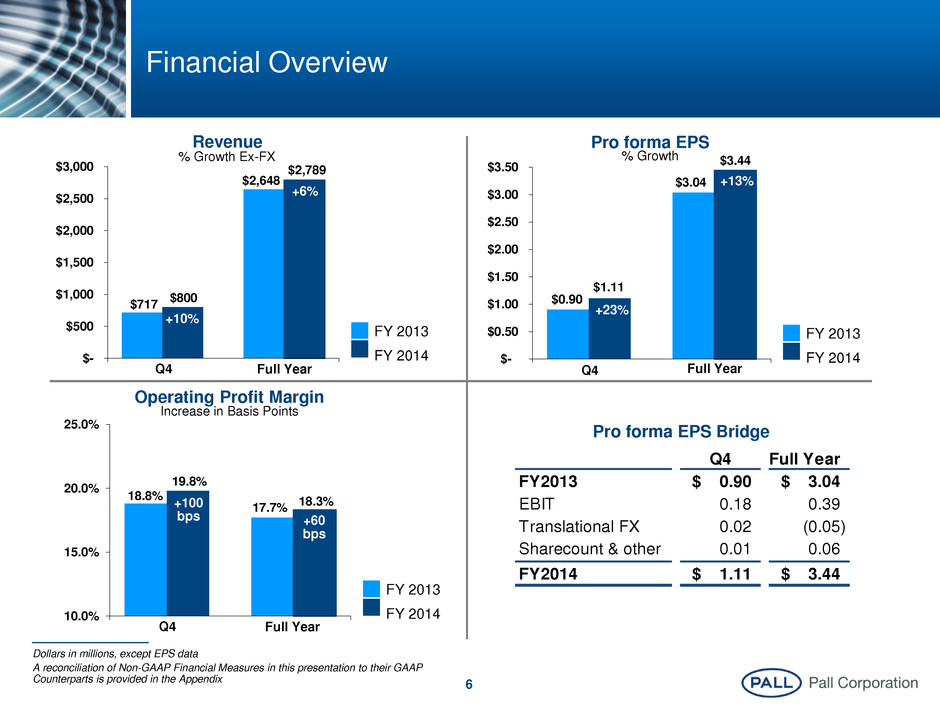

6 18.8% 19.8% 17.7% 18.3% 10.0% 15.0% 20.0% 25.0% Q4 Full Year +100 bps +60 bps FY 2013 FY 2014 $717 $800 $2,648 $2,789 $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 Q4 Full Year +6% +10% FY 2013 FY 2014 Revenue % Growth Ex-FX Financial Overview Dollars in millions, except EPS data A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Pro forma EPS % Growth Operating Profit Margin Increase in Basis Points Q4 Full Year FY2013 0.90$ 3.04$ EBIT 0.18 0.39 Translational FX 0.02 (0.05) Sharecount & other 0.01 0.06 FY2014 1.11$ 3.44$ Pro forma EPS Bridge $0.90 $1.11 $3.04 $3.44 $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 Q4 Full Year +13% +23% FY 2013 FY 2014

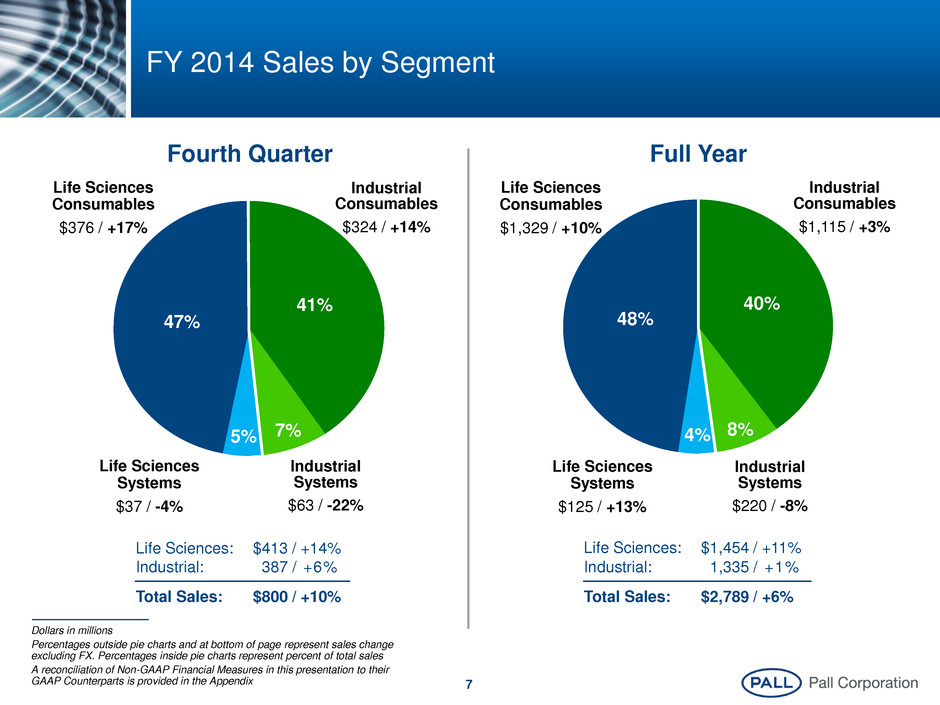

7 Fourth Quarter FY 2014 Sales by Segment Full Year Life Sciences Consumables $376 / +17% Industrial Consumables $324 / +14% Industrial Systems $63 / -22% Life Sciences Systems $37 / -4% 41% 47% 7% 5% Life Sciences Consumables $1,329 / +10% Industrial Consumables $1,115 / +3% Industrial Systems $220 / -8% Life Sciences Systems $125 / +13% 48% 40% 8% 4% Dollars in millions Percentages outside pie charts and at bottom of page represent sales change excluding FX. Percentages inside pie charts represent percent of total sales A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Life Sciences: $413 / +14% Industrial: 387 / +6% Total Sales: $800 / +10% Life Sciences: $1,454 / +11% Industrial: 1,335 / +1% Total Sales: $2,789 / +6%

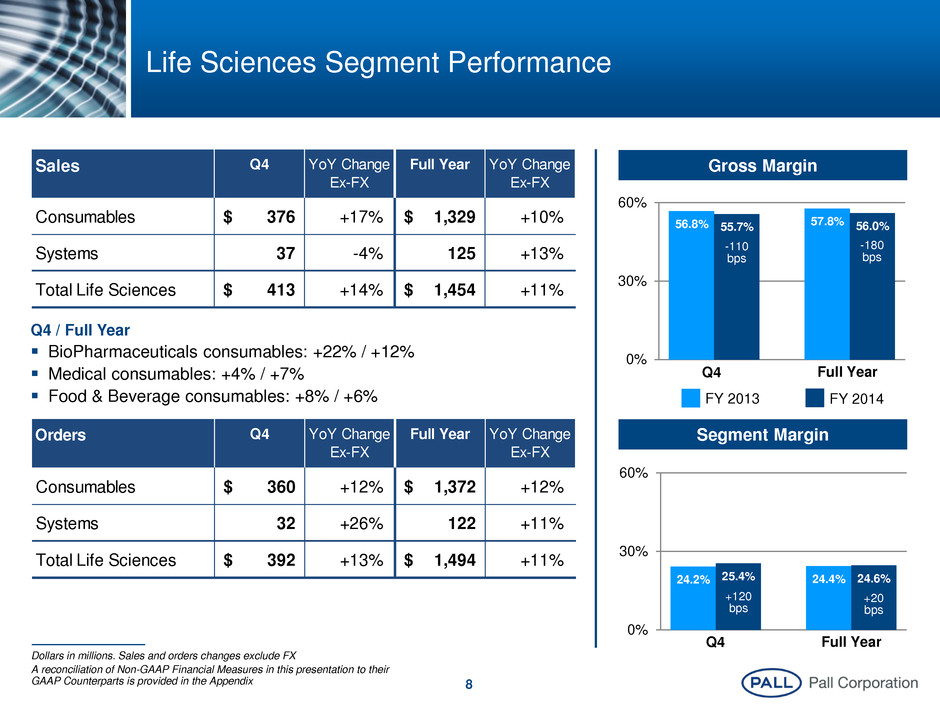

8 56.8% 55.7% 57.8% 56.0% 0% 30% 60% 24.2% 25.4% 24.4% 24.6% 0% 30% 60% Life Sciences Segment Performance Dollars in millions. Sales and orders changes exclude FX A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix -110 bps FY 2013 FY 2014 Gross Margin Segment Margin Q4 / Full Year BioPharmaceuticals consumables: +22% / +12% Medical consumables: +4% / +7% Food & Beverage consumables: +8% / +6% Sales Q4 YoY Change Ex-FX Full Year YoY Change Ex-FX Consumables 376$ +17% 1,329$ +10% Systems 37 -4% 125 +13% Total Life Sciences 413$ +14% 1,454$ +11%Orders Q4 YoY Change Ex-FX Full Year YoY Change Ex-FX Consumables 360$ +12% 1,372$ +12% Systems 32 +26% 122 +11% Total Life Sciences 392$ +13% 1,494$ +11% -180 bps +120 bps +20 bps Q4 Full Year Q4 Full Year

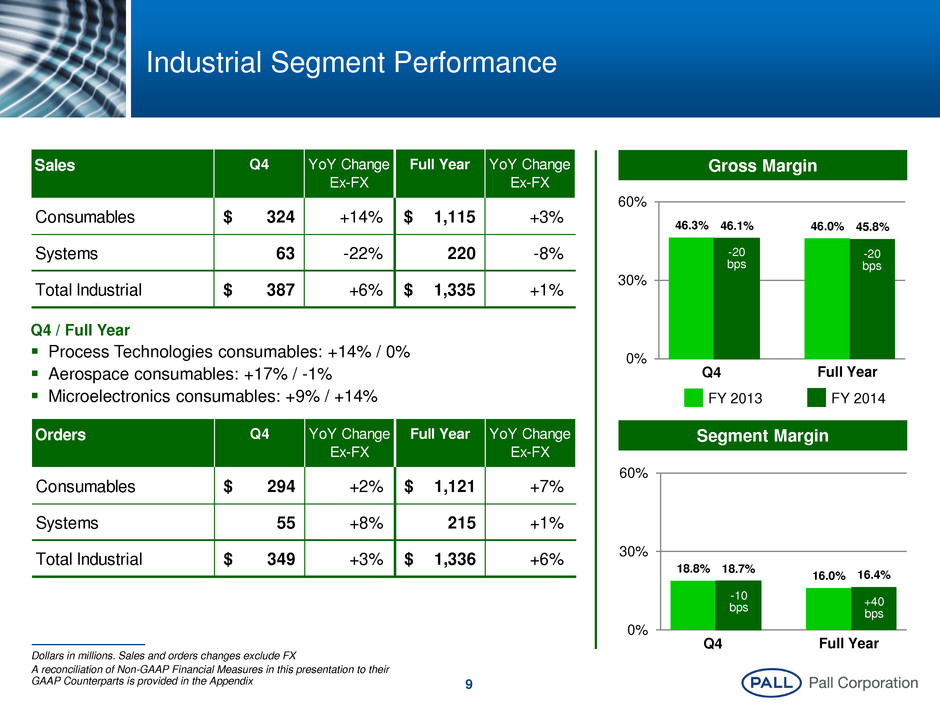

9 Industrial Segment Performance Gross Margin Segment Margin Q4 / Full Year Process Technologies consumables: +14% / 0% Aerospace consumables: +17% / -1% Microelectronics consumables: +9% / +14% 46.3% 46.1% 46.0% 45.8% 0% 30% 60% FY 2013 FY 2014 Sales Q4 YoY Change Ex-FX Full Year YoY Change Ex-FX Consumables 324$ +14% 1,115$ +3% Systems 63 -22% 220 -8% Total Industrial 387$ +6% 1,335$ +1% Orders Q4 YoY Change Ex-FX Full Year YoY Change Ex-FX Consumables 294$ +2% 1,121$ +7% Systems 55 +8% 215 +1% Total Industrial 349$ +3% 1,336$ +6% Dollars in millions. Sales and orders changes exclude FX A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Q4 Full Year 18.8% 18.7% 16.0% 16.4% 0% 30% 60% Q4 Full Year -20 bps -20 bps -10 bps +40 bps

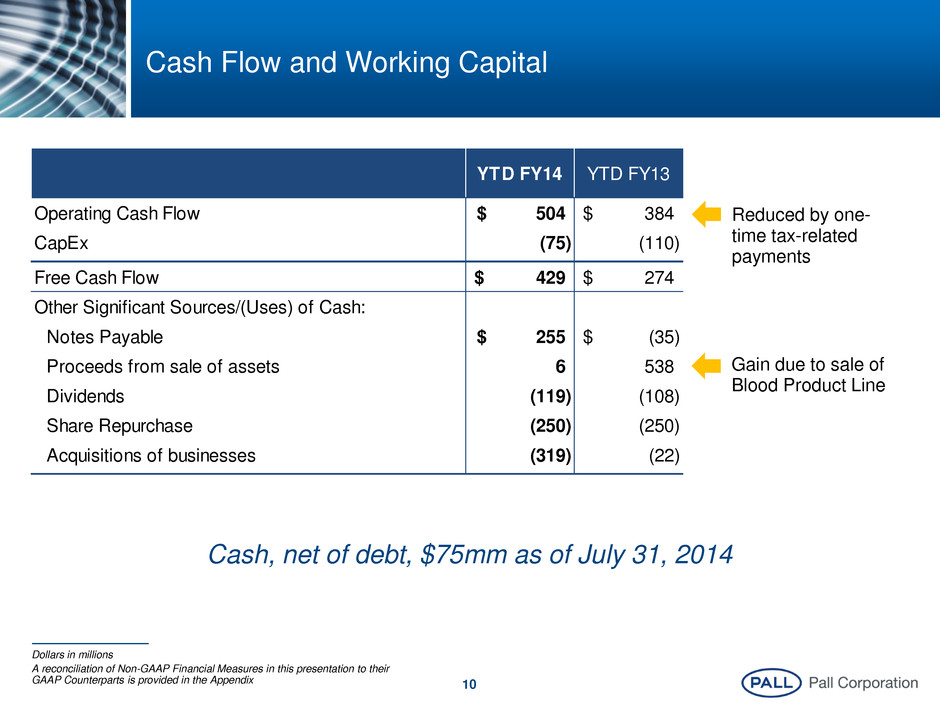

10 Cash Flow and Working Capital YTD FY14 YTD FY13 Operating Cash Flow 504$ 384$ CapEx (75) (110) Free Cash Flow 429$ 274$ Other Significant Sources/(Uses) of Cash: Notes Payable 255$ (35)$ Proceeds from sale of assets 6 538 Dividends (119) (108) Share Repurchase (250) (250) Acquisitions of businesses (319) (22) Dollars in millions A reconciliation of Non-GAAP Financial Measures in this presentation to their GAAP Counterparts is provided in the Appendix Cash, net of debt, $75mm as of July 31, 2014 Gain due to sale of Blood Product Line Reduced by one- time tax-related payments

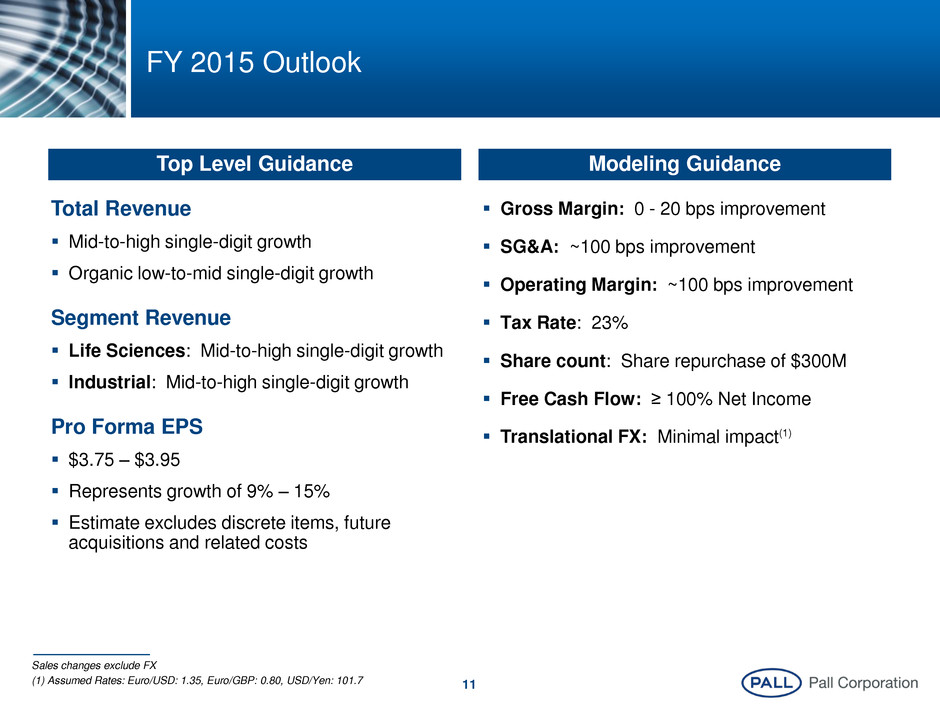

11 Total Revenue Mid-to-high single-digit growth Organic low-to-mid single-digit growth Segment Revenue Life Sciences: Mid-to-high single-digit growth Industrial: Mid-to-high single-digit growth Pro Forma EPS $3.75 – $3.95 Represents growth of 9% – 15% Estimate excludes discrete items, future acquisitions and related costs FY 2015 Outlook Gross Margin: 0 - 20 bps improvement SG&A: ~100 bps improvement Operating Margin: ~100 bps improvement Tax Rate: 23% Share count: Share repurchase of $300M Free Cash Flow: ≥ 100% Net Income Translational FX: Minimal impact(1) Sales changes exclude FX (1) Assumed Rates: Euro/USD: 1.35, Euro/GBP: 0.80, USD/Yen: 101.7 Top Level Guidance Modeling Guidance

Better Lives. Better Planet.SM © 2014 Pall Corporation Appendix

13 Appendix: Cash Flow Reconciliation of Non-GAAP Financial Measures Dollars in thousands Free Cash Flow FY2014 FY2013 FY2012 FY2011 FY2010 Operating cash flow $ 503,912 $ 384,459 $ 474,848 $ 429,987 $ 377,860 apital expenditures (74,737) (110,182) (158,909) (160,771) (136,313) Free cash flow 429,175$ 274,277$ 315,939$ 269,216$ 241,547$ Net income 363,956$ 574,935$ 319,309$ 315,496$ 241,248$ Free cash flow as a percent of net income 118% 48% 99% 85% 100%

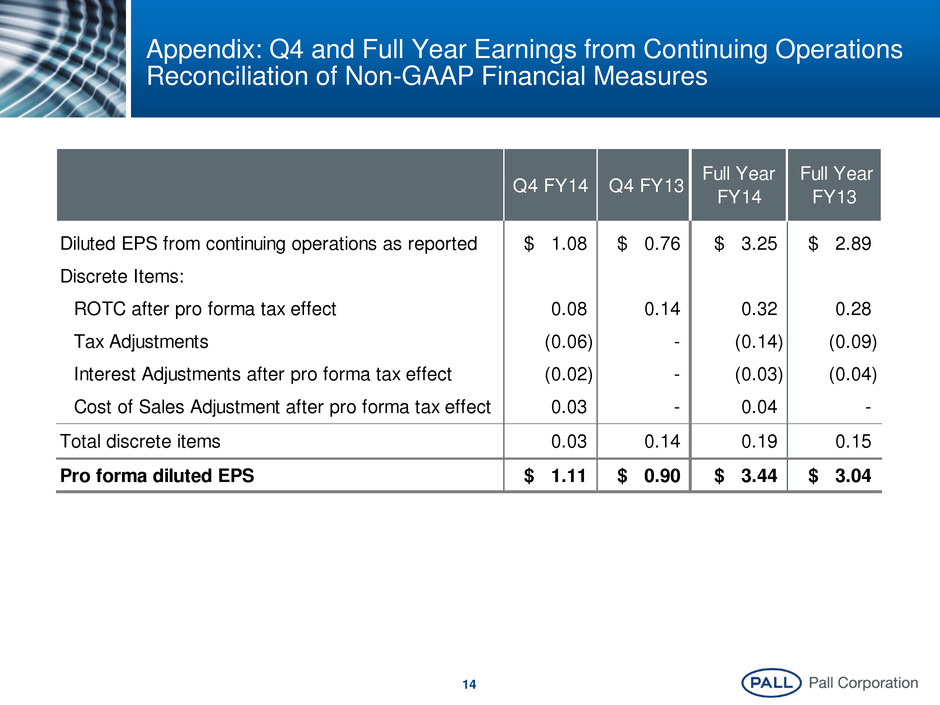

14 Appendix: Q4 and Full Year Earnings from Continuing Operations Reconciliation of Non-GAAP Financial Measures Diluted EPS from continuing operations as reported 1.08$ 0.76$ 3.25$ 2.89$ Discrete Items: ROTC after pro forma tax effect 0.08 0.14 0.32 0.28 Tax Adjustments (0.06) - (0.14) (0.09) I terest Adjustments after pro forma tax effect (0.02) - (0.03) (0.04) Cost of Sales Adjustment after pro forma tax effect 0.03 - 0.04 - Total discrete items 0.03 0.14 0.19 0.15 Pro forma diluted EPS 1.11$ 0.90$ 3.44$ 3.04$ Q4 FY14 Q4 FY13 Full Year FY13 Full Year FY14

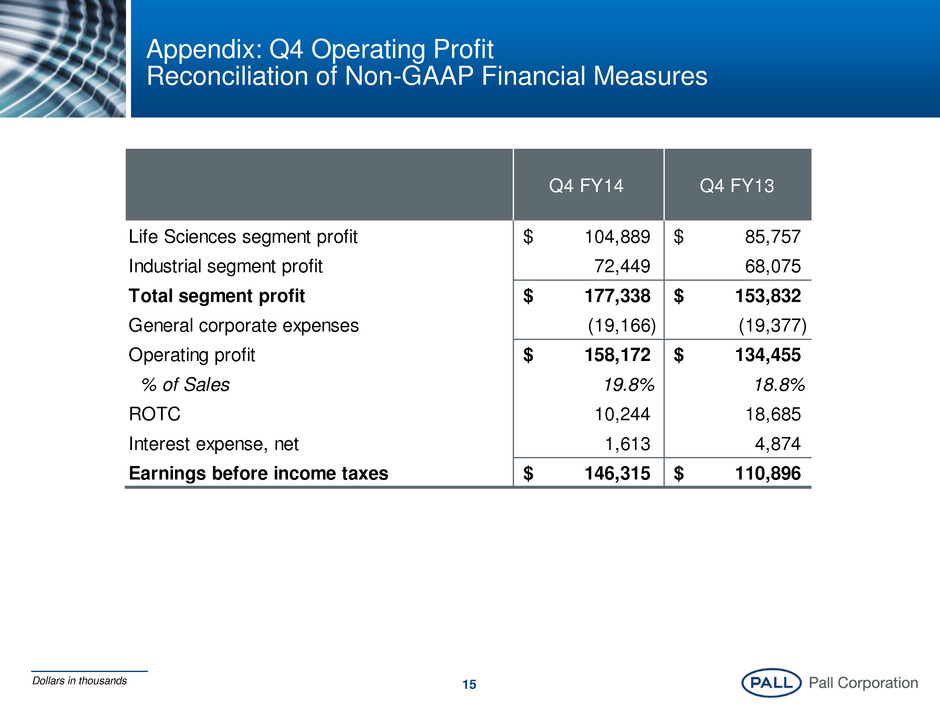

15 Appendix: Q4 Operating Profit Reconciliation of Non-GAAP Financial Measures Q4 FY14 Q4 FY13 Life Sciences segment profit 104,889$ 85,757$ Industrial segment profit 72,449 68,075 Total segment profit 177,338$ 153,832$ General corporate expenses (19,166) (19,377) Operating profit 158,172$ 134,455$ % of Sales 19.8% 18.8% ROTC 10,244 18,685 Interest expense, net 1,613 4,874 Earnings before income taxes 146,315$ 110,896$ Dollars in thousands

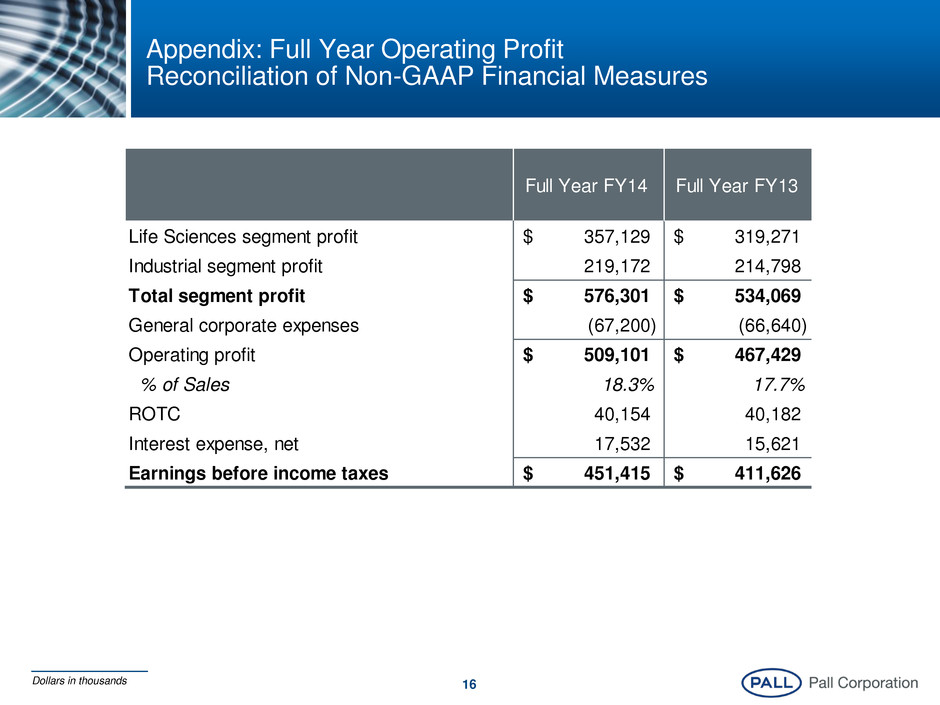

16 Appendix: Full Year Operating Profit Reconciliation of Non-GAAP Financial Measures Full Year FY14 Full Year FY13 Life Sciences segment profit 357,129$ 319,271$ Industrial segment profit 219,172 214,798 Total segment profit 576,301$ 534,069$ General corporate expenses (67,200) (66,640) Operating profit 509,101$ 467,429$ % of Sales 18.3% 17.7% ROTC 40,154 40,182 Interest expense, net 17,532 15,621 Earnings before income taxes 451,415$ 411,626$ Dollars in thousands

17 Appendix: Q4 Life Sciences Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Q4 FY14 Q4 FY14 Estimated Impact of FX Q4 FY14 Estimate Excluding FX Q4 FY13 % Change Excluding FX Consumables Sales: BioPharmaceuticals 267,075$ 5,442$ 261,633$ 215,211$ 21.6% Food & Beverage 51,503 275 51,228 47,364 8.2% Medical 57,450 1,303 56,147 53,965 4.0% Consumables Total 376,028$ 7,020$ 369,008$ 316,540$ 16.6% Systems Sales 36,630$ 399$ 36,231$ 37,605$ -3.7% Total Life Sciences 412,658$ 7,419$ 405,239$ 354,145$ 14.4% Dollars in thousands

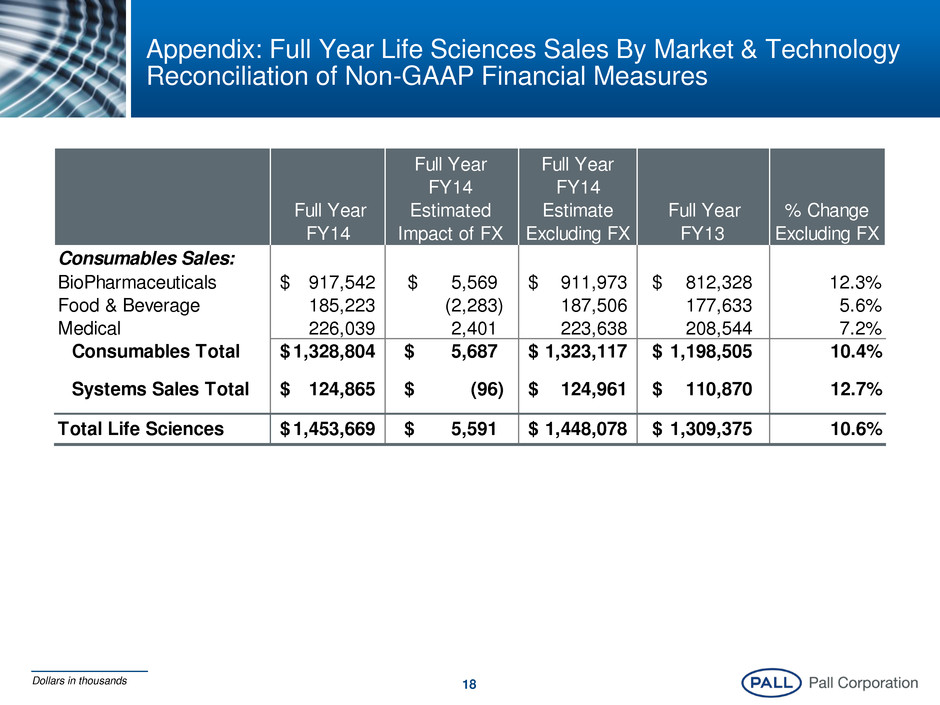

18 Appendix: Full Year Life Sciences Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Full Year FY14 Full Year FY14 Estimated Impact of FX Full Year FY14 Estimate Excluding FX Full Year FY13 % Change Excluding FX Consumables Sales: BioPharmaceuticals 917,542$ 5,569$ 911,973$ 812,328$ 12.3% Food & Beverage 185,223 (2,283) 187,506 177,633 5.6% Medical 226,039 2,401 223,638 208,544 7.2% Consumables Total 1,328,804$ 5,687$ 1,323,117$ 1,198,505$ 10.4% Systems Sales Total 124,865$ (96)$ 124,961$ 110,870$ 12.7% Total Life Sciences 1,453,669$ 5,591$ 1,448,078$ 1,309,375$ 10.6% Dollars in thousands

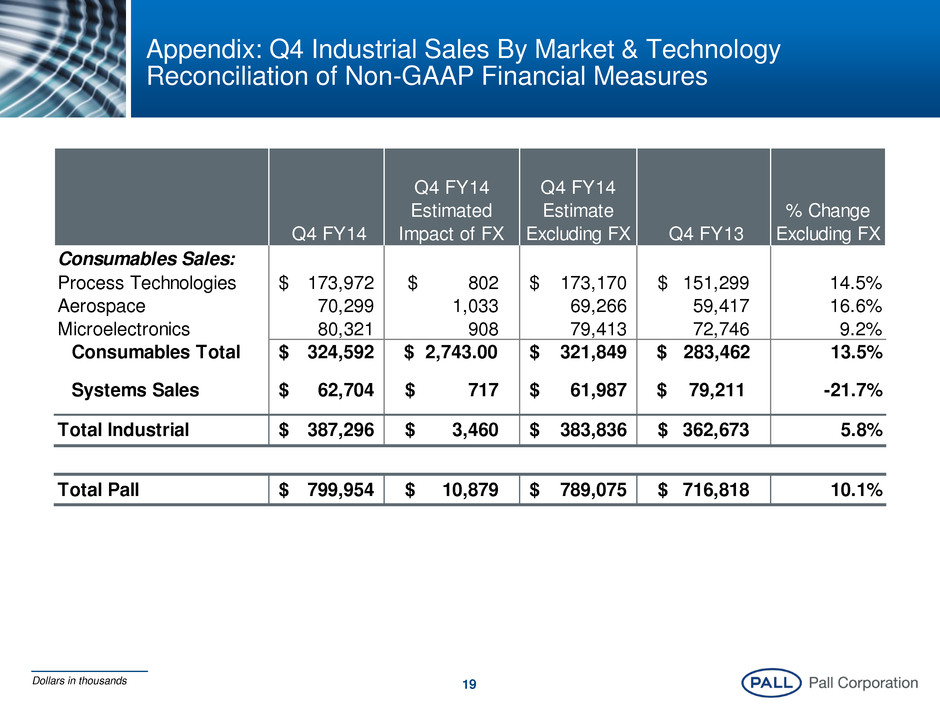

19 Appendix: Q4 Industrial Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Q4 FY14 Q4 FY14 Estimated Impact of FX Q4 FY14 Estimate Excluding FX Q4 FY13 % Change Excluding FX Consumables Sales: Process Technologies 173,972$ 802$ 173,170$ 151,299$ 14.5% Aerospace 70,299 1,033 69,266 59,417 16.6% Microelectronics 80,321 908 79,413 72,746 9.2% Consumables Total 324,592$ $ 2,743.00 321,849$ $ 283,462 13.5% Systems Sales 62,704$ 717$ 61,987$ $ 79,211 -21.7% Total Industrial 387,296$ 3,460$ 383,836$ 362,673$ 5.8%-3 5 Total Pall 799,954$ 10,879$ 789,075$ 716,818$ 10.1% Dollars in thousands

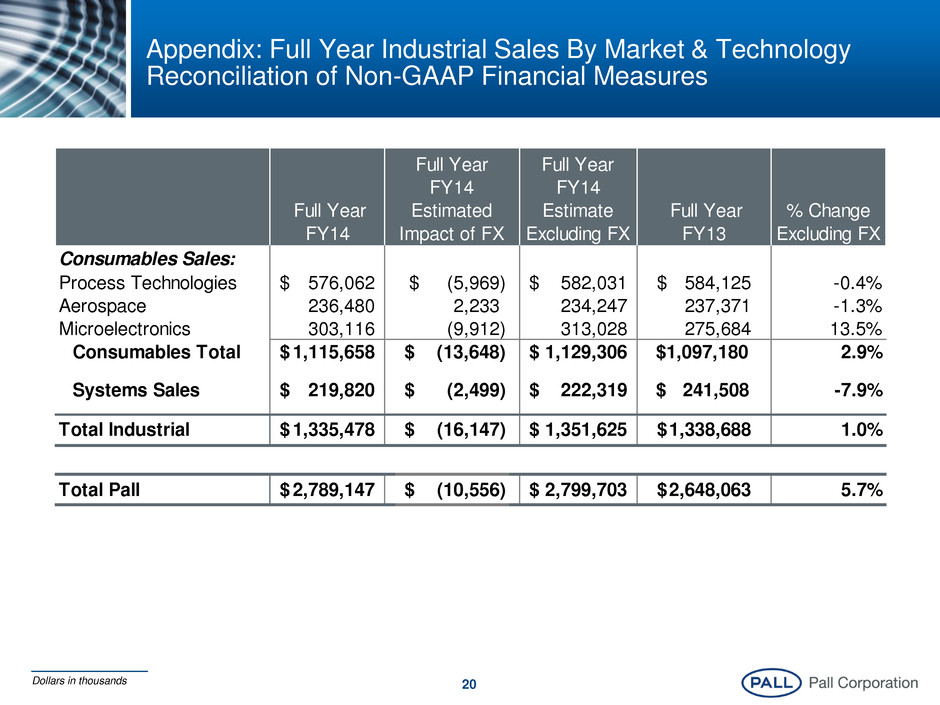

20 Appendix: Full Year Industrial Sales By Market & Technology Reconciliation of Non-GAAP Financial Measures Full Year FY14 Full Year FY14 Estimated Impact of FX Full Year FY14 Estimate Excluding FX Full Year FY13 % Change Excluding FX Consumables Sales: Process Technologies 576,062$ (5,969)$ 582,031$ 584,125$ -0.4% Aerospace 236,480 2,233 234,247 237,371 -1.3% Microelectronics 303,116 (9,912) 313,028 275,684 13.5% Consumables Total 1,115,658$ $ (13,648) 1,129,306$ $1,097,180 2.9% Systems Sales 219,820$ (2,499)$ 222,319$ $ 241,508 -7.9% Total Industrial 1,335,478$ (16,147)$ 1,351,625$ 1,338,688$ 1.0%-3 5 Total Pall 2,789,147$ (10,556)$ 2,799,703$ 2,648,063$ 5.7% Dollars in thousands

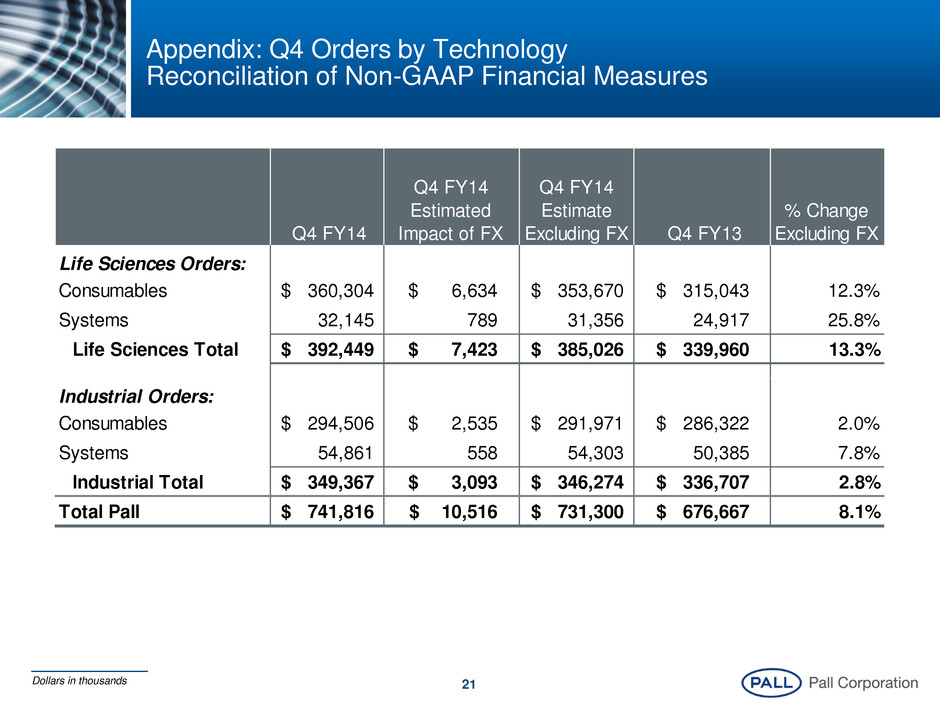

21 Appendix: Q4 Orders by Technology Reconciliation of Non-GAAP Financial Measures Q4 FY14 Q4 FY14 Estimated Impact of FX Q4 FY14 Estimate Excluding FX Q4 FY13 % Change Excluding FX Life Sciences Orders: Consumables 360,304$ 6,634$ 353,670$ 315,043$ 12.3% Systems 32,145 789 31,356 24,917 25.8% Life Sciences Total 392,449$ 7,423$ 385,026$ 339,960$ 13.3% Industrial Orders: C nsumables 294,506$ 2,535$ 291,971$ 286,322$ 2.0% Systems 54,861 558 54,303 50,385 7.8% Industrial Total 349,367$ 3,093$ 346,274$ 336,707$ 2.8% Total Pall 741,816$ 10,516$ 731,300$ 676,667$ 8.1% Dollars in thousands

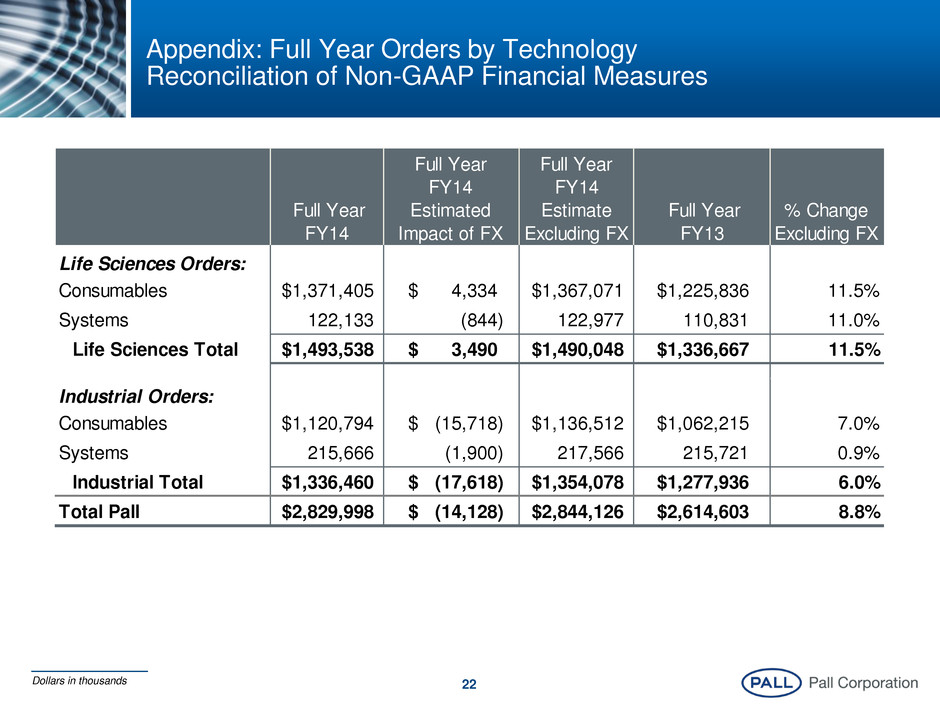

22 Appendix: Full Year Orders by Technology Reconciliation of Non-GAAP Financial Measures Full Year FY14 Full Year FY14 Estimated Impact of FX Full Year FY14 Estimate Excluding FX Full Year FY13 % Change Excluding FX Life Sciences Orders: Consumables 1,371,405$ 4,334$ 1,367,071$ 1,225,836$ 11.5% Systems 122,133 (844) 122,977 110,831 11.0% Life Sciences Total 1,493,538$ 3,490$ 1,490,048$ 1,336,667$ 11.5% Industrial Orders: C nsumables 1,120,794$ (15,718)$ 1,136,512$ 1,062,215$ 7.0% Systems 215,666 (1,900) 217,566 215,721 0.9% Industrial Total 1,336,460$ (17,618)$ 1,354,078$ 1,277,936$ 6.0% Total Pall 2,829,998$ (14,128)$ 2,844,126$ 2,614,603$ 8.8% Dollars in thousands

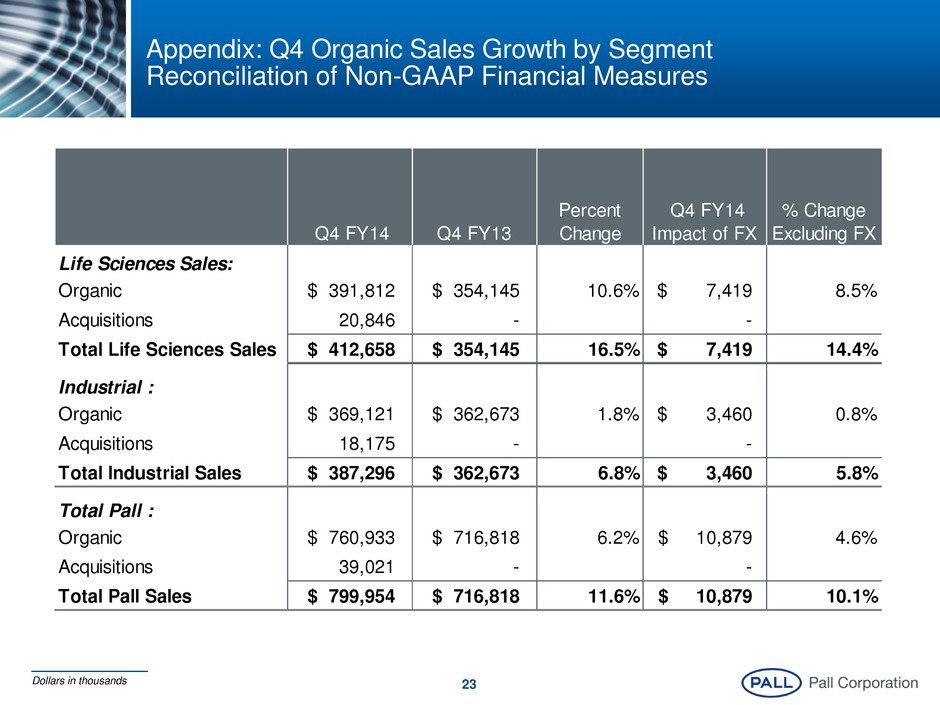

23 Appendix: Q4 Organic Sales Growth by Segment Reconciliation of Non-GAAP Financial Measures Q4 FY14 Q4 FY13 Percent Change Q4 FY14 Impact of FX % Change Excluding FX Life Sciences Sales: Organic 391,812$ 354,145$ 10.6% 7,419$ 8.5% Acquisitions 20,846 - - Total Life Sciences Sales 412,658$ 354,145$ 16.5% 7,419$ 14.4% Industrial : Organic 369,121$ 362,673$ 1.8% 3,460$ 0.8% Acquisitions 18,175 - - Total Industrial Sales 387,296$ 362,673$ 6.8% 3,460$ 5.8% Total Pall : Organic 760,933$ 716,818$ 6.2% 10,879$ 4.6% Acquisitions 39,021 - - Total Pall Sales 799,954$ 716,818$ 11.6% 10,879$ 10.1% Dollars in thousands

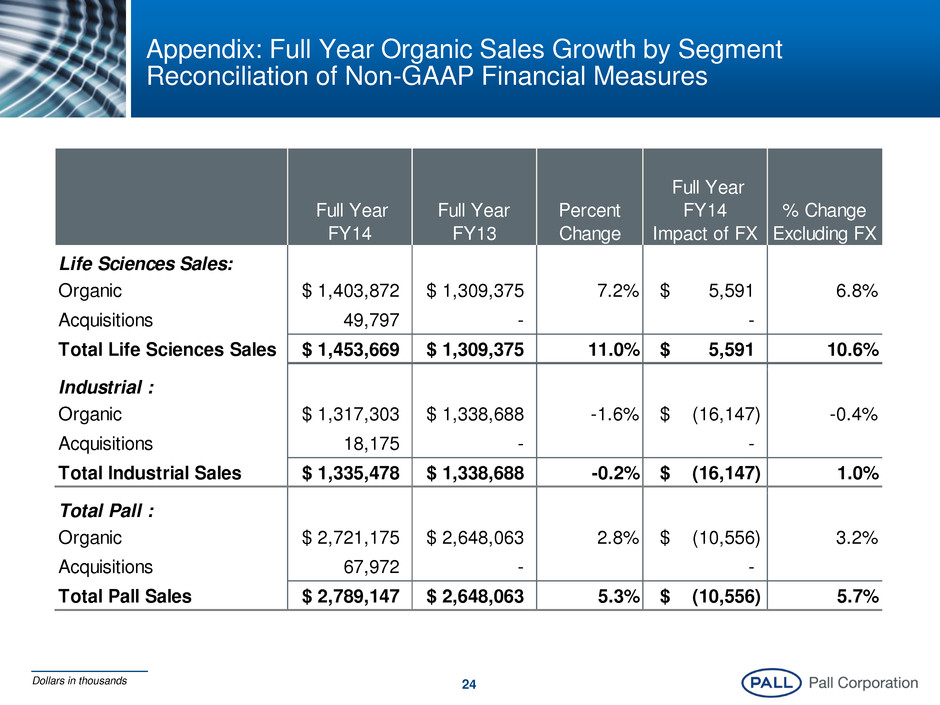

24 Appendix: Full Year Organic Sales Growth by Segment Reconciliation of Non-GAAP Financial Measures Full Year FY14 Full Year FY13 Percent Change Full Year FY14 Impact of FX % Change Excluding FX Life Sciences Sales: Organic 1,403,872$ 1,309,375$ 7.2% 5,591$ 6.8% Acquisitions 49,797 - - Total Life Sciences Sales 1,453,669$ 1,309,375$ 11.0% 5,591$ 10.6% Industrial : Organic 1,317,303$ 1,338,688$ -1.6% (16,147)$ -0.4% Acquisitions 18,175 - - Total Industrial Sales 1,335,478$ 1,338,688$ -0.2% (16,147)$ 1.0% Total Pall : Organic 2,721,175$ 2,648,063$ 2.8% (10,556)$ 3.2% Acquisitions 67,972 - - Total Pall Sales 2,789,147$ 2,648,063$ 5.3% (10,556)$ 5.7% Dollars in thousands