Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MID AMERICA APARTMENT COMMUNITIES INC. | v387538_8k.htm |

Exhibit 99.1

CAPITAL MARKETS UPDATE AUGUST 2014 6584 POPLAR AVENUE MEMPHIS, TN 38138 / WWW.MAAC.COM

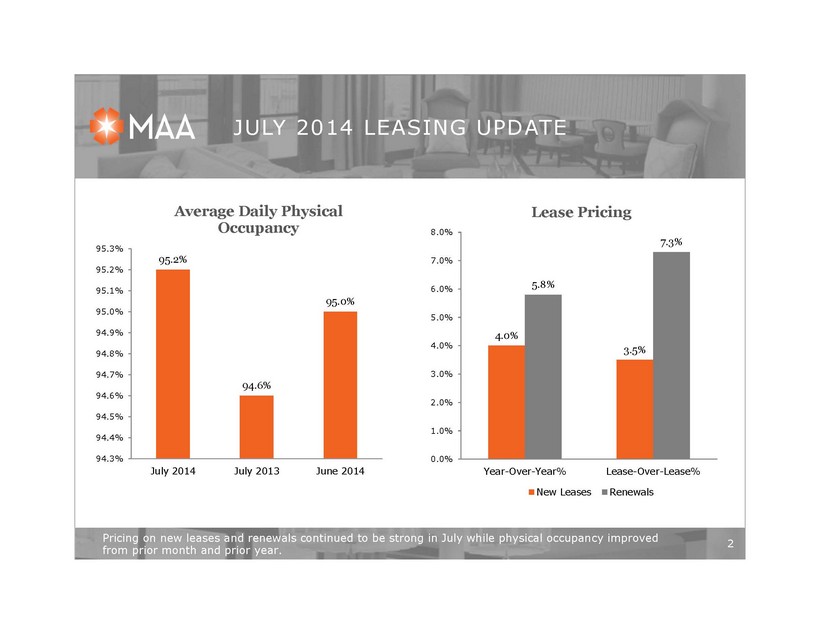

Pricing on new leases and renewals continued to be strong in J uly while physical occupancy improved from prior month and prior year. JULY 2014 LEASING UPDATE 2 95.2% 94.6% 95.0% 94.3% 94.4% 94.5% 94.6% 94.7% 94.8% 94.9% 95.0% 95.1% 95.2% 95.3% July 2014 July 2013 June 2014 Average Daily Physical Occupancy 4.0% 3.5% 5.8% 7.3% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Year-Over-Year% Lease-Over-Lease% Lease Pricing New Leases Renewals

Source: U.S. Census Bureau; Moody’s Economy.com CONTINUED SOLID LEASING ENVIRONMENT 3 • Over the last up cycle (2004 - 2007), the ratio of new jobs to multifamily completions in our markets averaged 7 to 1; 2014 - 15 projections average over 8 to 1 in our large markets and over 10 to 1 in our secondary markets. • The projected ratio for large and secondary markets should support steady rent growth. • MAA’s large markets expected to significantly exceed the national average in job growth while secondary markets are in line with average • This job growth should enable positive absorption of forecasted new supply and support continued above long - term average rent growth 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 2014 2015 2016 Projected Job Growth National MSA Average Large MAA Markets Secondary MAA Markets - 2.0 4.0 6.0 8.0 10.0 12.0 14.0 2014F 2015F New Jobs Per Multifamily Completion Large Secondary

Original expectations for overhead ($25 million), NOI operating synergies, and redevelopment opportunities remain intact. MERGER INTEGRATION UPDATE 4 Remainder of 2014 Realize 100% of stated overhead synergy opportunity on a run rate basis Complete remaining portion of $250M - $350M planned commercial and multifamily dispositions Complete all remaining merger and integration activities (final systems customizations and enhanced reporting) Majority of lease up communities stabilized Completed to Date Completed migration to one property management system Captured majority of overhead synergy opportunity on run rate basis Exited significant portion of operating commercial assets - $84M completed; $36M under contract Completed construction of majority of legacy CLP development pipeline Re development underway on legacy CLP portfolio 2015 and Beyond Begin to capture accretion from development pipeline and asset recycling Continue to capture NOI synergy benefits Increased r edevelopment of legacy CLP portfolio ongoing Exit significant portion of remaining non core assets Existing lease up and development pipeline fully stabilized by end of 2015 Final management structure in place – combining both legacy MAA and CLP personnel Completed consolidation of all payroll, HR, GL, and AP systems Formally launched new corporate identity Obtained $2.6 billion of lender consents to combine balance sheets Completed public bond offerings (inaugural, follow on, legacy CLP bond exchange) totaling $1 billion public bond float

*Expected stabilized NOI yield between 7% and 8% DEVELOPMENT AND LEASE - UP PIPELINE 5 Development and Lease - Up Pipeline ($mm, except per unit costs) at June 30, 2014 Total Expected MSA Units to Date to Complete Total Per Unit Stabilized Active Development *: CG at Bellevue Phase II Nashville 220 13.2$ 17.5$ 30.7$ 140$ 3Q15 220 Riverside Jacksonville 294 25.1$ 16.2$ 41.3$ 140$ 4Q15 Total Active Development 514 38.3$ 33.7$ 72.0$ 140$ Total Percent ConstructionExpected MSA Units Cost Occupied Finished Stabilized Lease Up Communities: Seasons at Celebrate Virginia II Fredericksburg 251 45.1$ 93% N/A 3Q14 CR at Frisco Bridges Dallas 252 36.5$ 96% 2Q13 3Q14 Stonefield Commons Charlottesville 251 47.7$ 89% N/A 4Q14 CG at Lake Mary III Orlando 132 16.2$ 52% 2Q14 4Q14 CR at South End Charlotte 353 57.1$ 84% 2Q14 4Q14 CG at Randal Lakes Orlando 462 52.5$ 63% 1Q14 1Q15 Total Lease Up Communities 1,701 255.1$ 80% Cost Expected Cost

2014 TRANSACTIONS UPDATE PROPERTY MARKET Grand Cypress* Houston, TX Venue at Stonebridge Ranch* Dallas, TX Stonefield Commons Charlottesville, VA Cityscape at Market Center Dallas, TX Verandas at Southwood * Tallahassee, FL *Purchase of partner’s interests in Fund II assets 6 Stonefield Commons, Charlottesville, VA Cityscape at Market Center, Dallas, TX Acquisitions to Date: Dispositions to Date: Total acquisitions of $178 million with an average age of 4 years and average cap rate of 5.8%. PROPERTY MARKET Willow Creek Columbus, GA CV at North Arlington Fort Worth, TX CV at Vista Ridge Fort Worth, TX Greenbrook Memphis, TN CV at Inverness Birmingham, AL CV at Charleston Place Charlotte, NC Ansley Village** Macon, GA **Sale of remaining Fund II asset Total dispositions of $138 million with an average age of 30 years and average cap rate of 6.9%.

FORWARD LOOKING STATEMENTS 7 Certain matters in this presentation may constitute forward - looking statements within the meaning of Section 27 - A of the Securities Act of 1933 and Section 21 E of the Securities and Exchange Act of 1934 . Such statements include, but are not limited to, statements made about anticipated economic and market conditions, expectations for future demographics , expectations for future performance and capture of synergies, and expectations for acquisition and disposition transaction activity . Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward - looking statements due to a number of factors, including a downturn in general economic conditions or the capital markets, competitive factors including overbuilding or other supply/demand imbalances in some or all of our markets, changes in interest rates and other items that are difficult to control such as the impact of legislation, as well as the other general risks inherent in the apartment and real estate businesses . Reference is hereby made to the filings of Mid - America Apartment Communities, Inc . , with the Securities and Exchange Commission, including quarterly reports on Form 10 - Q, reports on Form 8 - K, and its annual report on Form 10 - K, particularly including the risk factors contained in the latter filing . Eric Bolton Chairman and CEO 901 - 248 - 4127 eric.bolton@maac.com Al Campbell EVP, CFO 901 - 248 - 4169 al.campbell@maac.com Tim Argo SVP, Finance 901 - 248 - 4149 tim.argo@maac.com Jennifer Patrick Investor Relations 901 - 435 - 5371 jennifer.patrick@maac.com Rob DelPriore EVP, General Counsel 901 - 248 - 4150 robert.delpriore@maac.com Contact