Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Allied World Assurance Co Holdings, AG | d778510d8k.htm |

| EX-99.1 - PRESS RELEASE, DATED AUGUST 21, 2014. - Allied World Assurance Co Holdings, AG | d778510dex991.htm |

| Exhibit 99.2

|

Exhibit 99.2 Acquisition of RSA Singapore and Hong Kong August 21, 2014

|

|

Cautionary Note Regarding Forward-Looking Statements

This presentation contains forward-looking statements that involve a number of risks and uncertainties. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Any forward-looking statements made in this presentation reflect Allied World’s current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties, which may cause actual results to differ materially from those set forth in these statements. For example, these forward-looking statements could be affected by the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreements with Royal & Sun Alliance Insurance plc; the inability to receive the required regulatory approvals to complete the acquisitions; risks that the proposed acquisitions disrupt each company’s current plans and operations; the ability to retain key personnel; the ability to recognize the benefits of the acquisitions; the amount of costs, fees, expenses and charges related to the acquisitions; pricing and policy term trends; increased competition; the adequacy of our loss reserves; negative rating agency actions; greater frequency or severity of unpredictable catastrophic events; the impact of acts of terrorism and acts of war; the company or its subsidiaries becoming subject to significant income taxes in the United States or elsewhere; changes in regulations or tax laws; changes in the availability, cost or quality of reinsurance or retrocessional coverage; adverse general economic conditions; and judicial, legislative, political and other governmental developments, as well as management’s response to these factors, and other factors identified in our filings with the U.S. Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We are under no obligation (and expressly disclaims any such obligation) to update or revise any forward-looking statement that may be made from time to time, whether as a result of new information, future developments or otherwise.

2

|

|

Transaction Summary

Allied World has agreed to acquire the Singapore and Hong Kong operations of Royal & Sun Alliance Insurance plc (“RSA”)

Rare opportunity to acquire an established specialty property and casualty business in an attractive, high-growth market

‘Plug-and-Play’ with Allied World’s existing insurance operations in Singapore and Hong Kong

Purchase Price: approximately $215M in cash An additional $90M will likely be required to appropriately capitalize the business on an ongoing basis

Subject to a true up of the Net Asset Value at closing

No external financing; within Allied World’s excess capital position

Immediately accretive to earnings and ROE

Structure Transfer of the in-force insurance portfolio and related assets and liabilities into the existing Allied World Singapore and Hong Kong branches

Closing: During the first half of 2015 Subject to regulatory approval in Singapore and Hong Kong as well as court approval in Singapore

Based on exchange rate of USD 1 = GBP 0.60.

3

|

|

Compelling Strategic Rationale

Build scale in targeted key markets Rare opportunity to increase Allied World’s access to the rapidly-growing Asian specialty property casualty market

Unique fit with Allied World across geographies, risk profile and culture

Operation and infrastructure provide a core foundation to further future growth

Significantly diversifies product set High concentration of casualty products with attractive retail and property lines

Complementary to Allied World’s regional liability-centric products, resulting in a well-balanced portfolio

Enhances distribution capabilities and relationships Broad use of broker, agent and affinity channels

Strong relationships with which to export Allied World’s existing specialty products in the region

Attractive deployment of excess capital Immediate earnings and ROE accretive

Scale and opportunity in excess of what could be built organically

4

|

|

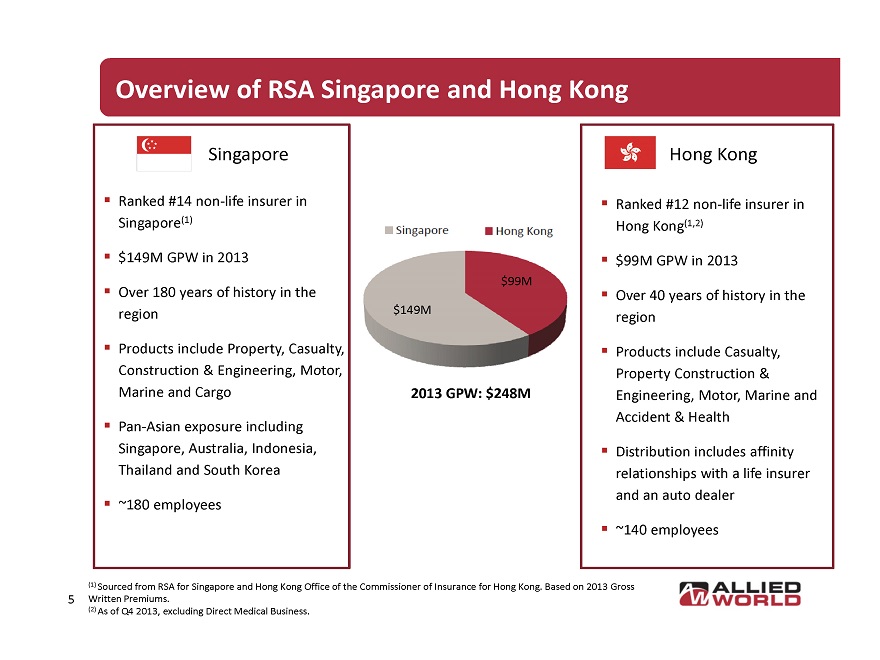

Overview of RSA Singapore and Hong Kong

Singapore

Ranked #14 non-life insurer in Singapore(1)

$149M GPW in 2013

Over 180 years of history in the region

Products include Property, Casualty, Construction & Engineering, Motor, Marine and Cargo

Pan-Asian exposure including Singapore, Australia, Indonesia, Thailand and South Korea

~180 employees

$149M

$99M

2013 GPW: $248M

Hong Kong

Singapore

Hong kong

Ranked #12 non-life insurer in Hong Kong(1,2)

$99M GPW in 2013

Over 40 years of history in the region

Products include Casualty, Property Construction & Engineering, Motor, Marine and Accident & Health

Distribution includes affinity relationships with a life insurer and an auto dealer

~140 employees

(1) Sourced from RSA for Singapore and Hong Kong Office of the Commissioner of Insurance for Hong Kong.

Based on 2013 Gross Written Premiums.

(2) As of Q4 2013, excluding Direct Medical Business.

5

|

|

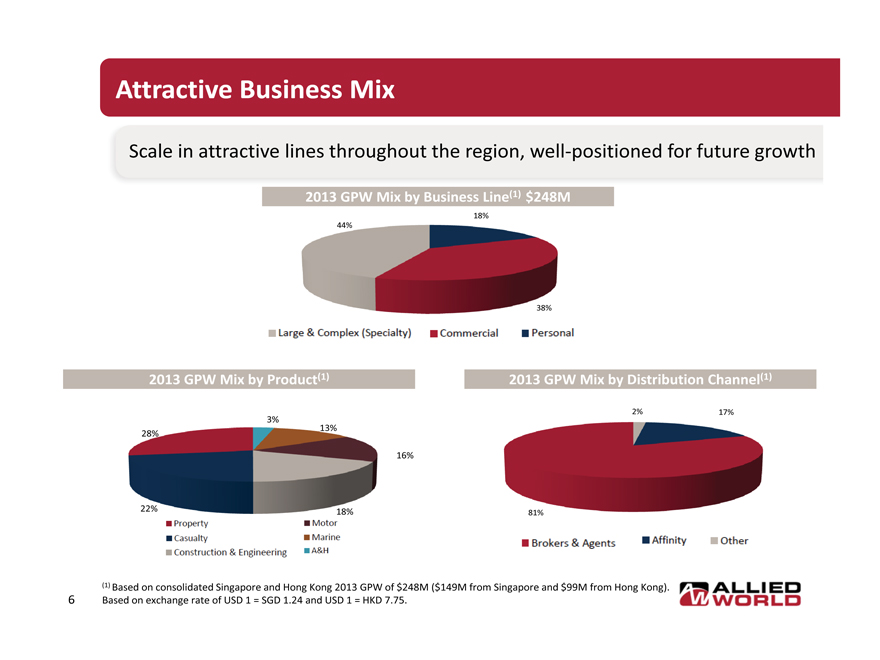

Attractive Business Mix

Scale in attractive lines throughout the region, well-positioned for future growth

2013 GPW Mix by Business Line(1) $248M

44%18%

38%

2013 GPW Mix by Product(1)

28%

3% 13%

16%

18%

22%

2013 GPW Mix by Distribution Channel(1)

2% 17%

81%

Property

Casualty

Construction & Engineering

Motor

Marine

A&H

Brokers & Agents

Affinity

Other

(1) Based on consolidated Singapore and Hong Kong 2013 GPW of $248M ($149M from Singapore and $99M from Hong Kong). Based on exchange rate of USD 1 = SGD 1.24 and USD 1 = HKD 7.75.

6

|

|

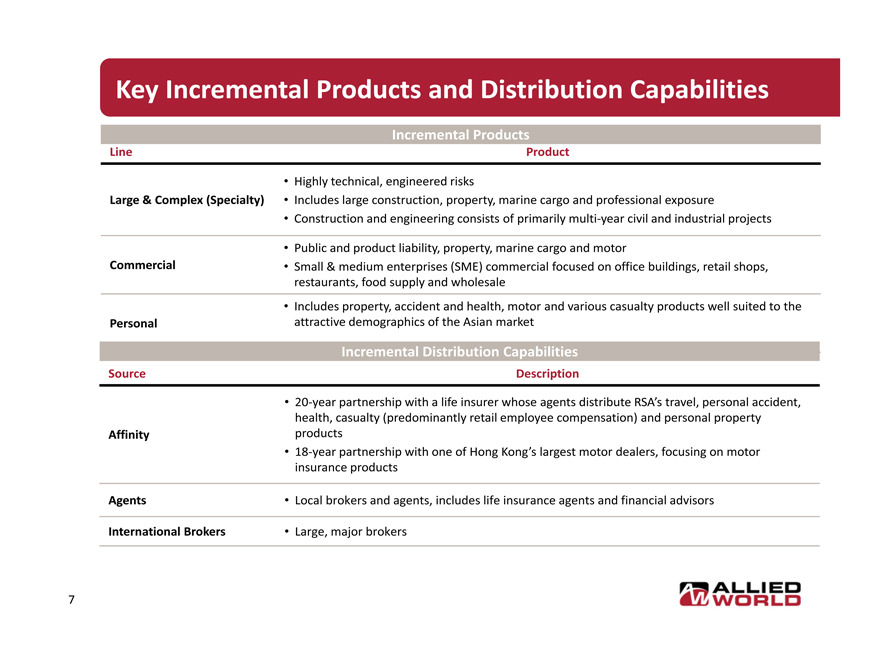

Key Incremental Products and Distribution Capabilities

Incremental Products

Line Product

Large & Complex (Specialty)

Highly technical, engineered risks

Includes large construction, property, marine cargo and professional exposure

Construction and engineering consists of primarily multi-year civil and industrial projects

Commercial

Public and product liability, property, marine cargo and motor

Small & medium enterprises (SME) commercial focused on office buildings, retail shops, restaurants, food supply and wholesale

Personal

Includes property, accident and health, motor and various casualty products well suited to the attractive demographics of the Asian market

Source Description

Internental Distribution capabilities

Affinity

20-year partnership with a life insurer whose agents distribute RSA’s travel, personal accident, health, casualty (predominantly retail employee compensation) and personal property products

18-year partnership with one of Hong Kong’s largest motor dealers, focusing on motor insurance products

Agents

Local brokers and agents, includes life insurance agents and financial advisors

International Brokers

Large, major brokers

7

|

|

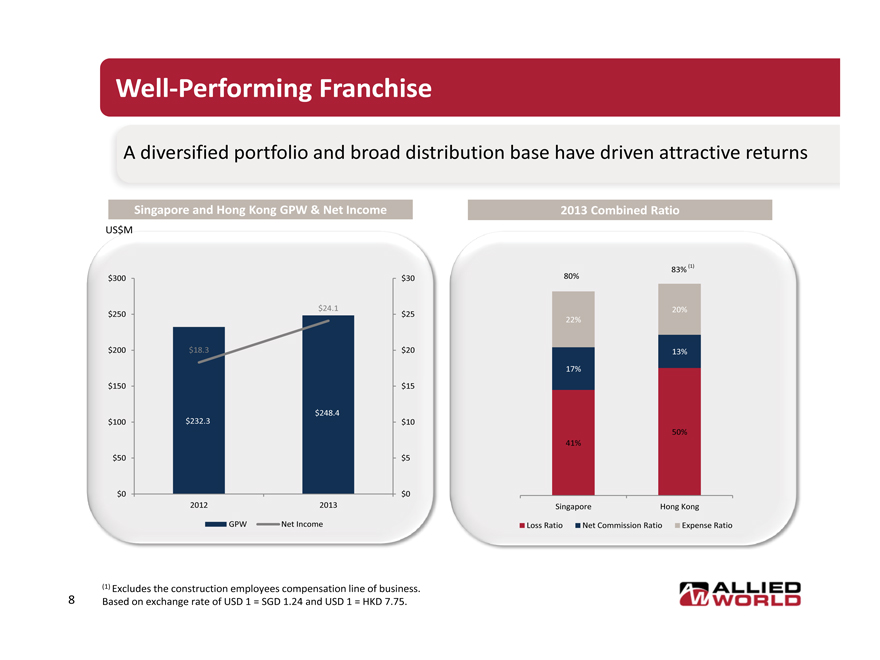

Well-Performing Franchise

A diversified portfolio and broad distribution base have driven attractive returns

Singapore and Hong Kong GPW & Net Income

$232.3

$248.4 $18.3

$24.1

$0

$5

$10

$15

$20

$25

$30

$0

$50

$100

$150

$200

$250

$300

2012

2013

GPW

Net Income

2013 Combined Ratio

80% 83% (1)

Singapore

Hong Kong

Loss Ratio

Net Commission Ratio

Expense Ratio

(1) Excludes the construction employees compensation line of business.

Based on exchange rate of USD 1 = SGD 1.24 and USD 1 = HKD 7.75.

8

|

|

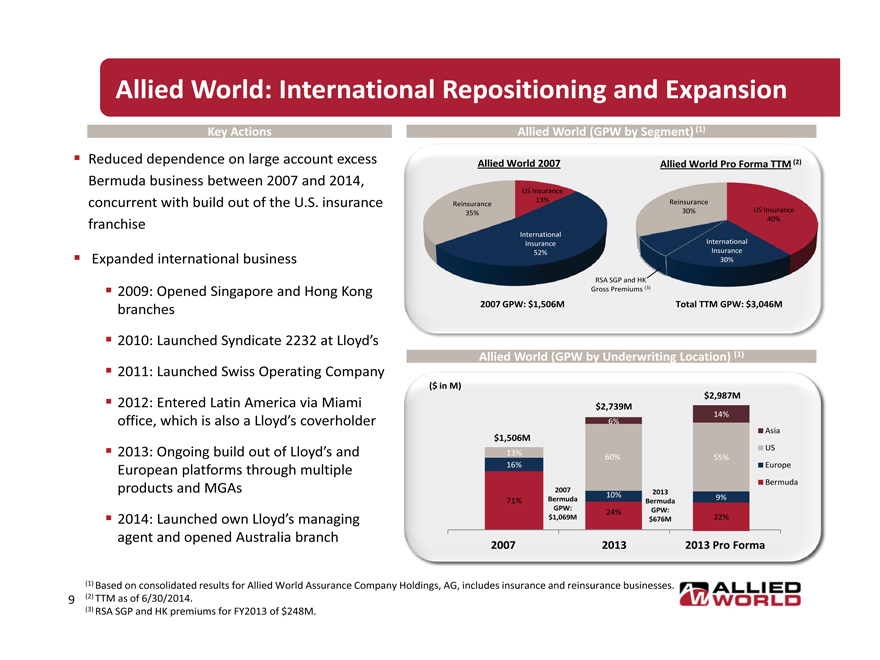

Allied World: International Repositioning and Expansion

Key Actions

Reduced dependence on large account excess Bermuda business between 2007 and 2014, concurrent with build out of the U.S. insurance franchise

§ Expanded international business 2009: Opened Singapore and Hong Kong branches

2010: Launched Syndicate 2232 at Lloyd’s

2011: Launched Swiss Operating Company

2012: Entered Latin America via Miami office, which is also a Lloyd’s coverholder

2013: Ongoing build out of Lloyd’s and European platforms through multiple products and MGAs

2014: Launched own Lloyd’s managing agent and opened Australia branch

Allied World (GPW by Segment) (1)

Allied World 2007

Allied World Pro Forma TTM (2)

US Insurance 13%

Reinsurance 35%

52%International Insurance

52%

Allied World Pro Forma TTM (2)

Reinsurance 30%

US Insurance 40%

International Insurance 30%

RSA SGP and HK Gross Premiums (3)

2007 GPW: $1,506M Total TTM GPW: $3,046M

Allied World (GPW by Underwriting Location) (1)

($ in M)

$1,506M $2,739M $2,987M 16% 13% 16% 71%

2007 Bermuda GPW: $1,069M

$2,739M

6%

60% 10%

24% 2013 Bermuda GPW: $676M

$2,987M

14% 55%

22%

9%

Asia

US

Europe

Bermuda

2007

2013

2013 Pro Forma

(1) Based on consolidated results for Allied World Assurance Company Holdings, AG, includes insurance and reinsurance businesses.

(2) TTM as of 6/30/2014.

(3) RSA SGP and HK premiums for FY2013 of $248M.

9

|

|

Integration Plan

Culture Strong overlap of underwriting-centric philosophy

Plan to maintain leadership team

Loss Reserves and Risk Management Detailed product-by-product, as well as Probable Maximum Loss (PML), analysis has been completed as part of due diligence

Some overlap of existing Allied World risks, although no product overlap in the region

Expense Savings Allied World is not assuming any expense savings in the pro forma projections

Transition Services Assets and services needed to run the business are included in the transaction

Minimal additional services to Allied World covered by transition services for six months post-closing

10

|

|

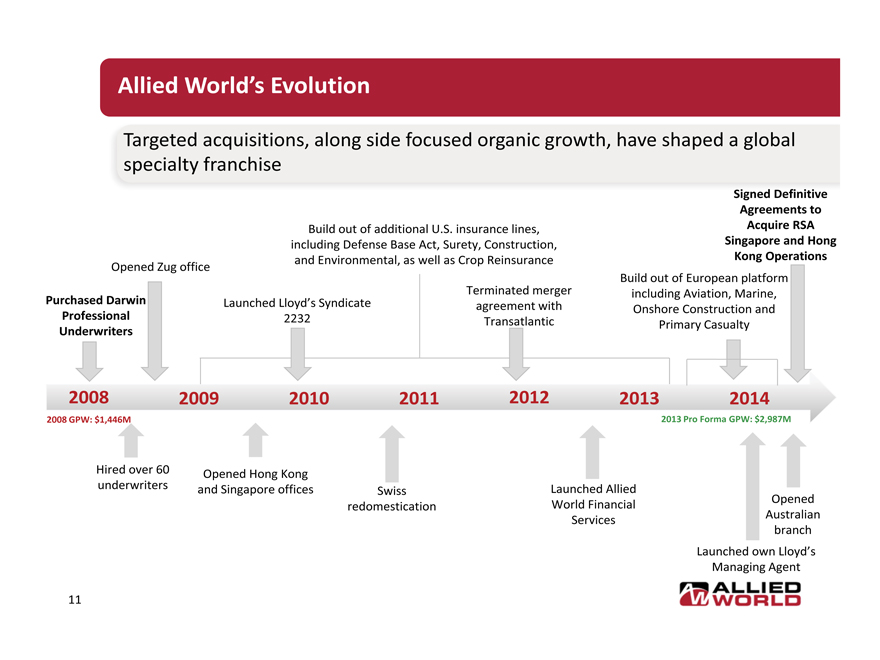

Allied World’s Evolution

Targeted acquisitions, along side focused organic growth, have shaped a global specialty franchise

Signed Definitive Agreements to Acquire RSA Singapore and Hong Kong Operations

Build out of additional U.S. insurance lines, including Defense Base Act, Surety, Construction, and Environmental, as well as Crop ReinsuranceOpened Zug office

Purchased Darwin Professional Underwriters

Launched Lloyd’s Syndicate 2232

Terminated merger agreement with Transatlantic

Build out of European platform including Aviation, Marine, Onshore Construction and Primary Casualty

2008 2009 2010 2011 2012 2013 2014

Hired over 60 underwriters

Opened Hong Kong and Singapore offices

Swiss redomestication

Launched Allied World Financial Services

2013 Pro Forma GPW: $2,987M

Opened

Australian branch

Launched own Lloyd’s Managing Agent 11

|

|

Conclusion

A rare, strategic opportunity to increase Allied World’s access to the fast growing Asian specialty property and casualty market

Ability to plug into Allied World’s existing primary insurance operations in Singapore and Hong Kong

Significantly diversifies product set via the addition of attractive casualty, property and retail lines

Enhances distribution capabilities through multiple entrenched channels

Earnings and ROE accretive immediately

12