Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARO Liquidation, Inc. | aro-20140821x8xk.htm |

| EX-10.1 - EXHIBIT 10.1 - ARO Liquidation, Inc. | q214-exhibit101.htm |

| EX-99.3 - EXHIBIT 99.3 - ARO Liquidation, Inc. | q214-exhibit993.htm |

| EX-99.1 - EXHIBIT 99.1 - ARO Liquidation, Inc. | q214-exhibit991.htm |

1 Second Quarter 2014 Financial Results

Condensed Consolidated Balance Sheets (unaudited) 3 August 2, 2014 February 1, 2014 August 3, 2013 ASSETS Current Assets: Cash and cash equivalents $ 152,274 $ 106,517 $ 100,291 Merchandise inventory 213,016 172,311 249,618 Other current assets 59,971 97,793 89,244 Total current assets 425,261 376,621 439,153 Fixtures, equipment and improvements, net 170,504 235,401 269,510 Goodwill and intangible assets 28,204 28,580 28,956 Other assets 10,813 7,039 6,037 TOTAL ASSETS $ 634,782 $ 647,641 $ 743,656 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Accounts payable $ 137,307 $ 138,245 $ 150,930 Accrued expenses 108,916 102,116 94,364 Total current liabilities 246,223 240,361 245,294 Long-term debt 133,590 - - Other non-current liabilities 102,468 126,588 130,033 Stockholders' equity 152,501 280,692 368,329 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY $ 634,782 $ 647,641 $ 743,656 _ (In thousands)

Condensed Consolidated Statements of Operation (unaudited) 4 August 2, 2014 % of sales August 3, 2013 % of sales Net sales $ 396,155 100.0 % $ 454,034 100.0 % Cost of sales (includes certain buying, occupancy and warehousing expenses) 1 333,605 84.2 % 372,863 82.1 % Gross profit 62,550 15.8 % 81,171 17.9 % Selling, general and administrative expenses 2 121,182 30.6 % 124,963 27.5 % Restructuring charges 3 3,019 0.8 % - 0.0 % Loss from operations (61,651) (15.6)% (43,792) (9.6)% Interest expense 2,424 0.6 % 192 0.0 % Loss before income taxes (64,075) (16.2)% (43,984) (9.6)% Income tax benefit 4 (256) (0.1)% (10,250) (2.2)% Net loss $ (63,819) (16.1)% $ (33,734) (7.4)% Basic loss per share $ (0.81) $ (0.43) Diluted loss per share $ (0.81) $ (0.43) Weighted average basic shares 78,753 78,470 Weighted average diluted shares 78,753 78,470 13 Weeks Ended 4 Income tax benefit for the second quarter of fiscal 2014 was unfavorably impacted by the establishment of reserves against net deferred tax assets of $3.4 million after tax, or $0.04 per diluted share. 2 Selling, general and administrative expenses for the second quarter of 2014 was unfavorably impacted by consulting fees of $3.1 million ($3.0 million after tax, or $0.04 per diluted share). Selling, general and administrative expenses for the second quarter of 2013 was unfavorably impacted by an accounting effect related to retirement features of our stock based compensation plan of $2.7 million ($1.6 million after tax, or $0.02 per diluted share). 3 Restructuring charges for the second quarter of 2014 increased by $3.0 million ($2.9 million after tax, or $0.04 per diluted share). (In thousands, except per share data) 1 Cost of sales for the second quarter of 2014 was unfavorably impacted by asset impairment charges of $19.0 million ($18.5 million after tax, or $0.23 per diluted share). Cost of sales for the second quarter of 2013 was unfavorably impacted by store asset impairment charges of $8.0 million ($5.2 million after tax, or $0.07 per diluted share)

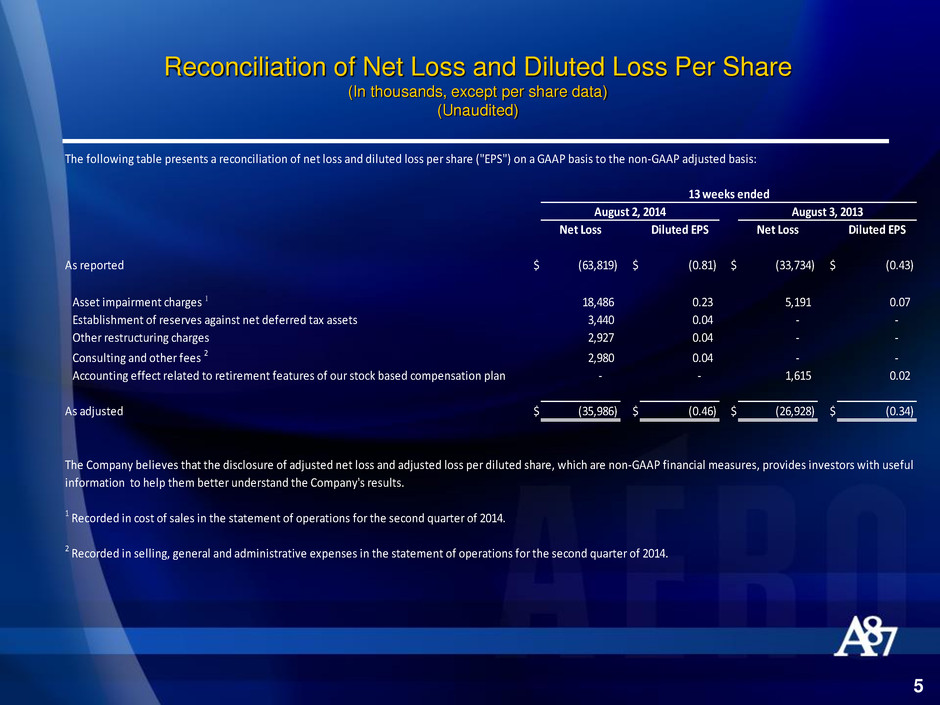

Reconciliation of Net Loss and Diluted Loss Per Share (In thousands, except per share data) (Unaudited) 5 Net Loss Diluted EPS Net Loss Diluted EPS As reported $ (63,819) $ (0.81) $ (33,734) $ (0.43) Asset impairment charges 1 18,486 0.23 5,191 0.07 Establishment of reserves against net deferred tax assets 3,440 0.04 - - Other restructuring charges 2,927 0.04 - - Consulting and other fees 2 2,980 0.04 - - Accounting effect related to retirement features of our stock based compensation plan - - 1,615 0.02 As adjusted $ (35,986) $ (0.46) $ (26,928) $ (0.34) The following table presents a reconciliation of net loss and diluted loss per share ("EPS") on a GAAP basis to the non-GAAP adjusted basis: August 2, 2014 August 3, 2013 13 weeks ended 2 Recorded in selling, general and administrative expenses in the statement of operations for the second quarter of 2014. 1 Recorded in cost of sales in the statement of operations for the second quarter of 2014. The Company believes that the disclosure of adjusted net loss and adjusted loss per diluted share, which are non-GAAP financial measures, provides investors with useful informa ion to help them better understand the Company's results.

6 Second Quarter Metrics Fiscal 2014 Fiscal 2013 Comparable sales change (13)% (15)% Comparable units per transaction change (5)% (1)% Comparable sales transactions change (14)% (10)% Comparable average unit retail change 6% (5)% Second Quarter

Second Quarter Metrics 7 August 2, 2014 August 3, 2013 Average square footage change (2)% 3 % Stores open at end of period 1,072 1,119 Total square footage at end of period 4,006,220 4,139,513 Change in total inventory over comparable period (15)% 1% Change in inventory per retail square foot (11)% (3)% over comparable period 13 Weeks Ended

8 Second Quarter 2014 Store Count Q1 Additions Closures Q2 Aéropostale U.S. 854 4 (10) 848 Aéropostale Canada 77 - (1) 76 Total Aéropostale 931 4 (11) 924 P.S. from Aéropostale 150 1 (3) 148 Total stores 1,081 5 (14) 1,072 _