Attached files

Exhibit 10.4

PURCHASE AND SALE AGREEMENT

FOR COMMERCIAL CONDOMINIUM UNIT #C2 AT

THE HIT FACTORY® CONDOMINIUM

LOCATED AT

421-429 WEST 54TH STREET

| SELLER: | Sagamore 54th St. Investments LLC and Sagamore Arizona LLC, as tenants in common, having an address c/o Plus Properties LLC, Two Stamford Landing, 68 Southfield Avenue, Suite 115, Stamford, CT 06902, Attention: Richard Saunders. | |

| PURCHASER: | New York City Operating Partnership, L.P., having an address c/o American Realty Capital, 405 Park Avenue, 12th Floor, New York, NY 10022, Attention: Michael A. Happel, President. | |

| PROPERTY OR | ||

| BUILDING: | 421-429 West 54th Street | |

| New York, NY 10019 | ||

| NAME OF | ||

| CONDOMINIUM: | The Hit Factory® Condominium | |

| PREMISES, UNIT OR | ||

| CONDOMINIUM UNIT AND | ||

| PERCENTAGE INTEREST | ||

| IN COMMON ELEMENTS: | Commercial Unit # C2 – including 17.173% in the Common Elements | |

| Block 1064 Lot 1102 | ||

| TOTAL PURCHASE PRICE: | $7,250,000 | |

| DOWNPAYMENT OR | ||

| DEPOSIT: | $ 700,000 | |

| BALANCE: | $6,550,000 | |

| CURRENT MONTHLY | ||

| COMMON CHARGES FOR | ||

| THE CONDOMINIUM UNIT: | $2,719.90 for common charges. |

| (1) | THE PLAN. |

Purchaser acknowledges having received and read a copy of the Offering Plan for the Hit Factory® Condominium and all amendments thereto, if any, filed with the Department of Law of the State of New York (hereinafter, collectively, referred to as the “Offering Plan” or the “Plan”) at least three (3) days prior to Purchaser’s signing this Agreement. If Purchaser has not received and read the Plan and all amendments thereto at least three (3) full days prior to Purchaser’s signing this Agreement, Purchaser shall have the right to rescind this Agreement within seven (7) days from the date of this Agreement. Such rescission must be by written notice addressed to the Sponsor and be post marked or hand delivered no later than midnight of the 7th day subsequent to Purchaser’s delivery of the executed Purchase Agreement to the Seller. The Plan is incorporated herein by reference and made a part hereof with the same force and effect as if set forth at length. In the event of any inconsistency between the provisions of this Agreement and the Plan, the provisions of the Plan will govern and be binding. Prior to execution of this Agreement, the Purchaser hereby acknowledges as having received and reviewed the Plan and all 22 Amendments to the Plan.

| (2) | DEFINITIONS. |

The following terms shall have the meaning indicated for each:

(A) “AGREEMENT” shall mean this Purchase and Sale Agreement.

(B) “BROKER” shall mean Eastern Consolidated.

(C) “CONDOMINIUM” shall mean The Hit Factory® Condominium.

(D) “CONDO UNIT” shall mean individually Unit C2 of the Condominium as more particularly described on Exhibit A attached hereto, and the respective appurtenant interest in the common elements as set forth on the first page of this Agreement.

(E) “DECLARATION” and “BYLAWS” shall mean the Declaration and Bylaws for the Condominium, as amended.

(F) “DEPOSIT” or “DOWNPAYMENT” shall be the deposit of $700,000 to be paid by the Purchaser and to be held in escrow during the pendency of this Agreement, pursuant to Section 3.

(G) “ESCROW AGENT” shall mean Philip Brody, Esq., 55 Fifth Avenue, 15th Floor, New York, NY 10003.

(H) “PREMISES” shall mean the Condo Unit.

(I) “PERMITTED EXCEPTIONS” or “PERMITTED TITLE EXCEPTIONS” shall mean the permitted title exceptions in the attached Exhibit C.

(J) “PROPERTY” or “BUILDING” shall mean the property or building located at 421-429 West 54th Street, New York, NY.

| 2 |

(K) “PURCHASER” shall mean New York City Operating Partnership, L.P.

(L) “SELLER” shall mean Sagamore 54th St. Investments LLC and Sagamore Arizona, LLC, as tenants in common.

(M) “LEASE” shall mean existing lease with the Tenant for leased premises in the Condo Unit. “

(N) “TENANT” shall mean the tenant under the Lease, which is Gibson Guitar Corp.

(O) “TITLE COMPANY” shall mean First American Title Insurance Company having an office at 633 Third Avenue, New York, NY 10017, Attention: Stephen Farber.

(P) “TOTAL PURCHASE PRICE,” “DOWNPAYMENT”, “DEPOSIT” and “BALANCE” shall mean the respective sums indicated on the first page of this Agreement.

(Q) “UNIT OWNER” shall mean the Seller as a Unit Owner in the Condominium under the Declaration.

All other terms not defined herein shall have the meanings ordinarily ascribed to them or as otherwise defined in this Agreement.

| (3) | AGREEMENT WITH PURCHASER AND CLOSING DATE. |

(a) Purchaser hereby agrees to purchase from the Seller, and the Seller, in consideration for the delivery of the Total Purchase Price, subject to adjustments, agrees to sell and convey to Purchaser, the Condo Unit.

(b) The closing of the sale of the Condo Unit contemplated by this Agreement (the “Closing”) shall take place on the date which is the 30th day following the receipt by the Purchaser or its attorney of a copy of this Agreement, which has been executed by the Seller an Purchaser, or such earlier date as mutually agreed upon by the Seller and Purchaser or such later date to which the Closing has been extended in accordance with the terms hereof (the “Closing Date”). The Purchaser shall have a one-time right to extent the Closing for a period of up to 30 days upon written notice to the Seller prior to the then-scheduled Closing Date, with the last of such 30 day extension period being time of the essence as to the performance of all of the Purchaser’s obligations under this Agreement.

| 3 |

(c) The Closing shall take place at the offices of the Seller or at the office of the lender or its attorney, providing the Purchaser with financing for the acquisition of the Condo Unit (provided such office is located in the New York metropolitan area). Alternatively, the Closing, at the option of the Purchaser, shall occur through an escrow style closing where Escrow Agent shall act at the settlement agent and all closing documents and payments shall be delivered or paid in advance to the Title Company (as hereinafter defined) for disbursement on the Closing Date, pursuant to the closing instructions of the Seller’s and Purchaser’s respective attorneys, which are consistent with the terms of this Agreement. If the Closing occurs through an escrow style closing, then the Seller and the Purchaser shall each pay 50% of any closing fees charged by the Title Company.

| (4) | CONSIDERATION, ESCROW OF THE DOWNPAYMENT. |

The Total Purchase Price of $7,250,000 shall be paid by Purchaser to the Seller as follows:

(i) The Downpayment or Deposit of $700,000 shall be paid by Purchaser by wire transfer to the trust account of Escrow Agent or by bank cashier or certified check drawn on a New York bank which is a member of the New York Clearing House Association, made payable to the order of the Escrow Agent, within two (2) business days after the delivery to the Purchaser or its attorney of a copy of this Agreement which has been executed by the Seller. The wiring instructions for funding of the Downpayment is set forth in the attached Exhibit G. The proceeds of the Downpayment shall be held in escrow by the Escrow Agent. The Downpayment shall be deposited by Escrow Agent in Escrow Agent's account at Capital One Bank, located at 1001 Avenue of the Americas, New York, New York, which Downpayment shall earn interest, and shall be held until the Closing hereunder or until the prior termination of this Agreement. If the Closing shall take place, the Downpayment shall be paid to the Seller in addition to the Balance of the Total Purchase Price, along with any interest earned on the Downpayment (which interest will be credited against the Balance due at Closing). If Purchaser is entitled to cancel this Agreement pursuant to the express terms of this Agreement, then the Downpayment and any interest earned thereon will be refunded to Purchaser. If this Agreement shall be terminated by reason of the default of either party, then the Downpayment and any interest earned thereon shall be held by the Escrow Agent pursuant to the terms of this Section and disbursed in accordance with this Agreement. The Escrow Agent shall not be liable for any loss of the escrowed funds due to the lack of FDIC insurance in excess of $250,000.

It is understood and agreed that Escrow Agent’s only duties and obligations hereunder are as expressly set forth in this Agreement and no other. Escrow Agent shall not be liable for any action taken or omitted hereunder or for any error in judgment or mistake in fact or law, except as a result of its own willful misconduct or gross negligence. Escrow Agent shall have the right to consult with separate counsel of its own choosing (if it deems such consultation advisable) and shall not be liable for any action taken, suffered, or omitted by it in accordance with the advice of such counsel, provided such action does not constitute willful misconduct or gross negligence. Escrow Agent shall be protected in acting upon any written or oral communication, notice, certificate, or instrument or documents believed by it to be genuine and to be properly given or executed without the necessity of verifying the truth or accuracy of the same or the authority of the person giving or executing the same.

| 4 |

Except for the delivery of the Downpayment to the Seller at the Closing or Purchaser’s cancelation of this Agreement pursuant to the express terms of this Agreement, the Downpayment and any interest earned thereon shall not be delivered to either party unless and until Escrow Agent gives ten (10) days’ prior written notice to both parties of its intention to release the Downpayment and any interest as provided in this Agreement. In the event (a) a party objects in writing given to the other party and Escrow Agent to such release within such ten (10) day period or (b) Escrow Agent determines that a dispute or uncertainty exists as to Escrow Agent’s duties, then Escrow Agent shall refrain from releasing the Downpayment and interest and either (i) continue to hold same in escrow until Escrow Agent is otherwise directed in writing by both parties or by final judgment of a court of competent jurisdiction as to the disposition thereof, or (ii) deposit or turn over the Downpayment and any interest earned thereon to any court of competent jurisdiction and thereupon be relieved from all responsibilities with respect thereto. Nothing in this Section shall prohibit Escrow Agent from acting as the Seller's attorney in the event of any dispute under this Agreement.

Upon disposing of the Downpayment and any interest earned thereon in accordance with the provisions of this Agreement, Escrow Agent shall be relieved and discharged of all claims and liabilities relating to such funds, and shall not be subject to any claims or surcharges made by or on behalf of either party hereto. The Escrow Agent may represent the Seller in connection with any matter pertaining to this transaction, including any litigation arising out of this Agreement.

The Seller and Purchaser jointly agree to indemnify and hold Escrow Agent harmless from all liability, costs, expenses, damages, actions or other charges which may be imposed upon, or incurred by, Escrow Agent in connection with the performance of its duties hereunder, except with respect to any liability, cost and expense incurred as a result of Escrow Agent's willful misconduct or gross negligence.

(ii) Upon execution of this Agreement, the Escrow Agent, the Seller and the Purchaser shall enter into an Escrow Agreement in the form attached hereto as Exhibit I regarding the Deposit, as set forth in the 22nd Amendment to the Offering Plan.

(iii) The Balance shall be paid at Closing by wire transfer to such account(s) designated in writing by the Seller or by an unendorsed certified check or bank cashier's check, drawn on a New York bank, which is a member of the New York Clearing House Association, made payable to the direct order of the Seller and/or to such other parties as designated by the Seller.

| (5) | Emergency Repair Liens. |

All emergency repair liens assessed against the Premises prior to the Closing shall be paid and discharged by the Seller upon the Closing.

| (6) | Assessments. |

If, at the time of the Closing, the Premises shall be or shall have been affected by any special or capital assessment due to the Condominium, the Seller shall be responsible for any such special or capital assessments, including any monthly installments, due prior to the Closing Date and the Purchaser shall be responsible for any special assessments, including monthly installments, due from and after the Closing Date. To the extent applicable, monthly installments for any such special or capital assessment for the month in which the Closing Date occurs shall be prorated between the Seller and the Purchaser pursuant to their respective periods of ownership of the Condo Unit. At the Closing, each of the Sellers or the Purchaser shall pay the amount of any such special or capital assessment that the Seller and/or the Purchaser is responsible for payment of same, as provided above.

| 5 |

| (7) | Deed. |

The deed shall be the usual bargain and sale deeds with covenants against grantor's acts in proper statutory form for recording and shall be duly executed and acknowledged so as to convey to the Purchaser the fee simple of the Premises, free of all encumbrances, except as herein stated, and shall contain the covenant required by subdivision 5 of Section 13 of the Lien Law. At the Closing the Seller shall deliver to the Purchaser possession of the Premises, subject only to the Permitted Exceptions set forth in Exhibit C. Except as set forth in this Agreement and/or the documents and/or agreements to be delivered at the Closing by the Seller, the acceptance of the deed by the Purchaser shall be deemed to be full performance and discharge of every obligation on the part of the Seller to be performed under this Agreement.

| (8) | Title. |

(a) Subject only to the Permitted Exceptions set forth in Exhibit C, the Seller shall give and the Purchaser shall accept title to the Premises such as the Title Company will be willing to approve and insure without any special premium in excess of the standard rates or any affirmative coverage. Purchaser shall promptly after executing this Agreement order a title examination and shall cause a copy of the title report to be delivered to Seller's attorneys concurrently with the delivery thereof to Purchaser's attorneys.

(b) Except as provided below, the Seller shall have the right but not the obligation to cure title objections constituting conditions of title varying from the state of title to be delivered in accordance with this Agreement (hereinafter, collectively, "Valid Title Objections" and, individually, "Valid Title Objection") and to adjourn the closing from time to time to a date specified by Seller upon five (5) business days' notice to Purchaser but not beyond a date ("Adjourned Date") which is more than thirty (30) days after the Closing Date or expiration of Purchaser’s mortgage commitment, whichever is sooner, but, in the case of such expiration of Purchaser’s mortgage commitment, in no event sooner than ten (10) business days after the Closing Date and provided the Seller cures the Valid Title Objections, as reasonably required by the Title Company, on or before the Adjourned Date, then the Closing shall occur on such Adjourned Date specified by Seller in accordance with the provisions of this Agreement. If Seller is not able to cure any Valid Title Objection or Seller fails to cure a Valid Title Objection on or before the Adjourned Date, then the Purchaser's sole right and remedy shall be, on the terms and conditions set forth below, to either:

(i) to declare this Agreement canceled and to recover the net cost actually incurred by Purchaser in examining the title, including municipal searches, which is not to exceed the reasonable charges fixed by Title Company and the net cost of any survey made or updated for the Premises, which was incurred by Purchaser and to receive the refund of the Deposit plus accrued interest thereon in accordance with the terms of this Agreement; or

| 6 |

(ii) to complete the purchase in accordance with this Agreement without reduction in the Purchase Price. Purchaser shall exercise its option pursuant to subparagraphs 8(b)(i) above or this subparagraph (ii) by notice given to and received by Seller within ten (10) business days from Purchaser's receipt of notice from Seller that Seller cannot cure all of the Valid Title Objections pursuant to the terms of this Contract of Sale. If Purchaser shall fail to send a written notice to Seller exercising either of Purchaser's options set forth under Section 8(b)(i) above or this subparagraph (ii) within the required time period, then it shall be deemed that Purchaser exercised the option set forth in Section 8(b)(i) above to declare this Agreement cancelled. Except as otherwise stated herein, nothing contained in this Agreement shall be construed to require Seller to bring any action or otherwise to incur any expenses to render title to the Premises marketable and/or to cure any Valid Title Objections. Notwithstanding anything contained herein to the contrary, the Seller shall apply the Purchase Price to pay off emergency repair liens, unpaid real estate taxes, unpaid assessments, unpaid mechanics liens and/or judgments against the Seller and/or the Premises, unpaid water and sewer charges, all mortgages encumbering the Premises and/or any other Valid Title Objection which can be reduced to a liquidated amount (hereinafter collectively referred to as “Monetary Obligations”).

(c) If on the date of Closing there may be any liens or encumbrances which the Seller is obligated to pay and discharge, the Seller may use any portion of the balance of the Purchase Price to satisfy the same, provided that the Title Company shall omit same from Purchaser’s title insurance policy for the Premises, at standard rates and the Seller shall simultaneously either deliver to the Purchaser or the Title Company at the Closing instruments in recordable form and sufficient to satisfy such liens and encumbrances of record together with cost of recording or filing said instruments; or, provided the Seller has made arrangements with the Title Company, Seller will deposit with said Title Company sufficient monies, reasonably acceptable to and required by it to omit any such liens or encumbrances from the title policy, at standard rates. The Purchaser, if request is made by Seller at least one (1) business days prior to the Closing Date, shall provide at the Closing separate bank checks (or arrange for wire transfers), not to exceed the amount of the balance of the Purchase Price, to facilitate the satisfaction of any such liens or encumbrances. The existence of any such taxes or other liens and encumbrances shall not be deemed objections to title if the Seller shall comply with the foregoing requirements.

(d) If a search of the title discloses judgments, bankruptcies or other returns against other persons having names the same as or similar to that of the Seller, the Seller will on request deliver to the Purchaser and Purchaser’s Title Company an affidavit showing that such judgments, bankruptcies or other returns are not against the Seller.

| (9) | EFFECT OF CLOSING. |

Upon consummation of the Closing, Purchaser shall be the owner of the Condo Unit and the landlord under the Lease.

| 7 |

| (10) | REMEDIES. |

(a) Default by Purchaser: The parties agree that if the Purchaser is in default, beyond all applicable notice and cure periods, of any of the material terms of this Agreement and Purchaser fails to close under this Agreement, the damages of Seller, while substantial, would be difficult or impossible to determine with mathematical precision. Thus, in such event, Seller's sole and exclusive remedy shall be to terminate this Agreement and retain as liquidated damages, the Downpayment and the interest, earned thereon, without any further recourse by the Seller against the Purchaser and/or its members, partners, employees and agents. The parties agree that the provisions of this Section represent an agreed measure of damages and are not to be deemed a forfeiture or penalty. In the event that any check delivered to Seller on account of the Downpayment or any other portion of the Purchase Price shall be dishonored for any reason whatsoever, it shall be deemed a material default by Purchaser hereunder and Seller may, in that event, cancel this Agreement. Notwithstanding the above provisions, if the check for the Downpayment shall be dishonored, the Seller shall notify the Purchaser of same and the Purchaser shall have one (1) business day to replace such check with a certified check made payable to the Escrow Agent or a wire transfer of Federal Funds for the amount of the Downpayment.

(b) Default by Seller: In the event that Seller should be in default under this Agreement, except as otherwise stated in this Agreement, Purchaser's sole remedies will be either to: (1) sue to specifically enforce this Agreement; or (2) to terminate this Agreement, whereupon the Escrow Agent shall return the Downpayment to Purchaser, together with all interest earned thereon, and sue for damages for costs relating title company searches actually incurred by the Purchaser. Except as otherwise stated in this Agreement, the Purchaser hereby expressly waives any and all right to seek damages as a result of Seller's default under this Agreement prior to Closing. In any action for specific performance, reasonable legal fees shall be awarded to the prevailing party.

| (11) | PREMISES “AS IS”. |

Purchaser has inspected the Premises and has become thoroughly acquainted with the conditions, expenses, operation, violations and any and all other matters or things affecting or relating to the Premises, and, except as otherwise specifically provided herein, agrees to accept the Premises and/or the Property in its “as is” present condition, with all faults, including, but not limited to, the environmental condition of the Premises and/or the Property, subject to reasonable use, wear and tear between the date hereof and the Closing. Except as otherwise specifically provided herein, Purchaser acknowledges and agrees that Seller has not made and does not make any representations or warranties of any kind, and shall have no liability or obligation, with respect to any matter relating to the Premises, the Property, the Condominium or this transaction, including, without limitation: (i) expenses, operation, rental income, zoning or development potential, physical condition, gross and rentable square footage of the Premises, access, fitness for any specific use, merchantability or habitability of any portion of the Premises; (ii) any violations affecting the Premises and/or the Building now or hereinafter existing, and liens, if any, arising from any such violations after the Closing, (iii) any patent or latent defect in or about the Premises and/or the Building, or in any of the improvements and/or structures on the Premises and/or the Building; (iv) any laws, regulations, ordinances, or orders pertaining to the Premises and/or the Building; (v) the presence or absence of asbestos or any hazardous materials or wastes in, under and/or upon the Premises and/or the Building; (vi) the existence, location or availability of utility lines for water, steam, sewer, drainage, electricity, gas and/or any other utility; (vii) any licenses, permits, approvals or commitments from governmental authorities in connection with the Premises and/or the Building; (viii) the certificate of occupancy for the Premises attached hereto as Exhibit K; and (ix) any other matter affecting or relating to the Premises and/or the Building.

| 8 |

| (12) | CLOSING DELIVERIES. |

At the Closing, the Seller and/or the Purchaser shall execute and/or deliver the following documents and agreements:

(i) The Seller shall execute and deliver the deed described in Section 6 hereof for the Premises to the Purchaser in the form attached hereto as Exhibit H.

(ii) An Assignment & Assumption of the Lease and the Security Deposit for the Tenant, to be executed by the Seller, as the assignor and the Purchaser, as the assignee, in the form attached hereto as Exhibit D;

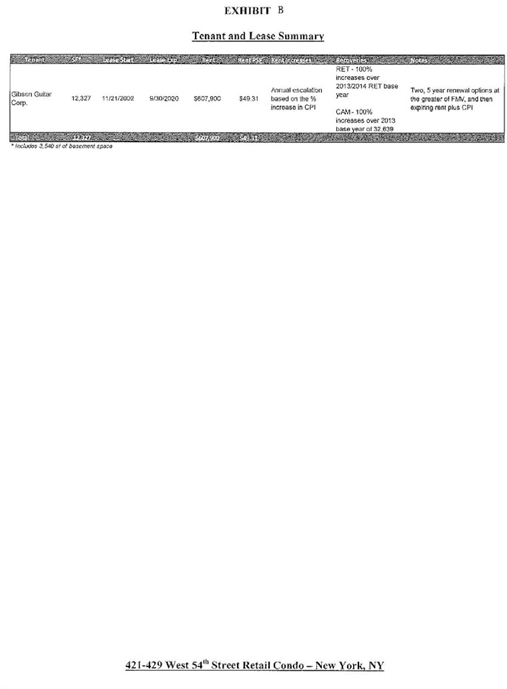

(iii) The Seller shall deliver a rent roll for the Tenant which includes the information set forth on the Rent Roll attached hereto as Exhibit B, and a list of any arrears in rent and additional rent for the Tenant in existence as of the Closing Date;

(iv) A tenant notice letter to the Tenant executed by the Seller, advising the Tenant of the sale of the Premises and the new instructions for payments under its Lease;

(v) Such title affidavits executed by either the Seller and/or the Purchaser, as may be reasonably required by the Title Company;

(vi) The Seller shall deliver to the Purchaser copies of the Lease and lease files for the Tenant;

(vii) Such consents and/or resolutions to be executed by the officers, owners and/or managers of the Seller and the Purchaser, as may be required under their respective organizational documents to authorize and empower the persons executing the closing documents, respectively, on behalf of the Seller and the Purchaser;

(viii) The Seller shall cause the managing agent for the Condominium to provide a letter confirming that all common charges and assessments (if any), have been paid in full through the month in which the Closing occurs;

| 9 |

(ix) As a condition precedent to Purchaser’s obligation to consummate the transaction contemplated hereby, the Seller shall deliver to the Purchaser, on or prior to the Closing, a tenant estoppel certificate from the Tenant, in substantially the form attached hereto in Exhibit E or in such form as set forth in the Lease.

(x) A Bill of Sale to be executed by the Seller in the form attached hereto as Exhibit F.

(xi) The execution and delivery by the Seller of a FIRPTA Affidavit for each entity comprising the Seller;

(xii) New York State Transfer Tax Return, The New York City Transfer Tax Return, and the Equalization Form as required by Section 14 of this Agreement;

(xiii) To the extent in Seller’s or its Agent’s possession (a) those transferable licenses and permits, authorizations and approvals pertaining to the Premises which are not posted at the Premises; (b) all transferable guarantees and warranties which Seller has received in connection with any work or services performed or equipment installed in and improvements erected on the Premises; and (c) any access codes, keys, or building plans applicable to the Premises;

(xiv) A certificate by the Seller confirming that all representations and warranties of the Seller set forth in this Agreement are true, complete and correct in all material respects as of Closing;

(xv) As a condition precedent to Purchaser’s obligation to consummate the transaction contemplated hereby, the Seller shall deliver to the Purchaser, on or prior to the Closing, an estoppel certificate from the Board of Managers, in the form attached hereto as Exhibit J, with such changes as may be required by the Board of Managers and are reasonably acceptable to Purchaser; and

(xvi) Seller’s representative on the Board of Managers for the Condominium shall resign so that the Purchaser’s representative can replace such person as a member of the Board of Managers, pursuant to Section 1 of the Bylaws of the Condominium.

| (13) | ADJUSTMENTS. |

(a) At the Closing, the Seller and the Purchaser shall complete the following adjustments or apportionments as to the month of the Closing as of 11:59 p.m. on the day preceding the Closing Date:

| (i) | Common charges and special assessments (or capital assessments) for the Condo Unit on a per diem basis; |

| (ii) | Real estate taxes on a per diem basis based on the fiscal year for which they are assessed; |

| 10 |

| (iii) | Rent and additional rent (including any prepaid rents) on a per diem basis to the extent collected under the Lease; |

| (iv) | The Purchaser shall either receive a credit against the Purchase Price or a check for the amount of Tenant’s security deposit; and |

| (v) | Such other items set forth in this Agreement and/or that are customarily prorated in transactions of this nature. |

(b) In completing such adjustments, the Seller shall be responsible for payment of all common charges (including special or capital assessments, if any) and real estate taxes through the day prior to the Closing and the Purchaser shall be responsible for such payments from and after the Closing Date. The Seller shall be entitled to all rent and additional rent under the Lease through the day prior to the Closing and the Purchaser shall be entitled to such rent and additional rent under the Lease for the period from and after the Closing Date. At the option of Seller, any adjustment due to the Purchaser may be credited at Closing against the balance of the Purchase Price.

(c) Any errors in calculation or apportionments shall be corrected or adjusted as soon as practicable, but in no event later than ninety (90) days after the Closing Date. The provisions of this Section 9 shall survive the Closing for a term of ninety (90) days.

| (14) | RENT ARREARS. |

If there are any arrears in rent and additional rent as to the Lease as of the Closing Date, rent and additional rent received after the Closing Date shall be applied first to any rent and additional rent owed for the month of the Closing to be allocated amongst the Purchaser and the Seller pro-rata based upon the number of days of ownership applicable to each party; second to any other rent and additional rent due and owing Purchaser from and after the Closing Date; and third to pay any other delinquent rent and additional rent owed to the Seller for its period of ownership. To the extent either party after the Closing Date receives any rent and additional rent due to the other party, as provided herein, such party shall hold any such rent and additional rent in trust for the other party and shall promptly remit to the proper party. Neither party shall have any obligation to collect past due rent, but each party shall use commercially reasonable efforts to do so, without any obligation on the part of the Purchaser to file a lawsuit to collect any such past due rent and additional rent. The provisions contained herein shall survive the Closing.

| (15) | NEW YORK STATE AND NEW YORK CITY TRANSFER TAXES. |

(a) Seller shall pay or cause to be paid at Closing, all New York City and New York State transfer taxes payable in connection with the Closing, including without limitation, the transfer of the Premises to Purchaser.

| 11 |

(b) At the Closing, the Seller shall deliver to the Purchaser a certified bank check (or direct Purchaser to deliver a bank check out of the balance of the Purchase Price) to the order of the Title Company (as hereinafter defined) for the amount of the New York State Transfer Tax payable by reason of delivery of the transfer of the Premises. At the Closing, the Seller and the Purchaser will both execute and deliver the State Transfer Tax Forms (TP584) and the New York State Equalization Forms to be filed with the payment of the New York State Transfer Tax for this transaction.

(c) In addition, the Seller shall at the same time deliver to the Purchaser a certified bank check (or direct Purchaser to deliver a certified or bank check out of the balance of the Purchase Price) to the order of the Title Company for the amount of the New York City Real Property Transfer Tax imposed by Title II of Chapter 46 of the Administrative Code of the City of New York and the Seller and the Purchaser shall both execute and deliver the New York City RPT Tax Forms required to be delivered with the payment of the City Transfer Tax for this transaction.

| (16) | PERSONAL PROPERTY. |

All fixtures, equipment, appliances and articles of personal property attached or appurtenant to or used in connection with the Premises, which are owned by the Seller, are included in this sale. No part of the Purchase Price is allocated to the purchase of such fixtures, equipment, appliances and other personal property owned by the Seller. At the Closing the Seller shall deliver to the Purchaser a Bill of Sale for all fixtures, equipment, appliances and other personal property owned by the Seller in the form attached hereto as Exhibit F, which shall provide that the fixtures, equipment, appliances and other personal property transferred to Purchaser, if any, shall be free and clear of all liens and encumbrances.

| (17) | RENT ROLL. |

(a) Attached hereto as Exhibit B, is a true and accurate rent roll, in all material respects, for the Premises (the "Rent Roll"), which lists the Tenant, the billable rent and additional rent for the Tenant, the expiration date of the Lease, and the amount of the Tenant’s security deposit under its Lease. The Seller has delivered to the Tenant a true and complete copy of the Lease (including all amendments thereto). There are no leases, licenses or other written occupancy agreement affecting all or any portion of the Premises other than the Lease set forth on the Rent Roll. To the extent there are any differences between the information contained in the attached Rent Roll and the terms of the Lease, the term of the Lease shall control and the Rent Roll shall be deemed modified accordingly.

| 12 |

(b) Any new lease or renewal of the Lease (or amendment or modification to such new lease or to the Lease) or assignment or a sublet of such new lease or the Lease by the Tenant (to the extent Seller’s approval is required under the Lease for such assignment or sublease), shall be subject to the prior written approval of the Purchaser, such approval subject to Purchaser’s sole discretion. The Seller shall submit to the Purchaser, a copy of the proposed new lease or renewal of the Lease (or amendment or modification to such new lease or to the Lease), assignment or sublet of such new lease or the Lease, financial and credit information obtained by the Seller as to any such tenant or the Tenant, or assignee, a list of any tenant improvements required to be made by the landlord under any such new lease or the Lease and the amount of any brokerage commission to be paid by the landlord under any such new lease or the Lease (hereinafter collectively referred to as the “Leasing Documents”). The Seller shall promptly submit for Purchaser’s approval (which approval Purchaser may grant or deny in Purchaser’s sole discretion) the Leasing Documents pertaining to any new lease, modification or renewal of such new lease or the Lease, assignment or sublet for which Seller’s approval, as landlord, is required for any space at the Premises. If the Purchaser does not respond to the Seller’s request for such approval by the Purchaser within three (3) business days after the Purchaser’s receipt of the Leasing Documents for any such new lease or the Lease, then the Purchaser shall automatically be deemed to approve any such leasing request of Seller. Purchaser shall at the Closing pay or reimburse Seller for any tenant improvements and/or leasing commissions incurred by the Seller as to any new lease and/or renewal of the Lease, which is entered into by the Seller from and after the date hereof and approved by Purchaser in accordance with the terms hereof.

| (18) | SECURITY DEPOSIT. |

Subject to this Section 18, The Seller reserves the right to apply the security deposit under the Lease against any uncollected rent and additional rent under any such Lease or any other sums due Seller under any such Lease in accordance with the terms of such Lease. The Seller shall promptly notify the Tenant and the Purchaser of any such application of the security deposit. In reference to the Seller’s application or withdrawal of the security deposit held for the Tenant, the Seller shall give the Purchaser written notice of any such application or withdrawal at the same time it notifies the Tenant of same and shall only withdraw or apply same to the extent of any default, beyond all applicable notice and grace periods, of the Tenant occurring after the date hereof in the payment of rent, additional rent and/or any other sums due and owing under the Lease.

| (19) | ACCESS TO BOOKS AND RECORDS. |

(a) Prior to the Closing the Seller shall permit Purchaser's staff, agents, appraisers, lenders, engineers, environmental consultants and architects (collectively "Agents") access to the Premises during normal business hours provided that: (i) the Purchaser shall give to the Seller at least two business days' advance notice of such inspection; (ii) any such inspection shall not impede to a material extent the normal day to day operations of the Premises and the Tenant’s operation of their respective businesses in their lease premises and (iii) a representative of the Seller shall accompany the Purchaser and/or its Agents in any such inspection of the Premises, unless otherwise agreed to by the Seller. The Seller shall endeavor to make such representative reasonably available for such inspections. The Purchaser hereby agrees to indemnify, hold harmless and defend the Seller and the Condominium from and against any and all claims, damages, liabilities, costs and expenses (including reasonable attorney's fees and disbursements) to the extent incurred by the Seller as a consequence of any such inspection of the Premises by the Purchaser and/or its Agents, except if caused by the gross negligence or recklessness of Seller and/or Seller’s agents, Tenants and/or occupants. This indemnification shall survive the Closing. Notwithstanding the foregoing, this indemnity shall not be applicable to any pre-existing condition except to the extent exacerbated by Purchaser and/or its Agents.

| 13 |

(b) The Seller hereby agrees, provided it is at no material cost to the Seller, to make available to the Purchaser and its Agents and accountants for their review and copying, upon at least two business days advance notice to the Seller, the books and records of the Seller to the extent in the possession or control of the Seller and/or its managing agent and/or any other agents of the Seller, relating to the Tenants and the maintenance and operation of the Premises. The Seller agrees that in connection with the examination of Seller's books and records, the Purchaser's accountants may make such tests of the accounting records and undertake such other auditing procedures as the Purchaser's accountants consider necessary in the circumstances. Prior to the Closing, any such information contained in the books and records for the Premises shall be kept confidential by the Purchaser, its Agents and accountants, except as otherwise approved by the Seller.

| (20) | PURCHASER'S REPRESENTATIONS AND WARRANTIES |

(a) Purchaser represents and warrants to the Seller, as of the date hereof, which representations and warranties shall also be true and accurate in all material respects on the Closing Date, that:

(i) Purchaser is a limited partnership, duly organized and validly existing and in good standing under the laws of the State of Delaware.

(ii) Purchaser has all requisite power and authority, in accordance with the law, to enter into this Agreement and to carry out the transactions contemplated hereby. The person signing this Agreement on behalf of the Purchaser is authorized and empowered to execute and deliver this Agreement on behalf of the Purchaser. The execution, delivery and performance of this Agreement by Purchaser has been duly authorized and (1) does not violate any provision of, or require any filing, registration or consent or approval under any law, rule or regulation, order, writ, judgment, injunction, decree, determination or award presently in effect having applicability to the Purchaser which has not been obtained; (2) will not result in a breach of or constitute a default or require any consent under any indenture, lease, loan, credit agreement of Purchaser or any other instrument by which Purchaser may be bound or affected; or (3) will not cause Purchaser to be in default under any such law, rule, regulation, order, writ, judgment, injunction, decree, determination or award, or any such indenture, lease, agreement or instrument; and

(iii) Purchaser is not a person or entity described by Sec. 1 of the Executive Order (No. 13,224) Blocking Property and Prohibiting Transactions with Persons Who Commit, Threaten to Commit, or Support Terrorism, 66 Fed. Reg. 49,079 (Sept. 24, 2001).

| 14 |

| (21) | SELLER’S REPRESENTATIONS AND WARRANTIES |

(a) Seller hereby represents and warrants to Purchaser, as of the date hereof, which representation and warranties shall also be true and accurate in all material respects on the Closing Date, that:

(i) Each of the tenants in common comprising the Seller is a New York limited liability company, duly organized and validly existing under the laws of the State of New York.

(ii) Seller has all requisite power and authority, in accordance with applicable law, to enter into this Agreement and to carry out the transactions contemplated hereby. The execution, delivery and performance of this Agreement by Seller has been duly authorized and (1) does not violate any provision of, or require any filing, registration or consent or approval under any law, rule or regulation, order, writ, judgment, injunction, decree, determination or award presently in effect having applicability to the Premises which has not been obtained; (2) will not result in a breach of or constitute a default or require any consent under any indenture, lease, loan, credit agreement of Seller or any other instrument or agreement by which Seller may be bound or affected; and (3) will not cause Seller to be in default under any law, rule, regulation, order, writ, judgment, injunction, decree, determination or award, or any such indenture, lease, agreement or instrument. The person executing this Agreement on behalf of the Seller has been authorized and empowered to execute this Agreement of behalf of the Seller;

(iii) The common charges and special or capital assessments currently payable for the Unit as of the date hereof, are specified on Page 1 hereof and all common charges and special (capital) assessment will be paid in full through the month in which the Closing occurs;

(iv) Seller has not received a written notice of default by Seller or Tenant under the Declaration that relates to the Unit and remains uncured; Seller has not delivered to the Board of Managers or the managing agent of the condominium a notice of default by the Board of Managers or the managing agent for the condominium under the Declaration; to Seller’s knowledge, no defaults by Tenant have occurred and are continuing under the Declaration.

(v) Seller is not a “foreign person” as defined in Section 1445 of the Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder;

(vi) There is no litigation currently pending or to the best of Seller's knowledge, threatened in writing, to which Seller is a party which would affect the transfer of Premises to the Purchaser;

| 15 |

(vii) The Seller, as a unit owner in the Condominium, as of the date hereof, has not received any written notice from the Condominium or the managing agent of the Condominium to the Unit Owners concerning changes in common charges and/or special assessments;

(viii) The Seller has delivered to the Purchaser or its attorneys true and complete copies of the existing Lease (including any amendments);

(ix) The Rent Roll for the Tenant, attached hereto as Exhibit B is accurate in all material respects. The Seller, as landlord, has not received any written notice of default from the Tenant as to the landlord’s obligations under the Lease, which remain uncured. To the best of Seller’s knowledge, except as reflected on the Rent Roll, all Tenant is in possession, and the Tenant has not sublet or assigned their leased premises. As of the date hereof, the Seller has not received from the Tenant any written notice of default under the Lease, which remains uncured. As of the date hereof, to Seller’s knowledge, neither the Seller nor the Tenant is in default under the Lease. Seller has not delivered to the Tenant a written notice of default by the Tenant under the Lease, which remains uncured;

(x) There have been no prepayments of rents and additional rents by the Tenant except those which will be adjusted at the Closing; from and after the date hereof the Seller shall not collect rent more than thirty (30) days in advance for the Tenant; the Tenant has not been given any concessions or free rent for the rental of their leased premises which would be binding on the Purchaser from and after the Closing Date;

(xi) There shall not be any brokerage commissions due and owing as to the existing Lease, which would be binding on the Purchaser after the Closing. All tenant improvements required of the Seller under the Lease, as of the date hereof, have been completed and there are no outstanding tenant improvement allowances provided for under the Lease;

(xii) All bills and claims for labor performed and materials furnished at the request of the Seller or its agents or employees to or for the benefit of the Premises will be paid in full by the Seller on or before the Closing Date;

(xiii) Seller is not a person or entity described by Sec. 1 of the Executive Order (No. 13,224) Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten to Commit, or Support Terrorism, 66 Fed. Reg. 49,079 (Sept. 24, 2001);

| 16 |

(xiv) There are no service contracts for the Premises that will be binding on the Purchaser from and after the Closing Date. There are no employees for the Premises that the Purchaser shall be required to hire or retain from and after the Closing Date;

(xv) Seller has not received notice of pending or threatened condemnation proceedings; and

(xvi) No options or rights of first refusal or other rights to acquire the Premises exist.

The above representations of Seller in this Section 21 shall survive the Closing for a period of one hundred fifty (150) days (the “Survival Period”) except there shall be no Survival Period after the Closing as to any material breach of Seller’s representations and warranties to which the Purchaser had knowledge on or prior to the Closing Date.

Seller may modify or update any representation or warranty in this Agreement to correct any mistake and/or to reflect any matter which arises subsequent to the date of this Agreement; provided, however, to the extent such modification or update evidences a change in any such representation or warranty that is "material" (as defined in this Section), then Purchaser’s sole remedy shall be to terminate this Agreement on or prior to the Closing Date. If Purchaser has knowledge of any matter which Purchaser claims would give rise to a right of Purchaser to terminate this Agreement pursuant to the terms hereof, Purchaser shall notify Seller in writing of such matter within the earlier of: (i) ten (10) business days of learning of same or (ii) the Closing Date, failing which any rights of Purchaser or obligation of Seller under this Agreement regarding such matter shall be waived. Purchaser’s notice shall include a reasonable estimate of the amount by which the damages arising from the alleged matter exceeds the materiality threshold as defined below (the “Breach Amount”), provided that such matter is susceptible to a reasonable estimation of damages. Seller shall have the right, but not the obligation, to attempt to cure such matter (but no such attempt shall constitute an acknowledgement or agreement that Purchaser has any right not to perform hereunder) or to credit Purchaser with the Breach Amount. In connection with Seller’s election to attempt to cure such matter, Seller shall have until the date that is the later of the originally scheduled Closing Date or sixty (60) days from the date of Purchaser’s notice to attempt to effectuate such cure and, at Seller’s option, the Closing Date shall be extended to such sixtieth (60th) day (or any earlier business day) after Purchaser's notice to permit such cure by Seller, provided that if Seller makes such election, Seller shall thereafter use commercially reasonable efforts to effect such cure as soon as reasonably practicable thereafter, and Purchaser shall be entitled to Close on or about such earlier date as such cure is completed. For the purposes of this Agreement, "material" shall mean any state of facts, taken alone or together with all other material untruths or inaccuracies and all such covenants and obligations with which Seller has not materially complied, the restoration of which to the condition represented or warranted by Seller under this Agreement, or the cost of compliance with which, would cost in excess of Twenty Five Thousand Dollars ($25,000).

| 17 |

Any survival of Seller’s representation and warranties shall automatically be null and void unless, within thirty (30) days after the end of the Survival Period, the Purchaser shall have asserted in writing a specific claims as to such material breach of Seller’s representations and Purchaser’s notice of such material breach shall include a reasonable estimate by which the damages arising from the alleged matter exceeds the materiality threshold of $25,000, provided that any such matter is susceptible to a reasonable estimate of damages. The Seller, in any event, shall not have any liability as to any breach of representation and warranties in excess of $350,000 and any such liability for damages shall not include any consequential damages.

| (22) | SELLER’S COVENANTS. |

Seller agrees that, prior to the Closing, it shall:

(a) Not enter into any new lease of space or other occupancy arrangement or any new contract, or materially amend or modify the same or the Lease, other than in accordance with Section 17 (b) of this Agreement;

(b) Not create, incur or suffer to exist any mortgage, lien, pledge or other encumbrance in any way affecting any portion of the Premises other than the liens encumbering the Premises on the date of this Agreement;

(c) Maintain the current insurance coverages for the Premises and otherwise operate the Premises in a manner substantially similar to the operation of the Premises prior to the date hereof; and

(d) Not terminate the Lease without Purchaser’s written consent thereto (which consent Purchaser may withhold in Purchaser’s sole discretion), unless such termination is as a result of a material default by the Tenant thereunder and such default has not been cured by the Tenant or, at Purchaser’s option, Purchaser, prior to the expiration of all notice and grace periods for the applicable material default.

| (23) | PERFORMANCE BY THE SELLER. |

Acceptance by Purchaser of the deed for the Premises shall be deemed to be a full performance and discharge of each and every agreement and obligation on the part of the Seller to be performed pursuant to the provisions of this Agreement, except those herein expressly stated to survive the Closing or in the Closing documents.

| (24) | NO MORTGAGE CONTINGENCY. |

Purchaser’s obligations under this Agreement are not contingent upon Purchaser's ability to obtain financing.

| (25) | BROKER. |

Seller and Purchaser each represent and warrant to the other that it has not dealt with any broker other than the Broker in connection with this transaction and each party hereby agrees to indemnify and hold the other harmless from and against any and all losses, costs, damages or expenses, including without limitation, reasonable attorneys' fees, paid or incurred by reason of any inaccuracy of the foregoing representation and warranty. The Seller agrees to pay the Broker a commission pursuant to separate agreement. The provisions of this Section shall survive the Closing.

| 18 |

| (26) | NOTICES. |

All notices, elections, consents, demands and communications (collectively called “Notices” or individually called “Notice”) shall be in writing, delivered personally or by overnight courier or by certified mail, postage prepaid and addressed to the Seller at Seller’s address given above with copies to Philip Brody, Esq., 55 Fifth Avenue, 15th Floor, New York, NY 10003, and to the Purchaser’s address given above, with a copy to Michael Ead, Esq, at MEad@nyrt.com. Unless otherwise provided herein, the Notices shall be deemed given when delivered, if sent by personal delivery, or on the next business day if sent by overnight courier, except that a Notice of a new address shall be deemed given when actually received.

| (27) | ENTIRE AGREEMENT. |

This Agreement constitutes the entire agreement between the parties hereto as to the subject matter hereof and supersedes all prior understandings and agreements. Purchaser acknowledges having entered into this Agreement without relying upon any promises, statements, estimates, representations, warranties, conditions or other inducements, expressed or implied, oral or written, not set forth herein. Purchaser further acknowledges having had full opportunity to examine all documents and investigate all facts referred to and stated herein including without limitation the minutes of the board of directors meetings of the Condominium, the financial statements, Declaration and Bylaws of the Condominium, the Lease and tenant files for the Tenants.

| (28) | MODIFICATIONS. |

This Agreement cannot be amended or modified orally, but only in writing signed by or on behalf of the party against whom same is sought to be enforced.

| (29) | ASSIGNMENT OF THE AGREEMENT. |

This Agreement is not assignable by Purchaser without the prior written consent of the Seller and shall bind and apply to Purchaser and Purchaser's executors, administrators, legal representatives, heirs, successors and permitted assigns. Notwithstanding the previous sentence, Purchaser may assign its rights under this Agreement to an entity controlled by or under common control of American Realty Capital III, LLC (“AMC III”) or its principal. “Controlled by” or “under common control” of AMC III or its principals (including Michael Happel) as used in the preceding sentence shall mean an entity in which AMC III or its principals directly or indirectly controls and/or manages such entity.

| 19 |

| (30) | RISK OF LOSS/CONDEMNATION. |

(a) The risk of loss or damage to the Premises, by fire or other cause, until the time of the Closing, is assumed by the Seller, but without any obligation on the part of the Seller, except at the Seller’s option, to repair or replace any such loss or damage. The Seller shall notify Purchaser (the “Casualty Notice”) of the occurrence of any such loss or damage within five (5) days after such occurrence or by the Closing Date, whichever first occurs, and in the Casualty Notice shall elect whether or not the Seller will repair or replace the loss or damage, which would be the obligation of the Seller to repair and/or replace under the Declaration and Bylaws for the Condominium and if Seller elects to do so, that it will complete the same within one hundred twenty (120) day period hereinafter referred to. The Casualty Notice shall contain, to the extent available to the Seller, an estimate of the cost to repair or replace such loss or damage to the Premises from the adjuster for the Seller’s insurance carrier (the “Cost Estimate”). If the Cost Estimate is not available, then the Seller shall deliver same when received. If the Seller elects in the Casualty Notice to make such repairs and/or replacements, then the Casualty Notice shall set forth an adjourned date for the Closing, which shall be not more than one hundred twenty (120) days after the date of the giving of the Seller's notice. If the Seller does not elect in the Casualty Notice to make such repairs and/or replacements, or if the Seller elects in the Casualty Notice to make such repairs and/or replacements and fails to substantially complete such repairs and/or replacements on or before said adjourned Closing Date set forth in the Casualty Notice, then Purchaser shall have the following options:

(i) to declare this Agreement canceled and receive a refund, with interest from the Seller of all sums theretofore paid on account of the Total Purchase Price; or

(ii) to complete the purchase in accordance with this Agreement, without reduction in the Total Purchase Price, except as provided in the next sentence. If the insurance carried by Seller covers such loss or damage, then Seller shall turn over to or pay Purchaser at the Closing the net proceeds (after legal and other expenses of collection) actually collected by the Seller under the provisions of such insurance policies to the extent that they are attributable to loss of or damage to the Premises and the amount of the Seller’s deductible under its insurance policy which is attributable to any such loss or damage; if the Seller has not received any of such proceeds, the Seller shall request that the Seller’s insurance carrier provide a letter confirming the insured loss and shall assign (without recourse to the Seller) the Seller's claim for damages against its insurer and any recovery therefrom which is attributable to the loss of or damage to the Premises, less any sums theretofore expended by it which has not been applied to the restoration.

(b) If the Seller does not give Purchaser the Casualty Notice in the time period provided in Section 30(a) hereof or fails to elect in the Casualty Notice to make such repairs and/or replacements, then Purchaser may exercise the resulting options under clause (i) or (ii) of Section 30(a) above only by written notice given to the Seller within ten (10) business days after Purchaser’s option arises (time being of the essence with respect to such ten (10) business day period), provided that during such time period Seller deliver to Purchaser the Cost Estimate. If Seller does not give Purchaser the Cost Estimate on or prior to the commencement of such ten (10) business day period, then such period of ten (10) business days shall be extended for one (1) business day for each day after the commencement of such ten business day period until Seller gives the Cost Estimated to Purchaser. If the Seller elects in the Casualty Notice to make such repairs and/or replacements and fails to substantially complete such repairs and/or replacements on or before the adjourned Closing Date, Purchaser may exercise the resulting options under clause (i) or (ii) of Section 30(a) above within ten (10) business days after the adjourned Closing Date.

| 20 |

(c) Notwithstanding anything contained therein to the contrary, if the Cost Estimate to restore the Premises is estimated to be $500,000 or greater, then Purchaser may elect to terminate this Agreement by giving notice to the Seller within ten (10) business days after the Seller gives the Cost Estimate to Purchaser (time being of the essence with respect to such ten (10) business day period), in which case this Agreement shall terminate on the date of Purchaser's notice and the Downpayment (plus any accrued interest) shall be returned to Purchaser. Failure of Purchaser to provide such notice within such ten (10) day period shall be deemed an election by Purchaser not to terminate this Agreement. To the extent the Seller elects to complete such restoration and Purchaser elects not to terminate this Agreement, the plans and specifications the contractor utilized to complete such restoration and the terms and conditions of any such construction contract for such restoration shall be subject to the approval of the Purchaser, not to be unreasonably withheld or delayed. In the event Purchaser elects to proceed with the transaction, the Seller shall not settle any insurance claims as to the Condo Unit without the prior written approval of Purchaser, not to be unreasonably withheld or delayed.

(d) In the event of a casualty and Purchaser elects to proceed with the purchase, as contemplated by this Agreement, the terms of Declaration and Bylaws shall apply to any such restoration. Any reference to the Seller’s restoration of the Premises shall include only the Seller’s obligations as the Unit Owner under the Declaration and Bylaws and any Cost Estimate required to be provided hereunder shall also relate to the cost to restore the Premises, which would be the obligation of the Seller as the Unit Owner in the Condominium.

(e) If, prior to the Closing Date, any portion of the land on which the Building is located or the Property is taken by eminent domain which results in either (i) a reduction of more than ten percent (10%) of the gross leasable area of the Condo Unit or the Property, or (ii) a material and adverse effect on access to the Condo Unit or the Property, then Seller shall promptly notify Purchaser of such fact and Purchaser shall have the option to terminate this Agreement upon notice to Seller given not later than fifteen (15) business days after Seller gives such notice to Purchaser. If this Agreement is terminated pursuant to this Section 30(e), then neither party shall thereafter have any rights or obligations hereunder (other than any such rights or such obligations that are expressly stated herein to survive the termination hereof). If Purchaser does not elect to terminate this Agreement or has no right to terminate this Agreement pursuant to this Section 30(e), then (x) Purchaser shall accept so much of the Condo Unit as remains after such casualty or taking in its “as-is” condition with no abatement of the Purchase Price, and (y) at the Closing, Seller shall assign and turn over to Purchaser, and Purchaser shall be entitled to receive and keep, all of Seller’s interest in and to all awards paid or payable to Seller for such taking by eminent domain, less, in either case, reasonable costs incurred by Seller to collect the same and the portion thereof that Seller uses to make temporary or emergency repairs to the Condo Unit. Seller shall not repair or restore any portion of the Condo Unit or the Property after the occurrence of a condemnation, or settle any condemnation claim, in either case without Purchaser’s consent, which consent Purchaser shall not unreasonably withhold, condition or delay.

| 21 |

| (31) | GOVERNING LAW. |

This Agreement shall be governed exclusively by and construed and enforced in accordance with the internal laws of the State of New York, without giving effect to the principles of conflicts of laws. Each of the parties hereby irrevocably waives all right to trial by jury in any action, proceeding or counterclaim arising out of relating to this agreement. Any action brought hereunder shall be brought the Supreme Court of the State of New York or the United States District Court for the Southern District of New York, in all instances located in the City, County and State of New York. The prevailing party in any such litigation shall be entitled to recovery of all of its reasonable fees and expenses (including reasonable legal fees) incurred in such action.

| (32) | 1031 TAX FREE EXCHANGE. |

The parties each hereby acknowledges that both the Seller and Purchaser may be disposing of or acquiring, as applicable, the Premises as part of an Internal Revenue Code Section 1031 Tax Deferred Exchange. Each party hereunder agrees to assist and cooperate in such exchange for the benefit of the other party (the “Exchanging Party”) at no cost, expense or liability to such cooperating party and each party hereunder further agrees to execute any and all documents (subject to the reasonable approval of the such party’s legal counsel) as are reasonably necessary in connection with such exchange (except that the Purchaser shall not be required to take title to any property other than the Premises). In connection with implementing such tax free exchange by Seller, the Purchaser shall at the Closing pay the cash portion of the Purchase Price to the qualified intermediary designated by the Seller in writing. As a part of such exchange, the Seller shall transfer the Premises directly to the Purchaser and the Purchaser shall not be obligated to acquire or convey any other property as part of such exchange. Any Exchanging Party further agrees to indemnify and hold the other party harmless from and against any and all causes of action, claims, damages, losses, costs, expenses, obligations, and/or liabilities, including reasonable attorneys’ fees, resulting from such Exchanging Party’s participation in such exchange. This indemnification shall survive the Closing.

| (33) | DATES. |

To the extent any operative date under this Agreement is on a weekend or a national holiday, such date shall be extended to the next business day.

| (34) | RECORDING. |

Seller and Purchaser hereby agree, that this Contract or a memorandum as to this Contract, may not be recorded against the Premises.

| 22 |

| (35) | UTILITY METER. |

To the extent there are any separate water meters and/or submeters for the Premises, that are not specifically allocated for the leased space to the Tenant for which the Tenant is responsible to pay all such charges, the Seller shall cause a final reading of the meter to be undertaken, as close as possible, to the Closing and shall pay, at the Closing, the charges or escrow with the Title Company for payment, as set forth in the bill for such final meter reading. Any interim period between the date of the final reading and the Closing shall be adjusted between the parties. The provisions of this Section shall survive Closing.

| (36) | FINES FOR VIOLATIONS. |

Any actual fines, penalties and/or interest payments assessed for any violations against the Premises, environmental control board liens and judgments pertaining to the Premises and/or emergency repair liens assessed against the Premises shall on or prior to the Closing be paid, discharged or escrowed with the Title Company by the Seller.

| (37) | SURVIVAL. |

Any provisions contained in this Agreement which expressly survive the Closing shall inure to the benefit of and be binding upon the heirs, personal representations, successors and permitted assigns of the parties.

| (38) | CONSTRUCTION AGAINST WAIVER. |

No provision of this Agreement shall be deemed to have been abrogated or waived by reason of the failure to enforce the same, irrespective of the number of violations or breaches which may occur.

| (39) | COUNTERPARTS. |

This Agreement may be executed in any number of counterparts, each of which, when executed, shall be an original, and all of which, taken together, shall constitute one and the same instrument as if all parties hereto had executed the same instrument and any party or signatory hereto may execute this Agreement by signing any such counterpart.

| (40) | CAPTIONS. |

The captions used herein are inserted only as a matter of convenience and for reference and in no way define, limit or describe the scope of this Subscription Agreement or the intent of any provision hereof.

| 23 |

| (41) | SEVERABILITY. |

If any provision of this Agreement is held by a court of competent jurisdiction to be invalid, void, or unenforceable, the remainder of the provisions of this Agreement shall remain in full force and effect and shall in no way be affected, impaired or invalidated unless such invalidity, voidance or unenforceability prevents (i) the conveyance of the Condo Unit to Purchaser as contemplated by, and in the state of title, as required by this Agreement, or (ii) the payment of the Purchase Price to Seller, in which case this Agreement shall be null and void and neither party shall have any further rights or liabilities hereunder, except that the Seller shall instruct the Escrow Agent to refund the Downpayment to the Purchaser and the Purchaser shall actually receive a refund of the Downpayment (and any interest thereon).

| (42) | Third Party Rights. |

Nothing in this Agreement, express or implied, is intended to confer any rights or remedies whatsoever upon any person, other than Seller and Purchaser and their respective successors, assigns and transferees as permitted hereunder.

| (43) | Exhibits. |

Exhibits A through K attached hereto are hereby incorporated by reference and made a part of this Agreement.

| (44) | Changes by Attorneys. |

The parties hereto agree that any changes or additions to the Agreement may be initialed by the respective attorneys for the parties with the same force and effect as if initialed by the parties themselves.

| (45) | Form of Contract. |

Submission of this form of Agreement for examination shall not bind Seller in any manner or be construed as an offer to sell, and no contract or obligation of Seller shall arise until this Agreement is executed and delivered by both Seller and Purchaser and the Downpayment has been received and collected by the Escrow Agent.

| (46) | Interpretation of this Agreement. |

This Agreement shall be interpreted without the aid of any presumption against the party drafting or causing the drafting of the provision in question.

| (47) | Binding Signature by E-mail. |

The delivery of an executed copy of this Agreement by e-mail to the other party shall constitute a binding and enforceable agreement as to such party, without the necessity for the other party to receive an original signed copy of this Agreement.

| 24 |

| (48) | SECTION 3.14 AUDIT. |

Seller covenants and agrees to cooperate with Purchaser, both prior to and after the Closing, in connection with any and all reasonable information requests made by or on behalf of Purchaser, which are required to complete a so-called “Section 314 audit”, including, but not limited to providing the following (to the extent applicable and in Seller’s possession or control or is information which Seller can obtain without undue burden or unreasonable cost on Seller): (a) monthly historical income statements for the Premises for 2013; (b) monthly historical income statements for the Premises for 2014, year to date; (c) five (5) years of annual historical occupancy and rent for the Premises; (d) back-up and supporting documents relating to the items set forth herein (such as bills, checks, etc.); and (e) the most current financial statement for each of the Tenants to the extent such current financial statements are in the possession of Seller or its managing agent. In addition, Seller shall reasonably cooperate with Purchaser, at Purchaser’s sole cost and expense, both prior to and after the Closing, in connection with any and all information requests made by or on behalf of Purchaser, provided that such information is in Seller’s possession or control or which Seller can obtain without undue burden or unreasonable cost on Seller, relating to the Premises, including the books and records of the Premises. For the avoidance of doubt, Purchaser acknowledges that to the extent such information or documentation referred to above does not exist or is not in Seller’s possession or control, Seller shall not be required to recreate or obtain such documentation or information for Purchaser. The provisions of this Section 48 shall survive the Closing until the third (3rd) anniversary of the Closing to the extent requests are made by the Securities and Exchange Commission (“SEC”); provided, however, that nothing in this Section 48 shall obligate Seller to remain in existence or prevent the Seller from dissolving after the Closing (subject to Seller’s other obligations pursuant to this Agreement) or require Seller to incur costs in excess of minimal costs for Seller’s compliance with this Section 48. Notwithstanding the above cooperation agreed to by the Seller in order to assist the Purchaser to complete its Section 3.14 audit, any failure of the Seller to provide such information either before or after the Closing shall not, prior to the Closing, be a condition precedent for the Closing, entitle the Purchaser to delay the Closing and/or give the Purchaser the right to terminate this Agreement and/or after the Closing give the Seller any liability to the Purchaser for damages, except if such actions of the Seller are a willful and deliberate failure of Seller to provide any cooperation to the Purchaser hereunder.

[tHE REMAINDER OF THE PAGE IS INTENTIONALLY EMPTY]

| 25 |

IN WITNESS WHEREOF, Purchaser and the Seller have executed this Agreement as of the 4th day of June, 2014.

| SELLER: | ||

| Sagamore 54th St. Investments LLC and | ||

| Sagamore Arizona, LLC, as tenants in common | ||

| By: | /s/ Richard Saunders | |

| Name: Richard Saunders | ||

| Title: Authorized Signatory | ||

| PURCHASER: | ||

| NEW YORK CITY OPERATING PARTNERSHIP, L.P. | ||

| By: | American Realty Capital New York City REIT, Inc., its general partner | |

| By: | /s/ Michael Happel | |

| Name: Michael Happel | ||

| Title: President | ||

|

The undersigned acknowledges Receipt of the Downpayment of $700,000 and agrees to hold the proceeds thereof in accordance with the terms of Section 3 hereof. |

| By: | /s/ Philip Brody | |

| Philip Brody, Esq. |

| 26 |

SCHEDULE OF

EXHIBITS TO

agreement

| Exhibit A | Legal Description for Condo Unit |

| Exhibit B | Rent Roll for the Lease |

| Exhibit C | Permitted Title Exceptions |

| Exhibit D | Form of Assignment and Assumption of Lease and Security Deposit |

| Exhibit E | Form of Tenant Estoppel Certificate for the Tenant |

| Exhibit F | Form of Bill of Sale |

| Exhibit G | Wiring Instructions for the Downpayment |

| Exhibit H | Form of Deed |

| Exhibit I | Form of Escrow Agreement |

| Exhibit J | Form of Condominium Estoppel Certificate |

| Exhibit K | Certificate of Occupancy |

| 27 |

EXHIBIT A

Legal Description for Condo Unit

The condominium unit known as Unit No. C2 in the building designated as The Hit Factory Condominium, located at 421-429 West 54th Street, New York, New York, in the declaration establishing a plan for condominium ownership of said premises under Article 9-B of the real property law of the state of New York (the “New York Condominium Act”), dated December 18, 2006 and recorded in the Office of the Register of New York County (the “Register’s Office”) on January 18, 2007 in CRFN 2007000035128, as amended by First Amendment to Declaration of Condominium dated as of September 19, 2007 recorded October 4, 2007 in CRFN 2007000507368, and also designated as Tax Lot 1102 in Block 1064 of the borough of Manhattan on the tax map of the Real Property Assessment Department of the City of New York and on the floor plans of said building, certified by Arpad Baksa Architect, P.C., Architect, on January 18, 2007, and filed with the Real Property Assessment Department of The City of New York as Condominium Plan No. 1642, and also filed in the City Register’s Office on January 18, 2007, as Map No. CRFN 2007000035129.

Together with an undivided 17.173% interest in the common elements.

The premises within which such condominium unit is located are more particularly described as follows:

All that certain plot, piece or parcel of land, situate, lying and being in the Borough of Manhattan, City, County and State of New York, bounded and described as follows:

BEGINNING at a point on the northerly side of 54th Street, distant 300 feet westerly from the corner formed by the intersection of the westerly side of Ninth Avenue with the northerly side of 54th Street;

RUNNING THENCE northerly parallel with Ninth Avenue, 100 feet 5 inches to the center line of the block between 54th and 55th Street;

THENCE westerly along said center line of the block, 125 feet;

THENCE southerly again parallel with Ninth Avenue, 100 feet 5 inches to the northerly side of 54th Street; and

THENCE easterly along the northerly side of 54th Street, 125 feet to the point or place of BEGINNING.

| 28 |

EXHIBIT B

Rent Roll for the Lease

| 29 |

EXHIBIT C

Permitted Exceptions

The Premises shall be sold and conveyed to Purchaser and the Purchaser agrees to take title to the Premises subject to the following permitted exceptions (collectively “Permitted Exceptions”):

| 1. | Rights of tenants or persons in possession pursuant to the Lease, as tenant only without any right to purchase all or any portion of the Premises. |

| 2. | Any state of facts which an accurate survey might show, provided the same do not render title to the Premises unmarketable. |

| 3. | The terms and conditions of the Declaration and Bylaws for The Hit Factory® Condominium as such may be amended. |

| 4. | Consents of record by the Seller or any former owner of the Premises for the erection of any structure or structures on, under or above any street or streets which said Premises may abut, provided the same do not render title to the Premises unmarketable. |

| 5. | The lien of any real estate taxes, and/or water meter charges, sewer rents, and assessments not due and payable as of the Closing Date, provided that apportionment thereof is made as provided in this Agreement; |

| 6. | Building and zoning restrictions, regulations and ordinances heretofore and hereafter adopted by any public authority; |

| 7. | Rights, if any, of public utility companies of record to maintain vaults and chutes under the sidewalk and rights to the construction and maintenance of electric, gas, telephone and other utility cables, wires and appurtenances on the Premises and/or the Property provided they do not render title unmarketable; |

| 8. | Possible minor variations between the description of the Premises on the tax maps and in this Agreement; |

| 9. | Minor encroachments of stoops, cellar steps, trim and cornices, fences, sheds or other such structures, if any, upon any property adjoining the Premises and/or the Property, provided the Title Company will insure at standard rates that any such structures may remain undisturbed; |