Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Starwood Waypoint Homes | d773642d8k.htm |

| EX-99.1 - EX-99.1 - Starwood Waypoint Homes | d773642dex991.htm |

SECOND QUARTER

2014 Supplemental Operating & Financial Data

Exhibit 99.2

Starwood Waypoint Residential Trust (“SWAY”)

acquires,

renovates,

leases,

maintains

and

manages

single

family

homes.

We also invest in non-performing loans to supplement growth and seek optimal resolutions

for each loan. Our mission is to reinvent the home rental experience

by providing quality homes, great service and rewarding lease programs

that offer valuable benefits to our residents while generating attractive returns for our

investors. |

Table of

Contents Pages

ABOUT SWAY

1-6

FINANCIAL INFORMATION

Selected Financial & Other Information

7

Consolidated Balance Sheets

8

Consolidated Statements of Operations

9

FFO & Core FFO

10

NOI

11

CAPITAL MARKETS

12

PORTFOLIO INFORMATION

Total Rental Homes Portfolio

13-14

Leasing Statistics

15

Non-Performing Loan Portfolio

16

TRANSACTION ACTIVITY

17

DEFINITIONS AND RECONCILIATIONS

18-19 |

1

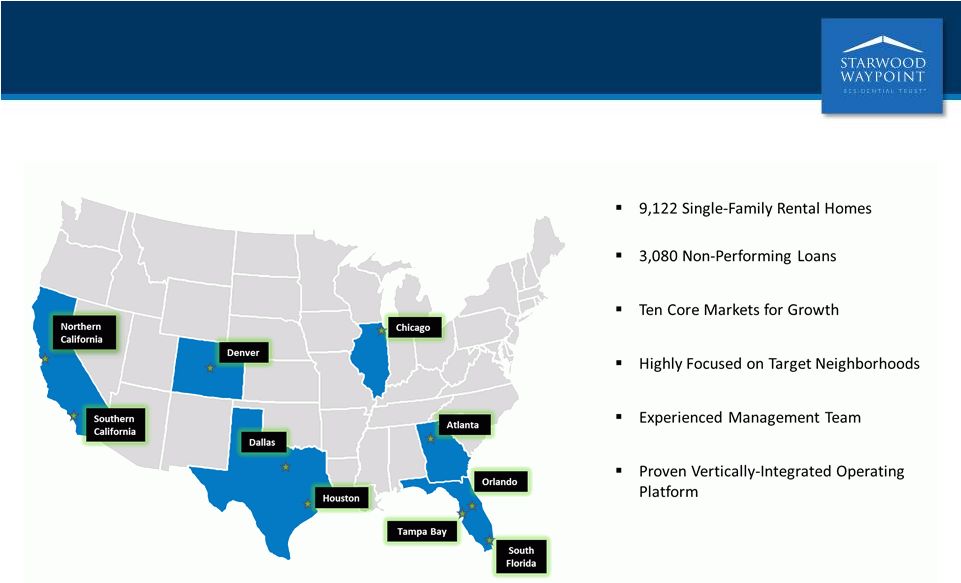

ABOUT SWAY

Attractive Markets for Growth |

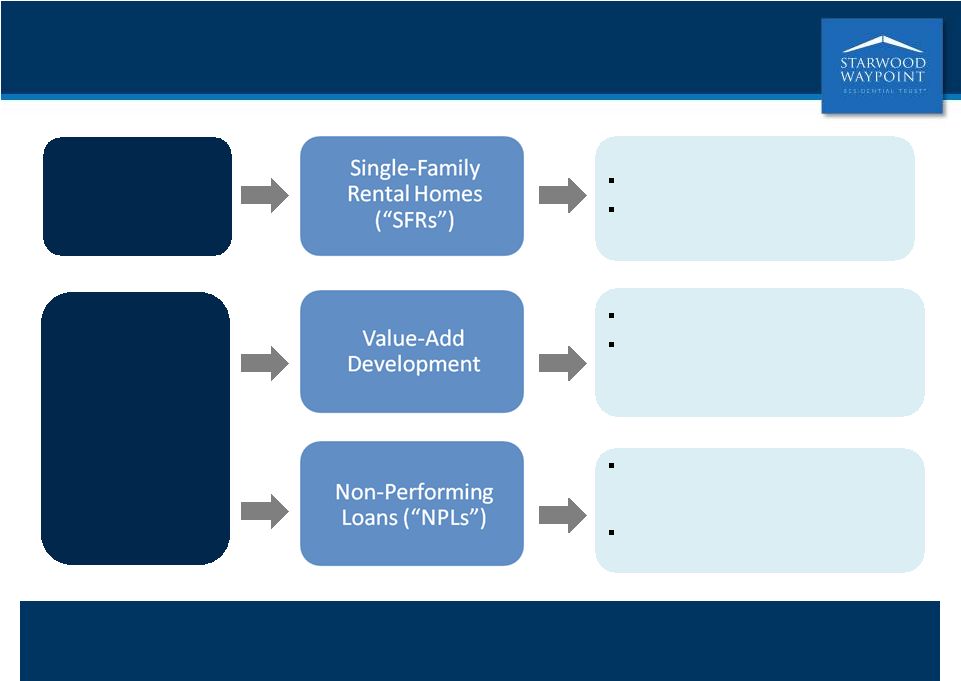

ABOUT

SWAY Hybrid Business Model

Stable cash flow from a growing SFR portfolio and income generated from our NPL business

supports our Board’s approval of an initial dividend.

2

Stability

Growth

Growing book of cash-flowing assets

Fully supports $0.14 per share dividend

Homes in renovation and lease-up phase

Provides meaningful upside

opportunities to enhance value and

downstream cash flow

Attractive channel to acquire SFRs at 20%-

30%

discount to broker price opinion

(“BPO”)

Alternative resolutions have potential for

high return on equity |

3

SFRs (77% of portfolio)

(1)

NPLs (23% of portfolio)

(1)

Number of Homes

(2)

9,122

Aggregate Investment ($mm)

(4)

$1,345

Aggregate Investment per Home

(4)

$147,434

Average Monthly Rent per Leased

Home

(5)

$1,416

Percent of Total Homes That Are

Leased (%)

77.5%

Percent of Homes Owned 180 Days or

Longer That Are Leased (%)

(7)

94.9%

Percent of 90+ Days Rent Ready

Homes That Are Leased (%)

(7)

98.8%

Number of Loans

(3)

3,080

Total Purchase Price ($mm)

$397.0

Total Unpaid Principal Balance (“UPB”) ($mm)

$681.7

Total BPO ($mm)

$635.3

Weighted Average Loan-to-Value (“LTV”)

(6)

135.8%

Purchase Price as a Percentage of UPB

58.2%

Purchase Price as a Percentage of BPO

62.5%

SWAY has a high quality and diverse portfolio of SFRs and NPLs

ABOUT SWAY

Portfolio Overview

Note: As of June 30, 2014.

(1)

(2)

(3)

(4)

(5)

(6)

(7)

Excludes 277 unsecured, second and third liens with an aggregate purchase price of $1.9

million. Based on

aggregate investment for SFRs and purchase price for NPLs. Excludes

285

homes

that

we

did

not

intend

to

hold

for

the

long

term.

Includes acquisition costs and actual and estimated upfront renovation costs. Actual renovation

costs may exceed estimated renovation costs, and we may acquire homes in the future with different characteristics that result

in higher renovation costs.

Represents average monthly contractual cash rent as of June 30, 2014. Average monthly

cash rent is presented before rent concession and credits (“Waypoints”). To date, rent concessions and Waypoints have been utilized

on a limited basis and have not had a significant impact on our average monthly rent. If

the use of rent concessions and Waypoints or other leasing incentives increases in the future, they may have a greater impact by

reducing the average monthly rent we receive from leased homes.

Weighted average LTV is based on the ratio of UPB to BPO weighted by UPB as of the respective

acquisition dates. References

to

“rent

ready

homes”

refer

to

homes

that

have

both

completed

renovations

and

been

deemed,

pursuant

to

an

inspection

from

one

of

our

agents,

to

be

in

a

condition

to

be

rented.

Our

policy

is

to

have

the

agent perform this inspection promptly after the renovations have been completed.

|

4

ABOUT SWAY

Q2 Highlights and Recent Developments

(1)

Portfolio

Growth

Increased SFR portfolio by 27% to 9,122 homes

Acquired a $117 million portfolio of 1,441 NPLs at 68.2% of BPO

Purchased 1,294 NPLs in August for $202 million at 72.2% of BPO

Estimated Net Asset Value (“NAV”) per share increased to $31.84; book value

per share of $27.97 as of June 30, 2014

Leasing

Momentum

180-Day Owned Portfolio: 94.9% up from 90.4% in Q1

90-Day Rent-Ready Portfolio: 98.8% up from 96.3% in Q1

Portfolio-wide lease percentage: 77.5% up from 76.6% in Q1

Grew SFR revenue 74% quarter-over-quarter

Expanded

Capacity

Upsized our two credit facilities by a total of $650 million in Q2

Raised $230 million in gross proceeds from convertible note offering (July)

Total

financing

capacity

now

$1.73

billion

with

convertible

debt

as

of

July

2014

Positive

Results

Achieved positive Q2 Core Funds from Operations (“FFO”) of $3.0 million or

$0.08 per share, an $8.5 million or $0.22 per share increase over reported Q1

SWAY Board approves initial dividend of $0.14 per share

Achieved stabilized net operating income (“NOI”) margin of 65.1%

(1)

Core FFO, NOI and Estimated NAV are non-GAAP measures. For a definition of

these non-GAAP measures, please refer to pages 18 and 19. |

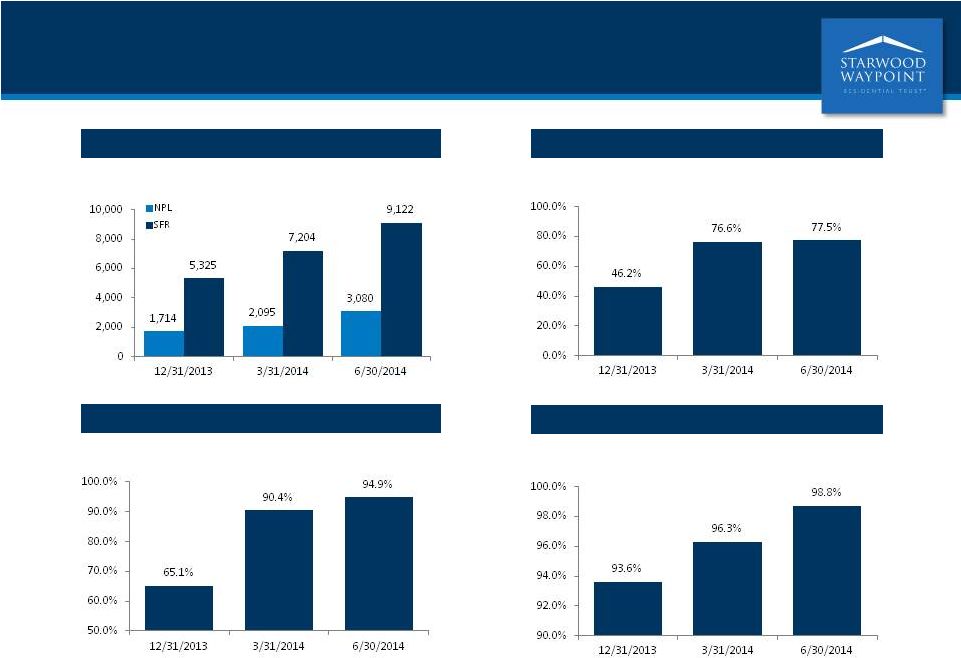

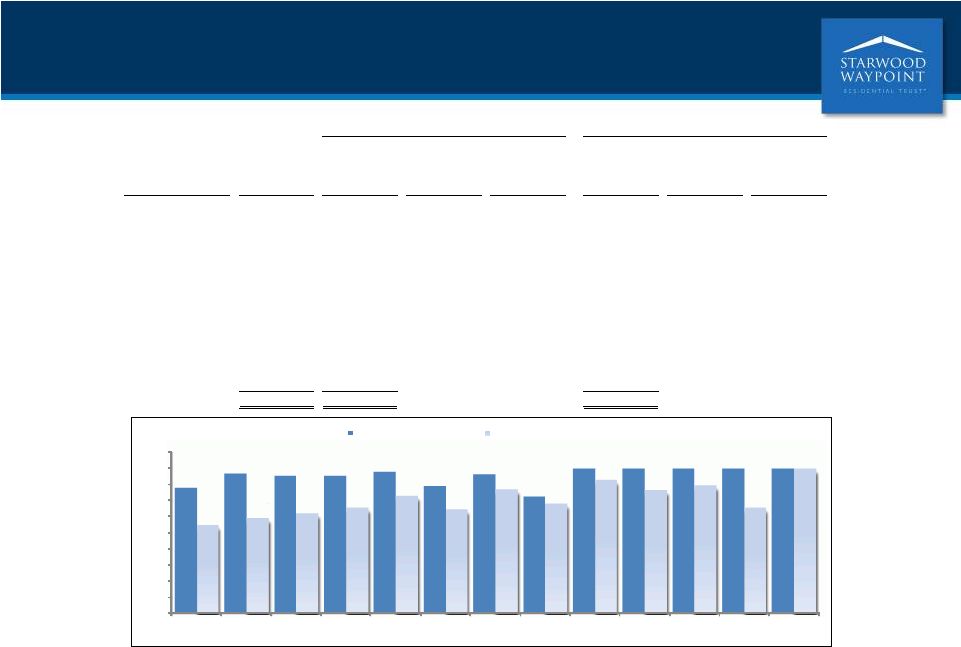

Total SFRs and NPLs

(1),(2)

% Leased: Total Rental Portfolio

5

ABOUT SWAY

Robust Growth, Well Executed

(1)

Excludes 285, 154, and 146 homes that we did not intend to hold for the long term as of June

30, 2014, March 30, 2014 and December 31, 2013, respectively. (2)

Excludes 277 unsecured, second and third liens as of June 30, 2014.

% Leased: Homes Owned 180 Days or Longer

% Leased: Homes 90 Days Past Rent Ready |

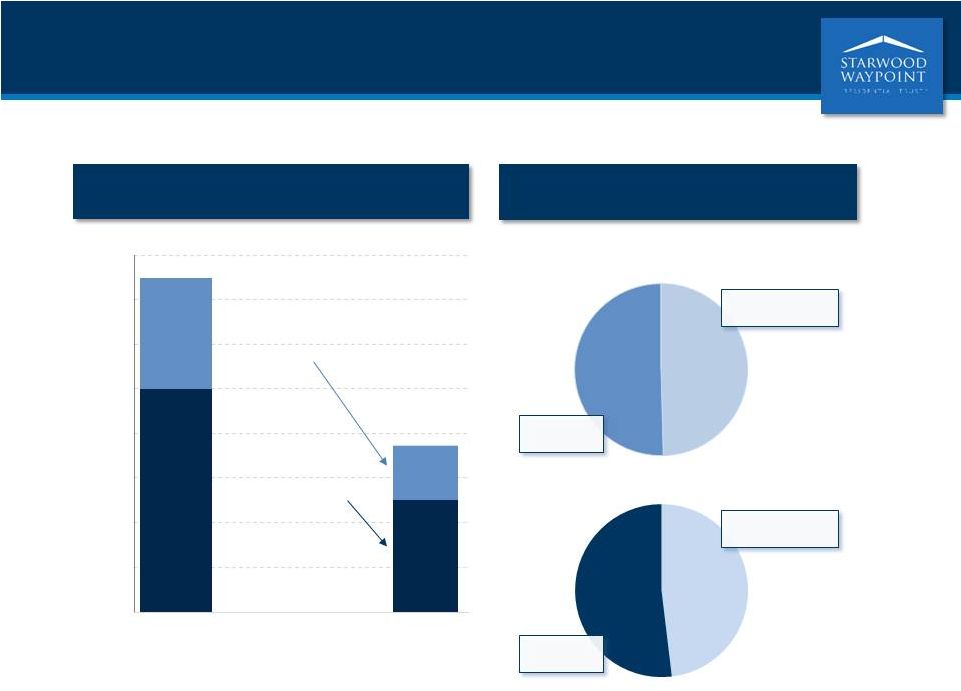

ABOUT

SWAY Financing Overview

Added $650 million of capacity, with $729

million undrawn as of June 30, 2014

2014 Financing Activity

(1)

Capacity

(1)

($ in millions)

Total

Capacity

Drawn NPL:

$252

million

Undrawn NPL:

$248

million

$519

$252

6

SFR Drawn:

$519

million

Undrawn SFR:

$481

million

(1)

As of June 30, 2014.

NPL

SFR

Upsized SFR Credit

Facility by $500 million

in Q2 to total capacity

of $1 billion

Upsized NPL Credit

Facility by $150 million

in Q2 to total capacity

of $500 million

$500

$1,000

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Drawn |

7

FINANCIAL INFORMATION

Selected Financial & Other Information

(1)

Please refer to page 18 for a definition of Core FFO. Core FFO is a non-generally

accepted accounting principle (“GAAP”) measure. For a reconciliation of Core FFO to net loss

attributable to common shareholders determined in accordance with GAAP, please refer to page

10. (2)

Stabilized portfolio NOI margin and Leased home portfolio NOI are non-GAAP measures. For a

reconciliation of stabilized portfolio NOI margin and leased home portfolio NOI to net

loss attributable to common shareholders determined in accordance with GAAP, please refer to

page 19. (3)

Please refer to page 18 for a definition of stabilized homes.

(4)

Excludes 285, 154, and 146 homes that we did not intend to hold for the long term as of June

30, 2014, March 30, 2014 and December 31, 2013, respectively. (5)

Three Months Ended

Six Months Ended

($ in thousands, except share and per share data)

June 30, 2014

June 30, 2014

(unaudited)

(unaudited)

Total revenues

34,332

$

55,833

$

Net loss attributable to common

shareholders (12,116)

$

(27,424)

$

Core FFO

(1)

2,978

$

(2,734)

$

Per

common

share

-

diluted

Net earnings attributable to common shareholders

(0.31)

$

(0.70)

$

Core FFO

(1)

0.08

$

(0.07)

$

Weighted Average Shares

Outstanding, Basic and Diluted 39,079,365

39,091,796

(2)

65.1%

62.3%

(2)

66.0%

63.9%

June 30, 2014

March 31, 2014

December 31, 2013

Home Count:

(3)

7,076

5,142

2,666

Non-stabilized homes

2,046

2,062

2,659

Total

Homes

(4)

9,122

7,204

5,325

Leased Percentages

(5)

95.0%

96.4%

91.6%

Homes 90 days past rent ready

98.8%

96.3%

93.6%

Homes owned 180 days or longer

94.9%

90.4%

65.1%

(4)

77.5%

76.6%

46.2%

As of

Stabilized homes

SWAY targets leased percentages on stabilized homes to be in the range of 94% to 96%.

Leased Home Portfolio NOI Margin

Stabilized Portfolio NOI Margin

Stabilized homes

Total rental portfolio |

8

FINANCIAL INFORMATION

Consolidated Balance Sheets

($ in thousands)

June 30, 2014

December 31, 2013

(unaudited)

ASSETS

Investments in real estate

Land

272,610

$

140,076

$

Building and improvements

1,170,016

604,839

Total investment in properties

1,442,626

744,915

Less: accumulated depreciation

(17,525)

(5,730)

Investment in real estate properties, net

1,425,101

739,185

Real estate held for sale, net

13,383

10,168

Total investments in real estate, net

1,438,484

749,353

Non-performing loans

178,311

214,965

Non-performing loans (fair value option)

218,797

-

Resident and other receivables, net

8,029

1,261

Cash and cash equivalents

17,151

44,613

Restricted cash

35,261

3,331

Deferred financing costs, net

13,318

-

Other assets

22,709

4,885

Total assets

1,932,060

$

1,018,408

$

LIABILITIES AND EQUITY

Liabilities:

Credit facilities

770,541

$

-

$

Accounts payable and accrued expenses

58,199

22,434

Resident security deposits and prepaid rent

11,742

3,918

Total liabilities

840,482

26,352

Equity:

Shareholders' equity:

Common shares, at par

391

-

Additional paid-in capital

1,117,026

1,018,267

Accumulated deficit

(26,503)

(27,848)

Total shareholders' equity

1,090,914

990,419

Non-controlling interests

664

1,637

Total equity

1,091,578

992,056

Total liabilities and equity

1,932,060

$

1,018,408

$

As of |

9

FINANCIAL INFORMATION

Consolidated Statements of Operations

($ in thousands, except share and per share data)

2014

2013

2014

2013

Revenues:

Rental revenues

23,602

$

2,889

$

37,367

$

4,013

$

Other property

revenues 890

64

1,369

105

Realized gain on non-performing loans, net

3,357

1,114

5,200

1,473

Realized

gain on loan conversions, net 6,483

-

11,897

-

Total revenues

34,332

4,067

55,833

5,591

Expenses:

Property operating and maintenance

7,791

1,161

13,823

1,711

Real

estate taxes and insurance 4,468

720

7,611

1,343

Mortgage

loan servicing costs 5,139

2,378

10,021

2,378

Non-performing loan management fees and expenses

1,871

1,575

4,286

2,425

General

and administrative 4,444

3,834

9,814

5,645

Share-based compensation

2,130

-

2,459

-

Investment management fees

3,993

-

6,750

-

Separation costs

-

-

3,543

-

Acquisition fees expensed and property management engagement costs

186

290

447

588

Interest expense, including amortization

5,191

-

6,691

-

Depreciation and amortization

7,243

767

12,716

1,424

Finance

related expenses and write-off of loan costs 5,441

-

5,441

-

Impairment of real estate

1,233

192

2,067

247

Total expenses

49,130

10,917

85,669

15,761

Loss before other income,

income tax expense and non-controlling interests (14,798)

(6,850)

(29,836)

(10,170)

Other income (expense)

Realized (loss) gain on sales of investments in real estate, net

(56)

578

(201)

665

Unrealized gain on non-performing loans, net

3,641

-

3,641

-

Loss on derivative financial instruments, net

(470)

-

(470)

-

Total other income (expense)

3,115

578

2,970

665

Loss before income tax expense and non-controlling interests

(11,683)

(6,272)

(26,866)

(9,505)

Income tax

expense 350

46

485

208

Net loss

(12,033)

(6,318)

(27,351)

(9,713)

Net (income) loss

attributable to non-controlling interests (83)

10

(73)

16

Net loss attributable to common shareholders

(12,116)

$

(6,308)

$

(27,424)

$

(9,697)

$

Net loss per share - basic

and diluted (0.31)

$

(0.16)

$

(0.70)

$

(0.25)

$

Number of shares

used in per share computations - basic and diluted 39,079,365

39,110,969

39,091,796

39,110,969

Six Months Ended June 30,

Three Months Ended June 30,

(unaudited)

(unaudited) |

10

FINANCIAL INFORMATION

FFO & Core FFO

(1)

(1)

Please refer to page 18 for definitions of FFO and Core FFO. Commencing with the three

months ended June 30, 2014, we have changed our definition of Core FFO to include

adjustments related to share-based compensation and exclude adjustments related to

acquisition pursuit costs. ($ in thousands, except share and per share data)

2014

2013

2014

2013

Reconciliation of net loss to FFO

Net loss attributable to common shareholders

(12,116)

$

(6,308)

$

(27,424)

$

(9,697)

$

Add (deduct) adjustments to net loss to

get to FFO: Depreciation and amortization on real estate assets

7,243

767

12,716

1,424

Non-controlling interests

83

(10)

73

(16)

Subtotal - FFO

(4,790)

(5,551)

(14,635)

(8,289)

Add (deduct) adjustments to

FFO to get to Core FFO: Share-based compensation

2,130

-

2,459

-

Separation costs

-

-

3,543

-

Acquisition fees expensed and property management engagement costs

186

290

447

588

Write-off of loan costs

5,032

-

5,032

-

Loss on derivative financial instruments, net

470

-

470

-

Amortization of derivative financial instruments cost

(50)

-

(50)

-

Core FFO

2,978

$

(5,261)

$

(2,734)

$

(7,701)

$

Core FFO per share - basic

and diluted 0.08

$

(0.13)

$

(0.07)

$

(0.20)

$

Weighted average shares

- basic and diluted 39,079,365

39,110,969

39,091,796

39,110,969

Six Months Ended June 30,

Three Months Ended June 30,

(unaudited)

(unaudited) |

11

FINANCIAL INFORMATION

NOI

(1)

(1)

Total Stabilized Portfolio NOI, Total Non-Stabilized Portfolio NOI, Total NPL NOI,

Total NOI and Total Leased Home Portfolio NOI are non-GAAP measures. For a reconciliation of these

non-GAAP measures to net loss attributable to common shareholders determined in accordance

with GAAP, please refer to Page 19.

(2)

Allowance for doubtful accounts (“bad debt”) is included in property operating and

maintenance in the consolidated statements of operations in accordance with GAAP. However,

we believe bad debt represents revenue lost and not an operating expense to the portfolio so

for purposes of calculating margins we treat bad debt as a reduction of revenue.

(3)

Property operating expenses is defined as property operating and maintenance expense plus real

estate taxes and insurance less bad debt.

(4)

Margin is calculated as total stabilized portfolio NOI or total leased home portfolio NOI

divided by total rental revenues.

($ in thousands, unaudited)

Stabilized

Portfolio

Non-Stabilized

Portfolio

NPL

Total

Stabilized

Portfolio

Non-Stabilized

Portfolio

NPL

Total

Revenues

Rental revenues

23,602

$

-

$

-

$

23,602

$

37,367

$

-

$

-

$

37,367

$

Less: Allowance for doubtful accounts

(2)

(614)

-

-

(614)

(1,123)

-

-

(1,123)

Total rental revenues

22,988

-

-

22,988

36,244

-

-

36,244

Other property revenues

890

-

-

890

1,369

-

-

1,369

Realized gain on non-performing loans, net

-

-

3,357

3,357

-

-

5,200

5,200

Realized gain on loan conversions, net

-

-

6,483

6,483

-

-

11,897

11,897

Unrealized gain on non-performing loans, net

-

-

3,641

3,641

-

-

3,641

3,641

Total revenues as adjusted

23,878

-

13,481

37,359

37,613

-

20,738

58,351

Expenses

Property operating expenses

(3)

8,919

2,726

-

11,645

15,022

5,289

-

20,311

Mortgage loan servicing costs

-

-

5,139

5,139

-

-

10,021

10,021

Total expenses

8,919

2,726

5,139

16,784

15,022

5,289

10,021

30,332

Total NOI

14,959

$

(2,726)

$

8,342

$

20,575

$

22,591

$

(5,289)

$

10,717

$

28,019

$

Stabilized portfolio NOI margin

(4)

65.1%

62.3%

Leased Home

Portfolio

Leased Home

Portfolio

Total stabilized portfolio NOI

14,959

$

22,591

$

Add: Property operating expenses on vacant stabilized homes

221

576

Total leased home portfolio NOI

15,180

$

23,167

$

Leased home portfolio NOI margin

(4)

66.0%

63.9%

Three Months Ended June 30, 2014

SFR

Six Months Ended June 30, 2014

SFR |

12

Capital Markets

(1)

Maturity dates include extension terms.

(2)

Please refer to page 18 for a definition of enterprise value.

As of June 30, 2014 ($ in thousands, except share and per share data)

Debt Maturities

(1)

Credit

Facility -

SFR

Credit

Facility -

NPL

Total

Security

Shares

Price

Value

2014

-

$

-

$

-

$

Common shares

39,007,239

26.21

$

1,022,380

$

2015

-

-

-

2016

-

251,599

251,599

2017

-

-

-

2018

518,942

-

518,942

Total debt to enterprise value

(2)

43.4%

Thereafter

-

-

-

Total debt to total assets

39.9%

Total

518,942

$

251,599

$

770,541

$

Weighted average interest rate

3.14%

3.15%

3.14%

Weighted average remaining maturity in years

3.6

2.2

3.1

Market equity

Debt

Debt Metrics |

13

PORTFOLIO INFORMATION

Total Rental Homes Portfolio –

June 30, 2014

(1)

Excludes 285 homes that we did not intend to hold for the long-term.

(2)

Includes acquisition costs and actual and estimated upfront renovation costs. Actual

renovation costs may exceed estimated renovation costs, and we may acquire homes in the

future with different characteristics that result in higher renovation costs.

Markets

Stabilized

Homes

Non-

Stabilized

Homes

Total

Homes

(1)

Total Homes

Leased (%)

Average

Acquisition

Cost per Home

Average

Investment

per Home

(2)

Aggregate

Investment

($ in millions)

Average

Home Size

(sq. ft.)

Weighted

Average

Age (year)

Average

Monthly Rent

Per Leased

Home

(3)

Atlanta

1,698

601

2,299

71.1%

95,551

$

117,265

$

269.6

$

1,909

22

1,155

$

South Florida

1,429

320

1,749

82.1%

133,741

$

158,740

$

277.7

1,588

44

1,557

$

Houston

959

190

1,149

79.5%

126,273

$

140,974

$

162.0

2,060

28

1,489

$

Tampa

763

209

972

83.2%

106,884

$

124,699

$

121.2

1,476

40

1,250

$

Dallas

662

253

915

70.5%

127,312

$

146,091

$

133.7

2,050

22

1,457

$

Chicago

316

139

455

76.0%

121,385

$

148,162

$

67.4

1,555

41

1,662

$

Denver

211

130

341

63.9%

183,932

$

212,859

$

72.6

1,512

31

1,708

$

Southern California

267

73

340

82.9%

235,913

$

247,210

$

84.1

1,617

36

1,791

$

Orlando

264

63

327

83.8%

118,158

$

137,110

$

44.8

1,644

37

1,295

$

Phoenix

206

42

248

83.9%

140,329

$

158,213

$

39.2

1,543

39

1,190

$

Northern California

218

26

244

89.3%

216,462

$

230,903

$

56.3

1,494

45

1,727

$

Las Vegas

42

-

42

95.2%

155,717

$

167,481

$

7.0

1,966

27

1,296

$

California Valley

41

-

41

100.0%

226,226

$

227,085

$

9.3

1,728

25

1,612

$

Total/Average

7,076

2,046

9,122

77.5%

127,087

$

147,434

$

1,344.9

$

1,760

32

1,416

$

Status

Total

Homes

(1)

Total Homes

Leased (%)

Average

Acquisition

Cost

Average

Investment

per Home

(2)

Aggregate

Investment

($ in millions)

Average

Home Size

(sq. ft.)

Weighted

Average Age

(year)

Leased

Rent

Stabilized

7,076

95.0%

127,126

$

146,053

$

1,033.5

1,746

32

1,413

$

Non-Stabilized

2,046

16.6%

126,952

$

152,210

$

311.4

1,811

32

1,482

$

Total/Average

9,122

77.5%

127,087

$

147,434

$

1,344.9

$

1,760

32

1,416

$

(3)

Represents average monthly contractual cash rent. Average monthly cash rent is presented

before rent concession and Waypoints. To date, rent concessions and Waypoints

have been utilized on a limited basis and have not had a significant impact on our average

monthly rent. If the use of rent concessions and Waypoints or other leasing incentives

increases in the future, they may have a greater impact by reducing the average monthly rent

we receive from leased homes.

$ |

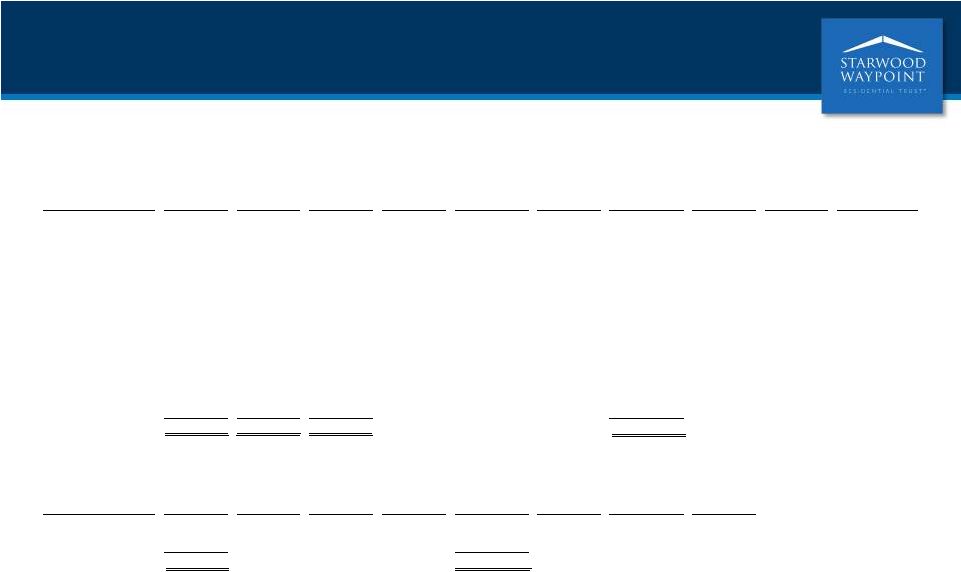

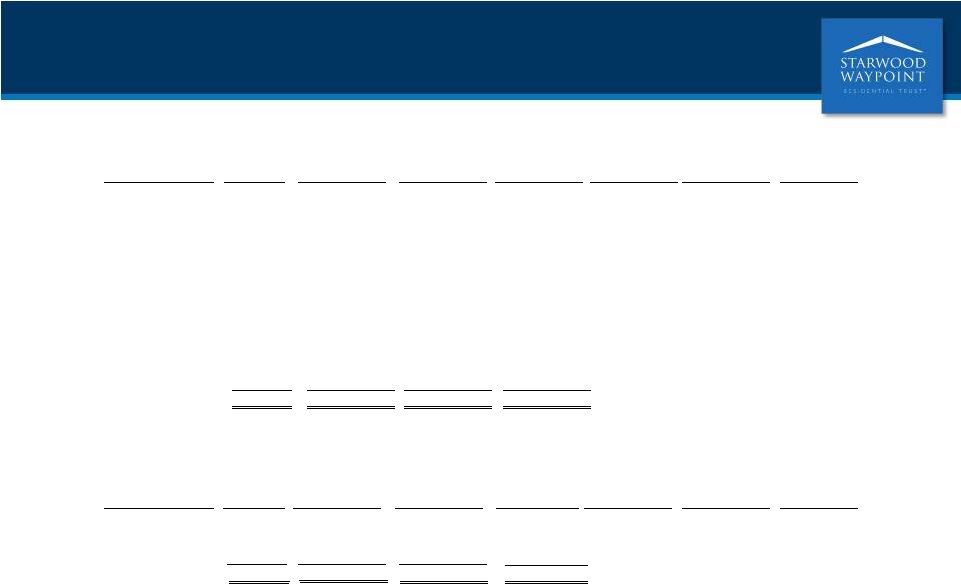

14

PORTFOLIO INFORMATION

Total Rental Homes Portfolio –

June 30, 2014 (cont’d)

$95.6

$133.7

$126.3

$106.9

$127.3

$121.4

$183.9

$235.9

$118.2

$140.3

$216.5

$155.7

$226.2

$21.7

$25.0

$14.7

$17.8

$18.8

$26.8

$29.0

$11.3

$18.9

$17.9

$14.4

$11.8

$0.9

$117.3

$158.7

$141.0

$124.7

$146.1

$148.2

$212.9

$247.2

$137.1

$158.2

$230.9

$167.5

$227.1

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

Atlanta

South

Florida

Houston

Tampa

Dallas

Chicago

Denver

Southern

California

Orlando

Phoenix

Northern

California

Las Vegas

California

Valley

Average Investment per Home ($ in thousands)

Average Acquisition Cost per Home

Estimated Renovation Costs |

Average

Average

Total

Monthly

Monthly

Number of

Number of

Percent

Rent per

Number of

Percent

Rent per

Markets

Homes

(1)

Homes

Leased

Leased Home

(2)

Homes

Leased

Leased Home

(2)

Atlanta

2,299

1,292

97.6%

1,140

$

1,213

93.0%

1,138

$

South Florida

1,749

1,143

99.4%

1,552

$

1,430

94.0%

1,553

$

Houston

1,149

759

99.1%

1,478

$

823

94.5%

1,470

$

Tampa

972

573

99.1%

1,229

$

654

95.2%

1,218

$

Dallas

915

481

99.6%

1,436

$

484

96.7%

1,422

$

Chicago

455

278

97.8%

1,653

$

261

95.0%

1,651

$

Denver

341

149

99.3%

1,700

$

161

97.5%

1,704

$

Southern California

340

230

96.5%

1,799

$

231

95.7%

1,814

$

Orlando

327

199

100.0%

1,308

$

222

98.6%

1,314

$

Phoenix

248

176

100.0%

1,181

$

152

97.4%

1,186

$

Northern California

244

192

100.0%

1,714

$

195

97.9%

1,706

$

Las Vegas

42

36

100.0%

1,309

$

42

95.2%

1,296

$

California Valley

41

37

100.0%

1,589

$

41

100.0%

1,612

$

Total/Average

9,122

5,545

98.8%

1,406

$

5,909

94.9%

1,413

$

Homes 90 Days Past Rent Ready

Homes Owned 180 Days or Longer

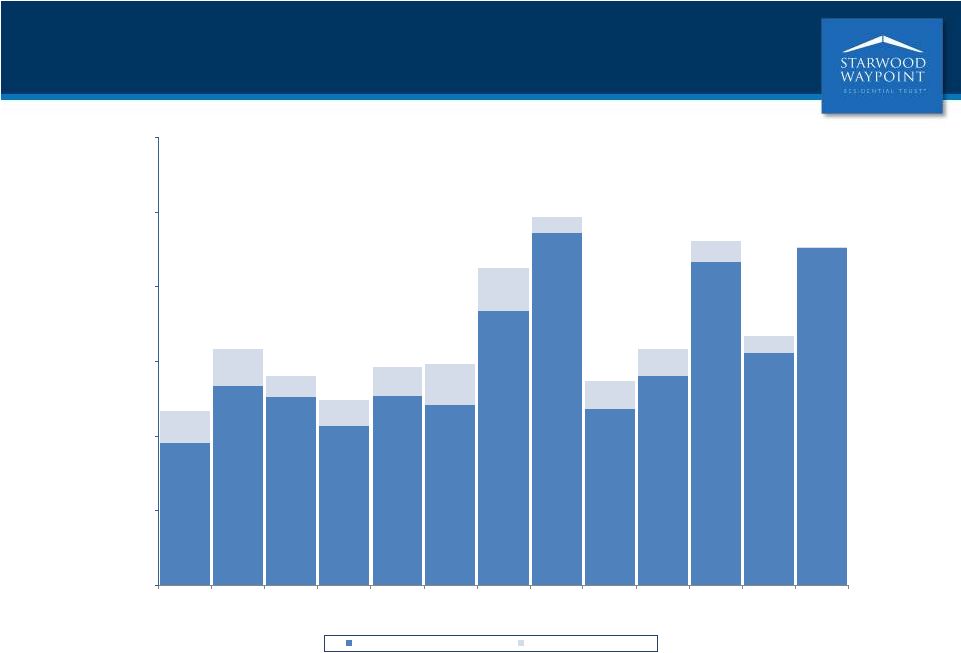

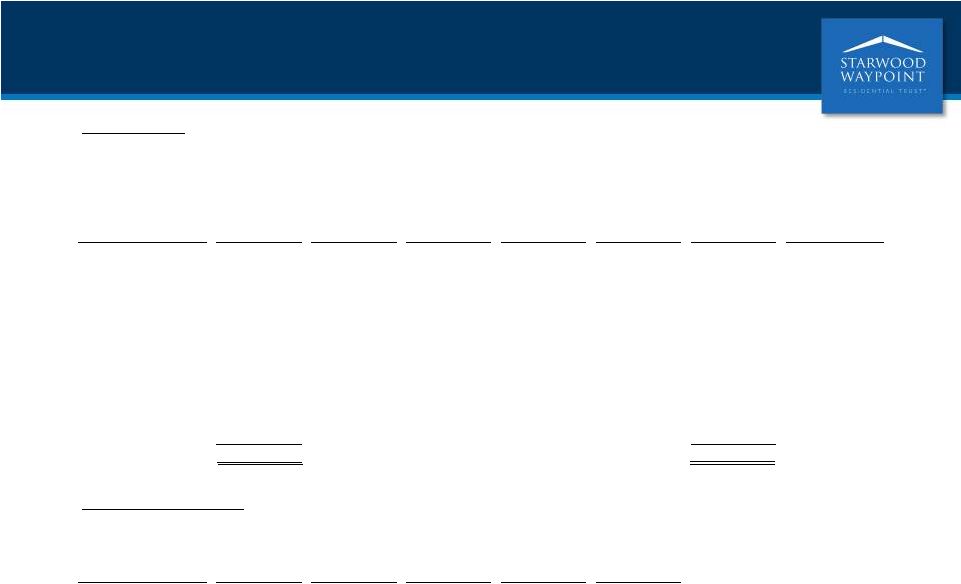

15

PORTFOLIO INFORMATION

Leasing Statistics –

June 30, 2014

97.6%

99.4%

99.1%

99.1%

99.6%

97.8%

99.3%

96.5%

100.0%

100.0%

100.0%

100.0%

100.0%

93.0%

94.0%

94.5%

95.2%

96.7%

95.0%

97.5%

95.7%

98.6%

97.4%

97.9%

95.2%

100.0%

82.0%

84.0%

86.0%

88.0%

90.0%

92.0%

94.0%

96.0%

98.0%

100.0%

102.0%

Atlanta

South Florida

Houston

Tampa

Dallas

Chicago

Denver

Southern

California

Orlando

Phoenix

Northern

California

Las Vegas

California

Valley

Homes 90 Days Past Rent Ready

Homes Owned 180 Days or Longer

(1)

Excludes 285 homes that we did not intend to hold for the long-term. (2)

Represents average monthly contractual cash rent. Average monthly cash

rent is presented before rent concession and Waypoints. To date, rent concessions and Waypoints have

been utilized on a limited basis and have not had a significant impact on our average monthly

rent. If the use of rent concessions and Waypoints or other leasing incentives increases

in the future, they may have a greater impact by reducing the average monthly rent we receive

from leased homes.

|

16

PORTFOLIO INFORMATION

Non-Performing Loan Portfolio –

June 30, 2014

Total

Loan

Purchase Price

Total UPB

Total BPO

Purchase Price

Purchase Price

Weighted

State

Count

(1),(2)

($ in millions)

($ in millions)

($ in millions)

as % of UPB

as % of BPO

Average LTV

(3)

Florida

762

94.4

$ 187.5

149.0

50.3%

63.3%

152.9%

Illinois

373

47.8

76.0

74.3

62.8%

64.3%

141.0%

Arizona

230

19.9

33.8

29.4

58.7%

67.5%

198.0%

Wisconsin

207

17.4

24.2

27.7

71.6%

62.8%

114.0%

New York

165

32.6

62.8

64.6

51.8%

50.4%

114.0%

California

148

42.9

60.8

68.6

70.6%

62.6%

100.4%

Indiana

152

10.8

15.1

17.1

71.9%

63.5%

109.8%

New Jersey

144

20.7

44.0

37.7

47.2%

54.9%

141.6%

Maryland

100

17.9

31.3

26.6

57.1%

67.1%

132.3%

Pennsylvania

74

6.9

11.7

10.5

58.8%

65.2%

137.7%

Georgia

65

8.0

13.2

12.2

60.8%

66.0%

131.0%

Other

660

77.7

121.3

117.6

64.1%

66.0%

124.4%

Total/Average

3,080

397.0

$ 681.7

635.3

58.2%

62.5%

135.8%

Total

Loan

Purchase Price

Total UPB

Total BPO

Purchase Price

Purchase Price

Weighted

Status

Count

(1),(2)

($ in millions)

($ in millions)

($ in millions)

as % of UPB

as % of BPO

Average LTV

(3)

Foreclosure

2,146

$ 285.5

$ 506.5

$ 457.2

56.4%

62.4%

137.4%

Delinquent

557

61.8

95.9

96.4

64.5%

64.1%

144.4%

Performing

377

49.7

79.3

81.7

62.6%

60.8%

115.3%

Total/Average

3,080

$ 397.0

$ 681.7

$ 635.3

58.2%

62.5%

135.8%

(1)

Represents first liens on 2,920 homes and 160 parcels of land. (2)

Excludes 277 unsecured, second and third liens with an aggregate purchase price

of $1.9 million.

(3)

Weighted average LTV is based on the ratio of UPB to BPO weighted by UPB for each state as of

the respective acquisition dates.

$

$

$

$ |

17

TRANSACTION ACTIVITY

Acquisitions –

Three Months Ended June 30, 2014

(1)

Includes acquisition costs and actual and estimated upfront renovation costs. Actual

renovation costs may exceed estimated renovation costs, and we may acquire homes in the

future with different characteristics that result in higher renovation costs. (2)

Estimated average monthly rent per home represents (1) for vacant homes,

management’s estimates of what rent would be generated if such homes were leased based on rents

estimated by examining multiple rent data sources (such as realized rents for comparable homes

in neighborhood, a proprietary rent setting algorithm, third-party vendors, etc.) and

using localized knowledge to establish rent for a given property and (2) for leased homes,

average monthly contractual rent. No assurance can be given that these estimates will

prove to be accurate, and you should not place undue reliance on them. Rental Homes:

Markets

Homes

Average Home

Size (sq. ft.)

Average

Acquisition

Cost per Home

Average

Estimated

Upfront

Renovation

Cost per Home

Average

Estimated

Investment

per Home

(1)

Aggregate

Investment

($ in millions)

Estimated

Average

Monthly

Rent per Home

(2)

Atlanta

514

2,013

104,084

$

24,404

$

128,489

$

66.0

$

1,220

$

Dallas

298

2,198

138,546

$

21,444

$

159,990

$

47.7

1,594

$

South Florida

272

1,685

149,994

$

32,316

$

182,310

$

49.6

1,730

$

Houston

219

2,044

126,776

$

22,095

$

148,872

$

32.6

1,572

$

Tampa

200

1,486

106,847

$

19,773

$

126,619

$

25.3

1,297

$

Denver

120

1,703

206,201

$

31,644

$

237,845

$

28.5

1,781

$

Chicago

109

1,528

114,382

$

35,399

$

149,781

$

16.3

1,664

$

Orlando

86

1,422

101,497

$

23,979

$

125,476

$

10.8

1,241

$

Southern California

52

1,649

225,980

$

18,514

$

244,494

$

12.7

1,888

$

Phoenix

45

1,475

128,498

$

28,740

$

157,237

$

7.1

1,202

$

Northern California

28

1,525

226,929

$

18,552

$

245,481

$

7.0

1,866

$

Total/Average

1,943

1,843

131,007

$

25,224

$

156,231

$

303.6

$

1,490

$

Non-Performing Loans:

Total

Purchase

Purchase

Purchase Price

Total UPB

Total BPO

Price as %

Price as %

Number of Loans

($ in millions)

($ in millions)

($ in millions)

of UPB

of BPO

1,441

$ 117.0

$

189.4

$ 171.6

61.8%

68.2% |

18

Definitions and Reconciliations

($ in thousands, except share and per share data)

Amount

Per Share

Investments in real estate properties, gross

1,442,626

$

36.98

$

Less: Accumulated depreciation

(17,525)

(0.44)

Add: Real estate held for sale,

net 13,383

0.34

Investments in real estate,

net 1,438,484

36.88

Add: Increase in estimated fair value of

investments in real estate 250,459

6.42

Less: Estimated renovation

reserve (155,551)

(3.99)

Estimated SFR Value

1,533,392

39.31

Non-performing loans

178,311

4.57

Non-performing loans

(fair value option) 218,797

5.61

Add: Increase in estimated

fair value of non-performing loans 56,076

1.44

Estimated NPL Value

453,184

11.62

Estimated SFR & NPL Value

1,986,576

$

50.93

$

Total shareholders' equity

1,090,914

$

27.97

$

Less: Investments in real estate, net

(1,438,484)

(36.88)

Less: Non-performing loans

(178,311)

(4.57)

Less: Non-performing loans

(fair value option) (218,797)

(5.61)

Add: Estimated SFR & NPL

Value 1,986,576

50.93

Estimated NAV

1,241,898

$

31.84

$

Number of Shares

39,007,239

June 30, 2014

(unaudited)

or as measures of profitability or liquidity. Further, not all real estate investment trusts

(“REITs”) compute the same non-GAAP measure; therefore, there can be no

assurance that our basis for computing this non- GAAP measure is comparable with

that of other REITs. Funds From Operations (“FFO”) and Core FFO.

FFO is used by industry analysts and investors as a supplemental performance measure of an

equity REIT. FFO is defined by the National Association of Real Estate Investment

Trusts (“NAREIT”) as net income or loss (computed in accordance with GAAP)

excluding gains or losses from sales of previously depreciated real estate assets,

plus depreciation and amortization of real estate assets and adjustments for

unconsolidated partnerships and joint ventures.

We believe that FFO is a meaningful supplemental measure of the operating performance of our

single- family home business because historical cost accounting for real estate

assets in accordance with GAAP assumes that the value of real estate assets diminishes

predictably over time, as reflected through depreciation. Because real estate values

have historically risen or fallen with market conditions, management considers FFO an

appropriate supplemental performance measure because it excludes historical cost

depreciation, as well as gains or losses related to sales of previously depreciated homes,

from GAAP net income. By excluding depreciation and gains or losses on sales of real estate,

management uses FFO to measure returns on its investments in real estate assets.

However, because FFO excludes depreciation and amortization and captures neither the

changes in the value of the homes that result from use or market conditions nor the

level of capital expenditures to maintain the operating performance of the homes, all

of which have real economic effect and could materially impact our results from operations,

the utility of FFO as a measure of our performance is limited.

We believe that Core FFO is a meaningful supplemental measure of our operating performance

for the same reasons as FFO and adjusting for non-routine items that when excluded

allows for more comparable periods. Our Core FFO begins with FFO as defined by the

NAREIT White Paper and is adjusted for: share- based compensation,

non-recurring costs associated with the separation, acquisition fees expensed and

property management engagement costs, write-off of loan costs, loss on derivative

financial instruments, amortization of derivative financial instruments cost and

other non-comparable items as applicable. Management also believes that FFO/Core FFO, combined with the required GAAP presentations, is

useful to investors in providing more meaningful comparisons of the operating

performance of a company’s real estate between periods or as compared to other

companies. FFO/Core FFO does not represent net income or cash flows from operations as

defined by GAAP and is not intended to indicate whether cash flows will be sufficient

to fund cash needs. It should not be considered an alternative to net income as an indicator

of the REIT’s operating performance or to cash flows as a measure of liquidity. Our

FFO/Core FFO may not be comparable to the FFO of other REITs due to the fact that not

all REITs use the NAREIT or similar Core FFO definition. For a reconciliation of FFO

and Core FFO to net loss attributable to common shareholders determined in accordance

with GAAP, please refer to page 10.

occupancy or subsequent occupancy after a renovation. Homes are considered stabilized

even after subsequent resident turnover. However, homes may be removed from the

stabilized home portfolio and placed in the non-stabilized home

portfolio due to renovation during the home lifecycle.

We define Estimated NAV as the estimated value of all assets net of

liabilities. To calculate the Estimated NAV, the historical net investments in real estate and

NPLs at carrying value are deducted from total shareholders’ equity and the

Estimated SFR Value and NPL Value are added (see table below). The costs of

selling properties in the portfolio, including commissions and other related costs are

not deducted for the purpose of calculating the Estimated SFR Value and Estimated NAV.

Further, future promoted interests on the NPL portfolio are not deducted for the

purpose of calculating Estimated SFR & NPL Value and Estimated NAV. We consider

Estimated NAV to be an appropriate supplemental measure as it illustrates the estimated

imbedded value in our SFR portfolio and NPL portfolio that is carried on our balance

sheet primarily at cost. The Estimated SFR Value, Estimated NPL Value and Estimated NAV

are non-GAAP financial measures. However, they are provided for informational

purposes to be used by investors in assessing the value of the assets. A reconciliation

of total shareholders’ equity to Estimated NAV is provided below.

These metrics should be considered along with other available information in valuing and

assessing us, including our GAAP financial measures and other cash flow and yield

metrics. These metrics should not be viewed as a substitute for book value, net

investments in real estate, equity, net income or cash flows from operations prepared

in accordance with GAAP, non-controlling interests less cash and cash

equivalents. Enterprise Value. We define

enterprise value as market value of equity plus debt plus We define the stabilized home

portfolio to include homes from the first day of initial Stabilized Homes.

Estimated

NAV. |

19

Definitions and Reconciliations (cont’d)

Total NOI, Total NPL NOI, Total Non-Stabilized Portfolio NOI, Total Stabilized Portfolio

NOI and Total Leased Home Portfolio NOI. We define Total NOI as

total revenues less property operating and maintenance expenses and real

estate taxes and insurance expenses (“property operating expenses”) and

mortgage loan servicing costs. We define Total NPL Portfolio NOI as gains on NPLs, net

and gains on loan conversions, net less mortgage loan servicing costs. We define Total Non-

Stabilized Portfolio NOI as total revenues on the non-stabilized portfolio less property

operating expenses on the non-stabilized portfolio. We define Total

Stabilized Portfolio NOI as total revenues on the stabilized portfolio less property

operating expenses on the stabilized portfolio. We define Total Leased Home Portfolio

NOI as the Total Stabilized Portfolio NOI less property operating expenses on vacant

stabilized homes. We consider these NOI measures to be appropriate supplemental

measures of operating performance to net income attributable to common shareholders

because they reflect the operating performance of our homes without allocation of

corporate level overhead or general and administrative costs and reflect the operations

of the segments and sub-segments of our business. A reconciliation of net loss

attributable to common shareholders to these NOI measures is provided below:

These NOI measures should not be considered alternatives to net loss or net cash flows from

operating activities, as determined in accordance with GAAP, as indications of our

performance or as measures of liquidity. Although we use these non-GAAP measures

for comparability in assessing their performance against other REITs, not all REITs

compute the same non-GAAP measures. Accordingly, there can be no assurance that

our basis for computing these non-GAAP measures are comparable with that of other

REITs. Total Rental Portfolio. We define total

rental portfolio to exclude homes designated as non-rental.

Non-rental homes are homes we do not intend to hold for the long term.

Three Months Ended

Six Months Ended

($ in thousands, unaudited)

June 30, 2014

June 30, 2014

Reconciliation of net loss to stabilized portfolio NOI and leased home

portfolio NOI

Net loss attributable to common shareholders

$

(12,116) $

(27,424)

Add (deduct) adjustments to get to total NOI

Non-performing loan management fees and expenses

1,871

4,286

General and administrative

4,444

9,814

Shared-based compensation

2,130

2,459

Investment management fees

3,993

6,750

Separation costs

-

3,543

Acquisition fees expensed and property management engagement costs

186

447

Interest expense, including amortization

5,191

6,691

Depreciation and amortization

7,243

12,716

Finance related expenses and write-off of loan costs

5,441

5,441

Impairment of real estate

1,233

2,067

Realized loss (gain) on sales of investments in real estate, net

56

201

Loss on derivative financial instruments, net

470

470

Income tax expense

350

485

Net income attributable to non-controlling interests

83

73

Total NOI

20,575

28,019

Add (deduct) adjustments to get to total stabilized home portfolio NOI

NPL portfolio NOI components:

Realized gain on non-performing loans, net

(3,357)

(5,200)

Realized gain on loan conversions, net

(6,483)

(11,897)

Mortgage loan servicing costs

5,139

10,021

Unrealized gain on non-performing loans, net

(3,641)

(3,641)

Deduct: Total NPL portfolio NOI

(8,342)

(10,717)

Non-stabilized portfolio NOI components:

Property operating expenses on non-stabilized homes

2,726

5,289

Add: Total Non-stabilized portfolio NOI

2,726

5,289

Total stabilized portfolio NOI

14,959

22,591

Add (deduct) adjustments to get to total leased home portfolio NOI

Property operating expenses on vacant stabilized homes

221

576

Total leased home portfolio NOI

15,180

$

23,167

$

|

Forward-Looking Statements

The statements herein that are not historical facts are forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve significant risks and

uncertainties, which are difficult to predict, and are not guarantees of future performance.

Such statements can generally be identified by words such as “anticipates,”

“expects,” “intends,” “will,” “could,” “believes,” “estimates,” “continue,” and similar expressions. Forward-looking statements are

based on certain assumptions, discuss future expectations, describe future plans and

strategies, contain financial and operating projections or state other

forward-looking information. Our ability to predict results or the actual effect of future events, actions, plans or strategies is inherently

uncertain. Although we believe that the expectations reflected in such forward-looking

statements are based on reasonable assumptions, our actual results and performance

could differ materially from those set forth in, or implied by, the forward-looking statements. Factors that could materially

and adversely affect our business, financial condition, liquidity, results of operations and

prospects, as well as our ability to make distributions to our shareholders, include,

but are not limited to: expectations regarding the timing of generating revenues; changes in our business and growth

strategies; volatility in the real estate industry, interest rates and spreads, the debt or

equity markets, the economy generally or the rental home market specifically; events or

circumstances that undermine confidence in the financial markets or otherwise have a broad impact on financial

markets; declines in the value of homes, and macroeconomic shifts in demand for, and

competition in the supply of, rental homes; the availability of attractive investment

opportunities in homes that satisfy our investment objective and business and growth strategies; the impact of changes to the

supply of, value of and the returns on distressed and non-performing residential mortgage

loans; our ability to convert the homes and distressed and non-performing

residential mortgage loans we acquire into rental homes generating attractive returns; our ability to successfully modify or otherwise

resolve distressed and non-performing residential mortgage loans; our ability to lease or

re-lease our rental homes to qualified residents on attractive terms or at all; the

failure of residents to pay rent when due or otherwise perform their lease obligations; our ability to manage our portfolio of rental

homes; the concentration of credit risks to which we are exposed; the availability, terms and

deployment of short-term and long-term capital; the adequacy of our cash

reserves and working capital; our relationships with Starwood Capital Group and our manager and their ability to retain

qualified personnel; potential conflicts of interest; unanticipated increases in financing and

other costs; our expected leverage; changes in governmental regulations, tax laws and

rates and similar matters; limitations imposed on our business and our ability to satisfy complex rules in order

for us to qualify as a REIT for U.S. federal income tax purposes; and estimates relating to

our ability to make distributions to our shareholders in the future. You should not

place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above,

as well as those more fully discussed in reports and other documents filed by us with the

Securities and Exchange Commission from time to time. Furthermore, except as required

by law, we are under no duty to, and we do not intend to, update any of our forward-looking statements appearing

herein, whether as a result of new information, future events or otherwise.

|