Attached files

| file | filename |

|---|---|

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - PEAK PHARMACEUTICALS, INC. | ctco_ex211.htm |

| EX-10.13 - SERVICES AGREEMENT - PEAK PHARMACEUTICALS, INC. | ctco_ex1013.htm |

| EX-10.14 - INDUSTRIAL HEMP REGISTRATION LICENSE - PEAK PHARMACEUTICALS, INC. | ctco_ex1014.htm |

| EX-10.12 - FARM LEASE AND SERVICE AGREEMENT - PEAK PHARMACEUTICALS, INC. | ctco_ex1012.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): August 8, 2014

|

CANNABIS THERAPY CORP.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

005-87668

|

26-1973257

|

||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

4450 Arapahoe Avenue, Suite 100

Boulder, CO

|

80303

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

303.415.2557

(Registrant’s telephone number, including area code)Copy to:

Scott Rapfogel, Esq.

Crone Kline Rinde LLP

488 Madison Avenue, 12th Floor

New York, NY 10022

(Former name and address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Page

|

|||||

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

3 | ||||

|

EXPLANATORY NOTE

|

4 | ||||

|

ITEM 5.06.

|

CHANGE IN SHELL COMPANY STATUS.

|

5 | |||

|

DESCRIPTION OF BUSINESS

|

6 | ||||

|

DESCRIPTION OF PROPERTIES

|

18 | ||||

|

RISK FACTORS

|

18 | ||||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

27 | ||||

|

FINANCIAL STATEMENTS

|

27 | ||||

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

27 | ||||

|

EXECUTIVE COMPENSATION

|

35 | ||||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

39 | ||||

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLSOURE

|

40 | ||||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

40 | ||||

|

MARKET PRICE OF AND DIVIDENDS ON COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

42 | ||||

|

RECENT SALES OF UNREGISTERED SECURITIES

|

44 | ||||

|

DESCRIPTION OF SECURITIES

|

45 | ||||

|

LEGAL PROCEEDINGS

|

47 | ||||

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

47 | ||||

|

ITEM 9.01.

|

FINANCIAL STATEMENTS AND EXHIBITS.

|

47 | |||

2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report (the “Report”) contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development, marketing and sale of our cannabis based products including those for the prevention and treatment of inflammatory and auto-immune diseases, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the accuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our ability to obtain adequate financing, cash flows and resulting liquidity, our ability to expand our business, government regulations, lack of diversification, our ability to penetrate the intended markets for our products, our ability to negotiate economically feasible agreements with third party service providers, increased competition, results of any arbitration and litigation, stock volatility and illiquidity, and our ability to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

3

EXPLANATORY NOTE

We were incorporated as Surf A Movie Solutions, Inc. in Nevada on December 18, 2007, to engage in the business of the development, sale and marketing of online video stores. We were not successful in our efforts and discontinued this line of business. Since that time and until recently, we have been a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)).

On August 30, 2013 we changed our name to Frac Water Systems, Inc. and on October 10, 2013 we determined to engage in the business of providing economically and environmentally sound solutions for the treatment and recycling of wastewater resulting principally from oil and gas exploration and production activities. On December 31, 2013 we determined not to move forward with this line of business.

In early March 2014 we determined to enter into the business of developing, manufacturing, marketing and selling pharmaceutical level products containing phytocannabinnoids, an abundant and pharmaceutically active component of cannabis, for the treatment of various conditions and diseases. From March 2014 to the present we have acted on our business plan and commenced material business operations. See Item 5.06 below.

In connection with our new business, on March 17, 2014 we changed our name to Cannabis Therapy Corporation and on March 24, 2014 we change our trading symbol to “CTCO.”

On March 10, 2014 Soren Mogelsvang, Cohava Gelber, Guy Yachin and Vered Caplan were appointed as directors of ours and effective March 11, 2014 Soren Mogelsvang was appointed as our Chief Executive Officer. Effective May 1, 2014 Mr. Mogelsvang was appointed as our President. Our officers and directors have extensive experience as biotech and biomedical executives, entrepreneurs or researchers.

As used in this Report, unless otherwise stated or the context clearly indicates otherwise, the terms “Cannabis Therapy,” the “Company,” the “Registrant,” “we,” “us,” and “our” refer to Cannabis Therapy Corp. (formerly known as Frac Water Systems, Inc. and Surf A Movie Solutions, Inc.), incorporated in Nevada, and its wholly owned subsidiary, Peak BioPharma Corp., a Colorado corporation.

This Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

Prior to August 8, 2014, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act”). As a result of the milestones achieved by us during the period March 10, 2014 through August 8, 2014, we have ceased to be a shell company. The information contained in this Report, together with the information contained in our Annual Report on Form 10-K for the fiscal year ended September 30, 2013, and our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as filed with the SEC, constitute the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

4

ITEM 5.06. CHANGE IN SHELL COMPANY STATUS.

We are actively engaged in the business of developing, manufacturing, marketing and selling pharmaceutical level products containing phytocannabinoids for the treatment of various conditions and diseases and are no longer a shell company. Since March 2014 we have achieved the following milestones:

|

Ÿ

|

March 2014: engagement of a management team with extensive experience as biotech and biomedical executives, entrepreneurs and researchers;

|

|

Ÿ

|

March 2014 – present: raising $815,000 in working capital through sales of our common stock;

|

|

Ÿ

|

March 31, 2014: establishment of corporate headquarters and operations in Boulder, Colorado;

|

|

Ÿ

|

May 1, 2014: execution of a Farm Lease and Service Agreement with Rocky Mountain Hemp Inc. and Ryan Loflin under which we are growing industrial hemp in Colorado and actively developing hemp seed genetics;

|

|

Ÿ

|

May 16, 2014: obtaining an Industrial Hemp License from the Colorado Department of Agriculture;

|

|

Ÿ

|

June 26, 2014: execution of a Services Agreement with Caerus Discovery, LLC, a biotech company which will be providing us with contract research services intended to support product development and design of our proposed anti-inflammatory and autoimmune disease prevention and alleviation products while out laboratory is being established in Colorado; and

|

|

Ÿ

|

July 29, 2014: execution of a License Agreement with Canna-Pet, LLC a company which develops, produces and sells medical cannabis products made from hemp and low tetrahydrocannabinol cannabis plants which are intended exclusively for consumption by pets, under which we received a perpetual, exclusive worldwide license to use Canna-Pet, LLC’s intellectual property and produce and sell products based thereon.

|

5

DESCRIPTION OF BUSINESS

Since early March 2014 we have been operating as a bio-pharmaceutical and neutraceutical company seeking to develop, manufacture, market and sell safe, high quality, medicinal products extracted from low tetrchydrocannabinoid (“THC”) cannabis plants. THC is the primary psychoactive ingredient in cannabis that produces a “high” effect. Our initial focus will be (i) the exploitation of the exclusive license we received from Canna-Pet, LLC, a developer of ingestible health products for pets made from hemp, and (ii) developing over-the-counter, THC-free, cannabis based products for the prevention and alleviation of the symptoms associated with inflammatory and auto-immune diseases. Using US-grown hemp, a low THC cannabis plant, we intend to develop, market and sell products containing non-psychotropic phytocannabinoids.

History

As described above, we were incorporated in Nevada as Surf A Movie Solutions, Inc. on December 18, 2007 to engage in the business of the development sale and marketing of online video sales. We were not successful in our efforts and discontinued this line of business. Since that time and until August 8, 2014, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act). On August 30, 2013 we changed our name to Frac Water Systems, Inc. and on October 10, 2013 we determined to engage in the business of providing economically and environmentally sound solutions for the treatment and recycling of wastewater resulting principally from oil and gas exploration and production activities. On December 31, 2013 we determined not to move forward with this line of business.

In early March 2014 we determined to enter into the business of developing, manufacturing and marketing pharmaceutical level products containing phytocannabinnoids, an abundant and pharmaceutically active component of cannabis, for the treatment of various conditions and diseases. In connection therewith, on March 17, 2014 we changed our name to Cannabis Therapy Corporation and on March 24, 2014 changed our trading symbol on OTC Markets to “CTCO”.

We currently have authorized 350,000,000 shares of capital stock, consisting of (i) 325,000,000 shares of common stock, and (ii) 25,000,000 shares of “blank check” Preferred Stock.

On August 15, 2012 our board of directors and stockholders owning a majority of our outstanding common shares authorized a 50 for 1 forward stock split of our common stock. The forward split became effective on September 27, 2012. As a result of the forward split each outstanding share was split into 50 shares. On March 11, 2014 our board of directors authorized a 1.5 for 1 forward stock split of our common stock in the form of a dividend. In connection therewith, our shareholders of record as of the close of business on March 28, 2014 received an additional .5 share of our common stock for each share of our common stock held by them on such date. The forward stock split became effective on April 1, 2014. All share amount references in this Report give retroactive effect to the forward stock splits.

Our principal executive offices are located at 4410 Arapahoe Avenue, Suite 100, Boulder, CO 80303. Our telephone number is 303.415.2557. Our primary website address is www.cannabistherapy.com.

6

Our Business

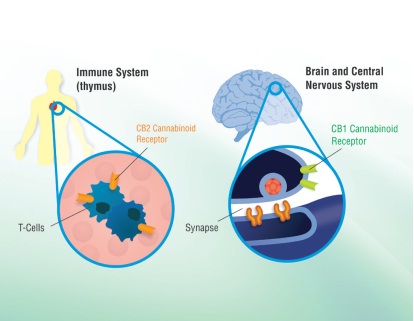

Since March 2014 we have been engaged in the business of developing and marketing low tetrahydrocannabinoid (“THC”) or THC free cannabis based medicinal products intended for over-the-counter sale via distribution networks applicable to products classified as nutraceuticals. By using U.S. grown hemp, a low THC content cannabis plant, we expect to be able to develop and market products containing cannabinoids under the same rules that apply to hemp-based energy drinks and other hemp based products. Hemp-based products have been legal in the U.S. for several years when manufactured with imported, THC-free hemp paste. Recently, hemp cultivation was legalized in 11 states, including Colorado, and, on a limited basis, at the federal level as part of the Agricultural Act of 2014 (the “2014 US Farm Bill”) passed in February 2014, which sets the agricultural product apart from marijuana. Industrial hemp has THC content below 0.3% compared to the 1-20% typically found in marijuana. The levels of non-THC medicinal cannabinoids are expected to vary between different hemp strains, and can be increased and optimized by plant breeding. One of our goals is to develop proprietary hemp strains containing improved medicinal properties and to establish third party product validation. Our initial focus is the leveraging of our Canna-Pet license under which we will produce and sell hemp based animal health products (see “Canna-Pet License Agreement”) and the development of products for the prevention and alleviation of the symptoms associated with inflammatory and auto-immune diseases. We have particular interest in cannabis-derived phytocannabinoids which can exert their different effects through the CB1 and CB2 cannabinoid receptors in the human body (see figure below). These receptors are triggered both by endogenous human cannabinoids, the endocannabinoids, and plant-derived phytocannabinoids, such as those extracted from cannabis plants. The CB1 and CB2 receptors are part of the endocannabinoid system, which is important for homeostasis and human health. CB1 receptors are primarily found in the brain and throughout peripheral nerves and the autonomic nervous system. These receptors have been associated with the anticonvulsive effects of cannabis. CB2 receptors localize primarily to immune cells and the spleen, and are thought to account for the anti-inflammatory and other therapeutic effects of cannabis.

7

We are planning to extract and develop non-psychotropic phytocannabinoids which have anti-inflammatory effects. We intend to use distinct extraction methods to enrich the phytocannabinoids and will then test them in different laboratory inflammation models. Scaleup manufacturing and production will be in compliance with the regulations for nutraceuticals.

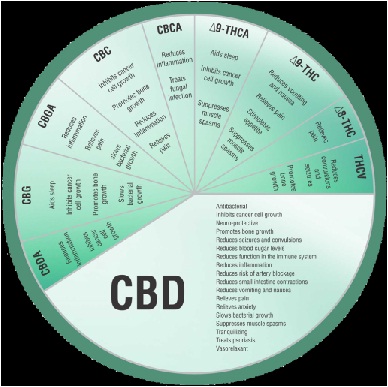

Phytocannabinoids are a class of plant-derived cannabinoids that can be isolated from the cannabis plant. More than 85 different phytocannabinoids have been described and fall into 8 classes of compounds, of which tetrahydrocannabinol (THC), Cannabidiol (CBD) and Cannabinol (CBN) are the best characterized. Accumulating scientific evidence supports the therapeutic properties of CBD, which is reported to be effective in easing symptoms of a wide range of conditions, including rheumatoid arthritis, diabetes, alcoholism, post-traumatic stress disorder, epilepsy, antibiotic-resistant infections and neurological disorders and in particular pain mitigation. The figure above summarizes different pharmacodynamic effects attributed to different phytocannabinoids.

8

In addition to the leveraging of our Canna-Pet license, our plan is to establish a vertically integrated operation in Colorado by the fourth quarter of 2014. The operation is expected to consist of three business units: (i) Plant Growth / Hemp Cultivation, (ii) Extraction and Testing, and (iii) Sales and Marketing. Each unit will have unique infrastructure, licensing and staffing requirements, and are expected to offer separate revenue streams while supporting our product development and sales.

Plant Growth / Hemp Cultivation

Hemp is an industrial plant related to marijuana. Fiber from the plant is used to make paper, clothing, rope and other products. Its oil is found in body-care products such as lotion, soap and cosmetics and in a variety of foods, including energy bars, waffles, milk-free cheese, veggie burgers and bread. Numerous uses exist, including hemp plant extracts that are used as a medicine, nutritional supplements and food sources. Beyond this, applications into textiles, building materials, bio-fuels, paper, bio-plastics, livestock feed/bedding as well as personal care products are readily available. Both hemp and marijuana are classified under the same biological category of Cannabis L Sativa. The basic difference between the two is that marijuana has significant amounts of tetrahydrocannabinoil (THC) (5–20%), a psychoactive ingredient; whereas hemp has virtually no THC (less than 0.3%). The 0.3% or less THC found in hemp is too low to provide the psychoactive effect or “high” that supports recreational usage.

9

In May 2014 we entered into an exclusive land lease and crop service agreement with Rocky Mountain Hemp Inc., a southeastern Colorado based hemp grower, and are currently growing hemp for the purpose of extracting and testing non-THC cannabinoids for product formulations (see “Farm Lease and Service Agreement”). We are also exploring relationships with cannabis breeders with the goal of developing proprietary hemp strains with improved medicinal properties. Within the next 12 months, we intend to start an indoor plant-breeding and cultivation program to develop new and proprietary strains with superior features, such as a high extractable cannabinoid content and improved anti-inflammatory properties.

We expect to harvest our first outdoor hemp crop in the third calendar quarter of 2014 and, in parallel, expect to outsource indoor hemp cultivation to local growers. In a second phase, we plan to lease an indoor grow facility and equip this facility for state-of-the-art hemp cultivation. The mandatory Colorado Department of Agriculture hemp cultivation license was obtained on May 6, 2014, to enable our outdoor crop cultivation. The licensing process for indoor cultivation will be initiated once the facility plans are completed and is expected to be swift based on our experience with the Colorado Department of Agriculture application process, although no assurance can be given that this will prove to be the case. A full-time gardener with soil and hydroponic cultivation experience will be hired to oversee the day-to-day operations of the plant growth facility. The required capital investment to equip the grow facility will be significant, with lease, seed and salary costs representing the majority of the operating costs. No assurance can be given that we will have available capital as and when needed for this purpose. We estimate requiring $150,000 for the first year of indoor hemp cultivation.

We estimate that our plant growth facility will have potential to produce four crops annually, with a total annual yield of approximately 500 pounds of high cannabinoid content plant material. Excess hemp material (fibrous plant parts) may be sold for industrial use, potentially providing a secondary revenue stream.

Extraction and Testing

In June 2014 we entered into a Services Agreement with Caerus Discovery, LLC pursuant to which we have outsourced our present laboratory and research requirements (see “Research Services Agreement”).

We intend to establish a fully operational in-house laboratory by the end of the first quarter of 2015. Our laboratory will serve multiple functions relating to CBD extraction, separation and characterization, as well as in-house quality control testing. It is expected that it will enable us to develop a proprietary, patentable, chemical extraction process platform that will drive new product development although no assurance can be given that this will prove to be the case. Quality control and validation systems are expected to be established in parallel, and as the laboratory expands, these capabilities may be offered to outside companies as a fee-for-service product, enabling a service-based revenue stream.

Our laboratory will operate under biopharma methods and standards, and will seek certification as soon as feasible. This will differentiate our laboratory, its services and cannabinoid products, from the majority of the cannabis industry, providing what we believe to be a significant competitive advantage. Our laboratory will also provide the necessary infrastructure to support collaborative work with scientists at the University of Colorado and elsewhere, with the goal of expanding our assets and developing intellectual property. Our laboratory will be an established wet laboratory facility to which we intend to add the specific extraction, testing and characterization equipment required for phytocannabinoid extraction, purification, product formulation and characterization. A fulltime process chemist will be hired to oversee the extraction, purification and testing activities. External consultants will be retained to start the process of gaining quality certification and whenever additional expertise is required for product development. Subsequently, a full time laboratory technician will be hired to help with routine tasks, and to run cell based and ex vivo assays for prototype product testing. It will require significant capital expenditures to establish these unique capabilities, with the equipment cost alone estimated at approximately $400,000. Lease options will be pursued to minimize capital expenditures.

10

As outlined above, our laboratory is intended to support our main business of manufacturing and marketing pharmaceutical level cannabis-based products for the treatment of various inflammatory and autoimmune conditions. In addition, the laboratory will enable activities such as cannabis strain improvement; cannabinoid extraction process development, product development and testing; biomarker identification; and development of mold and pest detection kits. We expect the laboratory to be fully operational by the end of the first calendar quarter of 2015 and we will, in the interim, when necessary and possible, outsource specific research tasks.

Business Development

Our Business Development unit will be responsible for branding, product marketing and sales, as well as for providing market intelligence to support product design and specifications. Another aspect will be to explore the feasibility of expanding our product offerings beyond those containing cannabinoids by structuring original equipment manufacturer or licensing arrangements with domestic and/or international herbal extract manufacturers.

In the near term, a business development person or consultant will be retained to assist with branding, messaging and development of a marketing strategy for the Canna-Pet brand and our future products. For Canna-Pet, the targets will include end-users, veterinarians and pet stores. For our in-house developed products and nutraceuticals, the goal will be to position us for an anticipated product launch in the next 18-24 months. Earlier launch of laboratory services and raw material distribution is anticipated, and we will work closely with the Colorado cannabis companies to establish channels for our products and laboratory services. In parallel, we intend to develop a long-term business and growth strategy, expanding our presence and product availability nationally and internationally, aiming to use existing distribution networks.

Target Markets

Our primary focus is to develop over-the-counter, ultra-low and THC-free, cannabis-based products for prevention and treatment of inflammatory and autoimmune diseases. The products are intended to be safe to use by adult and pediatric patient populations, and will be targeted to the over-the-counter and neutraceutical markets.

Pending market analysis and a detailed study of the cannabinoid literature along with input from key opinion leaders and clinicians, one or two inflammatory indications will be selected for targeted product development and product testing. Our management has extensive experience in conducting non-human based safety and efficacy testing, and will apply this expertise to support its product development and marketing. We anticipate developing several product lines including encapsulated extracts for oral administration, dermatological salves for topical application, and possibly teas and flavored beverages or edibles although no assurance can be given that this will prove to be the case.

We also intend to leverage our intellectual property license agreement with Canna-Pet, LLC under which we will procure and sell medical cannabis products made from hemp and low THC cannabis plants which are intended exclusively for consumption by pets. See “Canna-Pet License Agreement.”

11

Strategic Partnerships and Alliances

We are actively pursuing additional collaborations and partnerships with Colorado-based cannabis growers and breeders, as well as certified testing labs for third party product validation. When President Obama signed into law the 2014 US Farm Bill containing a stipulation that allows universities in the states that permit industrial hemp cultivation to conduct research into the plant, without jeopardizing their federal funding, it enabled a new era of academic cannabis research. At the University of Colorado, the Cannabis Genomic Research Initiative, is mapping the cannabis genome. We are exploring collaboration with the University of Colorado to support our cannabis development efforts and to create new intellectual property. Other US research institutions are conducting cannabis research and clinical trials with cannabis-based medicines, and we intend to pursue strategic partnerships with these researchers.

Farm Lease and Service Agreement

On May 1, 2014, we entered into a Farm Lease and Service Agreement (the “Lease Agreement”) with Rocky Mountain Hemp Inc. and Ryan Loflin (collectively, the “Landlord”) under which we leased two acres of farmland on which we are growing industrial hemp. Under the Lease Agreement, the Landlord is serving as our Cultivation Director and providing us with Landlord’s hemp cultivation expertise. In addition to the growing of hemp we are trying to develop proprietary hemp strains containing improved medicinal properties. In connection with the growing of hemp, we obtained an Industrial Hemp License from the Colorado Department of Agriculture on May 16, 2014. The license expires on April 15, 2015, and is subject to annual renewal. The Lease Agreement has a five month term and can be renewed by us, in our discretion, for up to six additional five-month terms. We are paying lease payments to the Landlord under the Lease Agreement of $6,000 per month.

Research Services Agreement

On June 26, 2014, we entered into a Services Agreement (the “Services Agreement”) with Caerus Discovery, LLC, (“Caerus”) a biotech company, whereby Caerus will be providing us with research services for the purpose of executing specific, specialized cell-based assays and animal studies intended to support product development and design of our proposed anti-inflammatory and autoimmune disease prevention and alleviation products. In connection therewith, we will be supplying Caerus with confidential materials and information including, but not limited to, intellectual property, know-how, data, test results, written materials and similar information (collectively, the “Materials and Information”). The research services will be conducted within Caerus’s laboratories by Caerus’s trained personnel. All patents, patent applications, trademarks, trade names, inventions, copyrights, know-how, and trade secrets (collectively, the “IP Rights”) related to the Materials and Information and arising thereunder will be owned by us. Similarly, if Caerus develops or discovers any development, invention, improvement, modification, product, use, method, technique, conception, know-how, technical data, specification, information, or result relating to any Materials and Information, including new substances (collectively, the “Developments”), Caerus will execute any assignments necessary to transfer title thereto to us. We will have sole responsibility, at our expense, for the preparation filing, prosecution and maintenance of patent applications and rights related to Developments and results of the services provided to us by Caerus. Pursuant to the Services Agreement we have granted to Caerus a non-exclusive, royalty free license, without the right to grant sublicenses, in any IP Rights and Developments for the limited purpose of conducting the services under the Services Agreement. Our Materials and Information is being protected under the confidentiality provisions of the Services Agreement. Caerus will invoice us for rendered services on a project by project basis with payment due within 30 days thereof. The scope and approximate cost of each project will be defined and agreed upon prior to the start of each project. The Services Agreement will terminate upon the earlier of (i) completion of all requested services; (ii) 30 days after we supply Caerus with written notices of termination; or (iii) June 30, 2015.

12

Cohava Gelber, one of our directors, is the Chief Executive Officer, President, and Principal Equity Holder of Caerus. Soren Mogelsvang, our President, Chief Executive Officer and a director previously served as Caerus’ Vice President of Research and Development.

Canna-Pet License Agreement

On July 29, 2014, through our wholly-owed subsidiary, Peak BioPharma Corp., we entered into a License Agreement (the “License Agreement”) with Canna-Pet, LLC, (“Licensor”) a Washington limited liability corporation, which owns the brand name “Canna-Pet” and certain related intellectual property including, but not limited to, trademarks and copyrights, formulations, recipes, production processes and systems, websites, domain names, customer lists, supplier lists, trade secrets and know-how, and other related intellectual property (collectively, the “Licensed Intellectual Property”), used by Licensor in the conduct of its business related to the production and sale of medical cannabis products made from hemp and low THC cannabis plants which are intended exclusively for consumption by pets. Pursuant to the License Agreement, Licensor granted to us a perpetual, exclusive, world-wide license to use the Licensed Intellectual Property in conjunction with our business and the production and sale of medical cannabis products made from hemp and low THC cannabis plants as well as the right to sublicense the Licensed Intellectual Property to third parties. The License Agreement gives us the right to produce and sell existing products utilizing the Licensed Intellectual Property and to develop new products, jointly with Licensor or otherwise, based upon the Licensed Intellectual Property. The License Agreement provides us with an immediate revenue source and access to Licensor’s customer base. During the term of the license, all intellectual property rights in and to the Licensed Intellectual Property remain the exclusive property of Licensor.

In consideration of the grant of the license, we have agreed to pay Licensor license fees in the form of royalty payments calculated on the basis of gross proceeds received by us from sales of products manufactured, marketed or sold by us utilizing the Licensed Intellectual Property or any subsequently developed intellectual property which is jointly owned by us and Licensor.

The royalty will be calculated and paid by us on a quarterly basis using calendar quarters ending March 31, June 30, September 30, and December 31 each year and will be equal to fifteen percent (15%) of the first $1,000,000 of gross proceeds received by us during the quarter and ten percent (10%) on gross proceeds in excess of $1,000,000 received by us during the quarter. On or before the date, which is 45 days following the end of each calendar quarter, we will calculate the amount of the royalty due to Licensor for that quarter and will make payment in full of such amount to Licensor. For purposes of calculating the amount of royalty due for each quarter, “gross proceeds” will not include amounts received by us as payments for any and all taxes, duties, governmental charges, sales expenses, freight or shipping charges, and the like.

Commencing in 2015, we have agreed to pay Licensor guaranteed minimum royalty amounts based upon the gross proceeds received by us from the sale of products (the “License Based Products”) utilizing the Licensed Intellectual Property or subsequently developed jointly owned intellectual property. The guaranteed minimum royalty payments are as follows:

13

|

Time Period

|

Minimum Annual License Fee

|

|||

|

January 1, 2015 through December 31, 2015

|

(1) | |||

|

January 1, 2016 through December 31, 2016

|

(2) | |||

|

January 1, 2017 through December 31, 2017

|

(2) | |||

|

January 1, 2018 through December 31, 2018

|

(2) | |||

|

January 1, 2019 through December 31, 2019

|

(2) | |||

|

January 1, 2020 through December 31, 2020, and all succeeding years

|

(3) | |||

|

(1)

|

Calculated based on gross proceeds equal to twice the verifiable sales of License Based Products for the calendar year ended December 31, 2014, with royalties equal to 15% on gross proceeds of up to $4,000,000 for the year and 10% on gross proceeds in excess of $4,000,000.

|

|

(2)

|

Calculated based on gross proceeds equal to 115% of the amount of gross proceeds used to calculate the minimum royalty for the prior calendar year ended December 31.

|

|

(3)

|

The minimum annual royalty payment for the calendar year beginning January 1, 2020 and for all subsequent calendar years will be equal to the minimum annual royalty payment calculated for the calendar year ended December 31, 2019.

|

All royalty payments made by us during any calendar year will be credited against the minimum annual royalty amounts due and payable by us for such year. In the event that the aggregate amount of royalties payable by us for any calendar year are not sufficient to satisfy our minimum annual royalty payment obligation for that year, we will be obligated to pay the unpaid balance of the minimum royalty amount to Licensor on or before February 28 of the following year.

Licensor has agreed to defend, at its own expense, any action against Licensor or us based on a claim that the Licensed Intellectual Property infringes a US or foreign patent, a US or foreign copyright or involves misappropriation of a trade secret.

The License Agreement may be terminated

|

Ÿ

|

by mutual consent of us and Licensor;

|

|

Ÿ

|

by us, upon 90 days prior written notice to Licensor;

|

|

Ÿ

|

by Licensor, upon written notice to us if any of the following events occur:

|

14

|

(i)

|

our failure to pay Licensor royalty payments within fifteen (15) days after we receive written notice that payment is overdue, provided that there is no good faith dispute over the fees or charges; or

|

|

(ii)

|

our failure to pay the minimum annual royalty payment for any year within fifteen (15) days after we receive written notice that payment is overdue, provided that there is no good faith dispute over the total amount due; or

|

|

(iii)

|

any breach by us of any material term or obligation of the License Agreement if not remedied within thirty (30) days after we receive written notice of such breach, provided that this time will be extended to the extent we have made a good faith effort to resolve any such breach; or

|

|

(iv)

|

we are acquired by another entity and our successor is unwilling to assume our obligations under the License Agreement, or refuses to enter into an Assumption of Obligations Agreement; or

|

|

(v)

|

we cease doing business as a going concern.

|

Our right to use the Licensed Intellectual Property ceases upon termination of the License Agreement.

In the event intellectual property is developed jointly by us and Licensor (including any development by us using the Licensed Intellectual Property) during the performance of the License Agreement, the ownership of such intellectual property will be determined according to principles of United States patent law. In such event, the parties have agreed to negotiate in good faith towards an intellectual property management agreement to define their respective rights and obligations with respect to legal protection, payment of expenses, licensing and infringement of any intellectual property which is jointly owned by the parties. Any party that does not bear its proportionate share of expenses in securing and maintaining patent protection on jointly owned intellectual property in any particular country or countries will be required to surrender its joint ownership under any resulting patents in such country or countries.

Our Business Strategy

Our business strategy is to develop and market safe, non psychoactive cannabis based medicinal products and to become a global leader in the research, development, manufacturing, testing and marketing of cannabis based therapies. We intend to do so by employing rigorous biopharma processes and quality controls to manufacture safe, hemp based products and to target the nutraceutical market which offers a shorter path to commercialization than prescription drugs, which require FDA approval. No assurance can be given that we will be successful in this endeavor.

Government Regulation

Hemp

For the first time since 1937, industrial hemp has been decriminalized at the federal level and can be grown legally in the United States, but only on a limited basis. A landmark provision in the 2014 US Farm Bill recognizes hemp as distinct from its genetic cousin, marijuana. Federal law now exempts industrial hemp from U.S. drug laws in order to allow for crop research by universities, colleges and state agriculture departments. The federal law allows for agricultural pilot programs for industrial hemp in states that permit the growth or cultivation of hemp.

15

Marijuana

Marijuana is a Schedule-I controlled substance and is illegal under federal law. Even in those states in which the use of marijuana has been legalized, its use remains a violation of federal laws. A Schedule I controlled substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety for use under medical supervision and a high potential for abuse. If the federal government decides to enforce the Controlled Substances Act in Colorado with respect to marijuana, persons that are charged with distributing, possessing with intent to distribute, or growing marijuana could be subject to fines and terms of imprisonment, the maximum being life imprisonment and a $50 million fine.

As of July 7, 2014, 23 states and the District of Columbia allow its citizens to use medical marijuana. Additionally, voters in the states of Colorado and Washington approved ballot measures in November 2013 to legalize marijuana for adult use.

The federal Controlled Substances Act, makes marijuana use and possession illegal on a national level. The Obama administration has effectively stated that it is not an efficient use of resources to direct law federal law enforcement agencies to prosecute those lawfully abiding by state-designated laws allowing the use and distribution of medical marijuana. However, there is no guarantee that the administration will not change its stated policy regarding the low-priority enforcement of federal laws. Additionally, any new administration that follows could change this policy and decide to enforce the federal laws strongly. Any such change in the federal government’s enforcement of current federal laws could cause significant financial damage to us. While we do not intend to harvest cannabis plants with high THC content or, distribute or sell cannabis, we may be irreparably harmed by a change in enforcement by the Federal or state governments.

Despite the Obama administration’s statements, the Department of Justice has stated that it will continue to enforce the Controlled Substances Act with respect to marijuana in Colorado to prevent:

|

Ÿ

|

the distribution of marijuana to minors;

|

|

Ÿ

|

criminal enterprises, gangs and cartels receiving revenue from the sale of marijuana;

|

|

Ÿ

|

the diversion of marijuana from states where it is legal under state law to other states;

|

|

Ÿ

|

state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity;

|

|

Ÿ

|

violence and the use of firearms in the cultivation and distribution of marijuana;

|

|

Ÿ

|

driving while impaired and the exacerbation of other adverse public health consequences associated with marijuana use;

|

|

Ÿ

|

the growing of marijuana on public lands; and

|

|

Ÿ

|

marijuana possession or use on federal property.

|

16

Nutraceuticals

Nutraceutical, a word that combines the words “nutrition” and “pharmaceutical” are foods or food products that provide health and medical benefits, including the prevention and treatment of disease. Such products range from isolated nutrients, dietary supplements and specific diets to genetically engineered foods, herbal products and processed foods. Nutraceutical foods are not subject to the same testing and regulation as pharmaceutical drugs. The use of nutraceutical as an attempt to accomplish desirable therapeutic outcomes with reduced side effects when compared with other therapeutic agents has met with significant public acceptance and monetary success.

Intellectual Property

We do not presently own any intellectual property but expect to develop intellectual property in the course of our development and commercialization of hemp based health products.

Research and Development

We have yet to incur any research and development expenses but expect to do so within the next 60 days in connection with our Research Services Agreement with Caerus and subsequent thereto in connection with our future establishment of an in-house laboratory.

Competition

The market for hemp based medicinal products is rapidly evolving. Many of our competitors have and will have greater financial and human resources and longer operating histories then we do. We expect to be able to compete based on the safety and efficacy of our products.

Customers

As of the date of this Report, we have yet to achieve revenues. Accordingly, we have no customers. In the near future, we expect to commence selling pet products through our License Agreement with Canna-Pet, LLC.

Employees

As of the date of this Report, we have 3 employees including our two executive officers. Two of our employees work on a part-time basis. Management believes its relationships with its employees to be good. We expect to add one or two additional employees in the fall of 2014.

Markets

Hemp

There is no official estimate of the value of U.S. sales of hemp-based products. According to the Congressional Research Service there are over 25,000 products on the global market that are derived from hemp. It is estimated that in the United States the market for hemp based products in 2012 was nearly 500 million dollars per year, although an exact number has not been determined. Between 156 and 171 million dollars of this market is made up of body care items and food based supplements. 100 million dollars is associated with hemp based clothing and textiles. The remaining balance is associated with an array of various other hemp based goods.

17

Marijuana

According to the 2014 edition of the Marijuana Business Factbook, U.S. retail cannabis sales are expected to rise over the next five years, from an estimated $2.2 – $2.6 billion in 2014 to $7.4 – 8.2 billion in 2018. The sales estimates include both medical marijuana and recreational cannabis sales, and account for additional states establishing and launching cannabis sales programs during the time span covered by the forecast. These predictions assume 4 – 5 new recreational states and 2 – 3 medical states will have fully-functional programs by 2018.

Nutraceuticals

The total global nutraceuticals market reached $142.1 billion in 2011 and is expected to reach $204.8 billion by 2017, growing at a compound annual growth rate of 6.3%, spurred primarily by dietary supplements. Rising health concerns, the growth of key demographics and growing consumer desire to lead a healthy life and avoid dependence on synthetic drugs are identified trends supporting market growth. The nutraceutical ingredient market is forecast to reach $33.6 billion by 2018. This is an emerging market sector with a range of stakeholders including raw material suppliers, processors, product manufacturers and end-use consumers. Nutraceutical cannabinoids are only just beginning to be introduced in product formulations and represent an untapped market segment.

Animal Health

According to a State of the American Pet Survey, one of the greatest challenges of pet ownership is maintaining pets’ health. 41% of pet owners have considered or tried various alternative therapies, including nutritional supplements (29%), herbal remedies (7%) and homeopathy (4%). The recession-resistant US animal health products industry is projected to reach $12 billion by 2016.

DESCRIPTION OF PROPERTIES

Our principal executive offices are located at 4450 Arapahoe Avenue, Suite 100, Boulder, CO 80303. At this location we receive receptionist services, have access to conference room space and pay nominal rent. We believe that this facility is adequate to meet our needs at this time, but as we expect to grow in the near future, we anticipate that we may move to a larger permanent office space that will have a higher rent.

RISK FACTORS

AN INVESTMENT IN OUR SECURITIES IS HIGHLY SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. WE FACE A VARIETY OF RISKS THAT MAY AFFECT OUR OPERATIONS OR FINANCIAL RESULTS AND MANY OF THOSE RISKS ARE DRIVEN BY FACTORS THAT WE CANNOT CONTROL OR PREDICT. BEFORE INVESTING IN OUR SECURITIES YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISKS, TOGETHER WITH THE FINANCIAL AND OTHER INFORMATION CONTAINED IN THIS REPORT. IF ANY OF THE FOLLOWING RISKS ACTUALLY OCCURS, OUR BUSINESS, PROSPECTS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS COULD BE MATERIALLY ADVERSELY AFFECTED. IN THAT CASE, THE TRADING PRICE OF OUR COMMON STOCK WOULD LIKELY DECLINE AND YOU MAY LOSE ALL OR A PART OF YOUR INVESTMENT. ONLY THOSE INVESTORS WHO CAN BEAR THE RISK OF LOSS OF THEIR ENTIRE INVESTMENT SHOULD CONSIDER AN INVESTMENT IN OUR SECURITIES.

18

THIS REPORT CONTAINS CERTAIN STATEMENTS RELATING TO FUTURE EVENTS OR THE FUTURE FINANCIAL PERFORMANCE OF OUR COMPANY. PROSPECTIVE INVESTORS ARE CAUTIONED THAT SUCH STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE RISKS AND UNCERTAINTIES, AND THAT ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS, PROSPECTIVE INVESTORS SHOULD SPECIFICALLY CONSIDER THE VARIOUS FACTORS IDENTIFIED IN THIS REPORT, INCLUDING THE MATTERS SET FORTH BELOW, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING STATEMENTS.

If any of the following or other risks materialize, the Company’s business, financial condition, and results of operations could be materially adversely affected which, in turn, could adversely impact the value of our common stock. In such a case, investors in our common stock could lose all or part of their investment.

Prospective investors should consider carefully whether an investment in the Company is suitable for them in light of the information contained in this Report and the financial resources available to them. The risks described below do not purport to be all the risks to which the Company or the Company could be exposed. This section is a summary of certain risks and is not set out in any particular order of priority. They are the risks that we presently believe are material to the operations of the Company. Additional risks of which we are not presently aware or which we presently deem immaterial may also impair the Company’s business, financial condition or results of operations.

General Risks

We have a limited operating history upon which investors can evaluate our future prospects. We may never attain profitability.

In March 2014 we determined to enter the business of developing, manufacturing, marketing and selling pharmaceutical level products containing phytocannabinoids, a component of cannabis, for the treatment of various conditions and diseases including, but not limited to, inflammatory and anti-immune diseases. As of the date of this Report, we have not achieved any revenues. Therefore, we have a limited operating history upon which an evaluation of our business plan or performance and prospects can be made. Our operations are therefore subject to all of the risks inherent in light of the expenses, difficulties, complications and delays frequently encountered in connection with the formation of any new business, the development of a product, as well as those risks that are specific to our business in particular. There are no assurances that we can successfully address these challenges. If we are unsuccessful, we and our business, financial condition and operating results will be materially and adversely affected.

19

Given our limited operating history, management has little basis on which to forecast future demand for our products and out anticipated revenues. Our anticipated and future expense levels are based largely on estimates of planned operations and future revenues rather than experience. It is difficult to accurately forecast future revenues because our business is new and our market has not been developed. Except for sales related to our License Agreement with Canna-Pet, LLC, we do not expect meaningful revenues until at least 2015. No assurance can be given that we will ever achieve profitability.

We have a history of losses and we may not achieve or sustain profitability in the future.

We have incurred losses in each fiscal year since our incorporation in 2011. We anticipate that our operating expenses will increase in the foreseeable future as we continue to invest to grow our business, acquire customers and expand our facilities and employee base. These efforts may prove more expensive than we currently anticipate, and we may not succeed in generating sufficient revenues to offset these higher expenses. If we are unable to do so, we and our business, financial condition and operating results could be materially and adversely affected.

We cannot predict our future capital needs and we may not be able to secure additional financing.

During the current fiscal year we have raised approximately $815,000 from sales of our common stock and expect to continue to raise capital through sales of our common stock. We believe that, we have sufficient funds to meet our presently anticipated working capital requirements for approximately six months. This belief is based on our operating plan which in turn is based on assumptions, which may prove to be incorrect. In addition, we may need to raise significant additional funds sooner in order to implement our business plan, support our growth, develop new or enhanced services and products, respond to competitive pressures, acquire or invest in complementary or competitive businesses or technologies, or take advantage of unanticipated opportunities. If our financial resources are insufficient, we will require additional financing in order to meet our plans for expansion. We cannot be sure that this additional financing, if needed, will be available on acceptable terms or at all. Furthermore, any debt financing, if available, may involve restrictive covenants, which may limit our operating flexibility with respect to business matters. If additional funds are raised through the issuance of equity securities, the percentage ownership of our existing shareholders will be reduced, our shareholders may experience additional dilution in net book value, and such equity securities may have rights, preferences, or privileges senior to those of our existing shareholders. If adequate funds are not available on acceptable terms, or at all, we may be unable to develop or enhance our products and services, take advantage of future opportunities, repay debt obligations as they become due, or respond to competitive pressures, any of which would have a material adverse effect on our business, prospects, financial condition, and results of operations.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern.

Our historical financial statements have been prepared under the assumption that we will continue as a going concern. Our independent registered public accounting firm has issued a report that included an explanatory paragraph referring to our recurring net losses and accumulated deficit and expressing substantial doubt in our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity financing or other capital, attain further operating efficiencies, reduce expenditures, and, ultimately, to generate revenue. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. However, if adequate funds are not available to us when we need it, and we are unable to commercialize our products giving us access to additional cash resources, we will be required to curtail our operations which would, in turn, further raise substantial doubt about our ability to continue as a going concern.

20

Our products may not be accepted in the market, which would have an adverse effect on our financial condition and operating results.

We cannot be certain that the products we may develop or market will achieve or maintain market acceptance. Market acceptance of our products depends on many factors, including the safety and efficacy of our products and public perception concerning hemp based products.

Business Risks

Due to the general negativity associated with the cannabis plant within the United States, we anticipate facing potential challenges getting our products into stores.

The majority of our products will be intended for ingestion purposes. We intend to produce hemp based products that contain no or low THC that are legal for ingestion within the U.S. as nutraceuticals. However, we anticipate that we may face scrutiny and run into issues getting our products into stores due to hesitation by certain retail establishments to carry products affiliated with the cannabis plant.

We operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. Our competition includes all other companies that are in the business of developing, manufacturing or selling nutraceutical products, including hemp based nutraceutical products, for personal use or consumption. This highly competitive environment could adversely affect our business, financial condition, results of operations, cash flows and prospects.

Our failure to manage growth, diversification and changes to our business could harm our business.

We expect our company to experience growth in connection with the development and sale of our products. Our failure to successfully manage and monetize any growth, and to successfully diversify our business in the future could harm the success and longevity of our company.

We depend on key personnel to operate our business, and if we are unable to retain, attract and integrate qualified personnel, our ability to develop and successfully grow our business could be harmed.

We believe that our future success is highly dependent on the continued services of our key officers, employees, and Board members as well as our ability to attract and retain highly skilled and experienced technical personnel. The loss of their services could have a detrimental effect on our operations. The departure of Soren Mogelsvang, our President and CEO, or any major change in our Board or management could adversely affect our operations.

21

Government regulation of cannabis is constantly evolving, and unfavorable developments could have an adverse effect on our operating results.

Any changes in laws or regulations relating to cannabis and hemp could adversely affect our business, results of operations and our business prospects.

We face competition from entities in our industry with substantially more capital, greater name recognition, more employees, greater resources, and longer operating histories than we do.

We have a limited operating history in our industry. Many of our competitors have greater human and financial resources, name recognition and operating histories than we do which potentially puts us at a competitive disadvantage.

Third Party Risks

We presently rely on third parties to provide cultivation, research and testing services necessary for the operation of our business, the loss of which service providers would have a material adverse effect on our expected operating results.

We are presently dependent on third party service providers to operate our business including, but not limited to, Rocky Mountain Hemp, Inc. and Caerus Discovery, LLC. The loss of these service providers would have an adverse effect on our operations and operating results.

Investment Risks

We may be unable to raise enough capital through sales of our equity and debt securities to implement our business plan.

We will be largely dependent on capital raised through sales of our equity and debt securities to implement our business plan and support our operations. Based upon our current cash position, we expect that we will be able maintain operations for a period of approximately six months. At the present time, we have not made any arrangements to raise additional cash, other than through sales of our equity securities. We cannot assure you that we will be able to raise the working capital as needed on terms acceptable to us, if at all. If we are unable to raise capital as needed, we may be required to reduce the scope of our business development activities, which could harm our business plans, financial condition and operating results, or cease our operations entirely.

22

You may experience dilution of your ownership interests because of the future issuance of additional shares of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock.

Any future issuance of our equity or equity-backed securities may dilute then-current stockholders’ ownership percentages and could also result in a decrease in the fair market value of our equity securities, because our assets would be owned by a larger pool of outstanding equity. As described above, we may need to raise additional capital through public or private offerings of our common or preferred stock or other securities that are convertible into or exercisable for our common or preferred stock. We may also issue such securities in connection with hiring or retaining employees and consultants (including stock options issued under our 2014 Equity Incentive Plan), as payment to providers of goods and services, in connection with future acquisitions or for other business purposes. Our Board may at any time authorize the issuance of additional common or preferred stock without common stockholder approval, subject only to the total number of authorized common and preferred shares set forth in our articles of incorporation. The terms of equity securities issued by us in future transactions may be more favorable to new investors, and may include dividend and/or liquidation preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect. Also, the future issuance of any such additional shares of common or preferred stock or other securities may create downward pressure on the trading price of our common stock. There can be no assurance that any such future issuances will not be at a price (or exercise prices) below the price at which shares of our common stock are then traded.

The ability of our Board to issue additional stock may prevent or make more difficult certain transactions, including a sale or merger of the Company.

We currently have authorized 350,000,000 shares of capital stock consisting of (i) 325,000,000 shares of common stock, and (ii) 25,000,000 shares of "blank check" Preferred Stock. As a result, our Board is authorized to issue up to 25,000,000 shares of preferred stock with powers, rights and preferences designated by it. See “Preferred Stock” in the section of this Report titled “Description of Securities.” Shares of voting or convertible preferred stock could be issued, or rights to purchase such shares could be issued, to create voting impediments or to frustrate persons seeking to effect a takeover or otherwise gain control of the Company. The ability of the Board to issue such additional shares of Preferred Stock, with rights and preferences it deems advisable, could discourage an attempt by a party to acquire control of the Company by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price for their shares in a tender offer or the temporary increase in market price that such an attempt could cause. Moreover, the issuance of such additional shares of preferred stock to persons friendly to the Board could make it more difficult to remove incumbent managers and directors from office even if such change were to be favorable to stockholders generally.

We have a concentration of stock ownership and control, which may have the effect of delaying, preventing, or deterring certain corporate actions and may lead to a sudden change in our stock price.

Our common stock ownership is highly concentrated. As of August 11, 2014 our officers and directors beneficially own 33,084,000 shares, or approximately 42.5% of our total outstanding common stock. Their interests may differ significantly from your interests. As a result of the concentrated ownership of our stock, a relatively small number of stockholders, acting together, will be able to control all matters requiring stockholder approval, including the election of directors and approval of mergers and other significant corporate transactions. In addition, because our stock is so thinly traded, the sale by any of our large stockholders of a significant portion of that stockholder’s holdings could cause a sharp decline in the market price of our common stock.

23

Restrictions on the use of Rule 144 by Shell Companies or Former Shell Companies could affect your ability to resale our shares.

Historically, the SEC has taken the position that Rule 144 under the Securities Act, as amended, is not available for the resale of securities initially issued by companies that are, or previously were, shell companies like us, to their promoters or affiliates despite technical compliance with the requirements of Rule 144. The SEC has codified and expanded this position in its amendments effective on February 15, 2008 and apply to securities acquired both before and after that date by prohibiting the use of Rule 144 for resale of securities issued by shell companies (other than business transaction related shell companies) or issuers that have been at any time previously a shell company. The SEC has provided an important exception to this prohibition, however, if the following conditions are met:

|

Ÿ

|

the issuer of the securities that was formerly a shell company has ceased to be a shell company;

|

|

Ÿ

|

the issuer of the securities is subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act;

|

|

Ÿ

|

the issuer of the securities has filed all Exchange Act reports and material required to be filed, as applicable, during the preceding 12 months (or such shorter period that the issuer was required to file such reports and materials), other than Form 8-K reports; and

|

|

Ÿ

|

at least one year has elapsed from the time that the issuer filed current Form 10 type information with the SEC reflecting its status as an entity that is not a shell company.

|

As such, due to the fact that we were a shell company until the date of this Report, holders of "restricted securities" within the meaning of Rule 144 will be subject to the conditions set forth herein. Therefore, sales under Rule 144 are prohibited for at least one year from the date this Report is filed.

There currently is a limited public market for our common stock. Failure to develop or maintain an active trading market could negatively affect the value of our common stock and make it difficult or impossible for you to sell your shares.

There is currently a limited public market for shares of our common stock and an active market may never develop. Our common stock is quoted on the OTC Markets. The OTC Markets is a thinly traded market and lacks the liquidity of certain other public markets with which some investors may have more experience. We may not ever be able to satisfy the listing requirements for our common stock to be listed on a national securities exchange, which are often a more widely-traded and liquid market. Some, but not all, of the factors which may delay or prevent the listing of our common stock on a more widely-traded and liquid market includes the following:

24

|

Ÿ

|

our stockholders’ equity may be insufficient;

|

|

Ÿ

|

the market value of our outstanding securities may be too low;

|

|

Ÿ

|

our net income from operations may be too low;

|

|

Ÿ

|

our common stock may not be sufficiently widely held;

|

|

Ÿ

|

we may not be able to secure market makers for our common stock; and

|

|

Ÿ

|

we may fail to meet the rules and requirements mandated by the several exchanges and markets to have our common stock listed.

|

Should we fail to satisfy the initial listing standards of the national exchanges, or our common stock is otherwise rejected for listing and remains listed on the OTC Markets or suspended from the OTC Markets, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid and our common stock price may be subject to increased volatility.

Our common stock is subject to the “penny stock” rules of the SEC and the trading market in the securities is limited, which makes transactions in the stock cumbersome and may reduce the value of an investment in the stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

Ÿ

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

Ÿ

|

the broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must:

|

Ÿ

|

obtain financial information and investment experience objectives of the person; and

|

|

Ÿ

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

25

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth:

|

Ÿ

|

the basis on which the broker or dealer made the suitability determination; and

|

|

Ÿ

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of common stock and cause a decline in the market value of stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. If we remain subject to the penny stock rules for any significant period, it could have an adverse effect on the market, if any, for our securities. If our securities are subject to the penny stock rules, investors will find it more difficult to dispose of our securities.

If securities analysts do not initiate coverage or continue to cover our common stock or publish unfavorable research or reports about our business, this may have a negative impact on the market price of our common stock.

The trading market for our common stock will depend on the research and reports that securities analysts publish about our business and the Company. It is often more difficult to obtain analyst coverage for companies whose securities are traded on the OTC Markets. We do not have any control over securities analysts. There is no guarantee that securities analysts will cover our common stock. If securities analysts do not cover our common stock, the lack of research coverage may adversely affect our market price. If we are covered by securities analysts, and our stock is the subject of an unfavorable report, our stock price and trading volume would likely decline. If one or more of these analysts ceases to cover the Company or fails to publish regular reports on the Company, we could lose visibility in the financial markets, which could cause our stock price or trading volume to decline.

We do not anticipate paying dividends on our common stock, and investors may lose the entire amount of their investment.

To date, cash dividends have not been declared or paid on our common stock, and we do not anticipate such a declaration or payment for the foreseeable future. We expect to use future earnings, if any, to fund business growth. Therefore, stockholders will not receive any funds absent a sale of their shares of common stock, subject to the limitation outlined herein. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if our stock price appreciates. We cannot assure stockholders of a positive return on their investment when they sell their shares, nor can we assure that stockholders will not lose the entire amount of their investment.

26

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

We incorporate herein by reference the information set forth in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Annual Report on Form 10-K for the year ended September 30, 2013 filed with the Securities and Exchange Commission on December 27, 2013.

We incorporate herein by reference the information set forth in Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 filed with the Securities and Exchange Commission on May 14, 2014.

FINANCIAL STATEMENTS

We incorporate herein by reference the information set forth in Item 15. “Financial Statements” of our Annual Report on From 10-K for the year ended September 30, 2013 filed with the Securities and Exchange Commission on December 27, 2013.

We incorporate herein by reference the information set forth in Item 1. “Financial Statements” of our Quarterly Report on From 10-Q for the quarter ended March 31, 2014 filed with the Securities and Exchange Commission on May 14, 2014.

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Directors and Executive Officers

Below are the names of and certain information regarding the Company’s current executive officers and directors:

|

Name

|

Age

|

Position

|

Date Named to

Board of Directors

|

||||

|

Soren Mogelsvang

|

42 |

President, Chief Executive Officer and Director

|

March 10, 2014

|

||||

|

Arnold Tinter

|

68 |

Chief Financial Officer, Secretary and Treasurer

|

N/A | ||||

|

Cohava Gelber

|

57 |

Director

|

March 10, 2014

|

||||

|

Guy Yachin

|

46 |