Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US FOODS, INC. | d774408d8k.htm |

Q2

2014 Performance Update

A Taste of What’s Cooking at US Foods

August 2014

Exhibit 99.1 |

1

FOOD. FOOD PEOPLE. EASY. While

the

information

provided

herein

is

believed

to

be

accurate

and

reliable,

US

Foods

(“US

Foods”)

does

not

make

any

representations

or

warranties,

express

or

implied,

as

to

the

accuracy

or

completeness

of

such

information

or

as

to

future

results.

No

representation

or

warranty

is

made that any of the projections presented herein will be realized.

Forward-looking statements notice

This

presentation

and

related

comments

by

our

management

may

include

“forward-looking

statements.”

Our

use

of

the

words

“expect,”

“anticipate,”

“possible,”

“potential,”

“target,”

“believe,”

“commit,”

“intend,”

“continue,”

“may,”

“would,”

“could,”

“should,”

“project,”

“projected,”

“positioned”

or similar expressions is intended to identify forward-looking statements that

represent our current judgment about possible future events. We believe

these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual

results may differ materially due to a variety of important factors. Among other

items, such factors might include: our ability to remain profitable during

times of cost inflation, commodity volatility, and other factors; competition in the industry and our ability to compete successfully; our

reliance on third-party suppliers, including the impact of any interruption of

supplies or increases in product costs; shortages of fuel and

increases

or

volatility

in

fuel

costs;

any

declines

in

the

consumption

of

food

prepared

away

from

home,

including

as

a

result

of

changes

in

the

economy or other factors affecting consumer confidence; costs and risks associated

with labor relations and the availability of qualified labor; any change in

our relationships with GPOs; our ability to increase sales to independent customers; changes in industry pricing practices;

changes in cost structure of competitors; costs and risks associated with

government laws and regulations, including environmental, health, and

safety, food safety, transportation, labor and employment, laws and regulations,

and changes in existing laws or regulations; technology disruptions

and

our

ability

to

implement

new

technologies;

product

liability

claims

relating

to

products

that

we

distribute;

our

ability

to

maintain

a

good reputation; costs and risks associated with litigation; our

ability to manage future expenses and liabilities with respect to our retirement

benefits; our ability to successfully integrate future acquisitions; our

ability to achieve the benefits that we expect to achieve from our cost

savings programs; risks relating to our indebtedness, including our substantial

amount of debt, our ability to incur substantially more debt,

increases

in

interest

rates,

and

our

proposed

acquisition

by

Sysco.

Additional

information

regarding

these

factors

is

contained

in

the

company’s

filings with the Securities and Exchange Commission, including, without limitation,

its Annual Report on Form 10-K for the fiscal year ended December 28,

2013. All

forward-looking

statements

speak

only

as

of

the

date

they

were

made.

The

company

does

not

undertake

any

obligation

to

update

or

publicly

release any revisions to any forward-looking statements to reflect events,

circumstances or changes in expectations after the date of this

presentation. |

2

FOOD. FOOD PEOPLE. EASY. Non-GAAP financial measures

This presentation contains unaudited non-GAAP financial measures, including

Reported EBITDA, Adjusted EBITDA, Consolidated EBITDA, Debt Coverage Ratio,

Interest Coverage Ratio, Adjusted Operating Expenses and Adjusted Gross

Profit. Management believes these non- GAAP financial measures provide

meaningful supplemental information regarding our operating performance because they exclude amounts

that our management and our board of directors do not consider part of core

operating results when assessing the performance of the Company. Our

management uses these non-GAAP financial measures to evaluate the Company’s historical financial performance, establish future

operating and capital budgets and determine variable compensation for management

and employees. Accordingly, the Company believes these non-GAAP

financial measures are useful in allowing for a better understanding of the Company's core operations.

While

management

believes

that

these

non-GAAP

financial

measures

provide

useful

information,

they

are

not

operating

measures

under

U.S.

GAAP, and there are limitations associated with their use. The Company's

calculation of these non-GAAP financial measures may not be completely

comparable to similarly titled measures of other companies due to potential differences between companies in their method of

calculation. As a result the use of these non-GAAP financial measures has

limitations and should not be considered in isolation from, or as a

substitute for, other measures such as Net income or Net income attributable to

stockholders. Due to these limitations, these non-GAAP financial

measures are used as a supplement to U.S. GAAP measures and should not be

considered as a substitute for net income (loss) from continuing operations,

operating profit or any other performance measures derived in accordance with GAAP, nor are they a substitute for cash flow from

operating activities as a measure of our liquidity.

Management uses Adjusted EBITDA Margin and Consolidated EBITDA Margin to focus on

year-over-year changes in the Company’s business and believes

this information is also helpful to investors. The Company uses Adjusted EBITDA in these EBITDA-related margin measures

because it believes its investors are familiar with Adjusted EBITDA and that

consistency in presentation of EBITDA-related measures is helpful to

investors. Management also uses Debt Coverage Ratios and Interest Coverage Ratios to focus management on year-over-year changes in

the Company’s leverage and believes this information is also helpful to

investors. The Company cautions investors that these non-GAAP financial

measures presented also are intended to supplement the Company’s GAAP

results and are not a substitute for such results. Additionally, the Company

cautions investors that the non-GAAP financial measures used by the Company may differ from the non-GAAP

measures used by other companies. |

3

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Quarterly Financial Update

•

Closing Comments

•

Appendix |

4

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Quarterly Financial Update

•

Closing Comments

•

Appendix |

5

FOOD. FOOD PEOPLE. EASY. Business Highlights

•

Q2 sales increased 4.2%, and units decreased 0.6%

•

Organic units decreased 0.9%

•

Acquisition units added 0.3%¹

•

Q2 results

•

Net income/(loss) was ($19) million

•

Adjusted EBITDA was $237 million, a 4.9% increase from last

year² •

Business transformation focused on differentiation and innovation

•

Category Management and Merchandising

•

Sales Force Effectiveness

•

Sysco merger

•

Deal is expected to close either late in Q3 or in Q4 2014

Note:

(1) Includes 2013 Acquisition volume

(2) Reconciliation of this non-GAAP measure is provided in the

appendix. |

6

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Quarterly Financial Update

•

Closing Comments

•

Appendix |

7

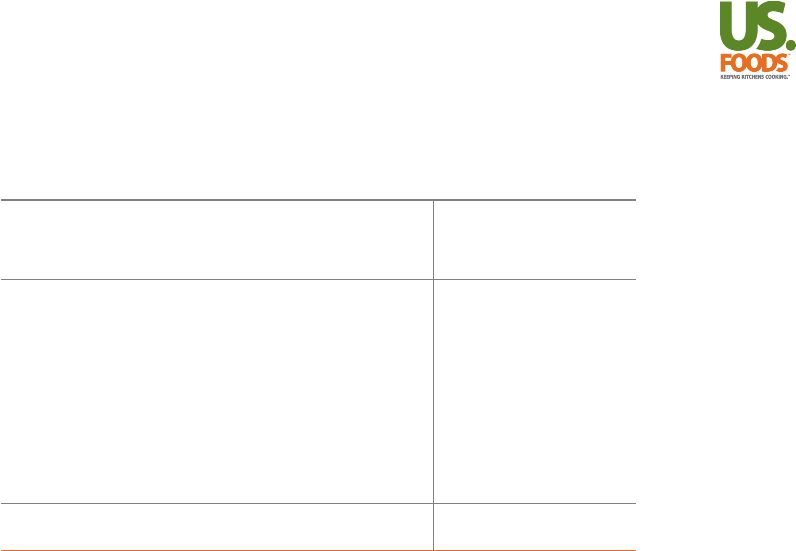

FOOD. FOOD PEOPLE. EASY. Q2 Financial Performance

Notes:

(1) Reconciliations of these non-GAAP measures are provided in the

appendix. (2) Represents Adjusted EBITDA as a percentage of Net Sales.

Individual components may not add to total presented due to rounding.

$ IN MILLIONS

Q2 2014

Q2 2013

B/(W) Y-O-Y

CHANGE

NET SALES

$5,898

$5,659

4.2%

GROSS PROFIT

$964

$972

($8)

ADJUSTED GROSS PROFIT¹

$988

$977

+ $11

% OF NET SALES

16.8%

17.3%

(51)bps

OPERATING EXPENSES

$900

$872

($28)

ADJUSTED OPERATING

EXPENSES¹

$751

$751

$-

% OF NET SALES

12.7%

13.3%

+ 54bps

NET INCOME/(LOSS)

($19)

$16

($35)

ADJUSTED EBITDA¹

$237

$226

+$11

ADJUSTED EBITDA MARGIN²

4.0%

4.0%

+ 3bps |

8

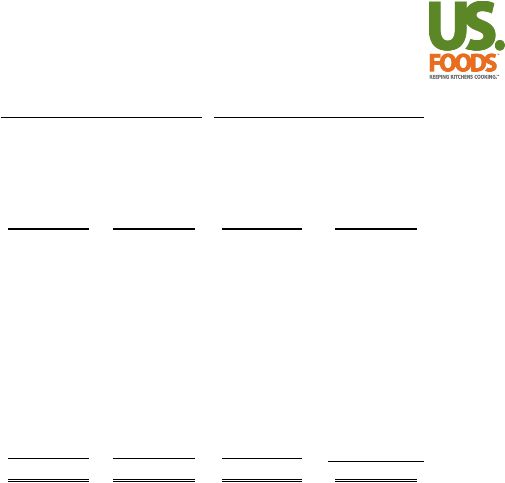

FOOD. FOOD PEOPLE. EASY. Q2 Last Twelve Month Financial Performance

Notes:

(1) Reconciliations of these non-GAAP measures are provided in the

appendix. (2) Represents Adjusted EBITDA or Consolidated EBITDA as a

percentage of Net Sales. (3) Consolidated EBITDA includes Adjusted EBITDA

plus $50 million for cost saving actions taken by the Company as specified under the Company’s debt agreements.

Individual components may not add to total presented due to rounding.

$ IN MILLIONS

Q2 2014 LTM

Q2 2013 LTM

B/(W) Y-O-Y CHANGE

NET SALES

$22,588

$22,006

2.6%

GROSS PROFIT

$3,801

$3,754

+$47

ADJUSTED GROSS PROFIT¹

$3,854

$3,771

+$83

% OF NET SALES

17.1%

17.1%

(8)bps

OPERATING EXPENSES

$3,523

$3,455

($68)

ADJUSTED OPERATING EXPENSES¹

$2,985

$2,953

($32)

% OF NET SALES

13.2%

13.4%

+21bps

NET INCOME/(LOSS)

($62)

($132)

+$70

ADJUSTED EBITDA¹

$869

$818

+$51

ADJUSTED EBITDA MARGIN²

3.8%

3.7%

+13bps

CONSOLIDATED EBITDA³

$919

CONSOLIDATED EBITDA MARGIN²

4.1% |

9

FOOD. FOOD PEOPLE. EASY. Quarterly Cash Flow

$ IN MILLIONS

Q3 2013

Q4 2013

Q1 2014

Q2 2014

LTM

Cash from Operating Activities

$5

$208

$31

$216

$460

Capital Expenditures, net of Proceeds

($34)

($56)

($40)

($25)

($156)

Acquisitions

-

($11)

-

-

($11)

Cash (Used in)/Provided by Financing

Activities

($36)

($98)

$1

($45)

($178)

Net Cash Change

($66)

$43

($8)

$146

$114

Beginning Cash

$203

$137

$180

$172

$203

Ending Cash

$137

$180

$172

$317

$317

Individual components may not add to total presented due to rounding.

1

Notes:

(1) Q2 2014 capital expenditures net of proceeds includes $7 million from sales of property and

equipment as well as $2 million of insurance recoveries related to property and equipment. |

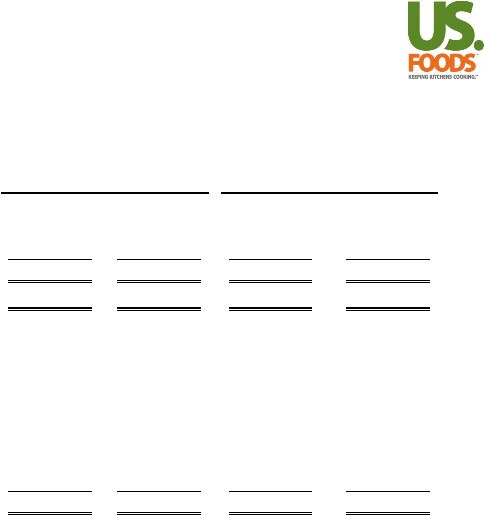

1.3x

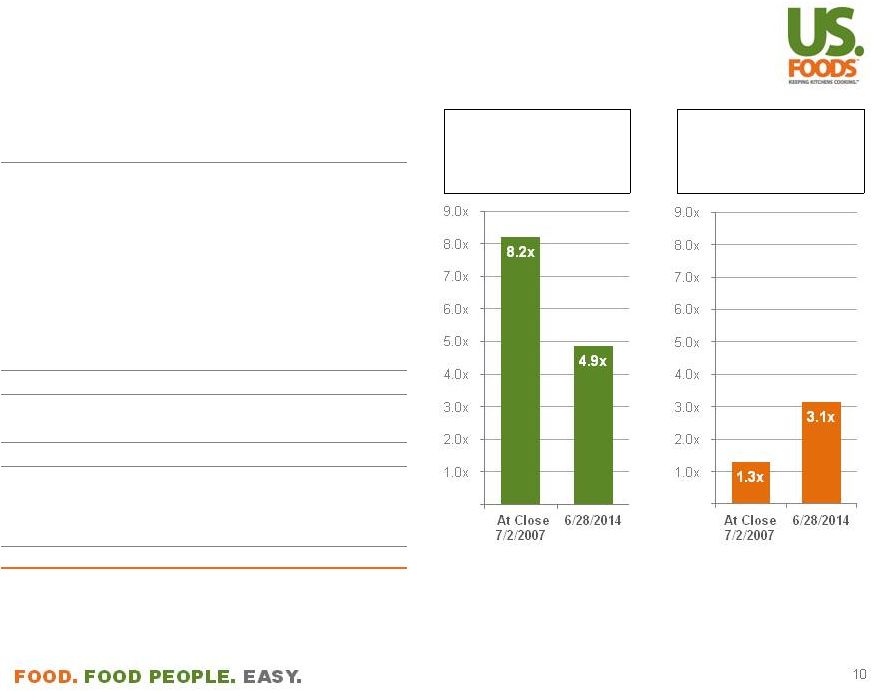

Capital Structure & Credit Statistics

1.3x

Notes:

(1) The ABS Facility was amended on August 8, 2014 to extend its maturity until the

earlier of August 5, 2016 or the termination date of the ABL (currently May 11, 2016).

(2) Total Debt includes $4,816 million of US GAAP debt as of June 28, 2014 less $17

million of unamortized premium on senior notes. (3) Debt coverage ratio

equals net debt divided by Consolidated EBITDA over last 12 months. (4)

Interest

coverage

ratio

equals

Consolidated

EBITDA

over

last

12

months

divided

by

net

interest

expense

over

last

12

months.

Credit Statistics

Debt Coverage

Interest Coverage

Ratio³

Ratio

4

Debt /LTM

As of

Consolidated

$ IN MILLIONS

6/28/2014

EBITDA

ABL Revolver (2016)

$0

ABS Facility (2015)¹

$686

CMBS Facility (2017)

$472

Term Loan (2019)

$2,084

Obligations Under Capital Leases

$195

Other Debt (2018 -

2031)

$12

Total Senior Secured Debt

$3,449

3.8x

Senior Notes (2019)

$1,350

Total Debt²

$4,799

5.2x

Less: Restricted Cash

($7)

Less: Cash and Cash Equivalents

($317)

Net Debt

$4,475

4.9x |

11

FOOD. FOOD PEOPLE. EASY. We have $1,192 million of available liquidity.

Liquidity

As of

$ IN MILLIONS

6/28/2014

Borrowing Availability:

ABL Facility (2016)

$813

ABS Facility (2015)¹

$62

Total Cash & Equivalents

$317

Total Cash and Borrowing Availability

$1,192

Note:

(1) The ABS Facility was amended on August 8, 2014 to extend its maturity until the

earlier of August 5, 2016 or the termination date of the ABL (currently May 11, 2016). |

12

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Quarterly Financial Update

•

Closing Comments

•

Appendix |

13

FOOD. FOOD PEOPLE. EASY. Agenda

•

Business Highlights

•

Quarterly Financial Update

•

Closing Comments

•

Appendix |

14

FOOD. FOOD PEOPLE. EASY. Non-GAAP Reconciliations

Management believes these non-GAAP financial measures provide meaningful

supplemental information regarding our operating performance because they

exclude amounts that our management and our board of directors do not consider

part of core operating results when assessing the performance of

the Company. Our management uses these non-GAAP

financial measures to evaluate the Company’s historical financial performance,

establish future operating and capital budgets and determine variable

compensation for management and employees. Accordingly, the Company believes

these non-GAAP financial measures are useful in allowing for a better

understanding of the Company's core operations. While

management

believes

that

these

non-GAAP

financial

measures

provide

useful

information,

they

are

not

operating

measures under U.S. GAAP, and there are limitations associated with their use. The

Company's calculation of these non-GAAP financial measures may not be

completely comparable to similarly titled measures of other companies due to

potential differences between companies in their method of calculation. As a

result, the use of these non-GAAP financial measures has limitations and

should not be considered in isolation from, or as a substitute for, other measures such as

Net income or Net income attributable to stockholders. Due to these limitations,

these non-GAAP financial measures are used as a supplement to U.S. GAAP

measures. |

15

FOOD. FOOD PEOPLE. EASY. Non-GAAP Reconciliation -

Adjusted EBITDA

Notes:

(1)

Consists of management fees paid to the Sponsors.

(2)

Consists primarily of facility closing, severance and related costs, and

tangible asset impairment charges. (3)

Share-based

compensation

expense

represents

costs

recorded

for

vesting

of

USF

Holding

Corp.

stock

option

awards,

restricted

stock,

and

restricted

stock

units.

(4)

Consists of changes in the LIFO reserve.

(5)

Includes fees paid to debt holders, third party costs, early redemption premiums,

and write-off of unamortized debt issuance costs. (6)

Consists of charges resulting from lump-sum payment settlements to retirees and

former employees participating in several Company sponsored pension plans.

(7)

Consists primarily of costs related to functionalization and significant

process and systems redesign. (8) Consists of direct and

incremental costs related to the Sysco merger. (9)

Other

includes

gains,

losses

or

charges,

as

specified

under

the

US

Foods’

debt

agreements.

Individual components may not add to total presented due to rounding.

Quarter Ended

LTM

(In millions)

June 28, 2014

June 29, 2013

June 28, 2014

June 29, 2013

Net loss (income)

(19)

$

16

$

(62)

$

(132)

$

Interest expense, net

74

78

292

326

Income tax provision (benefit)

9

(12)

48

41

Depreciation and amortization expense

106

97

403

375

EBITDA

170

179

681

610

Adjustments:

Sponsor fees (1)

2

2

10

10

Restructuring and tangible asset impairment charges (2)

-

2

5

4

Share-based compensation expense (3)

3

2

8

7

LIFO reserve change (4)

24

5

53

17

Loss on extinguishment of debt (5)

-

18

-

64

Pension settlement (6)

-

-

2

18

Business transformation costs (7)

14

15

59

63

Sysco merger costs (8)

16

-

24

-

Other (9)

8

3

27

25

Adjusted EBITDA

237

$

226

$

869

$

818

$

|

16

FOOD. FOOD PEOPLE. EASY. Non-GAAP Reconciliation -

Adjusted Gross Profit

and Adjusted Operating Expense

Notes:

(1)

Consists of changes in the LIFO reserve.

(2)

Consists of management fees paid to the Sponsors.

(3)

Consists primarily of facility closing, severance and related costs, and tangible

asset impairment charges. (4)

Share-based

compensation

expense

represents

costs

recorded

for

vesting

of

USF

Holding

Corp.

stock

option

awards,

restricted

stock,

and

restricted

stock

units.

(5)

Consists of charges resulting from lump-sum payment settlements to retirees and

former employees participating in several Company sponsored pension plans.

(6)

Consists primarily of costs related to functionalization and significant

process and systems redesign. (7) Consists of direct and

incremental costs related to the Sysco merger . (8)

Other

includes

gains,

losses

or

charges,

as

specified

under

the

US

Foods’

debt

agreements.

Individual components may not add to total presented due to rounding.

Quarter Ended

LTM

(In millions)

June 28, 2014

June 29, 2013

June 28, 2014

June 29, 2013

Gross Profit

964

$

972

$

3,801

$

3,754

$

LIFO reserve change (1)

24

5

53

17

Adjusted Gross Profit

988

$

977

$

3,854

$

3,771

$

Net sales

5,898

$

5,659

$

22,588

$

22,006

$

Operating Expenses

900

$

872

$

3,523

$

3,455

$

Adjustments:

Depreciation and amortization expense

(106)

(97)

(403)

(375)

Sponsor fees (2)

(2)

(2)

(10)

(10)

Restructuring and tangible asset impairment charges (3)

-

(2)

(5)

(4)

Share-based compensation expense (4)

(3)

(2)

(8)

(7)

Pension settlement (5)

-

-

(2)

(18)

Business transformation costs (6)

(14)

(15)

(59)

(63)

Sysco merger costs (7)

(16)

-

(24)

-

Other (8)

(8)

(3)

(27)

(25)

Adjusted Operating Expenses

751

$

751

$

2,985

$

2,953

$

|

|