Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ENANTA PHARMACEUTICALS INC | Financial_Report.xls |

| EX-32.1 - EX-32.1 - ENANTA PHARMACEUTICALS INC | d743226dex321.htm |

| EX-31.1 - EX-31.1 - ENANTA PHARMACEUTICALS INC | d743226dex311.htm |

| EX-31.2 - EX-31.2 - ENANTA PHARMACEUTICALS INC | d743226dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-35839

ENANTA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 2834 | 04-3205099 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

500 Arsenal Street

Watertown, Massachusetts 02472

(617) 607-0800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files): Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ¨ No x

The number of shares of the registrant’s Common Stock, $0.01 par value, outstanding as of August 8, 2014, was 18,582,628 shares.

Table of Contents

FORM 10-Q—Quarterly Report

For the Quarterly Period Ended June 30, 2014

TABLE OF CONTENTS

| Page | ||||||

| Item 1. |

||||||

| Unaudited Consolidated Balance Sheets as of June 30, 2014 and September 30, 2013 |

3 | |||||

| 4 | ||||||

| 5 | ||||||

| Unaudited Consolidated Statements of Cash Flows for the nine months ended June 30, 2014 and 2013 |

6 | |||||

| 7 | ||||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

22 | ||||

| Item 3. |

35 | |||||

| Item 4. |

36 | |||||

| Item 1A. |

37 | |||||

| Item 2. |

66 | |||||

| Item 6. |

67 | |||||

| 68 | ||||||

| 69 | ||||||

2

Table of Contents

| ITEM 1. | FINANCIAL STATEMENTS |

CONSOLIDATED BALANCE SHEETS

(unaudited)

(in thousands, except share amounts)

| June 30, 2014 |

September 30, 2013 |

|||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 26,374 | $ | 8,859 | ||||

| Short-term marketable securities |

69,513 | 92,621 | ||||||

| Accounts receivable |

399 | 808 | ||||||

| Unbilled receivables |

2,259 | 784 | ||||||

| Deferred tax assets |

11,183 | — | ||||||

| Prepaid expenses and other current assets |

1,950 | 1,641 | ||||||

|

|

|

|

|

|||||

| Total current assets |

111,678 | 104,713 | ||||||

| Property and equipment, net |

1,551 | 1,121 | ||||||

| Long-term marketable securities |

41,700 | 10,703 | ||||||

| Deferred tax assets |

4,149 | — | ||||||

| Restricted cash |

436 | 436 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 159,514 | $ | 116,973 | ||||

|

|

|

|

|

|||||

| Liabilities and Stockholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 1,284 | $ | 1,481 | ||||

| Accrued expenses |

2,984 | 3,035 | ||||||

| Deferred revenue |

— | 10 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

4,268 | 4,526 | ||||||

| Warrant liability |

1,675 | 1,620 | ||||||

| Series 1 nonconvertible preferred stock |

213 | — | ||||||

| Other long-term liabilities |

405 | 359 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

6,561 | 6,505 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies (Note 11) |

||||||||

| Stockholders’ equity: |

||||||||

| Common stock; $0.01 par value; 100,000,000 shares authorized at June 30, 2014 and September 30, 2013; 18,789,536 and 18,138,597 shares issued and 18,580,720 and 17,929,781 shares outstanding at June 30, 2014 and September 30, 2013, respectively |

188 | 181 | ||||||

| Additional paid-in capital |

220,741 | 217,741 | ||||||

| Treasury stock, at par value; 208,816 shares at June 30, 2014 and September 30, 2013 |

(2 | ) | (2 | ) | ||||

| Accumulated other comprehensive loss |

(4 | ) | (2 | ) | ||||

| Accumulated deficit |

(67,970 | ) | (107,450 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

152,953 | 110,468 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 159,514 | $ | 116,973 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these financial statements.

3

Table of Contents

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(in thousands, except share and per share amounts)

| Three Months Ended June 30, |

Nine Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Revenue |

$ | 42,051 | $ | 1,649 | $ | 45,104 | $ | 30,704 | ||||||||

| Operating expenses: |

||||||||||||||||

| Research and development |

4,553 | 4,039 | 13,538 | 12,541 | ||||||||||||

| General and administrative |

2,603 | 1,788 | 7,255 | 4,433 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

7,156 | 5,827 | 20,793 | 16,974 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

34,895 | (4,178 | ) | 24,311 | 13,730 | |||||||||||

| Other income: |

||||||||||||||||

| Interest income |

106 | 64 | 329 | 146 | ||||||||||||

| Interest expense |

(5 | ) | (7 | ) | (14 | ) | (23 | ) | ||||||||

| Change in fair value of warrant liability and Series 1 nonconvertible preferred stock |

(65 | ) | (17 | ) | (268 | ) | 217 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other income, net |

36 | 40 | 47 | 340 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

34,931 | (4,138 | ) | 24,358 | 14,070 | |||||||||||

| Income tax benefit |

15,122 | — | 15,122 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

50,053 | (4,138 | ) | 39,480 | 14,070 | |||||||||||

| Accretion of redeemable convertible preferred stock to redemption value |

— | — | — | (2,526 | ) | |||||||||||

| Net income attributable to participating securities |

— | — | — | (13,670 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to common stockholders |

$ | 50,053 | $ | (4,138 | ) | $ | 39,480 | $ | (2,126 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share attributable to common stockholders: |

||||||||||||||||

| Basic |

$ | 2.70 | $ | (0.23 | ) | $ | 2.16 | $ | (0.30 | ) | ||||||

| Diluted |

$ | 2.61 | $ | (0.23 | ) | $ | 2.06 | $ | (0.30 | ) | ||||||

| Weighted average common shares outstanding: |

||||||||||||||||

| Basic |

18,528,833 | 17,819,813 | 18,275,831 | 7,052,989 | ||||||||||||

| Diluted |

19,203,270 | 17,819,813 | 19,168,368 | 7,052,989 | ||||||||||||

The accompanying notes are an integral part of these financial statements.

4

Table of Contents

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(unaudited)

(in thousands)

| Three Months Ended June 30, |

Nine Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net income (loss) |

$ | 50,053 | $ | (4,138 | ) | $ | 39,480 | $ | 14,070 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive loss: |

||||||||||||||||

| Net unrealized losses on marketable securities, net of tax of $0 |

(65 | ) | (87 | ) | (2 | ) | (104 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other comprehensive loss |

(65 | ) | (87 | ) | (2 | ) | (104 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income (loss) |

$ | 49,988 | $ | (4,225 | ) | $ | 39,478 | $ | 13,966 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these financial statements.

5

Table of Contents

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

(in thousands)

| Nine Months Ended June 30, |

||||||||

| 2014 | 2013 | |||||||

| Cash flows from operating activities |

||||||||

| Net income |

$ | 39,480 | $ | 14,070 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization expense |

242 | 148 | ||||||

| Non-cash interest expense |

14 | 23 | ||||||

| Change in fair value of warrant liability and Series 1 nonconvertible preferred stock |

268 | (217 | ) | |||||

| Stock-based compensation expense |

1,887 | 777 | ||||||

| Gain on disposal of property and equipment |

— | (100 | ) | |||||

| Premium on marketable securities |

(1,824 | ) | (1,170 | ) | ||||

| Amortization of premium on marketable securities |

1,636 | 697 | ||||||

| Benefit from deferred income taxes |

(15,228 | ) | — | |||||

| Income tax benefit from the exercise of stock options |

(105 | ) | — | |||||

| Change in operating assets and liabilities: |

||||||||

| Accounts receivable |

409 | 173 | ||||||

| Unbilled receivables |

(1,475 | ) | 912 | |||||

| Prepaid expenses and other current assets |

161 | (291 | ) | |||||

| Other assets |

— | 22 | ||||||

| Accounts payable |

(190 | ) | (620 | ) | ||||

| Accrued expenses |

(200 | ) | (1,288 | ) | ||||

| Deferred revenue |

(10 | ) | (17 | ) | ||||

| Other long-term liabilities |

46 | 37 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

25,111 | 13,156 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities |

||||||||

| Purchases of property and equipment |

(543 | ) | (404 | ) | ||||

| Purchases of marketable securities |

(85,750 | ) | (100,253 | ) | ||||

| Sales of marketable securities |

7,413 | 2,454 | ||||||

| Maturities of marketable securities |

70,164 | 36,625 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(8,716 | ) | (61,578 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities |

||||||||

| Proceeds from exercise of stock options |

1,015 | 437 | ||||||

| Income tax benefit from the exercise of stock options |

105 | — | ||||||

| Proceeds from initial public offering, net of commissions |

— | 59,892 | ||||||

| Payments of initial public offering costs |

— | (3,540 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

1,120 | 56,789 | ||||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

17,515 | 8,367 | ||||||

| Cash and cash equivalents at beginning of period |

8,859 | 10,511 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 26,374 | $ | 18,878 | ||||

|

|

|

|

|

|||||

| Supplemental disclosure of noncash financing activities: |

||||||||

| Accretion of redeemable convertible preferred stock to redemption value |

$ | — | $ | 2,526 | ||||

| Conversion of preferred stock into common stock |

$ | — | $ | 161,808 | ||||

| Exercise of Series 1 warrant into Series 1 nonconvertible preferred stock |

$ | 206 | $ | — | ||||

The accompanying notes are an integral part of these financial statements.

6

Table of Contents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(amounts in thousands, except share and per share data)

| 1. | Nature of the Business and Basis of Presentation |

Enanta Pharmaceuticals, Inc. (the “Company”), incorporated in Delaware in 1995, is a research and development-focused biotechnology company that uses its chemistry-driven approach and drug discovery capabilities to create small molecule drugs primarily in the infectious disease field. The Company is developing novel protease, NS5A, cyclophilin and nucleotide polymerase inhibitors targeted against the hepatitis C virus (“HCV”). Additionally, the Company has created a new class of bridged bicyclic antibiotics known as Bicyclolides to overcome bacterial resistance. Antibacterial focus areas include “superbugs,” respiratory tract infections, and intravenous and oral treatments for hospital and community methicillin-resistant Staphylococcus aureus (“MRSA”).

The Company is subject to risks common to companies in the biotechnology industry including, but not limited to, difficulties in developing new therapies, competition from innovations of others, dependence on collaborative arrangements, protection of proprietary technology, dependence on key personnel, compliance with government regulations and the need for financial resources to fund research and development activities. Product candidates currently under development will require significant additional research and development efforts, including extensive preclinical and clinical testing and regulatory approval, prior to commercialization. These efforts require significant amounts of additional capital, adequate personnel infrastructure, and extensive compliance reporting capabilities.

Unaudited Interim Financial Information

The consolidated balance sheet at September 30, 2013 was derived from audited financial statements, but does not include all disclosures required by accounting principles generally accepted in the United States of America (“GAAP”). The accompanying unaudited consolidated financial statements as of June 30, 2014 and for the three and nine months ended June 30, 2014 and 2013 have been prepared by the Company, pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) for interim financial statements. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. These financial statements should be read in conjunction with the Company’s audited financial statements and the notes thereto for the year ended September 30, 2013 included in the Company’s 2013 Annual Report on Form 10-K.

In the opinion of management, all adjustments, consisting only of normal recurring adjustments necessary for a fair statement of the Company’s financial position as of June 30, 2014 and results of operations for the three and nine months ended June 30, 2014 and 2013 and cash flows for the nine months ended June 30, 2014 and 2013 have been made. The results of operations for the nine months ended June 30, 2014 are not necessarily indicative of the results of operations that may be expected for the year ending September 30, 2014.

The accompanying consolidated financial statements have been prepared in conformity with GAAP. All dollar amounts in the consolidated financial statements and in the notes to the consolidated financial statements, except share and per share amounts, are in thousands unless otherwise indicated.

| 2. | Summary of Significant Accounting Policies |

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent

7

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Significant estimates and assumptions reflected in these consolidated financial statements include, but are not limited to, management’s judgments of separate units of accounting and best estimate of selling price of those units of accounting within its revenue arrangements; the valuation of common stock for the periods prior to the completion of the Company’s initial public offering (“IPO”), valuation of warrants, Series 1 nonconvertible preferred stock and stock-based awards; the useful lives of property and equipment; and the accounting for income taxes, including uncertain tax positions and the valuation of net deferred tax assets. Estimates are periodically reviewed in light of changes in circumstances, facts and experience. Actual results could differ from the Company’s estimates.

Revenue Recognition

The Company’s revenue is generated primarily through collaborative research and license agreements. The terms of these agreements contain multiple deliverables, which may include (i) licenses, (ii) research and development activities, and (iii) participation in joint research and development steering committees. The terms of these agreements may include nonrefundable upfront license fees, payments for research and development activities, payments based upon the achievement of certain milestones, and royalty payments based on product sales derived from the collaboration. In all instances, revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, delivery has occurred or the services have been rendered, collectibility of the resulting receivable is reasonably assured, and the Company has fulfilled its performance obligations under the contract.

For multiple element agreements entered into or materially modified after October 1, 2011, the Company applies the principles included in Accounting Standards Update (“ASU”) No. 2009-13, Multiple-Deliverable Revenue Arrangements (“ASU 2009-13”) to account for revenue. Under this guidance the selling prices of deliverables under the arrangement may be derived using third-party evidence (“TPE”) or a best estimate of selling price (“BESP”), if vendor specific objective evidence (“VSOE”) is not available. The objective of BESP is to determine the price at which the Company would transact a sale if the element within the license agreement was sold on a standalone basis. Establishing BESP involves management’s judgment and considers multiple factors, including market conditions and company-specific factors including those factors contemplated in negotiating the agreements as well as internally developed models that include assumptions related to market opportunity, discounted cash flows, estimated development costs, probability of success, and the time needed to commercialize a product candidate pursuant to the license. In validating the Company’s BESP, the Company considers whether changes in key assumptions used to determine the BESP will have a significant effect on the allocation of the arrangement consideration between the multiple deliverables. Deliverables under the arrangement are separate units of accounting if (i) the delivered item has value to the customer on a standalone basis, and (ii) if the arrangement includes a general right of return relative to the delivered item, delivery or performance of the undelivered item is considered probable and substantially within the control of the Company. The arrangement consideration that is fixed or determinable at the inception of the arrangement is allocated to the separate units of accounting based on their relative selling prices. The appropriate revenue recognition model is applied to each element, and revenue is accordingly recognized as each element is delivered. The Company may exercise significant judgment in determining whether a deliverable is a separate unit of accounting.

In determining the separate units of accounting, the Company evaluates whether the license has standalone value to the collaborator based on consideration of the relevant facts and circumstances for each arrangement. Factors considered in this determination include the research and development capabilities of the collaborator and the availability of relevant research expertise in the marketplace. In addition, the Company considers whether or not

8

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

(i) the collaborator can use the license for its intended purpose without the receipt of the remaining deliverables, (ii) the value of the license is dependent on the undelivered items, and (iii) the collaborator or other vendors can provide the undelivered items.

Under a collaborative research and license agreement, a steering committee is typically responsible for overseeing the general working relationships, determining the protocols to be followed in the research and development performed, and evaluating the results from the continued development of the product in order to determine the clinical studies to be performed. The Company evaluates whether its participation in joint research and development steering committees is a substantive obligation or whether the services are considered inconsequential or perfunctory. The Company’s participation on a steering committee is considered “participatory” and therefore accounted for as a separate element when the collaborator requires the participation of the Company to ensure all elements of an arrangement are maximized. Steering committee services that are considered participatory are combined with other research services or performance obligations required under an arrangement, if any, in determining the level of effort required in an arrangement and the period over which the Company expects to complete its aggregate performance obligations. Alternatively, the Company’s participation on a steering committee is considered “protective” and therefore not accounted for as a separate element in a case where the Company can exercise or control when to be involved at its own discretion. Factors the Company considers in determining if its participation in a joint steering committee is participating or protective include: (i) which party negotiated or requested the steering committee, (ii) how frequently the steering committee meets, (iii) whether or not there are any penalties or other recourse if the Company does not attend the steering committee meetings, (iv) which party has decision making authority on the steering committee, and (v) whether or not the collaborator has the requisite experience and expertise associated with the research and development of the licensed intellectual property.

For agreements entered into prior to October 1, 2011, the Company accounted for the multiple elements within the agreements as a single unit of accounting and all payments received were recognized as revenue over the estimated period of performance of the entire arrangement as the Company was not able to separately recognize revenue for the elements under the provisions of previously applicable revenue recognition guidance.

For all periods presented, whenever the Company determines that an element is delivered over a period of time, revenue is recognized using either a proportional performance model or a straight-line model over the period of performance, which is typically the research and development term. Full-time equivalents (“FTEs”) are typically used as the measure of performance. At each reporting period, the Company reassesses its cumulative measure of performance and makes appropriate adjustments, if necessary. The Company recognizes revenue using the proportional performance model whenever the Company can make reasonably reliable estimates of the level of effort required to complete its performance obligations under an arrangement. Revenue recognized under the proportional performance model at each reporting period is determined by multiplying the total expected payments under the contract (excluding royalties and payments contingent upon achievement of milestones) by the ratio of the level of effort incurred to date to the estimated total level of effort required to complete the performance obligations under the arrangement. Revenue is limited to the lesser of the cumulative amount of payments received or the cumulative amount of revenue earned, as determined using the proportional performance model as of each reporting period. Alternatively, if the Company cannot make reasonably reliable estimates the level of effort required to complete its performance obligations under an arrangement, then revenue under the arrangement is recognized on a straight-line basis over the period expected to complete the Company’s performance obligations. If and when a contingent milestone payment is earned, the additional consideration to be received is allocated to the separate units of accounting in the arrangement based on their relative selling prices at the inception of the arrangement. Revenue is limited to the lesser of the cumulative amount of payments

9

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

received or the cumulative amount of revenue earned, as determined on a straight-line basis as of the period end date. If the Company cannot reasonably estimate when its performance obligation period ends, then revenue is deferred until the Company can reasonably estimate when the performance obligation period ends.

Royalty revenue, if any, is recognized based on contractual terms when reported sales are reliably measurable and collectibility is reasonably assured, provided that there are no performance obligations then remaining. To date, none of the Company’s products have been approved, and therefore the Company has not earned any royalty revenue from product sales.

During the three and nine months ended June 30, 2014 and 2013 the Company also generated revenue from a government contract, under which the Company is reimbursed for certain allowable costs for the funded project. Revenue from the government contract is recognized when the related service is performed. The related costs incurred by the Company under the government contract are included in research and development expenses in the statements of operations.

Amounts received prior to satisfying all revenue recognition criteria are recorded as deferred revenue in the accompanying consolidated balance sheets. Amounts not expected to be recognized as revenue within the next twelve months of the consolidated balance sheet date are classified as long-term deferred revenue.

In the event that a collaborative research and license agreement is terminated and the Company then has no further performance obligations, the Company recognizes as revenue any amounts that had not previously been recorded as revenue but were classified as deferred revenue at the date of such termination.

Recently Issued Accounting Pronouncements

In May, 2014, the Financial Accounting Standards Board issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), which supersedes all existing revenue recognition requirements, including most industry-specific guidance. The new standard requires a company to recognize revenue when it transfers goods or services to customers in an amount that reflects the consideration that the Company expects to receive for those goods or services. The new standard will be effective for the Company on October 1, 2017. The Company is currently evaluating the potential impact that Topic 606 may have on its financial position and results of operations.

10

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

| 3. | Fair Value of Financial Assets and Liabilities |

The following tables present information about the Company’s financial assets and liabilities that were subject to fair value measurement on a recurring basis as of June 30, 2014 and September 30, 2013 and indicate the fair value hierarchy of the valuation inputs utilized to determine such fair value:

| Fair Value Measurements as of June 30, 2014 Using: | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Cash equivalents |

$ | 21,972 | $ | — | $ | — | $ | 21,972 | ||||||||

| Commercial paper |

— | 11,840 | — | 11,840 | ||||||||||||

| Corporate bonds |

— | 93,860 | — | 93,860 | ||||||||||||

| U.S. Agency bonds |

— | 5,513 | — | 5,513 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 21,972 | $ | 111,213 | $ | — | $ | 133,185 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities: |

||||||||||||||||

| Warrant liability |

$ | — | $ | — | $ | 1,675 | $ | 1,675 | ||||||||

| Series 1 nonconvertible preferred stock |

— | — | 213 | 213 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | — | $ | — | $ | 1,888 | $ | 1,888 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Fair Value Measurements as of September 30, 2013 Using: | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Cash equivalents |

$ | 7,517 | $ | — | $ | — | $ | 7,517 | ||||||||

| U.S. Treasury notes |

1,005 | — | — | 1,005 | ||||||||||||

| Commercial paper |

— | 10,596 | — | 10,596 | ||||||||||||

| Corporate bonds |

— | 84,755 | — | 84,755 | ||||||||||||

| U.S. Agency bonds |

— | 3,518 | — | 3,518 | ||||||||||||

| Certificate of deposit |

— | 3,450 | — | 3,450 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 8,522 | $ | 102,319 | $ | — | $ | 110,841 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities: |

||||||||||||||||

| Warrant liability |

$ | — | $ | — | $ | 1,620 | $ | 1,620 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | — | $ | — | $ | 1,620 | $ | 1,620 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Cash equivalents at June 30, 2014 and September 30, 2013 consist of money market funds.

During the three and nine months ended June 30, 2014 and 2013, there were no transfers between Level 1, Level 2 and Level 3.

As of June 30, 2014 and September 30, 2013, respectively, the warrant liability was comprised of the values of warrants for the purchase of Series 1 nonconvertible preferred stock measured at fair value. At June 30, 2014 the outstanding Series 1 nonconvertible preferred stock was also measured at fair value based on significant inputs not observable in the market, which represented a Level 3 measurement within the fair value hierarchy. The Company utilized a probability-weighted valuation model which took into consideration various outcomes that may require the Company to transfer assets and which determined that the fair value of the Series 1 warrants was

11

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

$1,675 and $1,620, at June 30, 2014 and September 30, 2013, respectively. The fair value of Series 1 nonconvertible preferred stock was $213 as of June 30, 2014. Changes in the fair value of the warrant liability and Series 1 nonconvertible preferred stock are recognized in the consolidated statements of operations.

The recurring Level 3 fair value measurements of the Company’s warrant liability and Series 1 nonconvertible preferred stock using probability-weighted discounted cash flow include the following significant unobservable inputs:

| Unobservable Input |

Range | |||

| Warrant liability and Series 1 nonconvertible preferred stock |

Probabilities of payout | 70%–90% | ||

| Periods in which payout is expected to occur | 2015–2016 | |||

| Discount rate | 4.25% |

The following table provides a rollforward of the aggregate fair values of the Company’s warrants for the purchase of Series 1 nonconvertible preferred stock and the outstanding Series 1 nonconvertible preferred stock for which fair value is determined by Level 3 inputs:

| Warrants | Series 1 nonconvertible preferred stock |

|||||||

| Balance, September 30, 2013 |

$ | 1,620 | $ | — | ||||

| Warrants exercised |

(206 | ) | 206 | |||||

| Increase in fair value |

261 | 7 | ||||||

|

|

|

|

|

|||||

| Balance, June 30, 2014 |

$ | 1,675 | $ | 213 | ||||

|

|

|

|

|

|||||

| 4. | Marketable Securities |

As of June 30, 2014 and September 30, 2013, the fair value of available-for-sale marketable securities by type of security was as follows:

| June 30, 2014 | ||||||||||||||||

| Amortized Cost | Gross Unrealized Gains |

Gross Unrealized Losses |

Fair Value | |||||||||||||

| Commercial paper |

$ | 11,840 | $ | — | $ | — | $ | 11,840 | ||||||||

| Corporate bonds |

93,861 | 44 | (45 | ) | 93,860 | |||||||||||

| U.S. Agency bonds |

5,516 | — | (3 | ) | 5,513 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 111,217 | $ | 44 | $ | (48 | ) | $ | 111,213 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

12

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

| September 30, 2013 | ||||||||||||||||

| Amortized Cost | Gross Unrealized Gains |

Gross Unrealized Losses |

Fair Value | |||||||||||||

| Commercial paper |

$ | 10,596 | $ | — | $ | — | $ | 10,596 | ||||||||

| Corporate bonds |

84,757 | 23 | (25 | ) | 84,755 | |||||||||||

| U.S. Agency bonds |

3,519 | — | (1 | ) | 3,518 | |||||||||||

| Certificate of deposit |

3,450 | — | — | 3,450 | ||||||||||||

| U.S. Treasury notes |

1,004 | 1 | — | 1,005 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 103,326 | $ | 24 | $ | (26 | ) | $ | 103,324 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As of June 30, 2014, marketable securities consisted of investments that mature within one year, with the exception of certain corporate bonds, which have maturities within three years and an aggregate fair value of $41,700.

| 5. | Accrued Expenses and Other Long-Term Liabilities |

Accrued expenses (current) and other long-term liabilities consisted of the following as of June 30, 2014 and September 30, 2013:

| June 30, 2014 |

September 30, 2013 |

|||||||

| Accrued expenses: |

||||||||

| Accrued payroll and related expenses |

$ | 953 | $ | 1,041 | ||||

| Accrued preclinical and clinical expenses |

623 | 127 | ||||||

| Accrued vendor manufacturing |

477 | 989 | ||||||

| Accrued professional fees |

336 | 378 | ||||||

| Present value of accrued third-party license fees |

247 | 240 | ||||||

| Accrued other |

348 | 260 | ||||||

|

|

|

|

|

|||||

| $ | 2,984 | $ | 3,035 | |||||

|

|

|

|

|

|||||

| Other long-term liabilities: |

||||||||

| Present value of accrued third-party license fees |

$ | 190 | $ | 127 | ||||

| Accrued rent expense |

147 | 184 | ||||||

| Asset retirement obligation |

68 | 48 | ||||||

|

|

|

|

|

|||||

| $ | 405 | $ | 359 | |||||

|

|

|

|

|

|||||

| 6. | Collaboration Agreements |

AbbVie Collaboration

On November 27, 2006, the Company entered into a Collaborative Development and License Agreement (the “AbbVie Agreement”) with Abbott Laboratories to identify, develop and commercialize HCV NS3 and NS3/4A protease inhibitor compounds, including ABT-450. The agreement, which was amended in January and December 2009, was assigned by Abbott to AbbVie Inc. on January 1, 2013 in connection with Abbott’s transfer of its research-based pharmaceuticals business to AbbVie. Under the terms of the AbbVie Agreement, as amended, AbbVie paid to the Company upfront license payments and FTE reimbursements to fund research activities. The Company is also eligible to receive milestone payments for the successful development by

13

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

AbbVie of one or more HCV compounds as well as tiered royalties per product ranging from the low double digits up to twenty percent, or on a blended basis from the low double digits up to the high teens, on net sales by AbbVie allocable to the collaboration’s protease inhibitors. Deliverables under the AbbVie Agreement included a license, research services and participation on a steering committee. The Company concluded that all deliverables under the AbbVie Agreement should be treated as a single unit of accounting. Accordingly, revenue was recognized using the proportional performance model over the period during which the Company performed research services. The Company completed all remaining obligations under the agreement as of June 2011. All milestone payments received after June 2011 are recognized as revenue when each milestone is achieved by AbbVie.

Through June 2011, under the AbbVie Agreement the Company had received upfront license payments, research funding, and milestone payments totaling $92,450, all of which were recognized as revenue as of June 30, 2011.

In December 2012, the Company received an additional $15,000 milestone payment under the AbbVie Agreement as a result of AbbVie’s initiation of dosing in a Phase 3 clinical trial involving ABT-450. This amount was recognized as revenue during the nine months ended June 30, 2013.

In the quarter ending June 30, 2014, the Company received and recognized as revenue a total of $40,000 in milestone payments from AbbVie as a result of its U.S. regulatory filing with the FDA and a comparable European Union regulatory filing with the EMA for the first regimen containing a collaboration compound.

The Company is eligible to receive additional milestone payments totaling up to $155,000 upon AbbVie’s achievement of commercial regulatory approval milestones in selected world markets. The Company is also eligible to receive additional milestone payments totaling up to $80,000 upon AbbVie’s achievement of similar commercial regulatory approval milestones for each additional product containing a new protease inhibitor.

Novartis Collaboration

On February 16, 2012, the Company entered into a license and collaboration agreement with Novartis (the “Novartis Agreement”) for the development, manufacture and commercialization of its lead development candidate, EDP-239, from its NS5A HCV inhibitor program. Under the terms of the Novartis Agreement, Novartis agreed to pay a nonrefundable upfront fee to the Company and reimbursement of manufacturing and quality assurance expenses related to EDP-239 totaling $34,442. Under the agreement, the Company is eligible to receive aggregate milestone payments of up to $406,000 upon Novartis’ initiation of clinical trials, achievement of regulatory approvals, and/or net sales of products containing the Company’s NS5A inhibitors. The Company is also eligible to receive tiered royalties ranging on a blended basis from the low double digits up to the high teens on net product sales by Novartis allocable to the collaboration’s NS5A inhibitors. Under the agreement, a clinical milestone payment of $11,000 was due to the Company upon Novartis’ initiation of dosing in the first Phase 1 clinical trial involving EDP-239 or another NS5A inhibitor, and was received by the Company in January 2013. An additional milestone payment of $15,000 will be due upon Novartis’ initiation of the first Phase 2 clinical trial using a combination containing an NS5A inhibitor. In addition, Novartis agreed to fund research activities for one year commencing February 2012, up to a total of $1,800. In March 2013, the agreement was amended to extend research funding for an additional six months through August 2013 at the same reimbursement rate.

The Company determined that the deliverables under the Novartis Agreement were the license and the research services. As each of these deliverables had standalone value it was determined that they each represented a

14

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

separate unit of accounting. Arrangement consideration was allocated between the license and research services based on their relative selling prices using best estimate of selling price.

During the three and nine months ended June 30, 2014 the company recognized no revenue under the Novartis Agreement. During the three and nine months ended June 30, 2013 the Company recognized total revenue of $473 and $12,350, respectively, related to the delivery of the license and the performance of the research services under the Novartis Agreement.

NIAID Contract

On September 30, 2011, the Company entered into a contract with the National Institute of Allergy and Infectious Diseases (“NIAID”), a division of the National Institutes of Health (“NIH”), which could provide up to $42,700 in development funding to the Company over a five-year period. The contract will fund the preclinical and clinical development of a new class of bridged bicyclic antibiotics known as Bicyclolides to be used as medical countermeasures against multiple biodefense Category A and B bacteria.

The contract had an initial term of 30 months which ended on March 30, 2014. NIAID has the option to extend the contract up to six times. If each extension option is exercised, the contract would be extended until September 30, 2016. The initial award under the initial term was $14,300, with the possibility of up to a total of $42,700 if each option period is exercised by NIAID. In August 2013 NIAID exercised the first two options under this agreement which obligate it to provide an additional $9,200 in funding to the Company for preclinical and early clinical development of EDP-788, bringing total funding paid or committed to date by NIAID to approximately $23,500 through February 2015.

The Company recognizes revenue under this agreement as development services are performed in accordance with the funding agreement. During the three months ended June 30, 2014 and 2013, $2,051 and $1,176 of revenue, respectively, was recognized under this agreement. During the nine months ended June 30, 2014 and 2013, the Company recognized revenue of $5,104 and $3,354, respectively.

| 7. | Warrants to Purchase Series 1 Nonconvertible Preferred Stock and Series 1 Nonconvertible Preferred Stock |

In October and November 2010, the Company issued warrants to purchase up to a total of 1,999,989 shares of Series 1 nonconvertible preferred stock, which expire on October 4, 2017. As these warrants are free-standing financial instruments that may require the Company to transfer assets upon exercise, these warrants are classified as liabilities. The Company is required to remeasure the fair value of these preferred stock warrants at each reporting date, with any adjustments recorded within the change in fair value of warrant liability included in other income (expense) in the consolidated statement of operations. On February 5, 2014, 225,408 warrants were exercised resulting in the net issuance of 223,153 shares of Series 1 nonconvertible preferred stock. As of June 30, 2014, the total fair value of the Series 1 nonconvertible preferred stock was $213. The warrants and Series 1 nonconvertible preferred stock were remeasured at each reporting period, resulting in expense of $65 and $17 for the three months ended June 30, 2014 and 2013, respectively, and expense of $268 and income of $217 for the nine months ended June 30, 2014 and 2013, respectively. As of June 30, 2014 and September 30, 2013, the total fair value of the Series 1 nonconvertible preferred stock warrants was $1,675 and $1,620, respectively.

15

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

| 8. | Stock-Based Awards |

2012 Equity Incentive Plan

The Company’s 2012 Equity Incentive Plan (the “2012 Plan”) permits the Company to sell or issue common stock or restricted common stock, to grant incentive stock options or nonqualified stock options for the purchase of common stock, or to grant restricted stock units, stock appreciation rights or other cash incentive awards, to employees, members of the board of directors and consultants of the Company. Upon initial approval, the total number of shares of common stock that could be issued under the plan was 348,355. The number of shares of common stock that may be issued under the 2012 Plan is subject to increase by the number of shares forfeited under any options terminated and not exercised under the previous plan, known as the 1995 Equity Incentive Plan as well as by a number of additional shares on the first day of each fiscal year equal to the lowest amount among the following: (i) 3% of the Company’s outstanding shares of common stock as of that date, (ii) 2,088,167 shares of common stock, or (iii) a lower amount determined by the board of directors. As of June 30, 2014, 410,380 shares remained available for future grant.

In March 2013, the Company granted to certain executives 167,052 options that vest upon the achievement of certain performance-based targets. The fair value of these options is $2,479. During the nine months ended June 30, 2014, one performance-based target was achieved and the Company recorded compensation expense of $206 related to that target.

Employee Stock Purchase Plan

Under the Employee Stock Purchase Plan (the “ESPP”), a total of 185,614 shares of common stock were reserved for issuance. As of June 30, 2014, the Company has not commenced any offering under the ESPP and no shares have been issued.

Stock Option Valuation

The fair value of each stock option grant is estimated on the date of grant using the Black-Scholes option-pricing model. Prior to March 2013 the Company historically had been a private company and lacked sufficient company-specific historical and implied volatility information. Therefore, it estimates its expected stock volatility based on the historical volatility of a selected group of publicly traded peer companies, inclusive of the Company, commencing March 2013, and expects to continue to do so until such time as it has adequate historical data regarding the volatility of its own traded stock price. The expected term of the Company’s stock options has been determined utilizing the “simplified” method for awards that qualify as “plain-vanilla” options. The risk-free interest rate is determined by reference to the U.S. Treasury yield curve in effect at the time of grant of the award for time periods approximately equal to the expected term of the award. Expected dividend yield is based on the fact that the Company has never paid cash dividends and does not expect to pay any cash dividends in the foreseeable future. The relevant data used to determine the value of the stock option grants is as follows, presented on a weighted average basis:

| Three Months Ended June 30, | Nine Months Ended June 30, | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Risk-free interest rate |

1.93 | % | 1.16 | % | 1.89 | % | 1.03 | % | ||||||||

| Expected term (in years) |

6.10 | 6.00 | 6.06 | 6.09 | ||||||||||||

| Expected volatility |

76 | % | 77 | % | 75 | % | 73 | % | ||||||||

| Expected dividend yield |

0 | % | 0 | % | 0 | % | 0 | % | ||||||||

16

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

The Company recognizes compensation expense for only the portion of awards that are expected to vest. In developing a forfeiture rate estimate, the Company has considered its historical experience to estimate pre-vesting forfeitures for service-based awards. The impact of a forfeiture rate adjustment will be recognized in full in the period of adjustment, and if the actual forfeiture rate is materially different from the Company’s estimate, the Company may be required to record adjustments to stock-based compensation expense in future periods.

As required by the 2012 Plan, the exercise price for awards granted is not to be less than the fair value of common shares as of the date of grant. For periods prior to the IPO, the Company valued its common stock by taking into consideration its most recently available valuation of common shares performed by management and the board of directors as well as additional factors which may have changed since the date of the most recent contemporaneous valuation through the date of grant. For periods after the IPO, the Company based fair value of its common stock on the quoted market price.

The following table summarizes stock option activity during the nine months ended June 30, 2014:

| Shares Issuable Under Options |

Weighted Average Exercise Price |

Weighted Average Remaining Contractual Term |

Aggregate Intrinsic Value |

|||||||||||||

| (in years) | ||||||||||||||||

| Outstanding as of September 30, 2013 |

1,583,031 | $ | 5.15 | 5.0 | $ | 28,133 | ||||||||||

| Granted |

483,570 | 29.73 | ||||||||||||||

| Exercised |

(650,939 | ) | 1.56 | |||||||||||||

| Forfeited |

(9,343 | ) | 14.00 | |||||||||||||

| Expired |

(465 | ) | 0.73 | |||||||||||||

|

|

|

|||||||||||||||

| Outstanding as of June 30, 2014 |

1,405,854 | $ | 15.21 | 7.4 | $ | 38,818 | ||||||||||

|

|

|

|||||||||||||||

| Options vested and expected to vest as of June 30, 2014 |

1,221,172 | $ | 15.20 | 7.2 | $ | 34,028 | ||||||||||

|

|

|

|||||||||||||||

| Options exercisable as of June 30, 2014 |

676,867 | $ | 6.42 | 5.6 | $ | 24,960 | ||||||||||

|

|

|

|||||||||||||||

The Company recorded stock-based compensation expense for the three and nine months ended June 30, 2014 and 2013 in the following expense categories:

| Three Months Ended June 30, |

Nine Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Research and development |

$ | 196 | $ | 107 | $ | 562 | $ | 286 | ||||||||

| General and administrative |

580 | 132 | 1,325 | 491 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 776 | $ | 239 | $ | 1,887 | $ | 777 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As of June 30, 2014, the Company had an aggregate of $9,067 of unrecognized stock-based compensation cost, which is expected to be recognized over a weighted average period of 3.0 years.

17

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

| 9. | Net Income (Loss) Per Share |

Basic and diluted net income (loss) per share attributable to common stockholders was calculated as follows for the three and nine months ended June 30, 2014 and 2013, respectively:

| Three Months Ended June 30, |

Nine Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Basic net income (loss) per share attributable to common stockholders: |

||||||||||||||||

| Numerator: |

||||||||||||||||

| Net income (loss) |

$ | 50,053 | $ | (4,138 | ) | $ | 39,480 | $ | 14,070 | |||||||

| Accretion of redeemable convertible preferred stock to redemption value |

— | — | — | (2,526 | ) | |||||||||||

| Net income attributable to participating securities |

— | — | — | (13,670 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to common stockholders |

$ | 50,053 | $ | (4,138 | ) | $ | 39,480 | $ | (2,126 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted average common shares outstanding—basic |

18,528,833 | 17,819,813 | 18,275,831 | 7,052,989 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share attributable to common stockholders—basic |

$ | 2.70 | $ | (0.23 | ) | $ | 2.16 | $ | (0.30 | ) | ||||||

| Diluted net income (loss) per share attributable to common stockholders: |

||||||||||||||||

| Numerator: |

||||||||||||||||

| Net income (loss) |

$ | 50,053 | $ | (4,138 | ) | $ | 39,480 | $ | 14,070 | |||||||

| Accretion of redeemable convertible preferred stock to redemption value |

— | — | — | (2,526 | ) | |||||||||||

| Net income attributable to participating securities |

— | — | — | (13,670 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to common stockholders—diluted |

$ | 50,053 | $ | (4,138 | ) | $ | 39,480 | $ | (2,126 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator: |

||||||||||||||||

| Weighted average common shares outstanding—basic |

18,528,833 | 17,819,813 | 18,275,831 | 7,052,989 | ||||||||||||

| Dilutive effect of common stock equivalents |

674,437 | — | 892,537 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common shares outstanding—diluted |

19,203,270 | 17,819,813 | 19,168,368 | 7,052,989 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share attributable to common stockholders—diluted |

$ | 2.61 | $ | (0.23 | ) | $ | 2.06 | $ | (0.30 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

18

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

Stock options for the purchase of 433,535 and 1,525,952 weighted average shares were excluded from the computation of diluted net income per share attributable to common stockholders for the three months ended June 30, 2014 and 2013, respectively, because those options had an anti-dilutive impact due to either the net loss attributable to common stockholders incurred for the period or to the assumed proceeds per share using the treasury stock method being greater than the average fair value of the Company’s common shares for those periods. Stock options for the purchase of 300,428 and 1,685,921 weighted average shares were excluded from the computation of diluted net income per share attributable to common stockholders for the nine months ended June 30, 2014 and 2013, respectively, because those options had an anti-dilutive impact due to either the net loss attributable to common stockholders incurred for the period or to the assumed proceeds per share using the treasury stock method being greater than the average fair value of the Company’s common shares for those periods.

| 10. | Income Taxes |

As of September 30, 2013, December 31, 2013 and March 31, 2014, the Company had provided a valuation allowance for the full amount of its net deferred tax assets because it was not more likely than not that any future benefit from deductible temporary differences and net operating loss and tax credit carry forwards would be realized. At June 30, 2014, the Company reassessed the need for a valuation allowance against its deferred tax assets as the Company earned and collected $40,000 in milestone payments during the three months ended June 30, 2014 as a result of U.S. and European Union regulatory approval filing by AbbVie with respect to the collaboration’s leading product candidate. The Company concluded that it was more likely than not that it would be able to realize its deferred tax assets primarily as a result of historical profitability for the years 2010 through 2013, expected profitability for the year ending September 30, 2014 and forecasted future profits resulting from future expected milestone payments and on-going royalty payments from collaboration partners. Accordingly, the Company reversed its valuation allowance and recorded an income tax benefit of approximately $15,122 for each of the three and nine months ended June 30, 2014. The reversal of the valuation allowance released approximately $22,892, of which $15,333 was recorded as a discrete item in the period ended June 30, 2014 representing the change in estimate regarding future years’ income, and the remaining $7,559 was released to income as the deferred tax assets were utilized in fiscal 2014.

The effective tax rate benefit for the first nine months of fiscal 2014 was (80.70)% and differs from the federal statutory rate of 34% primarily due to a change in estimate as to the Company’s ability to utilize net operating loss carry-forwards and research and development credits resulting in a reduction of the Company’s valuation allowance against deferred tax assets in the amount of $22,892, as well as changes in estimates related to the fiscal 2014 research and development credits, and certain expenditures which are permanently not deductible for tax purposes.

The effective tax rate benefit for the first nine months of fiscal 2013 was 0% and differed from the federal statutory tax rate of 34% primarily because the Company had available tax loss carryforwards and other deferred tax assets to offset its taxable income in that period. The Company had concluded in that period, based on the weight of available evidence, that its net deferred tax assets were not more likely than not to be realized in the future. Accordingly, a full valuation allowance had been established against the deferred tax assets as of June 30, 2013.

19

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

| 11. | Commitments and Contingencies |

Leases

The Company has an office and laboratory lease that expires in September 2018. Payment escalation as specified in the lease agreement is accrued such that rent expense is recognized on a straight-line basis over the term of occupancy. The Company recorded rent expense of $237 for the three months ended June 30, 2014 and 2013, and $711 for the nine months ended June 30, 2014 and 2013.

In connection with the lease, the Company has outstanding a $436 letter of credit, collateralized by a money market account. As of June 30, 2014 and September 30, 2013, the Company classified $436 related to the letter of credit as restricted cash.

Intellectual Property Licenses

The Company has a non-exclusive intellectual property license agreement under which it is required to pay the licensor future license fees of $250 and $200 in fiscal years 2014 and 2015, respectively. In addition, the Company is required to pay (1) annual maintenance fees of $105 for each year that the agreement remains in effect in order to maintain the right to use the license, and (2) a one-time fee of $50 in each circumstance in which the Company provides the licensed intellectual property to one of its collaborators with the prior consent of the licensor. As of June 30, 2014, the Company had accrued expense relating to this obligation of $437, of which $247 was included in accrued expenses and $190 was included in other long-term liabilities.

The Company also has a non-exclusive license with respect to patents it uses in its HCV research. Under the license, the Company is obligated to pay milestones totaling up to $5,000, plus low single digit royalties, for each HCV product it develops outside of its collaboration with AbbVie or any other collaboration it may enter into in the future with a partner that has licensed these patents.

Litigation and Contingencies Related to Use of Intellectual Property

From time to time, the Company may become subject to legal proceedings, claims and litigation arising in the ordinary course of business. The Company currently is not a party to any threatened or pending litigation. However, third parties might allege that the Company or its collaborators are infringing their patent rights or that the Company is otherwise violating their intellectual property rights. Such third parties may resort to litigation against the Company or its collaborators, which the Company has agreed to indemnify. With respect to some of these patents, the Company expects that it will be required to obtain licenses and could be required to pay license fees or royalties, or both. These licenses may not be available on acceptable terms, or at all. A costly license, or inability to obtain a necessary license, could have a material adverse effect on the Company’s financial condition, results of operations or cash flows. The Company accrues contingent liabilities when it is probable that future expenditures will be incurred and such expenditures can be reasonably estimated.

Indemnification Agreements

In the ordinary course of business, the Company may provide indemnifications of varying scope and terms to customers, vendors, lessors, business partners, and other parties with respect to certain matters including, but not limited to, losses arising out of breach of such agreements, from services to be provided by the Company, or from intellectual property infringement claims made by third parties. In addition, the Company has entered into indemnification agreements with members of its board of directors that will require the Company, among other

20

Table of Contents

ENANTA PHARMACEUTICALS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(unaudited)

(amounts in thousands, except share and per share data)

things, to indemnify them against certain liabilities that may arise by reason of their status or service as directors or officers. Despite the fact that the Company has obtained insurance coverage for certain of these indemnification obligations, the maximum potential amount of future payments the Company could be required to make under these indemnification agreements is, in many cases, unlimited. To date, the Company has not incurred any material costs as a result of such indemnifications. The Company does not believe that the outcome of any claims under indemnification arrangements will have a material effect on its financial position, results of operations or cash flows, and it has not accrued any liabilities related to such obligations in its consolidated financial statements as of June 30, 2014.

21

Table of Contents

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the unaudited consolidated financial statements and notes thereto included elsewhere in this Quarterly Report on Form 10-Q and the audited consolidated financial statements and notes thereto for the year ended September 30, 2013 included in our Annual Report on From 10-K for our fiscal year ended September 30, 2013, referred to as an 2013 Annual report on Form 10-K. This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “should,” “estimate,” or “continue,” and similar expressions or variations. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in the section titled “Risk Factors,” set forth in Part II, Item 1A of this Quarterly Report on Form 10-Q. The forward-looking statements in this Quarterly Report on Form 10-Q represent our views as of the date of this Quarterly Report on Form 10-Q. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Quarterly Report on Form 10-Q.

Overview

We are a research and development-focused biotechnology company that uses its robust chemistry-driven approach and drug discovery capabilities to create small molecule drugs primarily in the infectious disease field. We are discovering and developing inhibitors designed for use against the hepatitis C virus, referred to as HCV. We believe that a successful approach to a complete cure for HCV in most patients will likely require treatment with a combination of drugs that attack different mechanisms necessary for replication and survival of HCV. Further, as there are many variants of HCV, we are developing inhibitors that may be used in multiple combination therapies, each designed and tested for effectiveness against one or more of those variants. Our development of inhibitors for validated HCV target mechanisms, as well as our collaborations with AbbVie (which name refers to Abbott Laboratories for all periods before January 1, 2013) and Novartis, should allow us to participate in multiple drug combinations as we seek the best combination therapies for HCV in its various forms. The reported worldwide sales of the two newest therapies for HCV (sofosbuvir and simeprevir) in the first six months of 2014 totaled $6.9 billion. We believe that annual worldwide sales of these therapies and future approved therapies could increase sales in this market to $10 billion to $20 billion within the next several years. In addition to our HCV programs, we have used our internal research capabilities to discover a new class of antibiotics which we are developing for the treatment of multi-drug resistant bacteria, including methicillin-resistant Staphylococcus aureus bacteria, also referred to as MRSA. We have utilized our internal chemistry and drug discovery capabilities and our collaborations to generate all of our development-stage programs, and we have active research efforts to broaden our infectious disease drug pipeline.

22

Table of Contents

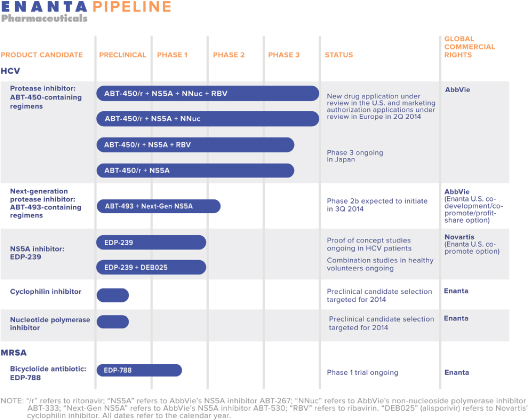

The following table summarizes our product development pipeline in HCV antivirals as well as MRSA antibiotics:

Our HCV portfolio includes inhibitors of four fundamental, validated HCV targets. Our lead product candidate, ABT-450, is a protease inhibitor being developed through our collaboration with AbbVie. In the quarter ended June 30, 2014, we received and recognized as revenue a total of $40.0 million in milestone payments from AbbVie as a result of a U.S. regulatory filing by AbbVie with the FDA and a comparable European Union regulatory filing with the EMA for the first regimens containing a collaboration compound. To date AbbVie has funded all research and development of our protease inhibitors since we entered into the collaboration in November 2006, and is responsible for obtaining regulatory approvals and commercializing ABT-450, ABT-493 and any other follow-on products worldwide. Our lead NS5A product candidate, EDP-239, is being developed through our collaboration with Novartis. Under our collaboration with Novartis, Novartis is responsible for all further development of our NS5A inhibitors. Novartis was also responsible for funding research that we conducted to discover additional NS5A compounds through August 2013.

Our independent HCV research activities are focused on our lead cyclophilin inhibitor candidates, which are in preclinical development. We also have a small-molecule drug discovery effort underway for nucleotide polymerase inhibitors. We are currently funding all research and development for our cyclophilin inhibitor and nucleotide polymerase inhibitor programs. We expect to incur substantially greater expenses as we seek to advance these programs into clinical development.

23

Table of Contents

In addition to our HCV programs, we have used our internal research capabilities to discover a new class of antibiotics called Bicyclolides, which we are developing for the treatment of multi-drug resistant bacteria, including methicillin-resistant Staphylococcus aureus bacteria, also referred to as MRSA. Initially, up to $14.3 million of the preclinical development of our lead antibiotic candidate, EDP-788, was funded under a September 2011 contract with the National Institute of Allergy and Infectious Diseases, a division of the National Institutes of Health, an agency of the United States Department of Health and Human Services, or NIAID, to develop EDP-788 for biodefence purposes. In August 2013 NIAID agreed to provide additional funding of $9.2 million under our contract, increasing total funding from NIAID to approximately $23.5 million.

Since commencing our operations in 1995, we have devoted substantially all of our resources to the discovery and development of novel inhibitors for the treatment of infectious diseases. We have historically funded our operations primarily through the sale of convertible preferred stock and payments received under our collaborations and a government contract. On March 26, 2013, we completed our IPO of 4,600,000 shares of common stock at an offering price of $14.00 per share, which included the exercise in full by the underwriters of their option to purchase up to 600,000 additional shares of common stock. We received net proceeds of approximately $59.9 million, after deducting underwriting discounts and commissions. As of June 30, 2014, we had $137.6 million in cash and investments.

Our revenue from our collaboration agreements has resulted in our reporting net income in each of our past four fiscal years and in the three and nine months ended June 30, 2014. However, we had an accumulated deficit of $68.0 million as of June 30, 2014 and have generated no royalties or other revenue from product sales. We expect that our revenue in the near term will continue to be substantially dependent on our collaborations with AbbVie and Novartis and their continued advancement of the related development programs. Given the schedule of potential milestone payments and the uncertain nature and timing of clinical development and regulatory approval, we cannot be certain as to when or whether we will receive further milestone payments under these collaborations or whether we will report either revenue or net income in future years.

Financial Operations Overview

Revenue

Since our inception, our revenue has been derived from two primary sources: collaboration agreements with pharmaceutical companies and one government research and development contract. We have not generated any revenue from product sales. In November 2006, we entered into a collaboration agreement with AbbVie and in February 2012 we entered into a collaboration agreement with Novartis. In September 2011, we entered into a contract with NIAID, which is funding the preclinical and Phase 1 development of our lead product candidate in our new class of Bicyclolide antibiotics.

The following table is a summary of revenue recognized from our collaboration agreements and government contract for the three and nine months ended June 30, 2014 and 2013:

| Three Months Ended June 30, |

Nine Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| (in thousands) | ||||||||||||||||

| AbbVie agreement: |

||||||||||||||||

| Milestone payments |

$ | 40,000 | $ | — | $ | 40,000 | $ | 15,000 | ||||||||

| Novartis agreement: |

||||||||||||||||

| Upfront license payment and research funding |

— | 473 | — | 1,350 | ||||||||||||

| Milestone payments |

— | — | — | 11,000 | ||||||||||||

| NIAID contract |

2,051 | 1,176 | 5,104 | 3,354 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

$ | 42,051 | $ | 1,649 | $ | 45,104 | $ | 30,704 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

24

Table of Contents

AbbVie Agreement