Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2014

o TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE EXCHANGE ACT

For the transition period from _________ to _________

000-54416

(Commission File Number)

EMC METALS CORP.

(Exact name of registrant as specified in its charter)

| British Columbia, Canada | 98-1009717 | |

|

(State or other jurisdiction

of incorporation or organization)

|

(IRS Employer

Identification No.)

|

1430 Greg Street, Suite 501, Sparks, Nevada 89431

(Address of principal executive offices) (Zip Code)

(775) 355-9500

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) filed all reports required to be filed by sections 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filed | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company, as defined in Rule 12b-2 of the Exchange Act. Yes o No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of August 6, 2014, the registrant’s outstanding common stock consisted of 193,070,379 shares.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

(An Exploration Stage Company)

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SIX MONTHS AND QUARTER ENDED JUNE 30, 2014

2

|

EMC Metals Corp.

|

||||

|

(An Exploration Stage Company)

|

||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS

|

||||

|

(Expressed in US Dollars) (Unaudited)

|

||||

|

As at:

|

June 30, 2014

|

December 31, 2013

|

||||||

|

ASSETS

|

||||||||

|

Current

|

||||||||

|

Cash

|

$ | 780,711 | $ | 785,075 | ||||

|

Prepaid expenses and receivables

|

23,460 | 127,410 | ||||||

|

Subscription receivable (Note 10)

|

234,175 | - | ||||||

|

Total Current Assets

|

1,038,346 | 912,485 | ||||||

|

Restricted cash (Note 3)

|

- | 149,868 | ||||||

|

Property, plant and equipment (Note 5)

|

8,361 | 10,278 | ||||||

|

Mineral interests (Note 6)

|

2,977,234 | 1,613,203 | ||||||

|

Total Assets

|

$ | 4,023,941 | $ | 2,685,834 | ||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Current

|

||||||||

|

Accounts payable and accrued liabilities

|

$ | 348,937 | $ | 247,613 | ||||

|

Convertible debentures (Note 7)

|

- | 650,000 | ||||||

|

Promissory notes payable (Note 8)

|

2,500,000 | 1,204,875 | ||||||

|

Total Liabilities

|

2,848,937 | 2,102,488 | ||||||

|

Stockholders’ Equity

|

||||||||

|

Capital stock (Note 10) (Authorized: Unlimited number of shares; Issued and outstanding: 188,429,143 (2013 – 165,358,337))

|

88,394,298 | 87,310,708 | ||||||

|

Treasury stock (Note 11)

|

(1,264,194 | ) | (1,264,194 | ) | ||||

|

Additional paid in capital (Note 10)

|

2,109,493 | 2,108,327 | ||||||

|

Accumulated other comprehensive loss

|

(853,400 | ) | (853,400 | ) | ||||

|

Deficit accumulated during the exploration stage

|

(87,211,193 | ) | (86,718,095 | ) | ||||

|

Total Stockholders’ Equity

|

1,175,004 | 583,346 | ||||||

|

Total Liabilities and Stockholders’ Equity

|

$ | 4,023,941 | $ | 2,685,834 | ||||

Nature and continuance of operations (Note 1)

Subsequent events (Note 14)

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

|

|

(Expressed in US Dollars) (Unaudited)

|

|

Cumulative amounts from incorporation on July 17, 2006 to June 30, 2014

|

Quarter ended June 30, 2014

|

Quarter ended June 30, 2013

|

Six Months ended June 30, 2014

|

Six Months ended June 30, 2013

|

||||||||||||||||

|

EXPENSES

|

||||||||||||||||||||

|

Amortization (Note 5)

|

$ | 2,150,714 | $ | 959 | $ | 1,074 | $ | 1,917 | $ | 2,149 | ||||||||||

|

Consulting

|

2,269,734 | 8,500 | 41,865 | 8,500 | 77,153 | |||||||||||||||

|

Exploration

|

15,127,312 | 635 | 2,044 | 53,391 | 309,115 | |||||||||||||||

|

General and administrative

|

7,344,025 | 39,788 | 44,978 | 87,110 | 120,225 | |||||||||||||||

|

Insurance

|

950,824 | (241 | ) | 7,593 | 6,448 | 15,015 | ||||||||||||||

|

Professional fees

|

3,278,246 | 62,691 | 32,020 | 83,813 | 78,942 | |||||||||||||||

|

Research and development

|

3,042,091 | - | - | - | - | |||||||||||||||

|

Salaries and benefits

|

7,567,767 | 89,475 | 137,347 | 186,769 | 280,349 | |||||||||||||||

|

Stock-based compensation (Note 10)

|

5,416,151 | - | 43,165 | 1,166 | 64,197 | |||||||||||||||

|

Travel and entertainment

|

1,631,765 | 5,176 | 4,872 | 12,442 | 13,718 | |||||||||||||||

|

Loss from continuing operations before other items

|

(48,778,629 | ) | (206,983 | ) | (314,958 | ) | (441,556 | ) | (960,863 | ) | ||||||||||

|

OTHER ITEMS

|

||||||||||||||||||||

|

Foreign exchange gain

|

363,136 | 11,355 | 38,099 | 4,124 | 27,783 | |||||||||||||||

|

Gain on transfer of marketable securities

|

181,238 | - | - | - | - | |||||||||||||||

|

Gain on settlement of convertible debentures

|

1,268,246 | - | - | - | - | |||||||||||||||

|

Gain on sale of marketable securities

|

1,720,016 | - | - | - | - | |||||||||||||||

|

Write-off of mineral interests and property, plant and equipment

|

(16,015,169 | ) | - | - | - | - | ||||||||||||||

|

Write-off of land and water rights

|

(2,800,000 | ) | - | - | - | - | ||||||||||||||

|

Gain on insurance proceeds

|

912,534 | - | - | - | - | |||||||||||||||

|

Interest expense

|

(873,640 | ) | (25,666 | ) | (156,427 | ) | (55,666 | ) | (302,706 | ) | ||||||||||

|

Other income

|

466,463 | - | - | - | - | |||||||||||||||

|

Gain on disposition of assets

|

933,075 | - | - | - | - | |||||||||||||||

|

Change in fair value of derivative liability

|

453,790 | - | - | - | - | |||||||||||||||

|

Unrealized loss on marketable securities

|

(3,070,425 | ) | - | - | - | - | ||||||||||||||

| (16,460,736 | ) | (14,311 | ) | (118,328 | ) | (51,542 | ) | (274,923 | ) | |||||||||||

|

Loss from continuing operations before income taxes

|

(65,239,365 | ) | (221,294 | ) | (433,286 | ) | (493,098 | ) | (1,235,786 | ) | ||||||||||

|

Deferred income tax recovery

|

6,020,527 | - | - | - | - | |||||||||||||||

|

Loss from continuing operations for the period

|

(59,218,838 | ) | (221,294 | ) | (433,286 | ) | (493,098 | ) | (1,235,786 | ) | ||||||||||

| Loss from discontinued operations (Note 4) | (25,501,664 | ) | - | (88,609 | ) | - | (196,397 | ) | ||||||||||||

| Loss for the period | (84,720,502 | ) | (221,294 | ) | (521,895 | ) | (493,098 | ) | (1,432,183 | ) | ||||||||||

|

Foreign currency translation adjustment

|

(2,844,668 | ) | - | - | - | - | ||||||||||||||

|

Comprehensive loss for the period

|

$ | (87,565,170 | ) | $ | (221,294 | ) | $ | (521,895 | ) | $ | (493,098 | ) | $ | (1,432,183 | ) | |||||

|

Basic and diluted loss per common share

|

||||||||||||||||||||

| Loss from continuing operations | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.01 | ) | ||||||||

| Loss from discontinued operations | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | $ | (0.00 | ) | ||||||||

|

Weighted average number of common shares outstanding

|

177,640,929 | 165,358,337 | 171,690,544 | 165,358,337 | ||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

|

EMC Metals Corp.

|

||||

|

(An Exploration Stage Company)

|

||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

||||

|

(Expressed in US Dollars) (Unaudited)

|

||||

|

Cumulative amounts from incorporation on July 17, 2006 to June 30, 2014

|

Six month period ended June 30, 2014

|

Six month period ended June 30, 2013

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

||||||||||||

|

Loss for the period

|

$ | (84,720,502 | ) | $ | (493,098 | ) | $ | (1,432,183 | ) | |||

|

Items not affecting cash:

|

||||||||||||

|

Amortization

|

2,361,260 | 1,917 | 11,854 | |||||||||

|

Research and development

|

3,042,091 | - | - | |||||||||

|

Consulting paid with common shares

|

9,379 | - | - | |||||||||

|

Gain on disposal of assets

|

(933,075 | ) | - | - | ||||||||

|

Convertible debenture costs

|

(1,149,630 | ) | - | - | ||||||||

|

Unrealized foreign exchange

|

794,240 | - | 8,660 | |||||||||

|

Stock-based compensation

|

5,416,151 | 1,166 | 64,197 | |||||||||

|

Unrealized gain on marketable securities

|

(46,707 | ) | - | - | ||||||||

|

Realized gain on marketable securities

|

(1,720,016 | ) | - | - | ||||||||

|

Write-off of mineral properties and property, plant & equipment

|

39,442,452 | - | - | |||||||||

|

Write-off of land and water rights

|

3,243,685 | - | - | |||||||||

|

Realized loss on transfer of marketable securities

|

2,935,895 | - | - | |||||||||

|

Change in fair value of derivative liability

|

(453,790 | ) | - | - | ||||||||

|

Deferred income tax recovery

|

(6,020,527 | ) | - | - | ||||||||

|

Finance charge

|

504,479 | - | 177,260 | |||||||||

| (37,294,615 | ) | (490,015 | ) | (1.170,212 | ) | |||||||

|

Changes in non-cash working capital items:

|

||||||||||||

|

Decrease (increase) in prepaids and receivables

|

(243,256 | ) | 103,950 | 51,042 | ||||||||

|

Increase (decrease) in accounts payable and accrued liabilities

|

(355,309 | ) | 101,324 | 279,556 | ||||||||

|

Increase in due to related parties

|

1,091,043 | - | - | |||||||||

|

Asset retirement obligations

|

(999,176 | ) | - | - | ||||||||

| (37,801,313 | ) | (284,741 | ) | (839,614 | ) | |||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

||||||||||||

|

Cash acquired from subsidiary

|

4,543,435 | - | - | |||||||||

|

Cash paid for Subsidiary

|

(10,602,498 | ) | - | - | ||||||||

|

Spin-out of Golden Predator Corp.

|

(66,890 | ) | - | - | ||||||||

|

Restricted cash

|

(11,293 | ) | 149,868 | - | ||||||||

|

Reclamation bonds

|

747,862 | - | - | |||||||||

|

Proceeds from sale of marketable securities, net

|

(3,881,287 | ) | - | - | ||||||||

|

Proceeds from sale of property, plant and equipment

|

5,633,294 | - | - | |||||||||

|

Purchase of property, plant and equipment

|

(19,920,751 | ) | - | - | ||||||||

|

Proceeds from sale of mineral interests

|

517,550 | - | - | |||||||||

|

Additions to unproven mineral interests

|

(5,588,419 | ) | (1,364,031 | ) | (1,108,484 | ) | ||||||

| (28,628,997 | ) | (1,214,163 | ) | (1,108,484 | ) | |||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

||||||||||||

|

Common shares issued

|

53,595,724 | 876,946 | - | |||||||||

|

Share issuance costs

|

(1,218,332 | ) | (27,531 | ) | - | |||||||

|

Special warrants

|

12,095,274 | - | - | |||||||||

|

Options exercised

|

370,812 | - | - | |||||||||

|

Warrants exercised

|

10,534,109 | - | - | |||||||||

|

Notes payable

|

(11,412,423 | ) | - | - | ||||||||

|

Receipt of promissory note

|

4,844,874 | 2,500,000 | 1,200,000 | |||||||||

|

Convertible debenture

|

2,650,000 | - | 649,175 | |||||||||

|

Debt issuance costs

|

(249,827 | ) | - | - | ||||||||

|

Payment of promissory note and convertible debenture

|

(4,540,103 | ) | (1,854,875 | ) | - | |||||||

|

Advances from related party

|

191,508 | - | - | |||||||||

|

Loans advanced to Midway

|

(1,822,651 | ) | - | - | ||||||||

|

Loan repayment from Midway

|

1,760,221 | - | - | |||||||||

| 66,799,186 | 1,494,540 | 1,849,175 | ||||||||||

|

Effect of foreign exchange on cash flows

|

411,835 | - | - | |||||||||

|

Change in cash during the period

|

780,711 | (4,364 | ) | (98,923 | ) | |||||||

|

Cash, beginning of period

|

- | 785,075 | 190,215 | |||||||||

|

Cash, end of period

|

$ | 780,711 | $ | 780,711 | $ | 91,292 | ||||||

Supplemental disclosure with respect to cash flows (Note 13)

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

|

EMC Metals Corp.

|

||||||||

|

(An Exploration Stage Company)

|

||||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

|

||||||||

|

(Expressed in US Dollars) (Unaudited) Page 1 of 2

|

||||||||

| Capital Stock |

Additional

|

Accumulated Other

|

Deficit Accumulated During the

|

|||||||||||||||||||||||||

|

Number of Shares

|

Amount

|

Paid in

Capital |

Treasury

Stock |

Comprehensive

Loss

|

Exploration

Stage

|

Total

|

||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

|

Balance, July 17, 2006

|

- | - | - | - | - | - | - | |||||||||||||||||||||

|

Private placements

|

5,000,000 | 3,017,350 | - | - | - | - | 3,017,350 | |||||||||||||||||||||

|

Excess of exchange amount over carrying

|

- | - | - | - | - | - | ||||||||||||||||||||||

|

Excess of exchange amount over carrying

amount of Springer Mining Company

|

- | - | - | - | - | (2,490,691 | ) | (2,490,691 | ) | |||||||||||||||||||

|

Loss for the period

|

- | - | - | - | - | (316,382 | ) | (316,382 | ) | |||||||||||||||||||

|

Balance, December 31, 2006

|

5,000,000 | 3,017,350 | - | - | - | (2,807,073 | ) | 210,277 | ||||||||||||||||||||

|

Private placements

|

17,577,500 | 35,598,475 | - | - | - | - | 35,598,475 | |||||||||||||||||||||

|

Conversion of special warrants

|

5,390,000 | 5,590,529 | - | - | - | - | 5,590,529 | |||||||||||||||||||||

|

Exercise of warrants

|

50,000 | 74,235 | - | - | - | - | 74,235 | |||||||||||||||||||||

|

Share issuance costs – broker’s fees

|

- | (1,202,721 | ) | 97,56500 | - | - | - | (1,105,156 | ) | |||||||||||||||||||

|

Share issuance costs – shares issued

|

100,000 | 99,910 | - | - | - | - | 99,910 | |||||||||||||||||||||

|

Shares issued for mineral properties

|

100,000 | 95,822 | - | - | - | - | 95,822 | |||||||||||||||||||||

|

Stock-based compensation

|

40,000 | 38,314 | 472,489 | - | - | - | 510,803 | |||||||||||||||||||||

|

Loss for the year

|

- | - | - | - | - | (5,579,477 | ) | (5,579,477 | ) | |||||||||||||||||||

|

Balance, December 31, 2007

|

28,257,500 | 43,311,914 | 570,054 | - | - | (8,386,550 | ) | 35,495,418 | ||||||||||||||||||||

|

Private placements

|

5,322,500 | 10,543,444 | - | - | - | - | 10,543,444 | |||||||||||||||||||||

|

Conversion of special warrants

|

7,610,000 | 7,484,629 | - | - | - | - | 7,484,629 | |||||||||||||||||||||

|

Share issuance costs – broker’s fees

|

- | (263,169 | ) | - | - | - | - | (263,169 | ) | |||||||||||||||||||

|

Shares issued for mineral properties

|

110,000 | 206,229 | - | - | - | - | 206,229 | |||||||||||||||||||||

|

Acquisition of Gold Standard Royalty Corp.

|

2,050,000 | 4,088,552 | 138,529 | - | - | - | 4,227,081 | |||||||||||||||||||||

|

Acquisition of Great American Minerals Inc.

|

1,045,775 | 2,065,059 | 419,891 | - | - | - | 2,484,950 | |||||||||||||||||||||

|

Acquisition of Fury Explorations Ltd.

|

10,595,814 | 12,963,070 | 7,343,879 | (1,964,364 | ) | - | - | 18,342,585 | ||||||||||||||||||||

|

Exercise of stock options

|

6,637,224 | 9,690,543 | (178,482 | ) | - | - | - | 9,512,061 | ||||||||||||||||||||

|

Shares issued for repayment of promissory note

|

4,728,000 | 2,017,257 | - | - | - | - | 2,017,257 | |||||||||||||||||||||

|

Stock-based compensation

|

- | - | 2,251,500 | - | - | - | 2,251,500 | |||||||||||||||||||||

|

Loss for the year

|

- | - | - | - | - | (16,979,873 | ) | (16,979,873 | ) | |||||||||||||||||||

|

Balance, December 31, 2008

|

66,356,813 | 92,107,528 | 10,545,371 | (1,964,364 | ) | - | (25,366,423 | ) | 75,322,112 | |||||||||||||||||||

|

Private placements

|

14,500,000 | 1,123,489 | - | - | - | - | 1,123,489 | |||||||||||||||||||||

|

Exercise of stock options

|

101,000 | 110,689 | (92,970 | ) | - | - | - | 17,719 | ||||||||||||||||||||

|

Shares issued for mineral properties

|

2,765,643 | 311,606 | - | - | - | - | 311,606 | |||||||||||||||||||||

|

Settlement of convertible debentures

|

7,336,874 | 2,299,061 | 49,278 | - | - | - | 2,348,339 | |||||||||||||||||||||

|

Shares issued for consulting

|

89,254 | 9,168 | - | - | - | - | 9,168 | |||||||||||||||||||||

|

Shares issued for acquisition of TTS

|

19,037,386 | 1,976,697 | - | - | - | - | 1,976,697 | |||||||||||||||||||||

|

Stock-based compensation before spin-out

|

- | - | 799,008 | - | - | - | 799,008 | |||||||||||||||||||||

|

Spin-out of GPD

|

- | (18,044,538 | ) | (11,300,687 | ) | - | - | - | (29,345,225 | ) | ||||||||||||||||||

|

Stock-based compensation after spin-out

|

- | - | 935,995 | - | - | - | 935,995 | |||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | (2,536,527 | ) | - | (2,536,527 | ) | |||||||||||||||||||

6

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

|

|

(Expressed in US Dollars) (Unaudited) Page 2 of 2

|

|

Capital Stock

|

Additional

|

Accumulated Other

|

Deficit Accumulated During the

|

|||||||||||||||||||||||||

|

Number of Shares

|

Amount

|

Paid in

Capital

|

Treasury

Stock |

Comprehensive Loss | Exploration Stage |

Total

|

||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||

|

Loss for the year

|

- | - | - | - | - | (18,954,099 | ) | (18,954,099 | ) | |||||||||||||||||||

|

Balance, December 31, 2009

|

110,186,970 | 79,893,700 | 935,995 | (1,964,364 | ) | (2,536,527 | ) | (44,320,522 | ) | 32,008,282 | ||||||||||||||||||

|

Private placements

|

30,252,442 | 4,563,680 | 441,565 | - | - | - | 5,005,245 | |||||||||||||||||||||

|

Exercise of stock options

|

1,320,000 | 443,329 | (219,732 | ) | - | - | - | 223,597 | ||||||||||||||||||||

|

Exercise of warrants

|

7,300,000 | 1,060,257 | - | - | - | - | 1,060,257 | |||||||||||||||||||||

|

Stock-based compensation

|

- | - | 772,179 | - | - | - | 772,179 | |||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | 99,091 | - | 99,091 | |||||||||||||||||||||

|

Loss for the year

|

- | - | - | - | - | (4,585,644 | ) | (4,585,644 | ) | |||||||||||||||||||

|

Balance, December 31, 2010

|

149,059,412 | 85,960,966 | 1,930,007 | (1,964,364 | ) | (2,437,436 | ) | (48,906,166 | ) | 34,583,007 | ||||||||||||||||||

|

Exercise of stock options

|

250,000 | 140,466 | (76,796 | ) | - | - | - | 63,670 | ||||||||||||||||||||

|

Exercise/expiry of warrants

|

1,369,301 | 378,563 | (700,170 | ) | 700,170 | - | - | 378,563 | ||||||||||||||||||||

|

Stock-based compensation

|

- | - | 296,127 | - | - | - | 296,127 | |||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | (984,896 | ) | - | (984,896 | ) | |||||||||||||||||||

|

Loss for the year

|

- | - | - | - | - | (7,156,033 | ) | (7,156,033 | ) | |||||||||||||||||||

|

Balance, December 31, 2011

|

150,678,713 | 86,479,995 | 1,449,168 | (1,264,194 | ) | (3,422,332 | ) | (56,062,199 | ) | 27,180,438 | ||||||||||||||||||

|

Private placements

|

13,679,624 | 790,508 | - | - | - | - | 790,508 | |||||||||||||||||||||

|

Stock-based compensation

|

- | - | 331,794 | - | - | - | 331,794 | |||||||||||||||||||||

|

Shares issued for mineral properties

|

1,000,000 | 40,205 | - | - | - | - | 40,205 | |||||||||||||||||||||

|

Issue of convertible debenture warrants

|

- | - | 252,756 | - | - | - | 252,756 | |||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | 577,664 | - | 577,664 | |||||||||||||||||||||

|

Loss for the year

|

- | - | - | - | - | (4,965,297 | ) | (4,965,297 | ) | |||||||||||||||||||

|

Balance, December 31, 2012

|

165,358,337 | 87,310,708 | 2,033,718 | (1,264,194 | ) | (2,844,668 | ) | (61,027,496 | ) | 24,208,068 | ||||||||||||||||||

|

Stock-based compensation

|

- | - | 74,609 | - | - | - | 74,609 | |||||||||||||||||||||

|

Foreign currency translation adjustment on disposal of Springer Mining Company

|

- | - | 1,991,268 | - | 1,991,268 | |||||||||||||||||||||||

|

Loss for the year

|

- | - | - | - | - | (25,690,599 | ) | (25,690,599 | ) | |||||||||||||||||||

|

Balance, December 31, 2013

|

165,358,337 | 87,310,708 | 2,108,327 | (1,264,194 | ) | (853,400 | ) | (86,718,095 | ) | 583,346 | ||||||||||||||||||

|

Private placements

|

23,070,806 | 1,083,590 | - | - | - | - | 1,083,590 | |||||||||||||||||||||

|

Stock-based compensation

|

- | - | 1,166 | - | - | - | 1,166 | |||||||||||||||||||||

|

Loss for the period

|

- | - | - | - | - | (493,098 | ) | (493,098 | ) | |||||||||||||||||||

|

Balance, June 30, 2014

|

188,429,143 | 88,394,298 | 2,109,493 | (1,264,194 | ) | (853,400 | ) | (87,211,193 | ) | 1,175,004 | ||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statement.

7

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

1.

|

NATURE AND CONTINUANCE OF OPERATIONS

|

EMC Metals Corp. (the “Company”) is a specialty metals and alloys company focusing on scandium and other specialty metals. The Company intends to utilize its knowhow and, in certain instances, patented technologies to maximize opportunities in scandium and other specialty metals.

The Company was incorporated under the laws of the Province of British Columbia, Canada in 2006. The Company currently trades on the Toronto Stock Exchange under the symbol “EMC”.

Our focus of operations is the exploration and development of our specialty metals assets, including the Nyngan scandium deposit located in New South Wales, Australia and the Tørdal scandium/rare earth minerals deposit in Norway. Prior to January 1, 2014, the Company’s principal asset was the Springer Tungsten mine and mill, held by the Springer Mining Company. On September 13, 2013, the Company signed a binding Letter of Intent to sell 100% of the Springer Mining Company entity, its assets and mineral and water rights to America Bullion Royalty Corp., for $5 million cash. The transaction was closed on December 31, 2013.

The sale also included the transfer of interests in the Company’s Carlin Vanadium property mineral assets and the Copper King property tungsten assets in Nevada to AMB, along with Springer Tungsten.

One of EMC’s directors is also a director of the company that purchased Springer. The common director recused himself from director level voting on all board level decisions related to the sale.

With the completion of the sale of the Tungsten asset, the Company’s focus is on the exploration and evaluation of its specialty metals assets, specifically the Nyngan scandium deposit located in New South Wales, Australia and the Tørdal scandium/rare earth minerals deposit in Norway. In June 2014, the Company made the final installment payment to acquire the Nyngan property. The Company is an exploration stage company and anticipates incurring significant additional expenditures prior to production at any and all of its properties.

These consolidated financial statements have been prepared on a going concern basis that contemplates the realization of assets and discharge of liabilities at their carrying values in the normal course of business for the foreseeable future. These financial statements do not reflect any adjustments that may be necessary if the Company is unable to continue as a going concern.

The Company currently earns no operating revenues and will require additional capital in order to advance both the Nyngan and Tørdal properties. The Company’s ability to continue as a going concern is uncertain and is dependent upon the generation of profits from mineral properties, obtaining additional financing and maintaining continued support from its shareholders and creditors. These are material uncertainties that raise substantial doubt about the Company’s ability to continue as a going concern. In the event that additional financial support is not received or operating profits are not generated, the carrying values of the Company’s assets may be adversely affected.

|

2.

|

BASIS OF PRESENTATION

|

Basis of presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). The interim condensed consolidated financial statements include the consolidated accounts of EMC Metals Corp. (the “Company”) and its wholly-owned subsidiaries with all significant intercompany transactions eliminated. In the opinion of management, all adjustments necessary for a fair statement of the consolidated financial position, results of operations and cash flows for the interim periods have been made. Certain information and footnote disclosures normally included in the consolidated financial statements prepared in accordance with generally accepted accounting principles have been condensed or omitted pursuant to such SEC rules and regulations. These interim condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2013 and with our Annual Report on Form 10-K filed with the SEC on March 25, 2014. Operating results for the three-month period ended March 31, 2014 may not necessarily be indicative of the results for the year ending December 31, 2014.

Change in functional and presentation currency

The Company’s expenses and overheads are now primarily being incurred in United States Dollars (“USD”) and it is anticipated that cash flows will continue to be primarily in USD. Accordingly the Company determined that effective January 1, 2013, the functional currency of the Company would change from the Canadian Dollar to the USD for the parent company and its wholly owned subsidiaries.

Use of estimates

The preparation of interim condensed consolidated financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. The Company regularly evaluates estimates and assumptions related to the deferred income tax asset valuations, asset impairment, stock-based compensation and loss contingencies. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between estimates and the actual results, future results of operations will be affected.

8

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

2.

|

BASIS OF PRESENTATION (cont’d…)

|

Fair value of financial assets and liabilities

The Company measures the fair value of financial assets and liabilities based on US GAAP guidance which defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements.

The Company classifies financial assets and liabilities as held-for-trading, available-for-sale, held-to-maturity, loans and receivables or other financial liabilities depending on their nature. Financial assets and financial liabilities are recognized at fair value on their initial recognition, except for those arising from certain related party transactions which are accounted for at the transferor’s carrying amount or exchange amount.

Financial assets and liabilities classified as held-for-trading are measured at fair value, with gains and losses recognized in net income. Financial assets classified as held-to-maturity, loans and receivables, and financial liabilities other than those classified as held-for-trading are measured at amortized cost, using the effective interest method of amortization. Financial assets classified as available-for-sale are measured at fair value, with unrealized gains and losses being recognized as other comprehensive income until realized, or if an unrealized loss is considered other than temporary, the unrealized loss is recorded in income.

Financial instruments, including receivables, accounts payable and accrued liabilities, convertible debentures and promissory notes payable are carried at amortized cost, which management believes approximates fair value due to the short term nature of these instruments.

The following table presents information about the assets that are measured at fair value on a recurring basis as at June 30, 2014, and indicates the fair value hierarchy of the valuation techniques the Company utilized to determine such fair value. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets. Fair values determined by Level 2 inputs utilize data points that are observable such as quoted prices, interest rates and yield curves. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and included situations where there is little, if any, market activity for the asset:

|

June 30,

2014

|

Quoted Prices

in Active Markets

(Level 1)

|

Significant Other

Observable Inputs

(Level 2)

|

Significant

Unobservable Inputs

(Level 3)

|

|||||||||||||

|

Assets:

|

||||||||||||||||

|

Cash

|

$ | 780,711 | $ | 780,711 | $ | — | $ | — | ||||||||

|

Total

|

$ | 780,711 | $ | 780,711 | $ | — | $ | — | ||||||||

The fair value of cash is determined through market, observable and corroborated sources.

Recently Adopted Accounting Policies

Accounting Standards Update 2013-05 - Foreign Currency Matters (Topic 830) - Parent’s Accounting for the Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign Entity or of an Investment in a Foreign Entity. This standard provides guidance with respect to the treatment of the cumulative translation adjustment upon the sale of a foreign subsidiary whereby the cumulative translation adjustment associated with that subsidiary are taken into net income of the parent company.

Accounting Standards Update 2013-11 - Income Taxes (Topic 740) - Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carry forward, a Similar Tax Loss, or a Tax Credit Carry forward Exists. This accounting standard deals with the treatment of tax loss carry forwards. The Company has reviewed this standard and has determined that it has little impact on the presentation of its financial statements.

Recent Accounting Pronouncements

Accounting Standards Update 2014-08 - Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360) Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity. This accounting pronouncement provides guidance on the treatment of Property, Plant and Equipment plus the reporting of discontinued operations and disclosure of disposals of components of an entity. The policy is effective December 15, 2014. The Company is evaluating this guidance and believes it will have little impact on the presentation of its financial statements.

9

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

3.

|

RESTRICTED CASH

|

The Company had a Bank of Montreal letter of credit of up to C$159,400 as a security deposit related to a Vancouver office lease obligation. The letter of credit was returned to the Bank of Montreal in July 2014 and funds were released for use by the Company.

|

4.

|

DISCONTINUED OPERATIONS

|

During fiscal 2013, the Company identified a buyer for its tungsten properties and related plant and mill held by its subsidiary, Springer Mining Company (“Springer”). On September 13, 2013, the Company signed a binding Letter Of Intent (“LOI”) to sell 100% of the Springer Mining Company entity, its assets and mineral and water rights to Americas Bullion Royalty Corp. (“AMB”), for $5 million cash. The transaction was finalized on December 31, 2013.

At the signing of the LOI, AMB paid $3.1 million directly to the existing convertible debt holder to retire a maturing debt plus accumulated interest.

|

·

|

Cash paid by AMB to the convertible debt holder paid the debt in full and released the security interest in the Springer property and assets,

|

|

·

|

The cash advanced by AMB formed a new loan, with AMB as lender, as at September 13, 2013,

|

|

·

|

The new loan carries a zero interest rate, and

|

|

·

|

AMB agreed to additionally fund all Springer property carrying costs until the final payment and closing date.

|

The sale also included the transfer of interests in the Company’s Carlin Vanadium property mineral assets and the Copper King property tungsten assets in Nevada to AMB, along with Springer Tungsten.

Springer was actively involved in the evaluation and re-start of the Company’s tungsten property, located in Pershing County, Nevada. Going forward, the Company has no further assets located in the US or continuing involvement with Springer.

A comparison of the Net Loss results from discontinued operations for the six month period ended June 30, 2014 and 2013 as well as Q2 of 2013 and 2014 is as follows:

|

Quarter ended June 30, 2014

|

Quarter ended June 30, 2013

|

Six month period ended June 30, 2014

|

Six month period ended June 30,2013

|

|||||||||||||

|

EXPENSES

|

||||||||||||||||

|

Amortization

|

- | 4,853 | - | 9,705 | ||||||||||||

|

Consulting

|

- | 438 | - | 10,053 | ||||||||||||

|

General and administrative

|

- | 21,767 | - | 57,779 | ||||||||||||

|

Insurance

|

- | 20,202 | - | 32,176 | ||||||||||||

|

Professional fees

|

- | 263 | - | 500 | ||||||||||||

|

Salaries and benefits

|

- | 128,469 | - | 232,646 | ||||||||||||

|

Travel and entertainment

|

- | - | - | 1,853 | ||||||||||||

|

OTHER ITEMS

|

||||||||||||||||

|

Interest expense

|

- | - | - | 56,250 | ||||||||||||

|

Other income

|

- | (87,383 | ) | - | (204,565 | ) | ||||||||||

|

Net loss from discontinued operations

|

- | (88,609 | ) | - | (196,397 | ) | ||||||||||

|

Six month period ended June 30,2014

|

Six month period ended June 30,2013

|

|||||||

|

Cash flows from discontinued operations

|

||||||||

|

Net cash used in (from) operating activities

|

- | (154,597 | ) | |||||

|

Net cash used in (from) investing activities

|

- | - | ||||||

|

Net cash used in (from) financing activities

|

- | - | ||||||

|

Net cash used in (from) discontinued operations

|

- | (154,597 | ) | |||||

|

Non-cash transactions from discontinued operations

|

- | - | ||||||

10

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

5.

|

PROPERTY, PLANT and EQUIPMENT

|

2014 Continuing Operations

|

December 31, 2013 Net Book Value

|

Additions (disposals) (write-offs)

|

Amortization

|

June 30, 2014 Net Book Value

|

|||||||||||||

|

Computer equipment

|

$ | 2,375 | $ | - | $ | (339 | ) | $ | 2,036 | |||||||

|

Office equipment

|

7,903 | - | (1,578 | ) | 6,325 | |||||||||||

|

Property, plant and equipment

|

$ | 10,278 | $ | - | $ | (1,917 | ) | $ | 8,361 | |||||||

2013 Continuing Operations

|

December 31, 2012 Net Book Value

|

Additions (disposals) (write-offs)

|

Amortization

|

December 31, 2013 Net Book Value

|

|||||||||||||

|

Computer equipment

|

$ | 3,402 | $ | - | $ | (1,027 | ) | $ | 2,375 | |||||||

|

Office equipment

|

11,058 | - | (3,155 | ) | 7,903 | |||||||||||

|

Property, plant and equipment

|

$ | 14,460 | $ | - | $ | (4,182 | ) | $ | 10,278 | |||||||

2013 Discontinued Operations

|

December 31, 2012 Net Book Value

|

Additions (disposals) (write-offs)

|

Amortization

|

December 31, 2013 Net Book Value

|

|||||||||||||

|

Land and water rights

|

$ | 4,252,146 | $ | (4,252,146 | ) | $ | - | $ | - | |||||||

|

Plant and equipment

|

25,749,852 | (25,749,852 | ) | - | - | |||||||||||

|

Buildings

|

165,959 | (163,235 | ) | (2,724 | ) | - | ||||||||||

|

Automobiles

|

11,262 | (9,134 | ) | (2,128 | ) | - | ||||||||||

|

Property, plant and equipment

|

$ | 30,179,219 | $ | (30,174,367 | ) | $ | (4,852 | ) | $ | - | ||||||

Land and water rights are in respect of properties in Nevada. The plant and equipment is comprised of the Springer Plant and Mill in Nevada which was sold to AMB as part of the binding LOI signed September 13, 2013.

|

6.

|

MINERAL INTERESTS

|

|

June 30, 2014

|

Scandium and other

|

Tungsten

|

Total

|

|||||||||

|

Acquisition costs, continuing operations

|

||||||||||||

|

Balance, December 31, 2013

|

$ | 1,613,203 | $ | - | $ | 1,613,203 | ||||||

| Additions | 1,364,031 | - | 1,364,031 | |||||||||

| Balance June 30, 2014 | $ | 2,977,234 | $ | - | $ | 2,977,234 | ||||||

|

December 31, 2013

|

Scandium and other

|

Tungsten

|

Total

|

|||||||||

|

Acquisition costs, continuing operations

|

||||||||||||

|

Balance, December 31, 2012

|

$ | 554,719 | $ | - | $ | 554,719 | ||||||

|

Additions

|

1,108,484 | - | 1,108,484 | |||||||||

|

Write-off

|

(50,000 | ) | - | (50,000 | ) | |||||||

|

Balance, December 31, 2013

|

$ | 1,613,203 | $ | - | $ | 1,613,203 | ||||||

| Acquisition costs, discontinued operations | ||||||||||||

|

Balance, December 31, 2012

|

$ | - | $ | 198,463 | $ | 198,463 | ||||||

|

Disposal

|

- | (198,463 | ) | (198,463 | ) | |||||||

|

Balance, December 31, 2013

|

$ | - | $ | - | $ | - | ||||||

11

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

6.

|

MINERAL INTERESTS (cont’d…)

|

Title to mineral property interests involves certain inherent risks due to the difficulties of determining the validity of certain claims as well as the potential for problems arising from the frequently ambiguous conveyancing history characteristic of many mineral property interests. The Company has investigated title to all of its mineral property interests and, to the best of its knowledge, title to all of its properties is in good standing.

SCANDIUM PROPERTIES

Nyngan, New South Wales Property

On February 5, 2010, the Company entered in to an earn-in agreement with Jervois Mining Limited (“Jervois”), whereby it would acquire a 50% interest in the Nyngan Scandium property (the “Nyngan Project”) located in New South Wales, Australia. The JV Agreement, as amended, gave the Company the right to earn a 50% interest in a joint venture with Jervois, for the purpose of holding and developing the Nyngan Project. On June 22, 2012, the Company received notice of a lawsuit filed against the Company with regard to the achievement of certain milestones required under the JV Agreement. On February 6, 2013, the Company announced agreement of an out of court settlement to the dispute with Jervois. The terms of the settlement transferred 100% ownership and control of the Nyngan Project to the Company, in return for AUD$2.6 million cash payments and a percentage royalty payable to Jervois on sales of product from the project. A total of $1,108,484 (AUD$1.2 million) was paid in June 2013 as part of the settlement. A total of $1,364,031 (AUD$1.4 million) was paid in June 2014 to fulfill the obligations under the settlement agreement which gives 100% of the property to the Company.

Tørdal and Evje-Iveland properties, Norway

During fiscal 2012 the Company entered into an option agreement with REE Mining AS (“REE”) to earn up to a 100% interest in the Tørdal and Evje-Iveland properties pursuant to which the Company paid $130,000 and issued 1,000,000 common shares valued at $40,000. To earn its interest, the original agreement required the Company to pay REE an additional $500,000, incur $250,000 of exploration work and issue 250,000 common shares upon releasing the second of two full feasibility studies on the two properties. The Company subsequently renegotiated the payments required to earn the interest and the Evje-Iveland property was removed from the option agreement. Pursuant to the amendment, the Company earned a 100% interest in the Tørdal property by paying an additional $35,000 and granting a 1% Net Smelter Return (“NSR”) payable to REE.

Hogtuva property, Norway

During fiscal 2011 the Company entered into an option agreement with REE to earn a 100% interest in three scandium and beryllium exploration sites in Norway pursuant to which the Company paid $50,000. To earn its interest, the original agreement required the Company to pay REE an additional $100,000 and issue up to 200,000 common shares. During fiscal 2013, the Company renegotiated the payments required to earn the interest and removed two of the exploration sites from the agreement.

Pursuant to the amendment, the Company earned a 100% interest in the Hogtuva property in consideration for the $50,000 original payment and the grant of a 1% NSR payable to REE. In early fiscal 2014 a decision was made by the Company not to renew its interest in the Hogtuva property and $50,000 in acquisition costs were written off during the year ended December 31, 2013.

TUNGSTEN PROPERTY

Springer Property

On November 21, 2006, the Company acquired all outstanding and issued shares of Springer Mining Company (“Springer”). Included in the assets of Springer and allocated to property, plant and equipment (Note 5) are the Springer Mine and Mill located in Pershing County, Nevada. The Company agreed to sell Springer Mining Company on September 13, 2013 (see Note 1), for $5 million, along with the Copper King Tungsten property and the Carlin Vanadium property. The transaction was completed and fully funded on December 31, 2013.

|

7.

|

CONVERTIBLE DEBENTURES

|

On February 22, 2013, the Company completed a $650,000 loan financing consisting of convertible debentures. The convertible debenture had a maturity date of February 22, 2014 and bore interest at 10% per annum. The lenders had the option to convert the loan into 13,000,000 common shares of the Company. There was no beneficial conversion feature associated with the conversion option. The loan was secured by an interest in the assets of the Company’s wholly owned subsidiary, Wolfram Jack Mining Corp. and the Company’s interest in the Hogtuva and Tørdal properties in Norway. This financing was repaid in full in February 2014.

On February 17, 2012, the Company completed a $3,000,000 loan financing consisting of a term loan of $1,000,000 (Note 9), a convertible debenture of $2,000,000 and warrants to acquire 3,000,000 common shares. The convertible debenture had a maturity date of August 15, 2013 and bore interest at 7% per annum. The lender had the option to convert a maximum of $2,000,000 of the principal amount of the loan into 10,000,000 common shares of the Company. The loan was secured by an interest in the assets of the Company’s subsidiary, Springer Mining Company. There was no beneficial conversion feature associated with the conversion option. The warrants were exercisable at C$0.20 per share expiring February 15, 2014. A relative fair value of $217,267 was assigned to the warrants and recorded in additional paid in capital. The Company paid financing costs of $249,827 and also issued 750,000 purchase warrants exercisable at C$0.20 per share expiring February 15, 2014. These warrants were valued at $58,716 with a volatility of 120%, expected life of 2 years, risk free rate of 1.0% and expected dividend yield of 0.0% and recorded in additional paid in capital. The financing costs were allocated between debt and the equity components. This resulted in a convertible debenture carrying amount of $1,663,681 upon deducting a debt discount of $336,319 from the principal balance of $2,000,000. During fiscal 2013, the Company recognized $138,627 in accretion through interest expense. During fiscal 2012, the Company recognized $197,692 in accretion through interest expense. This financing was repaid in full on September 13, 2013.

12

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

8.

|

PROMISSORY NOTES PAYABLE

|

|

June 30, 2014

|

December 31, 2013

|

|||||||

|

Promissory Note related to discontinued operations

Promissory note with a principal balance of $3,750,000, bearing interest at 6% per annum, maturing July 3, 2013 and secured by land and water rights.

During fiscal 2008 the Company entered into a promissory note for $6,750,000 as consideration for the acquisition of land and water rights. The Company subsequently made principal payments of $3,000,000 consisting of a cash payment of $1,000,000 and 4,728,000 units of the Company equity valued at $2,000,000. Each unit consisted of one common share and one-half share purchase warrant exercisable at C$0.75 each and exercisable for a period of two years. The note was secured by a First Deed of Trust on the Cosgrave property land and water rights.

In June 2013 the Company returned, to the note holder, the Cosgrave Ranch for the value of the promissory note thereby extinguishing this debt. (Note 5)

|

$ | Nil | $ | Nil | ||||

|

Promissory Notes related to continuing operations

On June 24, 2014, the Company completed a $2,500,000 loan financing which includes a convertible feature. The loan has a maturity date of December 24, 2015 and bears loan interest that increases in quarterly increments from 4% to a maximum of 12%. The full loan can be converted into an effective 20% JV interest in Nyngan and Honeybugle. This conversion features can convert at the lender’s option or once EMC raises $3,000,000 million in equity. The 20% JV partner has a carried interest until EMC meets two milestones: (1) filing a feasibility study on SEDAR, and (2) receiving a mining license on either JV property. The JV partner becomes fully participating on development and build costs thereafter. The JV partner holds an option to convert their 20% JV interest into equivalent value of EMC shares, at market prices, rather than participate in construction. The JV partner’s option to convert its project interest to EMC shares is a one-time option, at such time the partner becomes fully participating on project costs. If the Company is unable to raise $3,000,000 and repay the loan, the lender may exercise a purchase option wherein the debt will be settled in exchange for 100% interest in the Nyngan mineral rights.

|

$ | 2,500,000 | $ | Nil | ||||

|

On June 24, 2013 the Company completed a $1,204,875 financing consisting of a series of insider and non-insider loans. The loans had a maturity date in June 2014 and bore interest at 10% per annum. The loans were secured by the ownership interest the Company has or earns in the Nyngan Scandium Project. As an inducement to enter into this loan, the lenders received a royalty of 0.2% of average scandium sales value, produced from the Nyngan property, on the first 100 tonnes of scandium oxide product produced and sold. The royalty was capped at $370,000 and EMC retained a right to buy back the royalty from the lenders or their assigns for $325,000 at any time up to the commencement of first production, or three years from loan date, whichever occurs first. This financing was paid in full of June 2014.

|

Nil | $ | 1,204,875 | |||||

| During the year ended December 31, 2012, the Company completed a $3,000,000 loan financing which included a $1,000,000 note payable bearing interest of 7% per annum maturing August 15, 2013. Presented is this principle balance, less financing and costs, which are amortized over the term of the debt using the effective interest method. This resulted in a carrying costs of $831,841 upon deducting a debt discount of $168,159 from the principal balance of $1,000,000. During fiscal 2013, the Company recognized $69,313 in accretion through interest expense. During fiscal 2012, the Company recognized $98,847 in accretion through interest expense. The note payable was secured by an interest in the Company’s subsidiary, Springer Mining Company. The financing was repaid in full on September 13, 2013. | Nil | Nil | ||||||

| Less current portion | (2,500,000 | ) | (1,204,875 | ) | ||||

| $ | Nil | $ | Nil | |||||

13

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

9.

|

RELATED PARTY TRANSACTIONS

|

Accounts payable on June 30, 2014 included $91,835 owed to related parties. Accounts payable on December 31, 2013 included $170,000 owed to related parties.

A total of $350,000 from the loan financing completed on February 22, 2013, $579,875 from the loan financing completed on June 24, 2013 and all of the $100,000 financing completed on August 27, 2013, were funded from a combination of Directors, insiders, and independent shareholders. The Company has paid $78,500 in interest to related parties relating to these loans.

The $100,000 loan financing completed in 2013 was from directors and officers. The loan was repaid in full in 2013.

The loan financing completed on February 22, 2013, of which $350,000 was contributed from directors and officers was repaid in the three months ending March 31, 2014.

Of the $57,407 interest expensed in the six months, $14,375 was payable to a director of the Company.

During the six months ended June 30, 2013, the Company accrued a consulting fee of $51,000 for one of its directors. There is $8,500 for consulting fees incurred during the six month period ended June 30, 2014.

|

10.

|

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL

|

On June 26, 2014, the Company issued 10,415,396 common shares at a value of C$0.085 per common share for total proceeds of C$885,309, of which C$250,000 was received subsequent to June 30, 2014.

On April 24, 2014, the Company issued 4,122,150 common shares at a value of C$0.025 per common share for total proceeds of C$103,053.

On March 25, 2014, the Company issued 8,533,260 common shares at a value of C$0.025 per common share for total proceeds of $192,000.

On December 20, 2012, the Company issued 1,000,000 common shares at a value of $40,205 for the Tørdal and Hogtuva projects in Norway.

On December 16, 2012, the Company issued 2,000,000 common shares at a value of C$0.05 per common share for total proceeds of C$100,000.

On July 24, 2012, the Company issued 11,679,624 common shares at a value of C$0.06 per common share for total proceeds of C$700,777.

On December 3, 2010, the Company issued 18,929,740 common shares at a value of C$0.19 per common share for total proceeds of C$3,596,651. A total of C$210,249 was received during fiscal 2011.

On November 25, 2010, the Company issued 6,100,000 units at a value of C$0.10 per unit for total proceeds of C$610,000. Each unit consisted of one common share and one-half of one share purchase warrant exercisable at C$0.18 expiring on November 25, 2011. The warrants have a calculated total fair value of C$142,358 using the Black-Scholes pricing model with a volatility of 142.52%, risk-free rate of 1.73%, expected life of 1 year, and a dividend rate of 0%.

On June 30, 2010, the Company issued 2,947,702 units at a value of C$0.10 per unit for total proceeds of C$294,770. Each unit consisted of one common share and one-half of one share purchase warrant exercisable at C$0.18 until June 30, 2011. The warrants have a calculated total fair value of C$35,638 using the Black-Scholes pricing model with a volatility of 123.84%, risk-free rate of 1.39%, expected life of 1 year, and a dividend rate of 0%.

On February 17, 2010, the Company issued 2,275,000 units at a value of C$0.20 per unit for total proceeds of C$455,000. Each unit consisted of one common share and one-half of one share purchase warrant exercisable at C$0.25 until February 17, 2011. The warrants have a calculated total fair value of C$78,113 using the Black-Scholes pricing model with a volatility of 131.19%, risk-free rate of 1.34%, expected life of 1 year, and a dividend rate of 0%. All of the warrants were exercised during fiscal 2011.

On November 17, 2009, the Company issued 13,000,000 units at a value of C$0.08 per unit for total proceeds of C$1,040,000. Each unit consisted of one common share and one-half of one share purchase warrant. Each full warrant entitled the holder to purchase an additional share at C$0.15 per share until November 17, 2010.

On October 13, 2009, the Company issued 500,000 common shares at a value of C$45,000 for the Fostung Tungsten project.

On August 27, 2009, the Company issued 1,500,000 units at a value of C$0.10 per unit, pursuant to a non-brokered private placement for proceeds of C$150,000. Each unit consisted of one common share and one-half of one share purchase warrant. Each full warrant entitled the holder to purchase an additional share at C$0.15 per share until August 27, 2010.

14

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

10.

|

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL (cont’d…)

|

On May 13, 2009, the Company issued 89,254 common shares at a value of C$0.12 per share to a consultant for settlement of consulting fees for Fury Explorations Ltd. (“Fury”), a subsidiary of GPD, under the plan of Arrangement of spin-out. On April 21, 2009, the Company issued 51,859 common shares at a value of C$0.10 per share for the Platte River property.

On January 21, 2009, the Company issued 66,784 common shares at a value of C$0.20 per share for the Guijoso property for Fury.

On January 6, 2009, the Company issued 2,147,000 common shares at a value of $250,000 for the Adelaide and Tuscarora projects for Golden Predator Mines US Inc., a wholly owned subsidiary of the Company prior to the spin out.

On November 17, 2008, the Company issued 76,274 common shares in connection with the acquisition of the subsidiary, Great American Minerals Inc.

On October 18, 2008, the Company issued 4,728,000 units to Cosgrave for repayment of a promissory note at a value of $2,000,000. Each unit consisted of one common share of the Company and one-half of one common share purchase warrant with a two year life and exercisable at C$0.75.

In July 2008, the Company completed a private placement consisting of 2,500,000 common shares at C$2.00 per share for proceeds of C$5,000,000. In connection with this private placement the Company paid a finder’s fee of $250,000.

In January 2008, the Company completed a private placement consisting of 2,822,500 units at C$2.00 per unit for gross proceeds of C$5,645,000. Included in the proceeds was C$3,620,000 received in advance as of December 31, 2007. Each unit consisted of one common share and one half of one share purchase warrant. Each whole warrant entitled the holder to acquire one additional common share at C$3.00 for a period of 12 months.

In November 2007, the Company completed private placements consisting of 17,577,500 units at C$2.00 per unit for proceeds of C$35,155,000. Each unit consisted of one common share and one half of one common share purchase warrant. Each whole warrant entitled the holder to acquire one additional common share at C$3.00 for a period of 12 months following the closing of the placement.

In December 2007, the Company issued 5,390,000 common shares pursuant to the conversion of special warrants. The Company paid C$1,016,074 and issued 100,000 common shares valued at C$100,000 as issuance costs and finder’s fees. The Company also granted warrants to acquire 300,000 common shares exercisable at C$1.50 expiring September 22, 2008. The warrants were valued at C$99,000 with the Black-Scholes option pricing model using an expected volatility of 115%, life of one year, a risk free interest rate of 4% and a dividend yield of 0%.

In December 2006, the Company issued 5,000,000 common shares at C$0.70 per common share for gross proceeds of C$3,500,000.

Stock Options and Warrants

The Company established a stock option plan (the “Plan”) under which it is authorized to grant options to executive officers and directors, employees and consultants and the number of options granted under the Plan shall not exceed 15% of the shares outstanding. Under the Plan, the exercise period of the options may not exceed five years from the date of grant and vesting is determined by the Board of Directors.

Stock option and share purchase warrant transactions are summarized as follows:

|

Warrants

|

Stock Options

|

|||||||||||||||

|

Number

|

Weighted average exercise price in Canadian $

|

Number

|

Weighted average

exercise price in Canadian $

|

|||||||||||||

|

Outstanding, December 31, 2012

|

3,750,000 | $ | 0.20 | 13,546,250 | $ | 0.14 | ||||||||||

|

Granted

|

- | - | 2,100,000 | 0.07 | ||||||||||||

|

Cancelled

|

- | - | (1,477,500 | ) | 0.34 | |||||||||||

|

Exercised

|

- | - | - | - | ||||||||||||

|

Outstanding, December 31, 2013

|

3,750,000 | 0.20 | 14,168,750 | 0.12 | ||||||||||||

|

Granted

|

- | - | - | - | ||||||||||||

|

Cancelled

|

(3,750,000 | ) | 0.20 | (2,090,000 | ) | 0.18 | ||||||||||

|

Exercised

|

- | - | - | - | ||||||||||||

|

Outstanding, June 30, 2014

|

- | $ | - | 12,078,750 | $ | 0.11 | ||||||||||

|

Number currently exercisable

|

- | $ | - | 12,078,750 | $ | 0.11 | ||||||||||

15

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

10.

|

CAPITAL STOCK AND ADDITIONAL PAID IN CAPITAL (cont’d…)

|

As at June 30, 2014, incentive stock options were outstanding as follows:

|

Number of

options

|

Exercise

Price in Canadian $

|

Expiry Date

|

|||||||

|

Options

|

|||||||||

| 225,000 | 0.120 |

August 27, 2014

|

|||||||

| 200,000 | 0.105 |

December 16, 2014

|

|||||||

| 568,750 | 0.250 |

January 4, 2015

|

|||||||

| 500,000 | 0.050 |

May 9, 2015

|

|||||||

| 4,800,000 | 0.100 |

November 5, 2015

|

|||||||

| 250,000 | 0.315 |

May 4, 2016

|

|||||||

| 500,000 | 0.250 |

May 16, 2016

|

|||||||

| 300,000 | 0.155 |

September 15, 2016

|

|||||||

| 2,335,000 | 0.080 |

April 24, 2017

|

|||||||

| 1,400,000 | 0.070 |

August 8, 2017

|

|||||||

| 1,000,000 | 0.100 |

May 9, 2018

|

|||||||

| 12,078,750 | |||||||||

As at June 30, 2014, there were no warrants outstanding.

Stock-based compensation

During the six months ended June 30, 2014, the Company recognized stock-based compensation of $1,166 (June 30, 2013 - $64,197) in the statement of operations as a result of incentive stock options granted and vested in the current period. There were no stock options issued during the six months ended June 30, 2014 (June 30, 2013 – 2,100,000).

The weighted average fair value of the options granted in the period was C$Nil (2013 - C$0.07).

The fair value of all compensatory options and warrants granted is estimated on grant date using the Black-Scholes option pricing model. The weighted average assumptions used in calculating the fair values are as follows:

|

2014

|

2013

|

|||||||

|

Risk-free interest rate

|

N/A | 0.62 | % | |||||

|

Expected life

|

N/A |

5 years

|

||||||

|

Volatility

|

N/A | 144.60 | % | |||||

|

Forfeiture rate

|

N/A | 0.00 | % | |||||

|

Dividend rate

|

N/A | 0.00 | % | |||||

|

11.

|

TREASURY STOCK

|

|

Number

|

Amount

|

|||||||

|

Treasury shares, June 30, 2014 and December 31 2013

|

1,033,333 | $ | 1,264,194 | |||||

| 1,033,333 | $ | 1,264,194 | ||||||

Treasury shares comprise shares of the Company which cannot be sold without the prior approval of the TSX.

16

|

EMC Metals Corp.

|

|

(An Exploration Stage Company)

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

|

|

June 30, 2014

|

|

(Expressed in US Dollars) (Unaudited)

|

|

12.

|

SEGMENTED INFORMATION

|

The Company’s mineral properties are located in Norway and Australia. The Company’s capital assets’ geographic information is as follows:

|

June 30, 2014

|

Norway

|

Australia

|

United States

|

Total

|

||||||||||||

|

Property, plant and equipment

|

$ | - | $ | - | $ | 8,361 | $ | 8,361 | ||||||||

|

Mineral interests

|

203,181 | 2,774,053 | - | 2,977,234 | ||||||||||||

| $ | 203,181 | $ | 2,774,053 | $ | 8,361 | $ | 2,985,595 | |||||||||

|

December 31, 2013

|

Norway

|

Australia

|

United States

|

Total

|

||||||||||||

|

Property, plant and equipment

|

$ | - | $ | - | $ | 10,278 | $ | 10,278 | ||||||||

|

Mineral interests

|

203,181 | 1,410,022 | - | 1,613,203 | ||||||||||||

| $ | 203,181 | $ | 1,410,022 | $ | 10,278 | $ | 1,623,481 | |||||||||

|

13.

|

SUPPLEMENTAL DISCLOSURE WITH RESPECT TO CASH FLOWS

|

|

2014

|

2013

|

|||||||

|

Cash paid during the six months for interest

|

$ | 57,407 | $ | 56,250 | ||||

|

Cash paid during the six months for income taxes

|

$ | - | $ | - | ||||

There were no significant non-cash transactions in either of the six month periods ending June 30, 2014 and June 30, 2013.

|

14.

|

SUBSEQUENT EVENTS

|

Subsequent to June 30, 2014, the Company issued a second tranche of financing of 4,641,236 shares at C$0.085.

On July 25, 2014, the Company granted 3,525,000 stock options to various board members, employees and consultants entitling them to purchase shares at C$0.12. These options had vesting periods ranging from immediate to two years. The life of the granted options ranged from three to five years.

17

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion of the operating results, corporate activities and financial condition of EMC Metals Corp. (hereinafter referred to as “we”, “us”, “EMC”, or the “Company”) and its subsidiaries provides an analysis of the operating and financial results for the three and six months ended June 30, 2014 and and should be read in conjunction with our unaudited interim consolidated financial statements for the six month period ended June 30, 2014, and with the Company’s audited consolidated financial statements and the notes thereto for the year ended December 31, 2013 (the “Annual Statements”).

The interim statements have been prepared in accordance with US Generally Accepted Accounting Principles (“US GAAP”) in accordance with the requirements of U.S. federal securities laws as applicable to the Company, and as permitted under applicable Canadian securities laws. The Company is a reporting company under applicable securities laws in Canada, and in July of 2011 also became a reporting issuer under U.S. federal laws. The reporting currency used in our financial statements is the United States Dollar.

The information contained within this report is current as of August 6, 2014 unless otherwise noted. Additional information relevant to the Company’s activities can be found on SEDAR at www.sedar.com.

Technical information in this MD&A has been reviewed and approved by Willem Duyvesteyn, a Qualified Person as defined by Canadian National Instrument 43-101 (“NI 43-101”). Mr. Duyvesteyn is a director and consultant of EMC Metals.

EMC Corporate Overview

EMC is a specialty metals and alloys company focusing on scandium and other specialty metals. The Company intends to utilize its knowhow and, in certain instances, patented technologies to maximize opportunities in scandium and other specialty metals.

The Company was formed in 2006, under the name Golden Predator Mines Inc. As part of a reorganization and spin-out of the Company’s precious metals portfolio in March 2009, the Company changed its name to EMC Metals Corp. The Company currently trades on the Toronto Stock Exchange under the symbol “EMC”.

In 2013, the Company sold the Springer Mining Company, a tungsten mine and mill in Imlay, Nevada. The sale of this asset allowed the Company to direct its efforts towards the development of its scandium properties.

Our focus of operations is the exploration and development of our specialty metals assets, including the Nyngan scandium deposit located in New South Wales, Australia and the Tørdal scandium/rare earth minerals deposit in Norway. Prior to January 1, 2014, the Company’s principal asset was the Springer Tungsten mine and mill, held by the Springer Mining Company. On September 13, 2013, the Company signed a binding Letter of Intent to sell 100% of the Springer Mining Company entity, its assets and mineral and water rights to America Bullion Royalty Corp., for $5 million cash. The transaction was closed on December 31, 2013.

On February 5, 2010, the Company entered into a Joint Venture Agreement (“JV Agreement”) with Jervois Mining Limited (“Jervois”) to develop the Nyngan scandium property in New South Wales, Australia. The JV Agreement, came into dispute in February 2012, and was settled by the parties in February 2013. That settlement provided for EMC to acquire 100% of the project for A$2.6 million cash, in two installments. EMC has met the total payment obligation and now owns 100% of the project.

During the first half of 2014 EMC focused on financing the final required payments to secure the Nyngan project rights. Those required payments were successfully financed in June, along with additional working capital financings during June and July.

18

Principal Properties Review

Nyngan Scandium Project (NSW, Australia)

On February 5, 2010, EMC entered into an Exploration Joint Venture Agreement (“JV Agreement”) with Jervois Mining Limited (“Jervois”) of Melbourne, Australia (ASX: JRV) to co-develop the Nyngan scandium property in New South Wales, Australia which is commonly referred to as the Nyngan Scandium Project (“Nyngan”). The JV Agreement, gave EMC the right to earn a 50% interest in a joint venture with Jervois, for the purpose of holding and developing Nyngan, provided EMC met certain technical and financial milestones. EMC met all financial requirements and delivered proof of technical milestone achievement to Jervois on February 24, 2012.

On February 27, 2012, Jervois formally rejected EMC’s claim to have met the earn-in conditions specified in the JV. The parties discussed and successfully reached an agreed settlement in February 2013 that resolved all issues in dispute. The terms of the binding settlement provided for the transfer of 100% ownership and control of the Nyngan Project, including the relevant exploration tenements and surface (freehold) land holdings, to the Company, in return for AUD$2.6 million in future cash payments.. The settlement agreement also applied a production royalty on the Nyngan project of 1.7% of sales for products produced from the site, payable to Jervois. The royalty has a 12 year term from first production date, and a 10 tpa scandium oxide production minimum.

EMC has now completed all settlement payments required under its agreement with Jervois, and formal transfer of the Nyngan Project Exploration Tenements is currently underway, with completion of the transfers anticipated later in 2014. The details of the financing associated with the successful payment of these settlement amounts is further described in the quarterly news developments section of this MD&A.

Substantial Nyngan Project metallurgical test work has been completed, and additional work in this area is planned for 2014. EMC intends to produce a Feasibility Study demonstrating project economics and development viability on the project, expected to be completed in the second half of 2015.

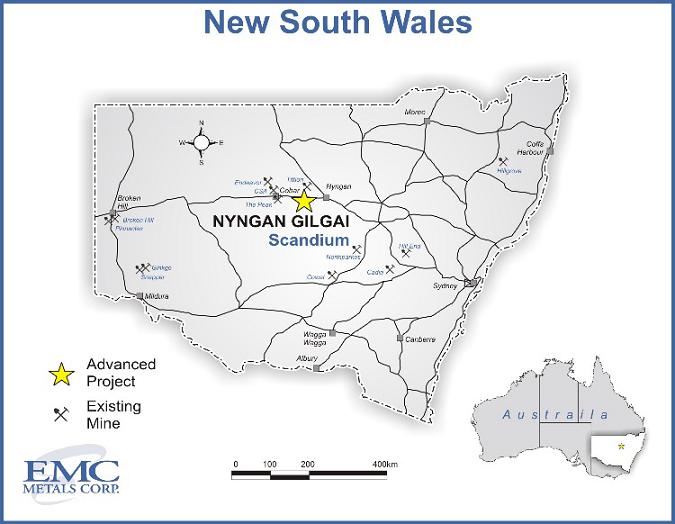

Nyngan Property Description and Location

The Nyngan scandium resource is located approximately 500 kilometers northwest of Sydney, Australia. The property consists of two exploration licenses, EL 6009 and EL 6096, which encompass over 9,000 hectares (29.6 sq km). Nyngan is classified as an Australia Property for purposes of financial statement segment information.