Attached files

| file | filename |

|---|---|

| EX-10.14 - EX-10.14 - INNOVATE Corp. | d739428dex1014.htm |

| EX-10.13 - EX-10.13 - INNOVATE Corp. | d739428dex1013.htm |

| EX-32 - EX-32 - INNOVATE Corp. | d739428dex32.htm |

| EX-10.4 - EX-10.4 - INNOVATE Corp. | d739428dex104.htm |

| EX-10.5 - EX-10.5 - INNOVATE Corp. | d739428dex105.htm |

| EX-10.15 - EX-10.15 - INNOVATE Corp. | d739428dex1015.htm |

| EX-31 - EX-31 - INNOVATE Corp. | d739428dex31.htm |

| EX-10.3 - EX-10.3 - INNOVATE Corp. | d739428dex103.htm |

| EXCEL - IDEA: XBRL DOCUMENT - INNOVATE Corp. | Financial_Report.xls |

| 10-Q - 10-Q - INNOVATE Corp. | d739428d10q.htm |

| EX-10.2 - EX-10.2 - INNOVATE Corp. | d739428dex102.htm |

Exhibit 10.12

SECOND AMENDED AND RESTATED CREDIT AND SECURITY AGREEMENT

Dated as of August 14, 2013

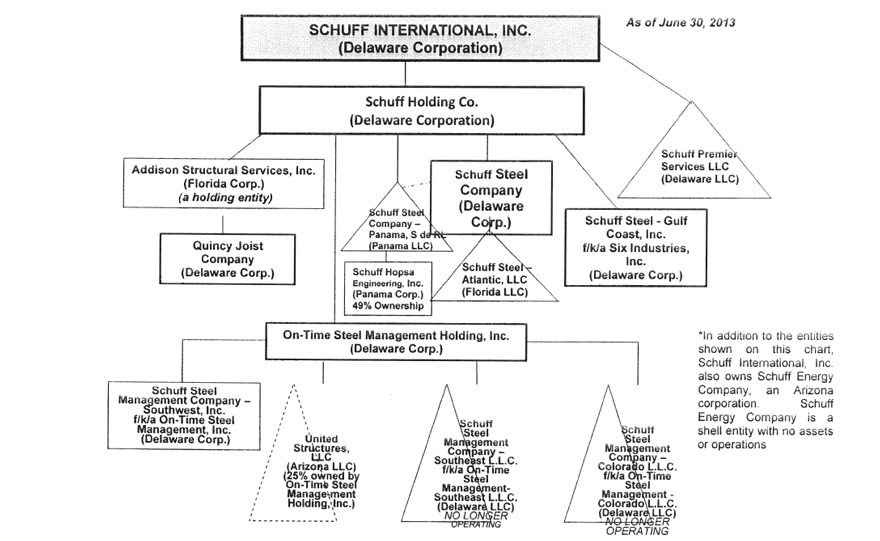

SCHUFF INTERNATIONAL INC., a Delaware corporation (“Schuff International”), and the other Persons listed in Schedule 1.1 (collectively, jointly and severally, the “Borrower”), and WELLS FARGO CREDIT, INC., a Minnesota corporation (the “Lender”), hereby agree as follows:

RECITALS

The Borrower and the Lender have entered into an Amended and Restated Credit and Security Agreement dated as of December 18, 2008, as amended from time to time prior to the date hereof (as so amended, the “Original Amended and Restated Credit Agreement”).

The Lender has agreed to make certain loan advances to the Borrower pursuant to the terms and conditions set forth in the Original Amended and Restated Credit Agreement.

The parties wish to amend and restate the Original Amended and Restated Credit Agreement in its entirety.

NOW THEREFORE, in consideration of the premises and promises contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree as follows:

ARTICLE I

DEFINITIONS

Section 1.1 Definitions. For all purposes of this Agreement, except as otherwise expressly provided, the following terms shall have the meanings assigned to them in this Section or in the Section referenced after such term:

“Accounts” means, with respect to any Person, all of the accounts of the Person, as such term is defined in the UCC, including each and every right of the Person to the payment of money, whether such right to payment now exists or hereafter arises, whether such right to payment arises out of a sale, lease or other disposition of goods or other property, out of a rendering of services, out of a loan, out of the overpayment of taxes or other liabilities, or otherwise arises under any contract or agreement, whether such right to payment is created, generated or earned by the Person or by some other person who subsequently transfers such person’s interest to the Person, whether such right to payment is or is not already earned by performance, and howsoever such right to payment may be evidenced, together with all other rights and interests (including ail Liens) which the Person may at any time have by law or agreement against any account debtor or other obligor obligated to make any such payment or against any property of such account debtor or other obligor; all including but not limited to all present and future accounts, contract rights, loans and obligations receivable, chattel papers, bonds, notes and other debt instruments, tax refunds and rights to payment in the nature of general intangibles.

“Advance” means a Revolving Advance or the Real Estate Term Advance, as the context requires.

“Affiliate” or “Affiliates” means, with respect to any Person, any other Person controlled by, controlling or under common control with the Borrower, including any Subsidiary of the Person. For purposes of this definition, “control,” when used with respect to any specified Person, means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” means this Amended and Restated Credit and Security Agreement.

“Airplane Security Agreement” means the Aircraft and Engine Security Agreement encumbering the Plane.

“Availability” means the difference of (i) the Borrowing Base and (ii) the sum of (A) the outstanding principal balance of the Revolving Note and (B) the L/C Amount.

“Banking Day” means a day on which the Federal Reserve Bank of New York is open for business.

“Book Net Worth” means the aggregate of the common and preferred stockholders’ equity in the Borrower, determined in accordance with GAAP.

“Borrowing Base” means at any time the lesser of:

(a) the Maximum Line; or

(b) the sum of:

(i) 85% of Eligible Quincy Accounts plus the lesser of (x) $3,000,000.00, or (y) 85% of Accounts owed by Mollycorp to Borrower (which do not constitute Eligible Non-Quincy Accounts solely as a result of a failure to satisfy Romanette (i) of the definition of Eligible Accounts) through December 31, 2013, plus

(ii) the lesser of (a) $15,000,000.00, or (b) 20% of Eligible Non-Quincy Accounts, plus

(iii) the lesser of (a) $9,324,000.00, which amount shall be automatically reduced by $225,000.00 on the first day of each month commencing on September 1, 2013, by all amounts which are paid to Lender pursuant to Section 6.2(c) of the Credit Agreement and by all amounts paid to Lender pursuant to Section 6.28 of the Credit Agreement until such time as said amount is equal to $0.00), or (b) 85% of the Net Orderly Liquidation Value of Eligible Equipment, plus

2

(iv) the lesser of (a) the lesser of (x) 49% of Eligible Inventory, or (y) 85% of the Net Orderly Liquidation Value of the Eligible Inventory, or (b) $15,000,000.00, plus

(v) $2,762,000.00 (the “Plane Amount”), which Plane Amount shall be automatically reduced by $31,250.00 on the first day of each month and which amount shall automatically be reduced to $0.00 on May 1, 2018, plus

(vi) the lesser of (a) $7,500,000.00 (which amount shall automatically be reduced by $62,500.00 on September 1, 2013, and on the first day of each month thereafter through and until the Real Estate Facility Termination Date, at which point it shall be equal to $0.00), or (b) 20% of the fair market value of the Real Property, as determined by appraisals which are acceptable to the Lender in its sole discretion (such lesser amount, the “Real Estate Sublimit”), minus

(vii) $5,000,000.00.

“Capital Expenditures” means for a period, any expenditure of money during such period for the lease, purchase or construction of assets, or for improvements or additions thereto, which are capitalized on the Borrower’s balance sheet.

“Cash” means, when used in connection with any Person, all monetary and non-monetary items (other than currency of any country of the United States of America) owned by that Person that are treated as cash in accordance with GAAP, consistently applied.

“Cash Equivalents” means, when used in connection with any Person, that Person’s investments in:

(a) Government Securities due within one year after the date of the making of the investment;

(b) readily marketable direct obligations of any State of the United States of America or any political subdivision of any such State given on the date of such investment a credit rating of at least Aa by Moody’s Investors Service, Inc. or AA by Standard & Poor’s Rating Group (a division of McGraw-Hill, Inc.), in each case due within one year after the date of the making of the investment;

(c) certificates of deposit issued by, bank deposits in, eurodollar deposits through, bankers’ acceptances of, and reverse repurchase agreements covering Government Securities executed by, the Lender or any bank, savings and loan or savings bank doing business in and incorporated under the laws of the United States of America or any State thereof and having on the date of such investment combined capital, surplus and undivided profits of at least $250,000,000.00, in each case due within one year after the date of the making of the investment;

3

(d) certificates of deposit issued by, bank deposits in, eurodollar deposits through, bankers’ acceptances of, and reverse repurchase agreements covering Government Securities executed by, any branch or office located in the United States of America of a bank incorporated under the laws of any jurisdiction outside the United States of America having on the date of such investment combined capital surplus and undivided profits of at least $500,000,000.00, in each case due within one year after the date of the making of the investment; and

(e) readily marketable commercial paper of corporations doing business in and incorporated under the laws of the United States of America or any State thereof given on the date of such investment the highest credit rating by Moody’s Investors Service, Inc. and Standard & Poor’s Rating Group (a division of McGraw-Hill, Inc.), in each case due within two hundred seventy (270) days after the date of the making of the investment.

“Cash Equivalent Value” means, with respect to any Cash Equivalents, the value of the Cash Equivalents, in form and amount as valued by the Lender.

“Change of Control” means that the Schuff family shall cease to directly or indirectly control at least 51% of the voting rights in each entity constituting the Borrower.

“Collateral” means all of the Accounts, chattel paper, deposit accounts, documents, the Real Estate, the Plane, Equipment, General Intangibles, goods, instruments, Inventory, Investment Property, letter-of-credit rights, and letters of credit of the Borrower (or any of them), all sums on deposit in any Collateral Account, any items in any Lockbox and all other personal property of the Borrower; together with (i) all substitutions and replacements for and products of any of the foregoing; (ii) in the case of all goods, all accessions; (iii) all accessories, attachments, parts, equipment and repairs now or hereafter attached or affixed to or used in connection with any goods; (iv) all warehouse receipts, bills of lading and other documents of title now or hereafter covering such goods; (v) all collateral subject to the Lien of any Security Document; (vi) any money, or other assets of the Borrower (or any of them) that now or hereafter come into the possession, custody, or control of the Lender; (vii) all sums on deposit in the Special Account; and (viii) proceeds of any and all of the foregoing, in each case, whether now owned or hereafter acquired.

“Collateral Account” has the meaning given to it in Section 2.11.

“Commitment” means the Lender’s commitment to make Advances to, and to cause the Issuer to issue Letters of Credit for the account of, the Borrower pursuant to Article II.

“Constituent Documents” means with respect to any Person, as applicable, such Person’s certificate of incorporation, articles of incorporation, by-laws, certificate of formation, articles of organization, limited liability company agreement, management agreement, operating agreement, shareholder agreement, partnership agreement or similar document or agreement governing such Person’s existence, organization or management or concerning disposition of ownership interests of such Person or voting rights among such Person’s owners.

4

“Credit Facility” means the credit facility being made available to the Borrower by the Lender under Article II.

“Daily Three Month LIBOR” means for any day, the rate of interest equal to LIBOR then in effect for delivery for a three (3) month period. When interest is determined in relation to Daily Three Month LIBOR, each change in the interest rate shall become effective each Business Day that Lender determines that Daily Three Month LIBOR has changed.

“Debt” of a Person means as of a given date, all items of indebtedness or liability which in accordance with GAAP would be included in determining total liabilities as shown on the liabilities side of a balance sheet for such Person and shall also include the aggregate payments required to be made by such Person at any time under any lease that is considered a capitalized lease under GAAP.

“Default” means an event that, with giving of notice or passage of time or both, would constitute an Event of Default.

“Default Period” means any period of time beginning on the day an Event of Default occurs and ending on the date the Lender notifies the Borrower in writing that such Default or Event of Default has been waived.

“Default Rate” means an annual interest rate equal to three percent (3%) over the Floating Rate and the Term Floating Rate, as applicable, which interest rates shall change when and as the Floating Rate and Term Floating Rate, as applicable, change.

“Director” means, with respect to any Person, a director if the Person is a corporation, a manager or a Person with similar authority if the Person is a limited liability company, or a general partner if the Person is a partnership.

“EBITDA” means, with respect to any fiscal period, Borrower’s consolidated Net Income (or loss), minus extraordinary gains, interest income, non-operating income and income tax benefits and decreases in any change in LIFO reserves, plus non-cash extraordinary losses, Interest Expense, income taxes, depreciation and amortization and increases in any change in LIFO reserves for such period, in each case, determined on a consolidated basis in accordance with GAAP.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“ERISA Affiliate”, with respect to any Person, means any trade or business (whether or not incorporated) that is a member of a group which includes the Person and which is treated as a single employer under Section 414 of the IRC.

5

“Eligible Accounts” means all unpaid Accounts of Borrower arising from the sale or lease of goods or the performance of services, net of any credits, but excluding any such Accounts having any of the following characteristics:

(i) That portion of Accounts unpaid 90 days or more after the invoice date or, if the Lender in its discretion has determined that a particular dated Account may be eligible, that portion of such Account which is unpaid more than 30 days past the stated due date or more than 120 days past the invoice date;

(ii) That portion of Accounts that is disputed or subject to a claim of offset or a contra account;

(iii) That portion of Accounts in excess of ten percent (10%) of Accounts in the aggregate which are not yet earned by the final delivery of goods or rendition of services, as applicable, by Borrower to the customer, including progress billings, and that portion of Accounts for which an invoice has not been sent to the applicable account debtor;

(iv) Accounts constituting (i) proceeds of copyrightable material unless such copyrightable material shall have been registered with the United States Copyright Office, or (ii) proceeds of patentable inventions unless such patentable inventions have been registered with the United States Patent and Trademark Office;

(v) Accounts owed by any unit of government, whether foreign or domestic (provided, however, that there shall be included in Eligible Accounts that portion of Accounts owed by such units of government for which Quincy Joist has provided evidence satisfactory to the Lender that (A) the Lender has a first priority perfected security interest and (B) such Accounts may be enforced by the Lender directly against such unit of government under all applicable laws);

(vi) Accounts owed by an account debtor located outside the United States which are not (A) backed by a bank letter of credit naming the Lender as beneficiary or assigned to the Lender, in the Lender’s possession or control, and with respect to which a control agreement concerning the letter-of-credit rights is in effect, and acceptable to the Lender in all respects, in its sole discretion, or (B) covered by a foreign receivables insurance policy acceptable to the Lender in its sole discretion;

(vii) Accounts owed by an account debtor that is insolvent, the subject of bankruptcy proceedings or has gone out of business;

(viii) Accounts owed by an Owner, Subsidiary, Affiliate, Officer or employee of the Borrower or any of its Subsidiaries;

6

(ix) Accounts not subject to a duly perfected security interest in the Lender’s favor or which are subject to any Lien in favor of any Person other than the Lender;

(x) That portion of Accounts that has been restructured, extended, amended or modified;

(xi) That portion of Accounts that constitutes advertising, finance charges, service charges or sales or excise taxes;

(xii) Accounts owed by an account debtor, regardless of whether otherwise eligible, to the extent that the balance of such Accounts exceeds 15% of the aggregate amount of all Eligible Accounts;

(xiii) Accounts owed by an account debtor, regardless of whether otherwise eligible, if 15% or more of the total amount due under Accounts from such debtor is ineligible under clauses (i), (ii) or (x) above; and

(xiv) Accounts, or portions thereof, otherwise deemed ineligible by the Lender in its sole discretion.

“Eligible Equipment” means that Equipment of Borrower designated by Lender as eligible from time to time in its sole discretion, but excluding Equipment having any of the following characteristics:

(a) Equipment that is subject to any Lien other than in favor of Lender or the Term Lenders;

(b) Equipment that has not been delivered to the Premises;

(c) Equipment in which Lender does not hold a first priority security interest;

(d) Equipment that is obsolete or not currently saleable;

(e) Equipment that is not covered by standard “all risk” hazard insurance for an amount equal to its forced liquidation value;

(f) Equipment that requires proprietary software in order to operate in the manner in which it is intended when such software is not freely assignable to Lender or any potential purchaser of such Equipment;

(g) Equipment consisting of computer hardware, software, tooling, or molds; and

(h) Equipment otherwise deemed unacceptable by Lender in its sole discretion.

7

“Eligible Inventory” means all raw steel Inventory of the Borrower, valued at the lower of cost or market in accordance with GAAP; but excluding any raw steel Inventory having any of the following characteristics:

(i) Inventory that is: in-transit; located at any warehouse, job site or other premises not approved by the Lender in writing; not subject to a duly perfected first priority security interest in the Lender’s favor; subject to any lien or encumbrance that is subordinate to the Lender’s first priority security interest; covered by any negotiable or non-negotiable warehouse receipt, bill of lading or other document of title; on consignment from any Person; on consignment to any Person or subject to any bailment unless such consignee or bailee has executed an agreement with the Lender;

(ii) Work-in-process Inventory;

(iii) Inventory that is damaged, defective, obsolete, slow moving (taking into consideration the nature and circumstances of Borrower’s business, together with industry norms, customs and practices) or not currently saleable in the normal course of the Borrower’s operations, or the amount of such Inventory that has been reduced by shrinkage;

(iv) Inventory that the Borrower has returned, has attempted to return, is in the process of returning or intends to return to the vendor thereof;

(v) Inventory manufactured by the Borrower pursuant to a license unless the applicable licensor has agreed in writing to permit the Lender to exercise its rights and remedies against such inventory;

(vi) Inventory that is subject to a Lien in favor of any Person other than the Lender;

(vii) Inventory otherwise deemed ineligible by the Lender in its sole discretion.

“Eligible Non-Quincy Accounts” means that portion of Eligible Accounts owed to the Borrower entities other than Quincy Joist.

“Eligible Quincy Accounts” means that portion of Eligible Accounts owed to Quincy Joist.

“Environmental Law” means any federal, state, local or other governmental statute, regulation, law or ordinance dealing with the protection of human health and the environment.

“Equipment” means, with respect to any Person, all of the Person’s equipment, as such term is defined in the UCC, whether now owned or hereafter acquired, including but not limited to all present and future machinery, vehicles, furniture, fixtures, manufacturing equipment, shop equipment, office and

8

recordkeeping equipment, parts, tools, supplies, and including specifically the goods described in any equipment schedule or list herewith or hereafter furnished to the Lender by the Person.

“Event of Default” has the meaning specified in Section 7.1.

“Financial Covenants” means the covenants set forth in Section 6.2.

“Fixed Charge Coverage Ratio” means (i) EBITDA, minus (a) unfinanced Capital Expenditures made (to the extent not already incurred in a prior period) or incurred during such period, and (b) cash taxes paid during such period, to the extent greater than zero, to (ii) Fixed Charges for such period. “Fixed Charges” means, with respect to any fiscal period and with respect to a Borrower determined on a consolidated basis in accordance with GAAP, the sum, without duplication, of (a) cash Interest Expense paid during such period (other than interest paid-in-kind, amortization of financing fees, and other non-cash Interest Expense) and (b) principal payments paid in cash in respect of Indebtedness paid during such period, including cash payments with respect to capital leases, but excluding principal payments made with respect to the Revolving Advances (unless there is a corresponding reduction in the Lender’s Commitment).

“Floating Rate” means an interest rate equal to the sum of (i) Daily Three Month LIBOR, which interest rate shall change whenever Daily Three Month LIBOR changes, plus (ii) four percent (4.00%).

“Free Cash Flow” means, for the applicable period, EBITDA minus principal payments minus cash interest minus unfinanced Capital Expenditures minus distributions minus cash taxes paid.

“Funding Date” has the meaning given in Section 2.1.

“GAAP” means generally accepted accounting principles, applied on a basis consistent with the accounting practices applied in the financial statements described in Section 5.6.

“General Intangibles” means, with respect to any Person, all of the Person’s general intangibles, as such term is defined in the UCC, whether now owned or hereafter acquired, including all present and future Intellectual Property Rights, customer or supplier lists and contracts, manuals, operating instructions, permits, franchises, the right to use the Person’s name, and the goodwill of the Person’s business.

“Government Securities” means readily marketable direct full faith and credit obligations of the United States of America or obligations unconditionally guaranteed by the full faith and credit of the United States of America.

“Guarantor(s)” means 19th Avenue/Buchanan Limited Partnership, and any other Person now or hereafter guarantying the Obligations.

“Hazardous Substances” means pollutants, contaminants, hazardous substances, hazardous wastes, petroleum and fractions thereof, and all other chemicals, wastes, substances and materials listed in, regulated by or identified in any Environmental Law.

9

“IRC” means the Internal Revenue Code of 1986.

“Infringe” means when used with respect to Intellectual Property Rights, any infringement or other violation of Intellectual Property Rights.

“Intellectual Property Rights” means all actual or prospective rights arising in connection with any intellectual property or other proprietary rights, including all rights arising in connection with copyrights, patents, service marks, trade dress, trade secrets, trademarks, trade names or mask works.

“Interest Expense” means, with respect to the Borrower, for a fiscal year-to-date period, the total gross interest expense of the Borrower on a consolidated basis during such period (excluding interest income), and shall in any event include (i) interest expense (whether or not paid) on all Debt of the Borrower (on a consolidated basis), (ii) the amortization of debt discounts, (iii) the amortization of all fees payable in connection with the incurrence of Debt of the Borrower (on a consolidated basis) to the extent included in interest expense, and (iv) the portion of any capitalized lease obligation allocable to interest expense.

“Inventory” means, with respect to any Person, all of the Person’s inventory, as such term is defined in the UCC, whether now owned or hereafter acquired, whether consisting of whole goods, spare parts or components, supplies or materials, whether acquired, held or furnished for sale, for lease or under service contracts or for manufacture or processing, and wherever located.

“Investment Property” means, with respect to any Person, all of the Person’s investment property, as such term is defined in the UCC, whether now owned or hereafter acquired, including but not limited to all securities, security entitlements, securities accounts, commodity contracts, commodity accounts, stocks, bonds, mutual fund shares, money market shares and U.S. Government securities.

“Issuer” means the issuer of any Letter of Credit.

“L/C Amount” means the sum of (i) the aggregate face amount of any issued and outstanding Letters of Credit and (ii) the unpaid amount of the Obligation of Reimbursement.

“L/C Application” means an application and agreement for letters of credit in a form acceptable to the Issuer and the Lender.

“Lender Affiliate” means with respect to the Lender, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Lender, including any Subsidiary of the Lender.

“Letter of Credit” has the meaning specified in Section 2.4.

10

“LIBOR” means the rate per annum (rounded upward, if necessary, to the nearest whole 1/8th of one percent (1%)) determined pursuant to the following formula:

| LIBOR = | Base LIBOR |

|||||

| 100% - LIBOR Reserve Percentage |

(a) “Base LIBOR” means the rate per annum for United States dollar deposits quoted by Lender for the purpose of calculating the effective Floating Rate for loans that reference Daily Three Month LIBOR as the Inter-Bank Market Offered Rate in effect from time to time for three (3) month delivery of funds in amounts approximately equal to the principal amount of such loans. Borrower understands and agrees that Lender may base its quotation of the Inter-Bank Market Offered Rate upon such offers or other market indicators of the Inter-Bank Market as Lender in its discretion deems appropriate, including but not limited to the rate offered for U.S. dollar deposits on the London Inter-Bank Market.

(b) “LIBOR Reserve Percentage” means the reserve percentage prescribed by the Board of Governors of the Federal Reserve System (or any successor) for “Eurocurrency Liabilities” (as defined in Regulation D of the Federal Reserve Board, as amended), adjusted by Lender for expected changes in such reserve percentage during the applicable term of the Revolving Note.

“Licensed Intellectual Property” has the meaning given in Section 5.11(c).

“Lien” means any security interest, mortgage, deed of trust, pledge, lien, charge, encumbrance, title retention agreement or analogous instrument or device, including the interest of each lessor under any capitalized lease and the interest of any bondsman under any payment or performance bond, in, of or on any assets or properties of a Person, whether now owned or hereafter acquired and whether arising by agreement or operation of law.

“Loan Documents” means this Agreement, the Revolving Note, the Real Estate Term Note, the Security Documents, any guaranty entered into by any Guarantor, and each L/C Application, together with every other agreement, note, document, contract or instrument to which the Borrower or any Guarantor now or in the future may be a party and which is required by the Lender.

“Lockbox” shall have the meaning given to it in Section 2.11.

“Maturity Date” means June 30, 2018.

“Maximum Line” means $50,000,000.00.

“Multiemployer Plan” means, with respect to any Person, a multiemployer plan (as defined in Section 4001(a)(3) of ERISA) to which such Person or any ERISA Affiliate contributes or is obligated to contribute.

“Net Cash Proceeds” means the cash proceeds of any asset sale (including cash proceeds received as deferred payments pursuant to a note,

11

installment receivable or otherwise, but only upon actual receipt) net of (a) attorney, accountant, and investment banking fees, (b) brokerage commissions,(c) amounts required to be applied to the repayment of debt secured by a Lien not prohibited by this Agreement on the asset being sold, and (d) taxes paid or reasonably estimated to be payable as a result of such asset sale.

“Net Income” (or “Net Loss”) means, with respect to any Person, the fiscal year-to-date after-tax net income (or net loss) from continuing operations as determined in accordance with GAAP.

“Net Orderly Liquidation Value” means a professional opinion of the probable Net Cash Proceeds that could be realized at a properly advertised and professionally conducted liquidation sale, conducted under orderly sale conditions for an extended period of time (usually six to nine months), under the economic trends existing at the time of the appraisal.

“Note” or “Notes” collectively means the Third Replacement Revolving Note and the Real Estate Term Note and any note issued in substitution or replacement thereof.

“Obligation of Reimbursement” has the meaning given in Section 2.6(a).

“Obligations” means the Advances (whether or not evidenced by the Notes), the Obligation of Reimbursement, any and all Swap Obligations and each and every other debt, liability and obligation of every type and description which the Borrower may now or at any time hereafter owe to the Lender or any Lender Affiliate under this Agreement or any Loan Document, whether such debt, liability or obligation now exists or is hereafter created or incurred, whether it arises in a transaction involving the Lender alone, a Lender Affiliate alone, and whether it is direct or indirect, due or to become due, absolute or contingent, primary or secondary, liquid or unliquid, or sole, joint, several or joint or joint and several, and including all indebtedness and obligations of the Borrower arising under any Loan Document, Swap Agreement or guaranty between Borrower and the Lender or between Borrower and any Lender Affiliate, whether now in effect or hereafter entered into.

“Officer” means with respect to any Person, an officer if the Person is a corporation, a manager or a Person with similar authority if the Person is a limited liability company, or a partner if the Person is a partnership.

“Owned Intellectual Property” has the meaning given in Section 5.11(a).

“Owner” means with respect to any Person, each Person having legal or beneficial title to an ownership interest in such Person or a right to acquire such an interest.

“Pass-Through Tax Liabilities” means the amount of state and federal income tax paid or to be paid by Borrower’s Owners on taxable income earned by Borrower and attributable to the Owners as a result of Company’s “pass-through” tax status, assuming the highest marginal income tax rate for federal and state (for the state or states in which the highest marginal income tax rate for

12

federal and state (for the state or states in which any Owner is liable for income taxes with respect to such income) income tax purposes, after taking into account any deduction for state income taxes in calculating the federal income tax liability and all other deductions, credits, deferrals and other reductions available to the Owners from or through Borrower.

“Pension Plan” means, with respect to any Person, a pension plan (as defined in Section 3(2) of ERISA) maintained for employees of the Person or any ERISA Affiliate and covered by Title IV of ERISA.

“Permitted Lien” has the meaning given in Section 6.3(a).

“Person” means any individual, corporation, partnership, joint venture, limited liability company, association, joint-stock company, trust, unincorporated organization or government or any agency or political subdivision thereof.

“Plan” means, with respect to any Person, an employee benefit plan (as defined in Section 3(3) of ERISA) maintained for employees of the Person or any ERISA Affiliate.

“Plane” means that certain 2006 Hawker Beechcraft airplane, model Hawker 850XP, serial number 258761, registration mark N761XP, with two TFE731-5BR engines, serial numbers P129175 and P129171, including all avionics and options installed therein, together with all present and future accessories, parts, repairs, replacements, substitutions, attachments, modifications, renewals, additions, improvements, up-grades and accessions thereto, but shall not include any equipment or parts installed on a temporary, loaner or exchange basis.

“Premises” means all premises where the Borrower conducts its business and has title or any rights of possession, including the premises legally described in Exhibit C attached hereto.

“Quincy Joist” means Quincy Joist Company, a Delaware corporation.

“Real Estate” means the real property encumbered by the Real Property Security Documents.

“Real Estate Facility Maturity Date” means June 30, 2018.

“Real Estate Facility Termination Date” means the earliest of (i) the Real Estate Facility Maturity Date, (ii) the date the Borrower terminates the Credit Facility, (iii) the Maturity Date, or (iv) the date the Lender demands payment of the Obligations after an Event of Default pursuant to Section 7.2.

“Real Estate Term Advance” has the meaning specified in Section 2.19(a).

“Real Estate Term Note” means the $10,000,000.00 Real Estate Term Note in favor of the Lender, as the same may be renewed and amended from time to time, and all replacements thereto.

“Real Property Security Documents” means the mortgages, deeds of trust, deeds to secure debt and any other documents delivered to the Lender from time to time to encumber the Real Estate and assign the rents, issues and profits therefrom.

13

“Reportable Event” means a reportable event (as defined in Section 4043 of ERISA), other than an event for which the 30-day notice requirement under ERISA has been waived in regulations issued by the Pension Benefit Guaranty Corporation.

“Revolving Advance” has the meaning given in Section 2.1.

“Revolving Note” means the $50,000,000.00 Third Replacement Revolving Note in favor of the Lender, as the same may be renewed and amended from time to time and all replacements thereto.

“Security Documents” means this Agreement, the Real Property Security Documents, the Airplane Security Agreement and any other document delivered to the Lender from time to time to secure the Obligations.

“Security Interest” has the meaning given in Section 3.1.

“Special Account” means a specified cash collateral account maintained by a financial institution acceptable to the Lender in connection with Letters of Credit, as contemplated by Section 2.6.

“Subsidiary” means, with respect to any Person, any corporation of which more than 50% of the outstanding shares of capital stock having general voting power under ordinary circumstances to elect a majority of the board of Directors of such corporation, irrespective of whether or not at the time stock of any other class or classes shall have or might have voting power by reason of the happening of any contingency, is at the time directly or indirectly owned by the Person, by the Person and one or more other Subsidiaries of the Person, or by one or more other Subsidiaries of the Person.

“Swap Agreement” means any agreement between the Borrower, the Lender or any affiliate of Lender with respect to any swap, forward, future or derivative transaction or option or similar agreement involving, or settled by reference to, one or more rates, currencies, commodities, equity or debt instruments or securities, or economic, financial or pricing indices or measures of economic, financial or pricing risk or value or any similar transaction or any combination of these transactions; provided that no phantom stock or similar plan providing for payments only on account of services provided by current or former directors, officers, employees or consultants of the Borrower or any Subsidiary shall be a Swap Agreement.

“Swap Obligations” of Borrower means any and all obligations of Borrower, whether absolute or contingent and howsoever and whensoever created, arising, evidenced or acquired (including all renewals, extensions and modifications thereof and substitutions therefor), under (a) any and all Swap Agreements, and (b) any and all cancellations, buy backs, reversals, terminations or assignments of any Swap Agreement transaction.

“Term Floating Rate” means an interest rate equal to the sum of (i) the greater of (A) 1.00%, and (B) Daily Three Month LIBOR, which interest rate shall change whenever Daily Three Month LIBOR changes, plus (ii) 6.00%.

14

“Termination Date” means the earliest of (i) the Maturity Date, (ii) the date the Borrower terminates the Credit Facility, or (iii) the date the Lender demands payment of the Obligations after an Event of Default pursuant to Section 7.2.

“Total Debt” means all indebtedness of the Borrower.

“UCC” means the Uniform Commercial Code as in effect in the state designated in Section 8.13 as the state whose laws shall govern this Agreement, or in any other state whose laws are held to govern this Agreement or any portion hereof.

“Wells Fargo Bank” means Wells Fargo Bank Arizona, National Association, unless the context otherwise requires.

Section 1.2 Other Definitional Terms; Rules of Interpretation. The words “hereof,” “herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement as a whole and not to any particular provision of this Agreement. All accounting terms not otherwise defined herein have the meanings assigned to them in accordance with GAAP. All terms defined in the UCC and not otherwise defined herein have the meanings assigned to them in the UCC. References to Articles, Sections, subsections, Exhibits, Schedules and the like, are to Articles, Sections and subsections of, or Exhibits or Schedules attached to or a part of, this Agreement unless otherwise expressly provided. The words “include,” “includes” and “including” shall be deemed to be followed by the phrase “without limitation.” Defined terms include in the singular number the plural and in the plural number the singular. Reference to any agreement (including the Loan Documents), document or instrument means such agreement, document or instrument as amended or modified and in effect from time to time in accordance with the terms thereof (and, if applicable, in accordance with the terms hereof and the other Loan Documents), except where otherwise explicitly provided, and reference to any promissory note includes any promissory note which is an extension or renewal thereof or a substitute or replacement therefor. Reference to any law, rule, regulation, order, decree, requirement, policy, guideline, directive or interpretation means as amended, modified, codified, replaced or reenacted, in whole or in part, and in effect on the determination date, including rules and regulations promulgated thereunder.

ARTICLE II

AMOUNT AND TERMS OF THE CREDIT FACILITY

Section 2.1 Revolving Advances. The Lender agrees, on the terms and subject to the conditions herein set forth, to make advances to the Borrower from time to time from the date all of the conditions set forth in Section 4.1 are satisfied (the “Funding Date”) to the Termination Date (the “Revolving Advances”) in an aggregate principal amount at any time outstanding not to exceed the Availability. The Lender shall have no obligation to make a Revolving Advance to the extent the amount of the requested Revolving Advance exceeds Availability.

The Borrower’s obligation to pay the Revolving Advances shall be evidenced by the Revolving Note and shall be secured by the Collateral. Within the limits set forth in this Section 2.1, the Borrower may borrow, prepay pursuant to Section 2.12, and reborrow.

15

Section 2.2 Procedures for Requesting Advances. The Borrower shall comply with the following procedures in requesting Revolving Advances:

(a) Time for Requests. The Borrower shall request each Advance not later than 11:00 a.m., Phoenix, Arizona time (the “Cut-Off Time”) on the Banking Day which is the date the Advance is to be made. Each such request shall be effective upon receipt by the Lender, shall be in writing or by telephone or telecopy transmission, to be confirmed in writing by the Borrower if so requested by the Lender, shall be by (i) an Officer of the Borrower; or (ii) a person designated as the Borrower’s agent by an Officer of the Borrower in a writing delivered to the Lender; or (iii) a person whom the Lender reasonably believes to be an Officer of the Borrower or such a designated agent. The Borrower shall repay all Advances even if the Lender does not receive such confirmation and even if the person requesting an Advance was not in fact authorized to do so. Any request for an Advance, whether written or telephonic, shall be deemed to be a representation by the Borrower that the conditions set forth in Section 4.2 have been satisfied as of the time of the request.

(b) Disbursement. Upon fulfillment of the applicable conditions set forth in Article IV, the Lender shall disburse the proceeds of the requested Advance by crediting the same to the Borrower’s demand deposit account maintained with Wells Fargo Bank unless the Lender and the Borrower shall agree in writing to another manner of disbursement.

Section 2.3

Section 2.3.1 [INTENTIONALLY DELETED]

Section 2.3.2 Increased Costs; Capital Adequacy; Funding Exceptions. If a Related Lender (as defined below) determines at any time that its Return (as defined below) has been reduced as a result of any Rule Change, such Lender may so notify the Borrower and require the Borrower, beginning fifteen (15) days after such notice, to pay it the amount necessary to restore its Return to what it would have been had there been no Rule Change. For purposes of this Section 2.3:

(a) “Capital Adequacy Rule” means any law, rule, regulation, guideline, directive, requirement or request regarding capital adequacy, or the interpretation or administration thereof by any governmental or regulatory authority, central bank or comparable agency, whether or not having the force of law, that applies to any Related Lender (as defined below), including rules requiring financial institutions to maintain total capital in amounts based upon percentages of outstanding loans, binding loan commitments and letters of credit. Notwithstanding anything herein to the contrary (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith, and (y) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a “Capital Adequacy Rule”, regardless of the date enacted, adopted or issued.

(b) “L/C Rule” means any law, rule, regulation, guideline, directive, requirement or request regarding letters of credit, or the interpretation or administration thereof by any governmental or regulatory authority, central bank

16

or comparable agency, whether or not having the force of law, that applies to any Related Lender, including those that impose taxes, duties or other similar charges, or mandate reserves, special deposits or similar requirements against assets of, deposits with or for the account of, or credit extended by any Related Lender, on letters of credit.

(c) “Related Lender” includes (but is not limited to) the Lender, any parent of the Lender, any assignee of any interest of the Lender hereunder and any participant in the Credit Facility.

(d) “Return,” for any period, means the percentage determined by dividing (i) the sum of interest and ongoing fees earned by the Related Lender under this Agreement during such period, by (ii) the average capital such Lender is required to maintain during such period as a result of its being a party to this Agreement, as determined by such Lender based upon its total capital requirements and a reasonable attribution formula that takes account of the Capital Adequacy Rules and L/C Rules then in effect, costs of issuing or maintaining any Advance or Letter of Credit and amounts received or receivable under this Agreement or the Notes with respect to any Advance or Letter of Credit. Return may be calculated for each calendar quarter and for the shorter period between the end of a calendar quarter and the date of termination in whole of this Agreement.

(e) “Rule Change” means any change in any Capital Adequacy Rule or L/C Rule occurring after the date of this Agreement, or any change in the interpretation or administration thereof by any governmental or regulatory authority, but the term does not include any changes that at the Funding Date are scheduled to take place under the existing Capital Adequacy Rules or L/C Rules or any increases in the capital that the Lender is required to maintain to the extent that the increases are required due to a regulatory authority’s assessment of such Related Lender’s financial condition.

The initial notice sent by the Related Lender shall be sent as promptly as practicable after such Lender learns that its Return has been reduced, shall include a demand for payment of the amount necessary to restore such Lender’s Return for the quarter in which the notice is sent, and shall state in reasonable detail the cause for the reduction in its Return and its calculation of the amount of such reduction. Thereafter, such Related Lender may send a new notice during each calendar quarter setting forth the calculation of the reduced Return for that quarter and including a demand for payment of the amount necessary to restore its Return for that quarter. The Related Lender’s calculation in any such notice shall be conclusive and binding absent demonstrable error.

Section 2.4 Letters of Credit.

(a) The Lender agrees, on the terms and subject to the conditions herein set forth, to cause an Issuer to issue, from the Funding Date to the Termination Date, one or more irrevocable standby or documentary letters of credit (each, a “Letter of Credit”) for the Borrower’s account by guaranteeing payment of the Borrower’s obligations or being a co-applicant. The Lender shall have no obligation to cause an Issuer to issue any Letter of Credit if the face amount of the Letter of Credit to be issued would exceed the lesser of (i) $5,000,000.00 less the Letter of Credit Amount, or (ii) Availability.

17

Each Letter of Credit, if any, shall be issued pursuant to a separate L/C Application entered into between the Borrower and the Lender for the benefit of the Issuer, completed in a manner satisfactory to the Lender and the Issuer. The terms and conditions set forth in each such L/C Application shall supplement the terms and conditions hereof, but if the terms of any such L/C Application and the terms of this Agreement are inconsistent, the terms hereof shall control.

(b) No Letter of Credit shall be issued with an expiry date later than the Termination Date in effect as of the date of issuance.

(c) Any request to cause an Issuer to issue a Letter of Credit shall be deemed to be a representation by the Borrower that the conditions set forth in Section 4.2 have been satisfied as of the date of the request.

Section 2.5 Special Account. If the Credit Facility is terminated for any reason while any Letter of Credit is outstanding, the Borrower shall thereupon pay the Lender in immediately available funds for deposit in the Special Account an amount equal to the L/C Amount. The Special Account shall be an interest bearing account maintained for the Lender by any financial institution acceptable to the Lender. Any interest earned on amounts deposited in the Special Account shall be credited to the Special Account. The Lender may apply amounts on deposit in the Special Account at any time or from time to time to the Obligations in the Lender’s sole discretion. The Borrower may not withdraw any amounts on deposit in the Special Account as long as the Lender maintains a security interest therein. The Lender agrees to transfer any balance in the Special Account to the Borrower when the Lender is required to release its security interest in the Special Account under applicable law.

Section 2.6 Payment of Amounts Drawn Under Letters of Credit; Obligation of Reimbursement. The Borrower acknowledges that the Lender, as co-applicant, will be liable to the Issuer for reimbursement of any and all draws under Letters of Credit and for all other amounts required to be paid under the applicable L/C Application. Accordingly, the Borrower shall pay to the Lender any and all amounts required to be paid under the applicable L/C Application, when and as required to be paid thereby, and the amounts designated below, when and as designated:

(a) The Borrower shall pay to the Lender on the day a draft is honored under any Letter of Credit a sum equal to all amounts drawn under such Letter of Credit plus any and all reasonable charges and expenses that the Issuer or the Lender may pay or incur relative to such draw and the applicable L/C Application, plus interest on all such amounts, charges and expenses as set forth below (the Borrower’s obligation to pay all such amounts is herein referred to as the “Obligation of Reimbursement”).

(b) Whenever a draft is submitted under a Letter of Credit, the Borrower authorizes the Lender to make a Revolving Advance in the amount of the Obligation of Reimbursement and to apply the proceeds of such Revolving Advance thereto. Such Revolving Advance shall be repayable in accordance with and be treated in all other respects as a Revolving Advance hereunder.

18

(c) If a draft is submitted under a Letter of Credit when the Borrower is unable, because a Default Period exists or for any other reason, to obtain a Revolving Advance to pay the Obligation of Reimbursement, the Borrower shall pay to the Lender on demand and in immediately available funds, the amount of the Obligation of Reimbursement together with interest, accrued from the date of the draft until payment in full at the Default Rate. Notwithstanding the Borrower’s inability to obtain a Revolving Advance for any reason, the Lender is irrevocably authorized, in its sole discretion, to make a Revolving Advance in an amount sufficient to discharge the Obligation of Reimbursement and all accrued but unpaid interest thereon.

(d) The Borrower’s obligation to pay any Revolving Advance made under this Section 2.6 shall be evidenced by the Revolving Note and shall bear interest as provided in Section 2.8.

Section 2.7 Obligations Absolute. The Borrower’s obligations arising under Section 2.6 shall be absolute, unconditional and irrevocable, and shall be paid strictly in accordance with the terms of Section 2.7, under all circumstances whatsoever, including (without limitation) the following circumstances:

(a) any lack of validity or enforceability of any Letter of Credit or any other agreement or instrument relating to any Letter of Credit (collectively the “Related Documents”);

(b) any amendment or waiver of or any consent to departure from all or any of the Related Documents;

(c) the existence of any claim, setoff, defense or other right which the Borrower may have at any time, against any beneficiary or any transferee of any Letter of Credit (or any persons or entities for whom any such beneficiary or any such transferee may be acting), or other person or entity, whether in connection with this Agreement, the transactions contemplated herein or in the Related Documents or any unrelated transactions;

(d) any statement or any other document presented under any Letter of Credit proving to be forged, fraudulent, invalid or insufficient in any respect or any statement therein being untrue or inaccurate in any respect whatsoever;

(e) payment by or on behalf of the Issuer under any Letter of Credit against presentation of a draft or certificate which does not strictly comply with the terms of such Letter of Credit; or

(f) any other circumstance or happening whatsoever, whether or not similar to any of the foregoing.

Section 2.8 Interest; Default Interest; Participations; Usury.

(a) Note. Except as set forth in subsections (b) and (d), (i) the outstanding principal balance of the Revolving Note and each Revolving Advance shall bear interest at the Floating Rate, and (ii) the outstanding principal balance of the Real Estate Term Note and the Real Estate Term Advance shall bear interest at the Term Floating Rate.

19

(b) Default Interest Rate. Upon notice to the Borrower from the Lender from time to time, the principal of the Advances outstanding from time to time shall bear interest at the Default Rate, effective as of the first day of the fiscal month during which any Default Period begins through the last day of such Default Period. The Lender’s election to charge the Default Rate shall be in its sole discretion and shall not be a waiver of any of its other rights and remedies. The Lender’s election to charge interest at the Default Rate for less than the entire period during which the Default Rate may be charged shall not be a waiver of its right to later charge the Default Rate for the entire such period.

(c) Participations. If any Person shall acquire a participation in the Advances or the Obligation of Reimbursement, the Borrower shall be obligated to the Lender to pay the full amount of all interest calculated under this Section 2.8(c), along with all other fees, charges and other amounts due under this Agreement, regardless if such Person elects to accept interest with respect to its participation at a lower rate than that calculated under this Section 2.8, or otherwise elects to accept less than its pro rata share of such fees, charges and other amounts due under this Agreement.

(d) Usury. In any event no rate change shall be put into effect which would result in a rate greater than the highest rate permitted by law. Notwithstanding anything to the contrary contained in any Loan Document, all agreements which either now are or which shall become agreements between the Borrower and the Lender are hereby limited so that in no contingency or event whatsoever shall the total liability for payments in the nature of interest, additional interest, Default Interest, fees payable hereunder, and other charges exceed the applicable limits imposed by any applicable usury laws. If any payments in the nature of interest, additional interest, Default Interest, fees payable hereunder, and other charges made under any Loan Document are held to be in excess of the limits imposed by any applicable usury laws, it will be deemed a mutual mistake and any such amount held to be in excess shall be considered payment of principal hereunder, and the indebtedness evidenced hereby shall be reduced by such amount (or if there is no existing indebtedness, refunded to the Borrower) so that the total liability for payments in the nature of interest, additional interest and other charges shall not exceed the applicable limits imposed by any applicable usury laws, in compliance with the desires of the Borrower and the Lender. All amounts constituting interest will be spread throughout the full term of the indebtedness evidenced hereby in determining whether interest exceeds lawful amounts. The Borrower agrees that the interest rate contracted for herein includes the interest rate set forth in this Section 2.8 plus any other charges or fees set forth herein and costs and expenses incident to this transaction paid by the Borrower to the extent that they are deemed interest under applicable law. This provision shall never be superseded or waived and shall control every other provision of the Loan Documents and all agreements between the Borrower and the Lender, or their successors and assigns.

20

Section 2.9 Fees.

(a) Amended and Restated Fee. The Borrower shall pay to the Lender, on the date hereof, a fully earned, non-refundable, amended, restated and origination fee in the amount of $37,500.00.

(b) Audit Fees. The Borrower shall pay the Lender, on demand, reasonable audit fees in connection with any audits or inspections conducted by or on behalf of the Lender of any Collateral or the Borrower’s operations or business at the rates established from time to time by the Lender as its audit fees (which fees are currently $125.00 per hour per auditor), together with all actual out-of-pocket costs and expenses reasonably incurred in conducting any such audit or inspection.

(c) Letter of Credit Fees. The Borrower shall pay to the Lender a fee with respect to each Letter of Credit, if any, accruing on a daily basis and computed at the annual rate of three percent (3.00%), of the aggregate amount that may then be drawn under it assuming compliance with all conditions for drawing (the “Aggregate Face Amount”), from and including the date of issuance of such Letter of Credit until such date as such Letter of Credit shall terminate by its terms or be returned to the Lender, due and payable monthly in arrears on the first day of each month and on the Termination Date; provided, however, that during Default Periods, in the Lender’s sole discretion and without waiving any of its other rights and remedies, such fee shall increase to six percent (6.0%) of the Aggregate Face Amount. The foregoing fee shall be in addition to any and all fees, commissions and charges of the Issuer with respect to or in connection with such Letter of Credit.

(d) Letter of Credit Administrative Fees. The Borrower shall pay to the Lender, on written demand, the administrative fees charged by the Issuer in connection with the honoring of drafts under any Letter of Credit, amendments thereto, transfers thereof and all other activity with respect to the Letters of Credit at the then-current rates published by the Issuer for such services rendered on behalf of customers of the Issuer generally.

(e) Termination and Line Reduction Fees. If (i) the Lender terminates the Credit Facility as a result of the occurrence of an Event of Default, or if (ii) the Borrower terminates the Credit Facility or reduces the Maximum Line on a date prior to the Maturity Date, then the Borrower shall pay the Lender as liquidated damages and not as a penalty a termination fee in an amount equal to a percentage of the Maximum Line (or the reduction of the Maximum Line, as the case may be) calculated as follows: (A) three percent (3.0%) if the termination or reduction occurs on or before June 30, 2015; (B) two percent (2.0%) if the termination or reduction occurs after June 30, 2015 but on or before June 30, 2017; and (C) one percent (1.0%) if the termination or reduction occurs after June 30, 2017.

(f) Waiver of Termination Fees. The Borrower will not be required to pay the termination fees otherwise due under subsection (e) if such termination is made because of refinancing by an affiliate of the Lender.

21

(g) Unused Line Fee. For the purposes of this Section 2.9(g), “Unused Amount” means the Maximum Line reduced by outstanding Revolving Advances. The Borrower agrees to pay to the Lender an unused line fee at the rate of one-half of one percent (0.50 %) per annum on the average daily Unused Amount from the date of this Agreement to and including the Termination Date, due and payable monthly in arrears on the first Banking Day of the month and on the Termination Date.

(h) Other Fees. The Lender may from time to time charge additional fees: (i) for Revolving Advances made and Letters of Credit issued in excess of Availability (which over-advance fees are currently $500 per day when there is no Default Period and $1,000 per day when a Default Period exists, and may be charged for each day that the over-advance exists); (ii) in lieu of imposing interest at the Default Rate during a Default Period; (iii) for wire transfer fees; and (iv) for other fees which are customarily charged by the Lender and are reasonable in amount. Fees charged pursuant to clause (ii) above will not exceed the Default Rate which could be charged because of the Default or Event of Default permitting the fees. Neither the charging nor the payment of overadvance fees shall be deemed to excuse or waive the Borrower’s obligation to comply with provisions of Section 2.13 or to waive any Default of the Borrower arising from the Borrower’s failure to comply with the provisions of Section 2.13. The Borrower’s request for a Revolving Advance in excess of Availability, the issuance of a Letter of Credit in excess of Availability or the Borrower’s failure to comply with the provisions of Section 2.13 shall constitute the Borrower’s agreement to pay the over-advance fees described in such notice.

(i) Real Estate Term Advance Closing Fee. The Borrower shall pay to the Lender, on the date hereof, a fully earned, non-refundable Real Estate Term Advance origination fee in the amount of $100,000.00

(j) Real Estate Term Advance Prepayment Fee. If the Real Estate Term Advance is prepaid in whole or in part prior to the Real Estate Facility Maturity Date for any reason, then on the date of any such prepayment, the Borrower shall pay to the Lender as liquidated damages and not as a penalty a prepayment fee in an amount equal to (i) three percent (3.0%) of the amount prepaid, if prepayment occurs on or before [insert date that is first anniversary of closing]; and (ii) two percent (2.0%) of the amount prepaid, if prepayment occurs after [insert date that is first anniversary of closing] but on or before [insert date that is second anniversary of closing].

(k) [Intentionally Deleted]

(l) [Intentionally Deleted]

(m) [Intentionally Deleted]

(n) [Intentionally Deleted]

(o) [Intentionally Deleted]

22

(p) Facility Fee. The Borrower agrees to pay an annual facility fee in the amount of $100,000.00 on each February 1st. All such amounts shall be paid in full when due regardless of whether they become due in any partial year.

(q) [Intentionally Deleted]

Section 2.10 Time for Interest Payments; Payment on Non-Banking Days; Computation of Interest and Fees.

(a) Time For Interest Payments. Accrued and unpaid interest accruing on Advances shall be due and payable on the first day of each month and on the Termination Date (each an “Interest Payment Date”), or if any such day is not a Banking Day, on the next succeeding Banking Day. Interest will accrue from the most recent date to which interest has been paid or, if no interest has been paid, from the date of advance to the Interest Payment Date. If an Interest Payment Date is not a Banking Day, payment shall be made on the next succeeding Banking Day.

(b) Payment on Non-Banking Days. Whenever any payment to be made hereunder shall be stated to be due on a day which is not a Banking Day, such payment may be made on the next succeeding Banking Day, and such extension of time shall in such case be included in the computation of interest on the Advances or the fees hereunder, as the case may be.

(c) Computation of Interest and Fees. Interest accruing on the outstanding principal balance of the Advances and fees hereunder outstanding from time to time shall be computed on the basis of actual number of days elapsed in a year of 360 days.

Section 2.11 Lockbox; Collateral Account; Application of Payments.

(a) Lockbox and Collateral Account.

(i) If an Event of Default occurs and the Lender requests that they do so, or regardless of whether or not an Event of Default or Default Period exists, if the sum of Availability plus Cash and Cash Equivalents on deposit with Lender at any time is less than $7,500,000.00 for five consecutive business days, then in either event (A) the Borrower shall instruct all account debtors to pay all its Accounts directly to a lockbox (the “Lockbox”) established with Wells Fargo Bank or another bank selected by the Lender and reasonably satisfactory to the Borrower and (B) the Borrower shall execute and deliver to the Lender a lockbox agreement in form and substance satisfactory to the Lender in its sole and absolute judgment. If, notwithstanding such instructions, the Borrower receives any payments on their Accounts, the Borrower shall deposit such payments into a collateral account maintained with Lender (the “Collateral Account”). The Borrower shall also deposit all other cash proceeds of Collateral directly to the Collateral Account if received at a time that the Borrower is required to deposit payments on their Accounts into the Collateral

23

Account. In addition, and regardless of whether or not an Event of Default or Default Period exists, if the sum of Availability plus Cash and Cash Equivalents on deposit with Lender at any time is less than $7,500,000.00 for five consecutive business days, then in such event, all proceeds of Collateral received by Borrower shall be immediately deposited in the Collateral Account. In all such events, until so deposited, the Borrower shall hold all such payments and cash proceeds received by it in trust for and as the property of the Lender and shall not commingle such property with any of its other funds or property. All deposits in the Collateral Account shall constitute proceeds of Collateral and shall not constitute payment of the Obligations.

(ii) All items deposited in the Collateral Account shall be subject to final payment. If any such item is returned uncollected, the Borrower will immediately pay the Lender, or, for items deposited in the Collateral Account, the bank maintaining such account, the amount of that item, or such bank at its discretion may charge any uncollected item to the commercial or other accounts. Borrower shall be liable as an endorser on all items deposited by it in the Collateral Account, whether or not in fact endorsed by it.

(b) Application of Payments.

(i) If a Collateral Account has been established and there are funds in the Collateral Account, the Borrower may, from time to time, cause funds in the Collateral Account to be transferred to the Lender’s general account for payment of the Obligations. Except as provided in the preceding sentence, amounts deposited in the Collateral Account shall not be subject to withdrawal by the Borrower, except after full payment and discharge of all Obligations and termination of the Credit Facility.

(ii) All payments to the Lender shall be made in immediately available funds and shall be applied to the Obligations upon receipt by the Lender. Funds received from the Collateral Account shall be deemed to be immediately available. The Lender may hold all payments not constituting immediately available funds for three (3) additional days before applying them to the Obligations.

Section 2.12 Voluntary Prepayment; Reduction of the Maximum Line; Termination of the Credit Facility by the Borrower. Except as otherwise provided herein, the Borrower may prepay the Advances in whole at any time or from time to time in part; provided that voluntary prepayments of the Real Estate Term Advance shall be in a minimum amount of $250,000.00. The Borrower may terminate the Credit Facility or reduce the Maximum Line at any time if it (i) gives the Lender at least 30 days’ prior written notice and (ii) pays the Lender termination or Maximum Line reduction fees in accordance with Section 2.9(e). Any reduction in the Maximum Line must be in an amount of not less than $500,000.00 or an integral multiple thereof. If the Borrower reduces the Maximum Line to zero, all Obligations shall be immediately due and

24

payable. Subject to termination of the Credit Facility and payment and performance of all Obligations, the Lender shall, at the Borrower’s expense, release or terminate the Security Interest and the Security Documents to which the Borrower is entitled by law.

Section 2.13 Mandatory Prepayment. Without notice or demand, if the sum of the outstanding principal balance of the Revolving Advances plus the L/C Amount shall at any time exceed the Borrowing Base, the Borrower shall (i) first, immediately prepay the Revolving Advances to the extent necessary to eliminate such excess; and (ii) if prepayment in full of the Revolving Advances is insufficient to eliminate such excess, pay to the Lender in immediately available funds for deposit in the Special Account an amount equal to the remaining excess. Any payment received by the Lender under this Section 2.13, or under Section 2.12, may be applied to the Obligations, in such order and in such amounts as the Lender, in its discretion, may from time to time determine.

Section 2.14 Revolving Advances to Pay Obligations. Notwithstanding anything in Section 2.1, the Lender may, in its discretion at any time or from time to time, without the Borrower’s request and even if the conditions set forth in Section 4.2 would not be satisfied, make a Revolving Advance in an amount equal to the portion of the Obligations from time to time due and payable.

Section 2.15 Use of Proceeds. The Borrower shall use the proceeds of Advances and each Letter of Credit for ordinary working capital purposes and for any other business purposes determined by Borrower.

Section 2.16 Liability Records. The Lender may maintain from time to time, at its discretion, records as to the Obligations. All entries made on any such record shall be presumed correct until the Borrower establishes the contrary. Upon the Lender’s demand, the Borrower will admit and certify in writing the exact principal balance of the Obligations that the Borrower then asserts to be outstanding. Any billing statement or accounting rendered by the Lender shall be conclusive and fully binding on the Borrower unless the Borrower gives the Lender specific written notice of exception within 30 days after receipt.

Section 2.17 Appraisals. Appraisals; Environmental Site Assessments. Borrower shall reimburse the Lender for Lender’s fees, costs and expenses incurred in connection with (i) one appraisal which is performed on the Real Property after June 30, 2013, (ii) one appraisal per year which is performed on Equipment, (iii) one appraisal per year which is performed on Inventory, and (iv) any appraisals performed during the existence of an Event of Default or Default Period. During the existence of an Event of Default or Default Period, Borrower shall reimburse Lender for any environmental site assessments.

Section 2.18 [INTENTIONALLY DELETED]

Section 2.19

(a) Real Estate Term Advance. Upon fulfillment of the applicable conditions set forth in Section 4 of this Agreement, subject to the terms and conditions of this Agreement, on the date hereof, the Lender agrees to make a term loan (the “Real Estate Term Advance”) to the Borrower in an amount equal to $10,000,000. The Lender shall disburse and pay the proceeds of the Real Estate Term Advance to the Borrower or its designee (and in a manner directed by the Borrower, including by wire transfer of cash credit or by crediting the same to the Borrower’s demand deposit account specified in Section 2.2(b)). The Borrower’s obligation to pay the Real Estate Term Advance shall be evidenced by the Real Estate Term Note and shall be secured by the Collateral.

25

(b) Payment of the Real Estate Term Advance. The outstanding principal balance of the Real Estate Term Advance shall be due and payable as follows:

(i) In equal quarterly installments of $166,750.00, beginning on the first day of the first full quarter following the disbursement of the Real Estate Term Advance, and on the 1st day of each quarter thereafter.

(ii) All prepayments of principal with respect to the Real Estate Term Advance shall be applied to the principal installments thereof in the inverse order of maturity.

(iii) On the Real Estate Facility Termination Date, the entire unpaid principal balance of the Real Estate Term Advance, and all unpaid interest accrued thereon, shall also be fully due and payable.

Section 2.20 [INTENTIONALLY DELETED]

Section 2.21 [INTENTIONALLY DELETED]

ARTICLE III

SECURITY INTEREST; OCCUPANCY; SETOFF

Section 3.1 Grant of Security Interest. The Borrower hereby pledges, assigns and grants to the Lender a lien and security interest (collectively referred to as the “Security Interest”) in the Collateral, as security for the payment and performance of the Obligations. Upon request by the Lender, the Borrower will grant the Lender a security interest in all commercial tort claims it may have against any Person. Notwithstanding anything herein or in any other Loan Document to the contrary, in no event shall the Security Interest attach to, or the term “Collateral” be deemed to include (a) any of the outstanding equity interests in a foreign Subsidiary (i) in excess of 65% of the voting power of all classes of equity interests of such foreign Subsidiary entitled to vote in the election of directors or other similar body of such foreign Subsidiary, or (ii) to the extent that the pledge thereof is prohibited by the laws of the jurisdiction of such foreign Subsidiary’s organization; (b) any equity interest in any foreign Subsidiary that is not a first-tier Subsidiary of a Borrower; (c) any lease, license, contract, property rights or agreement to which a Borrower is a party or any of such Borrower’s rights or interests thereunder, if, and for so long as and to the extent that, the grant of the security interest would constitute or result in (i) the abandonment, invalidation or unenforceability of any material right, title or interest of such Borrower therein, or (ii) a breach or termination pursuant to the terms of, or a default under, any such lease, license, contract, property rights or agreement (other than to the extent that any such breach, termination or default would be rendered ineffective pursuant to Section 9-406, 9-407, 9-408 or 9-409 of the Uniform Commercial Code (or any successor provision or provisions) of any relevant jurisdiction, any other applicable law or principles of equity), provided, however, that the security interest (x) shall attach immediately when the condition causing such abandonment, invalidation or unenforceability is remedies, (y) shall attach immediately to any severable term or such lease, license, contract, property rights or agreement to the extent that such attachment does not result in any of the consequences specified in (i) or (ii) above, and (z) shall attach immediately to any such lease, license, contract,

26

property rights or agreement to which the account debtor or such Borrower’s counterparty has consented to such attachment; (d) any equity interest acquired after the date hereof that is an equity interest in an entity other than a Subsidiary of any Borrower, solely to the extent such acquisition is permitted under this Agreement, if the terms of the organizational documents of the issuer of such equity interests do not permit the grant of the security interest in such equity interests by the owner thereof or the applicable Borrower, after employing commercially reasonable efforts, has been unable to obtain any approval or consent to the creation of the security interest therein that is required under such organizational documents, and (e) any application to register any trademark or service mark prior to the filing under applicable law of a verified statement of use (or the equivalent) for such trademark or service mark to the extent the creation of a security interest therein or the grant of a mortgage thereon would void or invalidate such trademark or service mark.

Section 3.2 Notification of Account Debtors and Other Obligors. The Lender may at any time during a Default Period notify any account debtor or other person obligated to pay the amount due that such right to payment has been assigned or transferred to the Lender for security and shall be paid directly to the Lender. The Borrower will join in giving such notice if the Lender so requests. At any time after the Borrower or the Lender gives such notice to one of its account debtors or other obligors, the Lender may, but need not, in the Lender’s name or in the name of the Borrower, (a) demand, sue for, collect or receive any money or property at any time payable or receivable on account of, or securing, any such right to payment, or grant any extension to, make any compromise or settlement with or otherwise agree to waive, modify, amend or change the obligations (including collateral obligations) of any such account debtor or other obligor; and (b) as the agent and attorney-in-fact of the Borrower, notify the United States Postal Service to change the address for delivery of the mail of the Borrower to any address designated by the Lender, otherwise intercept the mail of the Borrower, and receive, open and dispose of the Borrower’s mail, applying all Collateral as permitted under this Agreement and holding all other mail for the Borrower’s account or forwarding such mail to the last known address of either the Borrower to whom addressed or Schuff International.