Attached files

| file | filename |

|---|---|

| EX-31 - EXHIBIT 31.2 - Armco Metals Holdings, Inc. | ex31-2.htm |

| EX-32 - EXHIBIT 32.1 - Armco Metals Holdings, Inc. | ex32-1.htm |

| EX-31 - EXHIBIT 31.1 - Armco Metals Holdings, Inc. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Amendment No. 1)

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

OR

|

☐ |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM __________________ TO __________________________

COMMISSION FILE NUMBER: 001-34631

ARMCO METALS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

26-0491904 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

One Waters Park Drive, Suite 98, San Mateo, California |

94403 | |

|

(Address of principal executive offices) |

(Zip Code) |

|

Registrant's telephone number, including area code: |

(650) 212-7620 |

Securities registered under Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|

Common stock, par value $0.001 per share |

NYSE MKT |

Securities registered under Section 12(g) of the Act:

None

(Title of class)

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

☐ |

Yes |

☒ |

No |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

|

|

☐ | Yes | ☒ | No |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| ☒ | Yes | ☐ | No |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.4.05 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒

Yes

☐

No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company:

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ | |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐ Yes ☒ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. $5,530,377 on June 28, 2013.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date. 31,433,968 shares of common stock are issued and outstanding as of April 2, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

EXPLANATORY NOTE

We are filing this Amendment No. 1 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 as originally filed on April 4, 2014 (the “Original Filing”) to revise certain disclosure in response to comments from the staff of the Securities and Exchange Commission. These revisions include:

| ● |

we have revised the introductory paragraph to Item 1A. Risk Factors to eliminate certain qualifying language; |

|

● |

we have enhanced certain disclosure to further clarify the impact of weakening demand and price for scrap metal and overcapacity in that market has had on our company; |

|

● |

we had added additoinal diclosure provding more detail on our new business model; |

|

● |

we have enhanced certain disclosure to provide more information on known trends and uncertainities associted with CNBM’s non-performance and risks to us; and |

|

● |

we have added additional disclosure regarding the consideration of diversity by our Nominanting and Corporate Governance Committee in identifying director nominees. |

This Form 10-K/A also includes new certifications pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 as Exhibits 31.1, 31.2 and 32.1. Except as described above, no other information in the Original Filing has been updated and this Amendment continues to speak as of the date of the Original Filing. Other events occurring after the filing of the Original Filing or other disclosures necessary to reflect subsequent events have been or will be addressed in other reports filed with or furnished to the SEC subsequent to the date of the Original Filing.

TABLE OF CONTENTS

|

Page No. | |||

|

Part I | |||

|

Item 1. |

Business. |

4 | |

|

Item 1A. |

Risk Factors. |

11 | |

|

Item 1B. |

Unresolved Staff Comments. |

19 | |

|

Item 2. |

Properties. |

19 | |

|

Item 3. |

Legal Proceedings. |

20 | |

|

Item 4. |

Mine Safety Disclosures. |

20 | |

|

Part II | |||

|

Item 5. |

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

20 | |

|

Item 6. |

Selected Financial Data. |

21 | |

|

Item 7. |

Management's Discussion and Analysis of Financial Condition and Results of Operations. |

21 | |

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk. |

34 | |

|

Item 8. |

Financial Statements and Supplementary Data. |

34 | |

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. |

34 | |

|

Item 9A. |

Controls and Procedures. |

35 | |

|

Item 9B. |

Other Information. |

35 | |

|

Part III | |||

|

Item 10. |

Directors, Executive Officers and Corporate Governance. |

36 | |

|

Item 11. |

Executive Compensation. |

40 | |

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

42 | |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

43 | |

|

Item 14. |

Principal Accounting Fees and Services. |

45 | |

|

Part IV | |||

|

Item 15. |

Exhibits, Financial Statement Schedules. |

45 | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Throughout this report, or in other reports or registration statements filed from time to time with the Securities and Exchange Commission under the Securities Exchange Act of 1934, or under the Securities Act of 1933, as well as in documents we incorporate by reference or in press releases or oral statements made by our officers or representatives, we may make statements that express our opinions, expectations, or projections regarding future events or future results, in contrast with statements that reflect historical facts. These predictive statements, which we generally precede or accompany by such typical conditional words as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” or by the words “may,” “will,” or “should,” are intended to operate as “forward-looking statements” of the kind permitted by the Private Securities Litigation Reform Act of 1995, incorporated in Section 27A of the Securities Act and Section 21E of the Securities Exchange Act. That legislation protects such predictive statements by creating a “safe harbor” from liability in the event that a particular prediction does not turn out as anticipated.

While we always intend to express our best judgment when we make statements about what we believe will occur in the future, and although we base these statements on assumptions that we believe to be reasonable when made, these forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements. Forward-looking statements are subject to many uncertainties and other variable circumstances, many of which are outside of our control, that could cause our actual results and experience to differ materially from those we thought would occur.

The following listing represents some, but not necessarily all, of the factors that may cause actual results to differ from those we may have anticipated or predicted:

|

● |

We operate in cyclical industries and we experience volatile demand for our products; |

|

● |

Our ability to operate our scrap metal recycling facility efficiently and profitably; |

|

● |

Our ability to obtain sufficient capital to fund a potential expansion of our scrap metal recycling facility; |

|

● |

Our ability to establish adequate management, legal and financial controls in the United States and China; |

|

● |

The availability to us of supplies of metal ore and scrap metal upon favorable terms; |

|

● |

The availability of electricity to operate our scrap metal recycling facility; |

|

● |

Fluctuations in raw material prices may affect our operating results as we may not be able to pass on cost increases to customers; |

|

● |

The lack of various legal protections, which may be customarily contained in similar contracts among parties in the United States and are material to our operations, in certain agreements to which we are a party; |

|

● |

Our dependence on our key management personnel; |

|

● |

Our potential inability to meet the filing requirements imposed by the securities laws in the United States; |

|

● |

Our ineffective internal control over financial reporting; |

|

● |

The effect of changes resulting from the political and economic policies of the Chinese government on our assets and operations located in China; |

|

● |

The limitation on our ability to receive and use our revenues effectively as a result of restrictions on currency exchange in China; |

|

● |

The impact of future inflation in China on economic activities in China; |

|

● |

Our ability to enforce our rights due to policies regarding the regulation of foreign investments in China; |

|

● |

The restrictions imposed under regulations relating to offshore investment activities by Chinese residents, causing us increased administrative burdens and regulatory uncertainties, may limit or adversely affect our ability to complete any business combinations with our subsidiaries based in China; |

|

● |

Our ability to comply with the United States Foreign Corrupt Practices Act which could subject us to penalties and other adverse consequences; |

|

● |

The provisions of our articles of incorporation and by-laws that may delay or prevent a takeover may sometimes work against the best interests of our stockholders; and |

|

● |

Our controlling stockholders may take actions that conflict with the interests of our stockholders. |

You should read thoroughly this report and the documents that we refer to herein with the understanding that our actual future results may be materially different from and/or worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements including those made in Part I. Item 1A. Risk Factors appearing elsewhere in this report. Other sections of this report include additional factors which could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

OTHER PERTINENT INFORMATION

Unless otherwise set forth to the contrary, when used in this report the terms the “Company,” "we," "us," "ours," and similar terms refers to Armco Metals Holdings, Inc., a Nevada corporation, and our subsidiaries, the term “MT” refers to metric tons, and the term “Recycling Facility” refers to our metal recycling facility located in the Banqiao Industrial Zone, part of Lianyungang Economic Development Zone in the Jiangsu province of China.

The information which appears on our web site at www.armcometals.com is not part of this report.

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

Overview We engage in the business of metal ore trading and distribution and scrap metal recycling. Our operations are conducted primarily in China.

In our metal ore trading and distribution business, we import, sell and distribute to the metal refinery industry in China, a variety of metal ore that includes iron, chrome, nickel, copper, titanium and manganese ore, as well as non-ferrous metals, and coal. We obtain these raw materials from global suppliers primarily in Brazil, India, Indonesia, Ukraine and the United States and distribute them in China. In addition, we provide sourcing and pricing services for various metals to our network of customers.

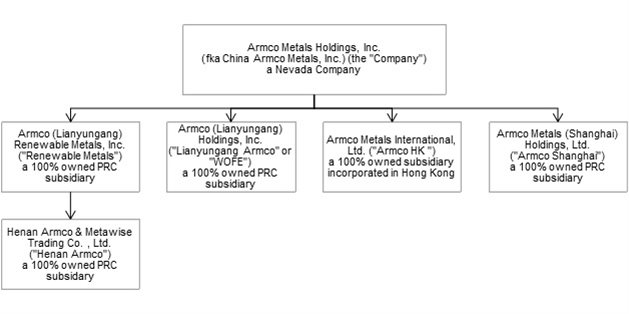

In our scrap metal recycling business, we recycle scrap metal at our recycling facility and sell the recycled product to steel mills in China for use in the production of recycled steel. Our recycling facility commenced formal operations in the third quarter of 2010, and is located in Banqiao Industrial Zone, part of Lianyungang Economic Development Zone, in the Jiangsu province of China. Our organization structure is summarized below:

Our Industry and Market

Steel Industry and Market for Iron Ore

China is the largest developing country in the world, and the demand for steel has been growing steadily over the past decade as the country continues to experience an industrial revolution. The steel industry is an important basic industry of China’s national economy, and it plays a vital role in the country’s industrialization efforts. Our management believes that domestic steel production in China will continue to increase at current levels as the country continues to grow. According to the World Steel Association, worldwide crude steel production reached 1,607 million MT for 20131, and increased 3. 5% from 2012 to 2013 and 1.2% from 2011 to 2012. Crude steel production in China reached 779 million MT in 2013, and increased 7.5% from 2012 to 20132, 3.1% from 2011 to 2012 and 8.9% from 2010 to 2011. China accounts for 33.8% of the world steel production in 2006, and increased to 48.5% of global production in 2013.

1 http://www.worldsteel.org/media-centre/press-releases/2014/World-crude-steel-output-increases-by-3-5--in-2013.html

2 http://www.worldsteel.org/media-centre/press-releases/2014/World-crude-steel-output-increases-by-3-5--in-2013.html

Scrap Metal Recycling Industry.

China is the largest market in the world for scrap metal used in the production of steel. China produced 779 million MT of steel in 2013 and expects to produce 810 million MT in 20143. According to a report released at year end of 2013 by the Ministry of Industry and Information Technology (MIIT), steel industry will grow at a slow rate, which will continue to earn merger profit in 2014. Our management anticipates that our growth will be enhanced by the favorable environmental and other economic stimulus policies of the Chinese government. The Chinese government is seeking to, reduce pollution and save energy, and recycling metal offers advantages in line with these goals. Recycling steel requires 60% less energy, reduces air pollution by 86% and water pollution by 76% as compared to the traditional iron ore to steel processing methods. In addition, recycling metal is believed to be less costly than mining iron ore and manipulating it through the production process to form 'new' steel. Metal does not lose its inherent physical properties during the recycling process and the recycling process drastically reduces required energy and material compared to the refinement from iron ore.

The Chinese government’s stated goal in its 12th Five Year Plan (2011-2015) is to increase consumption of scrap metal by producers from 15% to 20% between 2010 and 2015. The Chinese government estimates that the scrap metals demand will be in 92 million MT which increases 4 million MT comparing to 2013 and 880 million MT of steel will be consumed annually by the year 20154 and therefore domestic demand for scrap is likely to substantially increase by 2015. Accordingly we expect that demand for scrap metal will continue to be strong. For the steel industry, the Chinese government’s stated goal in the 12th Five Year Plan (2011-2015) is to increase consumption of scrap metal by producers from 15% in 2010 to 20% in 2015. The government’s stated goal will have impact on the development of our scrap steel business favorably in the next few years. So it is estimated that China’s total demand for scrap metal in 2015 should be approximately 140 million MT.

The amount of domestic steel available for recycling is largely a function of the amount of steel in products or other applications nearing the end of their useful lives. Much of China’s steel reserves or the steel in use in China today, has only recently been put into use. For example, according to the China Iron and Steel Association, the accumulated steel product consumption in China from 1949 to 2007, or the total volume of steel products consumed during that period, was approximately 4.13 billion MT, of which approximately 2.23 billion MT, or approximately 54%, was consumed in the period from 2001 to 2007.

Many of the steel products in use in China today have yet to reach the end of their useful lives. However, that is expected to change in the near future because many of the products put into use in China over the last few years have relatively short life spans, such as vehicles and home appliances. Moreover, many buildings and other infrastructure projects with longer life spans that were built during the early stages of China’s industrialization are soon expected to reach the end of their useful lives. We expect that each of these products will provide a significant source of domestic scrap steel available for recycling.

In addition, China’s steel production technology has become increasingly efficient, and enhancements in production technology have resulted in a reduction of scrap steel produced by steel manufacturers. As a result, the amount of scrap steel created by steel companies per MT of steel produced has decreased.

We expect the increasing focus on environmental matters and efficient utilization of resources will further strengthen demand for scrap steel in domestic steel production in China. With the expected increase in steel available for recycling, we believe scrap steel recycling companies with strong domestic supply networks like us should be particularly well positioned to capitalize on these trends. Prices of scrap steel are highly correlated to the price of steel. According to the China Association of Metal Scrap Utilization, the spread between hot rolled coil prices and average scrap steel prices in China remained relatively constant over the past few years. As a result, factors that affect the price of steel in China often have a similar impact on the price of scrap steel in China.

3 http://www.chinafastener.com/news-shows/fastener-news-1736.htm

4 http://www.hjkxyj.org.cn/ch/reader/view_abstract.aspx?file_no=20111118&flag=1

The Chinese government has identified the scrap metal recycling industry as a way to minimize the use of scarce natural resources and reduce energy consumption and emissions in the steel manufacturing industry. In July 2005, China’s “Steel Industry Development Policy” recommended that domestic steel producers increase the use of scrap metal in the production of steel. Chinese scrap companies once paid 17% VAT on their scrap transactions but could apply for a rebate. In 2010, this was reduced to 50% of the VAT charge, down from 70% in 2009. However, the policy expired on January 1, 2011 and was not renewed. In February 2006, The National Development and Reform Commission of China, The Ministry of Science and Technology of China, and The Ministry of Environmental Protection of China jointly issued the “Automotive Products Recycling Technology Policy.” Under the terms of this policy, auto makers were charged with the responsibility to recover and recycle abandoned vehicles. We believe that this law has increased the availability of raw materials necessary for scrap metal recycling.

The Chinese government also encourages the development of the scrap metal recycling industry. After the accession to the World Trade Organization, Chinese government adopted a favorable policy of zero tariffs on scrap steel imports and implemented a quota-free policy on the volume of imports via self-registration. In order to facilitate and regulate the domestic scrap steel recycling market, the Chinese government further revised China’s taxation policy on waste to encourage development of the scrap steel recycling industry. The Chinese government once increased the export tax to 13% for some steel and non-ferrous metal products effected for the period between April 2009 and the end of 2010. Since 2011, scrap steel and non-ferrous metal products no longer enjoy rebate for export tax. The favorable tariffs and taxation policies for scrap steel continue being in place, and we believe these policies will further benefit the scrap metal industry in China over the next few years.

Our Metal Ore Trading and Distribution Business

We believe that we are a leader in China in the trading and distribution of metal ore to the metal refining industry in China. We have also started trading and distribution of non-ferrous metals in China. Our products include a wide variety of metal ores such as iron ore, chrome ore, nickel ore, copper ore, manganese ore and scrap metal. We obtain our products from global suppliers in primarily Brazil, India, Indonesia, Ukraine, and the United States. We have established strong relationships with our clients and service their needs through our internal sales representatives and other company resources.

Customers

We sell processed and non-ferrous ore to end-users such as specialty steelmakers, foundries, aluminum sheet and ingot manufacturers, copper refineries and smelters, brass and bronze ingot manufacturers, wire and cable producers, utilities and telephone networks. In addition to coal and steel billet (which is a section of steel used for rolling into bars, rods and sections), we buy and sell the following metal ore from time to time:

| ● |

Iron Ore, which is the raw material used to make pig iron, which is in turn one of the main raw materials used to make steel. Approximately 98% of the mined iron ore is used to make steel; | |

|

● |

Chrome Ore, which is used to reinforce steel and, in association with high carbon, gives resistance to wear and abrasion. It is also used in heat-resisting steels and high duty cast irons; | |

|

● |

Nickel Ore, which is a silvery-white metal that takes on a high polish. It belongs to the transition metals, and is hard and ductile. It occurs most usually in combination with sulfur and iron in pentlandite, with sulfur in millerite, with arsenic in the mineral nickeline, and with arsenic and sulfur in nickel glance; | |

|

● |

Copper Ore, which is used as a heat conductor, an electrical conductor, as a building material and as a constituent of various metal alloys; | |

|

● |

Manganese Ore, which is a chemical element that is used industrially as pigments and as oxidation chemicals; | |

| ● |

Magnesium Ore, which is used in aluminum alloying. The addition of magnesium to aluminum produces high-strength, corrosion-resistant alloys; and | |

|

● |

Titanium Ore, which is one of the most widely distributed elements in the crust and an important raw material to manufacture titanium products and electrode coating. |

The following table sets forth our major customers for metal ore whose sales accounted for more than 10% of our total revenues for the year of 2013:

|

● |

Shanxi Gangxu Trade Co., Ltd.; | |

|

● |

Broad Max Holding Ltd.; and | |

|

● |

Sichuan Ming Da (Group) Enterprises Co., Ltd. |

Suppliers

In general, we obtain ferrous and non-ferrous ore from a variety of sources, including mining companies, brokers and other intermediaries. Our metal ore distribution business requires a significant amount of working capital to pay for the various ore and scrap metal we purchase and distribute. We currently finance these purchases through a combination of various facilities, including letters of credit, bank credit lines, internally generated funds and loans from Kexuan Yao, our Chairman, President and Chief Executive Officer. In September 2012, we purchased 30,000 MT of chrome ore from Mineracao Usiminas S.A. In March 2013, we signed sales contract of 28,000 MT with our customers and we have delivered approximately 27,000 MT of the chrome ore under the sales contract to the customers. We have been focusing our efforts on securing additional contracts for various ore and metals and are still in the early stages of evaluating potential new supply opportunities.

In 2013, our major suppliers in our metal ore business were:

|

● |

Fremery holdings Ltd; and | |

|

● |

Beijing CNR CR transportation Equipment Co., Ltd. |

Our current practice is to enter into single transaction contracts for the purchase and sale of metal ore, in which the sales price charged to our customers is based on the price we pay for the metal ore plus a predetermined amount. In the future, our goal is to enter into either long-term contracts with both suppliers and customers or negotiated spot sales contracts which establish the quantity purchased for the month. In general, the price we charge for ore depends upon market demand, supply and transportation costs, as well as quality and grade of the metal ore. In many cases, our selling price also includes the cost of transportation to the destination port of the end-user.

Our Metal Recycling Operations

In the third quarter of 2010, we commenced formal operations at our recycling facility, which is located in Banqiao Industrial Zone, part of Lianyungang Economic Development Zone in Jiangsu province of China. Jiangsu province, located in eastern PRC, is considered as one of the China’s major industrial centers. Lianyungang city in Jiangsu province is home to one of the China's ten largest deep-sea ports and has large ship access. Lianyungang is also located near 11 steel mills in the Jiangsu province. Our recycling facility is strategically located near this deep-sea port.

The recycling facility includes a scrap metal cutting production line, a large scrap metal cutting line, light thin waste/thin metal packing line and a preproduction facility that includes scrap metal grasping machines, scrap transportation machines, radiation detection equipment, factory, administrative and operations offices, material pile stock and load meters. The recycling facility is designed to recycle machinery, building materials, automobile parts and various other scrap metals and to dismantle ships. We believe we are the first company to install and operate in China a Texas Shredder Lindeman System, one of the most advanced metal recycling systems in the world.

The recycling facility is designed to have a production capacity to recycle approximately one million MT of metal annually, which includes 800,000 MT from a shredder and 200,000 MT from cutting machines. Our current production capacity at the recycling facility is 600,000 MT. As the recycling facility only became operational in the third quarter of 2010, we have no current plan to expand the production capacity of the recycling facility.

Depending upon future market conditions and our ability to operate our plant at its current production capacity, we may seek to expand the capacity of the recycling facility, and we have begun to formulate a plan for the second phase of these operations. This next phase would include an expansion to increase our production capacity to two million MT per year and construction of additional scrap automobile dismantling lines to address the emerging market demand of automobile recycling. China has become the largest automobile market in the world since 2009. Expansion of the recycling facility would require a significant investment by us and would likely require us to raise additional capital. Our decisions regarding the need to expand our recycling operations will be made in future periods as market conditions and availability of capital dictate.

We recycle scrap metals at the recycling facility using both heavy equipment and manual labor. Recycling scrap metal consists of a variety of steps, including collecting, inspecting, sorting, stripping, shearing, cutting, shredding and bailing. The precise steps involved depend upon the types and condition of the raw materials that we purchase. For thin scrap metal, we primarily use our shredder to process the raw material, and for the medium and larger sized scrap metal, we use hydraulic machinery, including cutting machines, and manual labor to break down the scrap metals into standard sized pieces. In the shredding process, the ferrous metal is separated from other metals by an automated electronic magnetic drum. We also recover non-ferrous scrap metal through the use of an eddy current separator in the shredding process, which separates non-ferrous metals from non-metal materials. The non-ferrous metals are then manually separated into copper, aluminum and other non-ferrous metals, primarily based on color and weight of the extracted metal pieces.

Customers

In 2012 and 2013, we sold scrap metal of approximately 148,983 and 157,772MT, respectively. The following table sets forth our major customers for scrap metal whose sales accounted for more than 10% of our total revenues for the year of 2013:

|

● |

Shanxi Gangxu Trade Co., Ltd.; | |

|

● |

Sinosteel Zhejiang Co., Ltd.; and | |

|

● |

Dafeng HengMao metal renewable Co., Ltd. |

In addition, CNBM International Corporation ("CNBM") is one of our major customers in 2013 whose sales accounted for approximately 9.4% of our total revenues for the year of 2013. We signed a long-term contract with CNBM but the customer was not able to perform the contract during December of 2013 and the first quarter of 2014 due to the deteriorate market condition and strict public finance and monetary policy in China. It is not clear if CNBM is able to perform the remaining contract while the contract has not been terminated. CNBM usually resells the steel scrap purchased from Armco to Chinese steel mills. When market price of scrap metals declined sharply due to the deteriorate market condition, CNBM could not perform the contract when two parties could not reach an agreement on the price as both parties would suffer losses at the sharply declining market prices. Meanwhile, CNBM's customers, most of which are Chinese steel mills, were not able to obtain sufficient funding from China financial institutions to make prompt payment to or make new orders with CNBM due to strict public finance and monetary policy in China. Consequently, CNBM was not able to make prepayment to Armco nor perform the contract. There are no assurances CNBM will ever perform under this long-term contract.

Suppliers

In 2013, we entered into short-term agreements with multiple small deliveries at spot prices with local suppliers for the purchase of scrap metals. The names of our major suppliers are as follows:

|

● |

LianYunGang HeBang Renewable Resource Co., Ltd.; and | |

|

● |

Beijing CNR CR transportation Equipment Co., Ltd. |

The raw scrap metal that we purchase is transported to the recycling facility primarily via railroads, waterways and major highways. The recycling facility is located in close proximity to transportation facilities, 11 kilometers to railroads and 10 kilometers to shipping ports. Similar to our metal ore business, our current practice in our recycling business is to enter into single transaction contracts for the purchase and sale of scrap metal. In the future, our goal is to enter into either long-term contracts with suppliers of scrap metal or negotiated spot sales contracts which establish the quantity purchased for the month.

The price we pay for scrap metal depends upon market demand, supply and transportation costs, as well as quality and grade of the scrap metal. In periods of low prices, suppliers may elect to hold metal to wait for higher prices or intentionally slow their metal collection activities. In addition, a global slowdown of industrial production would reduce the supply of industrial grades of metal to the metal recycling industry, potentially reducing the amount of metals available for us to recycle.

Our primary target customers in our scrap metal recycling operations are steel mills, which use our recycled metal in the production of steel. In December 2012 and January 2013, we entered into annual sales agreements with Jiangsu Lihuai Steel Co., Ltd. and ZhongJin Renewable Resources (Tianjin) Investment Co., Ltd., respectively. PRC’s 12th Five Year Plan (2011-2015) implemented beginning January 1, 2011 includes as one of its stated objectives the increase use of recycled steel to save energy and reduce emission. For the steel industry, the 12th Five Year Plan's goal is to increase consumption of scrap metal by producers from 15% in 2010 to 20% in 2015. In addition, according to such Five Year Plan, China will likely to force out low-end steel manufacturers, by way of shutting down their businesses or initiating merger with other manufacturers. The low-end steel manufacturers are believed to have contributed to declining industry profit margins and undermining the government’s goal of more orderly industry development. The planned consolidation in the industry is expected to expel a number of small unqualified players and better discipline the industry. We expect to benefit from this policy to achieve more market shares as a qualified company. We expect that the customer and supplier bases for our metal recycling operations will increase as a result of the 12th Five Year Plan and we believe we are well-positioned to benefit directly from this government mandate in 2014 and beyond. The number of our major customers for our recycling business has increased to 14 since we started our recycling operation, including recently added Mitsui & Co.(Shanghai) Ltd., a wholly owned subsidiary of Mitsui & Co., Ltd., a globally well-known company. We also expanded our supplier base which we have been working with 12 middle and large-scale suppliers whose annual supply capacity is over 1 million MT since 2010 when we started the recycling operation.

New business model

In 2013 we developed a new business model, “Platform Model”, in our recycling operation which our business partners and customers involved in the entire recycling process from participating in acquisition and preparation of raw materials to delivering of processed scrap products. Our profits, by nature, mainly generate from the process fees by taking advantage of our facility and equipment as a platform for recycling scrap metals. The new business model differs from our prior business model in several aspects of transaction process and the comparison is shown as below table.

|

Terms |

Prior business model |

New business model |

New business model advantage over Prior business model |

|

Payment term |

Generally Letter of Credit (usually we need to use our own cash to purchase raw materials and make production or use L/C to financing the transactions) |

Customer make full payment in advance |

Decrease our cash needs for raw material acquisition and production and in turn decrease our working capital needs; decrease accounts receivable as payment received in advance and resulted in improvement on working capital turnover and efficiency |

|

Raw material acquisition |

Armco purchase raw materials by itself |

Customer provide |

Decrease market risk and cash needs for material purchase |

|

Process / Production |

by Armco |

by Armco |

|

|

Sales |

Armco need to find customers in the market to make the sales by itself |

Sales locked to the Customer (under the new business model) or the buyers designated by the Customer |

Decrease sales and market risks as the new business model Customers have been locked with the sales so Armco shares the risks with customers under new business model |

|

Nature of Profit |

Difference between the cost and sale price |

Processing fee charged on customers |

Decrease the market price risk and lower the volatility of revenue and profit |

|

Price risk |

High, subject to market |

Low |

Lower vulnerability to market price change |

|

Working capital needs in transaction |

Armco need use its own cash in the transaction before receiving payment after sales |

Armco use little its own cash in the transaction |

No additional or little working capital requirement while increasing revenue and profit |

|

transaction cycle |

longer |

shorter |

Decrease transaction cycle and improve asset turnover and efficiency |

By this unique sales and operation model, we work with our customers more closely, lower our market risks by sharing them with our customers, increase our sales with less or without additional working capital, and improve the efficiency and utilization of our facility and equipment by reducing the operating cost of idle facility.

Sales and Marketing

We operate our sales network through our offices in China and we supervise certain import and export activities in our office in San Mateo, California. As of March 2014, our sales and marketing team included approximately eight employees. Our sales teams are responsible for coordinating with our PRC customers, and our U.S. staff focuses on both overseas and PRC customers. Members of our sales team contact our customers to negotiate sales orders and prices and provide after-sales services, including delivery logistics and handling questions and feedback on our products. The sales team members in China and the United States also visit customers to provide administrative and logistical support where necessary.

Competition

Each of our businesses operates in highly competitive environments.

The principal competitive factors in our ore trading and distribution business are price, product availability, quantity, service, and financing terms for purchases and sales of ore. The scrap metal recycling business is subject to cyclical fluctuations based upon the availability and price of unprocessed scrap metal and demand for steel and non-ferrous metals. The scrap metal recycling industry in China is highly fragmented and competitive, and we compete with numerous other companies for both raw materials and sales of recycled scrap metal. We compete with large steel manufacturers that have vertically integrated their operations and have their own scrap steel processing and production lines, and who have substantially greater financial, marketing and other resources. We also compete with a number of specialized scrap steel companies that have emerged in recent years. Competition for raw materials is primarily based on price and proximity to the source of raw materials. Competition for sales of recycled scrap metal is primarily based on price and quality of the recycled scrap metal, the level of service in terms of capacity, reliability and timely delivery, proximity to customers and the availability of scrap metal and scrap metal substitutes.

We compete primarily with local metal recycling companies and new entrants to the market, some of which may have a lower cost structure than ours due to lower capital expenditures or lower labor costs resulting from being located in other regions of China. The barriers to entry in the metal recycling industry are relatively low. However, many of these local metal recycling companies have small production capacity and relatively low efficiency. We also compete with large metal recycling companies and may face competition from other sources as well, such as foreign metal recycling companies and metal manufacturers seeking to vertically integrate their operations. Many of our competitors may have greater financial and other resources than we do. Finally, we also face competition from companies in China that import recycled scrap metal from overseas markets such as the United States, Australia and Europe. Further appreciation of the Renminbi, which may have the effect of lowering the cost of imported recycled scrap metal, may intensify such competition.

In the 12th Five Year Plan, China is aiming to increase the share of top ten steel manufacturers with intention to achieve an economy of scale, energy-efficiency and better bargaining power with raw material suppliers. A consolidated steel industry is also expected to have a positive effect on global steel markets as greater competitiveness and therefore production discipline will gradually solve the problem of overcapacity. We are facing challenges as well as opportunities. We expect to benefit from a better regulated and healthier market and achieve more market shares when malignant competition and small unfair players gradually phase out from the industry.

While we believe that our operations and use of advanced equipment will allow us to compete effectively, we cannot assure you that we will be able to successfully compete in our existing markets.

Government Regulation

Despite efforts to develop the legal system over the past several decades, including but not limited to legislation dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade, China continues to lack a comprehensive system of laws. Further, the laws that do exist in China are often vague, ambiguous and difficult to enforce, which could have a material adverse effect on our business, financial condition and results of operations.

In September 2006, the Ministry of Commerce, or MOFCOM, promulgated the Regulations on Foreign Investors’ Mergers and Acquisitions of Domestic Enterprises (M&A Regulations) in an effort to better regulate foreign investment in China. The M&A Regulations were adopted in part as a needed codification of certain joint venture formation and operating practices, and also in response to the government's increasing concern about protecting domestic companies in perceived key industries and those associated with national security, as well as the outflow of well-known trademarks, including traditional Chinese brands.

Effective in September 2009, China simplified the procedures for the import of scrap by removing the licensing requirements from Ministry of Commerce.

As a U.S. based company doing business in China and Hong Kong, we seek to comply with all Chinese laws, rules and regulations and pronouncements, and endeavor to obtain all necessary approvals from applicable Chinese regulatory agencies such as the MOFCOM, the State Assets Supervision and Administration Commission, or SASAC, the State Administration for Taxation, the State Administration for Industry and Commerce, China Securities Regulatory Commission, or CSRC, the State Administration of Foreign Exchange, or SAFE, and all applicable laws of Hong Kong.

Economic Reform Issues. Since 1979, the Chinese government has reformed its economic systems. Many reforms are unprecedented or experimental; therefore they are expected to be refined and improved. Other political, economic and social factors, such as political changes, changes in the rates of economic growth, unemployment, inflation, or the disparities in per capita wealth between regions within China, could lead to further readjustment of the reform measures. We cannot predict if this refining and readjustment process may have a material adverse effect on our business, financial condition and results of operations, particularly in relation to future policies including but not limited to foreign investment, taxation, inflation and trade.

Currency. The value of the Renminbi, or RMB, the main currency used in China, fluctuates and is affected by, among other things, changes in China’s political and economic conditions. The conversion of RMB into foreign currencies such as the U.S. dollar have been generally based on rates set by the People’s Bank of China, which are set daily based on the previous day’s interbank foreign exchange market rates and current exchange rates on the world financial markets.

Environment. We are currently subject to numerous Chinese provincial and local laws and regulations relating to the protection of the environment that are highly relevant to our metal ore business and the recycling facility. These laws continue to evolve and are becoming increasingly stringent. The ultimate impact of complying with such laws and regulations is not always clearly known or determinable because regulations under some of these laws have not yet been promulgated or are undergoing revision. In 2012 and 2013 we did not spend any funds related to compliance with environmental regulations.

According to Chinese environmental laws and regulations, we are required to adopt effective measures to prevent and control pollution to the environment during the course of our operations. We were required to carry out an environmental impact assessment before commencing construction of the recycling facility, and to install equipment to reduce pollution in accordance with relevant environmental standards. The scrap metal recycling process involves sorting, cutting, shredding, shearing, stripping and baling. The principal environmental impact is the discharge of dust and sound generated in the physical or mechanical breaking process. Substantially all materials output from the recycling process are sold, including the non-metal components. The principal solid waste produced during the recycling process is dust, which is collected by a dust filtering sub-system of the shredder and disposed of through the urban department of the local government. We have also installed water drainage and filtering systems in the recycling facility for the waste minimization control for our operations and to process rainwater passing through the stored scrap metal.

Scrap metal recycling companies in China are subject to laws and regulations governing various aspects of their operations, including the import of solid waste and the handling of waste vehicles and disused vessels. Under China’s Law on Prevention and Control of Environmental Pollution by Solid Waste and related regulations, waste materials are classified into various categories that have differing restrictions and licensing requirements for import. Scrap iron, steel and copper in fragments generally fall within the automatic category of solid waste usable as raw materials and are eligible for import under the automatic licensing administration. Scrap wires, appliances and electrical equipment, which are imported for the purpose of recycling iron, steel and copper in such wires, appliances and equipment, fall within the restrictive category of solid waste usable as raw materials and are eligible for import under the restricted licensing administration.

The disposal and recycling of waste vehicles and disused vessels are strictly regulated in China, and only companies that have been authorized by the economic and trade commission of the local government in China are permitted to recycle waste vehicles, and only companies that have been authorized by the local environmental protection authority or port supervision authority in China may recycle disused vessels. We have on occasion acquired waste vehicle scraps but these scraps had been crushed and stripped of their engines, airbags and other components that contain potentially hazardous materials. As a result, these waste vehicle scraps were not deemed to be waste vehicles for purposes of Chinese regulations. To date, our principal source of raw materials has been scrap metal from household appliances and the construction and manufacturing industries, not vehicles or vessels. Our raw materials may at times include pieces of scrap metal that were originally part of vehicles or vessels. Our policy is to purchase raw materials from suppliers that are properly authorized and admitted by the relevant government authority.

We believe we have obtained all material approvals, permits, licenses and certificates required for our operations, including registrations from the local police department authorizing the purchase of raw materials and an approval from the local environmental protection authorities indicating that the recycling facility has passed an environmental protection assessment. We are not required to obtain licenses or approvals for scrap metal sourced from suppliers within China.

Governmental Policy

PRC’s 12th Five Year Plan (2011-2015) implemented beginning January 1, 2011 includes as one of its stated objectives the increase use of recycled steel to save energy and reduce emission. For the steel industry, the 12th Five Year Plan's goal is to increase consumption of scrap metal by producers from 15% in 2010 to 20% in 2015. In addition, according to such Five Year Plan, China will likely to force out low-end steel manufacturers, by way of shutting down their businesses or initiating merger with other manufacturers. The low-end steel manufacturers are believed to have contributed to declining industry profit margins and undermining the government’s goal of more orderly industry development.

The Market Access Conditions for Scrap Iron and Steel Processing Industry, or the Market Access Conditions, are formulated and promulgated for implementation on September 28, 2012, with the purpose of promoting the comprehensive utilization of scrap iron and steel resources, regulating and advancing the healthy development of the scrap iron and steel processing industry, guiding the effective and reasonable utilization of the scrap iron and steel resources, facilitating the energy conservation and emission reduction in the iron and steel industry. The Market Access Conditions, including, among other things, updated enterprise layout and construction requirements, scale, technology and equipment requirements, standard for product quality, energy consumption and comprehensive utilization of resources, shall prevail for all departments concerned, autonomous regions and municipalities directly under the Central Government when approving (recording) and managing the investment, conducting management on land and resources, environmental impact assessment, credit financing and safety supervision etc. in relation to the processing and construction projects of the scrap iron and steel.

Employees

As of March 31, 2014, we had 58 full time employees, including 55 in China and three full time employees in the United States. We believe we have good working relationships with our employees. We are currently not a party to any collective bargaining agreements.

For our employees in China, we are required to contribute a portion of their total salaries to the Chinese government’s social insurance funds, including medical insurance, unemployment insurance and job injuries insurance, as well as a housing assistance fund, in accordance with relevant regulations. We expect the amount of our contribution to the government’s social insurance funds to increase in the future as we expand our workforce and operations.

Our Corporate History

We were formerly known as Cox Distributing, Inc., which was founded as an unincorporated business in January 1984 and became a “C” corporation in the State of Nevada on April 6, 2007. Cox Distributing, Inc. was founded by Stephen E. Cox, our former president and chief executive officer, and engaged in the distribution of organic fertilizer products used to improve soil and growing conditions for the potato farmers of eastern Idaho. Prior to June 27, 2008, Mr. Cox was our only employee.

On June 27, 2008, we entered into a share purchase agreement with Armco HK, and Feng Gao, the sole stockholder of Armco HK. In connection with the acquisition, we purchased from Ms. Gao 100% of the issued and outstanding shares of Armco HK’s capital stock for $6,890,000 by delivery of our purchase money promissory note. In addition, we issued to Ms. Gao a stock option entitling Ms. Gao to purchase a total of 5,300,000 shares of our common stock exercisable at $1.30 per share which expired on September 30, 2008 and 2,000,000 shares exercisable at $5.00 per share which expired on June 30, 2010. On August 12, 2008, Ms. Gao exercised her option to purchase and we issued 5,300,000 shares of our common stock in exchange for our $6,890,000 note held by Ms. Gao. Prior to the acquisition, there were 10,000,000 shares of our common stock issued and outstanding. In connection with the acquisition, 7,694,000 shares of common stock held by Mr. Cox were cancelled, leaving 2,306,000 shares of common stock issued and outstanding. The 5,300,000 shares issued to Ms. Gao represented approximately 69.7% of our then issued and outstanding common stock giving effect to the cancellation of 7,694,000 shares of our common stock owned by Mr. Cox. No additional common stock was issued to Mr. Cox in connection with the acquisition. After the cancellation of 7,694,000 shares of common stock, Mr. Cox held 6,200 shares. These shares were exchanged on December 30, 2008 for all of the assets and liabilities of our fertilizer business, after which time we no longer operated the fertilizer business and Mr. Cox was no longer a stockholder.

On June 27, 2008, we amended our articles of incorporation to change our name to China Armco Metals, Inc. to better identify our company with the business conducted, through its wholly owned subsidiaries in China, import, export and distribution of ferrous and non-ferrous ores and metals, and processing and distribution of scrap steel.

On January 9, 2007, Armco HK formed Renewable Metals, a WOFE, subsidiary in the City of Lianyungang, Jiangsu Province, PRC. Renewable Metals engages in the processing and distribution of scrap metal. On December 28, 2007, Armco HK entered into a share transfer agreement with Renewable Metals, whereby Armco HK transferred to Renewable Metals all of its equity interest in Henan Armco, a company incorporated on June 6, 2002 in the City of Zhengzhou, Henan Province, PRC and under common control of Armco HK. Henan Armco engages in the import, export and distribution of ferrous and non-ferrous ores and metals. On December 1, 2008, Armco HK transferred its 100% equity interest in Renewable Metals to our company.

On June 4, 2009, we formed Lianyungang Armco, a WOFE subsidiary in the City of Lianyungang, Jiangsu Province, PRC. Lianyungang Armco intends to engage in marketing and distribution of the recycled scrap steel. Lianyungang Armco currently has no material business operations.

On July 16, 2010, we formed a new subsidiary named Armco Shanghai. Armco Shanghai serves as our China operations headquarters and oversees the activities of the company regarding financing and international trading.

On July 3, 2013, we filed a certificate of amendment to articles of incorporation to change our corporate name to Armco Metals Holdings, Inc.

ITEM 1.A RISK FACTORS.

Our business, operations and financial condition are subject to various significant risks. These risks are described below and you should take these risks into account in making a decision to invest in our common stock. If any of the following risks actually occurs, we may not be able to conduct our business as currently planned and our financial condition and operating results could be seriously harmed. In that case, the market price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

We have a history of losses, and we cannot guarantee that we will not incur continued losses for the foreseeable future.

We reported net losses of approximately $4.1 million and $2.6 million in 2013 and 2012, respectively. For 2013, we had net cash used in operating activities of approximately $9.5 million. Although we achieved positive gross profits from our operations for 2013, we cannot guarantee that we will become profitable in the future. Our ability to achieve profitability is based on numerous factors, many of which are out of our control, including but not limited to, cost of our raw materials, demand of our products, inability to maintain our bank facilities as result of deterioration of financial market environment, significant increase in interest expenses due to financial market turmoil, additional new costs or expenses occurred in our operation attribute to new government regulation.

We will need additional financing to fund our operations and working capital and the potential expansion of the recycling facility. Additional capital raising efforts in future periods is likely to be dilutive to our then current stockholders or result in increased interest expense in future periods.

We will need to raise additional capital to fund our operations and working capital. Moreover, if we decide to expand the capacity of our recycling facility, we will also need additional capital to fund that expansion. Our future capital requirements depend on a number of factors. These factors include, but are not limited to, the scope of our expansion efforts and the amount of available metal ore, our ability to manage growth and expansion and our ability to control expenses. In the event we seek to raise additional capital through the issuance of debt or its equivalents, this will result in increased interest expense. If we raise additional capital through the issuance of equity or convertible debt securities, the percentage ownership of our company held by existing stockholders will be reduced and those stockholders may experience significant dilution. As we will generally not be required to obtain the consent of our stockholders if we elect to expand the recycling facility or to purchase more raw materials required in our operations, stockholders are dependent upon the sole discretion and judgment of our management in determining the number of, and characteristics of, stock issued to raise funds for these purposes and others. In addition, new securities may contain certain rights, preferences or privileges that are senior to those of our common stock. We cannot assure you that we will be able to raise the working capital as needed in the future on terms acceptable to us, if at all. Any inability to raise capital as needed would have a material adverse effect on our business, financial condition and results of operations.

We operate in a business that is cyclical and where demand can be volatile, which could have a material adverse effect on our business, financial condition or results of operations.

We operate in a business that is cyclical and where demand can be volatile, which could have a material adverse effect on our results of operations and financial condition. The timing and magnitude of the cycles in the business in which we operate are difficult to predict. Purchase prices for the raw materials we purchase (metal ore and scrap metal), and selling prices for our products (metal ore, scrap and recycled metal) are volatile and beyond our control. While we attempt to respond to changing raw material costs through adjustments to the sales price of our products, our ability to do so is limited by competitive and other market factors. Differences in economic conditions between the foreign markets, where we acquire our metal ore and a significant portion of our scrap metal, and the markets in China, where we sell our products, could have a material adverse effect on our business, financial condition and results of operations. A significant reduction in selling prices for our products may have a material adverse effect on our business, financial condition and results of operations, and adversely impact our ability to recover purchase costs from end customers. A decline in market prices for our products between the date of the sales order and shipment of the product may impact the customer’s ability to obtain letters of credit to cover the full sales amount. A decline in selling prices for our products coupled with customers failing to meet their contractual obligations may also result in a net realizable value adjustment to the average cost of inventory to reflect the lower of cost or fair market value. Additionally, changing prices could potentially impact the volume of raw materials available to us, the volume of ore and processed metal sold by us and inventory levels. The cyclical nature of our businesses tends to reflect and be amplified by changes in general economic conditions, both domestically and internationally. For example, the automobile and construction industries typically experience cutbacks in production, resulting in decreased demand for steel, copper and aluminum. This can lead to significant decreases in demand and pricing for our metal ore and recycled metal. Specifically, in 2013 an approximately $3.0 million of loss, including an inventory write-off $2.3 million and a loss of $0.65 million in scrap metal sales, was resulted from the weakening demand and price for scrap metal and overcapacity in the market described elsewhere in this report.

Our business depends on adequate supply and availability of metal ore and scrap metal.

Our business requires metal ore and scrap metal that are sourced from third-party suppliers. We are affected by industry supply conditions, which generally involve risks beyond our control, including costs of these materials, transportation costs and market demand. As a result, we may not be able to obtain an adequate supply of quality metal ore or scrap metal in a timely or cost-effective manner. If an adequate supply of scrap metal is not available to us, we would be unable to recycle metals at desired volumes, which would have a material adverse effect on our business, financial condition and results of operations.

Our business depends on adequate supply and availability of electricity, which has recently been curtailed by the PRC authorities.

We rely on electricity to operate equipment at the recycling facility. Our steel mill and other customers are also dependent on electricity to convert our recycled scrap metal into steel and other products. Accordingly, the successful operation of our business and the recycling facility requires a reliable supply of electricity. China’s electricity industry has historically experienced shortages and price volatility as a result of a variety of factors, including surging demand as a result of rapid growth in China and disruptions in the supply of coal used to produce electricity. In addition, the PRC authorities mandated a significant reduction of energy usage and instituted “rolling brownouts” during the third and fourth quarters of 2010 in an effort to meet targets for energy consumption and emissions set by the 11th Five Year Plan (2006-2010). This policy adversely impacted our revenues in the end of third quarter and the entire fourth quarter of 2010 by reducing our ability to operate the recycling facility. The energy restrictions also negatively affected steel companies’ production thereby reducing the demand and prices for the metal ore we distributed and the processed scrap metal produced at the recycling facility. As a result, we experienced a decrease in revenues, which adversely impact our business, financial condition and results of operations for the third and fourth quarters of 2010. While the “rolling brownouts” restrictions has been eliminated with the implementation of China’s 12th Five Year Plan (2011-2015) on January 1, 2011, there can be no assurances that additional energy use restrictions will not be imposed in the future. Any continuation of these restrictions will have a material adverse effect on our business, financial condition and results of operations. We are also unable to predict whether other energy or environmental policies will be adopted by the PRC government that could adversely impact our operations in future periods.

Unexpected equipment failures may lead to production curtailments or shutdowns.

If we suffer interruptions in our production capabilities, such interruptions will adversely affect our production costs, steel available for sales and revenues for the affected period, and may have a material adverse effect on our business, financial condition and results of operations. In addition to equipment failures, the recycling facility is also subject to the risk of catastrophic loss due to unanticipated events such as acts of god (including earthquakes and floods), fires, explosions, terrorism, public health pandemics and labor disputes. Our recycling processes are highly dependent upon critical pieces of equipment, such as shredders and cutting machines, as well as electrical equipment. This equipment may, on occasion, be out of service as a result of unanticipated failures. We may in the future experience material shutdowns of the recycling facility or periods of reduced production as a result of such equipment failures. Our shredding machine is highly complex and requires experienced and knowledgeable personnel to efficiently operate and maintain. Because we are in the early stages of operating this machine, we have experienced delays and inefficiencies due to our lack of operational experience with the machine.

The recycling facility is not currently operating at full production capability.

We have carried the operations at the recycling facility for about three years and we are currently still operating at significantly less than full production capacity. Our ability to achieve full production capacity is dependent upon, among other items, our ability to attract sufficient customers to purchase the scrap metal that we recycle and our ability to obtain raw materials at favorable prices to support our production. There can be no assurance that we will achieve full production capability at the recycling facility in the future.

The scrap metal recycling markets in which we operate are highly competitive. Competitive pressures from existing and new companies could have a material adverse effect on our business, financial condition and results of operations.

The markets for scrap metal are highly competitive, both in the purchase of raw scrap and the sale of processed scrap. We compete to purchase raw scrap with numerous independent recyclers, large public scrap processors and smaller scrap companies. Successful procurement of materials is determined primarily by the price and promptness of payment for the raw scrap and the proximity of the recycling facility to the source of the unprocessed scrap. We occasionally face competition for purchases of unprocessed scrap from producers of steel products, such as integrated steel mills and mini-mills, which have vertically integrated their operations by entering the scrap metal recycling business. Many of these producers have substantially greater financial, marketing and other resources. Our operating costs could increase as a result of competition with these other companies for raw scrap.

We compete in a global market with regard to the sale of processed scrap. Competition for sales of processed scrap is based primarily on the price, quantity and quality of the scrap metals, as well as the level of service provided in terms of consistency of quality, reliability and timing of delivery. To the extent that one or more of our competitors becomes more successful with respect to any key factor, our ability to attract and retain consumers could be materially and adversely affected. Our scrap metal processing operations also face competition from substitutes for prepared ferrous scrap, such as pre-reduced iron pellets, hot briquetted iron, pig iron, iron carbide and other forms of processed iron. The availability of substitutes for ferrous scrap could result in a decreased demand for processed ferrous scrap, which could result in lower prices for such products.

Unanticipated disruptions in our scrap metal recycling operations or slowdowns by our shipping companies could adversely affect our ability to deliver our products, which could have a material adverse effect on our business, financial condition and results of operation, and our relationship with our consumers.

Our ability to process and fulfill orders and manage inventory depends on the efficient and uninterrupted operation of the recycling facility. In addition, our products are usually transported to consumers by third-party truck, rail carriers and vessel services. As a result, we rely on the timely and uninterrupted performance of these third party shipping companies. Due to factors beyond our control, including changes in fuel prices, political events, governmental regulation of transportation, changes in market rates, carrier availability and disruptions in transportation infrastructure, we may be forced to increase our charges for transportation services. Consequently, we may not be able to transport our products in a timely and cost-effective manner. Any interruption in our operations or interruption or delay in transportation services could cause orders to be canceled, lost or delivered late, goods to be returned or receipt of goods to be refused. As a result, any disruption could negatively impact our relationships with our customers and have a material adverse effect on our business, financial condition and results of operations.

If we were to lose order volumes from any of our major customers, our sales would decline significantly and our cash flows would be reduced, which could have a material adverse effect on our business, results of operations and financial condition.

In 2013, our largest customers purchased products from us on a spot or short term contract basis and in the future may choose not to continue to purchase our products. A loss of order volumes from any major customer, or a significant reduction in their purchase orders could have a material adverse effect on our business, financial condition and results of operations. In addition, if we experience such a loss of order volumes or significant reduction in purchase orders, we would likely be required to increase borrowings under our credit facilities to meet our cash flow needs.

During uncertain economic conditions, customers may be unable to fulfill their contractual obligations.

We enter into sales contracts preceded by negotiations that include fixing price, quantities, shipping terms and other contractual elements. Upon finalization of these terms and satisfactory completion of other contractual contingencies by us, our customers typically open a letter of credit to satisfy their obligation under the contract prior to shipment by us. In many instances, and particularly during uncertain economic conditions, we are at risk on consummating the transaction until our customers successfully obtain the letter of credit. As a result, the customer may not be able to fulfill its obligation under the contract in times of illiquid market conditions. Moreover, as described elsewhere in this report, suppliers and customers in China often breach contracts and there may be inadequate recourse for us to enforce such agreements. In 2013, We signed a long-term contract with CNBM but the customer was not able to perform the contract during December of 2013 and the first quarter of 2014 due to the deteriorate market condition and strict public finance and monetary policy in China. It is not clear if CNBM is able to perform the remaining contract while the contract has not been terminated. CNBM usually resells the steel scrap purchased from Armco to Chinese steel mills. When market price of scrap metals declined sharply due to the deteriorate market condition, CNBM could not perform the contract when two parties could not reach an agreement on the price as both parties would suffer losses at the sharply declining market prices. Meanwhile, CNBM's customers, most of which are Chinese steel mills, were not able to obtain sufficient funding from China financial institutions to make prompt payment to or make new orders with CNBM due to strict public finance and monetary policy in China. Consequently, CNBM was not able to make prepayment to Armco nor perform the contract. There are no assurances CNBM will ever perform under this long-term contract.

If our customers do not comply with their existing commercial contracts and commitments, it could have a material adverse effect on our business, financial condition and results of operations.

Most consumers of the metals products we sell have been adversely impacted by the global recession and related economic downturn. Many of our customers have experienced reductions in their operations. Prices for many of the metals products we sell have declined, in some instances substantially. These factors have contributed to attempts by some of our customers to seek renegotiation or cancellation of their existing purchase commitments. In addition, some of our customers have breached previously agreed upon contracts to buy our products by refusing delivery of the products. Where appropriate, we will in the future pursue litigation to recover our damages resulting from customer contract defaults, although the success of any such litigation and our ultimate ability to recover for contractual breaches is uncertain. If a large number of our customers were to default on their existing contractual obligations to purchase our products, it would have a material adverse effect on our business, financial condition and results of operations.

We depend on our key management personnel and the loss of their services could adversely affect our business.

Our future performance depends substantially on the services of our senior management and other key personnel, as well as our ability to retain and motivate them. The loss of the services of any of our executive officers, including Mr. Kexuan Yao, our Chairman, President and Chief Executive Officer, or other key employees could have a material adverse effect on our business, results of operations and financial condition. Although we entered into a three-year employment agreement with Kexuan Yao, our Chairmen of the Board, President, and Chief Executive Officer and pursuant to such employment agreement we will purchase on the life of Kexuan Yao up to $50 million of key man life insurance with our company as the beneficiary of the death benefit, we cannot guarantee that these measures will sufficiently secure Kexuan Yao’s services with us or remedy the loss of the services of Kexuan Yao if that occurs. Our business also depends on attracting and retaining key personnel. Our future success also will depend on our ability to attract, train, retain and motivate highly skilled technical, managerial, sales, and customer support personnel. Competition for these personnel is intense, and we may be unable to successfully attract, integrate, or retain sufficiently qualified personnel.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.