Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMEDISYS INC | d774724d8k.htm |

Amedisys

Investor Presentation August 2014

Exhibit 99.1 |

2

Forward-looking Statements

This

presentation

may

include

forward-looking

statements

as

defined

by

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-looking

statements

are

based

upon

current

expectations

and

assumptions

about

our

business

that

are

subject

to

a

variety

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

described

in

this

presentation.

You

should

not

rely

on

forward-looking

statements

as

a

prediction

of

future

events.

Additional

information

regarding

factors

that

could

cause

actual

results

to

differ

materially

from

those

discussed

in

any

forward-looking

statements

are

described

in

reports

and

registration

statements

we

file

with

the

SEC,

including

our

Annual

Report

on

Form

10-K

and

subsequent

Quarterly

Reports

on

Form

10-Q

and

Current

Reports

on

Form

8-K,

copies

of

which

are

available

on

the

Amedisys

internet

website

http://www.amedisys.com

or

by

contacting

the

Amedisys

Investor

Relations

department

at

(225)

292-2031.

We

disclaim

any

obligation

to

update

any

forward-looking

statements

or

any

changes

in

events,

conditions

or

circumstances

upon

which

any

forward-looking

statement

may

be

based

except

as

required

by

law.

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we have

posted additional important

information such as press releases,

profiles concerning our business and

clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-critical

information regarding the Company in

advance of or in lieu of distributing a

press release or a filing with the SEC

disclosing the same information. |

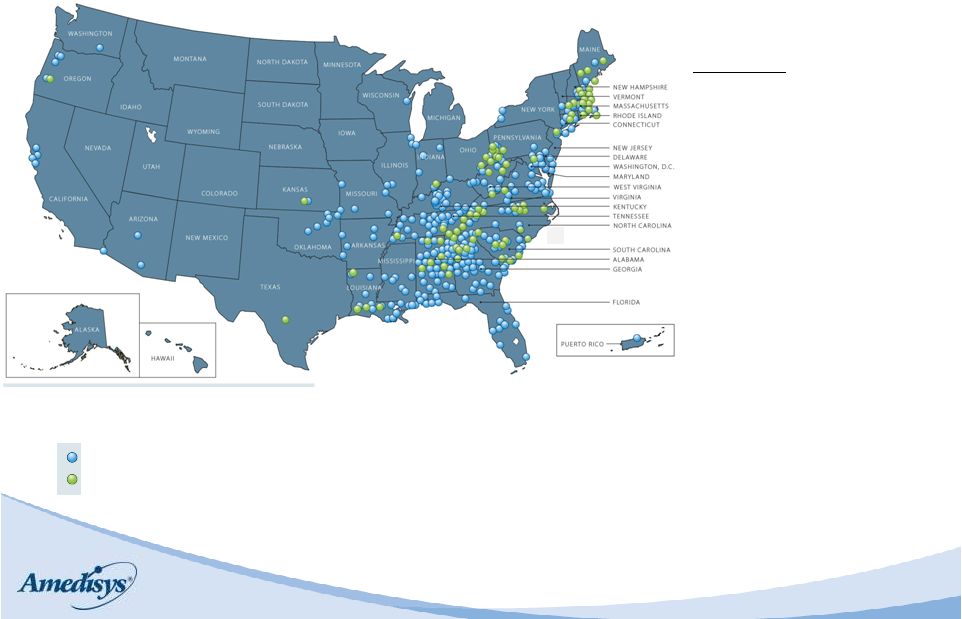

3

Amedisys Snapshot

Overview

•

Founded

in

1982,

publicly

listed

1994

•

396

care

centers

in

33

states

•

Over

13,000

employees

•

Over

55,000

patients

currently

on

census

•

2013

revenue

of

$1.25

billion

Amedisys Home Health Care Centers (316 locations)

Amedisys Hospice Care Centers (80 locations) |

4

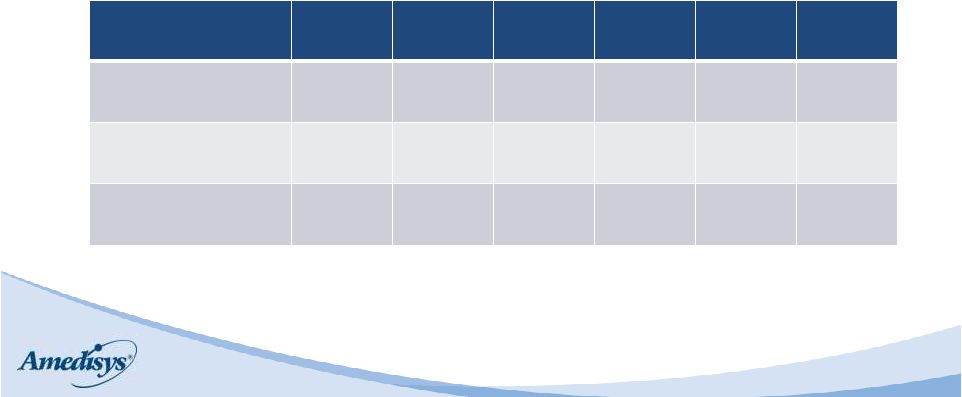

Business Overview

Business

$ (in millions) /

% of Revenue

Revenue per

Visit / Revenue

per Day

Gross Margin %

Reimbursement Type

Home Health

Medicare

$192 / 63%

$156

45.6%

60-day episode of care

Non-Medicare Episodic

$21 / 7%

$159

46.6%

60-day episode of care

Non-Medicare Per Visit

$31 / 10%

$111

23.2%

Per visit

Total Home Health

$244 / 80%

Hospice

$61 / 20%

$145

46.2%

99% routine care; daily rate

Total

$305 / 100%

Based on 2Q14 financials. Gross margin computed by subtracting cost per visit from

revenue per visit in home health and cost per day from hospice revenue per day

|

5

Favorable Long Term Trends

•

Compelling demographics

•

Patient preference

•

Increased payer and hospital focus

•

Low cost of care delivery

Inpatient

Hospital

LTAC

IRF

SNF

Hospice

Home

Health

Average cost of stay

$12,000

$39,493

$17,995

$10,392

$11,852

$5,294

Average length of stay

5 days

26 days

13 days

27 days

88 days

120 days

Average per diem cost

$2,448

$1,507

$1,395

$399

$135

$44

Source: MedPAC March 2014 report and Amedisys estimates; hospital information is

for inpatient facilities only and is estimated based on patient

discharges |

6

Summary Financials –

Quarterly

($ in millions, except per share data)

2Q13

(1)

1Q14

(2)

2Q14

(1)

Net Revenue

$316

$299

$305

Adj. Gross Margin %

43.7%

41.0%

43.4%

Adjusted G&A Expenses

(3)

114

113

106

Adjusted EBITDA

$20

$5

$22

Adjusted EBITDA Margin

6.2%

1.8%

7.3%

Adjusted EPS

$0.18

($0.07)

$0.25

1.

The financial results for the three-month periods ended June 30, 2013 and

June 30, 2014 are adjusted for certain items and should be considered a non-

GAAP financial measure. A reconciliation of this non-GAAP financial

measure is included as Exhibit 99.1 to our Form 8-K filed with the Securities and

Exchange Commission on July 30, 2014

2.

The financial results for the three-month period ended March 31, 2014 are

adjusted for certain items and should be considered a non-GAAP financial

measure. A reconciliation of this non-GAAP financial measure is

included as Exhibit 99.1 to our Form 8-K filed with the Securities and Exchange

Commission on May 8, 2014

3.

Adjusted G&A expenses do not include bad debt, depreciation or amortization

expenses |

7

($ in millions)

2Q13

(1)

1Q14

(2)

2Q14

(1)

Net Revenue

$251

$237

$244

Adj. Gross Margin %

42.8%

39.5%

42.8%

Key Operating Statistics

Medicare admissions

47,734

46,527

43,974

Revenue per episode

$2,831

$2,778

$2,845

Medicare recert rate

36.4%

38.2%

37.4%

Cost per visit

$84.09

$90.28

$85.08

Home Health Segment

1.

The financial results for the three-month periods ended June 30, 2013 and

June 30, 2014 are adjusted for certain items and should be considered a non-GAAP financial measure. A reconciliation of

this non-GAAP financial measure is included as Exhibit 99.1 to our Form 8-K

filed with the Securities and Exchange Commission on July 30, 2014 2.

The

financial

results

for

the

three-month

period

ended

March

31,

2014

are

adjusted

for

certain

items

and

should

be

considered

a

non-GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial measure is included as Exhibit 99.1 to our Form 8-K filed with the

Securities and Exchange Commission on May 8, 2014 •

Operating stats above include some contribution from closed/consolidated care

centers •

In

2Q14,

our

go-forward

home

health

portfolio

(316

care

centers)

exhibited

2.6%

year

over

year

growth

in

Medicare

admissions |

8

($ in millions)

2Q13

(1)

1Q14

(2)

2Q14

(1)

Net Revenue

$65

$62

$61

Adj. Gross Margin %

47.2%

46.8%

46.0%

Key Operating Statistics

Average daily census

5,006

4,721

4,649

Admissions

4,655

4,595

4,350

Revenue per day

$143.61

$145.95

$145.44

Cost per day

$75.34

$77.47

$78.24

Hospice Segment

1.

The

financial

results

for

the

three-month

periods

ended

June

30,

2013

and

June

30,

2014

are

adjusted

for

certain

items

and

should

be

considered

a

non-GAAP

financial

measure.

A

reconciliation

of

this non-GAAP financial measure is included as Exhibit 99.1 to our Form 8-K

filed with the Securities and Exchange Commission on July 30, 2014 2.

The

financial

results

for

the

three-month

period

ended

March

31,

2014

are

adjusted

for

certain

items

and

should

be

considered

a

non-GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial measure is included as Exhibit 99.1 to our Form 8-K filed with the

Securities and Exchange Commission on May 8, 2014 •

Operating stats above include some contribution from closed/consolidated care

centers •

In

2Q14,

our

go-forward

hospice

portfolio

(80

care

centers)

exhibited

a

1.9%

decline

in

average

daily

census |

9

Credit Facilities

•

In late July, Amedisys amended its existing senior credit facility and announced a

new $70 million 2

nd

lien term loan

•

The senior facility’s revolving credit line was reduced by $45 million to $120

million total

•

$39 million outstanding senior term loan remains unchanged

•

The 2

nd

lien term loan has a term of six years with no amortization and

is priced

at L + 750 basis points with a 1% LIBOR floor (8.5% all-in)

•

OID of 2.5% and minimal call protection of 102 in the first year

and 101 in

the second year

•

Amended credit facilities provide adequate liquidity as we approach the final DOJ

payment of $35 million

•

Strong free cash flow in the second quarter has helped to further strengthen

our balance sheet

•

As we move forward and de-lever the company, the facilities also provide

increased flexibility around uses of capital |

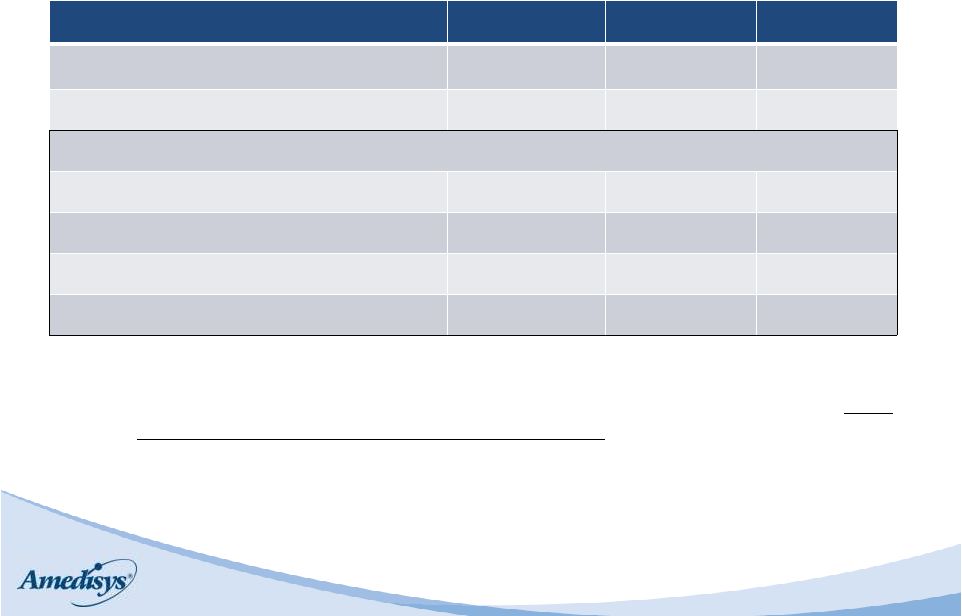

10

Summary Balance Sheet

Assets ($ in MM)

12/31/13

6/30/14

Cash

$17

$11

Accounts Receivable, net

111

111

Property and Equipment

159

148

Goodwill

209

206

Other

230

234

Total Assets

726

710

Liabilities and Equity

Other Liabilities

$157

$160

Senior Debt

47

144

2

nd

Lien Term Loan

--

--

DOJ Settlement Reserve

150

35

Equity

372

371

Total Liabilities and Equity

726

710

Leverage Ratio

2.9x

2.7x

Days Sales Outstanding

32

32 |

11

Amedisys Turnaround –

2Q14 Progress

Continuing to deliver clinical excellence

•

Primary focus is improving or maintaining clinical outcomes

Driving consistent organic growth

•

Seeing positive volume trends from home health operations

•

Hospice volume lagging

Getting “back to basics”

on core operations

•

Progress in home health direct cost management

•

Continue to look for efficiencies in terms of direct costs and G&A

|

12

Contact Information

Dale Redman

Interim Chief Financial Officer

dale.redman@amedisys.com

David Castille

Director, Treasury/Finance

david.castille@amedisys.com

Amedisys, Inc.

5959 S. Sherwood Forest Blvd.

Baton Rouge, LA 70816

Office: 225.292.2031 |