Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - FBR & Co. | Financial_Report.xls |

| EX-32.02 - EX-32.02 - FBR & Co. | d760148dex3202.htm |

| EX-31.01 - EX-31.01 - FBR & Co. | d760148dex3101.htm |

| EX-31.02 - EX-31.02 - FBR & Co. | d760148dex3102.htm |

| EX-32.01 - EX-32.01 - FBR & Co. | d760148dex3201.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-33518

FBR & CO.

(Exact name of Registrant as specified in its charter)

| Virginia | 20-5164223 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1001 Nineteenth Street North Arlington, VA |

22209 | |

| (Address of principal executive offices) | (Zip code) | |

(703) 312-9500

(Registrant’s telephone number including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ¨ No x

The number of shares outstanding of the registrant’s common stock, $0.001 par value per share, as of July 31, 2014 was 10,094,888 shares.

Table of Contents

FORM 10-Q

FOR THE QUARTER ENDED JUNE 30, 2014

INDEX

| Page | ||||||

| PART I—FINANCIAL INFORMATION |

||||||

| Item 1. |

Financial Statements | |||||

| Consolidated Financial Statements and Notes—(unaudited) | ||||||

| Consolidated Balance Sheets—June 30, 2014 and December 31, 2013 | 1 | |||||

| Consolidated Statements of Operations—Three and Six Months Ended June 30, 2014 and 2013 | 2 | |||||

| Consolidated Statements of Comprehensive Income—Three and Six Months Ended June 30, 2014 and 2013 |

3 | |||||

| 4 | ||||||

| Consolidated Statements of Cash Flows—Six Months Ended June 30, 2014 and 2013 | 5 | |||||

| Notes to Consolidated Financial Statements | 6 | |||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 | ||||

| Item 3. |

Quantitative and Qualitative Disclosures about Market Risk | 40 | ||||

| Item 4. |

Controls and Procedures | 44 | ||||

| PART II—OTHER INFORMATION |

||||||

| Item 1. |

Legal Proceedings | 46 | ||||

| Item 1A. |

Risk Factors | 47 | ||||

| Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds | 47 | ||||

| Item 4. |

Mine Safety Disclosures | 47 | ||||

| Item 6. |

Exhibits | 48 | ||||

| Signature | 49 | |||||

Table of Contents

PART I

FINANCIAL INFORMATION

| Item 1. | Financial Statements |

FBR & CO.

(Dollars in thousands, except per share data)

(Unaudited)

| June 30, 2014 |

December 31, 2013 |

|||||||

| Assets |

||||||||

| Cash and cash equivalents |

$ | 176,905 | $ | 207,973 | ||||

| Receivables: |

||||||||

| Due from brokers, dealers and clearing organizations |

330,386 | 4,949 | ||||||

| Customers |

4,194 | 4,485 | ||||||

| Other |

1,285 | 658 | ||||||

| Financial instruments owned, at fair value |

190,479 | 144,743 | ||||||

| Other investments, at cost |

2,428 | 7,681 | ||||||

| Furniture, equipment, software and leasehold improvements, net of accumulated depreciation and amortization |

5,827 | 3,286 | ||||||

| Deferred tax assets, net of valuation allowance |

27,356 | 30,893 | ||||||

| Prepaid expenses and other assets |

7,261 | 5,904 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 746,121 | $ | 410,572 | ||||

|

|

|

|

|

|||||

| Liabilities and Shareholders’ Equity |

||||||||

| Liabilities |

||||||||

| Securities sold but not yet purchased, at fair value |

$ | 361,275 | $ | 42,241 | ||||

| Accrued compensation and benefits |

49,534 | 58,502 | ||||||

| Accounts payable, accrued expenses and other liabilities |

17,868 | 10,351 | ||||||

| Due to brokers, dealers and clearing organizations |

19,507 | 8,701 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

448,184 | 119,795 | ||||||

|

|

|

|

|

|||||

| Commitments and Contingencies (Note 6) |

||||||||

| Shareholders’ Equity |

||||||||

| Preferred stock, $0.001 par value, 100,000,000 shares authorized, none issued and outstanding |

— | — | ||||||

| Common stock, $0.001 par value, 75,000,000 shares authorized, 10,087,159 and 10,545,509 shares issued and outstanding, respectively |

10 | 11 | ||||||

| Additional paid-in capital |

349,070 | 362,983 | ||||||

| Restricted stock units |

29,951 | 21,487 | ||||||

| Accumulated other comprehensive income, net of taxes |

58 | 34 | ||||||

| Accumulated deficit |

(81,152 | ) | (93,738 | ) | ||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

297,937 | 290,777 | ||||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | 746,121 | $ | 410,572 | ||||

|

|

|

|

|

|||||

See notes to consolidated financial statements.

1

Table of Contents

FBR & CO.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share data)

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Revenues: |

||||||||||||||||

| Investment banking: |

||||||||||||||||

| Capital raising |

$ | 35,312 | $ | 49,165 | $ | 68,628 | $ | 148,851 | ||||||||

| Advisory |

472 | 2,872 | 3,795 | 4,476 | ||||||||||||

| Institutional brokerage |

14,643 | 13,122 | 29,734 | 26,827 | ||||||||||||

| Net investment income |

9,091 | 1,209 | 12,925 | 3,307 | ||||||||||||

| Interest, dividends and other |

663 | 874 | 1,134 | 1,707 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenues |

60,181 | 67,242 | 116,216 | 185,168 | ||||||||||||

| Interest expense |

3,083 | — | 4,760 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Revenues, net of interest expense |

57,098 | 67,242 | 111,456 | 185,168 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Non-Interest Expenses: |

||||||||||||||||

| Compensation and benefits |

32,070 | 37,923 | 63,370 | 104,334 | ||||||||||||

| Professional services |

4,424 | 3,379 | 7,362 | 6,835 | ||||||||||||

| Business development |

3,057 | 2,610 | 5,425 | 4,743 | ||||||||||||

| Clearing and brokerage fees |

1,137 | 1,307 | 2,361 | 2,911 | ||||||||||||

| Occupancy and equipment |

3,003 | 3,068 | 6,155 | 6,350 | ||||||||||||

| Communications |

2,856 | 2,776 | 5,748 | 5,745 | ||||||||||||

| Other operating expenses |

1,576 | 1,547 | 3,045 | 3,711 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total non-interest expenses |

48,123 | 52,610 | 93,466 | 134,629 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations before income taxes |

8,975 | 14,632 | 17,990 | 50,539 | ||||||||||||

| Income tax provision (benefit) |

1,999 | (25,700 | ) | 5,404 | (24,241 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from continuing operations, net of taxes |

6,976 | 40,332 | 12,586 | 74,780 | ||||||||||||

| Income from discontinued operations, net of taxes |

— | 2,316 | — | 3,122 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 6,976 | $ | 42,648 | $ | 12,586 | $ | 77,902 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic income per share: |

||||||||||||||||

| Income from continuing operations, net of taxes |

$ | 0.65 | $ | 3.32 | $ | 1.15 | $ | 6.13 | ||||||||

| Income from discontinued operations, net of taxes |

— | 0.19 | — | 0.25 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic income per share |

$ | 0.65 | $ | 3.51 | $ | 1.15 | $ | 6.38 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted income per share: |

||||||||||||||||

| Income from continuing operations, net of taxes |

$ | 0.58 | $ | 3.06 | $ | 1.04 | $ | 5.71 | ||||||||

| Income from discontinued operations, net of taxes |

— | 0.17 | — | 0.24 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted income per share |

$ | 0.58 | $ | 3.23 | $ | 1.04 | $ | 5.95 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic weighted average shares outstanding (in thousands) |

10,795 | 12,166 | 10,927 | 12,201 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted weighted average shares outstanding (in thousands) |

11,965 | 13,216 | 12,050 | 13,102 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to consolidated financial statements.

2

Table of Contents

FBR & CO.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Dollars in thousands)

(Unaudited)

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net income |

$ | 6,976 | $ | 42,648 | $ | 12,586 | $ | 77,902 | ||||||||

| Other comprehensive income, net of tax: |

||||||||||||||||

| Change in unrealized gain on available-for-sale investment securities, net of taxes of $2, $102, $14, and $102, respectively |

5 | 1,359 | 24 | 1,241 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income |

$ | 6,981 | $ | 44,007 | $ | 12,610 | $ | 79,143 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to consolidated financial statements.

3

Table of Contents

FBR & CO.

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(Dollars and shares in thousands)

(Unaudited)

| Common Stock Shares |

Common Stock Amount |

Additional Paid-in Capital |

Employee Stock Loan Receivable |

Restricted Stock Units |

Accumulated Other Comprehensive Income (Loss) |

Accumulated Deficit |

Total | |||||||||||||||||||||||||

| Balances at December 31, 2012 |

12,224 | $ | 12 | $ | 402,668 | $ | (307 | ) | $ | 25,235 | $ | (1,094 | ) | $ | (186,650 | ) | $ | 239,864 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

— | — | — | — | — | — | 92,912 | 92,912 | ||||||||||||||||||||||||

| Issuance of common stock, net of forfeitures |

699 | 1 | 14,880 | 307 | (13,688 | ) | — | — | 1,500 | |||||||||||||||||||||||

| Repurchase of common stock |

(2,378 | ) | (2 | ) | (55,539 | ) | — | — | — | — | (55,541 | ) | ||||||||||||||||||||

| Stock compensation expense for options granted to purchase common stock |

— | — | 974 | — | — | — | — | 974 | ||||||||||||||||||||||||

| Issuance of restricted stock units |

— | — | — | — | 9,940 | — | — | 9,940 | ||||||||||||||||||||||||

| Other comprehensive income: |

||||||||||||||||||||||||||||||||

| Change in unrealized gain (loss) on available-for-sale investment securities, net of taxes |

— | — | — | — | — | 1,128 | — | 1,128 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balances at December 31, 2013 |

10,545 | $ | 11 | $ | 362,983 | $ | 0 | $ | 21,487 | $ | 34 | $ | (93,738 | ) | $ | 290,777 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Net income |

— | — | — | — | — | — | 12,586 | 12,586 | ||||||||||||||||||||||||

| Issuance of common stock, net of forfeitures |

204 | — | 3,312 | — | (3,162 | ) | — | — | 150 | |||||||||||||||||||||||

| Repurchase of common stock |

(662 | ) | (1 | ) | (17,328 | ) | — | — | — | — | (17,329 | ) | ||||||||||||||||||||

| Stock compensation expense for options granted to purchase common stock |

— | — | 103 | — | — | — | — | 103 | ||||||||||||||||||||||||

| Issuance of restricted stock units |

— | — | — | — | 11,626 | — | — | 11,626 | ||||||||||||||||||||||||

| Other comprehensive income: |

||||||||||||||||||||||||||||||||

| Change in unrealized gain (loss) on available-for-sale investment securities, net of taxes |

— | — | — | — | — | 24 | — | 24 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balances at June 30, 2014 |

10,087 | $ | 10 | $ | 349,070 | $ | 0 | $ | 29,951 | $ | 58 | $ | (81,152 | ) | $ | 297,937 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

See notes to consolidated financial statements.

4

Table of Contents

FBR & CO.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

| Six Months Ended June 30, |

||||||||

| 2014 | 2013 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 12,586 | $ | 77,902 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Deferred income taxes |

3,522 | (25,994 | ) | |||||

| Depreciation and amortization |

717 | 697 | ||||||

| Stock compensation |

4,546 | 4,046 | ||||||

| Net investment income from investments |

(12,925 | ) | (3,307 | ) | ||||

| Gain on sale of assets |

— | (3,430 | ) | |||||

| Other |

(13 | ) | 71 | |||||

| Changes in operating assets: |

||||||||

| Receivables: |

||||||||

| Brokers, dealers and clearing organizations |

(10,343 | ) | (20,961 | ) | ||||

| Customers |

135 | (3,568 | ) | |||||

| Other |

(240 | ) | (685 | ) | ||||

| Trading securities |

(19,744 | ) | 10,247 | |||||

| Prepaid expenses and other assets |

(1,357 | ) | 1,582 | |||||

| Changes in operating liabilities: |

||||||||

| Trading securities sold but not yet purchased |

21,725 | (16,887 | ) | |||||

| Accrued compensation and benefits |

(1,650 | ) | 45,851 | |||||

| Accounts payable, accrued expenses and other liabilities |

4,898 | (2,954 | ) | |||||

| Brokers, dealers and clearing organizations |

10,807 | 20,599 | ||||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

12,664 | 83,209 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of investments |

(41,507 | ) | (29,411 | ) | ||||

| Proceeds from sales of and distributions from investments |

26,610 | 8,653 | ||||||

| Securities sold but not yet purchased, net |

302,006 | — | ||||||

| Due from brokers, dealers and clearing organizations |

(311,816 | ) | — | |||||

| Purchases of furniture, equipment, software, and leasehold improvements |

(3,257 | ) | (154 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(27,964 | ) | (20,912 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Repurchases of common stock |

(17,329 | ) | (12,284 | ) | ||||

| Proceeds from sales of common stock and repayment of employee stock purchase plan |

1,561 | 1,796 | ||||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(15,768 | ) | (10,488 | ) | ||||

|

|

|

|

|

|||||

| Net (decrease) increase in cash and cash equivalents |

(31,068 | ) | 51,809 | |||||

| Cash and cash equivalents, beginning of period |

207,973 | 174,925 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 176,905 | $ | 226,734 | ||||

|

|

|

|

|

|||||

| Supplemental Cash Flow Information: |

||||||||

| Income tax payments |

$ | 2,781 | $ | 2,422 | ||||

| Interest payments |

$ | 7,219 | $ | — | ||||

See notes to consolidated financial statements.

5

Table of Contents

FBR & CO.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Dollars in thousands, except per share data)

(Unaudited)

1. Basis of Presentation:

The consolidated financial statements of FBR & Co. and subsidiaries (collectively, the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and with the instructions to Form 10-Q. Therefore, they do not include all information required by accounting principles generally accepted in the United States of America for complete annual financial statements. The interim financial statements reflect all adjustments (consisting only of normal recurring adjustments) which are, in the opinion of management, necessary for a fair statement of the results for the periods presented. All significant intercompany accounts and transactions have been eliminated in consolidation. The results of operations for the three and six months ended June 30, 2014 and 2013 are not necessarily indicative of the results for the entire year or any subsequent interim period. These financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 (“2013 Form 10-K”).

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions affecting the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Although the Company bases its estimates and assumptions on historical experience and market information (when available) and on various other factors that it believes to be reasonable under the circumstances, management exercises significant judgment in the final determination of its estimates. Actual results may differ from those estimates.

Revision to Previously Reported Financial Statements

As previously disclosed by the Company and as presented in its 2013 Form 10-K, the Company has revised its June 30, 2013 financial statements in this quarterly report on Form 10-Q. The revision reduced the previously reported second quarter 2013 tax benefit by $3,891, net income by $3,891, basic earnings per share by $0.32 and diluted earnings per share by $0.29. The revision reduced the previously reported six months ended June 30, 2013 tax benefit by $3,891, net income by $3,891, basic earnings per share by $0.32 and diluted earnings per share by $0.30.

2. Financial Instruments and Long-Term Investments:

Fair Value of Financial Instruments

The Financial Accounting Standards Board’s (“FASB”) Accounting Standards Codification (“ASC”) 820 “Fair Value Measurement” (“ASC 820”) defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, not adjusted for transaction costs. ASC 820 also establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value into three broad levels giving the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3) as described below:

| Level 1 Inputs |

— |

Unadjusted quoted prices in active markets for identical assets or liabilities that are accessible by the Company; | ||

| Level 2 Inputs |

— |

Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly; | ||

| Level 3 Inputs |

— |

Unobservable inputs for the asset or liability, including significant assumptions of the Company and other market participants. | ||

6

Table of Contents

The Company determines fair values for the following assets and liabilities:

Equity securities, listed options and warrants—The Company classifies marketable equity securities and listed options within Level 1 of the fair value hierarchy because quoted market prices from an exchange are used to value these securities. Non-public equity securities, which primarily include securities where the Company acted as a placement agent in an offering of equity securities and where the Company facilitates over-the-counter trading activity for the securities, are classified within Level 3 of the fair value hierarchy. In determining the fair value of these securities, the Company considers enterprise value and analyzes various financial, performance and market factors to estimate the value, including where applicable over-the-counter market trading activity. Non-exchange traded warrants to purchase equity securities are classified as Level 3 as a Black-Scholes valuation model is used to value these securities.

U.S. government securities, convertible and fixed income debt instruments—The Company classifies U.S government securities, including highly liquid U.S. Treasury securities within Level 1 as quoted prices are used to value these securities. Convertible and fixed income debt instruments are classified within Level 2 of the fair value hierarchy as they are valued using quoted market prices provided by a broker or dealer, or alternative pricing services that provide reasonable levels of price transparency. The Company primarily uses price quotes from one independent broker dealer who makes markets in or is a specialist with expertise in the valuation of these financial instruments. The Company reviews broker or pricing service quotes it receives to assess the reasonableness of the values provided, such reviews include comparison to internal pricing models and, when available, prices observed for recently executed market transactions of comparable size. Based on this assessment, at each reporting date the Company will adjust price quotes it receives if such an adjustment is determined to be appropriate.

Investment Funds—The Company invests in proprietary investment funds that are valued at net asset value (“NAV”) determined by the fund administrator. For investments in non-registered investment companies (private equity, debt funds and fund of funds), the Company classifies these investments within Level 3 as the underlying securities held by these investment companies are primarily corporate and asset-backed fixed income securities and restrictions exist on the redemption of amounts invested by the Company. As a practical expedient, the Company relies on the NAV of these investments as their fair value. The NAVs that have been provided by investees are derived from the fair values of the underlying investments as of the reporting date. As of June 30, 2014, the Company’s $93,290 of investments in non-registered investment funds were subject to various redemption provisions. Approximately 88% of the fair value amount of the funds was redeemable on at least a three month period basis primarily with a notice period of 90 days or less. At June 30, 2014, 16% of the fair value amount of these funds was subject to early withdrawal fees of 5% or less, all of which expire during 2014. Additionally, approximately 81% of the fair value amount of these funds was subject to redemption holdbacks of 10% or less.

7

Table of Contents

Fair Value Hierarchy

The following tables set forth, by level within the fair value hierarchy, financial instruments accounted for under ASC 820 as of June 30, 2014 and December 31, 2013. As required by ASC 820, assets and liabilities that are measured at fair value are classified in their entirety based on the lowest level of input that is significant to the fair value measurement.

Items Measured at Fair Value on a Recurring Basis

| June 30, 2014 |

Level 1 | Level 2 | Level 3 | |||||||||||||

| Financial instruments owned, at fair value: |

||||||||||||||||

| Financial instruments held for trading activities at broker-dealer subsidiary: |

||||||||||||||||

| Marketable and non-public equity securities |

$ | 35,474 | $ | 35,294 | $ | — | $ | 180 | ||||||||

| Listed options |

177 | 177 | — | — | ||||||||||||

| Convertible and fixed income debt instruments |

42,290 | — | 42,290 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 77,941 | 35,471 | 42,290 | 180 | |||||||||||||

| Financial instruments held for investment activities: |

||||||||||||||||

| Designated as trading: |

||||||||||||||||

| Marketable and non-public equity securities |

17,721 | 9,749 | — | 7,972 | ||||||||||||

| Warrants |

1,334 | — | — | 1,334 | ||||||||||||

| Designated as available-for-sale: |

||||||||||||||||

| Marketable equity securities |

193 | 193 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 19,248 | 9,942 | — | 9,306 | |||||||||||||

| Investment Funds |

93,290 | — | — | 93,290 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 190,479 | $ | 45,413 | $ | 42,290 | $ | 102,776 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Securities sold but not yet purchased, at fair value: |

||||||||||||||||

| U.S. Treasury securities |

$ | 297,309 | $ | 297,309 | $ | — | $ | — | ||||||||

| Marketable equity securities |

52,782 | 52,782 | — | — | ||||||||||||

| Listed options |

124 | 124 | — | — | ||||||||||||

| Convertible and fixed income debt instruments |

11,060 | — | 11,060 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 361,275 | $ | 350,215 | $ | 11,060 | $ | — | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As of June 30, 2014, financial assets measured and reported at fair value on a recurring basis and classified within Level 3 were $102,776 or 13.8% of the Company’s total assets at that date. Regarding these Level 3 financial assets, in determining fair value, the Company analyzes various financial, performance and market factors to estimate the value, including for non-public equity securities, over-the-counter market trading activity. The following table provides the valuation technique and unobservable inputs primarily used in assessing the value of these securities as of June 30, 2014:

| Valuation Technique |

Fair Value | Unobservable Input |

Range | Weighted Average |

||||||||

| Market approach—assets |

$ | 8,152 | Over-the counter trading activity | $0.67 – $21.25/share | $ | 10.68 | ||||||

| Black-Scholes—assets |

$ | 1,334 | Volatility | 30% | 30 | % | ||||||

| Dividend Yield | 0% | 0 | % | |||||||||

| Interest Rate | 2.39% | 2.39 | % | |||||||||

8

Table of Contents

For those non-public equity securities valued using a market approach, adverse industry market conditions or events experienced by the underlying entities could result in lower over-the-counter trading prices for the securities. Such lower trading prices would result in a decline in the estimated fair value of these assets. For warrants valued using Black-Scholes, adverse industry market conditions or events experienced by the issuer could result in a lower trading price for the underlying equity security and therefore a lower value of these warrants. A reduction in the estimated volatility would also result in a lower value of the warrants. The Company assessed the reasonableness of the fair values of the non-public equity securities noted above based on its consideration of available financial data related to these issuers as well as an assessment of the nature of any over-the-counter trading activity during the period. The Company assessed the reasonableness of the fair value of the non-exchange traded warrants valued using a Black-Scholes valuation based on its consideration of the fair values of comparable exchange-traded options.

The table above excludes $93,290 of investments in 18 non-registered investment funds that are valued at NAV as determined by the fund administrators. The underlying fund investments consist primarily of corporate and asset-backed fixed income securities. Considering the general lack of transparency necessary to conduct an independent assessment of the fair value of the securities underlying each of the NAVs provided by the fund administrators, our quarterly reporting process includes a number of assessment processes to assist the Company in the evaluation of the information provided by fund managers and fund administrators. These assessment processes include, but are not limited to regular review and discussion of each fund’s performance with its manager and regular evaluation of performance against applicable benchmarks.

| December 31, 2013 |

Level 1 | Level 2 | Level 3 | |||||||||||||

| Financial instruments owned, at fair value: |

||||||||||||||||

| Financial instruments held for trading activities at broker-dealer subsidiary: |

||||||||||||||||

| Marketable and non-public equity securities |

$ | 25,402 | $ | 22,054 | $ | — | $ | 3,348 | ||||||||

| Listed options |

771 | 771 | — | — | ||||||||||||

| Convertible and fixed income debt instruments |

32,024 | — | 32,024 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 58,197 | 22,825 | 32,024 | 3,348 | |||||||||||||

| Financial instruments held for investment activities: |

||||||||||||||||

| Designated as trading: |

||||||||||||||||

| Marketable and non-public equity securities |

21,142 | 14,951 | — | 6,191 | ||||||||||||

| Warrants |

1,996 | — | — | 1,996 | ||||||||||||

| Fixed income debt instruments |

2,055 | — | 2,055 | — | ||||||||||||

| Designated as available-for-sale: |

||||||||||||||||

| Marketable equity securities |

156 | 156 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 25,349 | 15,107 | 2,055 | 8,187 | |||||||||||||

| Investment Funds |

61,197 | — | — | 61,197 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 144,743 | $ | 37,932 | $ | 34,079 | $ | 72,732 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Securities sold but not yet purchased, at fair value: |

||||||||||||||||

| Marketable and non-public equity securities |

$ | 35,720 | $ | 34,221 | $ | — | $ | 1,499 | ||||||||

| Listed options |

354 | 354 | — | — | ||||||||||||

| Convertible and fixed income debt instruments |

6,167 | — | 6,167 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 42,241 | $ | 34,575 | $ | 6,167 | $ | 1,499 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As of December 31, 2013, financial assets measured and reported at fair value on a recurring basis and classified within Level 3 were $72,732 or 17.7% of the Company’s total assets at that date. As of December 31, 2013, financial liabilities measured and reported at fair value on a recurring basis and classified within Level 3 were $1,499 or 1.3% of the Company’s total liabilities at the date. Regarding these Level 3 financial assets and financial liabilities, in

9

Table of Contents

determining fair value, the Company analyzes various financial, performance and market factors to estimate the value, including where applicable over-the-counter market trading activity. The following table provides the valuation technique and unobservable inputs primarily used in assessing the value of these securities as of December 31, 2013:

| Valuation Technique |

Fair Value | Unobservable Input |

Range | Weighted Average |

||||||||

| Market approach—assets |

$ | 9,539 | Over-the-counter trading activity | $ 0.77 – $19.00/share | $ | 13.44 | ||||||

| Market approach—liabilities |

$ | 1,499 | Over-the-counter trading activity | $65.15/share | $ | 65.15 | ||||||

| Black-Scholes—assets |

$ | 1,996 | Volatility | 30% | 30 | % | ||||||

| Dividend Yield | 0% | 0 | % | |||||||||

| Interest Rate | 2.9% | 2.9 | % | |||||||||

For those non-public equity securities valued using a market approach, adverse industry market conditions or events experienced by the underlying entities could result in lower over-the-counter trading prices for the securities. Such lower trading prices would result in a decline in the estimated fair value of these assets. An increase in the trading prices of trading securities sold but not yet purchased would result in an increase in the estimated fair value of these liabilities. For warrants valued using Black-Scholes, adverse industry market conditions or events experienced by the issuer could result in a lower trading price for the underlying equity security and therefore a lower value of these warrants. A reduction in the estimated volatility would also result in a lower value of the warrants. The Company assessed the reasonableness of the fair values of the non-public equity securities noted above based on its consideration of available financial data related to these issuers as well as an assessment of the nature of any over-the-counter trading activity during the period. The Company assessed the reasonableness of the fair value of the non-exchange traded warrants valued using a Black-Scholes valuation based on its consideration of the fair values of comparable exchange-traded options.

The table above excludes $61,197 of investments in 14 non-registered investment funds that are valued at NAV as determined by the fund administrators. The underlying fund investments consist primarily of corporate and asset-backed fixed income securities. Considering the general lack of transparency necessary to conduct an independent assessment of the fair value of the securities underlying each of the NAVs provided by the fund administrators, our quarterly reporting process includes a number of assessment processes to assist the Company in the evaluation of the information provided by fund managers and fund administrators. These assessment processes include, but are not limited to regular review and discussion of each fund’s performance with its manager and regular evaluation of performance against applicable benchmarks.

Level 3 Gains and Losses

The tables below set forth a summary of changes in the fair value of the Company’s Level 3 financial assets that are measured at fair value on a recurring basis for the three months ended June 30, 2014 and 2013. As of June 30, 2014 and 2013, the Company did not have any net unrealized gains (losses) included in accumulated other comprehensive income on Level 3 financial assets.

| Trading Securities |

Investment Funds |

Total | ||||||||||

| Beginning balance, April 1, 2014 |

$ | 3,884 | $ | 77,854 | $ | 81,738 | ||||||

| Total net gain/losses (realized/unrealized) |

||||||||||||

| Included in earnings |

168 | 2,201 | 2,369 | |||||||||

| Included in other comprehensive income |

— | — | — | |||||||||

| Purchases |

34,937 | 13,487 | 48,424 | |||||||||

| Sales/Distributions |

(29,470 | ) | (252 | ) | (29,722 | ) | ||||||

| Transfers out of level 3 |

(33 | ) | — | (33 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Ending balance, June 30, 2014 |

$ | 9,486 | $ | 93,290 | $ | 102,776 | ||||||

|

|

|

|

|

|

|

|||||||

| The amount of total gains or losses for the period included in earnings attributable to the change in unrealized gains or losses relating to assets still held at the reporting date |

$ | 102 | $ | 2,201 | $ | 2,303 | ||||||

|

|

|

|

|

|

|

|||||||

10

Table of Contents

| Trading Securities |

Investment Funds |

Total | ||||||||||

| Beginning balance, April 1, 2013 |

$ | 2,867 | $ | 27,884 | $ | 30,751 | ||||||

| Total net gain/losses (realized/unrealized) |

||||||||||||

| Included in earnings |

1,545 | 874 | 2,419 | |||||||||

| Included in other comprehensive income |

— | — | — | |||||||||

| Purchases |

183,362 | — | 183,362 | |||||||||

| Sales/Distributions |

(176,407 | ) | (25 | ) | (176,432 | ) | ||||||

| Transfers out of level 3 |

(1,166 | ) | — | (1,166 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Ending balance, June 30, 2013 |

$ | 10,201 | $ | 28,733 | $ | 38,934 | ||||||

|

|

|

|

|

|

|

|||||||

| The amount of total gains or losses for the period included in earnings attributable to the change in unrealized gains or losses relating to assets still held at the reporting date |

$ | 19 | $ | 1,933 | $ | 1,952 | ||||||

|

|

|

|

|

|

|

|||||||

There were no transfers in to, or out of Level 2 financial assets during the three months ended June 30, 2014. One transfer was made out of Level 3 and into Level 1 during the three months ended June 30, 2014 for an equity security that was previously a non-public equity security and during the period became publicly traded.

There were no transfers of securities in to, or out of, Level 2 financial assets during the three months ended June 30, 2013. One transfer was made out of Level 3 and into Level 1 during the three months ended June 30, 2013 for an equity security that was previously a non-public equity security and during the period became publicly traded.

The tables below set forth a summary of changes in the fair value of the Company’s Level 3 financial assets that are measured at fair value on a recurring basis for the six months ended June 30, 2014 and 2013.

| Trading Securities |

Trading Securities Sold not yet Purchased |

Investment Funds |

Total | |||||||||||||

| Beginning balance, January 1, 2014 |

$ | 11,535 | $ | (1,499 | ) | $ | 61,197 | $ | 71,233 | |||||||

| Total net gains (losses) (realized/unrealized) |

||||||||||||||||

| Included in earnings |

88 | (122 | ) | 3,892 | 3,858 | |||||||||||

| Included in other comprehensive income |

— | — | — | — | ||||||||||||

| Purchases |

48,779 | 6,043 | 28,487 | 83,309 | ||||||||||||

| Sales/Distributions |

(44,667 | ) | (4,422 | ) | (286 | ) | (49,375 | ) | ||||||||

| Transfers out of level 3 |

(6,249 | ) | — | — | (6,249 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Ending balance, June 30, 2014 |

$ | 9,486 | $ | — | $ | 93,290 | $ | 102,776 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| The amount of total gains or losses for the period included in earnings attributable to the change in unrealized gains or losses relating to assets still held at the reporting date |

$ | (275 | ) | $ | — | $ | 3,810 | $ | 3,535 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

11

Table of Contents

| Trading Securities |

Investment Funds |

Total | ||||||||||

| Beginning balance, January 1, 2013 |

$ | 2,615 | $ | 17,600 | $ | 20,215 | ||||||

| Total net gains (losses) (realized/unrealized) |

||||||||||||

| Included in earnings |

2,235 | 2,158 | 4,393 | |||||||||

| Included in other comprehensive income |

— | — | — | |||||||||

| Purchases |

236,210 | 9,000 | 245,210 | |||||||||

| Sales/Distributions |

(229,693 | ) | (25 | ) | (229,718 | ) | ||||||

| Transfers out of level 3 |

(1,166 | ) | — | (1,166 | ) | |||||||

|

|

|

|

|

|

|

|||||||

| Ending balance, June 30, 2013 |

$ | 10,201 | $ | 28,733 | $ | 38,934 | ||||||

|

|

|

|

|

|

|

|||||||

| The amount of total gains or losses for the period included in earnings attributable to the change in unrealized gains or losses relating to assets still held at the reporting date |

$ | 128 | $ | 3,877 | $ | 4,005 | ||||||

|

|

|

|

|

|

|

|||||||

There were no transfers of securities in to, or out of, Level 2 financial assets during the six months ended June 30, 2014. Two transfers were made out of Level 3 and into Level 1 during the six months ended June 30, 2014 for two equity securities that were each previously a non-public equity security and during the period became publicly traded.

There were no transfers of securities in to, or out of, Level 2 financial assets during the six months ended June 30, 2013. One transfer was made out of Level 3 and into Level 1 during the six months ended June 30, 2013 for an equity security that was previously a non-public equity security and during the period became publicly traded.

Gains and losses from Level 3 financial assets that are measured at fair value on a recurring basis, included in earnings for the three and six months ended June 30, 2014 and 2013, are reported in the following line descriptions on the Company’s statements of operations:

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Total gains and losses included in earnings for the period: |

||||||||||||||||

| Institutional brokerage |

$ | 42 | $ | 486 | $ | 3 | $ | 487 | ||||||||

| Net investment income |

2,327 | 1,933 | 3,855 | 3,906 | ||||||||||||

| Change in unrealized gains or losses relating to assets still held at the end of the respective period: |

||||||||||||||||

| Institutional brokerage |

$ | (24 | ) | $ | 19 | $ | (238 | ) | $ | 128 | ||||||

| Net investment income |

2,015 | 1,933 | 3,461 | 3,877 | ||||||||||||

Financial Instruments Held for Investment—Designated as Trading

As of June 30, 2014, and during the year ended December 31, 2013, the Company had certain investments in marketable equity securities held by other than its broker-dealer subsidiary that are classified as trading securities. In addition, as of June 30, 2014, the Company had short positions in U.S. Treasury securities held by other than its broker-dealer subsidiary that are classified as trading securities. These investments are designated as trading based on the Company’s intent at the time of designation. In accordance with ASC 320, “Investments—Debt and Equity Securities” (“ASC 320”), these securities are carried at fair value with resulting realized and unrealized gains and losses reflected as net investment income in the statements of operations. In addition, pursuant to ASC 825, “Financial Instruments” (“ASC 825”), from time-to-time the Company may elect to account for non-public equity securities acquired by other than the Company’s broker-dealer subsidiary as part of its trading portfolio at fair value with resulting realized and unrealized gains and losses reflected as net investment income in the statements of operations. During the three months ended June 30, 2014, the Company

12

Table of Contents

elected to account for one non-public equity security, purchased at a cost of $4,148, at fair value. During the six months ended June 30, 2014, the Company elected to account for two non-public equity securities, purchased at a cost of $6,148, at fair value. Net gains and losses on such trading securities as of the dates indicated were as follows:

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net gains recognized on trading securities |

$ | 5,665 | $ | 310 | $ | 8,050 | $ | 1,016 | ||||||||

| Less: Net (gains) losses recognized on trading securities sold during the period |

(804 | ) | 27 | (931 | ) | (634 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Unrealized gains recognized on trading securities still held at the reporting date |

$ | 4,861 | $ | 337 | $ | 7,119 | $ | 382 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

As part of the Company’s investing activities, during the three months ended June 30, 2014 the Company entered into one short-sale of a $75,000 face value 7.25% U.S. Treasury security, and during the three months ended March 31, 2014 the Company entered into two short-sales of $100,000 face value each, 4.50% U.S. Treasury securities. These securities mature in May 2016, November 2015 and February 2016, respectively. These positions are included in securities sold but not yet purchased on the Company’s balance sheet as of June 30, 2014. Proceeds from these short-sales, as well as related margin requirements, are held in a collateral account and are included in due from brokers, dealers and clearing organizations in the Company’s balance sheet. Such amounts are not available for withdrawal and are subject to closure of the open short positions. During the three and six months ended June 30, 2014, the Company incurred $3,083 and $4,760, respectively, of interest expense related to these transactions. The Company is obligated to fund the fixed-rate coupon interest on these securities while the short-positions are outstanding.

Financial Instruments Held for Investment—Designated as Available-for-Sale

As of June 30, 2014 and December 31, 2013, the Company had certain investments in marketable equity securities held by other than the Company’s broker-dealer subsidiary that are classified as available-for-sale securities. These investments are designated as available-for-sale due to the Company’s intent at the time of designation to hold these securities for investment purposes over an extended period. However, these investments are available to be sold should economic conditions warrant such a transaction. In accordance with ASC 320, these securities are carried at fair value with resulting unrealized gains and losses reflected as other comprehensive income or loss. Gross unrealized gains and losses on these securities as of the dates indicated were as follows:

| June 30, 2014 | ||||||||||||||||

| Cost Basis |

Unrealized | Fair Value | ||||||||||||||

| Gains | Losses | |||||||||||||||

| Marketable equity securities |

$ | 108 | $ | 85 | $ | 0 | $ | 193 | ||||||||

| December 31, 2013 | ||||||||||||||||

| Cost Basis |

Unrealized | Fair Value | ||||||||||||||

| Gains | Losses | |||||||||||||||

| Marketable equity securities |

$ | 108 | $ | 48 | $ | 0 | $ | 156 | ||||||||

The Company evaluates its portfolio of marketable equity securities for impairment as of each reporting date. For the securities with unrealized losses, the Company will review the underlying cause for the impairments, as well as the severity and duration of the impairments. If the impairment is determined to be other-than-temporary, the Company will recognize an other-than-temporary impairment loss in its statement of operations. The Company did not recognize any other-than-temporary impairment losses during the three and six months ended June 30, 2014, and as of June 30, 2014, the Company did not hold any marketable securities that

13

Table of Contents

were in an unrealized loss position. During the three months ended June 30, 2013, the Company did not recognize any other-than-temporary impairment losses, however during the six months ended June 30, 2013 the Company recorded an other-than-temporary impairment charge of $545 related to an investment in a company in the financial services industry. The Company recognized this impairment charge as a result of a change in its intent to hold this investment for a period of time sufficient for a forecasted recovery of its fair value. In this case the change in intent was a result of changes in market conditions during the quarter specific to this investment. The carrying value of this investment subsequent to the impairment was $4,257.

There were no sales of marketable securities during the three and six months ended June 30, 2014. During the three months ended June 30, 2013, the Company received proceeds of $4,225 from sales of marketable equity securities resulting in gross losses of $(32). During the six months ended June 30, 2013, the Company received proceeds of $4,297 from sales of marketable equity securities resulting in gross gains of $36 and gross losses of $(32).

Other Comprehensive Income (Loss)

The following tables set forth the changes in the Company’s accumulated other comprehensive income (loss) by component for the period indicated along with detail regarding reclassifications from other comprehensive income (loss). All such reclassifications from other comprehensive income (loss) are included in net investment income in the Company’s consolidated statements of operations.

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Accumulated other comprehensive income (loss), beginning balance |

$ | 53 | $ | (1,212 | ) | $ | 34 | $ | (1,094 | ) | ||||||

| Other comprehensive income before reclassifications |

5 | 1,359 | 24 | 732 | ||||||||||||

| Amounts reclassified from other comprehensive income |

— | — | — | 509 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Accumulated other comprehensive income, at period end |

$ | 58 | $ | 147 | $ | 58 | $ | 147 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Reclassifications from other comprehensive income (loss) |

||||||||||||||||

| Other-than-temporary impairment loss |

$ | — | $ | — | $ | — | $ | 545 | ||||||||

| Realized gains on sale of securities |

— | — | — | (36 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | — | $ | — | $ | — | $ | 509 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Other Investments, at Cost

Other investments consisted of the following as of the dates indicated:

| June 30, 2014 |

December 31, 2013 |

|||||||

| Non-public equity securities |

$ | 2,428 | $ | 2,681 | ||||

| Corporate debt investments |

— | 5,000 | ||||||

|

|

|

|

|

|||||

| $ | 2,428 | $ | 7,681 | |||||

|

|

|

|

|

|||||

The Company evaluates its non-public equity securities and corporate debt investments, carried at cost, for impairment as of each reporting date. This evaluation includes consideration of the operating performance of the respective companies, their financial condition and their near-term and long-term prospects. Based on its evaluations of these investments, the Company recorded no impairment losses during the three and six months ended June 30, 2014 and 2013.

14

Table of Contents

During both the three and six months ended June 30, 2014, the Company received proceeds of $1,428 from the sale of a non-public equity security resulting in a gross gain of $1,176. During the six months ended June 30, 2014, the Company received $5,000 reflecting the full repayment at its maturity of a corporate debt investment. During the three and six months ended June 30, 2013, there were no sales of non-public equity securities or corporate debt investments carried at cost. During the three months ended June 30, 2013, the Company received $317 from the maturity of a note receivable that was carried at cost. In addition, during the three months ended June 30, 2013, a non-public equity security carried at cost with a basis of $2,390 became publicly traded during the period. The Company designated this security as trading at the time it became publicly traded.

3. Income Taxes:

During the three and six months ended June 30, 2014, the Company recorded tax provisions of $1,999 and $5,404, respectively. The Company’s quarterly tax provision is determined pursuant to ASC 740, “Income Taxes” (“ASC 740”), which requires using an estimated annual effective rate based on forecasted taxable income for the full year. The Company’s effective tax rates for the three and six months ended June 30, 2014 were 22.3% and 30.0%, respectively. The Company’s 2014 tax rate differed from statutory tax rates primarily due to capital loss carryforwards subject to a valuation allowance that are projected to be utilized during the year. As a result of the valuation allowance release discussed in more detail below, during the three and six months ended June 30, 2013, the Company recorded income tax benefits of $25,700 and $24,241, respectively. The Company’s effective tax rates for the three and six months ended June 30, 2013 were (175.6)% and (48.0)%, respectively. These tax rates differed from statutory tax rates primarily due to the effects of the valuation allowance reversal.

During the three months ended June 30, 2013, the Company released a significant component of its valuation allowance against its net deferred tax assets since, based on the application of the criteria in ASC 740, it concluded that it was more likely than not that the benefits of these assets would be realized in the future. Following the criteria in ASC 740, the Company reviews this valuation allowance on a quarterly basis assessing the positive and negative evidence to determine if it is more likely than not that some or all of the deferred tax assets will be realized. The Company’s operating results since June 30, 2013 have provided additional positive evidence in support of the valuation allowance release. As of June 30, 2013 and subsequently, as described below, the Company’s valuation allowance for its deferred tax assets relates to capital loss carryforwards and net unrealized losses on investments. Realization of the Company’s deferred tax assets not subject to a valuation allowance is dependent on the Company’s prospective operating performance and its ability to generate positive operating results.

At December 31, 2013, the Company’s net deferred tax assets totaled $49,165 and were partially offset by valuation allowance of $18,272. This valuation allowance related to capital loss carryforwards and net unrealized losses on investments and was determined based on the Company’s application of the guidance in ASC 740 and its conclusion that it was more likely than not that the benefits of these assets would not be realized in the future. Based on its assessment as of June 30, 2014, the Company determined that a valuation allowance related to its capital loss carryforwards and net unrealized losses on investments continued to be appropriate. As of June 30, 2014, these deferred tax assets and related valuation allowance totaled approximately $14,800. Recognition of these deferred tax assets will be dependent on the Company’s ability to generate capital gains.

4. Net Capital Requirements:

FBR Capital Markets & Co. (“FBRCM”), the Company’s broker-dealer subsidiary, is registered with the Securities and Exchange Commission (“SEC”) and is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). As such, it is subject to the minimum net capital requirements promulgated by the SEC. As of June 30, 2014, FBRCM had net capital of $72,899 which was $68,050 in excess of its required net capital of $4,849.

15

Table of Contents

5. Earnings Per Share:

Basic earnings per share includes no dilution and is computed by dividing net income or loss available to common shareholders by the weighted average number of common shares outstanding for the period. Diluted earnings per share includes the impact of dilutive securities such as stock options, unvested shares of restricted stock and restricted stock units (“RSUs”), all of which are subject to forfeiture. The following table presents the computations of basic and diluted earnings per share for the periods indicated:

| Three Months Ended June 30, 2014 |

Three Months Ended June 30, 2013 |

|||||||||||||||

| Basic | Diluted | Basic | Diluted | |||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Common stock (in thousands) |

10,795 | 10,795 | 12,166 | 12,166 | ||||||||||||

| Stock options, unvested restricted stock and unvested RSUs (in thousands) |

— | 1,170 | — | 1,050 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common and common equivalent shares outstanding (in thousands) |

10,795 | 11,965 | 12,166 | 13,216 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income applicable to common stock |

$ | 6,976 | $ | 6,976 | $ | 42,648 | $ | 42,648 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per common share |

$ | 0.65 | $ | 0.58 | $ | 3.51 | $ | 3.23 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Six Months Ended June 30, 2014 |

Six Months Ended June 30, 2013 |

|||||||||||||||

| Basic | Diluted | Basic | Diluted | |||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Common stock (in thousands) |

10,927 | 10,927 | 12,201 | 12,201 | ||||||||||||

| Stock options, unvested restricted stock and unvested RSUs (in thousands) |

— | 1,123 | — | 901 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average common and common equivalent shares outstanding (in thousands) |

10,927 | 12,050 | 12,201 | 13,102 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income applicable to common stock |

$ | 12,586 | $ | 12,586 | $ | 77,902 | $ | 77,902 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per common share |

$ | 1.15 | $ | 1.04 | $ | 6.38 | $ | 5.95 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table presents the number of anti-dilutive stock options, unvested restricted stock and unvested RSUs for the periods indicated (in thousands):

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Stock options—employees and directors |

728 | 592 | 730 | 592 | ||||||||||||

| Stock options—non-employee |

27 | 4 | 27 | 71 | ||||||||||||

| Restricted Stock, unvested |

6 | 10 | 6 | 10 | ||||||||||||

| Restricted Stock Units, unvested |

1,056 | 1,058 | 1,100 | 1,140 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1,817 | 1,664 | 1,863 | 1,813 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

6. Commitments and Contingencies:

Litigation

As of June 30, 2014, except as described below, the Company was neither a defendant nor plaintiff in any lawsuits or arbitrations nor involved in any governmental or self-regulatory organization matters that are expected to have a material adverse effect on its financial condition, results of operations or liquidity. The

16

Table of Contents

Company has been named as a defendant in a small number of civil lawsuits relating to its various businesses. In addition, the Company is subject to various reviews, examinations, investigations and other inquiries by governmental agencies and self regulatory organizations. There can be no assurance that these matters individually or in aggregate will not have a material adverse effect on the Company’s financial condition, results of operations, or liquidity in a future period. However, based on management’s review with counsel, resolution of these matters is not expected to have a material adverse effect on the Company’s financial condition, results of operations or liquidity.

Many aspects of the Company’s business involve substantial risks of liability and litigation. Underwriters, broker-dealers and investment advisers are exposed to liability under Federal and state securities laws, other Federal and state laws and court decisions, including decisions with respect to underwriters’ liability and limitations on indemnification, as well as with respect to the handling of customer accounts. For example, underwriters may be held liable for material misstatements or omissions of fact in a prospectus used in connection with the securities being offered and broker-dealers may be held liable for statements made by their securities analysts or other personnel. In the past, FBRCM has been named as a defendant in a small number of securities claims involving investment banking clients of FBRCM as a result of FBRCM’s role as an underwriter. In these cases, the underwriting agreement provides, subject to certain conditions, that the investment banking client is required to indemnify FBRCM against certain claims or liabilities, including claims or liabilities under the Securities Act of 1933, as amended (the “Securities Act”), or contribute to payments which FBRCM is required to make as a result of the litigation. There can be no assurance that such indemnification or contribution will ultimately be available to the Company or that an investment banking client will be able to satisfy its indemnity or contribution obligations when due.

FBRCM was named a defendant in the putative class action lawsuit MHC Mutual Conversion Fund, L.P. v. United Western Bancorp, Inc., et al. in the United States District Court for the District of Colorado. The complaint, filed in March 2011 against United Western Bancorp, Inc. (the “Bank”), its officers and directors, underwriters and outside auditors, alleged material misrepresentations and omissions in the registration statement and prospectus issued in connection with the Bank’s September 2009 offering. On December 19, 2012 the Court granted Defendants’ motion to dismiss the class action complaint with prejudice and entered final judgment for the underwriters. Class plaintiffs filed a timely notice of appeal to the 10th Circuit Court of Appeals, challenging the District Court’s findings, and on August 1, 2014, the Court of Appeals affirmed the District Court’s judgment.

In accordance with applicable accounting guidance, the Company establishes an accrued liability for litigation and regulatory matters when those matters present loss contingencies that are both probable and estimable. In such cases, there may be an exposure to loss in excess of any amounts accrued. When a loss contingency is not both probable and estimable, the Company does not establish an accrued liability. As a litigation or regulatory matter develops, management, in conjunction with counsel, evaluates on an ongoing basis whether such matter presents a loss contingency that is probable and estimable.

In certain circumstances, broker-dealers and asset managers may also be held liable by customers and clients for losses sustained on investments. In recent years, there has been an increasing incidence of litigation and actions by government agencies and self regulatory organizations involving the securities industry, including class actions that seek substantial damages. The Company is also subject to the risk of litigation, including litigation that may be without merit. As the Company intends to actively defend any such litigation, significant legal expenses could be incurred. An adverse resolution of any future litigation against the Company could materially affect its financial condition, operating results and liquidity.

17

Table of Contents

Other

On March 27, 2014, the Company entered into a Transaction Agreement with Lazard Capital Markets LLC (“LCM”) pursuant to which FBRCM agreed to purchase LCM’s securities lending business (the “Transaction Agreement”). Pursuant to the Transaction Agreement, the Company issued to certain counterparties of LCM guarantees of LCM’s obligations under securities loan agreements up to an aggregate of $75,000.

As of June 30, 2014, the Company had issued such guarantees to counterparties of LCM up to an aggregate of $75,000. Based on the nature of the related securities loan agreements, including the applicable collateral and other capital that support LCM’s obligations under these securities loan agreements, the Company has valued these guarantees at zero as of June 30, 2014. To-date, the Company has not incurred any costs relative to these guarantees. The Company’s purchase of LCM’s securities lending business closed on August 4, 2014 (see Note 12, “Subsequent Events”). The guarantees discussed above will terminate in connection with the closing of the transaction.

7. Shareholders’ Equity:

Share Repurchases

During the three and six months ended June 30, 2014, the Company repurchased 400,195 shares and 662,012 shares, respectively, of its common stock in open market or privately negotiated transactions at weighted average share prices of $26.19 per share and $26.18 per share, respectively, for a total cost, including transaction costs, of $10,480 and $17,329, respectively. During the three and six months ended June 30, 2013, the Company repurchased 150,064 shares and 715,537 shares, respectively, of its common stock primarily in privately negotiated or open market transactions at weighted average share prices of $20.95 per share and $17.17 per share, respectively, for a total cost, including transaction costs, of $3,144 and $12,284, respectively. As of June 30, 2014, the Company has remaining authority to repurchase 953,654 additional shares.

Employee Stock Purchase Plan

Under the Company’s Employee Stock Purchase Plan (the “Purchase Plan”), eligible employees may purchase common stock through payroll deductions at a price that is 85% of the lower of the market value of the common stock on the first day of the offering period or the last day of the offering period. In accordance with the provisions of ASC 718, “Compensation—Stock Compensation,” the Company is required to recognize compensation expense relating to shares offered under the Purchase Plan. For the three and six months ended June 30, 2014, the Company recognized compensation expense of $39 and $188, respectively. For the three and six months ended June 30, 2013, the Company recognized compensation expense of $83 and $163, respectively

Stock Compensation Plans

FBR & Co. Amended 2006 Long-Term Incentive Plan (“FBR & Co. Long-Term Incentive Plan”)

Under the FBR & Co. Long-Term Incentive Plan, as amended, the Company may grant options to purchase stock, stock appreciation rights, performance awards, restricted and unrestricted stock and RSUs for up to an aggregate of 7,217,496 shares of common stock, subject to increase under certain provisions of the plan, to eligible participants. Participants include employees, officers and directors of the Company and its subsidiaries. The plan’s termination date is October 22, 2023 unless it is terminated sooner by the Company’s Board of Directors. The FBR & Co. Long-Term Incentive Plan has a term of 10 years and options granted may have an exercise period of up to 10 years. Options may be incentive stock options, as defined by Section 422 of the Internal Revenue Code, or nonqualified stock options.

18

Table of Contents

The Company grants options to purchase stock, restricted shares of common stock and RSUs to employees that vest based on meeting specified service conditions of three to five years and in certain cases achievement of specified market conditions or performance goals. The following table presents compensation expense related to these awards for the periods indicated:

| Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Stock options |

$ | 27 | $ | 115 | $ | (85 | ) | $ | 333 | |||||||

| Restricted shares |

$ | 72 | $ | 15 | $ | 135 | $ | 20 | ||||||||

| RSUs |

$ | 2,235 | $ | 1,975 | $ | 4,308 | $ | 3,511 | ||||||||

The following table presents issuance activity related to grants of these awards for the period indicated:

| Three Months Ended June 30, 2014 | Six Months Ended June 30, 2014 | |||||||||||||||||||||||

| Stock Options |

Restricted Shares |

RSUs | Stock Options |

Restricted Shares |

RSUs | |||||||||||||||||||

| Stock-based award issuances |

— | 12,218 | 17,548 | — | 12,218 | 306,676 | ||||||||||||||||||

| Grant date fair value per share |

$ | — | $ | 26.19 | $ | 26.42 | $ | — | $ | 26.19 | $ | 24.13 | ||||||||||||

Included in the RSUs granted during the six months ended June 30, 2014 are 283,153 RSU awards that will vest based on both individual service requirements and the Company’s achievement of a specified performance goal. For these awards, the performance goal will be met at: (1) 50% rate on December 31, 2016 if the tangible book value of the Company, measured on a per share basis, has increased by an amount equal to a 6% compound annual growth rate over the three-year period beginning on January 1, 2014; (2) 100% rate if the tangible book value of the Company, measured on a per share basis, has increased by an amount equal to a 9% compound annual growth rate over the performance period; and (3) a proportional rate between 50% and 100% in the event the tangible book value of the Company, measured on a per share basis, has increased by an amount between a 6% and a 9% compound annual growth rate over the performance period. In the event the tangible book value of the Company, measured on a per share basis, has not increased by an amount equal to a 6% compound annual growth rate over the performance period, no performance share units will be earned and the award will be forfeited. During the six months ended June 30, 2014, compensation was recognized based on the Company’s assessment that the awards would vest at a 50% rate.

The following table presents the unrecognized compensation related to unvested options to purchase stock, restricted shares of common stock, and RSUs and the weighted average vesting period in which the expense will be recognized:

| As of June 30, 2014 | ||||||||||||

| Stock Options |

Restricted Shares |

RSUs | ||||||||||

| Unrecognized compensation |

$ | 48 | $ | 296 | $ | 14,674 | ||||||

| Unvested awards |

36,418 | 12,218 | 1,949,952 | |||||||||

| Weighted average vesting period |

0.58 years | 0.93 years | 1.64 years | |||||||||

In addition, as part of the Company’s satisfaction of incentive compensation earned for past service under the Company’s variable compensation programs, employees may receive RSUs in lieu of cash payments. These RSUs are issued to an irrevocable trust for the benefit of the employees and are not returnable to the Company. In settlement of such accrued incentive compensation, for the six months ended June 30, 2014, the Company granted 294,843 of such RSUs with an aggregate fair value upon grant date of $7,317. For the six months ended June 30, 2013, the Company granted 127,978 comparable RSUs with an aggregate fair value upon grant date of $2,099.

19

Table of Contents

8. Related Party Transactions:

Professional Services Agreement

Under a professional services agreement with Crestview Partners, L.P., the Company agreed to pay Crestview Advisors, L.L.C. a $1,000 annual strategic advisory fee plus reimbursement of reasonable out-of-pocket expenses as long as Crestview continued to own at least 50% of the shares purchased by certain Crestview affiliates in the Company’s 2006 private offering. During the fourth quarter of 2013, the Company repurchased 736,781 shares from Crestview representing its remaining shares of the Company’s common stock. Accordingly, subsequent to these share repurchases the Company no longer had any obligations under the professional services agreement with Crestview. In June 2013, Crestview elected to receive a portion of the management fee in options to purchase shares of the Company’s common stock as allowed for under the agreement. Based on Crestview’s election, the Company issued 32,432 options to Crestview Advisors, L.L.C. valued at $270. During the three and six months ended June 30, 2013, the Company recognized $250 and $500, respectively, of expense associated with this agreement.

9. Discontinued Operations:

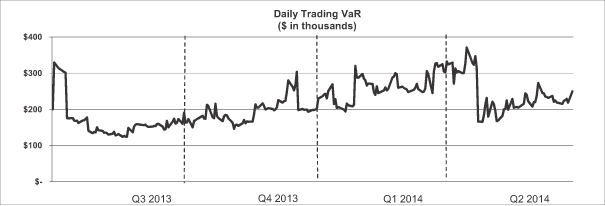

The Company completed the sale of the FBR Funds, a family of mutual funds, in October 2012. Subsequent to the sale closing, the Company has had no continuing involvement in the management of these funds. As a result of this sale transaction, the Company has reported the results of its asset management operations as discontinued operations.