Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNEDISON, INC. | sunedisonform8-k6302014pre.htm |

| EX-99.1 - PRESS RELEASE - SUNEDISON, INC. | exhibit991-6302014pressrel.htm |

Second Quarter 2014 Results Conference Call August 7, 2014

Safe Harbor 2 With the exception of historical information, the matters disclosed in this presentation are forward-looking statements. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties are described in the Company’s filings with the Securities and Exchange Commission (SEC), including its 2013 Form 10-K and its Forms 10-Q for 2Q’14, 1Q’14, 3Q’13, 2Q’13 and 1Q’13, in addition to the risks and uncertainties described on page 3 of this presentation. These forward-looking statements represent the Company’s judgment as of the date of this presentation. The Company disclaims, however, any intent or obligation to update these forward-looking statements. This presentation also includes non-GAAP financial measures. You can find a reconciliation of the non-GAAP financial measures to the most directly comparable GAAP financial measures in our results press release filed on Form 8-K today with the SEC and posted in the Investor Relations portion of our web site at www.SunEdison.com.

Forward-Looking Statements 3 Certain matters discussed in this presentation and conference call are forward-looking statements, including that for the third quarter of 2014, the company expects solar energy systems sold total non-GAAP sales volume to be in the range of 70 MW to 80 MW, solar energy systems MW retained on the balance sheet to be between 200 MW and 230 MW, total solar energy systems completed to be between 270 MW and 310 MW, and that fully developed solar energy systems average project pricing to be between $2.60/watt and $3.00/watt; that for the 2014 full year, the company expects solar energy systems sold total non-GAAP sales volume to be in the range of 290 MW to 320 MW, solar energy systems MW retained on the balance sheet to be between 710 MW and 830 MW, total energy systems completed to be between 1,000 MW and 1,150 MW, and total solar energy systems average project pricing to be between $2.50/watt and $3.00/watt and that the company estimates compound annual growth rate through 2014 of 95%. Such statements involve certain risks and uncertainties that could cause actual results to differ materially from those in the forward-looking statements. Potential risks and uncertainties include concentrated project development risks related to large scale solar projects; the availability of attractive project finance and other capital for Solar Energy projects; market demand for our products and services; changes in the pricing environment for silicon wafers and polysilicon, as well as solar power systems; the availability and size of government and economic incentives to adopt solar power, including tax policy and credits and renewable portfolio standards; the ability to effectuate and realize the savings from the restructuring plan; our ability to maintain adequate liquidity and compliance with our debt covenants; the need to impair long lived assets or other intangible assets due to changes in the carrying value or realizability of such assets; the effect of any antidumping or countervailing duties imposed on photovoltaic cells and/or modules in connection with any trade complaints in the United States, Europe or elsewhere; the result of any Chinese government investigations of unfair trade practices in connection with polysilicon exported from the United States or South Korea into China; changes to accounting interpretations or accounting rules; existing or new regulations and policies governing the electric utility industry; our ability to convert solar project pipeline into completed projects in accordance with our current expectations; dependence on single and limited source suppliers; utilization of our manufacturing volume and capacity; the terms of any potential future amendments to or terminations of our long-term agreements with our solar wafer customers or any of our suppliers; general economic conditions, including interest rates; the ability of our customers to pay their debts as they become due; changes in the composition of worldwide taxable income and applicable tax laws and regulations, including our ability to utilize any net operating losses; failure of third-party subcontractors to construct and install our solar energy systems; quarterly fluctuations in our Solar Energy business; the impact of competitive products and technologies; inventory levels of our customers; supply chain difficulties or problems; interruption of production; outcome of pending and future litigation matters; good working order of our manufacturing facilities; our ability to reduce manufacturing and operating costs; assumptions underlying management's financial estimates; actions by competitors, customers and suppliers; changes in the retail industry; damage to our brand; acquisitions of pipeline in our Solar Energy segment; changes in product specifications and manufacturing processes; changes in financial market conditions; changes in foreign economic and political conditions; changes in technology; changes in currency exchange rates; with respect to the separation of the semiconductor business, SunEdison Semiconductor Limited, and initial public offering of TerraForm Power, Inc.: (i) the expected use of the proceeds received; and (ii) we may be involved in various conflicts of interest which could be resolved in a manner unfavorable to us; we may not be able to achieve some or all of the expected benefits; and other risks described in the company’s filings with the Securities and Exchange Commission; and we are exposed to risks associated with certain obligations to TerraForm associated with the initial portfolio, future Call Right Projects and interests in additional clean energy projects. These forward-looking statements represent the company’s judgment as of the date of this press release. The company disclaims, however, any intent or obligation to update these forward-looking statements.

Quarter Overview 4 Completed 218 MW in 2Q’14 • Exceeded high end of guidance range • 475 MW under construction at end of 2Q Retained 164 MW; ~50 MW above guidance midpoint • Represents an estimated $330 million in retained value ‒ Capturing $185 million of additional value above foregone gross margin Gross pipeline additions were 902 MW; Pipeline now at 4.3 GW • Backlog grew to 1.1 GW • Added ~ 130 projects in USA, UK, Africa, India Closed financings for growth and project retention • $600 million convertible bond offering • Successful IPO of SunEdison Semiconductor

SUNE Benefits From TERP Success 5 Terraform IPO completed on July 23 • SUNE retains 64% of ownership • Current yield < 3% due to projected forward growth rate, 20 year average contracted cash flows, high counterparty credit, low commodity price risk SUNE development engine enables future TERP growth • Solar market growth continues to be robust • SUNE demonstrating 90% CAGR 2009-2014 ‒ Strong and growing pipeline supports call rights and ROFO project obligations to TERP Cost of capital advantage accrues to SUNE • MLP/Yieldco Cost of Equity = Current Yield + Forward Growth Rate • Typical MLPs have a 8-10% Cost of Equity • Incentive as Sponsor to ensure TERP CAFD growth per unit of 15% ‒ Targeted high growth should allow low current yields into the future

2Q 2014 Results Review 6 2Q Highlights Total MW completions above guidance Exceeded plan for MWs held on balance sheet • Retained value $330 million • $185 million above foregone margin ASP above guidance • Favorable geographic mix Key Metrics 2Q 2014 Outlook 2Q 2014 Actual Solar Energy Systems MW Sold (Non-GAAP) 60 to 80 54 Solar Energy Systems MW Retained on Balance Sheet 100 to 120 164 Solar Energy Systems Total MW Completions 160 to 200 218 Fully-Developed Solar Energy Systems Avg. Price ($/Wdc) $2.85 to $3.15 $3.33 Note: Unaudited

Solar Energy (Non-GAAP) 7 Note: Unaudited 4Q’13 1Q’14 2Q’14 4Q’13 1Q’14 2Q’14 MW Sold 206 76 54 333 150 218 MW Retained 127 74 164 0 0 0 Total MW Completed 333 150 218 333 150 218 Revenue ($M) 749 372 343 1,138 553 845 Gross Margin ($M) 40 13 5 139 38 150 Gross margin % 5% 3% 2% 12% 7% 18% OpEx ($M) 131 100 115 131 100 115 Op Profit ($M) (91) (87) (110) 8 (62) 35 Retained Value ($M) 257 122 330 Net Value Created ($M) 160 35 220 Foregone Rev ($M) 389 181 502 Foregone Margin ($M) 99 25 145 Actuals Pro Forma (Assumes all MWs sold) Pro Forma illustrates results if all projects completed are sold to 3 rd parties Retaining projects on balance sheet captures incremental value

Global MW Completions Proven Track Record of Strong Growth 8 Note: Unaudited Global solar market expected to show 17% CAGR through 20201 • SUNE positioned to capture a disproportionate share SUNE core markets growing 30% CAGR 2012 -20162 Commercial & Industrial: 39% CAGR 2012-20162 • Focus on DG and international markets will enable growth to 2017 and beyond Continued future growth expected in project completions • 2015: > 1.5 GW • 2016: > 2.0 GW CAGR 95% 1 Source: 2012-2017 installations based on IHS, GTM and SunEdison 2 Source: Bloomberg New Energy Finance 0 200 400 600 800 1,000 1,200 1,400 2009 2010 2011 2012 2013 2014E MW Range

Conversion %1 10% 40% 60% 90% Cycle Time -Utility -DG 24 – 36 months 6 – 12 months 23.8 4.7 3.2 1.1 Leads Qualified Leads Pipeline Backlog ~2.4 GW ~1.9 GW ~1.9 GW Origination: • Global footprint • DG segment • Utility segment • Repeat business Underwriting • Project finance • Legal & corporate • Technical Execution • D&E and EPC • Financing • Asset management • 100% completion Distinct Capabilities and Alignment Lead to High Conversion Volume ~1.0 GW 7.2 GW Produces Visibility into 7.2 GW of Growth 1 Conversions based on SunEdison’s historical conversion rates from each category. 2 Pipeline equals 4.3 GW and excludes Qualified Leads and Leads High Velocity Engine Driving Continued Growth Conversion Weighted tility G

Solar Project Activity Pipeline by Region Pipeline by Size 4.3 GWdc Pipeline Up 684 MW from 1Q’14 902 MW gross additions in 2Q’14 475 MWdc Under Construction Up from 463 MW in 1Q’14 due mostly to addition of several large projects. 218 MWdc Completed Solar Project Pipeline & Installations 10 US 46% EMEA & LA 24% Emerging Markets 24% Canada 6% MWdc Note: Unaudited 49 169 74 91 45 51 75 206 76 54 5 41 12 25 127 74 164 147 104 117 73 135 200 558 504 463 475 - 100 200 300 400 500 600 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 2012 2013 2014 Retained on Bal Sheet Sold Under Construction * MW Sold, MW’s Retained on Balance Sheet and MW under construction include percentage of completion (POC) 10 ≤ MW <50 26% 1 ≤ MW <10 10% MW <1 5% MW≥100 30% 50 ≤ MW <100 29% US 46% Canada 6% EMEA & LA 24% Markets 24%

1.1 GW Backlog 4.3 GW Pipeline Solar Project Backlog 11 Pipeline: A project with a signed or awarded PPA or other energy off-take agreement or has achieved each of the following three items: site control, an identified interconnection point with interconnection cost estimate, and executed energy off-take agreement or the determination that there is a reasonable likelihood that an energy off-take agreement will be signed. Backlog: A project with an executed PPA or other energy off-take agreement, such as a FiT. Pipeline 75% Backlog 14% 475 MWdc (11%) Under Construction USA 52% Canada 10% North America Projects • 12 (301 MWdc) US utility • 473 (265 MWdc) US DG • 9 (104 MWdc) Canada Emerging 24% EMEA/LatAm 14% dc dc Backlog up 99 MW Q/Q • Additions in USA & India partially offset by completions in UK Note: Unaudited 475 MW of Backlog was Under Construction at quarter end • All backlog projects have signed PPA of FiT • Most expected to be completed in the next 24 months

$175M Call Right CAFD Commitment Estimated SUNE Value SUNE Value from CAFD Commitment: Illustrative 12 IPO 2015 Post-Drop Down 1 2016 Post Drop Down 2 $282 $100 $182 $75 $107 Key Assumptions: • $0.90/share dividend at IPO, $1.71/share pro forma after meeting the $175m CAFD commitment • TERP acquires call right assets at 8-10% equity yield financed with 35% equity, 65% project-level debt • Assets are acquired by TERP for 50% cash / 50% equity contribution. SUNE ownership at IPO (64%) drops to approximately 60% following the satisfaction of CAFD commitment. • TERP valued based on 3% dividend yield @ 85% of CAFD (1) Assumes 60% SUNE ownership At IPO Drop Down Value After Commitment Future Drop downs $2.9B (1) $2.0B $4.9B Creating Value

Progress Towards $175 M CAFD Commitment 13 $68 $79 $86 0% 25% 50% 75% 100% $0 $25 $50 $75 $100 May 29: S-1 July IPO Roadshow August 7 CAFD Identified in Call Right Projects ($M) % of $175M commitment

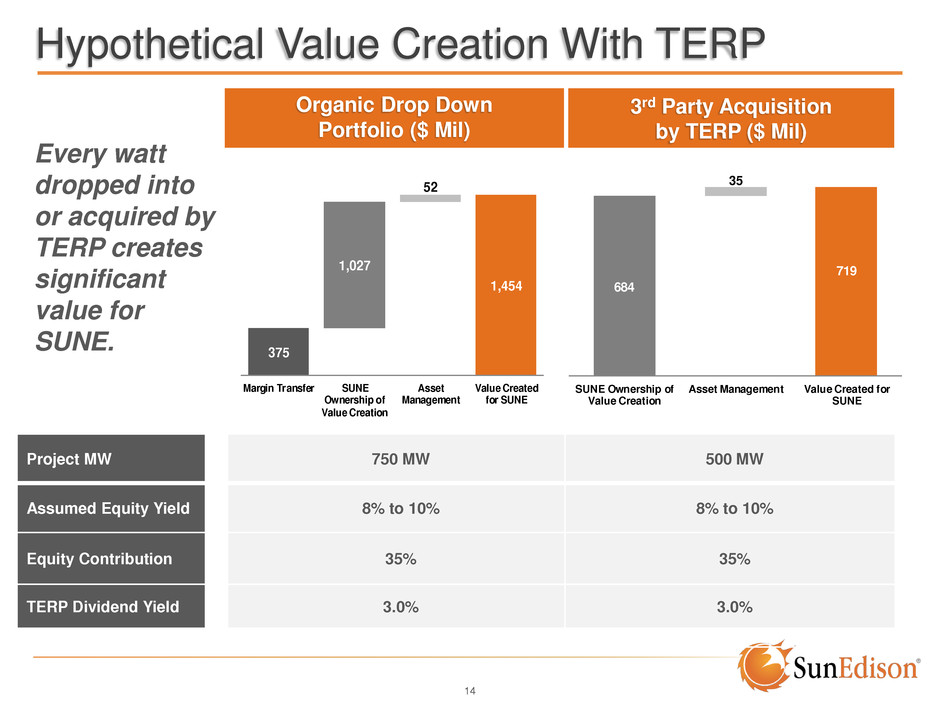

Organic Drop Down Portfolio ($ Mil) 3rd Party Acquisition by TERP ($ Mil) 14 Project MW 750 MW 500 MW Assumed Equity Yield 8% to 10% 8% to 10% Equity Contribution 35% 35% TERP Dividend Yield 3.0% 3.0% Every watt dropped into or acquired by TERP creates significant value for SUNE. Hypothetical Value Creation With TERP 375 375 1,027 1,454 52 Margin Transfer SUNE Ownership of Value Creation Asset Management Value Created for SUNE 684 684 35 719 SUNE Ownership of Value Creation Asset Management Value Created for SUNE

SunEdison Value Proposition 15 Global Platform • Strength in Utility and DG across a number of geographies • 211 MW on SUNE balance sheet at 6/30 (not designated for dropdown to TERP) TerraForm & Other Vehicles • 64% TERP ownership, IDRs, cost of capital • Other potential public vehicles (emerging markets, securitizations, etc.) Services • Recurring revenues with 2.3 GW managed as of 6/30 Technology / IP • FBR and CCZ • Opportunities to monetize technology in the future SunEdison Semiconductor • 57% ownership valued ~ $397 million as of 6/30

Strong financing activity to fund project development & acquisition: • $235M proceeds from Solar Energy system financing, net • $535M Convertible Debt Issuance, net • $150M TERP Acquisition Facility addition SSL 2Q ending cash balance is $115M Solar Cash Walk 16 (77) 409 (487) Note: Unaudited Cash: Cash above includes cash and cash equivalents and cash committed for construction projects. 98 150 535 235 $1,015 2Q Ending Cash - excluding SSL Other Operating / Financing (10) SSL IPO Proceeds SMP & Project Acquisitions (242) TERP Acquisition Facility Convert - 2020 CapEx (53) Solar System Financing, net Solar Systems Construction (325) Net Working Capital 23 1Q Ending Cash - excluding SSL $604

41 419 417 473 385 400 2,981 1,015 3,053 Balance Sheet & Liquidity – Solar Only 17 ($ Millions) Assets Liabilities / Equity $1,015 M cash & cash equivalents • $176 M cash committed for construction projects Debt: • Non-Recourse Solar Energy Systems Project Debt • Supported by underlying Solar Energy System Revenue • Excluded from leverage covenant in LC Facility covenants • Equity-linked convertible debt also excluded from leverage covenant in LC Facility Note: Unaudited Cash: Cash above includes cash and cash equivalents and cash committed for construction projects. • SSL Balance Sheet is not included above. Total SSL debt at 06/30/14 is $208M. Cash Solar Energy Systems (PPE) Convert-(2018) Convert-(2020) Convert-(2021) SMP Credit Facility - NR TERP Acquisition Facility -NR Solar Energy Systems Project Debt- NR Other Solar Recourse Debt

Guidance: Moving Mix Towards Retaining Projects 18 Key Metrics 3Q 2014 Forecast FY 2014 Forecast Comments Prior Current Solar Energy Systems MW Sold (Non-GAAP) 70 to 80 460 to 580 290 to 320 Retaining more as % of total Solar Energy Systems MW Retained on Balance Sheet 200 to 230 440 to 570 710 to 830 Driving higher retained value Solar Energy Systems Total MW Completions 270 to 310 900 to 1,150 1,000 to 1,150 Nearly doubling Year over Year Fully-Developed Solar Energy Systems Avg. Price ($/Wdc) $2.60 to $3.00 $2.40 to $2.75 $2.50 to $3.00 ASP primarily a function of geographic and product mix

Appendix

2Q 2014 Summary Results 20 Adjustments to GAAP are related to direct sale and financing sale-leaseback solar projects Non-GAAP net income excludes $47.6 million, or $0.18 per share, of fair value adjustments related to convertible note related derivatives. Note: Unaudited. See non-GAAP to GAAP reconciliation included in our earnings press release filed on Form 8-K dated 5/8/2014 ($ Millions, except per share) Semiconductor Materials Solar Energy SunEdison GAAP Non-GAAP Adjustments (Solar Energy) SunEdison Non-GAAP Net Sales 214.6$ 431.6$ 646.2$ (88.7)$ 557.5$ Gross Profit 25.8 (0.2) 25.6 Gross Margin% 4.0% 4.6% Operating Expenses 134.5 - 134.5 Operating Income (Loss) 1.0 (109.7) (108.7) (0.2) (108.9) Operating Margin % 0.5% -25.4% -16.8% -19.5% Other Expense / (Income) (6.1) (61.1) (67.2) Loss Before Tax (102.6) 60.9 (41.7) Income Tax Expense / (Income) (43.0) (14.0) (57.0) Equity in Earnings of JVs/Noncontrolling Interest 18.4 - 18.4 Net Income (Loss) (41.2)$ 74.9$ 33.7$ Diluted Earnings (Loss) per Share (0.16)$ 0.28$ 0.12$

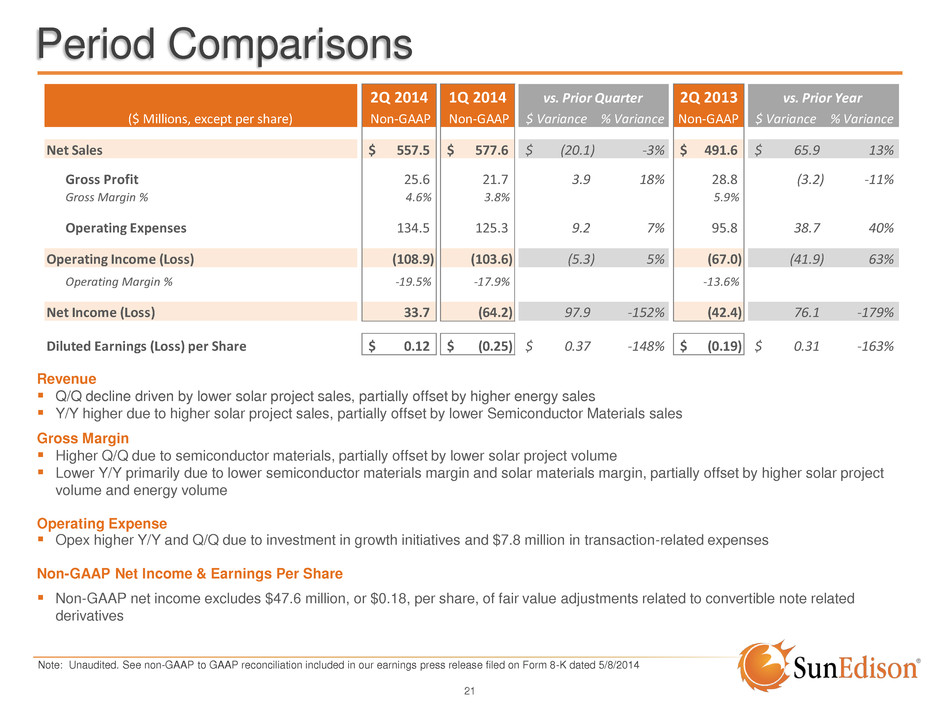

Period Comparisons 21 Revenue Q/Q decline driven by lower solar project sales, partially offset by higher energy sales Y/Y higher due to higher solar project sales, partially offset by lower Semiconductor Materials sales Gross Margin Higher Q/Q due to semiconductor materials, partially offset by lower solar project volume Lower Y/Y primarily due to lower semiconductor materials margin and solar materials margin, partially offset by higher solar project volume and energy volume Operating Expense Opex higher Y/Y and Q/Q due to investment in growth initiatives and $7.8 million in transaction-related expenses Non-GAAP Net Income & Earnings Per Share Non-GAAP net income excludes $47.6 million, or $0.18, per share, of fair value adjustments related to convertible note related derivatives Note: Unaudited. See non-GAAP to GAAP reconciliation included in our earnings press release filed on Form 8-K dated 5/8/2014 2Q 2014 1Q 2014 2Q 2013 ($ Millions, except per share) Non-GAAP Non-GAAP $ Variance % Variance Non-GAAP $ Variance % Variance Net Sales 557.5$ 577.6$ (20.1)$ -3% 491.6$ 65.9$ 13% Gross Profit 25.6 21.7 3.9 18% 28.8 (3.2) -11% Gross Margin % 4.6% 3.8% 5.9% Operating Expenses 134.5 125.3 9.2 7% 95.8 38.7 40% Operating Income (Loss) (108.9) (103.6) (5.3) 5% (67.0) (41.9) 63% Operating Margin % -19.5% -17.9% -13.6% Net Income (Loss) 33.7 (64.2) 97.9 -152% (42.4) 76.1 -179% Diluted Earnings (Loss) per Share 0.12$ (0.25)$ 0.37$ -148% (0.19)$ 0.31$ -163% vs. Prior Quarter vs. Prior Year

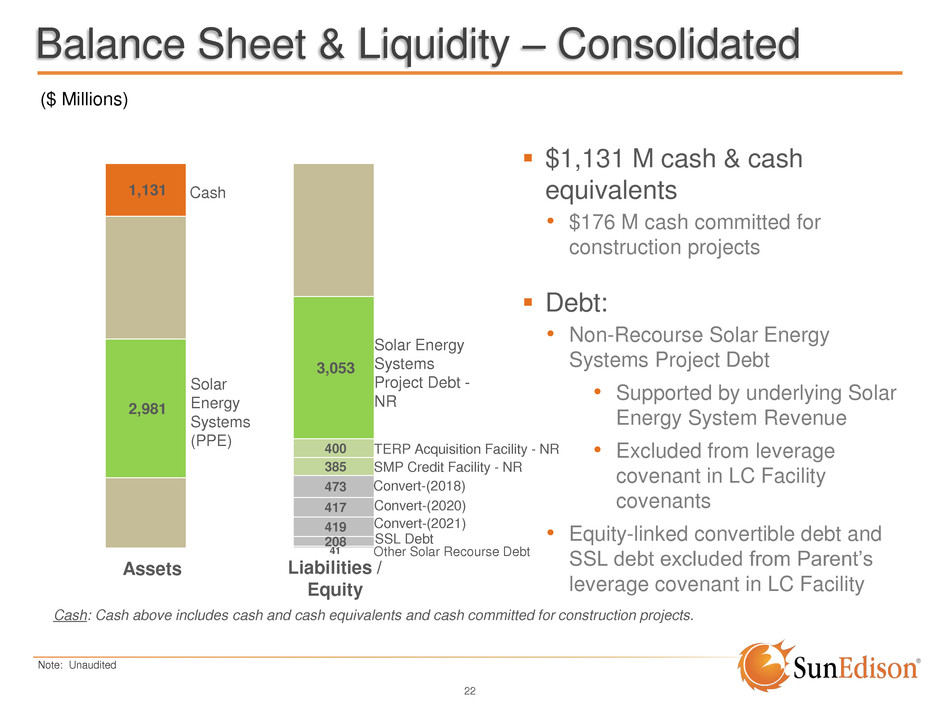

41 208 419 417 473 385 400 2,981 1,131 3,053 Balance Sheet & Liquidity – Consolidated 22 ($ Millions) Assets Liabilities / Equity $1,131 M cash & cash equivalents • $176 M cash committed for construction projects Debt: • Non-Recourse Solar Energy Systems Project Debt • Supported by underlying Solar Energy System Revenue • Excluded from leverage covenant in LC Facility covenants • Equity-linked convertible debt and SSL debt excluded from Parent’s leverage covenant in LC Facility Note: Unaudited Cash: Cash above includes cash and cash equivalents and cash committed for construction projects. Cash Solar Energy Systems (PPE) Convert-(2018) Convert-(2020) Convert-(2021) SMP Credit Facility - NR TERP Acquisition Facility - NR Solar Energy Systems Project Debt - NR SSL Debt Other Solar Recourse Debt

Segment Cash Flow 23 *2011 metrics are un-adjusted Note: Unaudited Semiconductor ($ Millions) Materials For the Quarter ending Jun. 30, 2014 Net (Loss) Income (65.3)$ 14.1$ (51.2)$ Depreciation & Amortization 62.0 29.8 91.8 Stock Compensation 4.1 1.7 5.8 Loss on Convertible Notes Derivatives, net 47.6 0.0 47.6 Gain on Previously Held Equity Investment (145.7) 0.0 (145.7) Accounts Receivable (2.8) (7.6) (10.4) Inventory/Solar Energy Systems 77.7 (2.1) 75.6 Accounts Payable & Accrueds 26.2 (12.6) 13.6 Deferred Revenue 11.4 0.0 11.4 Other Operating 55.3 (133.7) (78.4) Taxes, net (23.9) (14.8) (38.7) Operating Cash Flow 46.6 (125.2) (78.6) Capital Expenditures (52.6) (22.3) (74.9) Construction of PV Systems (325.3) 0.0 (325.3) PV System Financing & Capital Lease Obligations, net 385.1 0.0 385.1 Proceeds from Noncontrolling Interests 13.5 0.0 13.5 Free Cash Flow 67.3 (147.5) (80.2) Cash Committed to Construction Projects 2.1 0.0 2.1 R stricted Cash & Other 344.2 225.2 569.4 Total Cash Flow 413.6$ 77.7$ 491.3$ Solar Energy SunEdison