Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CrossAmerica Partners LP | d771574d8k.htm |

CST Brands

and Lehigh Gas Partners Investor Conference Call

CST Brands’

Strategic Acquisition of

LGP’s General Partner and IDRs

August 7, 2014

Exhibit 99.1 |

Safe Harbor

Statements Safe Harbor for Forward-Looking Statements

Statements

contained

in

this

presentation

that

state

the

companies’

or

their

respective

managements’

(CST

Brands,

Lehigh Gas Partners or affiliates) expectations or predictions of the future are

forward-looking. The words “believe,” “expect,”

“should,”

“intends,”

“estimates,”

and other similar expressions identify forward-looking statements. It is

important to note that actual results could differ materially from those projected in such

forward-looking statements. Statements regarding the proposed transactions

between CST Brands and Lehigh Gas Corporation and associated parties, the timing and

costs related to such transaction, the ability to achieve strategic or financial results associated

with

the

transactions,

future

opportunities

and

other

statements

related

to

CST

Brands

and

Lehigh

and

these

transactions also may constitute forward-looking statements.

For more information concerning factors that could cause actual results to differ from those

expressed or forecasted, see CST Brands’

and Lehigh Gas Partners LP’s filings with the Securities and Exchange Commission

(“SEC”), including the Risk Factors in the most recently filed Annual Report

on Form 10-K or Quarterly Report on Form 10-Q as filed with the

SEC

and

available

on

CST

Brands’

website

at

www.cstbrands.com

,

the

Lehigh

Gas

Partners

LP

website

at

www.lehighgaspartners.com

or

the

Securities

and

Exchange

Commission

website

at

www.sec.gov.

If

any

of

these

risks

or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual

results may vary significantly from what we projected. Any forward-looking

statement you see or hear during this presentation reflects our current views

as

of

the

date

of

this

presentation

with

respect

to

future

events.

Neither

CST

Brands

or

Lehigh

Gas

Partners

undertake any obligation to publicly update or revise these forward-looking statements for

any reason, whether as a result of new information, future events, or otherwise.

1 |

CST Brands and

Lehigh Gas Partners Overview

•

CST Brands

–

Based in San Antonio, Texas

–

Ranks 266 in Fortune 500

–

One of the largest independent retailers of motor fuels and

convenience merchandise in North America

–

Strong urban footprint of nearly 1,900 locations throughout nine

southwestern states in the U.S. and six provinces in eastern Canada

–

CST Corner Stores sell primarily Valero sourced fuels and signature products such as Fresh

Choices baked and packaged goods

–

In Canada, CST is the exclusive provider of Ultramar fuel in Canada, and its Dépanneur

du Coin and Corner Stores sell signature Transit Café

coffee and pastries

•

Lehigh Gas Partners (LGP)

–

Based in Allentown, Pennsylvania

–

A leading wholesale distributor of motor fuels and owner and

lessor of real estate used in the retail distribution of motor fuels

–

Distributes fuel to nearly 1,100 locations and owns or leases more

than 625 sites in sixteen states primarily across the eastern U.S.

–

Distributes several major brands of fuel, including Exxon, Mobil,

BP, Shell, Chevron, Sunoco, Valero, Gulf and Citgo

CST Brands

Lehigh Gas Partners

2

* -

LGO –

Lehigh Gas Ohio, LLC is currently a private

affiliate of LGP

•

U.S. company operated = 1,044

•

U.S. dealer/agents = 3

•

CAN company operated = 279

•

CAN dealer/agents = 498

•

CAN cardlock = 73

•

Company operated = 87

•

Independent dealers = 445

•

Lessee dealers = 255

•

Commission agents = 68

•

Affiliated dealers (LGO*) = 238 |

Transaction

Overview 3

Post Closing Result:

Lehigh Gas

Partners (LGP)

General Partner

(GP)

Lehigh Gas

Corporation (LGC)

A

B

C

A

B

C

Joe Topper

*“IDRs”

are Incentive Distribution Rights that provide for incentive cash distributions from LGP as

its limited partner distributions per unit increase IDRs*

CST purchases the General Partner of LGP for $500k in cash

CST purchases the IDRs* ($16.5 million in cash and the remainder

in CST common shares

at approximately 2.04 million shares, a combined current value of $85 million)

At closing, CST will elect Joe Topper to the Board of CST, and he will remain as LGP’s

President and CEO

•

CST owns 100% of the GP & IDR interests in LGP

•

CST will control LGP through its 100% ownership of the GP

•

Topper and other insiders will continue to own approximately 44%

of the LP interests in LGP

•

Public ownership of LGP units will continue to be approximately

56% |

Post Closing

Structure General Partner

Lehigh Gas

Partners LP

NYSE: LGP

Operating

Subsidiaries

CST Brands

NYSE: CST

100%

IDR

Interest

Topper and

other insiders

Public

Unitholders

44%

Ownership

Interest

100%

Ownership Interest

4

56%

Ownership

Interest

•

LGP will to continue to be a separate, publicly traded MLP

•

No change in ownership of common or subordinated units

of LGP as a result of the transaction

•

CST Brands expects to receive an ownership interest in LGP

common units over time as partial consideration for drop-

down assets

100%

Controlling

Interest |

•

CST Brands

–

Provides CST with a growth vehicle to fund future expansion

–

Provides CST Brands with infrastructure for the development and maintenance of a

wholesale fuel supply business, new store growth and a front seat in a consolidating

industry

•

Lehigh Gas Partners

–

Transforms LGP into a “sponsored”

MLP

–

Provides LGP with more than 5 years of drop-down opportunities from CST’s U.S.

wholesale fuel supply business and New-To-Industry (NTI) real property

assets •

“Best”

of both organizations –

c-store operations, wholesale fuel distribution

and M&A expertise

•

Enhances both organizations’

goals of increasing total shareholder and

unitholder returns

Strategic Rationale Overview

5 |

•

Provides CST access to the MLP capital markets to fuel organic growth

•

Partially monetizes the multiple disparity between C-corp and MLP structures

•

CST acquires IDRs that should increase in cash flow in the coming years

–

IDRs reach the “high splits”

sooner than if CST Brands had created its own MLP

capital structure

•

CST benefits from value creation at LGP through its ownership of

common units

received as partial consideration for asset drop-downs

–

CST receives cash flow from distributions on its LGP common units

•

Positions CST and LGP to expand their core operations through third-party

acquisitions

–

Flexible capital structure allows for cash or equity consideration to sellers

–

Management team experienced in executing M&A transactions

•

CST avoids the market risk, expense and management time associated with a

potential MLP IPO

•

Increases the geographic and brand diversity of CST’s current portfolio

Benefits for CST Shareholders

6 |

•

Provides for both greater certainty of and an increased rate of future

distribution growth

–

Greater certainty of drop-down asset acquisitions versus third-party

acquisitions •

Creates an enhanced platform with which to pursue third-party acquisitions

jointly with CST

•

Lessens over time LGP’s concentration with LGO (a private affiliate) and

increase its concentration with CST (a publicly traded company)

•

Increases the geographic and brand diversity of LGP’s current portfolio

Benefits for LGP Unitholders

7 |

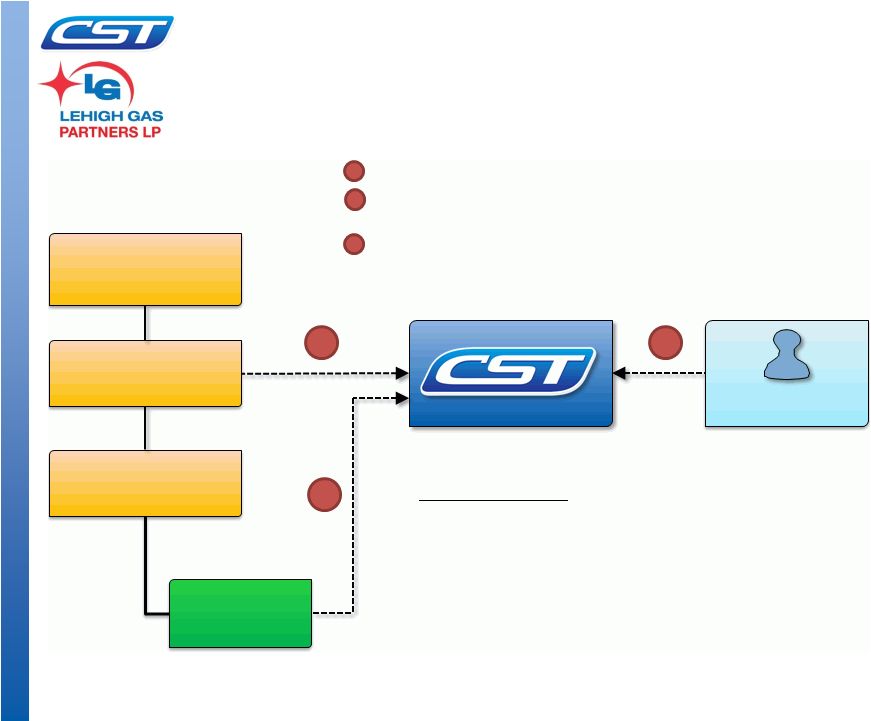

Future

Potential Asset Drop Activity Between CST and LGP

CST Brands, Inc.

NYSE: CST

General Partner

and IDRs

Lehigh Gas Partners LP

NYSE: LGP

New construction (NTI) of real

property is dropped (sold) to LGP

at fair market value

CST receives cash (at least 75%)

and LP units (maximum of 25%)

Equity in CST’s Wholesale Fuel

Supply business is dropped (sold)

to

LGP

(over

time

–

5+

years)

at

fair market value

CST receives cash (at least 75%)

and LP units (maximum of 25%)

CST receives on-going income

from distributions related to the

IDRs and from the LP units CST

received in the drop (sales)

transactions in A and B above

100% ownership interest

100% controlling interest

B

C

A

A

A

B

B

C

8 |

Post Closing

Network Footprint* 9

CST

Brands

(U.S.)

-

1,047

sites

CST

Brands

(CAN)

-

850

sites

Lehigh

Gas

Partners

(LGP)

-

1,093

sites

*Pro Forma site count as of 06/30/14

•

Pro forma combined entities to have a coast-to-coast national network of assets

|

Post Closing

Fuel Brands and Statistics*

10

* Statistics

include

LGP

acquisitions

pro

forma

as

of

06/30/14.

Total

site

count

includes

both

retail

and

distribution

sites.

CST Before

CST / LGP Combined

CST Brands

Lehigh Gas

Partners

CST/LGP

Combined

$12.8

$3.5

$16.3

Annual Volume (gallons in

billions)

2.9

1.0

3.9

Total Sites

1,894

1,093

2,987

Network Footprint (U.S. states

and Canadian provinces)

15

16

31

•

Creates a platform with meaningful relationships with multiple major oil suppliers

Annual Revenues ($ in billions) |

CST Operations

and Investments Potential Annual Cash Flow

Existing:

multiplied by 3-5 cents per gallon*

$57 -

$95 million*

Annually incremental:

investment per year on 30 U.S. NTI locations (2013 est.) multiplied

by 7.5% capitalization rate

$7.5 million

Annually incremental:

NTI locations multiplied by 3-5 cents per gallon

$3 -

$5 million

11

CST Brands’

“MLPable”

Asset

Drop-Down Options

* -

Existing fuel supply is expected to be dropped (sold) to LGP over a 5+ year timeframe

1.9 billion gallons of fuel distributed through U.S. in 2013

$100 million in real property capital

100 million of gallons per year on 30 U.S.

•

The following is for illustrative purposes only and is subject to the LGP Conflicts

Committee and CST Board approval

•

CST expects to drop-down assets for cash (minimum 75% of consideration) and

LGP common units |

Post Closing

Operational Responsibilities

12

CST U.S.

Operations

CST Brands, Inc.

Lehigh Gas

Partners LP

•

CST manages and runs all C-

store operations

•

CST manages merchandising in

all C-store locations

•

All employees are CST

employees –

sharing one

culture and one mission –

to

Delight More Customers

Everyday

•

CST U.S. will continue to

receive income from the U.S.

Wholesale Fuel Supply

business it has not dropped

(sold) to LGP

CST creates shareholder value from:

•

LGP manages all U.S.

wholesale fuel operations

•

LGP manages the U.S. dealer /

agent network

•

LGP leases real property and

receives lease income to both

CST operated stores, that have

been dropped (sold) into LGP,

and third parties

•

U.S. C-Store operations

•

Canadian operations (no changes)

•

Cash flow from the drop-downs

(sales) of CST’s Wholesale Fuel Supply

business (over a 5+ year time frame)

•

Cash flow from drop-downs (sales) of

newly constructed real property

•

On-going income and cash flow from

IDRs and the common units CST

receives as partial consideration from

the above described asset drop-

downs (sales) |

Other Deal

Considerations •

Expected close: Early fourth quarter 2014

–

Both CST and LGP’s credit facilities and banks will require consent / modification as

a condition to close

–

Other customary conditions to closing

•

CST Brands’

Tax Matters Agreement restrictions (outlined in CST’s 8K filed on

May 1, 2013) still apply

–

The following restrictions expire on May 1, 2015

o

Restrictions on sales of assets existing on spin date (May 1, 2013)

o

Restrictions on stock repurchases (except certain open market repurchases)

o

Restrictions on stock issuances

o

Restrictions on corporate restructuring

–

Form and timing of this transaction complies with the Tax Matters Agreement and

these short-term restrictions will not delay implementation of our long-term

strategic plans

13

This transaction has the potential to “unlock”

$300 -

$500 million

in

value for CST shareholders while also providing LGP unitholders the

benefits of a sponsored MLP structure |