Attached files

Property Management

Beal and Company, Inc., 177 Milk Street, Boston, Massachusetts 02109-3410

617 451-2100 Fax 617 451-1801

July 17, 2012

Arthur H. Tinkelenberg, PhD

President and CEO

Enumeral Biomedical Corp.

1450 Broadway, 245h Floor

New York, New York 10018

| Re: | Enumeral Biomedical Corp. – One Kendall Square |

Dear Arthur:

Enclosed for your files please find one (1) fully-executed counterpart of the Lease by and between Enumeral Biomedical Corp., as Tenant, and RB Kendall Fee, LLC, as Landlord, dated July 16, 2012, with respect to Enumeral’s space at One Kendall Square, Cambridge, Massachusetts.

As you know, the Lease required delivery of the Letter of Credit with execution. Debbie Howitt Easton provided you with a form of the LC that is satisfactory to Landlord. Therefore, I am sending the enclosed Lease to you on the condition that by Wednesday, July 25th we will receive the original Letter of Credit in a form that has been approved by Landlord.

Also before Tenant occupies the premises, please provide the certificate of insurance to Erin Orpik, the Senior Property Manager at the Property.

Please contact me with any questions or comments.

| Sincerely, | |

| /s/ Deliris Colon | |

| Deliris Colon | |

| Lease Administrator |

:dc

Enclosure

| cc: | Jonathan M. Lourie, Esquire (w/enc.) |

| Erin S. Orpik, Senior Property Manager (w/o enc.) |

| Deborah Howitt Easton, Esquire (w/o enc.) |

EXHIBIT 1, SHEET 1

Building No. 400, One Kendall Square

Cambridge, Massachusetts

(the “Building”)

| Execution Date: | July 16, 2012 |

| Tenant: | Enumeral Biomedical Corp. |

| A Delaware corporation | |

| Mailing Address: | One Kendall Square, Cambridge, Massachusetts 02139 |

| Landlord: | RB Kendall Fee, LLC |

| Mailing address: | c/o The Beal Companies LLP, 177 Milk Street, Boston, Massachusetts 02109 |

| Attn: Senior Vice President – Asset Management | |

| Building: | Building No.400 in One Kendall Square in the City of Cambridge, Middlesex |

| County, Commonwealth of Massachusetts |

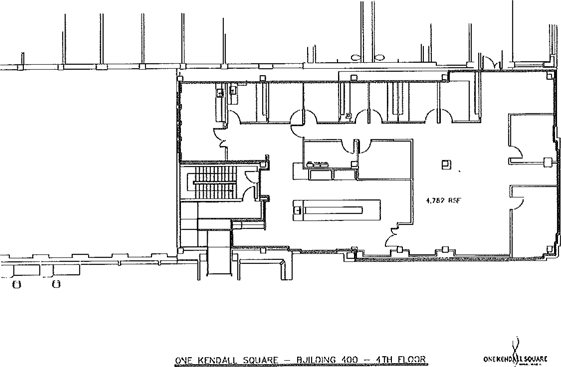

| Art. 2 | Premises: An area on the fourth (4th) floor of the Building, substantially as shown on Lease Plan, Exhibit 2. |

| Art. 3.1 | Term Commencement Date: October 1, 2012 |

| Art. 3.2 | Termination Date: November 30, 2015 |

| Art. 5 | Use of Premises: Laboratory, research and development and general office use and for no other purposes except in accordance with the terms of the Lease. |

Yearly Rent/Monthly Rent:

| Time Period | Yearly Rent | Monthly Rent | P.S.F. | |||||||||

| October 1, 2012 - September 30, 2013 | $ | 224,754.00 | * | $ | 18,729,50 | * | $ | 47.00 | ||||

| October 1, 2013 – September 30, 2014 | $ | 229,536.00 | $ | 19,128.00 | $ | 48.00 | ||||||

| October 1, 2014 – September 30, 2015 | $ | 248,664.00 | $ | 20,722.00 | $ | 52.00 | ||||||

| October 1, 2015 – November 30, 2015 | $ | 253,446.00 | $ | 21,120.50 | $ | 53.00 | ||||||

* Notwithstanding the foregoing, so long as Tenant is not in default of this Lease beyond any applicable notice and cure period(s), Tenant shall be entitled to an abatement of the Monthly Installments of the Yearly Rent (but not Tenant’s Operating Expense Excess or Tax Excess or other amounts due hereunder, to the extent same are payable pursuant hereto), or so-called “free rent” period, for the month of October, 2012

| Art. 7 | Total Rentable Area: 4,782 square feet |

Total Rentable Area of Building No.400: 20,319 square feet

Total Rentable Area of Complex: 639,586 square feet

| Art. 8 | Electric current will be furnished by Landlord to Tenant |

| Art. 9 | Operating and Taxes: |

Tenant’s Proportionate Common Share: 0.75%

Tenant’s Proportionate Building Share: 23.53%

Art. 29.3 Broker: NAI Hunneman, for Tenant, and Cassidy Turley FHO, for Landlord

Art. 29.5 Arbitration: Massachusetts; Superior Court

Art. 29.13 Security Deposit: $26,129.65 in the form of a Letter of Credit in accordance with Article 29.13

Art. 29.14 Parking Spaces: Four (4) spaces

Art. 29.15 Option to Extend Term: One (1) three (3) year term as set forth in Article 29.15

| 1. | REFERENCE DATA | 1 | |

| 2. | DESCRIPTION OF DEMISED PREMISES | 1 | |

| 2.1 | Demised Premises | 1 | |

| 2.2 | Appurtenant Rights | 1 | |

| 2.3 | Exclusions and Reservations | 2 | |

| 3. | TERM OF LEASE | 2 | |

| 3.1 | Definitions | 2 | |

| 3.2 | Habendum | 2 | |

| 3.3 | Declaration Fixing Term Commencement Date | 2 | |

| 4. | READINESS FOR OCCUPANCY-ENTRY BY TENANT PRIOR TO TERM COMMENCEMENT DATE | 3 | |

| 4.1 | Acceptance of Premises | 3 | |

| 4.2 | Tenant’s Work | 3 | |

| 5. | USE OF PREMISES | 3 | |

| 5.1 | Permitted Use | 3 | |

| 5.2 | Prohibited Uses | 3 | |

| 5.3 | Licenses and Permits | 3 | |

| 6. | RENT | 4 | |

| 7. | RENTABLE AREA | 4 | |

| 8. | SERVICES FURNISHED BY LANDLORD | 4 | |

| 8.1 | Electric Current | 4 | |

| 8.2 | Water | 6 | |

| 8.3 | Elevators, Heat and Cleaning | 6 | |

| 8.4 | Air Conditioning | 6 | |

| 8.5 | Additional Heat and Air Conditioning Services | 7 | |

| 8.6 | Additional Air Conditioning Equipment | 7 | |

| 8.7 | Repairs | 7 | |

| 8.8 | Interruption or Curtailment of Services | 7 | |

| 8.9 | Energy Conservation | 8 | |

| 8.10 | Access | 8 | |

| 9. | ESCALATION | 8 | |

| 9.1 | Definitions | 8 | |

| 9.2 | Tax Share | 12 | |

| 9.3 | Operating Expense Share | 12 | |

| 9.4 | Part Years | 13 | |

| 9.5 | Effect of Taking | 13 | |

| 9.6 | Survival | 13 | |

| 9.7 | Tenant Audit Right | 13 | |

| 10. | CHANGES OR ALTERATIONS BY LANDLORD | 14 | |

| 11. | FIXTURES, EQUIPMENT AND IMPROVEMENTS-REMOVAL BY TENANT | 14 | |

| 12. | ALTERATIONS AND IMPROVEMENTS BY TENANT | 15 | |

| 13. | TENANT’S CONTRACTORS-MECHANICS’ AND OTHER LIENS-STANDARD OF TENANT’S PERFORMANCE-COMPLIANCE WITH LAWS | 15 | |

| 14. | REPAIRS BY TENANT-FLOOR LOAD | 16 | |

| 14.1 | Repairs by Tenant | 16 | |

| 14.2 | Floor Load-Heavy Machinery | 17 | |

| 15. | INSURANCE, INDEMNIFICATION, EXONERATION AND EXCULPATION | 17 | |

| 15.1 | General Liability Insurance | 17 | |

| 15.2 | Certificates of Insurance | 18 | |

| 15.3 | General | 18 | |

| 15.4 | Property of Tenant | 18 | |

| 15.5 | Bursting of Pipes, etc. | 19 | |

| 15.6 | Repairs and Alterations-No Diminution of Rental Value | 19 | |

| 15.7 | Landlord Insurance | 19 | |

| 16. | ASSIGNMENT, MORTGAGING AND SUBLETTING | 19 | |

| 16.1 | Generally | 19 | |

| 16.2 | Reimbursement, Recapture and Excess Rent | 21 | |

| 16.3 | Certain Transfers/Miscellaneous | 22 | |

| 17. | MISCELLANEOUS COVENANTS | 23 | |

| 17.1 | Rules and Regulations | 23 | |

| 17.2 | Access to Premises-Shoring | 23 | |

| 17.3 | Accidents to Sanitary and Other Systems | 24 | |

| 17.4 | Signs, Blinds and Drapes | 24 | |

| 17.5 | Estoppel Certificate and Financial Statements. | 25 | |

| 17.6 | Prohibited Materials and Property | 25 | |

| 17.7 | Requirements of Law-Fines and Penalties | 25 | |

| 17.8 | Tenant’s Acts—Effect on Insurance | 26 | |

| 17.9 | Miscellaneous | 26 | |

| 18. | DAMAGE BY FIRE, ETC. | 26 | |

| 19. | WAIVER OF SUBROGATION | 27 | |

| 20. | CONDEMNATION-EMINENT DOMAIN | 27 | |

| 21. | DEFAULT | 29 | |

| 21.1 | Conditions of Limitation-Re-Entry-Termination | 29 | |

| 21.2 | Intentionally Omitted | 29 | |

| 21.3 | Damages-Termination | 29 | |

| 21.4 | Fees and Expenses | 30 | |

| 21.5 | Waiver of Redemption | 30 | |

| 21.6 | Landlord’s Remedies Not Exclusive | 30 | |

| 21.7 | Grace Period | 31 | |

| 22. | END OF TERM-ABANDONED PROPERTY | 31 | |

| 23. | SUBORDINATION | 32 | |

| 24. | QUIET ENJOYMENT | 33 | |

| 25. | ENTIRE AGREEMENT-WAIVER-SURRENDER | 34 | |

| 25.1 | Entire Agreement | 34 | |

| 25.2 | Waiver by Landlord | 34 | |

| 25.3 | Surrender | 34 | |

| 26. | INABILITY TO PERFORM-EXCULPATORY CLAUSE | 34 | |

| 27. | BILLS AND NOTICES | 35 | |

| 28. | PARTIES BOUND-SEIZING OF TITLE | 36 | |

| 29. | MISCELLANEOUS | 36 | |

| 29.1 | Separability | 36 | |

| 29.2 | Captions, etc. | 36 | |

| 29.3 | Broker | 36 | |

| 29.4 | Modifications | 36 | |

| 29.5 | Arbitration | 37 | |

| 29.6 | Governing Law | 37 | |

| 29.7 | Assignment of Rents | 37 | |

| 29.8 | Representation of Authority | 37 | |

| 29.9 | Expenses Incurred by Landlord Upon Tenant Requests | 37 | |

| 29.10 | Survival | 38 | |

| 29.11 | Hazardous Materials | 38 | |

| 29.12 | Patriot Act | 39 | |

| 29.13 | Letter of Credit | 40 | |

| 29.14 | Parking | 41 | |

| 29.15 | Tenant’s Option to Extend the Term of the Lease | 42 | |

| 29.16 | Definition of Fair Market Rental Value | 42 | |

Exhibit 2 - Lease Plan

Exhibit 2A - Tenant’s Work Letter

Exhibit 3 - Plan of Complex

Exhibit 4 - Term Commencement Date Agreement

Exhibit 5 - Form of Letter of Credit

THIS INDENTURE OF LEASE made and entered into on the Execution Date as stated in Exhibit 1 and between the Landlord and the Tenant named in Exhibit 1.

Landlord and Tenant acknowledge and agree that as of the Execution Date Tenant leases approximately 1,746 square feet of space in Building 1400 in the Complex(the “Existing Premises”) pursuant to that certain Indenture of Lease dated April 28, 2011 (the “Prior Lease”). Landlord and Tenant agree that after the Term Commencement Date of this Lease, and no later than November 30, 2012, Tenant shall surrender the Existing Premises in accordance with the terms of the Prior Lease (including, without limitation, Section 29.11(f) ) and the Prior Lease shall be deemed terminated and of no further force and effect. In addition to Tenant’s obligations under this Lease (including the Monthly Rent obligations commencing November 1, 2012), Tenant shall remain liable to Landlord pursuant to the Prior Lease for any and all amounts due and payable or accrued on or before the date of surrender (including, without limitation, Monthly Rent provided therein) and for any amounts incurred by Landlord or due and payable under the Prior Lease in the event Tenant fails to quit and deliver up the Existing Premises as required herein. If requested by Landlord, Tenant shall execute such other documentation as Landlord may require to evidence the termination of the Prior Lease.

Landlord does hereby demise and lease to Tenant, and Tenant does hereby hire and take from Landlord, the premises hereinafter mentioned and described (hereinafter referred to as “Premises”), upon and subject to the covenants, agreements, terms, provisions and conditions of this Lease for the term hereinafter stated:

1. REFERENCE DATA

Each reference in this Lease to any of the terms and titles contained in any Exhibit attached to this Lease shall be deemed and construed to incorporate the data stated under that term or title in such Exhibit.

2. DESCRIPTION OF DEMISED PREMISES

2.1 Demised Premises. The Premises are that portion of the Building as described in Exhibit 1 (as the same may from time to time be constituted after changes therein, additions thereto and eliminations therefrom pursuant to rights of Landlord hereinafter reserved) and is hereinafter referred to as the “Building”, substantially as shown hatched or outlined on the Lease Plan (Exhibit 2) hereto attached and incorporated by reference as a part hereof. Landlord reserves the right, at its own cost and expense, to require Tenant, upon not less than sixty (60) days’ notice, to relocate its Premises elsewhere in the Building or Complex of which the Building is a part, to an area of substantially equivalent size, layout, construction, utility and finish as designated by Landlord and to include fixtures, appurtenances and leasehold improvements at least comparable in kind and quality to those contained in the Premises at the time Landlord gives its Relocation Notice. Any dispute between the parties as to whether the area designated by Landlord is “substantially equivalent” shall be submitted to arbitration pursuant to Article 29.5 hereof.

2.2 Appurtenant Rights. Tenant shall have, as appurtenant to the Premises, rights to use in common with others entitled thereto, subject to reasonable rules and regulations from time to time made by Landlord of which Tenant is given notice; (a) the common lobbies, hallways, stairways and elevators of the Building, serving the Premises in common with others, (b) common walkways necessary for access to the Building, and (c) if the Premises include less than the entire rentable area of any floor, the common toilets and other common facilities of such floor; and no other appurtenant rights or easements. Notwithstanding anything to the contrary herein or in the Lease contained, Landlord has no obligation to allow any particular telecommunication service provider to have access to the Building or to Tenant’s Premises. If Landlord permits such access, Landlord may condition such access upon the payment to Landlord by the service provider of fees assessed by Landlord in its sole discretion. During the term of the Lease, Tenant shall also have the right to use the 50kw emergency generator located on the roof of the Building that exclusively serves the Premises (the “Generator”). Tenant agrees to perform, at Tenant’s sole cost, all necessary maintenance, repair and replacements to the Generator to keep such Generator in good working order and repair at all times. Tenant shall keep in place at all times a service contract providing for routine maintenance of the Generator, Landlord may require Tenant to use a roofing contractor selected by Landlord to perform any work on the Generator that could damage, penetrate or alter the roof and Landlord may require anyone going on the roof to execute in advance a liability waiver satisfactory to Landlord.

| -1- |

2.3 Exclusions and Reservations. All the perimeter walls of the Premises except the inner surfaces thereof, any balconies (except to the extent same are shown as part of the Premises on the Lease Plan (Exhibit 2)), terraces or roofs adjacent to the Premises, and any space in or adjacent to the Premises used for shafts, stacks, pipes, conduits, wires and appurtenant fixtures, fan rooms, ducts, electric or other utilities, sinks or other Building facilities, and the use thereof, as well as the right of access through the Premises for the purposes of operation, maintenance, decoration and repair, are expressly excluded from the Premises and reserved to Landlord.

3. TERM OF LEASE

3.1 Definitions. As used in this Lease the words and terms which follow mean and include the following:

(a) Intentionally omitted

(b) “Term Commencement Date” - October 1, 2012

(c) “Complex” shall be defined as all of the Building, the other buildings, and the Common Areas serving such buildings, all located on the land (“Land”) shown outlined on Exhibit 3.

(d) “Common Areas” shall be defined as the common walkways, accessways, and parking facilities located on the Land and common facilities in the Complex, as the same may be changed, from time to time, including without limitation, alleys, sidewalks, lobbies, hallways, toilets, stairways, fan rooms, utility closets, shaftways, street entrances, elevators, wires, conduits, meters, pipes, ducts, vaults, and any other equipment, machinery, apparatus, and fixtures wherever located on the Land, in the Complex, in the buildings in the Complex or in the Premises that either (a) serve the Premises as well as other parts of the Land or Complex, or (b) serve other parts of the Land or Complex but not the Premises.

3.2 Habendum. TO HAVE AND TO HOLD the Premises for a term of years commencing on October 1, 2012 and ending at 11:59 p.m. on November 30, 2015 or on such earlier date upon which said term may expire or be terminated pursuant to any of the conditions of limitation or other provisions of this Lease or pursuant to law (which date for the termination of the terms hereof will hereafter be called “Termination Date”). Notwithstanding the foregoing, if the Termination Date as stated in Exhibit 1 shall fall on other than the last day of a calendar month, said Termination Date shall, at the option of Landlord, be deemed to be the last day of the calendar month in which said Termination Date occurs.

3.3 Declaration Fixing Term Commencement Date. Landlord and Tenant hereby agree to execute a Term Commencement Date Agreement substantially in the form attached hereto as Exhibit 4, or as otherwise reasonably requested by Landlord confirming the actual Term Commencement Date and Termination Date, once same are determined. As soon as may be after the execution date hereof, each of the parties hereto agrees, upon demand of the other party to join in the execution, in recordable form, of a statutory notice, memorandum, etc. of lease. If this Lease is terminated before the term expires, then upon Landlord’s request the parties shall execute, deliver and record an instrument acknowledging such fact and the date of termination of this Lease, and Tenant hereby appoints Landlord its attorney-in-fact in its name and behalf to execute such instrument if Tenant shall fail to execute and deliver such instrument after Landlord’s request therefor within ten (10) days. In no event shall this Lease be recorded or filed by Tenant with the Middlesex South Registry of Deeds or Middlesex South Registry District of the Land Court.

| -2- |

4. READINESS FOR OCCUPANCY-ENTRY BY TENANT PRIOR TO TERM COMMENCEMENT DATE

4.1 Acceptance of Premises. Tenant accepts the Premises "as is”, in the condition in which the Premises are in as of the Execution Date, without any obligation on the part of Landlord to complete any work in the Premises or to prepare or construct the Premises for Tenant’s occupancy and without any warranty or representation by Landlord as to the condition of the Premises, Building or Complex.

4.2 Tenant’s Work. Tenant shall perform, at its expense, and subject to the terms and conditions of this Lease, the work and installations necessary or desirable for Tenant to operate at the Premises (“Tenant’s Work”), Tenant shall complete the Tenant’s Work pursuant to the Work Letter attached hereto as Exhibit 2A. Tenant shall be liable for any damages or delays caused by Tenant’s activities at the Premises in connection with Tenant’s Work.

5. USE OF PREMISES

5.1 Permitted Use. Tenant shall during the term hereof occupy and use the Premises only for the purposes as stated in Exhibit 1 and for no other purposes. Service and utility areas (whether or not a part of the Premises) shall be used only for the particular purpose for which they were designed. Without limiting the generality of the foregoing, Tenant agrees that it shall not use the Premises or any part thereof, or permit the Premises or any part thereof to be used for the preparation or dispensing of food, whether by vending machines or otherwise. Notwithstanding the foregoing, but subject to the other terms and provisions of this Lease, Tenant may, with Landlord’s prior written consent, which consent shall not be unreasonably withheld, install at its own cost and expense so-called hot-cold water fountains, coffee makers and so-called Dwyer refrigerator-sink-stove combinations for the preparation of beverages and foods, provided that no cooking, frying, etc., are carried on in the Premises to such extent as requires special exhaust venting, Tenant hereby acknowledging that the Building is not engineered to provide any such special venting.

5.2 Prohibited Uses. Notwithstanding any other provision of this Lease, Tenant shall not use, or suffer or permit the use or occupancy of, or suffer or permit anything to be done in or anything to be brought into or kept in or about the Premises or the Building or any part thereof (including, without limitation, any materials, appliances or equipment used in the construction or other preparation of the Premises and furniture and carpeting): (i) which would violate any of the covenants, agreements, terms, provisions and conditions of this Lease or that are otherwise applicable to or binding upon the Premises; (ii) for any unlawful purposes or in any unlawful manner; (iii) which, in the reasonable judgment of Landlord shall in any way (a) impair the appearance or reputation of the Building; or (b) impair, interfere with or otherwise diminish the quality of any of the Building services or the proper and economic heating, cleaning, ventilating, air conditioning or other servicing of the Building or Premises, or with the use or occupancy of any of the other areas of the Building, or occasion discomfort, inconvenience or annoyance, or injury or damage to any occupants of the Premises or other tenants or occupants of the Building; or (iv) which is inconsistent with the maintenance of the Building as an office, laboratory, R&D building of the first class in the quality of its maintenance, use, or occupancy. Tenant shall not install or use any electrical or other equipment of any kind which, in the reasonable judgment of Landlord, might cause any such impairment, interference, discomfort, inconvenience, annoyance or injury.

5.3 Licenses and Permits. If any governmental license or permit shall be required for the proper and lawful conduct of Tenant’s business, and if the failure to secure such license or permit would in any way affect Landlord, the Premises, the Building or Tenant’s ability to perform any of its obligations under this Lease, Tenant, at Tenant’s expense, shall duly procure and thereafter maintain such license and submit the same to inspection by Landlord. Tenant, at Tenant’s expense, shall at all times comply with the terms and conditions of each such license or permit. Tenant shall furnish all data and information to governmental authorities and Landlord as required in accordance with legal, regulatory, licensing or other similar requirements as they relate to Tenant’s use or occupancy of the Premises or the Building.

| -3- |

6. RENT

During the term of this Lease, the Yearly Rent and other charges, at the rate stated in Exhibit 1, shall be payable by Tenant to Landlord by monthly payments, as stated in Exhibit 1, in advance and without demand on the first day of each month for and in respect of such month. The rent and other charges reserved and covenanted to be paid under this Lease shall commence on the Term Commencement Date. Notwithstanding the provisions of the next preceding sentence, Tenant shall pay the first monthly installment of rent on the execution of this Lease even if the rent payments commence later than the Term Commencement Date or if there is a free rent period. If, by reason of any provisions of this Lease, the rent reserved hereunder shall commence or terminate on any day other than the first day of a calendar month, the rent for such calendar month shall be prorated. The rent and all other amounts payable to Landlord at the address provided in Exhibit 1 to this Lease or, if Landlord shall so direct in writing, to Landlord’s agent or nominee, in lawful money of the United States which shall be legal tender for payment of all debts and dues, public and private, at the time of payment, at the office of the Landlord or such place as Landlord may designate, and the rent and other charges in all circumstances shall be payable without any setoff or deduction whatsoever, Rental and any other sums due hereunder not paid on or before the date due shall bear interest for each month or fraction thereof from the due date until paid computed at the annual rate of five percentage (5%) points over the so-called prime rate then currently from time to time charged to its most favored corporate customers by the largest national bank (N.A.) located in the city in which the Building is located, or at any applicable lesser maximum legally permissible rate for debts of this nature.

7. RENTABLE AREA

Total Rentable Area of the Premises, the Building and the Complex are agreed to be the amounts set forth in Exhibit 1. Landlord reserves the right, throughout the term of the Lease, to recalculate the Total Rentable Area of the Building and/or the Complex in the event of a physical change to the Building and/or Complex, such as, by way of example and not limitation, increases or decreases in the Common Areas or rentable areas within same, and not solely by reason of the re-measurement by Landlord of the same without a physical change.

8. SERVICES FURNISHED BY LANDLORD

8.1 Electric Current.

(a) As stated in Exhibit 1, Tenant will reimburse Landlord for the cost of all electric current utilized in the Premises (including all associated with the Generator) as measured by separate submeter(s) or checkmeter(s), as hereinafter set forth or Landlord shall require Tenant to contract with the company supplying electric current for the purchase and obtaining by Tenant of electric current directly from such company to be billed directly to, and paid for by, Tenant.

(b) Tenant shall reimburse Landlord for the entire cost of such electric current as follows:

(1) Commencing as of the Term Commencement Date and continuing until the procedures set forth in Paragraph 2 of this Article 8.1(b) are effected, Tenant shall pay to Landlord at the same time and in the same manner that it pays its monthly payments of Yearly Rent hereunder, estimated payments (i.e., based upon Landlord’s reasonable estimate) on account of Tenant’s obligation to reimburse Landlord for electricity consumed in the Premises.

| -4- |

(2) Periodically after the Term Commencement Date, Landlord shall determine the actual cost of electricity consumed by Tenant in the Premises (i.e. by reading Tenant’s submeter(s) and by applying an electric rate which shall not exceed the retail rate which would have been payable by Tenant had Tenant obtained electric services directly from the utility company providing electric current to Landlord.) If the total of Tenant’s estimated monthly payments on account of such period is less than the actual cost of electricity consumed in the Premises during such period, Tenant shall pay the difference to Landlord within thirty (30) days of when billed therefor. If the total of Tenant’s estimated monthly payments on account of such period is greater than the actual cost of electricity consumed in the Premises during such period, Tenant may credit the difference against its next installment of rental or other charges due hereunder, provided that any excess credit shall be repaid to Tenant within a reasonable time following the expiration of the Lease term provided Tenant is not in default under this Lease.

(3) After each adjustment, as set forth in Paragraph 2 above, the amount of estimated monthly payments on account of Tenant’s obligation to reimburse Landlord for electricity in the Premises shall be adjusted based upon the actual cost of electricity consumed during the immediately preceding period.

(c) Landlord, at any time, at its option and upon not less than thirty (30) days’ prior written notice to Tenant, may discontinue such furnishing of electric current to the Premises; and in such case Tenant shall contract with the company supplying electric current for the purchase and obtaining by Tenant of electric current directly from such company. In the event Tenant itself contracts for electricity with the supplier, pursuant to Landlord’s option as above stated, Landlord shall (i) permit its risers, conduits and feeders to the extent available, suitable and safely capable, to be used for the purpose of enabling Tenant to purchase and obtain electric current directly from such company, (ii) without cost or charge to Tenant, make such alterations and additions to the electrical equipment and/or appliances in the Building as such company shall specify for the purpose of enabling Tenant to purchase and obtain electric current directly from such company, and (iii) at Landlord’s expense, furnish and install in or near the Premises any necessary metering equipment used in connection with measuring Tenant’s consumption of electric current and Tenant, at Tenant’s expense, shall maintain and keep in repair such metering equipment.

(d) Whether or not Landlord is furnishing electric current to Tenant, if Tenant shall require electric current for use in the Premises in excess of such reasonable quantity to be furnished for such use as hereinabove provided and if (i) in Landlord’s reasonable judgment, Landlord’s facilities are inadequate for such excess requirements or (ii) such excess use shall result in an additional burden on the Building air conditioning system and additional cost to Landlord on account thereof, then, as the case may be, (x) Landlord, upon written request and at the sole cost and expense of Tenant, will furnish and install such additional wire, conduits, feeders, switchboards and appurtenances as reasonably may be required to supply such additional requirements of Tenant if current therefor be available to Landlord, provided that the same shall be permitted by applicable laws and insurance regulations and shall not cause damage to the Building or the Premises or cause or create a dangerous or hazardous condition or entail excessive or unreasonable alterations or repairs or interfere with or disturb other tenants or occupants of the Building or (y) Tenant shall reimburse Landlord for such additional cost, as aforesaid. Tenant acknowledges that it has been provided with an opportunity to confirm that the electric current serving the Premises will be adequate to supply its proposed permitted uses of the Premises.

(e) Landlord, at Tenant’s expense and upon Tenant’s request, shall purchase and install all replacement lamps of types generally commercially available (including, but not limited to, incandescent and fluorescent) used in the Premises.

(f) Landlord shall not in any way be liable or responsible to Tenant for any loss, damage or expense which Tenant may sustain or incur if the quantity, character, or supply of electrical energy is changed or is no longer available or suitable for Tenant’s requirements, subject to Section 8.8 below.

(g) Tenant agrees that it will not make any material alteration or material addition to the electrical equipment and/or appliances in the Premises without the prior written consent of Landlord in each instance first obtained, which consent will not be unreasonably withheld, and using contractor(s) approved by Landlord, and will promptly advise Landlord of any other alteration or addition to such electrical equipment and/or appliances.

| -5- |

8.2 Water. Landlord shall furnish hot and cold water for ordinary Premises, cleaning, toilet, lavatory and drinking purposes. If Tenant requires, uses or consumes water for any purpose other than for the aforementioned purposes, Landlord may (i) assess a reasonable charge for the additional water so used or consumed by Tenant or (ii) install a water meter and thereby measure Tenant’s water consumption for all purposes. In the latter event, Tenant shall pay the cost of the meter and the cost of installation thereof and shall keep said meter and installation equipment in good working order and repair. Tenant agrees to pay for water consumed, as shown on said meter, together with the sewer charge based on said meter charges, as and when bills are rendered, and on default in making such payment Landlord may pay such charges and collect the same from Tenant. All piping and other equipment and facilities for use of water outside the building core will be installed and maintained by Landlord at Tenant’s sole cost and expense.

8.3 Elevators, Heat and Cleaning. Landlord shall: (i) provide necessary elevator facilities (which may be manually or automatically operated, either or both, as Landlord may from time to time elect) on Mondays through Fridays, excepting Massachusetts and federal legal holidays, from 8:00 a.m. to 6:00 p.m. and on Saturdays, excepting legal holidays, from 8:00 a.m. to 1:00 p.m. (called “business days”) and have one (1) elevator in operation available for Tenant’s use, non-exclusively, together with others having business in the Building, at all other times; (ii) furnish heat (substantially equivalent to that being furnished in comparably aged similarly equipped office, laboratory, R&D buildings in the same city) to the Premises during the normal heating season on business days; (iii) cause the common areas of the Building to be cleaned on Monday through Friday (excepting Massachusetts or City of Cambridge legal holidays) in a manner consistent with cleaning standards generally prevailing in the comparable office, laboratory, R&D buildings in the City of Cambridge, and (iv) provide commercially reasonable twenty-four (24) hour security to the Building, after normal business hours in the form of roving security guards or such other security measures as Landlord reasonably deems appropriate. All costs and expenses incurred by Landlord in connection with foregoing services shall be included as part of the Operating Costs (as defined below). Tenant shall be responsible, at its sole cost and expense, for providing cleaning and janitorial services to the Premises in a neat and first-class manner consistent with the cleaning standards generally prevailing in the comparable buildings in the City of Cambridge or as otherwise reasonably established by Landlord in writing from time to time using an insured contractor or contractors selected by Tenant and approved in writing by Landlord and such provider shall not interfere with the use and operation of the Building or Complex by Landlord or any other tenant or occupant thereof. Landlord shall deliver in good condition and repair the base Building systems serving the Premises (including, without limitation, sanitary, electrical, heating, air conditioning, or other systems), subject to Section 8.7 below. Landlord shall also be responsible for the on-going maintenance, repair and replacement of said systems subject to inclusion in Operating Costs as hereinafter described. Tenant may elect to contract with Landlord’s cleaning service to clean the Premises in which case the cost of such service will be billed either directly to Tenant or through Operating Costs. Landlord shall provide a dumpster and/or compactor at in such location as Landlord may designate from time to time for Tenant’s use, in common with other tenants in the Complex, in discarding non-hazardous substances.

8.4 Air Conditioning. Landlord shall through the air conditioning equipment of the Building furnish to and distribute in the Premises air conditioning as normal seasonal changes may require on business days during the hours as aforesaid in Article 8.3 when air conditioning may reasonably be required for the comfortable occupancy of the Premises by Tenant. Tenant agrees to lower and close the blinds or drapes when necessary because of the sun’s position, whenever the air conditioning system is in operation, and to cooperate fully with Landlord with regard to, and to abide by all the reasonable regulations and requirements which Landlord may prescribe for the proper functioning and protection of the air conditioning system.

| -6- |

8.5 Additional Heat and Air Conditioning Services. Landlord will use reasonable efforts upon reasonable advance written notice from Tenant of its requirements in that regard, to furnish additional heat or air conditioning services to the Premises on days and at times other than as above provided. Tenant will pay to Landlord a reasonable charge for any such additional heat or air conditioning service required by Tenant.

8.6 Additional Air Conditioning Equipment. In the event Tenant requires additional air conditioning for business machines, meeting rooms or other special purposes, or because of occupancy or excess electrical loads, any additional air conditioning units, chillers, condensers, compressors, ducts, piping and other equipment, such additional air conditioning equipment will be installed, but only if, in Landlord’s reasonable judgment, the same will not cause damage or injury to the Building or create a dangerous or hazardous condition or entail excessive or unreasonable alterations, repairs or expense or interfere with or disturb other tenants. At Landlord’s sole election, such equipment will either be installed:

(a) by Landlord at Tenant’s expense and Tenant shall reimburse Landlord in such an amount as will compensate it for the cost incurred by it in operating, maintaining, repairing and replacing, if necessary, such additional air conditioning equipment. At Landlord’s election, such equipment shall (i) be maintained, repaired and replaced by Tenant at Tenant’s sole cost and expense, and (ii) throughout the term of this Lease, Tenant shall, at Tenant’s sole cost and expense, purchase and maintain a service contract for such equipment from a service provider approved by Landlord. Tenant shall obtain Landlord’s prior written approval of both the form of service contract and of the service provider; or

(b) by Tenant, subject to Landlord’s prior approval of Tenant’s plans and specifications for such work. In such event: (i) such equipment shall be maintained, repaired and replaced by Tenant at Tenant’s sole cost and expense, and (ii) throughout the term of this Lease, Tenant shall, at Tenant’s sole cost and expense, purchase and maintain a service contract for such equipment from a service provider approved by Landlord. Tenant shall obtain Landlord’s prior written approval of both the form of service contract and of the service provider.

8.7 Repairs. Except as otherwise provided in Articles 18 and 20, and subject to Tenant’s obligations in Article 14, Landlord shall repair, keep and maintain the roof, exterior walls, structural floor slabs, columns, elevators, public stairways and corridors, parking areas, parking deck, loading docks, public lavatories, and other common equipment (including, without limitation, sanitary, electrical, heating, air conditioning, or other systems) serving both the Building and the Common Areas in good condition and repair. Landlord shall keep the paved portions of the Common Areas reasonably free of ice and snow. All of the foregoing shall be included in Operating Costs as and to the extent provided in Article 9 below.

8.8 Interruption or Curtailment of Services. When necessary by reason of accident or emergency, or for repairs, alterations, replacements or improvements which in the reasonable judgment of Landlord are desirable or necessary to be made, or of difficulty or inability in securing supplies or labor, or of strikes, or of any other cause beyond the reasonable control of Landlord, whether such other cause be similar or dissimilar to those hereinabove specifically mentioned until said cause has been removed, Landlord reserves the right to interrupt, curtail, stop or suspend (i) the furnishing of heating, elevator, air conditioning, and cleaning services and (ii) the operation of the plumbing and electric systems. Landlord shall exercise reasonable diligence to eliminate the cause of any such interruption, curtailment, stoppage or suspension, but there shall be no diminution or abatement of rent or other compensation due from Landlord to Tenant hereunder, nor shall this Lease be affected or any of the Tenant’s obligations hereunder reduced, and the Landlord shall have no responsibility or liability for any such interruption, curtailment, stoppage, or suspension of services or systems. Notwithstanding the foregoing, Tenant shall be entitled to a proportionate abatement of Yearly Rent in the event of a Landlord Service Interruption (as defined below). For the purposes hereof, a “Landlord Service Interruption” shall occur in the event (i) the Premises shall lack any service which Landlord is required to provide hereunder thereby rendering the Premises untenantable for the entirety of the Landlord Service Interruption Cure Period (as defined below), (ii) such lack of service was not caused by Tenant, its employees contractors, invitees or agents; (iii) Tenant in fact ceases to use the entire Premises for the entirety of the Landlord Service Interruption Cure Period; and (iii) such interruption of service was the result of causes, events or circumstances within the Landlord’s reasonable control and the cure of such interruption is within Landlord’s reasonable control. For the purposes hereof, the “Landlord Service Interruption Cure Period” shall be defined as fifteen (15) consecutive business days after Landlord’s receipt of written notice from Tenant of the Landlord Service Interruption.

| -7- |

8.9 Energy Conservation. Notwithstanding anything to the contrary in this Article 8 or in this Lease contained, Landlord may institute, and Tenant shall comply with, such policies, programs and measures as may be necessary, required, or expedient for the conservation and/or preservation of energy or energy services, or as may be necessary or required to comply with applicable codes, rules regulations or standards.

8.10 Access. Subject to terms and conditions of this Lease, matters of force majeure, closures due to casualty or condemnation or necessary repairs, Landlord’s rules and regulations and reasonable security requirements as the same may be amended from time to time and of which Tenant has received prior written notice, Tenant shall have access to the Premises and all Common Areas and parking areas appurtenant to the Premises twenty-four (24) hours a day, seven (7) days a week. Landlord shall have the right to control access to the Building via card key access systems and/or other security systems on the entry doors thereto from time to time.

9. ESCALATION

9.1 Definitions. As used in this Article 9, the words and terms which follow mean and include the following:

(a) “Operating Year” shall mean a calendar year in which occurs any part of the term of this Lease.

(b) “Tenant’s Proportionate Building Share” shall initially be the figure as stated in Exhibit 1. Tenant’s Proportionate Building Share is the ratio of the Total Rentable Area of the Premises to the aggregate Total Rentable Area of the Building, from time to time. As changes or modifications to the Building occurs, Tenant’s Proportionate Building Share shall be adjusted to equal the then current ratio of the Total Rentable Area of the Premises to the aggregate Total Rentable Area within the Building which is then completed and as to which a certificate of occupancy is issued.

(c) “Tenant’s Proportionate Common Share” shall initially be the figure as stated in Exhibit 1. Tenant’s Proportionate Common Share is the ratio of the Total Rentable Area of the Premises to the aggregate Total Rentable Area, from time to time, of all buildings within the Complex which have been completed and for which a certificate of occupancy has been issued. As additional buildings are completed within the Complex, Tenant’s Proportionate Common Share shall be adjusted to equal the then current ratio of the Total Rentable Area of the Premises to the aggregate Total Rentable Area within the Complex which is then completed and as to which a certificate of occupancy is issued.

(d) “Taxes” shall mean the real estate taxes and other taxes, levies and assessments imposed upon the Building and the Common Areas of the Complex and upon any personal property of Landlord used in the operation thereof, or Landlord’s interest in the Building, the Common Areas, or such personal property; charges, fees and assessments for transit, housing, police, fire or other governmental services or purported benefits to the Building and/or the Common Areas; service or user payments in lieu of taxes; and any and all other taxes, levies, betterments, assessments and charges arising from the ownership, leasing, operating, use or occupancy of the Building, the Common Areas or based upon rentals derived therefrom, which are or shall be imposed by Federal, State, Municipal or other authorities. As of the Execution Date, “Taxes” shall not include any franchise, rental, income or profit tax, capital levy or excise, provided, however, that any of the same and any other tax, excise, fee, levy, charge or assessment, however described, that may in the future be levied or assessed as a substitute for or an addition to, in whole or in part, any tax, levy or assessment which would otherwise constitute “Taxes,” whether or not now customary or in the contemplation of the parties on the Execution Date of this Lease, shall constitute “Taxes,” but only to the extent calculated as if the Complex is the only real estate owned by Landlord. “Taxes” shall also include expenses of tax abatement or other proceedings contesting assessments or levies. The parties acknowledge that, as of the Execution Date, Taxes are based upon several separate tax bills affecting the Complex. Taxes shall be allocated by Landlord, in Landlord’s reasonable judgment, among the Building (the portion of Taxes allocable to the Building being referred to herein as “Building Taxes”), the other buildings of the Complex, and the Common Areas (the portion of Taxes allocable to the Common Areas being referred to herein as “Common Area Taxes”).

| -8- |

(e) “Tax Period” shall be any fiscal/tax period in respect of which Taxes are due and payable to the appropriate governmental taxing authority, any portion of which period occurs during the term of this Lease, the first such Period being the one in which the Term Commencement Date occurs.

(f) “Operating Costs”:

(1) Definition of Operating Costs. “Operating Costs” shall mean all costs incurred and expenditures of whatever nature made by Landlord in the operation and management, for repair and replacements, cleaning and maintenance of the Building, the Complex, and the Common Areas of the Complex including, without limitation, vehicular and pedestrian passageways related to the Complex, related equipment, facilities and appurtenances, elevators, cooling and heating equipment. In the event that Landlord or Landlord’s managers or agents perform services for the benefit of the Complex off-site which would otherwise be performed on-site (e.g., accounting), the cost of such services shall be reasonably allocated among the properties benefiting from such service and shall be included in Operating Costs. Landlord shall have the right but not the obligation, from time to time, to equitably allocate some or all of the Operating Costs among different tenants of the Building or properties (the “Cost Pools”). Such Cost Pools may include, but shall not be limited to, tenants that share particular systems or equipment or tenants that are similar users of particular systems or equipment such as by way of example but not limitation the office space tenants of the Building or properties, the laboratory or incubator tenants of the Building or properties and the retail space tenants of the Building or properties. Operating Costs shall include, without limitation, those categories of “Specifically Included Operating Costs,” as set forth below, but shall not include “Excluded Costs,” as hereinafter defined.

(2) Definition of Excluded Costs. “Excluded Costs” shall be defined as mortgage charges, brokerage commissions, salaries of executives and owners not directly employed in the management/operation of the Complex, the cost of work done by Landlord for a particular tenant for which Landlord has the right to be reimbursed by such tenant, and, subject to Subparagraph (3) below, such portion of expenditures as are not properly chargeable against income. In addition, the following items shall also be “Excluded Costs”: (a) amounts reimbursed or paid to Landlord directly by other tenants of the Building (including Tenant), from insurance proceeds or pursuant to any warranty; (b) any debt service related to indebtedness secured in whole or in part by the Building or the Land; (c) costs, fines or penalties incurred due to violations by Landlord or any management company employed by Landlord of any leases or any governmental laws, rules or regulations; (d) franchise or income taxes imposed upon Landlord; (e) leasing commissions and other costs of marketing space in the Building; (f) depreciation on the Building and equipment; (g) the cost of tenant installations incurred in connection with preparing premises for a new tenant; (h) salaries of personnel above the grade of General Manager or Senior Property Manager (and/or such other grade or title of any person performing property management functions); (i) legal fees incurred in connection with any negotiation or enforcement of any space lease in the Building; (j) costs and expenses incurred in connection with the creation of a mortgage or in connection with the refinancing of a mortgage or the sale of the Building or the Land or any portion thereof; (k) the cost of electrical energy furnished and paid directly to Tenant or any other tenant of the Building; (1) amounts paid on account of tort claims relating to personal injury or property damage (excluding commercially reasonable deductibles); (m) the cost of any special work or service performed for or facilities furnished to a tenant which are not generally offered or available to other tenants of the Building; (n) reserves; (o) any capital expenditures other than as expressly provided herein; and (p) any rent loss or other bad debt.

| -9- |

(3) Capital Expenditures.

(i) Replacements. If, during the term of this Lease, Landlord shall replace any capital items or make any capital expenditures (collectively called “capital expenditures”) the total amount of which is not properly includible in Operating Costs for the Operating Year in which they were made, there shall nevertheless be included in such Operating Costs and in Operating Costs for each succeeding Operating Year the amount, if any, by which the Annual Charge-Off (determined as hereinafter provided) of such capital expenditure (less insurance proceeds, if any, collected by Landlord by reason of damage to, or destruction of the capital item being replaced) exceeds the Annual Charge-Off of the capital expenditure for the item being replaced.

(ii) New Capital Items. If a new capital item is acquired which does not replace another capital item which was worn out, has become obsolete, etc., then there shall be included in Operating Costs for each Operating Year in which and after such capital expenditure is made the Annual Charge-Off of such capital expenditure.

(iii) Annual Charge-Off. “Annual Charge-Off” shall be defined as the annual amount of principal and interest payments which would be required to repay a loan (“Capital Loan”) in equal monthly installments over the Useful Life, as hereinafter defined, of the capital item in question on a direct reduction basis at an annual interest rate equal to the Capital Interest Rate, as hereinafter defined, where the initial principal balance is the cost of the capital item in question. Notwithstanding the foregoing, if Landlord reasonably concludes on the basis of engineering estimates that a particular capital expenditure will effect savings in Building operating expenses including, without limitation, energy- related costs, and that such projected savings will, on an annual basis (“Projected Annual Savings”), exceed the Annual Charge-Off of such capital expenditure computed as aforesaid, then and in such events, the Annual Charge-Off shall be increased to an amount equal to the Projected Annual Savings; and in such circumstances, the increased Annual Charge-Off (in the amount of the Projected Annual Savings) shall be made for such period of time as it would take to fully amortize the cost of the capital item in question, together with interest thereon at the Capital Interest Rate as aforesaid, in equal monthly payments, each in the amount of one-twelfth (1/12th) of the Projected Annual Savings, with such payments being applied first to interest and the balance to principal.

(iv) Useful Life. “Useful Life” shall be reasonably determined by Landlord in accordance with generally accepted accounting principles and practices in effect at the time of acquisition of the capital item.

| -10- |

(v) Capital Interest Rate. “Capital Interest Rate” shall be defined as an annual rate of either one percentage point over the AA Bond rate (Standard & Poor’s corporate composite or, if unavailable, its equivalent) as reported in the financial press at the time the capital expenditure is made or, if the capital item is acquired through third-party financing, then the actual (including fluctuating) rate paid by Landlord in financing the acquisition of such capital item.

(4) Specifically included Categories of Operating Costs. Operating Costs shall include, but not be limited to, the following:

Taxes (other than real estate taxes): Sales, Federal Social Security, Unemployment and Old Age Taxes and contributions and State Unemployment taxes and contributions accruing to and paid by the Landlord on account of all employees of Landlord and/or Landlord’s managing agent, who are employed in, about or on account of the Complex, except that taxes levied upon the net income of the Landlord and taxes withheld from employees, and “Taxes” as defined in Article 9.1(d) shall not be included herein.

Water: All charges and rates connected with water supplied to the Building and related sewer use charges.

Heat and Air Conditioning: All charges connected with heat and air conditioning supplied to the Building.

Wages: Wages and cost of all employee benefits of all employees of the Landlord and/or Landlord's managing agent who are employed in, about or on account of the Building.

Cleaning: The cost of labor (including third party janitorial contracts), supplies, tools and material for cleaning the Building and Complex.

Elevator Maintenance: All expenses for or on account of the upkeep and maintenance of all elevators in the Building.

Management Fee: The cost of professional management of the Complex, the fee for which shall not exceed five percent (5%) of the gross revenue of the Complex.

Administrative Costs: The commercially reasonable cost of office expense for the management of the Complex, including, without limitation, rent, business supplies and equipment.

Electricity: The cost of all electric current for the operation of any machine, appliance or device used for the operation of the Premises and the Building, including the cost of electric current for the elevators, lights, air conditioning and heating, but not including electric current which is paid for directly to the utility by the user/tenant in the Building or for which the user/tenant reimburses Landlord. (If and so long as Tenant is billed directly by the electric utility for its own consumption as determined by its separate meter, or billed directly by Landlord as determined by a check meter, then Operating Costs shall include only Building and public area electric current consumption and not any demised Premises electric current consumption.) Wherever separate metering is unlawful, prohibited by utility company regulation or tariff or is otherwise impracticable, relevant consumption figures for the purposes of this Article 9 shall be determined by fair and reasonable allocations and engineering estimates made by Landlord.

| -11- |

Insurance, etc.: Fire, casualty, liability, rent loss and such other insurance as may from time to time be required by lending institutions on first-class office, laboratory, R&D buildings in the City or Town wherein the Building is located and all other expenses customarily incurred in connection with the operation and maintenance of first-class office, laboratory, R&D buildings in the City or Town wherein the Building is located including, without limitation, insurance deductible amounts.

(5) Definitions of Building Operating Costs and Common Area Operating Costs. “Building Operating Costs” shall be defined as the amount of Operating Costs allocable to the Building in any Operating Year. “Common Area Operating Costs” shall be defined as the amount of Operating Costs allocable to the Common Areas in any Operating Year. All Operating Costs incurred by Landlord in respect of the Complex shall be allocated, in Landlord’s reasonable judgment, among the Building, the other buildings of the Complex, and the Common Areas.

(6) Gross-Up Provision. Notwithstanding the foregoing, in determining the amount of Operating Costs for any calendar year or any portion thereof falling within the term, if less than ninety-five percent (95%) of the Rentable Area of the Building shall have been occupied by tenants at any time during the period in question, then, at Landlord’s election, Operating Costs for such period shall be adjusted to equal the amount Operating Costs would have been for such period had occupancy been ninety-five percent (95%) throughout such period. The extrapolation of Operating Costs under this paragraph shall be performed by appropriately adjusting the cost of those components of Operating Costs that are impacted by changes in the occupancy of the Building.

9.2 Tax Share. Commencing as of the Term Commencement Date and continuing thereafter with respect to each Tax Year occurring during the term of the Lease, Tenant shall pay to Landlord, with respect to any Tax Period, the sum of: (x) Tenant’s Proportionate Building Share of Building Taxes for such Tax Period, plus (y) Tenant’s Proportionate Common Share of Common Area Taxes for such Tax Period, such sum being hereinafter referred to as “Tax Share”. Tax Share shall be due when billed by Landlord. In implementation and not in limitation of the foregoing, Tenant shall remit to Landlord pro rata monthly installments on account of projected Tax Share, calculated by Landlord on the basis of the most recent Tax data or budget available. If the total of such monthly remittances on account of any Tax Period is greater than the actual Tax Share for such Tax Period, Landlord may credit the difference against the next installment of rental or other charges due to Landlord hereunder. If the total of such remittances is less than the actual Tax Share for such Tax Period, Tenant shall pay the difference to Landlord within thirty (30) days of when billed therefor.

Appropriate credit against Tax Share shall be given for any refund obtained by reason of a reduction in any Taxes by the Assessors or the administrative, judicial or other governmental agency responsible therefor, The original computations, as well as reimbursement or payments of additional charges, if any, or allowances, if any, under the provisions of this Article 9.2 shall be based on the original assessed valuations with adjustments to be made at a later date when the tax refund, if any, shall be paid to Landlord by the taxing authorities. Expenditures for reasonable legal fees and for other similar or dissimilar expenses incurred in obtaining the tax refund may be charged against the tax refund before the adjustments are made for the Tax Period.

9.3 Operating Expense Share. Commencing as of the Term Commencement Date and continuing thereafter with respect to each Operating Year occurring during the term of the Lease, Tenant shall pay to Landlord, with respect to any Operating Year, the sum of: (x) Tenant’s Proportionate Building Share of Building Operating Costs for such Operating Year, plus (y) Tenant’s Proportionate Common Share of Common Operating Costs for such Operating Year, such sum being hereinafter referred to as “Operating Expense Share”. In implementation and not in limitation of the foregoing, Tenant shall remit to Landlord pro rata monthly installments on account of projected Operating Expense Share, calculated by Landlord on the basis of the most recent Operating Costs data or budget available. If the total of such monthly remittances on account of any Operating Year is greater than the actual Operating Expense Share for such Operating Year, Landlord may credit the difference against the next installment of rent or other charges due to Landlord hereunder. If the total of such remittances is less than actual Operating Expense Share for such Operating Year, Tenant shall pay the difference to Landlord within thirty (30) days of when billed therefor.

| -12- |

9.4 Part Years. If the Term Commencement Date or the Termination Date occurs in the middle of an Operating Year or Tax Period, Tenant shall be liable for only that portion of the Operating Expense or Tax Share as the case may be, in respect of such Operating Year or Tax Period represented by a fraction, the numerator of which is the number of days of the herein term which falls within the Operating Year or Tax Period and the denominator of which is three hundred sixty-five (365), or the number of days in said Tax Period, as the case may be.

9.5 Effect of Taking. In the event of any taking of the Building or the land upon which it stands under circumstances whereby this Lease shall not terminate under the provisions of Article 20 then, Tenant’s Proportionate Building Share and Tenant’s Proportionate Common Share shall be adjusted appropriately to reflect the proportion of the Premises and/or the Building remaining after such taking.

9.6 Survival. Any obligations under this Article 9 which shall not have been paid at the expiration or sooner termination of the term of this Lease shall survive such expiration and shall be paid when and as the amount of same shall be determined to be due.

9.7 Tenant Audit Right. Landlord shall permit Tenant, at Tenant’s expense and during normal business hours, but only one time with respect to any Operating Year, to review Landlord’s invoices and statement relating to the Operating Costs for the applicable Operating Year for the purpose of verifying the Operating Costs and Tenant’s share thereof; provided that notice of Tenant’s desire to so review is given to Landlord not later than thirty (30) days after Tenant receives an annual statement from Landlord, and provided that such review is thereafter commenced and prosecuted by Tenant with due diligence. Any Operating Costs statement or accounting by Landlord shall be binding and conclusive upon Tenant unless (i) Tenant duly requests such review within such 30-day period, and (ii) within three (3) months after such review request, Tenant shall notify Landlord in writing that Tenant disputes the correctness of such statement, specifying the particular respects in which the statement is claimed to be incorrect. Tenant shall have no right to conduct a review or to give Landlord notice that it desires to conduct a review at any time Tenant is in default under the Lease. The accountant conducting the review shall (i) be a qualified lease auditor approved by Landlord (such approval not to be unreasonably withheld) having at least five (5) years applicable experience, and (ii) be compensated on an hourly basis and shall not be compensated based upon a percentage of overcharges it discovers. No subtenant shall have any right to conduct a review, and no assignee shall conduct a review for any period during which such assignee was not in possession of the Premises. Tenant agrees that all information obtained from any such Operating Costs review, including without limitation, the results of any Operating Costs review shall be kept strictly confidential by Tenant and shall not be disclosed to any other person or entity. If the audit shows that Tenant has overpaid with respect to Operating Costs for an Operating Year then, then, absent a good faith challenge by Landlord to such results, Landlord shall reimburse any such overpayment to Tenant. If the audit shows that Tenant has underpaid with respect to Operating Costs for an Operating Year Tenant shall reimburse Landlord for such underpayment.

| -13- |

10. CHANGES OR ALTERATIONS BY LANDLORD

Subject to Section 17.2 below with respect to entry into the Premises, Landlord reserves the right, exercisable by itself or its nominee, at any time and from time to time without the same constituting an actual or constructive eviction and without incurring any liability to Tenant therefor or otherwise affecting Tenant’s obligations under this Lease, to make such changes, alterations, additions, improvements, repairs or replacements in or to: (i) the Building (including the Premises) and the fixtures and equipment thereof, (ii) the street entrances, halls, passages, elevators, escalators, and stairways of the Building, and (iii) the Common Areas, and facilities located therein, as Landlord may deem necessary or desirable, and to change the arrangement and/or location of entrances or passageways, doors and doorways, and corridors, elevators, stairs, toilets, or other public parts of the Building and/or the Common Areas, provided, however, that there be no unreasonable obstruction of the right of access to, or unreasonable interference with the use and enjoyment of, the Premises by Tenant. Nothing contained in this Article 10 shall be deemed to relieve Tenant of any duty, obligation or liability of Tenant with respect to making any repair, replacement or improvement or complying with any law, order or requirement of any governmental or other authority. Landlord reserves the right to adopt and at any time and from time to time to change the name or address of the Building. Neither this Lease nor any use by Tenant shall give Tenant any right or easement for the use of any door, passage, concourse, walkway or parking area within the Building or in the Common Areas, and the use of such doors, passages, concourses, walkways, parking areas and such conveniences may be regulated or discontinued at any time and from time to time by Landlord without notice to Tenant and without affecting the obligation of Tenant hereunder or incurring any liability to Tenant therefor, provided, however, that there be no unreasonable obstruction of the right of access to, or unreasonable interference with the use of the Premises by Tenant.

If at any time any windows of the Premises are temporarily closed or darkened for any reason whatsoever including but not limited to, Landlord’s own acts, Landlord shall not be liable for any damage Tenant may sustain thereby and Tenant shall not be entitled to any compensation therefor nor abatements of rent nor shall the same release Tenant from its obligations hereunder nor constitute an eviction.

11. FIXTURES, EQUIPMENT AND IMPROVEMENTS-REMOVAL BY TENANT

All fixtures (excluding trade fixtures installed by or on behalf of Tenant), equipment (excluding trade equipment installed by or on behalf of Tenant), improvements and appurtenances attached to or built into the Premises prior to or during the term, whether by Landlord at its expense or at the expense of Tenant (either or both) or by Tenant shall be and remain part of the Premises and shall not be removed by Tenant during or at the end of the term unless Landlord otherwise elects to require Tenant to remove such fixtures, equipment, improvements and appurtenances, in accordance with Articles 12 and/or 22 of the Lease. All electric, telephone, telegraph, communication, radio, plumbing, heating and sprinkling systems, fixtures and outlets, vaults, paneling, molding, shelving, radiator enclosures, cork, rubber, linoleum and composition floors, ventilating, silencing, air conditioning and cooling equipment, shall be deemed to be included in such fixtures, equipment, improvements and appurtenances, whether or not attached to or built into the Premises. Where not built into the Premises, all of Tenant’s removable electric fixtures, carpets, drinking or tap water facilities, furniture, or trade fixtures or business or laboratory equipment or Tenant’s inventory or stock in trade shall not be deemed to be included in such fixtures, equipment, improvements and appurtenances and may be, and upon the request of Landlord as set forth above, will be removed by Tenant upon the condition that such removal shall not materially damage the Premises or the Building and that the cost of repairing any damage to the Premises or the Building arising from installation or such removal shall be paid by Tenant. The covenants of this Section shall survive the expiration or earlier termination of the Term.

| -14- |

12. ALTERATIONS AND IMPROVEMENTS BY TENANT

Tenant shall make no alterations, decorations, installations, removals, additions or improvements in or to the Premises without Landlord’s prior written consent and unless made by contractors or mechanics approved by Landlord. No installations or work shall be undertaken or begun by Tenant until: (i) Landlord has approved written plans and specifications and a time schedule for such work; (ii) Tenant has made provision for either written waivers of liens from all contractors, laborers and suppliers of materials for such installations or work, the filing of lien bonds on behalf of such contractors, laborers and suppliers, or other appropriate protective measures approved by Landlord; and (iii) Tenant has procured appropriate surety payment and performance bonds. No amendments or additions to such plans and specifications shall be made without the prior written consent of Landlord. Landlord’s consent and approval required under this Article 12 shall not be unreasonably withheld, conditioned or delayed. Landlord’s approval is solely given for the benefit of Landlord and neither Tenant nor any third party shall have the right to rely upon Landlord’s approval of Tenant’s plans for any purpose whatsoever. Without limiting the foregoing, Tenant shall be responsible for all elements of the design of Tenant’s plans (including, without limitation, compliance with law, functionality of design, the structural integrity of the design, the configuration of the Premises and the placement of Tenant’s furniture, appliances and equipment), and Landlord’s approval of Tenant’s plans shall in no event relieve Tenant of the responsibility for such design. Landlord shall have no liability or responsibility for any claim, injury or damage alleged to have been caused by the particular materials, whether building standard or non-building standard, appliances or equipment selected by Tenant in connection with any work performed by or on behalf of Tenant in the Premises including, without limitation, furniture, carpeting, copiers, laser printers, computers and refrigerators. Any such work, alterations, decorations, installations, removals, additions and improvements shall be done at Tenant’s sole expense and at such times and in such manner as Landlord may from time to time designate. If Tenant shall make any alterations, decorations, installations, removals, additions or improvements, then Landlord may elect, at the time consent thereto is requested and granted, to require the Tenant at the expiration or sooner termination of the term of this Lease to restore the Premises to substantially the same condition as existed at the Term Commencement Date. Tenant shall pay, as an additional charge, the entire increase in real estate taxes on the Building which shall, at any time prior to or after the Term Commencement Date, result from or be attributable to any alteration, addition or improvement to the Premises made by or for the account of Tenant.

If, as a result of any alterations, decorations, installations, removals, additions and improvements made by Tenant, Landlord is obligated to comply with the Americans With Disabilities Act or any other federal, state or local laws or regulations and such compliance requires Landlord to make any improvement or alteration to any portion of the Building or the Complex, as a condition to Landlord’s consent, Landlord shall have the right to require Tenant to pay to Landlord prior to the construction of any such alteration, decoration, installation, removal, addition or improvement by Tenant, the entire cost of any improvement or alteration Landlord is obligated to complete by such law or regulation.

Without limiting any of the terms hereof, Landlord will not approve any alteration, decoration, installation, removal, addition or improvement requiring unusual expense to readapt the Premises to normal office use on lease termination or increasing the cost of construction, insurance or Taxes on the Building or of Landlord’s services to the Premises, unless Tenant first gives assurances or security acceptable to Landlord that such re-adaptation will be made prior to such termination without expense to Landlord and makes provisions acceptable to Landlord for payment of such increased cost.

Notwithstanding the forgoing, Tenant shall have the right, upon prior written notice to Landlord, but without the necessity of obtaining Landlord’s consent, to make interior, nonstructural alterations to the Premises that (a) cost less than $10,000 in the aggregate in any calendar year, (b) do not materially or adversely affect any fire, safety, telecommunication, electrical, mechanical, ventilation, plumbing or other systems of the Building, (c) do not cause any material penetration in or otherwise affect any walls, floors, roofs or other structural elements of the Building, (d) do not require the issuance of any permits, licenses, approvals or the like, and (e) do not require unusual expense to readapt the Premises to normal laboratory use at the termination, provided that all work shall be done by contractors reasonably approved by Landlord and otherwise in accordance with the terms of this Lease.

13. TENANT’S CONTRACTORS-MECHANICS’ AND OTHER LIENS-STANDARD OF TENANT’S PERFORMANCE-COMPLIANCE WITH LAWS

Whenever Tenant shall make any alterations, decorations, installations, removals, additions or improvements in or to the Premises—whether such work be done prior to or after the Term Commencement Date—Tenant will strictly observe the following covenants and agreements:

| -15- |

(a) Tenant agrees that it will not, either directly or indirectly, use any contractors and/or materials if their use will create any difficulty, whether in the nature of a labor dispute or otherwise, with other contractors and/or labor engaged by Tenant or Landlord or others in the construction, maintenance and/or operation of the Building or any part thereof.

(b) In no event shall any material or equipment be incorporated in or added to the Premises, so as to become a fixture or otherwise a part of the Building, in connection with any such alteration, decoration, installation, addition or improvement which is subject to any lien, charge, mortgage or other encumbrance of any kind whatsoever or is subject to any security interest or any form of title retention agreement. No installations or work shall be undertaken or begun by Tenant until (i) Tenant has made provision for written waiver of liens from all contractors, laborers and suppliers of materials for such installations or work, and taken other appropriate protective measures approved by Landlord; and (ii) Tenant has procured appropriate surety payment and performance bonds which shall name Landlord as an additional obligee and has filed lien bond(s) (in jurisdictions where available) on behalf of such contractors, laborers and suppliers. Any mechanic’s lien filed against the Premises or the Building for work claimed to have been done for, or materials claimed to have been furnished to, Tenant shall be discharged by Tenant within ten (10) days thereafter, at Tenant’s expense by filing the bond required by law or otherwise. If Tenant fails so to discharge any lien, Landlord may do so at Tenant’s expense and Tenant shall reimburse Landlord for any expense or cost incurred by Landlord in so doing within fifteen (15) days after rendition of a bill therefor.

(c) All installations or work done by Tenant shall be at its own expense and shall at all times comply with (i) laws, rules, orders and regulations of governmental authorities having jurisdiction thereof; (ii) orders, rules and regulations of any Board of Fire Underwriters, or any other body hereafter constituted exercising similar functions, and governing insurance rating bureaus; (iii) Rules and Regulations of Landlord; and (iv) plans and specifications prepared by and at the expense of Tenant theretofore submitted to and approved by Landlord.

(d) Tenant shall procure and deliver to Landlord copies of all necessary permits before undertaking any work in the Premises; do all of such work in a good and workmanlike manner, employing materials of good quality and complying with all governmental requirements; and defend, save harmless, exonerate and indemnify Landlord from all injury, loss or damage to any person or property occasioned by or growing out of such work. Tenant shall cause contractors employed by Tenant to carry Worker’s Compensation Insurance in accordance with statutory requirements, Automobile Liability Insurance and, naming Landlord as an additional insured, Commercial General Liability insurance covering such contractors on or about the Premises in the amounts stated in Article 15 hereof or in such other reasonable amounts as Landlord shall require and to submit certificates evidencing such coverage to Landlord prior to the commencement of such work.

14. REPAIRS BY TENANT-FLOOR LOAD