Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Eiger BioPharmaceuticals, Inc. | d762637dex11.htm |

| EX-5.1 - EX-5.1 - Eiger BioPharmaceuticals, Inc. | d762637dex51.htm |

| EX-23.1 - EX-23.1 - Eiger BioPharmaceuticals, Inc. | d762637dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on August 7, 2014

Registration No. 333-197720

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Celladon Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2836 | 33-0971591 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

11988 El Camino Real, Suite 650

San Diego, California 92130

(858) 366-4288

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Paul Cleveland

President and Chief Financial Officer

Celladon Corporation

11988 El Camino Real, Suite 650

San Diego, California 92130

(858) 366-4288

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| Jason L. Kent, Esq. Cooley LLP 4401 Eastgate Mall San Diego, California 92121 (858) 550-6000 |

Elizabeth Reed Vice President, General Counsel and Secretary Celladon Corporation 11988 El Camino Real, Suite 650 San Diego, California 92130 (858) 366-4288 |

Cheston J. Larson, Esq. Michael E. Sullivan, Esq. Latham & Watkins LLP 12670 High Bluff Drive San Diego, California 92130 (858) 523-5400 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1) |

Amount of registration fee | ||

| Common Stock, $0.001 par value per share |

$63,250,000 | $8,147(2) | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act. Includes the offering price of additional shares that the underwriters have the option to purchase. |

| (2) | Previously paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Preliminary Prospectus

SUBJECT TO COMPLETION, DATED AUGUST 7, 2014

4,000,000 Shares

Common Stock

We are offering 4,000,000 shares of our common stock.

Our common stock is listed on The NASDAQ Global Market under the symbol “CLDN.” The closing price of our common stock on The NASDAQ Global Market on August 6, 2014, was $10.54 per share.

We are an emerging growth company as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

The underwriters have a thirty-day option to purchase a maximum of 600,000 additional shares of our common stock.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 12 of this prospectus.

| Price to Public |

Underwriting Discounts and |

Proceeds to Us, Before | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

| (1) | We have agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting.” |

Delivery of the shares of common stock will be made on or about , 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| Credit Suisse | Jefferies |

Co-Managers

| Stifel | Wedbush PacGrow Life Sciences |

The date of this prospectus is , 2014

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 22 | ||||

| 24 | ||||

| 70 | ||||

| 79 | ||||

| 85 | ||||

| 89 | ||||

| 94 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS OF OUR COMMON STOCK |

96 | |||

| 100 | ||||

| 106 | ||||

| 106 | ||||

| 106 | ||||

| 106 | ||||

Neither we nor any of the underwriters has authorized anyone to provide you with information different from, or in addition to, that contained in or incorporated by reference into this prospectus or any free writing prospectus prepared by or on behalf of us or to which we may have referred you in connection with this offering. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor any of the underwriters is making an offer to sell or seeking offers to buy these securities in any jurisdiction where, or to any person to whom, the offer or sale is not permitted. The information contained in or incorporated by reference into this prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock, and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and future growth prospects may have changed since those dates.

This prospectus includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe these industry publications and third-party research, surveys and studies are reliable, we have not independently verified such data.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus and any free writing prospectus outside of the United States.

Table of Contents

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference into this prospectus. You should read the entire prospectus and the information incorporated herein carefully, especially “Risk Factors” and our consolidated financial statements and the related notes incorporated by reference into this prospectus, before deciding to buy shares of our common stock. Unless the context requires otherwise, references in this prospectus to “Celladon,” “we,” “us” and “our” refer to Celladon Corporation.

Overview

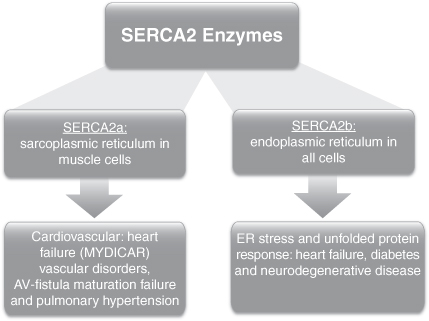

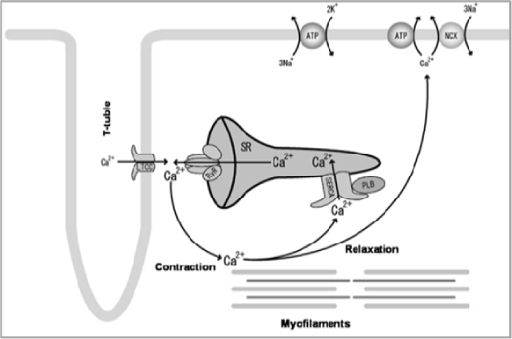

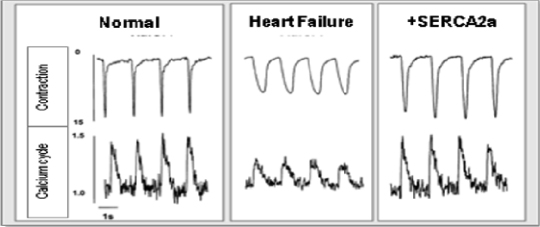

We are a clinical-stage biotechnology company applying our leadership position in the field of gene therapy and calcium dysregulation to develop novel therapies for diseases with tremendous unmet medical needs. Our lead programs target sarco/endoplasmic reticulum Ca2+ -ATPase, or SERCA, enzymes, which are a family of enzymes that play an integral part in the regulation of intra-cellular calcium in all human cells. Calcium dysregulation is implicated in a number of important and complex medical conditions and diseases, such as heart failure, which is a clinical syndrome characterized by poor heart function resulting in inadequate blood flow to meet the body’s metabolic needs, as well as blood vessel health, diabetes and neurodegenerative diseases. SERCA2a, an enzyme that becomes deficient in patients with heart failure, was scientifically validated as a molecular target for heart failure in the 1990s and became a focus of internal discovery efforts for many large pharmaceutical companies. However, to date, no other company has been successful in targeting SERCA2a using traditional discovery methods.

Our therapeutic portfolio includes both gene therapies and small molecule compounds targeting diseases characterized by SERCA enzyme deficiency. MYDICAR, our most advanced product candidate, uses gene therapy to target SERCA2a. We believe that our gene therapy approach to modulating SERCA2a overcomes the issues encountered by previous efforts and has the potential to provide transformative disease-modifying effects with long-term benefits in patients with heart failure. In addition, we have recently in-licensed worldwide rights to patents covering an additional gene therapy product opportunity, the membrane-bound form of Stem Cell Factor, or mSCF, for the treatment of cardiac ischemic damage. We have also identified a number of potential first-in-class compounds addressing novel targets in diabetes and neurodegenerative diseases with our small molecule platform of SERCA2b modulators.

We are the first company to enter clinical development with a product candidate, MYDICAR, that selectively targets SERCA2a. We refer to our Phase 1 trial and Phase 2a trial of MYDICAR together as our CUPID 1 trial. In Phase 2a of our CUPID 1 trial, 39 patients with systolic heart failure, which is caused by the inability of the heart to pump blood efficiently due to weakening and enlargement of the ventricles, were enrolled in a randomized, double-blind, placebo-controlled trial. MYDICAR was safe and well-tolerated, reduced heart failure-related hospitalizations, improved patients’ symptoms, quality of life and serum biomarkers and improved key markers of cardiac function predictive of survival, such as end systolic volume. Based on these results, as well as our previous preclinical studies and clinical trials, we advanced MYDICAR to a 250-patient randomized, double-blind, placebo-controlled international Phase 2b trial in patients with systolic heart failure, which we refer to as CUPID 2. We completed enrollment of CUPID 2 in February 2014 and expect to announce results in April 2015. If successful, these results, along with other studies, will form the basis for regulatory submissions for approval with the United States Food and Drug Administration, or FDA, and European Medicines Agency, or EMA. In 2012, we obtained a Special Protocol Assessment, or SPA, whereby the FDA agreed to use time-to-multiple heart failure-related hospitalizations as the primary endpoint for a MYDICAR Phase 3 pivotal trial. Our ongoing CUPID 2 trial uses a similar clinical protocol with identical endpoints as agreed to in the SPA. In

1

Table of Contents

November 2013, the EMA indicated that if MYDICAR demonstrates a substantial and highly significant treatment effect in the advanced heart failure population, and no untoward effects attributable to MYDICAR are observed, a safety database of approximately 205 to 230 MYDICAR-treated subjects may be sufficient for a safety assessment to allow for acceptance of a Marketing Authorization Application, or MAA, for MYDICAR for the treatment of systolic heart failure. We therefore believe that, if the above conditions are met, a Phase 3 trial may not be required for marketing approval in Europe.

In April 2014, the FDA’s Center for Biologics Evaluation and Research, or CBER, granted Breakthrough Therapy designation to MYDICAR for reducing hospitalizations for heart failure in patients who test negative for adeno-associated viral vector 1, or AAV1, neutralizing antibodies, are class III or IV heart failure patients under the New York Heart Association, or NYHA, classification system, and are not in immediate need of a left-ventricular assist device, or LVAD, or heart transplant. The Breakthrough Therapy program is intended to expedite drug development and review of innovative new drugs that are intended to treat serious or life-threatening diseases and for which preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on a clinically significant endpoint. MYDICAR was the third product candidate to receive this designation from CBER, and the designation indicates that the FDA has determined that the CUPID 1 trial provided preliminary clinical evidence that MYDICAR may demonstrate substantial improvement over available therapies in heart failure patients for which the designation was granted.

We are initially developing MYDICAR to treat patients with systolic heart failure. We are also developing MYDICAR for additional indications, including arteriovenous fistula, or AVF, maturation failure, and for the treatment of patients with advanced heart failure who are on an LVAD. In addition, we expect to initiate a clinical trial in 2015 for the treatment of diastolic heart failure, a condition caused by the inability of the heart to relax normally between contractions, if data from our preclinical research warrants.

2

Table of Contents

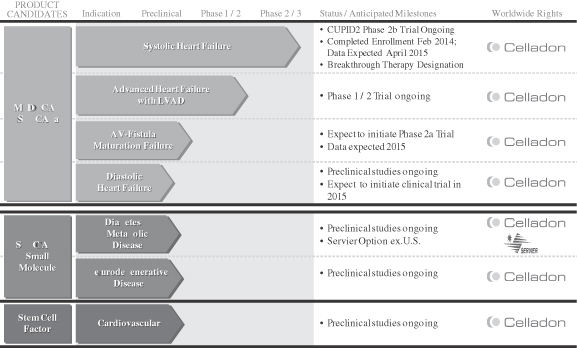

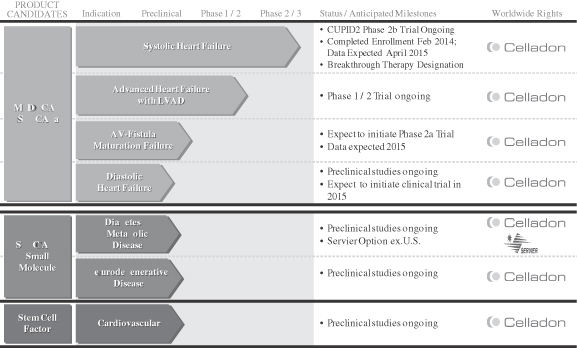

Our Product Pipeline

The following chart depicts key information regarding our development programs, their indications, and their current stage of development:

MYDICAR: Genetic Enzyme Replacement Therapy of SERCA2a Deficiency

Our lead product candidate, MYDICAR, uses genetic enzyme replacement therapy to correct the SERCA2a enzyme deficiency in heart failure patients that results in inadequate pumping of the heart. MYDICAR is delivered directly to the heart in a routine outpatient procedure, similar to an angiogram, in a cardiac catheterization laboratory. MYDICAR has the potential to provide transformative disease-modifying effects with long-term benefits in heart failure patients with a single administration.

MYDICAR utilizes a recombinant adeno-associated viral vector 1, or AAV1 serotype, which is a group of adeno-associated viruses, or AAVs, sharing specific antigens, to deliver the gene for the SERCA2a enzyme. We believe AAV1 serotype vectors are particularly well suited for administration to the heart muscle because AAV vectors are safe and are less immunogenic than other viral vectors commonly used in gene therapy. Most people are exposed to wild type AAV (serotype 2) during childhood, without experiencing any symptoms, because AAV causes no disease. In addition, local delivery of AAV1 to the heart requires extremely small quantities to achieve therapeutic effect, which has contributed to the low incidence of side effects in clinical trials to date. We have developed a companion diagnostic to identify the patients who are AAV1 neutralizing antibody, or NAb, negative and therefore eligible for MYDICAR treatment. We believe approximately 40% of patients in the United States are AAV1 NAb negative and estimate that there are over 350,000 systolic heart failure patients in the United States alone who will be eligible for MYDICAR therapy upon launch. In an effort to expand the population of heart failure patients with systolic dysfunction that may be eligible for MYDICAR treatment, we are currently exploring whether plasma exchange can be used to remove AAV1 neutralizing antibodies from the circulation in advance of MYDICAR administration. If we are able to successfully utilize plasma exchange on

3

Table of Contents

patients to reduce AAV1 neutralizing antibodies in advance of MYDICAR administration, we estimate that this number could be increased by approximately 175,000 patients. In late 2014, we plan to initiate a pilot, 24 patient, Phase 1/2 study of MYDICAR in advanced heart failure patients with systolic dysfunction and pre-existing levels of neutralizing antibodies against the AAV1 vector, who will undergo plasma exchange prior to administration of MYDICAR. Initial results from this study are expected in 2015.

We hold worldwide rights to MYDICAR in all indications and markets. We plan to commercialize MYDICAR for all approved heart failure indications using a targeted sales force in the United States focused on selected cardiologists and heart failure specialists who treat the majority of heart failure patients. We believe we can maximize the value of our company by retaining substantial commercialization rights to our product candidates and, where appropriate, entering into partnerships for specific therapeutic indications and/or geographic territories.

MYDICAR for Systolic Heart Failure

Heart failure caused by systolic dysfunction is characterized by a decreased contraction of the heart muscle. In 2013, the American Heart Association estimated that there are nearly six million patients currently diagnosed with heart failure in the United States. Despite optimal guideline-directed therapies employing a wide range of pharmacologic, device, and surgical options, many heart failure patients deteriorate over time. The long-term prognosis associated with heart failure is worse than that associated with the majority of cancers, with a mortality rate of approximately 50% at five years following initial diagnosis. There are one million primary heart failure-related hospitalizations and over 280,000 heart failure-related deaths annually in the United States. The estimated direct cost of heart failure in the United States in 2012 was $60.2 billion, half of which was related to repeated hospitalizations. The one- and six-month readmission rates after heart failure-related hospitalization are close to 25% and 50%, respectively, and there is growing pressure on hospitals to reduce readmissions for heart failure.

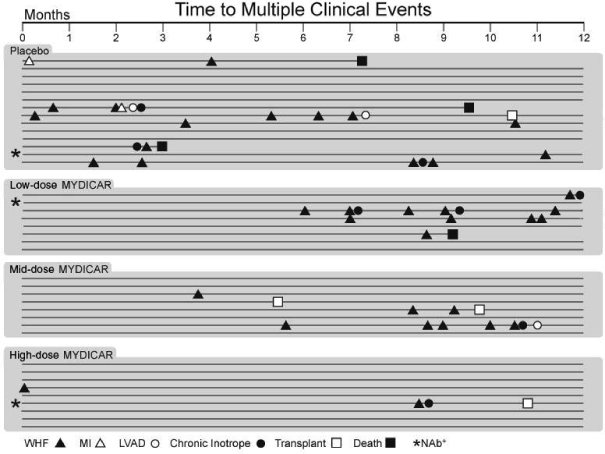

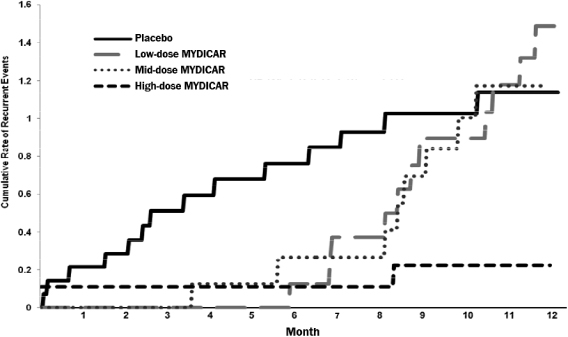

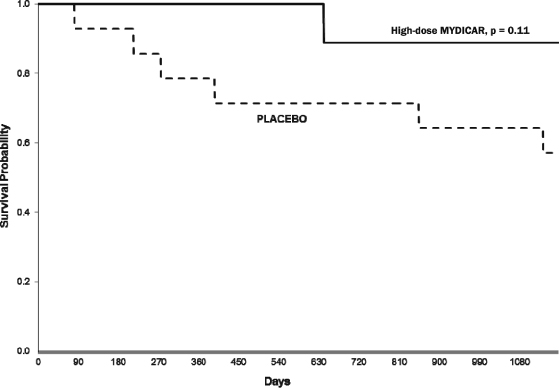

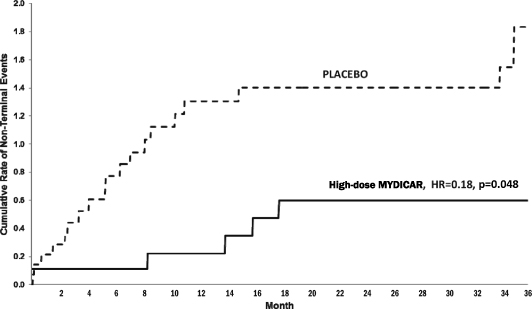

MYDICAR was initially evaluated in Phase 1 of our CUPID 1 trial, which was an open-label, dose-escalation trial in which patients with heart failure received a single intracoronary infusion of MYDICAR on top of maximal optimized heart failure therapy. Of the 12 patients who received MYDICAR, several demonstrated improvements from baseline to month six across a number of parameters important in heart failure. Based on these results, we advanced MYDICAR to Phase 2a of our CUPID 1 trial. In this 39-patient trial, MYDICAR was found to be safe and well-tolerated, reduced heart failure-related hospitalizations, improved patients’ symptoms and quality of life, and improved key markers of cardiac function predictive of survival, such as elevated levels of natriuretic peptides and end systolic volume. This trial included a single intracoronary infusion of MYDICAR followed by an on-study observation period of 12 months, plus a two-year long-term follow-up period. High-dose MYDICAR (1 x 1013 DNase resistant particles) met the primary endpoint versus placebo at six months, and all positive trends were confirmed at 12 months. The hazard ratio at 12 months for the high-dose MYDICAR group versus placebo for recurrent adjudicated clinical events was 0.12 (p=0.003, where p-value is the statistical probability of a result due to chance alone) representing a risk reduction of 88% with MYDICAR versus placebo. Benefit in preventing clinical events such as hospitalizations has been confirmed at three years as well as a trend in improved survival. The hazard ratio at 36 months for the high-dose MYDICAR group versus placebo for recurrent adjudicated clinical events was 0.18 (p=0.048) representing a risk reduction of 82% with high-dose MYDICAR versus placebo.

Following the completion of our CUPID 1 trial, we received Fast Track designation from the FDA in December 2011 for MYDICAR for the treatment of systolic heart failure in New York Heart Association Class III/IV heart failure patients. Subsequently, we held an End-of-Phase 2 meeting with the FDA, as a result of which the FDA has indicated that: data supported proceeding to a Phase 3 clinical trial with high-dose MYDICAR; our proposed safety database, which will include approximately 610 patients (one-half treated), may be acceptable if the safety profile is similar to CUPID 1; time-to-recurrent heart failure-related hospitalizations, in the presence of

4

Table of Contents

terminal events (all-cause death, LVAD implantation, and heart transplant), is acceptable as the primary endpoint, pending details of the statistical analysis plan and further discussion with agency statisticians; and a single clinical trial may be acceptable for a biologics license application, or BLA, submission assuming statistically significant primary outcome and strong concordance of primary and secondary endpoint analyses. We have also held a Type A meeting with the FDA, as a result of which the FDA approved a 572-patient Phase 3 trial protocol under the SPA guidance and agreed that the design and planned analyses of this trial would be sufficient to provide data that, depending on outcome, could support a BLA submission. Pursuant to the SPA, we also obtained an agreement from the FDA that the primary efficacy endpoint of time-to-recurrent heart failure-related hospitalizations in the presence of terminal events would be acceptable for a pivotal trial of MYDICAR. This endpoint counts multiple heart failure-related hospitalizations per patient, and “corrects” for the occurrence of terminal events. Based on published FDA guidance, we believe that the FDA may not require us to complete a Phase 3 trial if the results of our CUPID 2 trial meet the requirements necessary to support a BLA submission based on a single trial as outlined by the FDA.

Based on the CUPID 1 results and following discussions with the FDA, we advanced MYDICAR to our CUPID 2 Phase 2b trial. The primary objective of our ongoing CUPID 2 trial is to determine the efficacy of a single intracoronary infusion of high-dose MYDICAR compared to placebo, in conjunction with maximal optimized heart failure therapy, in reducing the frequency of and/or delaying heart failure-related hospitalizations in patients with systolic heart failure (having an ejection fraction less than 35%) who are at increased risk of terminal events based on elevated levels of natriuretic peptides or a recent heart failure-related hospitalization. Ejection fraction, or EF, is the measurement used to describe the contractility of the heart. The dose being used in this trial is equivalent to the high-dose used in CUPID 1. Patients were randomized in parallel to high-dose MYDICAR or placebo in a 1:1 ratio. We completed enrollment of this trial in February 2014. Approximately 250 patients were enrolled to obtain at least 186 adjudicated heart failure-related hospitalizations. The primary efficacy endpoint is time-to-recurrent heart failure-related hospitalizations in the presence of terminal events at the time of primary analysis data cutoff. We expect to announce results from this trial in April 2015.

Upon completion of our ongoing CUPID 2 trial, we plan to discuss results with the FDA and the EMA with the possibility that MYDICAR could qualify for expedited approval if the trial outcome demonstrates substantial reduction in recurrent heart failure-related hospitalizations and concordant trends in reduction in and/or delay of terminal events overall, and death in particular. However, if the FDA requires another trial, we have an SPA in place for a 572-patient Phase 3 pivotal trial using the same endpoint as in our CUPID 2 trial. We believe the results of one or both of these trials could support submission of a BLA for MYDICAR for the treatment of systolic heart failure. In November 2013, the EMA indicated that if MYDICAR demonstrates a substantial and highly significant treatment effect in the advanced heart failure population, and no untoward effects attributable to MYDICAR are observed, a safety database of approximately 205-230 subjects may be sufficient for a safety assessment to allow for acceptance of a MAA for MYDICAR for the treatment of systolic heart failure. We therefore believe that, if the above conditions are met, a Phase 3 trial may not be required for marketing approval in Europe.

In addition to the ongoing CUPID 2 trial, we are planning two other studies for MYDICAR to support our BLA filing, an AAV1 NAb positive trial called CELL-005, and a viral shedding trial called CELL-006. MYDICAR will also be evaluated in an investigator-initiated trial called AGENT-HF. The primary objective of the AAV1 NAb positive trial is to determine the safety of a single intracoronary infusion of high-dose MYDICAR in patients who test positive for NAbs who would otherwise be ineligible for treatment with MYDICAR. The FDA has required this approximately 70 patient safety trial, as a condition to the submission of a BLA, to cover the possibility that MYDICAR may be used in NAb positive patients. The viral shedding trial is required as part of the environmental risk assessment that must be included in a marketing application to regulatory authorities, both in the United States and in Europe. In this open-label trial, ten patients with heart failure will be treated with high-dose MYDICAR and will be followed until they have two consecutive bodily

5

Table of Contents

fluid samples that are negative for presence of the SERCA2a gene. The patients would continue to be followed for safety for up to two years to add to the overall MYDICAR safety database. We expect to initiate the AAV1 NAb positive and viral shedding trials in 2014. The primary objective of the AGENT-HF trial is to determine whether treatment with MYDICAR leads to a reversal in the decline of left-ventricular function of the heart. This trial will enroll approximately 44 heart failure patients in France with half receiving MYDICAR and the other half placebo. The primary endpoint at six months will be change, compared to baseline, in left ventricular end systolic volume as measured by cardiac computed tomography.

MYDICAR in Additional Indications

Beyond our proposed lead indication of systolic heart failure, we are also developing MYDICAR for additional indications including enhancement of AVF maturation, diastolic heart failure and treatment of patients with advanced heart failure who are on an LVAD. Each of these conditions is characterized by a SERCA2a deficiency, and MYDICAR has demonstrated disease-modifying capability in preclinical models of these diseases. We are currently engaged in preclinical research regarding MYDICAR for the treatment of diastolic heart failure, and plan to initiate clinical trials in this indication in 2015 if data warrants. The broad potential of MYDICAR in multiple indications presents opportunities to maximize the value of our development programs for indications that are poorly managed by existing treatment options.

Recent Developments

Regulatory and Clinical Trial Update

| • | We completed enrollment of CUPID 2 in February 2014 and expect to announce results in April 2015. |

| • | In April 2014, the FDA’s Center for Biologics Evaluation and Research granted Breakthrough Therapy designation to MYDICAR for reducing hospitalizations for heart failure in patients who test negative for adeno-associated viral vector 1 neutralizing antibodies, are NYHA class III or IV heart failure patients and are not in immediate need of an LVAD or heart transplant. |

Business Development Update

| • | In February 2014, we entered into a material transfer and exclusivity agreement with Les Laboratories Servier, or Servier, for the purpose of enabling Servier to conduct an evaluation of our small molecule compounds that modulate the SERCA2b enzyme. As part of this agreement, we granted Servier an option to enter into a license and research collaboration agreement for the joint collaboration, research and development of these compounds for the treatment of type 2 diabetes and other metabolic diseases, pursuant to which Servier may obtain an exclusive, royalty-bearing license to commercialize one or more of these compounds and any related products in the field of type 2 diabetes and other metabolic diseases outside of the United States. |

| • | In July 2014, we in-licensed worldwide rights to gene therapy applications for the membrane bound form of Stem Cell Factor, or mSCF, for treatment of cardiac ischemia from Enterprise Partners Management, LLC. Our approach with mSCF gene therapy is to recruit and expand resident stem cells, thereby harnessing advances in gene therapy technologies and also expanding the application to those in which cardiac stem cells have shown promise in clinical and preclinical testing. Our initial focus will be to generate clinically acceptable gene therapy vectors in support of potentially conducting a future clinical trial in patients who have suffered cardiac damage, as well as exploration of other potential applications. mSCF induces c-kit+ stem/progenitor cell expansion in situ, as well as cardiomyocyte proliferation, which may represent a new therapeutic strategy to reverse adverse remodeling after cardiac injury. In a preclinical setting, mSCF has demonstrated potential improvements in cardiac function and survival |

6

Table of Contents

| following a myocardial infarction. Specifically, these data suggest mSCF gene therapy promoted a regenerative response characterized by an enhancement in cardiac hemodynamic function; an improvement in survival; a reduction in fibrosis, infarct size and apoptosis; an increase in cardiac c-kit+ progenitor cells recruitment to the injured area; an increase in cardiomyocyte cell-cycle activation; and Wnt/ß-catenin pathway induction. |

| • | In July 2014, we entered into a Loan and Security Agreement with Hercules Technology III, L.P. and Hercules Technology Growth Capital, Inc. under which we may borrow up to $25.0 million in two tranches. We borrowed the first tranche of $10.0 million on August 1, 2014. We plan to use the proceeds of the Loan and Security Agreement to provide additional funding for the development of MYDICAR, for other development programs in our pipeline and for general corporate purposes. The second tranche of up to $15.0 million can be drawn through May 31, 2015, but only if data from our ongoing CUPID 2 trial supports the continued development of MYDICAR for its Breakthrough Therapy designation to either a Phase 3 clinical trial or for registration for approval. |

Strategy

We are committed to applying our first-mover scientific leadership position in the field of SERCA2 enzymes to transform the lives of patients with debilitating, life-threatening diseases or conditions. Each of our ongoing and planned development projects addresses diseases or conditions with high unmet medical need that are characterized by an underlying SERCA2 enzyme deficiency. The core elements of our strategy include:

| • | successfully develop MYDICAR as a novel, first-in-class therapy for patients with heart failure due to systolic dysfunction; |

| • | advance MYDICAR through an expedited development and approval process as a Breakthrough Therapy product candidate; |

| • | maximize the value of our MYDICAR franchise by expanding into additional indications; |

| • | commercialize MYDICAR using a highly-targeted cardiology-focused sales force in the United States; |

| • | advance our additional preclinical assets including mSCF gene therapy and our small molecule platform targeting SERCA2 enzymes; and |

| • | deploy capital strategically to develop our portfolio of product candidates and create shareholder value. |

Risks Associated With Our Business

Our business and our ability to implement our business strategy are subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary and in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014. You should read these risks before you invest in our common stock. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business include:

| • | We have incurred significant losses since our inception, which we anticipate will continue for the foreseeable future. We have never generated revenue from product sales and may never be profitable. |

| • | Failure to obtain additional funding when needed may force us to delay, limit or terminate our product development efforts or other operations. |

| • | MYDICAR is based on a novel technology, which makes it difficult to predict the time and cost of product candidate development and, subsequently, for obtaining regulatory approval. |

| • | We are highly dependent on the success of MYDICAR and we may not be able to successfully obtain regulatory or marketing approval for, or successfully commercialize, this product candidate. |

7

Table of Contents

| • | We may find it difficult to enroll patients in our clinical trials, which could delay or prevent clinical trials of our product candidates. |

| • | Failure to successfully validate, commercialize and obtain regulatory approval for our companion diagnostic could delay or prevent commercialization of MYDICAR. |

| • | If our product candidates fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities, we may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates. |

| • | We rely on third parties to conduct some or all aspects of our current vector production, product manufacturing, companion diagnostic testing, reagent manufacturing, protocol development, research, and preclinical and clinical testing. If they fail to meet deadlines or perform in an unsatisfactory manner, our business could be harmed. |

| • | The commercial success of any current or future product candidate will depend upon the degree of market acceptance by physicians, patients, third-party payors and others in the medical community. |

| • | Our future success depends on our ability to retain key executives and to attract, retain and motivate qualified personnel. |

| • | If we are unable to obtain or protect intellectual property rights related to our product candidates, we may not be able to compete effectively in our markets. |

Corporate Information

We were originally incorporated in California in December 2000. In April 2012, we reincorporated in Delaware. Our principal executive offices are located at 11988 El Camino Real, Suite 650, San Diego, California 92130, and our telephone number is (858) 366-4288. Our corporate website address is www.celladon.com. Information contained on or accessible through our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

We have obtained a registered trademark for MYDICAR® in the United States. This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeded $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 in this prospectus as the “JOBS Act,” and references in this prospectus to “emerging growth company” have the meaning associated with it in the JOBS Act.

8

Table of Contents

The Offering

| Common stock offered by us |

4,000,000 shares |

| Common stock to be outstanding after this offering |

22,534,480 shares |

| Option to purchase additional shares |

We have granted to the underwriters the option, exercisable for 30 days from the date of this prospectus, to purchase up to 600,000 additional shares of common stock. |

| Use of proceeds |

We estimate that we will receive net proceeds of approximately $39.2 million (or approximately $45.1 million if the underwriters’ option to purchase 600,000 additional shares is exercised in full) from the sale of the shares of common stock offered by us in this offering, based on an assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014), and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to fund (1) research and development activities related to seeking regulatory approval for MYDICAR and our companion diagnostic for the treatment of systolic heart failure and other indications, (2) development of manufacturing capabilities for the commercial production of MYDICAR and preparation activities for the potential commercial launch of MYDICAR for the treatment of systolic heart failure in the United States and Europe, (3) clinical development of a potential plasma exchange procedure designed to remove AAVI neutralizing antibodies in advanced heart failure patients to enable their treatment with MYDICAR, (4) research and, if supported by pre-clinical data, clinical development of MYDICAR for the treatment of diastolic heart failure, and (5) working capital and general corporate purposes. See “Use of Proceeds.” |

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of certain of the factors to consider carefully before deciding to purchase any shares of our common stock. |

| NASDAQ Global Market symbol |

CLDN |

The number of shares of our common stock to be outstanding after this offering is based on 18,534,480 shares of common stock outstanding as of June 30, 2014, and excludes:

| • | 2,510,828 shares of common stock issuable upon the exercise of outstanding stock options as of June 30, 2014, at a weighted-average exercise price of $6.06 per share; |

| • | 206,340 shares of common stock issuable upon the exercise of outstanding warrants as of June 30, 2014, each at an exercise price of $5.61 per share; |

| • | 156,748 shares of common stock reserved for future issuance under our 2013 employee stock purchase plan, or the ESPP, as of June 30, 2014; and |

| • | 532,871 shares of common stock reserved for future issuance under our 2013 equity incentive plan, or the 2013 plan, as of June 30, 2014. |

Unless otherwise indicated, all information contained in this prospectus assumes no exercise by the underwriters of their option to purchase up to an additional 600,000 shares of our common stock.

9

Table of Contents

SUMMARY FINANCIAL DATA

The following table summarizes certain of our financial data. We changed our fiscal year end from June 30 to December 31, effective for the fiscal period ended December 31, 2011. We derived the summary statement of operations data for the fiscal year ended June 30, 2011, the six months ended December 31, 2011, and the years ended December 31, 2012 and 2013 from our audited consolidated financial statements incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2013. The summary statement of operations data for the six months ended June 30, 2013 and 2014 and the period from December 21, 2000 (inception) to June 30, 2014 and the summary balance sheet data as of June 30, 2014 were derived from our unaudited financial statements incorporated by reference into this prospectus from our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014. Our historical results are not necessarily indicative of the results that may be expected in the future and results of interim periods are not necessarily indicative of the results for the entire year. The summary financial data should be read together with our financial statements and related notes, “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing elsewhere or incorporated by reference in this prospectus.

| Year Ended June 30, 2011 |

Six Months Ended December 31, 2011 |

Year Ended |

Six Months Ended June 30, 2014 |

Period From December 21, 2000 (inception) to June 30, 2014 |

||||||||||||||||||||

| 2012 | 2013 | |||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||

| Research and development |

$ | 4,193 | $ | 1,252 | $ | 13,314 | $ | 16,927 | $ | 10,199 | $ | 102,243 | ||||||||||||

| General and administrative |

1,832 | 920 | 2,631 | 3,037 | 3,730 | 23,252 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

6,025 | 2,172 | 15,945 | 19,964 | 13,929 | 125,495 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Loss from operations |

(6,025 | ) | (2,172 | ) | (15,945 | ) | (19,964 | ) | (13,929 | ) | (125,495 | ) | ||||||||||||

| Other income (expense) |

(965 | ) | (689 | ) | 74 | (127 | ) | (225 | ) | (1,495 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Consolidated net loss |

(6,990 | ) | (2,861 | ) | (15,871 | ) | (20,091 | ) | (14,154 | ) | (126,990 | ) | ||||||||||||

| Net loss attributable to noncontrolling interest |

— | — | 154 | 96 | — | 250 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to Celladon Corporation |

(6,990 | ) | (2,861 | ) | (15,717 | ) | (19,995 | ) | (14,154 | ) | (126,740 | ) | ||||||||||||

| Accretion to redemption value of redeemable convertible preferred stock |

— | — | (343 | ) | — | — | (343 | ) | ||||||||||||||||

| Change in fair value of noncontrolling interest |

— | — | (154 | ) | (3,105 | ) | — | (3,259 | ) | |||||||||||||||

| Deemed dividend |

— | — | — | (856 | ) | — | (856 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to common stockholders |

$ | (6,990 | ) | $ | (2,861 | ) | $ | (16,214 | ) | $ | (23,956 | ) | $ | (14,154 | ) | $ | (131,198 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other comprehensive loss: |

||||||||||||||||||||||||

| Unrealized gain (loss) on investments |

— | — | 9 | (7 | ) | 16 | 18 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Comprehensive loss |

$ | (6,990 | ) | $ | (2,861 | ) | $ | (15,862 | ) | $ | (20,098 | ) | $ | (14,138 | ) | $ | (126,972 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss per share attributable to common stockholders, basic and diluted(1) |

$ | (2,729.66 | ) | $ | (1,022.52 | ) | $ | (19.74 | ) | $ | (27.09 | ) | $ | (0.94 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Weighted-average shares outstanding, basic and diluted(1) |

2,561 | 2,798 | 821,568 | 884,179 | 15,092,098 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | See Note 1 to our consolidated audited financial statements incorporated by reference in this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2013 for an explanation of the method used to calculate historical and pro forma basic and diluted net loss per common share attributable to common stockholders and the number of shares used in the computation of the per share amounts. |

10

Table of Contents

The unaudited pro forma balance sheet data set forth below give effect to our issuance and sale of 4,000,000 shares of our common stock in this offering at an assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014) after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

| As of June 30, 2014 | ||||||||

| Actual | Pro Forma(1) | |||||||

| (unaudited, in thousands) | ||||||||

| Consolidated Balance Sheet Data: |

||||||||

| Cash, cash equivalents and investments |

$ | 51,172 | $ | 90,364 | ||||

| Working capital |

48,094 | 87,286 | ||||||

| Total assets |

52,278 | 91,470 | ||||||

| Deficit accumulated during the development stage |

(126,740 | ) | (126,740 | ) | ||||

| Total stockholders’ equity |

48,564 | 87,756 | ||||||

| (1) | A $1.00 increase (decrease) in the assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014) would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $3.8 million, assuming the number of shares offered by us, as set forth on the cover of this prospectus, remains unchanged and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, a one million share increase (decrease) in the number of shares offered by us, as set forth on the cover of this prospectus, would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ equity by $9.9 million, assuming the assumed public offering price of $10.54 per share remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The pro forma information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

11

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014 which are incorporated by reference in this prospectus in their entirety, before deciding whether to invest in our common stock. The occurrence of any of the risks described below or incorporated by reference in this prospectus could have a material adverse effect on our business, financial condition, results of operations and future growth prospects. In these circumstances, the market price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to this Offering

Our principal stockholders and management own a significant percentage of our stock and will be able to exert significant control over matters subject to stockholder approval.

Our executive officers, directors, 5% stockholders and their affiliates beneficially owned approximately 74.9% of our voting stock as of June 30, 2014. Based upon the assumed number of shares to be sold in this offering as set forth on the cover page of this prospectus, upon the closing of this offering, that same group will beneficially own approximately 62.2% of our outstanding voting stock. Therefore, even after this offering these stockholders will have the ability to influence us through this ownership position. These stockholders may be able to determine all matters requiring stockholder approval. For example, these stockholders, acting together, may be able to control elections of directors, amendments of our organizational documents, or approval of any merger, sale of assets, or other major corporate transaction. This may prevent or discourage unsolicited acquisition proposals or offers for our common stock that you may believe are in your best interest as one of our stockholders.

If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares.

Investors purchasing common stock in this offering will pay a price per share that substantially exceeds the pro forma net tangible book value per share as of June 30, 2014. Net tangible book value is our tangible assets after subtracting our liabilities. As a result, investors purchasing common stock in this offering will incur immediate dilution of $6.65 per share, based on an assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014), and our pro forma net tangible book value as of June 30, 2014. For more information on the dilution you may suffer as a result of investing in this offering, see “Dilution.”

This dilution is due to the substantially lower price paid by our investors who purchased shares prior to this offering as compared to the price offered to the public in this offering, and the exercise of stock options granted to our employees and warrants issued to our existing investors. As of June 30, 2014, options to purchase 2,510,828 shares of our common stock at a weighted-average exercise price of $6.06 per share, and warrants to purchase 206,340 shares of our common stock each at an exercise price of $5.61 per share, were outstanding. The exercise of any of these options or warrants would result in additional dilution. As a result of the dilution to investors purchasing shares in this offering, investors may receive significantly less than the purchase price paid in this offering, if anything, in the event of our liquidation.

Sales of a substantial number of shares of our common stock in the public market could cause our stock price to fall.

Sales of a substantial number of shares of our common stock in the public market or the perception that these sales might occur could depress the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. We are unable to predict the effect that sales may have on the prevailing market price of our common stock.

12

Table of Contents

We, along with our directors, executive management team and the entities affiliated with our directors, as well as certain of our existing stockholders, have agreed that for a period of 90 days after the date of this prospectus, subject to specified exceptions, not to offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, any of our common stock. Subject to certain limitations, including sales volume limitations with respect to shares held by our affiliates, approximately 1,281,478 shares of our common stock will become eligible for sale upon expiration of the lock-up period, as calculated and described in more detail in the section entitled “Shares Eligible for Future Sale.” In addition, shares issued or issuable upon exercise of options and warrants vested as of the expiration of the lock-up period will also be eligible for sale at that time. Sales of stock by these stockholders upon expiration of the lock-up period could have a material adverse effect on the trading price of our common stock.

Certain holders of our securities are entitled to rights with respect to the registration of their shares under the Securities Act of 1933, as amended, or the Securities Act, subject to the 90-day lock-up arrangement described above. Registration of these shares under the Securities Act would result in the shares becoming freely tradable without restriction under the Securities Act, except for shares held by our affiliates as defined in Rule 144 under the Securities Act. Any sales of securities by these stockholders could have a material adverse effect on the trading price of our common stock.

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds, including for any of the purposes described in “Use of Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially from their currently intended use. The failure by our management to apply these funds effectively could harm our business. If we do not invest or apply the net proceeds from this offering in ways that enhance stockholder value, we may fail to achieve expected financial results, which could cause our stock price to decline.

13

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain forward-looking statements. The forward-looking statements are contained principally in the sections entitled “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” in this prospectus or the documents incorporated by reference. We may, in some cases, use words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, and similar expressions that convey uncertainty of future events or outcomes to identify these forward-looking statements. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. Forward-looking statements in this prospectus include, but are not limited to, statements about:

| • | the success, cost and timing of our product development activities and clinical trials; |

| • | our ability to obtain and maintain regulatory approval for MYDICAR, our companion diagnostic, and any of our future product candidates, and any related restrictions, limitations, and/or warnings in the label of an approved product candidate; |

| • | our ability to obtain funding for our operations, including funding necessary to complete all clinical trials that may potentially be required to file a biologics license application, or BLA, and a Marketing Authorization Application, or MAA, for MYDICAR for the treatment of systolic heart failure; |

| • | the commercialization of our product candidates and companion diagnostic, if approved; |

| • | our plans to research, develop and commercialize our product candidates and companion diagnostic; |

| • | our ability to attract collaborators with development, regulatory and commercialization expertise; |

| • | our plans and expectations with respect to future commercial scale-up activities, including our expectation regarding the building of a commercial manufacturing facility for the production of MYDICAR; |

| • | future agreements with Lonza Houston, Inc., or Lonza, and other third parties in connection with the commercialization of MYDICAR, our companion diagnostic and any other approved product; |

| • | the size and growth potential of the markets for our product candidates, and our ability to serve those markets; |

| • | the rate and degree of market acceptance of our product candidates and companion diagnostic; |

| • | regulatory developments in the United States and foreign countries; |

| • | the performance of our third-party suppliers and manufacturers; |

| • | the success of competing therapies that are or may become available; |

| • | our ability to attract and retain key scientific or management personnel; |

| • | the accuracy of our estimates regarding expenses, future revenues, capital requirements and needs for additional financing; |

| • | our expectations regarding the period during which we qualify as an emerging growth company under the JOBS Act |

| • | our use of the proceeds from this offering; and |

| • | our expectations regarding our ability to obtain and maintain intellectual property protection for our product candidates. |

These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this prospectus and are subject to risks and

14

Table of Contents

uncertainties. We discuss many of these risks in greater detail under “Risk Factors” and in the risk factors incorporated by reference in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

You should read this prospectus and the documents that we reference in this prospectus and have filed as exhibits to the registration statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements by these cautionary statements. Except as required by law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

15

Table of Contents

We estimate that we will receive net proceeds of approximately $39.2 million (or approximately $45.1 million if the underwriters’ option to purchase additional shares is exercised in full) from the sale of the shares of common stock offered by us in this offering, based upon an assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014) and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

A $1.00 increase (decrease) in the assumed public offering price of $10.54 per share would increase (decrease) the net proceeds to us from this offering by approximately $3.8 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Similarly, a one million share increase (decrease) in the number of shares offered by us, as set forth on the cover of this prospectus, would increase (decrease) the net proceeds to us by $9.9 million, assuming the assumed public offering price of $10.54 per share remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

We currently intend to use the net proceeds from this offering to fund: research and development activities, including internal salaries and external costs, related to seeking regulatory approval for MYDICAR and our companion diagnostic for the treatment of systolic heart failure; development of manufacturing capabilities for the commercial production of MYDICAR; early preparation for the potential commercial launch of MYDICAR for the treatment of systolic heart failure in the United States and Europe; research and development activities related to seeking regulatory approval for MYDICAR for the treatment of patients with end-stage renal disease on hemodialysis undergoing surgery for arteriovenous fistula creation; clinical development of a potential plasma exchange procedure designed to remove AAVI neutralizing antibodies from advanced heart failure patients to enable their treatment with MYDICAR; research and, if supported by pre-clinical data, clinical development of MYDICAR for the treatment of diastolic heart failure; and general and administrative expenses, potential future development programs, early-stage research and development activities and general corporate purposes. We may also use a portion of the remaining net proceeds to in-license, acquire, or invest in complementary businesses, technologies, products or assets. However we have no current commitments or obligations to do so. Our expected use of the net proceeds from this offering represents our current intentions based on our present business plans and business condition. We cannot currently allocate specific percentages of the net proceeds that we may use for the purposes specified above, and we cannot predict with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering, or the amounts that we will actually spend on the uses set forth above. The amounts and timing of our actual use of the net proceeds will vary depending on numerous factors, including our ability to obtain additional financing, the relative success and cost of our research, preclinical and clinical development programs and whether we are able to enter into future licensing arrangements. As a result, our management will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding the application of the net proceeds of this offering. In addition, we might decide to postpone or not pursue clinical trials or preclinical activities if the net proceeds from this offering and our other sources of cash are less than expected. Pending their use, we plan to invest the net proceeds from this offering in short- and intermediate-term, interest-bearing obligations, investment-grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government. We anticipate that we will need to secure additional funding for the further development, regulatory approval and commercial launch of MYDICAR.

16

Table of Contents

PRICE RANGE OF OUR COMMON STOCK

Our common stock has been listed on The NASDAQ Global Market since January 30, 2014 under the symbol “CLDN.” Prior to that date, there was no public market for our common stock. Shares sold in our initial public offering on January 29, 2014 were priced at $8.00 per share.

On August 6, 2014, the closing price for our common stock as reported on The NASDAQ Global Market was $10.54 per share. The following table sets forth the ranges of high and low sales prices per share of our common stock as reported on The NASDAQ Global Market for the periods indicated. Such quotations represent inter-dealer prices without retail markup, markdown or commission and may not necessarily represent actual transactions.

| Year Ending December 31, 2014 |

High | Low | ||||||

| First Quarter (from January 30, 2014) |

$ | 17.16 | $ | 7.45 | ||||

| Second Quarter |

$ | 16.47 | $ | 7.82 | ||||

| Third Quarter (through August 6, 2014) |

$ | 16.72 | $ | 10.30 | ||||

As of June 30, 2014, there were 37 stockholders of record, which excludes stockholders whose shares were held in nominee or street name by brokers. The actual number of common stockholders is greater than the number of record holders, and includes stockholders who are beneficial owners, but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include stockholders whose shares may be held in trust by other entities.

We have never declared or paid any cash dividends on our capital stock. We currently intend to retain all available funds and any future earnings to support our operations and finance the growth and development of our business. We do not intend to pay cash dividends on our common stock for the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements, contractual restrictions, business prospects and other factors our board of directors may deem relevant.

17

Table of Contents

The following table sets forth our cash, cash equivalents and investments, and our capitalization as of June 30, 2014:

| • | on an actual basis; and |

| • | on a pro forma basis, giving effect to the sale by us of 4,000,000 shares of our common stock in this offering at an assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014), after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The pro forma information below is illustrative only and our capitalization following the closing of this offering will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. You should read this table together with “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes appearing elsewhere or incorporated by reference in this prospectus.

| As of June 30, 2014 | ||||||||

| Actual | Pro Forma(1) | |||||||

| (unaudited) | ||||||||

| (in thousands, except per share data) | ||||||||

| Cash, cash equivalents and investments |

$ | 51,172 | $ | 90,364 | ||||

|

|

|

|

|

|||||

| Capitalization: |

||||||||

| Stockholders’ equity: |

||||||||

| Preferred stock, $0.0001 par value; 10,000,000 shares authorized and no shares issued or outstanding, actual and pro forma |

$ | — | $ | — | ||||

| Common stock, $0.001 par value; 200,000,000 shares authorized and 18,534,480 shares issued and outstanding, actual; 200,000,000 shares authorized and 22,534,480 issued and outstanding, pro forma |

18 | 22 | ||||||

| Additional paid-in capital |

175,268 | 214,456 | ||||||

| Accumulated other comprehensive income |

18 | 18 | ||||||

| Deficit accumulated during the development stage |

(126,740 | ) | (126,740 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

48,564 | 87,756 | ||||||

|

|

|

|

|

|||||

| Total liabilities, preferred stock and stockholders’ deficit |

$ | 52,278 | $ | 91,470 | ||||

|

|

|

|

|

|||||

| (1) | A $1.00 increase (decrease) in the assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014) would increase (decrease) the amount of cash and cash equivalents, additional paid-in capital and total capitalization by approximately $3.8 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering costs payable by us. Similarly, a one million share increase (decrease) in the number of shares offered by us, as set forth on the cover page of this prospectus, would increase (decrease) each of cash and cash equivalents and total stockholders’ equity (deficit) and total capitalization by $9.9 million, assuming the assumed public offering price of $10.54 per share remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

The number of common shares shown in the table above is based on the number of shares of our common stock outstanding as of June 30, 2014, and excludes:

| • | 2,510,828 shares of common stock issuable upon the exercise of outstanding stock options as of June 30, 2014, at a weighted-average exercise price of $6.06 per share; |

| • | 206,340 shares of common stock issuable upon the exercise of outstanding warrants issued after June 30, 2014, each at an exercise price of $5.61 per share; |

| • | 156,748 shares of common stock reserved for future issuance under the ESPP as of June 30, 2014; and |

| • | 532,871 shares of common stock reserved for future issuance under the 2013 plan as of June 30, 2014. |

18

Table of Contents

If you invest in our common stock in this offering, your ownership interest will be immediately diluted to the extent of the difference between the public offering price per share of our common stock and the pro forma net tangible book value per share of our common stock after this offering.

Our historical net tangible book value per share is determined by dividing our total tangible assets less our total liabilities by the actual number of outstanding shares of our common stock. Our historical net tangible book value as of June 30, 2014 was approximately $48.6 million, or $2.62 per share of our common stock.

After giving pro forma effect to the sale of shares of our common stock in this offering at an assumed public offering price of $10.54 per share (the last reported sale price of our common stock on The NASDAQ Global Market on August 6, 2014), and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us, our net tangible book value as of June 30, 2014 would have been approximately $87.8 million, or $3.89 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $1.27 per share to our existing stockholders, and an immediate dilution of $6.65 per share to new investors purchasing shares of common stock in this offering at the assumed public offering price.

The following table illustrates this dilution on a per share basis:

| Assumed public offering price per share |

$ | 10.54 | ||||||

| Historical net tangible book value per share as of June 30, 2014 |

$ | 2.62 | ||||||

|

|

|

|||||||

| Increase in net tangible book value per share attributable to investors participating in this offering |

$ | 1.27 | ||||||

|

|

|

|||||||

| Pro forma net tangible book value per share after this offering |

$ | 3.89 | ||||||

|

|

|

|||||||

| Pro forma dilution per share to investors participating in this offering |

$ | 6.65 | ||||||

|

|

|

A $1.00 increase (decrease) in the assumed public offering price of $10.54 per share would increase (decrease) the pro forma net tangible book value per share after this offering by approximately $0.17 (0.16) per share and the dilution per share to investors participating in this offering by approximately $0.83 (0.84) per share, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. An increase of one million shares in the number of shares offered by us would increase the net tangible book value by approximately $0.26 per share and decrease the dilution per share to investors in this offering by $0.26 per share, assuming that the assumed public offering price of $10.54 per share remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

Similarly, a decrease of one million shares in the number of shares offered by us, as set forth on the cover of this prospectus, would decrease the pro forma net tangible book value per share after this offering by approximately $0.27 per share and increase the dilution per share to investors participating in this offering by approximately $0.27 per share, assuming the assumed public offering price of $10.54 per share remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us.

If the underwriters exercise in full their option to purchase 600,000 additional shares of our common stock in this offering, the pro forma net tangible book value will increase to $4.05 per share, representing an immediate increase in pro forma net tangible book value to existing stockholders of $1.43 per share and immediate dilution of $6.49 per share to new investors participating in this offering.

19

Table of Contents

The following table summarizes, on a pro forma basis as of June 30, 2014, the number of shares purchased or to be purchased from us, the total consideration paid or to be paid to us, and the average price per share paid or to be paid to us by existing stockholders and investors participating in this offering at an assumed public offering price of $10.54 per share, before deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. As the table below shows, investors participating in this offering will pay an average price per share substantially higher than our existing stockholders paid.

| Shares Purchased | Total Consideration | Average Price Per Share |

||||||||||||||||||

| Number | Percent | Amount | Percent | |||||||||||||||||

| Existing stockholders before this offering |

18,534,480 | 82.2 | % | $ | 175,581,000 | 80.6 | % | $ | 9.47 | |||||||||||

| Investors participating in this offering |

4,000,000 | 17.8 | % | 42,160,000 | 19.4 | % | 10.54 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

22,534,480 | 100 | % | $ | 217,741,000 | 100 | % | $ | 9.66 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||