Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WALGREEN CO | d771941d8k.htm |

| EX-2.1 - EX-2.1 - WALGREEN CO | d771941dex21.htm |

| EX-99.2 - EX-99.2 - WALGREEN CO | d771941dex992.htm |

| EX-99.3 - EX-99.3 - WALGREEN CO | d771941dex993.htm |

Walgreens-Alliance Boots

Investor Call

August 6, 2014

Exhibit 99.1 |

Rick

Hans, CFA Divisional Vice President, Investor Relations & Finance,

Walgreens Questions & Answers

Greg Wasson

President & Chief Executive Officer, Walgreens

Alliance Boots Step 2 Update

Global Management Structure

Corporate Structure

Fiscal Year 2016 Goals

Cost Reduction Program

Capital Structure

Near Term Outlook

Long Term Opportunities

Introduction & Safe Harbor

Greg Wasson

Stefano Pessina

2

Investor Call Agenda

Stefano Pessina

Executive Chairman, Alliance Boots

Introducing:

Tim McLevish

EVP & Chief Financial Officer, Walgreens

Global Outlook and

Opportunities |

Certain

statements

and

projections

of

future

results

made

in

these

presentations

constitute

forward-looking

statements

that

are

based

on

current

market,

competitive

and

regulatory

expectations

that

involve

risk

and

uncertainty

that

could

cause

results

to

vary

materially.

Except

to

the

extent

required

by

the

law,

we

undertake

no

obligation

to

update

publicly

any

forward-looking

statement

after

these

presentations,

whether

as

a

result

of

new

information,

future

events,

changes

in

assumptions

or

otherwise.

Please see our latest Form 10-K &10-Q filings for a discussion of risk

factors as they relate to forward-looking statements.

Today’s presentation includes certain non-GAAP financial measures,

and we refer you to the Appendix to the presentation materials

available on our investor relations website for reconciliations to the

most directly comparable GAAP financial measures and related

information.

Safe Harbor and Non-GAAP

3 |

Walgreens-Alliance Boots

Investor Call

Greg Wasson

President & CEO, Walgreens

August 6, 2014 |

Walgreens to Combine with Alliance Boots

Walgreens exercises option to acquire remaining 55% of Alliance Boots

Transaction expected to close in 1

quarter of calendar year 2015

5

New holding company name to be Walgreens Boots Alliance, Inc.

st

†

†

Forward-Looking Statements – See Cautionary Note in attached Appendix |

Procurement

Prescription drugs

Branded goods

Private brands

Indirect spend

Revenue Enhancing

Beauty

Own brands

Wellness solutions

Best & Next Practices

Store formats

Loyalty

E-commerce

Pharmacy

Walgreens Today

Combined Vision

US Pharmacy:

Health & Daily Living

Global Pharmacy:

Health & Wellbeing

Global Wholesale &

Distribution

Compelling Strategic and Financial Rationale

6

COMPLEMENTARY CAPABILITIES & ASSETS

REVENUE & PROFIT POOL DIVERSIFICATION

SUBSTANTIAL SYNERGY POTENTIAL

PLATFORM FOR FUTURE GROWTH |

Employees

350,000

Stores

~11,000*

Distribution Centers

370

Global Pharmacy Distribution Points

~180,000

Global Healthcare Service Providers

~92,000

Active Loyalty Members

~100,000,000

Leader on a Global Scale

Our Combined Assets

*Excludes the pending 1,400 store FASA acquisition by Alliance Boots

7 |

Step

1 Step 2

†

Total

†

Cash

$4.0 B

$5.3 B*

$9.3 B*

Walgreens Shares Issued

83.4 M

144.3 M

227.7M

TERMS

STEP

TWO

(Option

Exercise)

†

Structure

•

Purchase of remaining 55% equity interest in Alliance Boots

Consideration

•

3.1 B Pounds Sterling ($5.3 B*)

•

Shares fixed at 144.3 M

•

WAG assumes outstanding Alliance Boots net debt

Timing

•

Option exercised on August 5, 2014

•

Expect to close in 1

quarter of calendar year 2015

Conditions

•

Subject to Walgreens shareholder approval

•

Subject to regulatory approvals

Step 2 -

Transaction Terms

Forward-Looking

Statements

–

See

Cautionary

Note

in

attached

Appendix

Based

on

current

$1.69

=

£

1

exchange

rate

8

st

†

* |

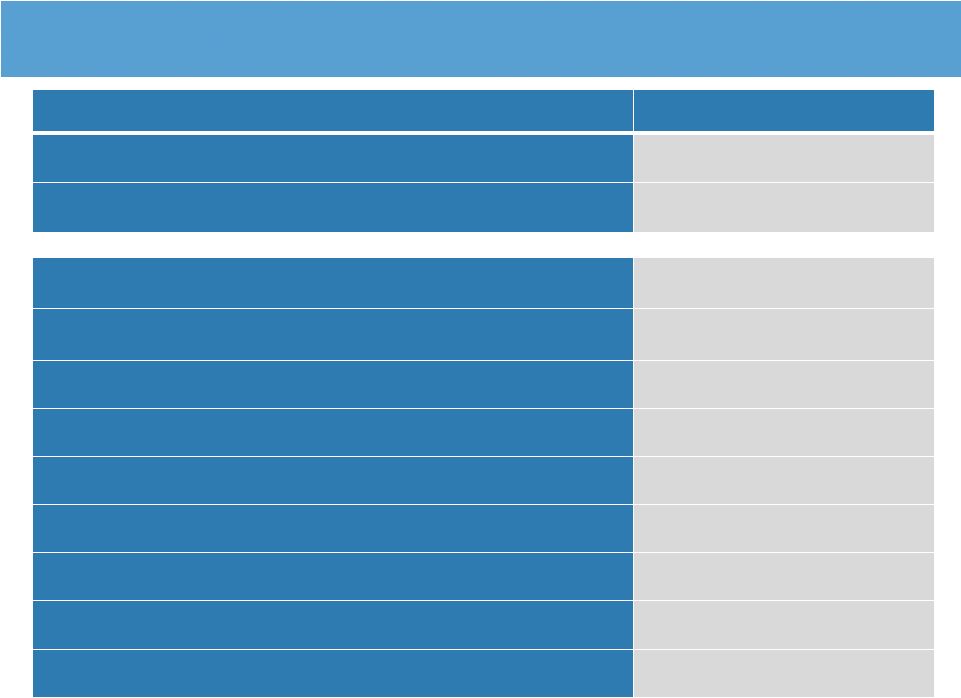

Title

Name

President & CEO, Walgreens Boots Alliance, Inc.

Greg Wasson

Executive Vice Chairman, Strategy & New Market Development

Stefano Pessina

EVP, Walgreens Boots Alliance,

President & Chief Executive, Global Wholesale & International Retail

Ornella Barra

EVP, Walgreens Boots Alliance,

President of Pharma & Global Market Access

Jeff Berkowitz

EVP, Walgreens Boots Alliance, President, Walgreens

Alex Gourlay

EVP and Chief Financial Officer, Walgreens Boots Alliance

Tim McLevish

EVP, Walgreens Boots Alliance, President, Global Brands

Ken Murphy

EVP, Walgreens Boots Alliance, President, Boots

Simon Roberts

EVP, Global Chief Legal & Administrative Officer, Walgreens Boots

Alliance Tom Sabatino

EVP & Global Chief Information Officer, Walgreens Boots Alliance

Tim Theriault

EVP & Global Chief Human Resource Officer, Walgreens Boots Alliance

Kathleen Wilson-Thompson

Blended Management Team

9 |

Domicile of Combined Enterprise

Rationale of U.S. Domicile

Walgreens Boots Alliance, Inc.

U.S. Domicile

Global Headquarters in Chicago area

Walgreens Operational Headquarters

Deerfield, IL

Boots Operational Headquarters

Nottingham, U.K.

The Company and Board undertook a balanced, rigorous, and extensive

analysis of the inversion question.

The Company and Board looked at the full range of issues, including the

potential opportunities and benefits, as well as the risks associated with

an inversion, and determined that an inversion was not in the long term

best interests of our company and its shareholders.

10 |

11

Next Chapter Plan

Differentiated

Retail Experience

Global Pharmaceutical

Services

Integrated Pharmacy

and Health Care

3 Focus Areas to Accelerate Core Business Performance |

FY

2016 Goals †

Revenue*

$126 -

$130 Billion

Adjusted EPS**

$4.25 -

$4.60

†Forward-Looking

Statements – See cautionary note in

attached Appendix. All figures assume constant currency and current

management assumptions regarding future interest rates. Also assumes closing

of Step 2 in the first calendar quarter of 2015. All

financial

goals

assume

no

major

mergers

and

acquisitions

or

strategic

transactions.

*Revenue excludes Alliance Boots share of associates and joint venture sales

**Non-GAAP Financial Measures –

see Appendix.

12

Establishing New Fiscal 2016 Goals |

Accelerating a broad $1B cost savings plan for Walgreens by

FY 2017

Additional cost savings opportunities beyond 2016 will come

from combined entity post integration

Cost Savings Plan

13

Key Areas of Cost Focus

Store

Field

Distribution

Corporate |

Invest in Core

Business

Pursue Strategic

Opportunities

Return Cash To

Shareholders

Maintain Strong

Balance Sheet and

Financial Flexibility

Investing across core businesses at suitable returns to drive organic growth

Balanced and disciplined approach to capital allocation

Returning cash to shareholders through dividends and share repurchases

Pursuing strategic opportunities, including mergers and acquisitions, that

are consistent with our strategy, meet return requirements, and are

accretive and drive long-term growth

Commitment to 30%-35% long-term dividend payout ratio

Increased quarterly dividend per share by 7.1% to $0.3375 per share

Pursue share repurchases with excess capacity

Capital Allocation Priorities

Capital Allocation Priorities

Commitment to solid investment grade credit ratings

14

Capital Structure

$3 billion repurchase program effective immediately through end of

Fiscal Year 2016 |

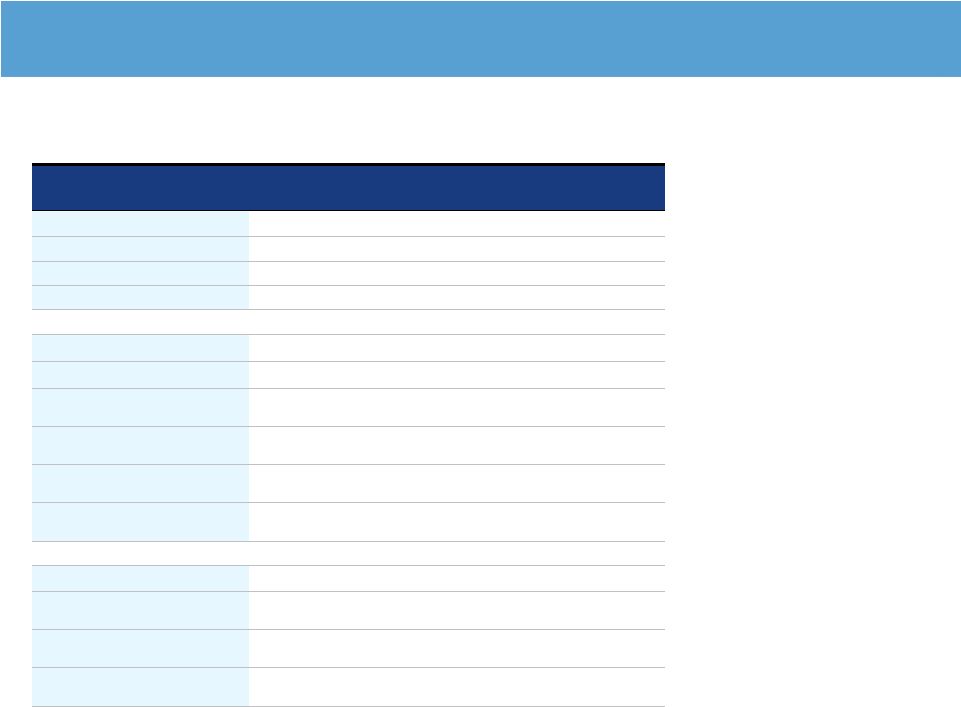

Metrics

Expectations

†

Operating Income (GAAP)

Adjusted Gross Profit Margin*

Expected to be down Year over

Year similar to 3Q14

Synergies

Adjusted SG&A $ Growth*

Last Year’s 4Q included net gains

from certain litigation matters that

reduced adjusted SG&A $ growth

by 90bps

Net Debt**

~$X Billion

†Forward-Looking

Statements – See cautionary note in

attached Appendix. *

Non-GAAP

Financial

Measures

–

See

Appendix.

15

Near Term Outlook –

4Q14 |

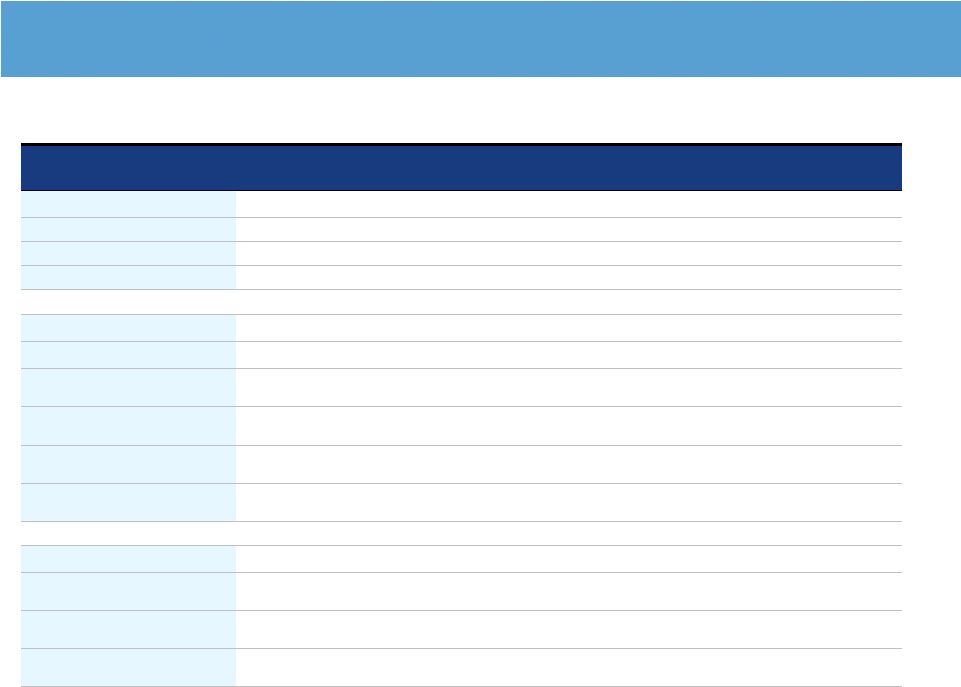

Longer Term Opportunities

†

Additional Synergies

Aging Population

Owned Brand Expansion

Bigger in Beauty

Growth in Pharmacy,

Health and Wellness

International Expansion

†

Forward-Looking

Statements

–

See

Cautionary

Note

in

attached

Appendix

16 |

Global Outlook

Stefano Pessina

Executive Chairman, Alliance Boots

August 6, 2014 |

Global Outlook

Two Iconic Retail Pharmacy Brands

Focused on Creating Shareholder Value

18 |

Appendix

The following information provides reconciliations of the supplemental non-GAAP

financial measures, as defined under SEC rules, presented in this

presentation to the most directly comparable financial measures calculated

and presented in accordance with generally accepted accounting principles in

the United States (GAAP). The company has provided these non-GAAP financial

measures in the presentation, which are not calculated or presented in

accordance with GAAP, as supplemental information in addition to the

financial measures that are calculated and presented in accordance with

GAAP. These supplemental non-GAAP financial measures are presented

because management has evaluated the company’s financial results both

including and excluding the adjusted items and believes that the

non-GAAP financial measures presented provide additional perspective and

insights when analyzing the core operating performance of the Company’s

business from period to period and trends in the company’s historical

operating results. The company does not provide a non-GAAP

reconciliation for non-GAAP estimates on a forward-looking basis where it

is unable to provide a meaningful or accurate calculation or estimation of

reconciling items and the information is not available without unreasonable

effort. The supplemental non-GAAP financial measures presented should

not be considered superior to, as a substitute for or as an alternative to, and should be

considered in conjunction with, the GAAP financial measures presented in the

presentation. 19 |

4Q08

1Q09

2Q09

3Q09

4Q09

Net sales (GAAP)

$ 14,597

$ 14,947

$ 16,475

$ 16,210

$ 15,703

Gross profit (GAAP)

$ 4,035

$ 4,151

$ 4,657

$ 4,459

$ 4,346

LIFO provision

24

43

49

32

48

Adjusted gross profit (Non-GAAP)

$ 4,059

$ 4,194

$ 4,706

$ 4,491

$ 4,394

YOY Change

Gross profit $ (GAAP)

$ 311

Gross profit % (GAAP)

Gross profit % 2-year stack (GAAP)

Adjusted gross profit $ (Non-GAAP)

$ 335

Adjusted gross profit % (Non-GAAP)

Adjusted gross profit % 2-year stack

(Non-GAAP)

Gross profit margin (GAAP)

Year over year basis point impact

(GAAP)

Adjusted gross profit margin

(Non-GAAP)

Adjusted year over year basis point

impact (Non-GAAP)

Reconciliation of Adjusted Gross Profit & Margin

20

$ in Millions |

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

Net sales (GAAP)

$ 16,364

$ 16,987

$ 17,199

$ 16,870

$ 17,344

$ 18,502

$ 18,371

$ 17,967

Gross profit (GAAP)

$ 4,538

$ 4,897

$ 4,749

$ 4,792

$ 4,945

$ 5,324

$ 5,154

$ 5,069

LIFO provision

34

27

18

61

42

56

50

60

Adjusted gross profit (Non-GAAP)

$ 4,572

$ 4,924

$ 4,767

$ 4,853

$ 4,987

$ 5,380

$ 5,204

$ 5,129

YOY Change

Gross profit $ (GAAP)

$ 387

$ 240

$ 290

$ 446

$ 407

$ 427

$ 405

$ 277

Gross profit % (GAAP)

9.0%

8.7%

8.5%

5.8%

Gross profit % 2-year stack (GAAP)

Adjusted gross profit $ (Non-GAAP)

$ 378

$ 218

$ 276

$ 459

$ 415

$ 456

$ 437

$ 276

Adjusted gross profit % (Non-GAAP)

9.1%

9.3%

9.2%

5.7%

Adjusted gross profit % 2-year stack

(Non-GAAP)

Gross profit margin (GAAP)

28.4%

28.5%

28.8%

28.1%

28.2%

Year over year basis point impact

(GAAP)

-0.2%

Adjusted gross profit margin

(Non-GAAP)

28.8%

28.8%

29.1%

28.3%

28.5%

Adjusted year over year basis point

impact (Non-GAAP)

-0.3%

Reconciliation of Adjusted Gross Profit & Margin

21

$ in Millions |

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

Net sales (GAAP)

$ 18,157

$ 18,651

$ 17,752

$ 17,073

$ 17,316

$ 18,647

$ 18,313

$ 17,941

Gross profit (GAAP)

$ 5,104

$ 5,389

$ 5,014

$ 4,835

$ 5,099

$ 5,607

$ 5,222

$ 5,191

LIFO provision

45

72

60

132

55

72

120

(8)

Adjusted gross profit (Non-GAAP)

$ 5,149

$ 5,461

$ 5,074

$ 4,967

$ 5,154

$ 5,679

$ 5,342

$ 5,183

YOY Change

Gross profit $ (GAAP)

$ 159

$ 65

$ (140)

$ (234)

$ (5)

$ 218

$ 208

$ 356

Gross profit % (GAAP)

3.2%

1.2%

-2.7%

-4.6%

-0.1%

4.0%

4.1%

7.4%

Gross profit % 2-year stack (GAAP)

12.2%

9.9%

5.8%

1.2%

3.1%

5.2%

1.4%

2.8%

Adjusted gross profit $ (Non-GAAP)

$ 162

$ 81

$ (130)

$ (162)

$ 5

$ 218

$ 268

$ 216

Adjusted gross profit % (Non-

GAAP)

3.2%

1.5%

-2.5%

-3.2%

0.1%

4.0%

5.3%

4.3%

Adjusted gross profit % 2-year stack

(Non-GAAP)

12.3%

10.8%

6.7%

2.5%

3.3%

5.5%

2.8%

1.1%

Gross profit margin (GAAP)

28.1%

28.9%

28.2%

28.3%

29.4%

30.1%

28.5%

28.9%

Year over year basis point impact

(GAAP)

-0.4%

0.1%

0.1%

0.1%

1.30%

1.2%

0.3%

0.6%

Adjusted gross profit margin

(Non-GAAP)

28.4%

29.3%

28.6%

29.1%

29.8%

30.5%

29.2%

28.9%

Adjusted year over year basis point

impact (Non-GAAP)

-0.4%

0.2%

0.3%

0.6%

1.40%

1.2%

0.6%

-0.2%

Reconciliation of Adjusted Gross Profit & Margin

22

$ in Millions |

1Q14

2Q14

3Q14

Net sales (GAAP)

$ 18,329

$ 19,605

$ 19,401

Gross profit (GAAP)

$ 5,152

$ 5,650

$ 5,440

LIFO provision

58

51

41

Organizational Efficiency Costs

5

-

-

Adjusted gross profit (Non-GAAP)

$ 5,215

$ 5,701

$ 5,481

YOY Change

Gross profit $ (GAAP)

$ 53

$ 43

$ 218

Gross profit % (GAAP)

1.0%

0.8%

4.2%

Gross profit % 2-year stack (GAAP)

0.9%

4.8%

8.3%

Adjusted gross profit $ (Non-GAAP)

$ 61

$ 22

$ 139

Adjusted gross profit % (Non-

GAAP)

1.2%

0.4%

2.6%

Adjusted gross profit % 2-year stack

(Non-GAAP)

1.3%

4.4%

7.9%

Gross profit margin (GAAP)

28.1%

28.8%

28.1%

Year over year basis point impact

(GAAP)

-1.3%

-1.3%

-0.4%

Adjusted gross profit margin

(Non-GAAP)

28.5%

29.1%

28.3%

Adjusted year over year basis point

impact (Non-GAAP)

-1.3%

-1.4%

-0.9%

Reconciliation of Adjusted Gross Profit & Margin

23

$ in Millions |

4Q08

1Q09

2Q09

3Q09

4Q09

Selling general and administrative

expenses (GAAP)

$ 3,324

$ 3,482

$ 3,627

$ 3,613

$ 3,644

Acquisition-related amortization

26

35

35

38

40

Alliance Boots transaction costs

-

-

-

-

-

Adjusted selling general and

administrative expenses

(Non-GAAP)

$ 3,298

$ 3,447

$ 3,592

$ 3,575

$ 3,604

YOY Change

Selling

general

and

administrative

expenses $ (GAAP)

$ 320

Selling

general

and

administrative

expenses % (GAAP)

9.6%

Selling general and administrative

expenses % 2-year stack (GAAP)

Adjusted selling general and

administrative expenses $

(Non-GAAP)

$ 306

Adjusted selling general and

administrative expenses %

(Non-GAAP)

9.3%

Adjusted selling general and

administrative expenses % 2-year

stack (Non-GAAP)

Reconciliation of Adjusted SG&A

24

$ in Millions |

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

Selling general and administrative

expenses (GAAP)

$ 3,741

$ 3,811

$ 3,920

$ 4,046

$ 4,004

$ 4,117

$ 4,203

$ 4,237

Acquisition-related amortization

39

38

52

53

52

46

54

67

Alliance Boots transaction costs

-

-

-

-

-

-

-

-

Adjusted selling general and

administrative expenses

(Non-GAAP)

$ 3,702

$ 3,773

$ 3,868

$ 3,993

$ 3,952

$ 4,071

$ 4,149

$ 4,170

YOY Change

Selling general and administrative

expenses $ (GAAP)

$ 259

$ 184

$ 307

$ 402

$ 263

$ 306

$ 283

$ 191

Selling general and administrative

expenses % (GAAP)

7.4%

5.1%

8.6%

11.0%

7.0%

8.0%

7.2%

4.8%

Selling general and administrative

expenses % 2-year stack (GAAP)

20.6%

14.4%

13.1%

15.8%

15.8%

Adjusted selling general and

administrative expenses $

(Non-GAAP)

$ 255

$ 181

$ 293

$ 389

$ 250

$ 298

$ 281

$ 177

Adjusted selling general and

administrative expenses %

(Non-GAAP)

7.4%

5.0%

8.2%

10.8%

6.8%

7.9%

7.3%

4.4%

Adjusted selling general and

administrative expenses % 2-year

stack (Non-GAAP)

20.1%

14.2%

12.9%

15.5%

15.2%

Reconciliation of Adjusted SG&A

25

$ in Millions |

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

Selling general and administrative

expenses (GAAP)

$ 4,204

$ 4,284

$ 4,141

$ 4,249

$ 4,398

$ 4,497

$ 4,362

$ 4,286

Acquisition-related amortization

60

61

64

70

74

75

67

73

Acquisition-related costs

-

-

19

50

37

21

27

11

Hurricane Sandy

-

-

-

-

39

-

-

-

DEA Settlement Costs

-

-

-

-

-

-

28

-

Organizational Efficiency costs

-

-

-

-

-

-

-

13

Adjusted selling general and

administrative expenses (Non-GAAP)

$ 4,144

$ 4,223

$ 4,058

$ 4,129

$ 4,248

$ 4,401

$ 4,240

$ 4,189

YOY Change

Selling general and administrative

expenses $ (GAAP)

$ 200

$ 167

$ (62)

$ 12

$ 194

$ 213

$ 221

$ 37

Selling general and administrative

expenses % (GAAP)

5.0%

4.0%

-1.6%

0.2%

4.6%

5.0%

5.3%

0.9%

Selling general and administrative

expenses % 2-year stack (GAAP)

12.0%

12.0%

5.6%

5.0%

9.6%

9.0%

3.7%

1.1%

Adjusted selling general and

administrative expenses $ (Non-GAAP)

$ 192

$ 152

$ (91)

$ (41)

$ 104

$ 178

$ 182

$ 60

Adjusted selling general and

administrative expenses %(Non-GAAP)

4.9%

3.7%

-2.2%

-1.0%

2.5%

4.2%

4.5%

1.5%

Adjusted selling general and

administrative expenses % 2-year stack

(Non-GAAP)

11.7%

11.6%

5.1%

3.4%

7.4%

7.9%

2.3%

0.5%

Reconciliation of Adjusted SG&A

26

$ in Millions |

1Q14

2Q14

3Q14

Selling general and administrative

expenses (GAAP)

$ 4,379

$ 4,569

$ 4,551

Acquisition-related amortization

70

73

71

Acquisition-related costs

25

17

20

Hurricane Sandy

-

-

-

DEA Settlement Costs

-

-

-

Store Closures and other optimization

costs

19

2

99

Adjusted selling general and

administrative expenses (Non-GAAP)

$ 4,265

$ 4,477

$ 4,361

YOY Change

Selling general and administrative

expenses $ (GAAP)

$ (19)

$ 72

$ 189

Selling general and administrative

expenses % (GAAP)

(0.4%)

1.6%

4.3%

Selling general and administrative

expenses % 2-year stack (GAAP)

4.2%

6.6%

9.6%

Adjusted selling general and

administrative expenses $ (Non-GAAP)

$ 17

$ 76

$ 121

Adjusted selling general and

administrative expenses %(Non-GAAP)

0.4%

1.7%

2.9%

Adjusted selling general and

administrative expenses % 2-year stack

(Non-GAAP)

2.9%

5.9%

7.4%

Reconciliation of Adjusted SG&A

27

$ in Millions |

Operating

Income

(GAAP)

Acquisition

Related

Costs

Hurricane

Sandy

Acquisition

Related

Amortization

LIFO

Provision

DEA

Settlement

Costs

Alliance

Boots Fair

Value of

Warrant

Adjustment

Gain on WHI

Sale

Organizational

Efficiency Costs

Adjusted

Operating

Income (Non-

GAAP)

Fiscal 2010

Q1

797

-

-

39

34

-

-

-

-

870

Q2

1,086

-

-

38

27

-

-

-

-

1,151

Q3

829

-

-

52

18

-

-

-

-

899

Q4

746

-

-

53

61

-

-

-

-

860

Full Year

3,458

-

-

182

140

-

-

-

-

3,780

Fiscal 2011

Q1

941

-

-

52

42

-

-

-

-

1,035

Q2

1,207

-

-

46

56

-

-

-

-

1,309

Q3

951

-

-

54

50

-

-

-

-

1,055

Q4

1,266

-

-

67

60

-

-

(434)

-

959

Full Year

4,365

-

-

219

208

-

-

(434)

-

4,358

Fiscal 2012

Q1

900

-

-

60

45

-

-

-

-

1,005

Q2

1,105

-

-

61

72

-

-

-

-

1,238

Q3

873

19

-

64

60

-

-

-

-

1,016

Q4

586

50

-

70

132

-

-

-

-

838

Full Year

3,464

69

-

255

309

-

-

-

-

4,097

Fiscal 2013

Q1

705

37

39

88

55

-

-

-

-

924

Q2

1,215

21

-

110

72

-

-

(20)

-

1,398

Q3

991

27

-

83

120

28

-

-

-

1,249

Q4

1,029

11

-

92

(8)

-

(34)

-

13

1,103

Full Year

3,940

96

39

373

239

28

(34)

(20)

13

4,674

28

Reconciliation of Adjusted Operating Income

$ in Millions |

Operating

Income

(GAAP)

Acquisition

Related

Costs

Hurricane

Sandy

Acquisition

Related

Amortization

LIFO

Provision

DEA

Settlement

Costs

Alliance

Boots Fair

Value of

Warrant

Adjustment

Gain on WHI

Sale

Store Closure and

Other

Optimization

Costs

Adjusted

Operating Income

(Non-GAAP)

Fiscal 2014

Q1

924

25

-

91

58

-

(19)

-

24

1,103

Q2

1,275

17

-

92

51

-

(99)

-

2

1,338

Q3

1,026

20

-

92

41

-

27

-

99

1,305

29

Reconciliation of Adjusted Operating Income

$ in Millions |

Net

Earnings

(GAAP)

Acquisition

Related

Costs

Hurricane

Sandy

Acquisition

Related

Amortization

LIFO

Provision

Gain on

WHI

Sale

Fair Market

Value of

warrants

Adjustment

DEA

Settlement

Costs

Medicare

Part D

Organizational

Efficiency

Costs

Alliance

Boots Related

Tax

Adjusted Net

Earnings

(Non-GAAP)

Fiscal 2010

Q1

489

-

-

25

20

-

-

-

-

-

-

534

Q2

669

-

-

24

17

-

-

-

-

-

-

710

Q3

463

-

-

33

11

-

-

-

43

-

-

550

Q4

470

-

-

34

39

-

-

-

-

-

-

543

Full Year

2,091

-

-

116

87

-

-

-

43

-

-

2,337

Fiscal 2011

Q1

580

-

-

33

26

-

-

-

-

-

-

639

Q2

739

-

-

28

35

-

-

-

-

-

-

802

Q3

603

-

-

35

32

-

-

-

-

-

-

670

Q4

792

-

-

42

38

(273)

-

-

-

-

-

599

Full Year

2,714

-

-

138

131

(273)

-

-

-

-

-

2,710

Fiscal 2012

Q1

554

-

-

37

28

-

-

-

-

-

-

619

Q2

683

-

-

39

45

-

-

-

-

-

-

767

Q3

537

12

-

41

38

-

-

-

-

-

-

628

Q4

353

70

-

45

85

-

-

-

-

-

-

553

Full Year

2,127

82

-

161

195

-

-

-

-

-

-

2,565

Fiscal 2013

Q1

413

23

24

59

34

-

-

-

-

-

-

553

Q2

756

13

-

71

46

(13)

-

-

-

-

42

915

Q3

624

17

-

52

76

-

(48)

47

-

-

44

812

Q4

657

7

-

59

(5)

-

(62)

-

-

8

38

702

Full Year

2,450

60

24

241

151

(13)

(110)

47

-

8

124

2,982

Reconciliation of Adjusted Net Earnings

$ in Millions

30 |

Net

Earnings

(GAAP)

Acquisition

Related

Costs

Acquisition

Related

Amortization

LIFO

Provision

Gain on

WHI

Sale

Fair Market

Value of

warrants

Adjustment

DEA

Settlement

Costs

Medicare

Part D

Store

Closures and

other

Optimization

Costs

Alliance

Boots Related

Tax

Adjusted Net

Earnings

(Non-GAAP)

Fiscal 2014

Q1

695

16

-

58

37

-

(161)

-

-

15

28

688

Q2

754

11

-

60

33

-

(26)

-

-

1

47

880

Q3

722

14

-

63

28

-

(67)

-

-

68

55

883

Reconciliation of Adjusted Net Earnings

$ in Millions

31

Hurricane

Sandy |

Diluted

EPS

(GAAP)

Acquisition

Related

Costs

Alliance

Boots Share

Issuance

Effect

Hurricane

Sandy

Acquisition

Related

Amortization

LIFO

Provision

Fair Market

Value of

warrants

Adjustment

Gain

on WHI

Sale

DEA

Settlement

Costs

Medicare

Part D

Efficiency

Costs

Alliance

Boots

Related

Tax

Adjusted

Diluted

EPS (Non-

GAAP)

Fiscal 2010

Q1

0.49

-

-

-

0.03

0.02

-

-

-

-

-

-

0.54

Q2

0.68

-

-

-

0.02

0.02

-

-

-

-

-

-

0.72

Q3

0.47

-

-

-

0.03

0.02

-

-

-

0.04

-

-

0.56

Q4

0.49

-

-

-

0.03

0.04

-

-

-

-

-

-

0.56

Full Year

2.12

-

-

-

0.12

0.09

-

-

-

0.04

-

-

2.37

Fiscal 2011

Q1

0.62

-

-

-

0.03

0.03

-

-

-

-

-

-

0.68

Q2

0.80

-

-

-

0.03

0.04

-

-

-

-

-

-

0.87

Q3

0.65

-

-

-

0.04

0.03

-

-

-

-

-

-

0.72

Q4

0.87

-

-

-

0.05

0.04

-

(0.30)

-

-

-

-

0.66

Full Year

2.94

-

-

-

0.15

0.14

-

(0.30)

-

-

-

-

2.93

Fiscal 2012

Q1

0.63

-

-

-

0.05

0.03

-

-

-

-

-

-

0.71

Q2

0.78

-

-

-

0.05

0.05

-

-

-

-

-

-

0.88

Q3

0.62

0.01

-

-

0.05

0.04

-

-

-

-

-

-

0.72

Q4

0.39

0.08

0.01

-

0.05

0.10

-

-

-

-

-

-

0.63

Full Year

2.42

0.09

0.02

-

0.18

0.22

-

-

-

-

-

-

2.93

Fiscal 2013

Q1

0.43

0.02

-

0.03

0.06

0.04

-

-

-

-

-

-

0.58

Q2

0.79

0.01

-

-

0.08

0.05

-

(0.01)

-

-

-

0.04

0.96

Q3

0.65

0.02

-

-

0.05

0.08

(0.05)

-

0.05

-

-

0.05

0.85

Q4

0.69

0.01

-

-

0.05

(0.01)

(0.06)

-

-

-

0.01

0.04

0.73

Full Year

2.56

0.06

-

0.03

0.25

0.16

(0.12)

(0.01)

0.05

-

0.01

0.13

3.12

32

Reconciliation of Adjusted Diluted EPS

Organiza-

tional |

Diluted EPS

(GAAP)

Acquisition

Related Costs

Alliance Boots

Share Issuance

Effect

Hurricane

Sandy

Acquisition

Related

Amortization

LIFO

Provision

Fair Market

Value of

warrants

Adjustment

Gain on

WHI Sale

DEA

Settlement

Costs

Medicare

Part D

Organizational

Efficiency

Costs

Alliance

Boots

Related Tax

Adjusted Diluted

EPS (Non-GAAP)

Fiscal 2014

Q1

0.72

0.02

-

-

0.06

0.04

(0.17)

-

-

-

0.02

0.03

0.72

Q2

0.78

0.01

-

-

0.06

0.04

(0.03)

-

-

-

-

0.05

0.91

Q3

0.75

0.01

-

-

0.06

0.03

(0.07)

-

-

-

0.07

0.06

0.91

33

Reconciliation of Adjusted Diluted EPS |

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

Cash Flow from

Operations (GAAP)

$312

$1,428

$1,519

$852

$1,168

$595

$1,056

$925

Capital

Expenditures

(GAAP)

(638)

(454)

(442)

(393)

(304)

(220)

(262)

(228)

Free Cash Flow

(Non-GAAP)*

($326)

$974

$1,077

$459

$864

$375

$794

$697

Reconciliation of Free Cash Flow

$ in Millions

34

*Free cash flow is defined as net cash provided by operating activities in a period

minus additions to property and equipment (capital expenditures) made in

that

period.

This

measure

does

not

represent

residual

cash

flows

available

for

discretionary

expenditures

as

the

measure

does

not

deduct

the

payments

required for debt service and other contractual obligations or payments for future

business acquisitions. Therefore, we believe it is important to view free

cash

flow

as

a

measure

that

provides

supplemental

information

to

our

entire

statements

of

cash

flows. |

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

Cash Flow

from

Operations

(GAAP)

$1,165

$886

$1,230

$362

$809

$1,007

$1,847

$768

$601

$1,198

$1,379

$1,123

Capital

Expenditures

(GAAP)

(273)

(196)

(230)

(514)

(419)

(304)

(379)

(448)

(336)

(245)

(293)

(338)

Free Cash

Flow (Non-

GAAP)*

$892

$690

$1,000

($152)

$390

$703

$1,468

$320

$265

$953

$1,086

$785

$ in Millions

35

Reconciliation of Free Cash Flow

*Free cash flow is defined as net cash provided by operating activities in a period

minus additions to property and equipment (capital expenditures) made in

that

period.

This

measure

does

not

represent

residual

cash

flows

available

for

discretionary

expenditures

as

the

measure

does

not

deduct

the

payments

required for debt service and other contractual obligations or payments for future

business acquisitions. Therefore, we believe it is important to view free

cash

flow

as

a

measure

that

provides

supplemental

information

to

our

entire

statements

of

cash

flows. |

1Q14

2Q14

3Q14

Cash Flow

from

Operations

(GAAP)

$133

1,104

1,272

Capital

Expenditures

(GAAP)

(364)

(227)

(230)

Free Cash

Flow (Non-

GAAP)*

(231)

877

1,042

$ in Millions

36

Reconciliation of Free Cash Flow

*Free cash flow is defined as net cash provided by operating activities in a period

minus additions to property and equipment (capital expenditures) made in

that

period.

This

measure

does

not

represent

residual

cash

flows

available

for

discretionary

expenditures

as

the

measure

does

not

deduct

the

payments

required for debt service and other contractual obligations or payments for future

business acquisitions. Therefore, we believe it is important to view free

cash

flow

as

a

measure

that

provides

supplemental

information

to

our

entire

statements

of

cash

flows. |

1Q12

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

2Q14

3Q14

Total LIFO Inventory

$8,231

$7,347

$7,004

$7,036

$7,821

$7,253

$6,881

$6,852

$7,729

$7,213

$6,439

YOY % Change

4.1%

(3.4%)

(7.3%)

(12.5%)

(5.0%)

(1.3%)

(1.8%)

(2.6%)

(1.2%)

(0.6%)

(6.4%)

LIFO Reserve

1,633

1,704

1,764

1,897

1,952

2,024

2,144

2,136

2,194

2,246

2,286

Total FIFO Inventory

$9,864

$9,051

$8,768

$8,933

$9,773

$9,277

$9,025

$8,988

$9,923

9,459

8,725

YOY % Change

5.7%

(0.4%)

(3.4%)

(7.3%)

(0.9%)

2.5%

2.9%

0.6%

1.5%

2.0%

(3.3%)

# of Drugstores

7,812

7,841

7,890

7,930

8,058

8,072

8,097

8,116

8,200

8,210

8,217

LIFO Inventory per

Drugstore (000’s)

1,054

937

888

887

971

899

850

844

943

879

784

YOY % Change

1.9%

(5.3%)

(9.3%)

(14.4%)

(7.9%)

(4.1%)

(4.3%)

(4.8%)

(2.9%)

(2.2%)

(7.8%)

FIFO Inventory per

Drugstore (000’s)

1,263

1,154

1,111

1,126

1,213

1,149

1,115

1,107

1,210

1,152

1,062

YOY % Change

3.6%

(2.3%)

(5.6%)

(9.3%)

(4.0%)

(0.4%)

0.4%

(1.7%)

(0.2%)

0.3%

(4.8%)

37

$ in Millions except as indicated

Reconciliation of FIFO Inventory |

Certain Definitions & Assumptions

38

CERTAIN

ASSUMPTIONS:

Unless

the

context

otherwise

indicates

or

requires:

•

All figures assume constant currency and current management assumptions regarding

future interest rates. •

References to the combined company and pro forma combined financial and other

information assume closing of Step 2 in

the first calendar quarter of 2015;

•

Walgreens transaction with Alliance Boots does not include the benefit of Alliance

Boots minority interest in Galenica Ltd., a Swiss healthcare group, so

Walgreens shareholders will not benefit from the financial performance of Galenica Ltd. even

though Alliance Boots proportionate interest in their profits is

reflected in Alliance Boots financial statements for periods prior

to May 10, 2013; and

•

All financial goals assume no major mergers and acquisitions or

other strategic transactions.

Trading

Profit

-

Profit

from

operations

before

amortization

of

customer

relationships

and

brands,

exceptional

items

and

share of post-tax earnings of associates and joint ventures

Historical

Alliance

Boots

Financial

Information

–

Alliance

Boots’

audited

consolidated

financial

statements,

comprised

of

the Group statements of financial position at March 31, 2014 and

2013, and the related Group income statements, Group

statements of comprehensive income, Group statements of changes in equity and Group

statements of cash flows for each of the years in the three-year period

ended March 31, 2014, were filed as Exhibit 99.1 to the Walgreen Co. Form 8-K filed on

May 15, 2014. Such financial statements of Alliance Boots were prepared in

accordance with International Financial Reporting Standards as issued by the

International Accounting Standards Board (IFRS) and audited in accordance with

auditing standards generally accepted in the United States.

All descriptions of the company’s agreements relating to

Alliance Boots and the arrangements and transactions contemplated thereby in this

presentation are qualified in their entirety by

reference

to

the

full

text

of

the

agreements,

copies

of

which

have

been

filed

with

the

SEC.

See

the

Company’s

Form

8-K

filings on June 19, 2012, August 6, 2012, September 10, 2012 , September 13, 2012,

May 15, 2013 May 15, 2014, and August 6, 2014.

All descriptions in this presentation of the agreements relating

to the strategic long-term relationship with AmerisourceBergen

announced by the Company and Alliance Boots on March 18, 2013 and the arrangements

and transactions contemplated thereby are qualified in their entirety by

reference to the description and the full text of the agreements in the Company’s

Form 8-K filing on March 20, 2013 and Schedule 13D filing on April 15,

2014. |

Cautionary Note Regarding Forward-Looking Statements

39

Cautionary Note Regarding Forward-Looking Statements. Statements in these materials and the

accompanying presentation and remarks that are not historical are forward-looking

statements for purposes of applicable securities laws. Words such as “expect,” “likely,”

“outlook,” “forecast,” “would,” “could,” “should,”

“can,” “will,” “project,” “intend,” “plan,” “goal,” “target,” “continue,” “sustain,” “synergy,” “on

track,” “believe,” “seek,” “estimate,” “anticipate,”

“may,” “possible,” “assume,” variations of such words and similar expressions are

intended to identify such forward-looking statements. These forward-looking statements are not

guarantees of future performance and involve risks, assumptions and uncertainties, including:

the risks that one or more closing conditions to the transactions may not be satisfied or

waived, on a timely basis or otherwise, including that a governmental entity may prohibit, delay or refuse to grant approval for

the consummation of the transactions or that the required approvals by the Company’s shareholders

may not be obtained; the risk of a material adverse change that the Company or Alliance

Boots or either of their respective businesses may suffer as a result of disruption or

uncertainty relating to the transactions; risks associated with changes in economic and business conditions generally or in the markets

in which we or Alliance Boots participate; risks associated with new business areas and activities;

risks associated with acquisitions, joint ventures, strategic investments and

divestitures, including those associated with cross-border transactions; risks associated with

governance and control matters; risks associated with the Company’s ability to timely arrange for

and consummate financing for the contemplated transactions on acceptable terms; risks

relating to the Company and Alliance Boots’ ability to successfully integrate our

operations, systems and employees, realize anticipated synergies and achieve anticipated financial

results, tax and operating results in the amounts and at the times anticipated; the potential

impact of announcement of the transactions or consummation of the transactions on relationships

and terms, including with employees, vendors, payers, customers and competitors; the amounts and timing of costs and

charges associated with our optimization initiatives; our ability to realize expected savings and

benefits in the amounts and at the times anticipated; changes in management’s

assumptions; the risks associated with transitions in supply arrangements; risks that legal

proceedings may be initiated related to the transactions; the amount of costs, fees, expenses and

charges incurred by Walgreens and Alliance Boots related to the transactions; the ability to

retain key personnel; changes in financial markets, interest rates and foreign currency

exchange rates; the risks associated with international business operations; the risk of unexpected costs, liabilities or delays;

changes in network participation and reimbursement and other terms; risks associated with the

operation and growth of our customer loyalty program; risks associated with outcomes of legal

and regulatory matters, and changes in legislation, regulations or interpretations

thereof; and other factors described in Item 1A (Risk Factors) of our most recent Form 10-K and

Form 10-Q, each of which is incorporated herein by reference, and in other documents

that we file or furnish with the SEC. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or

anticipated by such forward-looking statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of the date they

are made. Except to the extent required by law, Walgreens does not undertake, and

expressly disclaims, any duty or obligation to update publicly any forward-looking statement after

the date of this presentation, whether as a result of new information, future events,

changes in assumptions or otherwise. |

Cautionary Note Regarding Forward-Looking Statements

40

Important Information for Investors and Shareholders

This communication does not constitute an offer to sell or the solicitation of an

offer to buy any securities or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws

of any such jurisdiction. No offer of securities

shall

be

made

except

by

means

of

a

prospectus

meeting

the

requirements

of

Section

10

of

the

Securities

Act

of

1933, as amended. In connection with the proposed transaction between Walgreens and

Alliance Boots, Walgreens Boots Alliance will file with the Securities and

Exchange Commission (SEC) a registration statement on Form S-4 that will include

a proxy statement of Walgreens that also constitutes a prospectus of Walgreens

Boots Alliance. After the registration statement

has

been

declared

effective

by

the

SEC,

the

definitive

proxy

statement/prospectus

will

be

delivered

to

shareholders of Walgreens. INVESTORS AND SECURITY HOLDERS OF WALGREENS ARE URGED TO READ THE

DEFINITIVE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND

SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE TRANSACTION THAT WILL

BE FILED WITH THE SEC CAREFULLY AND

IN

THEIR

ENTIRETY

WHEN

THEY

BECOME

AVAILABLE

BECAUSE

THEY

WILL

CONTAIN

IMPORTANT

INFORMATION

ABOUT

THE

PROPOSED

TRANSACTION.

Investors

and

security

holders

will

be

able

to

obtain

free

copies of the registration statement and the definitive proxy statement/prospectus

(when available) and other documents filed

with

the

SEC

by

Walgreens

or

Walgreens

Boots

Alliance

through

the

website

maintained

by

the

SEC

at

www.sec.gov.

Copies of the documents filed with the SEC by Walgreens or Walgreens Boots Alliance

will be available free of charge on Walgreens’

internet

website

at

www.walgreens.com

under

the

heading

“Investor

Relations”

and

then

under

the

heading

“SEC Filings”

or by contacting Walgreen’s Investor Relations Department at (847)

315-2500. Participants in the Solicitation

Walgreens, Alliance Boots and their respective directors, executive officers and

certain other members of management and employees may be deemed to be

participants in the solicitation of proxies from the holders of Walgreens common

stock in respect of the proposed transaction. Information regarding the persons who

are, under the rules of the SEC, participants in the solicitation of proxies

in favor of the proposed transaction will be set forth in the proxy

statement/prospectus

when

it

is

filed

with

the

SEC.

You

can

find

information

about

Walgreens’

directors

and

executive

officers in Walgreens’

Annual Report on Form 10-K for the year ended August 31, 2013 and definitive

proxy statement filed with

the

SEC

on

November

25,

2013.

You

can

obtain

free

copies

of

these

documents,

which

are

filed

with

the

SEC,

from

Walgreens using the contact information above. |