Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - Bioquest Corp | select_8k.htm |

Exhibit 10.1

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| 6 |

MERGER AGREEMENT

This Agreement (the “Agreement”) made as of the 18th day of July, 2014 by and among, SELECT-TV SOLUTIONS (USA), INC.., a Florida corporation (hereinafter sometimes referred to as the "Merging Entity"), and SELECT-TV SOLUTIONS, INC., a Nevada Corporation (hereinafter sometimes referred to as the “Company”) in contemplation of the merger of the Merging Entity with the Company being effective from and as of the close of business on the 31st day of July, 2014 (the “Merger”).

PRELIMINARY STATEMENT

WHEREAS SELECT-TV SOLUTIONS (USA), INC., the Merging Entity, carries on a business, in the United States of America, consisting of delivering interactive entertainment systems and information technology solutions to a wide range of customers, including in the hospitality, healthcare and residential sectors, to which it offers its Interactive Television system (ITV) using the Select-TV Internet Protocol Television (IPTV) Technology with its Set-Top Box and the wide range of services that can be accessed therefrom (the “Select-TV Business”);

WHEREAS SELECT-TV SOLUTIONS (USA), INC. carries on the Select-TV Business in the United States and its territories and possessions, pursuant to a sublicense granted by SELECT-TV SOLUTIONS (USA), INC.’s wholly-owned Canadian subsidiary, Oriana Technologies Inc. (“Oriana Canada”), a Canadian business corporation licensed to carry on the Select-TV Business, and to grant sublicenses thereto, the whole pursuant to a Licensee Agreement, dated effective October 01, 2012, between Oriana Canada, as Licensee and Select-TV Solutions Sdn. Bhd., of 873 A&B, Toman Kok Lian, Batu 5, Jalan Ipoh, 51200 Kuala Lumpur, Malaysia, as Licensor (the “Select-TV Licensor”), pursuant to which the Select-TV Licensor granted to Oriana Canada the license (with the right to sublicense) to market and sell the Select-TV HITV (Hospitality Interactive TV software and hardware, any related updates or upgrades and related documentation) and EMAGINE (home IPTV software and hardware, any related updates or upgrades and related documentation) and associated hardware and Third Party Software offered, from time to time, by the Select-TV Licensor, (A) on an exclusive basis, in North America, including Canada and the United States of America (USA) and in Central America, South America, the Caribbean and their respective territories and possessions; and (B) on a non-exclusive basis, in rest of the World (the “Select-TV License”);

WHEREAS, besides being the parent corporation of Oriana Canada, SELECT-TV SOLUTIONS (USA), INC. is also the parent corporation holding all of the issued and outstanding shares of the capital stock of SELECT-TV SOLUTIONS (CANADA) INC., a Canadian business corporation which carries on the Select-TV Business in Canada and its territories and possessions, pursuant to a sublicense granted to it by its sister corporation, Oriana Canada;

WHEREAS SELECT-TV SOLUTIONS, INC. is a US public company, currently trading as “SEDFD” and, shortly, as “SELT”, and is fully current in its SEC filings;

| 7 |

WHEREAS the authorized capital of SELECT-TV SOLUTIONS, INC. consists of 500,000,000 shares of Common Stock having a par value of $0.001 per share, of which, as at the time of the Merger contemplated by this Agreement, 54,134,000 shares of Common Stock of the capital of SELECT-TV SOLUTIONS, INC. shall be issued and outstanding as fully paid and non-assessable shares and publicly listed under the trading symbol “SEDFD” to be subsequently changed to the trading symbol “SELT” on the OTC-QB Exchange (the “Exchange”);

WHEREAS the authorized capital of SELECT-TV SOLUTIONS (USA), INC., the Merging Entity, consists of 90,000,000 shares of Common Stock having a par value of $0.001 per share, of which, as at the time of the Merger contemplated by this Agreement, (A) 39,742,754 shares of Common Stock of the capital of SELECT-TV SOLUTIONS (USA), INC. shall be issued and outstanding as fully paid and non-assessable shares; and (B) 1,397,600 Common Stock Purchase Warrant granting the right to acquire shares of Common Stock of the capital of SELECT-TV SOLUTIONS (USA), INC. shall be issued and outstanding;

WHEREAS SELECT-TV SOLUTIONS (USA), INC. also issued a Convertible Promissory Note, maturing December 31, 2014, in favour of Vector Resources Inc. (“Vector”), for a principal amount of CAN$150,000.00 (the “Vector Note”), which Vector Note provides that SELECT-TV SOLUTIONS (USA), INC. will procure to Vector that any reporting issuer in the United States or Canada with whom SELECT-TV SOLUTIONS (USA), INC completes a business combination transaction (the “Transaction”) will assume the obligations under the Vector Note and will agree to convert the principal amount of such Vector Note into the securities of such reporting issuer issued within the framework of a financing concurrent with the Transaction (the “Concurrent Financing”), at a per security price equal to 50% of the deemed issue price of the reporting issuer’s securities issued to SELECT-TV SOLUTIONS (USA), INC or its shareholders in connection with the Transaction, which deemed issue price is currently contemplated to be $0.05 per share, resulting in the Vector Note conversion price of $0.025 per share and the issuance, as at the time of the Merger contemplated by this Agreement, of 6,000,000 shares of Common Stock of the capital of SELECT-TV SOLUTIONS, INC., in consideration of the sum of $150,000.00 of the Principal of the said Vector Note;

WHEREAS SELECT-TV SOLUTIONS, INC. is desirous of acquiring SELECT-TV SOLUTIONS (USA), INC.’s Assets, inclusive of its proprietary rights & knowledge, and SELECT-TV SOLUTIONS (USA), INC.. is desirous to have said assets be obtained and licensed through SELECT-TV SOLUTIONS, INC.; therefore the two parties have come together hereby to enter into this binding Merger Agreement, it being understood that, notwithstanding the date of execution of this Agreement, the Merger shall become effective from and as of the close of business on the 31st day of July, 2014.

Article 1 – Merger of the Assets & Liabilities

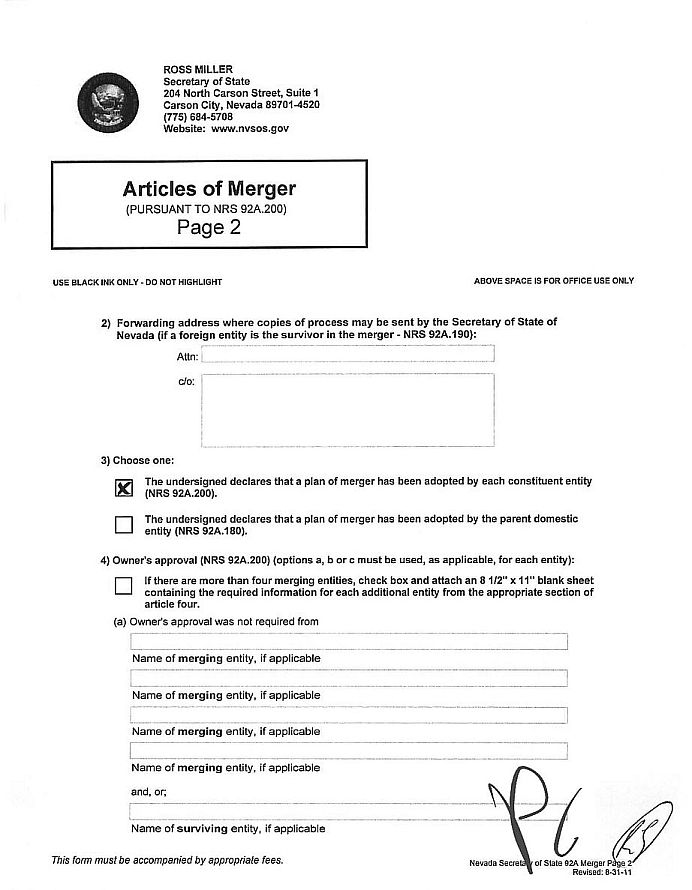

1.1. a) Subject to and upon the terms and conditions of this Agreement, following the closing of the transactions contemplated by this Agreement from and as of the close of business on the 31st day of July, 2014 (the "Closing"), SELECT-TV SOLUTIONS (USA), INC. shall be merged with and into SELECT-TV SOLUTIONS, INC. as the surviving entity in accordance with this Merger Agreement and the applicable provisions of the Articles of Merger attached hereto as Exhibit “A” forming an integral part of this Agreement. Following the Merger, the Merging Entity and the Company will continue as the surviving merged corporation (hereinafter sometimes referred to as the “Surviving Corporation”) and the separate existence of SELECT-TV SOLUTIONS (USA), INC. and the Company shall cease immediately from and as of the close of business on the 31st day of July, 2014.

| 8 |

The Merger shall have the effects set forth in §92A.190 of the Nevada Statutes and §607.1101 of the Florida Statutes. Without limiting the generality of the foregoing, and subject thereto, at the close of business on the 31st day of July, 2014, all the property, rights, privileges, powers and franchise of SELECT-TV SOLUTIONS (USA), INC. and the Company will vest in the Company as the surviving entity and the Surviving Corporation without further act or deed, and all debts, liabilities and duties of SELECT-TV SOLUTIONS (USA), INC. and the Company will become the debts, liabilities and duties of the Surviving Corporation.

Further and for purposes of clarity, at the time of the Merger, the name of the Surviving Corporation shall remain “SELECT-TV SOLUTIONS, INC.” and (A) the registered office, (B) the authorized capital and (C) the By-Laws of the Surviving Corporation shall remain identical to those of the Company immediately prior to the Merger.

b) Upon and subject to the terms and conditions of this Agreement, at the Closing, all of SELECT-TV SOLUTIONS (USA), INC.’s right, title and interest in and to all the Assets, properties and associated rights (whether tangible or intangible) that are used or held for use by SELECT-TV SOLUTIONS (USA), INC. as the same shall exist at and as of the Closing (collectively, the “Merged Assets”), shall, within the framework of the Merger and by operation of the Law, be automatically transferred, conveyed, assigned and delivered to the Surviving Corporation, free and clear of any and all Liens, save and except as may have been disclosed by SELECT-TV SOLUTIONS (USA), INC. to the Company prior to the Closing.

The “Assets” of SELECT-TV SOLUTIONS (USA), INC. consist primarily of its Select-TV Sublicense giving it the right to carry-on the Select-TV Business, Intellectual Property, Trademarks, Trade names, copyrights, corporate trade secrets, equipment and parts, investments and participating interests in its subsidiaries, contract rights with its customers, and goodwill. The foregoing is inclusive of trade names, trademarks, registered copyrights, service marks, trademark registrations and applications, service mark registrations and applications, copyright registrations and applications, corporate or other entity names, internet addresses and other internet related assets used primarily in the operation of the Select-TV Business, including without limitation such of the foregoing as are listed or described on the Disclosure Schedule.

Intellectual Property.

(i) SELECT-TV SOLUTIONS (USA), INC. owns and has good and marketable title to, is licensed or otherwise possesses legally enforceable rights to use, all Intellectual Property used in the Select-TV Business of SELECT-TV SOLUTIONS (USA), INC. as currently conducted by SELECT-TV SOLUTIONS (USA), INC. The Intellectual Property and/or the rights thereto owned by SELECT-TV SOLUTIONS (USA), INC. collectively constitutes all the Intellectual Property necessary to enable SELECT-TV SOLUTIONS (USA), INC. to conduct the Select-TV Business as such business is currently being conducted.

(ii) SELECT-TV SOLUTIONS (USA), INC. has not interfered with, infringed upon, misappropriated, or violated any material Intellectual Property rights of third parties in any material respect, and none of SELECT-TV SOLUTIONS (USA), INC. nor SELECT-TV SOLUTIONS (USA), INC.’s officers has ever received any charge, complaint, claim, demand, or notice alleging any such interference, infringement, misappropriation, or violation (including any claim that SELECT-TV SOLUTIONS (USA), INC. must license or refrain from using any Intellectual Property rights of any third party). There is no unauthorized use, disclosure, infringement, or misappropriation of any SELECT-TV SOLUTIONS (USA), INC. Intellectual Property by any third party, including any employee or former employee of SELECT-TV SOLUTIONS (USA), INC.

| 9 |

(iii) The Disclosure Schedule adequately identifies each patent or registration that has been issued to SELECT-TV SOLUTIONS (USA), INC. with respect to any of its Intellectual Property, identifies each pending patent application or application for registration that SELECT-TV SOLUTIONS (USA), INC. has made with respect to any of its Intellectual Property. SELECT-TV SOLUTIONS (USA), INC. has delivered to the Company correct and complete copies of all such patents, registrations, if any and as the case may be.

Additionally, all applications, licenses, sublicenses, agreements, and permissions (as amended to date) of the Disclosure Schedule also identifies each material trade name or unregistered trademark, service mark, corporate name, internet domain name, copyright, and material computer software item used by SELECT-TV SOLUTIONS (USA), INC. in connection with the Select-TV Business. With respect to each item of Intellectual Property required to be identified in the Disclosure Schedule:

(A) SELECT-TV SOLUTIONS (USA), INC. possesses sufficient right, title, and interest in and to the item, free and clear of any Lien, license, or other restriction;

(B) The item is not subject to any outstanding injunction, judgment, order, decree, ruling, or charge;

(C) No action, suit, proceeding, hearing, investigation, charge, complaint, claim, or demand is pending or, to the knowledge of SELECT-TV SOLUTIONS (USA), INC., is threatened that challenges the legality, validity, enforceability, use, or ownership of the item; and

(D) SELECT-TV SOLUTIONS (USA), INC. has never agreed to indemnify any Person for or against any interference, infringement, misappropriation, or other conflict with respect to the item.

At the time of the Merger, all of SELECT-TV SOLUTIONS (USA), INC.’s full right of use of all of its tangible and intangible Assets, including without limitation, its Intellectual Property, its rights thereto and its knowledge regarding the Select-TV Business it currently conducts in the United States of America, its territories and possessions, by providing, pursuant to its Select-TV Sublicense, interactive entertainment systems and information technology solutions to a wide range of customers, including in the hospitality, healthcare and residential sectors, to which it offers its Interactive Television system (ITV) using the Select-TV Internet Protocol Television (IPTV) Technology with its Set-Top Box and the wide range of services that can be accessed therefrom (collectively, the "Merging entity Assets") shall inure to the Surviving Corporation. The Disclosure Schedule attached hereto contains a true, complete and correct list of, and/or reference to, the Merging Entity Assets. Additionally, any and all revenues from any contract previously signed, shall inure to the Surviving Corporation’s account and ledger.

1.2 SCOPE OF THE MERGER

The Merger of all the assets and liabilities of the Company and of all the tangible and intangible Assets, including without limitation, Intellectual Property, rights thereto and knowledge and of all the liabilities of SELECT-TV SOLUTIONS (USA), INC. into SELECT-TV SOLUTIONS, INC., as the Surviving Corporation, shall be global and complete from and as of the close of business on the 31st day of July, 2014.

| 10 |

1.3 CAPITALIZATION OF THE SURVIVING CORPORATION.

Within the framework of the Merger and the resulting merging of the assets and liabilities of each of the Merging Entity and the Company into the Surviving Corporation and, based on the premise that, (A) immediately prior to the Merger, 54,134,000 shares of Common Stock of the capital of SELECT-TV SOLUTIONS, INC. shall be issued and outstanding as fully paid and non-assessable shares; (B) immediately prior to the Merger, 39,742,754 shares of Common Stock of the capital of SELECT-TV SOLUTIONS (USA), INC. shall be issued and outstanding as fully paid and non-assessable shares; (C) immediately prior to the Merger, 1,397,600 Common Stock Purchase Warrant granting the right to acquire 1,397,600 shares of Common Stock of the capital of SELECT-TV SOLUTIONS (USA), INC. shall be issued and outstanding; and (D) at or shortly after the Merger, 6,000,000 shares of Common Stock of the capital of SELECT-TV SOLUTIONS, INC. shall be issued to the holders of the Vector Note in consideration of the sum of $150,000.00 of the Principal of the said Vector Note, - the holders of securities of the Company and the Merging Entity, shall respectively receive:

(a) For each of the 54,134,000 shares of Common Stock of the capital of the Company held, One share of Common Stock of the capital of the Surviving Corporation, publicly listed under the trading symbol “SEDFD” and, shortly, under the trading symbol “SELT”, consisting of 54,134,000 shares of Common Stock of the capital of the Surviving Corporation of corresponding type, nature and terms;

(b) For each of the 39,742,754 shares of Common Stock of the capital of the Merging Entity held, One and One-Quarter (1.25) share of Common Stock of the capital of the Surviving Corporation, publicly listed under the trading symbol “SEDFD” and, shortly, under the trading symbol “SELT”, consisting of 49,678,443 shares of Common Stock of the capital of the Surviving Corporation of corresponding type, nature and terms, the whole as set forth under Exhibit “B” hereto forming an integral part of this Agreement and setting forth the name, coordinates of each of the shareholders of the Merging Entity and the number and percentage of shares of Common Stock held in the capital of the said Merging Entity prior to the Merger, as well as the number and percentage of shares of Common Stock held in the capital of the Surviving Corporation as of the time of the Merger; and

(c) For each of the 1,397,600 Common Stock Purchase Warrants granting the right to acquire a share of Common Stock of the capital of the Merging Entity and held, One and One-Quarter (1.25) Common Stock Purchase Warrants granting the right to acquire a share of Common Stock of the capital of the Surviving Corporation, publicly listed under the trading symbol “SELT”, consisting of 1,747,000 Common Stock Purchase Warrants of corresponding type, nature and terms, the whole as set forth under Exhibit “C” hereto forming an integral part of this Agreement and setting forth the name of each of the Warrantholders of the Merging Entity and the number, Warrant Price and Warrant Period of their respective Common Stock Purchase Warrants of the said Merging Entity prior to the Merger, as well as the number, Warrant Price and Warrant Period of their respective Common Stock Purchase Warrants to be received from the Surviving Corporation at the time of the Merger.

| 11 |

1.4 CLOSING.

The Closing shall take place at the offices of the Corporate Secretary on July 18th, 2014, by close of business. The Merger into the Surviving Corporation of SELECT-TV SOLUTIONS (USA), INC., the Merging Entity and of SELECT-TV SOLUTIONS, INC., the Company and of their respective Assets and liabilities shall be and effective from and as of the close of business on the 31st day of July, 2014.

Article 2 – Future Research & Development

2.1 SELECT-TV SOLUTIONS (USA), INC.’s merged Technology Rights. As of the time of the Merger, the Surviving Corporation shall be free to pursue the research, development, manufacture of any product which incorporates SELECT-TV SOLUTIONS (USA), INC.’s proprietary technology going forward, the whole in the same manner and to the same extent as SELECT-TV SOLUTIONS (USA), INC. does so up to the time of the Merger.

Article 3 – Proprietary Information

All Proprietary Information which is disclosed by one party to the other during the term of this Agreement shall be maintained in confidence by the receiving party and shall not be disclosed by the receiving party to any other person, firm, or agency, governmental or private, without the prior written consent of the disclosing party, except to the extent that such Proprietary Information:

| (a) | is required to be disclosed to governmental agencies in order to gain approval to sell Products or otherwise carry on the Select-TV Business, list and/or issue securities, whether or not within the framework of this Agreement, or |

| (b) | is necessary to be disclosed to agents, consultants and/or other third parties for the research, development and/or marketing of Products, which entities first agree in writing to be bound by the confidentiality obligations contained in this Agreement. |

Article 4 - Ownership of Intellectual Property

It is understood and agreed by both parties that the Surviving Corporation shall, by virtue and within the framework of the Merger, become the owner of all the Intellectual Property, trademark and other rights relating to all the technology and knowledge conveyed, and management of SELECT-TV SOLUTIONS (USA), INC. shall assist the Surviving Corporation in registering any and all such Intellectual Property and marks in the Surviving Corporation’s name.

Article 5 - Patent Prosecution & Infringement

Enforcement of Intellectual Property Rights. In the event that the Surviving Corporation becomes aware of any infringement by a third party of any of the Intellectual Property forming part of the Assets, including trade names, trademarks, registered copyrights, service marks, trademark registrations and applications, service mark registrations and applications, copyright registrations and applications, corporate or other entity names, internet addresses and other internet related assets used primarily in the operation of the Select-TV Business (“Infringing Activities”), it shall promptly institute, prosecute and control any action or proceeding with respect to any such Infringing Activities, using counsel of its choice, including any declaratory judgment action arising from such infringement.

| 12 |

Article 6 - Warranties/Indemnification

6.1 Representations and Warranties. Each party represents and warrants to the other that (a) it has the full right, power and authority to execute, deliver and perform this Agreement, and (b) the terms of this Agreement do not conflict with any other agreement, order or judgment to which such party is a party or by which it is bound.

6.2. Disclaimer. EXCEPT AS OTHERWISE PROVIDED HEREIN, SELECT-TV SOLUTIONS (USA), INC. DOES NOT WARRANT THE VALIDITY OF THE LICENSED INTELLECTUAL PROPERTY AND MAKES NO REPRESENTATION WHATSOEVER WITH REGARD TO THE SCOPE OF THE LICENSED INTELLECTUAL PROPERTY.

6.3 Indemnification. Each party shall indemnify, defend and hold harmless the other party, its directors, officers, employees and agents and their respective successors, heirs and assigns (the "Indemnitees") against any liability, damage, loss or expense (including reasonable attorneys' fees and expenses of litigation) incurred by or imposed upon the Indemnitees, or any one of them, in connection with any claims, suits, actions, demands or judgments relating to, or arising out of (a) any breach of the indemnifying party's representations, warranties, agreements or covenants in this Agreement, including without limitation the confidentiality obligations set forth above, and (b) any other activities to be carried out by the indemnifying party, its Affiliate(s) or agents.

Article 7 - Assignability

Except as expressly set forth in this Agreement, this Agreement shall not be assignable by SELECT-TV SOLUTIONS, INC. and any attempt to assign (directly or indirectly) this Agreement shall be void ab initio.

Article 8 - Term and Termination

8.1 Term. This Agreement will become effective on the date of its execution by SELECT-TV SOLUTIONS, INC. and SELECT-TV SOLUTIONS (USA), INC., unless terminated under another specific provision of this Agreement or extended by mutual consent of such parties.

8.2 Survival. Termination of this Agreement for whatever reason shall be without prejudice to the settlement of the rights and obligations of the parties arising out of this Agreement prior to the date of termination, including, without limitation: (a) obligations of indemnity, (b) any cause of action or claim accrued or to accrue because of any breach or default by the other party hereunder, (c) obligations of confidentiality and (d) all of the terms, provisions, representations, rights and obligations contained in this Agreement that by their sense and context are intended to survive until performance thereof by either or both parties.

| 13 |

Article 9 – Representations & Warranties

9.1 SELECT-TV SOLUTIONS, INC. hereby represents and warrants as follows:

a) CORPORATE ORGANIZATION AND GOOD STANDING. SELECT-TV SOLUTIONS, INC. is duly organized, validly existing, and in good standing under the laws of the State of Nevada and is qualified to do business as a foreign corporation in each jurisdiction, if any, in which its property or business requires such qualification.

b) CORPORATE AUTHORITY. SELECT-TV SOLUTIONS, INC. has all requisite corporate power and authority to own, operate and lease its properties, to carry on its business as it is now being conducted and to execute, deliver, perform and conclude the transactions contemplated by this Agreement and all other agreements and instruments related to this Agreement.

c) AUTHORIZATION. Execution of this Agreement has been duly authorized and approved by SELECT-TV SOLUTIONS, INC. via its Board Resolution and Shareholders to that effect.

d) CAPITALIZATION. The authorized capital stock of SELECT-TV SOLUTIONS, INC. consists of 500,000,000 shares of Common Stock $0.001 par value. At current, immediately prior to the Merger there are 54,134,000 shares issued and outstanding, all of which are duly authorized, validly issued, fully paid and non-assessable and none of which were issued in violation of any preemptive rights; (ii) no shares of SELECT-TV SOLUTIONS, INC. were reserved for issuance upon the exercise of outstanding options, warrants or other rights to purchase shares; and (iii) no shares of SELECT-TV SOLUTIONS, INC. stock were held in the treasury of SELECT-TV SOLUTIONS, INC. Except as set forth above, as of the date hereof, no shares or other voting securities of SELECT-TV SOLUTIONS, INC. are issued, reserved for issuance or outstanding and no shares or other voting securities of SELECT-TV SOLUTIONS, INC. shall be issued or become outstanding after the date hereof. There are no bonds, debentures, notes or other indebtedness or securities of SELECT-TV SOLUTIONS, INC. that have the right to vote (or that are convertible into, or exchangeable for, securities having the right to vote) on any matters on which stockholders of SELECT-TV SOLUTIONS, INC. may vote. Further, SELECT-TV SOLUTIONS, INC. has no contract or other obligation to repurchase, redeem or otherwise acquire any shares of SELECT-TV SOLUTIONS, INC. stock, or make any investment (in the form of a loan, capital contribution or otherwise) in any other Person. There are no outstanding subscriptions, options, warrants, puts, calls, rights, exchangeable or convertible securities or other commitments or agreements of any character relating to the issued or unissued shares or other securities of SELECT-TV SOLUTIONS, INC. None of the outstanding equity securities or other securities of SELECT-TV SOLUTIONS, INC. was issued in violation of the Securities Act of 1933 or any other legal requirement.

e) LITIGATION. To the knowledge of SELECT-TV SOLUTIONS, INC., there are no pending, threatened, or existing litigation, bankruptcy, criminal, civil, or regulatory proceeding or investigation, threatened or contemplated against SELECT-TV SOLUTIONS, INC.

| 14 |

f) FINANCIAL STATEMENTS.

(i) SELECT-TV SOLUTIONS (USA), INC. has had the ability to review SELECT-TV SOLUTIONS, INC.’s filings on the SEC website Edgar showing true and complete copies of the audited financial statements of SELECT-TV SOLUTIONS, INC. for its past two fiscal years.

(ii) The SELECT-TV SOLUTIONS, INC. Financial Statements were prepared in accordance with IFRS or the equivalent applied on a basis consistent throughout the periods indicated (except as otherwise stated in such financial statements, including the related notes, and except that, in the case of unaudited statements for the subsequent quarterly periods referenced above, such unaudited statements fairly present in all material respects the consolidated financial condition and the results of operations of the Company as at the respective dates thereof and for the periods indicated therein (subject, in the case of unaudited statements, to year-end audit adjustments).

g) ABSENCE OF CERTAIN CHANGES OR EVENTS. Since the end of its most recent fiscal year and to the date of this Agreement, (i) SELECT-TV SOLUTIONS, INC. has, in all material respects, conducted its business in the ordinary course consistent with past practice; (ii) there has not occurred any change, event or condition that is or would reasonably be expected to result in a material adverse effect; and (iii) SELECT-TV SOLUTIONS, INC. has not taken and will not take any of the actions that SELECT-TV SOLUTIONS, INC. has agreed not to take from the date hereof through the Closing.

h) UNDISCLOSED LIABILITIES. SELECT-TV SOLUTIONS, INC. has no material obligations or liabilities of any nature (whether accrued, matured or unmatured, fixed or contingent or otherwise) other than (i) those set forth or adequately provided for in the consolidated balance sheet (and the related notes thereto) of SELECT-TV SOLUTIONS, INC. as of the end of the most recent fiscal year included in the SELECT-TV SOLUTIONS, INC. Financial Statements, (ii) those incurred in the ordinary course of business consistent with past practice since the end of the most recent fiscal year, and (iii) those incurred in connection with the execution of this Agreement.

i) LEGAL PROCEEDINGS. SELECT-TV SOLUTIONS, INC. is not a party to any, and there is no pending or, to the knowledge of SELECT-TV SOLUTIONS, INC., threatened, legal, administrative, arbitral or other proceeding, claim, action or governmental or regulatory investigation of any nature against SELECT-TV SOLUTIONS, INC., or any of its officers or directors which, if decided adversely to SELECT-TV SOLUTIONS, INC., would, individually or in the aggregate, be material to SELECT-TV SOLUTIONS, INC. There is no injunction, order, judgment or decree imposed upon SELECT-TV SOLUTIONS, INC., or any of its officers or directors, or the assets of SELECT-TV SOLUTIONS, INC.

9.2 REPRESENTATIONS AND WARRANTIES OF SELECT-TV SOLUTIONS (USA), INC. SELECT-TV SOLUTIONS (USA), INC. represents and warrants as follows:

a) CORPORATE ORGANIZATION AND GOOD STANDING. SELECT-TV SOLUTIONS (USA), INC. is duly organized, validly existing, and in good standing under the laws of the State of Florida and is qualified to do business as a foreign corporation in each jurisdiction, if any, in which its property or business requires such qualification.

| 15 |

b) CORPORATE AUTHORITY. SELECT-TV SOLUTIONS (USA), INC. has all requisite corporate power and authority to own, operate and lease its properties, to carry on its business as it is now being conducted and to execute, deliver, perform and conclude the transactions contemplated by this Agreement and all other agreements and instruments related to this Agreement.

c) AUTHORIZATION. Execution of this Agreement has been duly authorized and approved by SELECT-TV SOLUTIONS (USA), INC. via its Board Resolution and Shareholders to that effect.

d) LITIGATION. To the knowledge of SELECT-TV SOLUTIONS (USA), INC., and except as already disclosed by SELECT-TV SOLUTIONS (USA), INC. to the Company, there are no pending, threatened, or existing litigation, bankruptcy, criminal, civil, or regulatory proceeding or investigation, threatened or contemplated against Company.

e) ABSENCE OF CERTAIN CHANGES OR EVENTS. Since the end of its most recent fiscal year and to the date of this Agreement, (i) SELECT-TV SOLUTIONS (USA), INC has, in all material respects, conducted its business in the ordinary course consistent with past practice; (ii) there has not occurred any change, event or condition that is or would reasonably be expected to result in a material adverse effect; and (iii) SELECT-TV SOLUTIONS (USA), INC. has not taken and will not take any of the actions that SELECT-TV SOLUTIONS (USA), INC. has agreed not to take from the date hereof through the Closing.

f) UNDISCLOSED LIABILITIES. SELECT-TV SOLUTIONS (USA), INC. has no material obligations or liabilities of any nature (whether accrued, matured or unmatured, fixed or contingent or otherwise) other than (i) those set forth or adequately provided for in the consolidated balance sheet (and the related notes thereto) of ORIANA TECHNOLOGIES, INC. as of the end of the most recent fiscal year included in the ORIANA TECHNOLOGIES, INC. Financial Statements, (ii) those incurred in the ordinary course of business consistent with past practice since the end of the most recent fiscal year and (iii) those incurred in connection with the execution of this Agreement.

g) LEGAL PROCEEDINGS. SELECT-TV SOLUTIONS (USA), INC. is not a party to any, and there is no pending or, to the knowledge of SELECT-TV SOLUTIONS (USA), INC., threatened, legal, administrative, arbitral or other proceeding, claim, action or governmental or regulatory investigation of any nature against SELECT-TV SOLUTIONS (USA), INC., or any of its officers or directors which, if decided adversely to SELECT-TV SOLUTIONS (USA), INC., would, individually or in the aggregate, be material to SELECT-TV SOLUTIONS (USA), INC. There is no injunction, order, judgment or decree imposed upon SELECT-TV SOLUTIONS (USA), INC., or any of its officers or directors, or the assets of SELECT-TV SOLUTIONS (USA), INC.

| 16 |

Article 10 - Miscellaneous

10.1 Notices. Any notice or other communication to be given under this Agreement shall be in writing and shall be deemed to have been duly given when delivered personally or deposited in the United States mail, certified or registered with return receipt, or sent by courier requiring proof of receipt, addressed as follows:

| To: | SELECT-TV SOLUTIONS, INC. |

| Espirito Santo Plaza | |

| 1395 Brickell Avenue | |

| Suite 800 | |

| Miami, Florida | |

| 33131, USA | |

| Email: support@selectv.co | |

| To: | SELECT-TV SOLUTIONS (USA), INC.: |

| Espirito Santo Plaza | |

| 1395 Brickell Avenue | |

| Suite 800 | |

| Miami, Florida | |

| 33131, USA | |

| Email: support@selectv.co |

or to such other address as either party shall designate by written notice, similarly given, to the other party. If sent by telex, facsimile, email or other electronic media, an original confirmation copy must be sent within thirty (30) days by means listed above.

10.2 Governing Law; Jurisdiction and Venue. This Agreement shall be governed by the internal laws of the State of Nevada (without regard to conflict of law provisions); except that questions affecting the construction and effect to any patent shall be determined by the law of the country in which the patent has been granted. Arbitration. In the event of any controversy among the parties hereto arising out of, or relating to, this Agreement, which cannot be settled amicably by the parties, such controversy shall be settled by Arbitration. Both sides shall choose a mutually agreed upon competent jurist from a short list and informal Arbitration shall commence as expeditiously as possible. Either party may institute such arbitration proceeding by giving written notice to the other party. A hearing shall be held by the Arbitrator within 10 miles of Washington, DC, and a decision of the matter submitted to the Arbitrator shall be biding and enforceable against all parties in any Court of competent jurisdiction. The prevailing party shall be entitled to all costs and expenses with respect to such arbitration, including reasonable attorneys' fees. The decision of the Arbitrator shall be final, binding upon all parties hereto and enforceable in any Court of competent jurisdiction. Each party hereto irrevocably waives any objection to the laying of venue of any such Arbitration action or proceeding brought and irrevocably waives any claim that any such action brought has been brought in an inconvenient forum. Each of the parties hereto waives any right to request a trial by jury in any litigation with respect to this agreement and represents that counsel has been consulted specifically as to this waiver.

10.3 Waiver. Except as specifically provided for herein, the waiver from time to time by either party of any of its rights or a party's failure to exercise any remedy shall not operate or be construed as a continuing waiver of same or of any other of such party's rights or remedies provided in this Agreement.

10.4 Enforceability. If any term, covenant or condition of this Agreement or the application thereof to any party or circumstance shall, to any extent, be held to be invalid or unenforceable, then (a) the remainder of this Agreement, or the application of such term, covenant or condition to the parties or circumstances other than those as to which it is held invalid or unenforceable, shall not be affected thereby and each term, covenant or condition of this Agreement shall be valid and be enforced to the fullest extent permitted by law; and (b) the parties covenant and agree to renegotiate any such term, covenant or application thereof in good faith in order to provide a reasonably acceptable alternative to the term, covenant or condition of this Agreement or the application thereof that is invalid or unenforceable, and in the event that the parties are unable to agree upon a reasonable acceptable alternative, then the parties agree that a submission to arbitration shall be made to establish an alternative to such invalid or unenforceable term, covenant or condition of this Agreement or the application thereof, it being the intent that the basic purposes of this Agreement are to be effectuated.

| 17 |

10.5 Entire Agreement and Amendment. This Agreement contains the entire understandings of the parties with respect to the matters contained herein, and supersedes all prior agreements, oral or written, and all other communication between them relating to the subject matter hereof. The parties hereto may, from time to time during the continuance of this Agreement, modify, vary or alter any of the provisions of this Agreement, but only by an instrument duly executed by authorized officers of the parties hereto.

10.6 Headings. The headings of the several Articles and sections of this Agreement are intended for convenience of reference only and are not intended to be a part of or to affect the meaning or interpretation of this Agreement.

10.7 Further Instruments. Each party agrees to execute, acknowledge and deliver such further instruments and to do all such further acts as may be necessary or appropriate in order to carry out the purposes and intent of this Agreement.

10.8 Force Majeure. Performance of a party's obligations hereunder may be delayed if (a) such performance is delayed by causes beyond that party's reasonable control, including, but not limited to, acts of God, war, riot, epidemics, fire, flood, insurrection, or acts of civil or military authorities, and (b) such delaying party is at all times working diligently to correct the matter causing the delay and otherwise performing as required under the Agreement. Notwithstanding the foregoing, the parties shall remain liable for all obligations incurred by them prior to any termination of this Agreement.

10.9 Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement. One or more counterparts may be delivered via telecopier or emailed in portable document format (pdf) and any such telecopied or emailed pdf counterpart shall have the same force and effect as an original counterpart hereto.

IN WITNESS WHEREOF, the parties have executed this Agreement as an instrument under seal as of the date and year first written above, such that the Merger contemplated hereby become effective from and as of the close of business on the 31st day of July, 2014.

|

SELECT-TV SOLUTIONS, INC. |

SELECT-TV SOLUTIONS (USA), INC. |

| By: /s/ Philippe Germain | By: /s/ Richard T. Groome |

| Philippe Germain, Director | Richard T. Groome |

| 18 |