Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARDELYX, INC. | d771942d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

Investor Presentation

Mike Raab CEO

AUGUST 2014

|

|

Forward Looking Statements and Further Information

Special Note Regarding Forward-Looking Statements

To the extent that statements contained in this presentation are not descriptions of historical facts regarding Ardelyx, they are forward-looking statements reflecting the current beliefs and expectations of management made pursuant to the safe harbor of the Private Securities Reform Act of 1995, including statements regarding the availability and timing of data from ongoing tenapanor clinical trials, potential milestone payments from our collaboration partners, and the potential sufficiency of capital resources available to further develop our pipeline and our drug discovery and design platform. Such forward-looking statements involve substantial risks and uncertainties that could cause the development of tenapanor, or Ardelyx’s future results, performance or achievements to differ significantly from those expressed or implied by the forward-looking statements. Such risks and uncertainties include, among others, the uncertainties inherent in the clinical development process, Ardelyx’s reliance upon AstraZeneca for the development of tenapanor, Ardelyx’s reliance upon Sanofi for the discovery and development under the licensed NaP2b inhibitor program, and the uncertainties inherent in the research and discovery process. Ardelyx undertakes no obligation to update or revise any forward-looking statements. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to Ardelyx’s business in general, please refer to Ardelyx’s prospectus filed with the Securities and Exchange Commission on June 19, 2014, and its future periodic reports to be filed with the Securities and Exchange Commission.

| 2 |

|

|

|

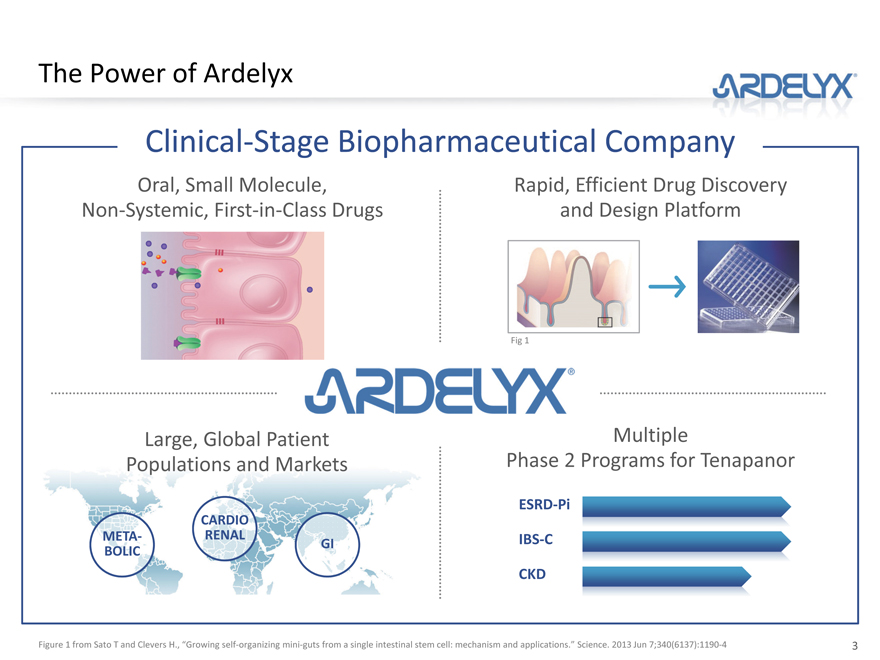

The Power of Ardelyx

Clinical-Stage Biopharmaceutical Company

Oral, Small Molecule, Non-Systemic, First-in-Class Drugs

Rapid, Efficient Drug Discovery and Design Platform

Large, Global Patient

Populations and Markets

CARDIO

META- RENAL

BOLIC GI

Multiple

Phase 2 Programs for Tenapanor

ESRD-Pi

IBS-C

CKD

Figure 1 from Sato T and Clevers H., “Growing self-organizing mini-guts from a single intestinal stem cell: mechanism and applications.” Science. 2013 Jun 7;340(6137):1190-4

| 3 |

|

|

|

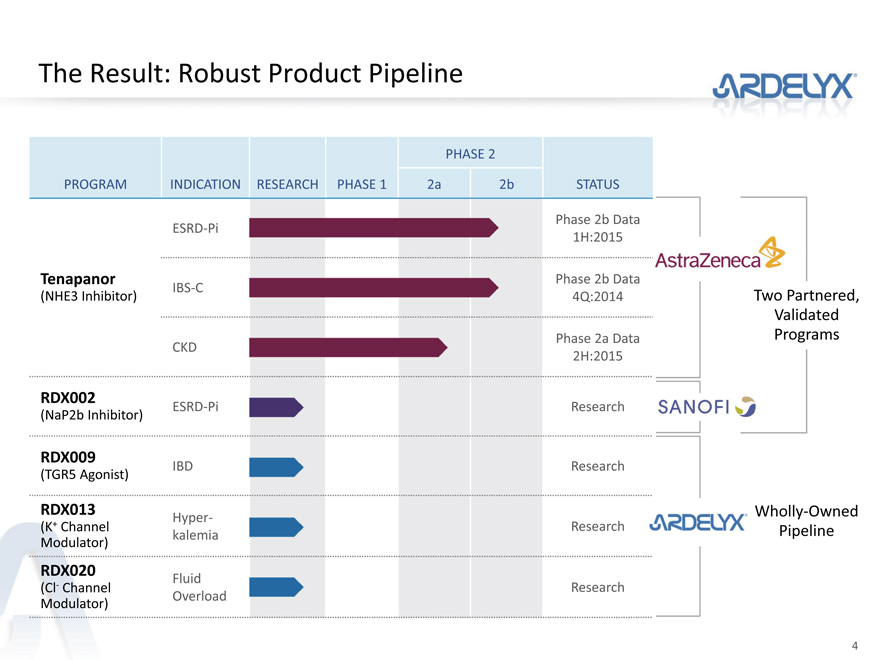

The Result: Robust Product Pipeline

PHASE 2

PROGRAM INDICATION RESEARCH PHASE 1 2a 2b STATUS

Phase 2b Data

ESRD-Pi

1H:2015

Tenapanor Phase 2b Data

IBS-C

(NHE3 Inhibitor) 4Q:2014 Two Partnered,

Validated

Phase 2a Data Programs

CKD

2H:2015

RDX002 ESRD-Pi Research

(NaP2b Inhibitor)

RDX009 IBD Research

(TGR5 Agonist)

RDX013 Wholly-Owned

Hyper-

(K+ Channel Research Pipeline

Modulator) kalemia

RDX020 Fluid

(Cl- Channel Research

Modulator) Overload

| 4 |

|

|

|

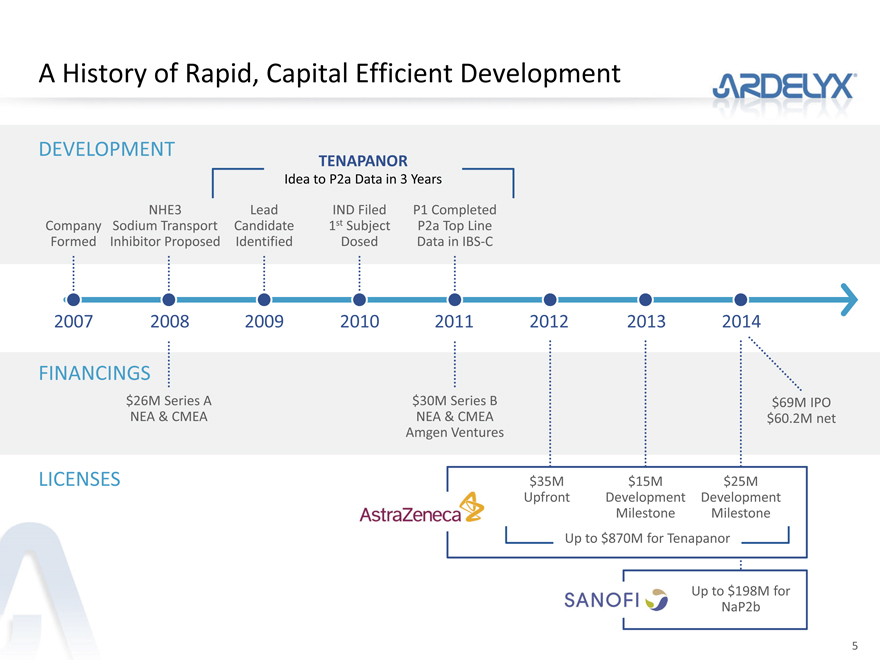

A History of Rapid, Capital Efficient Development

DEVELOPMENT

TENAPANOR

Idea to P2a Data in 3 Years

NHE3 Lead IND Filed P1 Completed

Company Sodium Transport Candidate 1st Subject P2a Top Line

Formed Inhibitor Proposed Identified Dosed Data in IBS-C

2007 2008 2009 2010 2011 2012 2013 2014

FINANCINGS

$26M Series A $30M Series B $69M IPO

NEA & CMEA NEA & CMEA $60.2M net

Amgen Ventures

LICENSES $35M $15M $25M

Upfront Development Development

Milestone Milestone

Up to $870M for Tenapanor

Up to $198M for

NaP2b

| 5 |

|

|

|

Proven Management Team

MIKE RAAB Chief Executive Officer

DOMINIQUE CHARMOT, PhD Chief Scientific Officer

MARK KAUFMANN Chief Financial Officer

DAVID ROSENBAUM, PhD VP Drug Development

ELIZABETH GRAMMER VP and General Counsel

JEFF JACOBS, PhD VP Chemistry

GEORGE JUE VP Finance and Operations

ROB BLANKS Sr. Dir. Regulatory Affairs and QA

ANDY SPENCER, PhD Sr. Dir. R&D Alliance Management

| 6 |

|

|

|

Investment Highlights

PROPRIETARY PLATFORM

2 VALIDATED PROGRAMS

WHOLLY-OWNED PIPELINE

CAPITAL EFFICIENCY

PROVEN MANAGEMENT TEAM

Discovery and Design of Non-Systemic,

Small Molecule Therapeutics

Tenapanor: AstraZeneca Collaboration;

Phase 2 in Three Indications

NaP2b Inhibition: Sanofi Collaboration

Multiple Near-Term Catalysts

Pipeline Provides Additional Opportunity

Strong History

Deep Domain Expertise

7

|

|

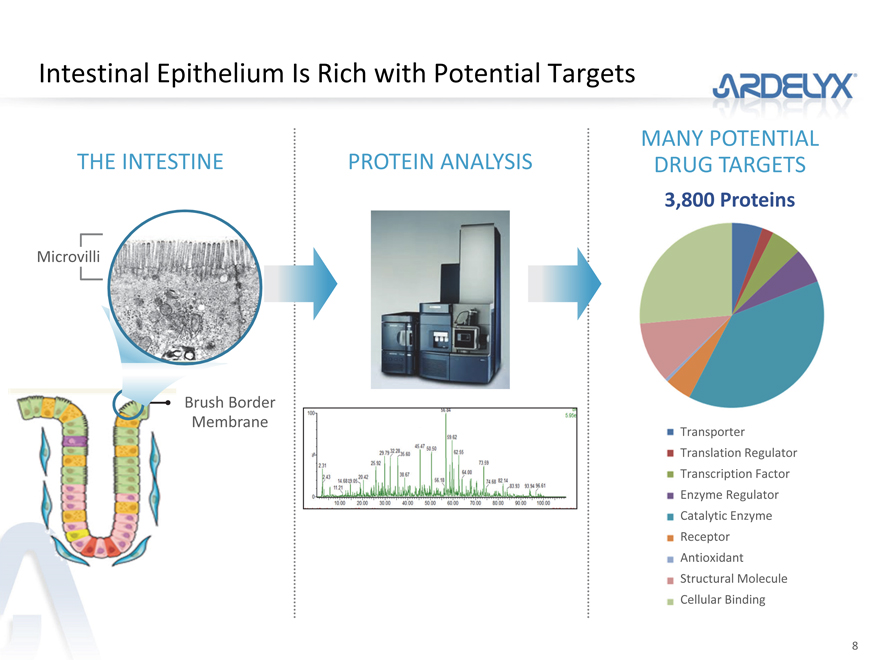

Intestinal Epithelium Is Rich with Potential Targets

THE INTESTINE

Microvilli

Brush Border

Membrane

PROTEIN ANALYSIS

MANY POTENTIAL DRUG TARGETS

3,800 Proteins

Transporter

Translation Regulator Transcription Factor Enzyme Regulator Catalytic Enzyme Receptor Antioxidant Structural Molecule Cellular Binding

| 8 |

|

|

|

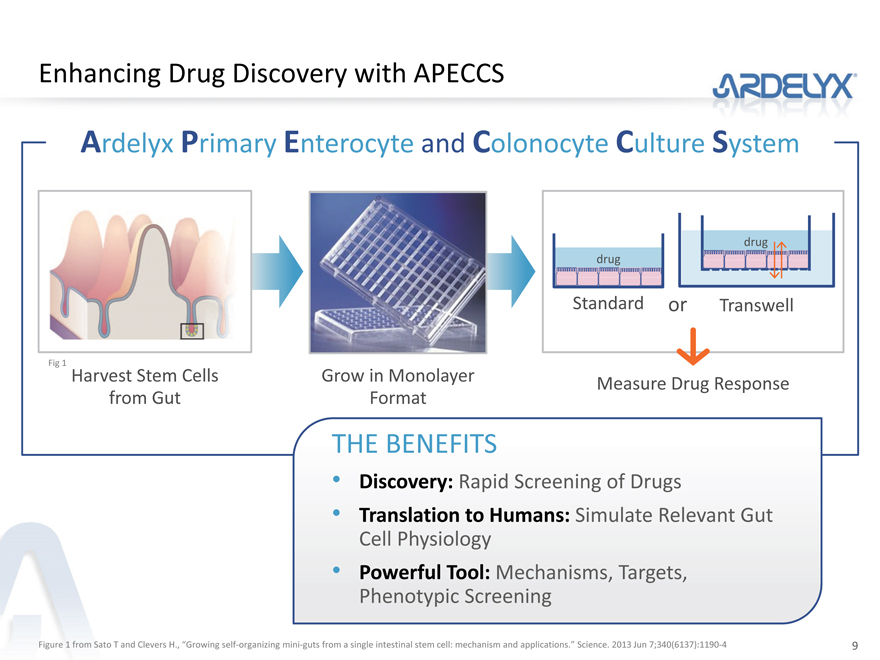

Enhancing Drug Discovery with APECCS

Ardelyx Primary Enterocyte and Colonocyte Culture System

drug

drug

Standard or Transwell

Fig 1

Harvest Stem Cells Grow in Monolayer Measure Drug Response

from Gut Format

THE BENEFITS

Discovery: Rapid Screening of Drugs

Translation to Humans: Simulate Relevant Gut

Cell Physiology

Powerful Tool: Mechanisms, Targets,

Phenotypic Screening

Figure 1 from Sato T and Clevers H., “Growing self-organizing mini-guts from a single intestinal stem cell: mechanism and applications.” Science. 2013 Jun 7;340(6137):1190-4

9

|

|

Tenapanor and Our Collaboration with AstraZeneca

PROPRIETARY PLATFORM Discovery and Design of Non-Systemic,

Small Molecule Therapeutics

Tenapanor: AstraZeneca Collaboration;

| 2 |

|

VALIDATED PROGRAMS Phase 2 in Three Indications |

NaP2b Inhibition: Sanofi Collaboration

Multiple Near-Term Catalysts

WHOLLY-OWNED PIPELINE Pipeline Provides Additional Opportunity

CAPITAL EFFICIENCY Strong History

PROVEN MANAGEMENT TEAM Deep Domain Expertise

10

|

|

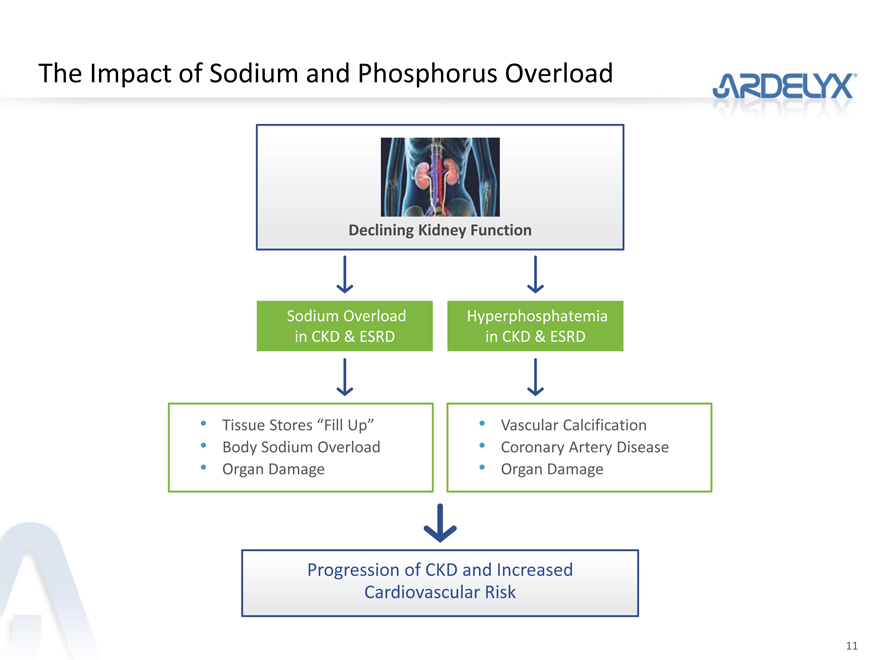

The Impact of Sodium and Phosphorus Overload

Declining Kidney Function

Sodium Overload Hyperphosphatemia

in CKD & ESRD in CKD & ESRD

Tissue Stores “Fill Up” Vascular Calcification

Body Sodium Overload Coronary Artery Disease

Organ Damage Organ Damage

Progression of CKD and Increased

Cardiovascular Risk

11

|

|

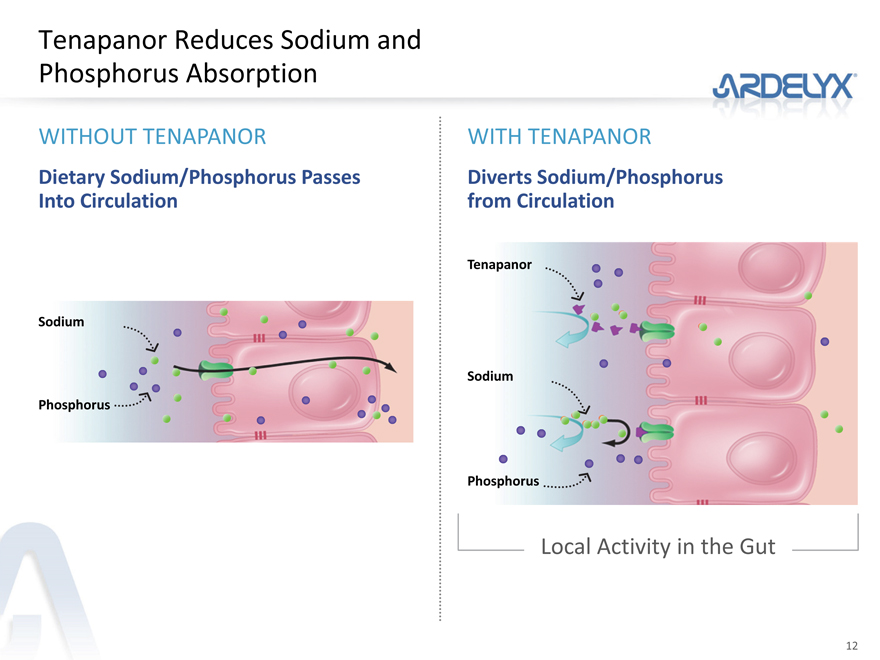

Tenapanor Reduces Sodium and Phosphorus Absorption

WITHOUT TENAPANOR WITH TENAPANOR

Dietary Sodium/Phosphorus Passes Diverts Sodium/Phosphorus

Into Circulation from Circulation

Tenapanor

Sodium

Sodium

Phosphorus

Phosphorus

Local Activity in the Gut

12

|

|

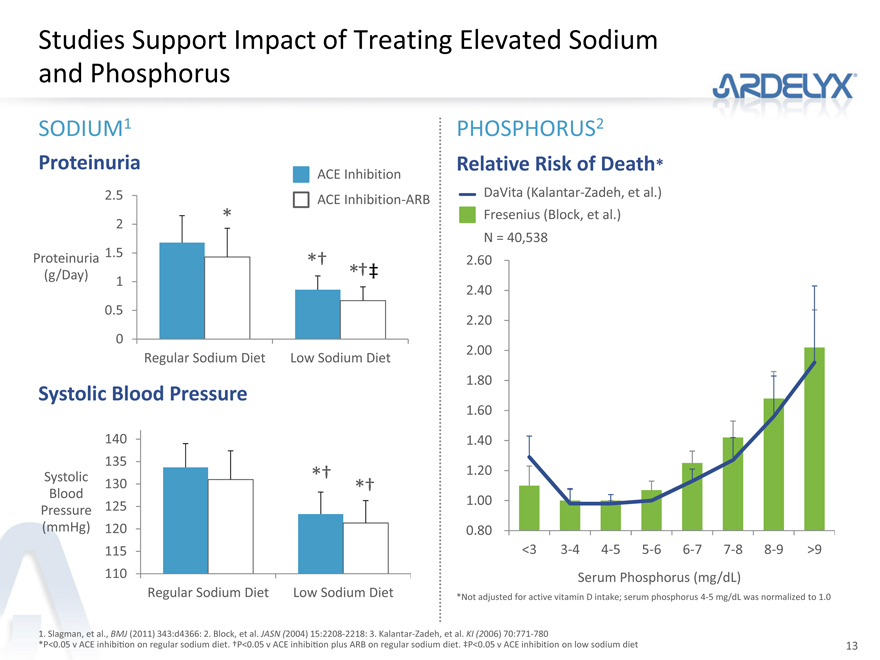

Studies Support Impact of Treating Elevated Sodium and Phosphorus

SODIUM1 PHOSPHORUS2

Proteinuria Relative Risk of Death*

ACE Inhibition

2.5 ACE Inhibition-ARB DaVita (Kalantar-Zadeh, et al.)

2 * Fresenius (Block, et al.)

N = 40,538

Proteinuria 1.5 *† 2.60

(g/Day) *†‡

1

2.40

0.5

2.20

0

Regular Sodium Diet Low Sodium Diet 2.00

1.80

Systolic Blood Pressure

1.60

140 1.40

135

Systolic *† 1.20

Blood 130 *†

1.00

Pressure 125

(mmHg) 120 0.80

115 <3 3-4 4-5 5-6 6-7 7-8 8-9 >9

110 Serum Phosphorus (mg/dL)

Regular Sodium Diet Low Sodium Diet *Not adjusted for active vitamin D intake; serum phosphorus 4-5 mg/dL was normalized to 1.0

1. Slagman, et al., BMJ (2011) 343:d4366: 2. Block, et al. JASN (2004) 15:2208-2218: 3. Kalantar-Zadeh, et al. KI (2006) 70:771-780

*P<0.05 v ACE inhibition on regular sodium diet. †P<0.05 v ACE inhibition plus ARB on regular sodium diet. ‡P<0.05 v ACE inhibition on low sodium diet

13

|

|

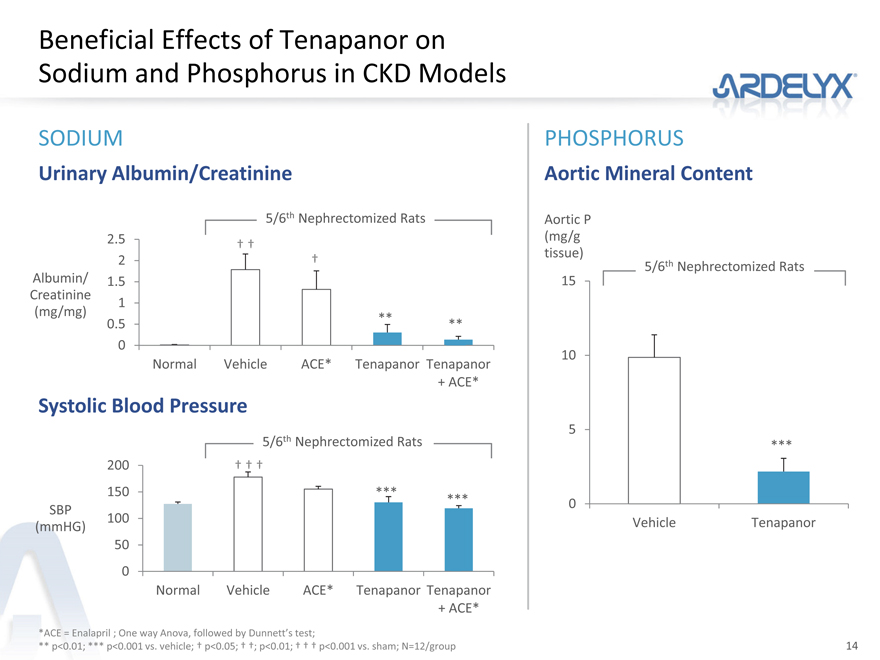

Beneficial Effects of Tenapanor on Sodium and Phosphorus in CKD Models

SODIUM PHOSPHORUS

Urinary Albumin/Creatinine Aortic Mineral Content

5/6th Nephrectomized Rats Aortic P

2.5 (mg/g

† †

| 2 |

|

† tissue) 5/6th Nephrectomized Rats |

Albumin/ 1.5 15

Creatinine 1

(mg/mg) **

0.5 **

0

10

Normal Vehicle ACE* Tenapanor Tenapanor

+ ACE*

Systolic Blood Pressure

| 5 |

|

5/6th Nephrectomized Rats ***

200 † † †

150 ***

SBP *** 0

100

(mmHG) Vehicle Tenapanor

50

0

Normal Vehicle ACE* Tenapanor Tenapanor

+ ACE*

*ACE = Enalapril ; One way Anova, followed by Dunnett’s test;

** p<0.01; *** p<0.001 vs. vehicle; † p<0.05; † †; p<0.01; † † † p<0.001 vs. sham; N=12/group

14

|

|

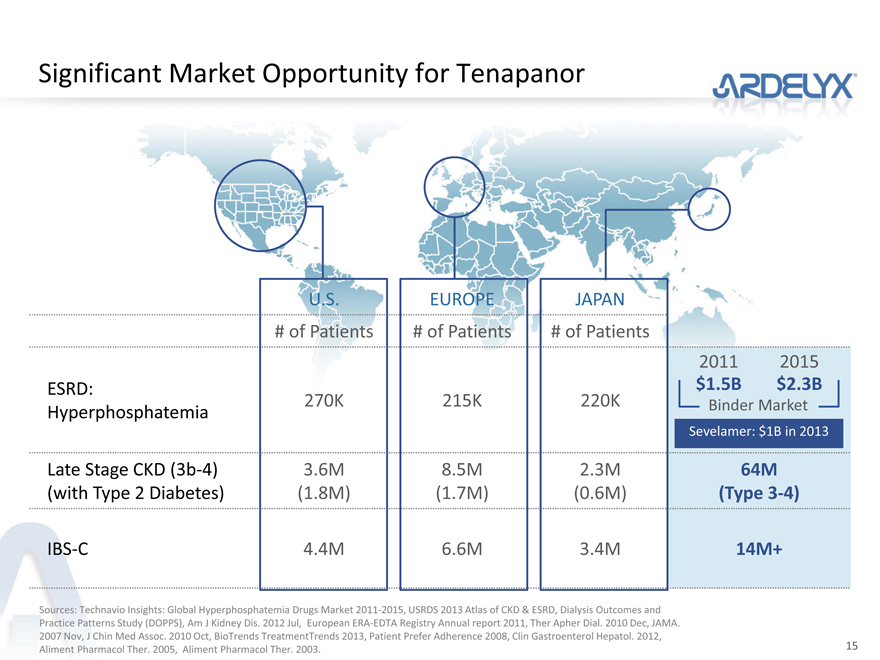

Significant Market Opportunity for Tenapanor

U.S. EUROPE JAPAN

# of Patients # of Patients # of Patients

2011 2015

ESRD: $1.5B $2.3B

Hyperphosphatemia 270K 215K 220K Binder Market

Sevelamer: $1B in 2013

Late Stage CKD (3b-4) 3.6M 8.5M 2.3M 64M

(with Type 2 Diabetes) (1.8M) (1.7M) (0.6M) (Type 3-4)

IBS-C 4.4M 6.6M 3.4M 14M+

Sources: Technavio Insights: Global Hyperphosphatemia Drugs Market 2011-2015, USRDS 2013 Atlas of CKD & ESRD, Dialysis Outcomes and Practice Patterns Study (DOPPS), Am J Kidney Dis. 2012 Jul, European ERA-EDTA Registry Annual report 2011, Ther Apher Dial. 2010 Dec, JAMA. 2007 Nov, J Chin Med Assoc. 2010 Oct, BioTrends TreatmentTrends 2013, Patient Prefer Adherence 2008, Clin Gastroenterol Hepatol. 2012, Aliment Pharmacol Ther. 2005, Aliment Pharmacol Ther. 2003.

15

|

|

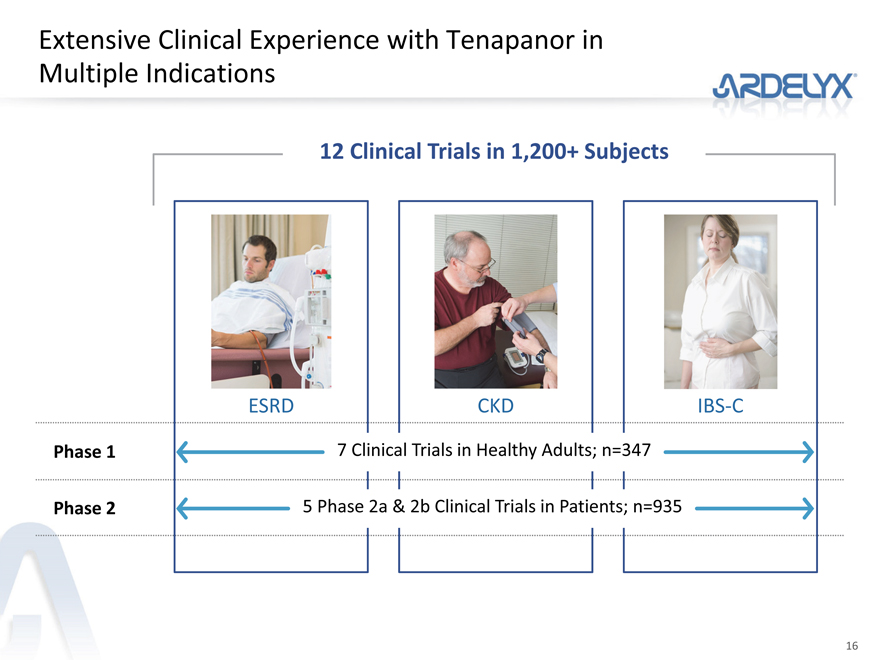

Extensive Clinical Experience with Tenapanor in Multiple Indications

12 Clinical Trials in 1,200+ Subjects

ESRD CKD IBS-C

Phase 1 7 Clinical Trials in Healthy Adults; n=347

Phase 2 5 Phase 2a & 2b Clinical Trials in Patients; n=935

16

|

|

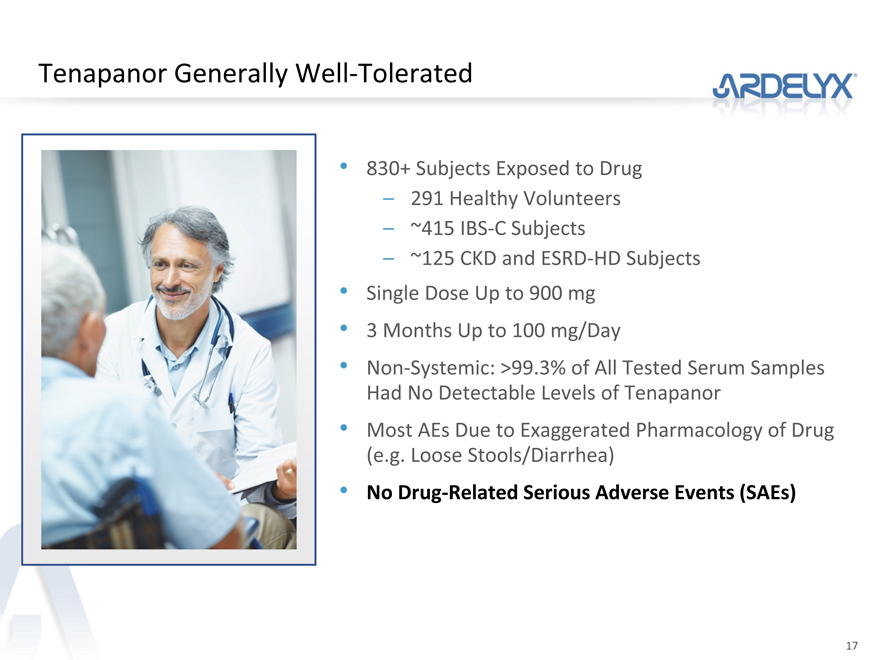

Tenapanor Generally Well-Tolerated

830+ Subjects Exposed to Drug

291 Healthy Volunteers

~415 IBS-C Subjects

~125 CKD and ESRD-HD Subjects

Single Dose Up to 900 mg

3 Months Up to 100 mg/Day

Non-Systemic: >99.3% of All Tested Serum Samples Had No Detectable Levels of Tenapanor

Most AEs Due to Exaggerated Pharmacology of Drug (e.g. Loose Stools/Diarrhea)

No Drug-Related Serious Adverse Events (SAEs)

17

|

|

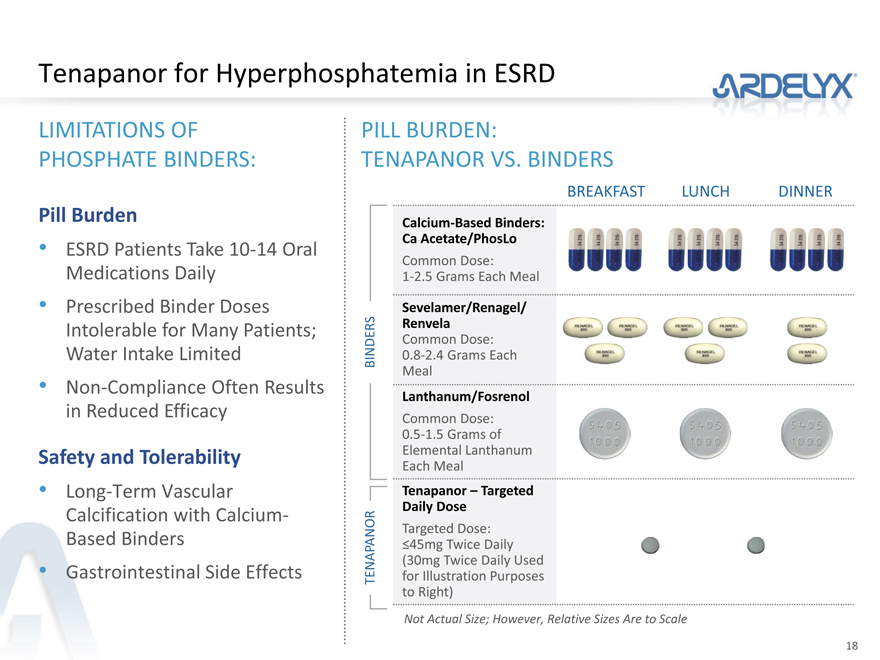

Tenapanor for Hyperphosphatemia in ESRD

LIMITATIONS OF PHOSPHATE BINDERS:

Pill Burden

ESRD Patients Take 10-14 Oral Medications Daily

Prescribed Binder Doses Intolerable for Many Patients; Water Intake Limited

Non-Compliance Often Results in Reduced Efficacy

Safety and Tolerability

Long-Term Vascular Calcification with Calcium-Based Binders

Gastrointestinal Side Effects

PILL BURDEN:

TENAPANOR VS. BINDERS

BREAKFAST LUNCH DINNER

Calcium-Based Binders:

Ca Acetate/PhosLo

Common Dose:

1-2.5 Grams Each Meal

Sevelamer/Renagel/

Renvela

Common Dose:

BINDERS 0.8-2.4 Grams Each

Meal

Lanthanum/Fosrenol

Common Dose:

0.5-1.5 Grams of

Elemental Lanthanum

Each Meal

Tenapanor – Targeted

Daily Dose

Targeted Dose:

TENAPANOR

£45mg Twice Daily

(30mg Twice Daily Used

for Illustration Purposes

to Right)

Not Actual Size; However, Relative Sizes Are to Scale

18

|

|

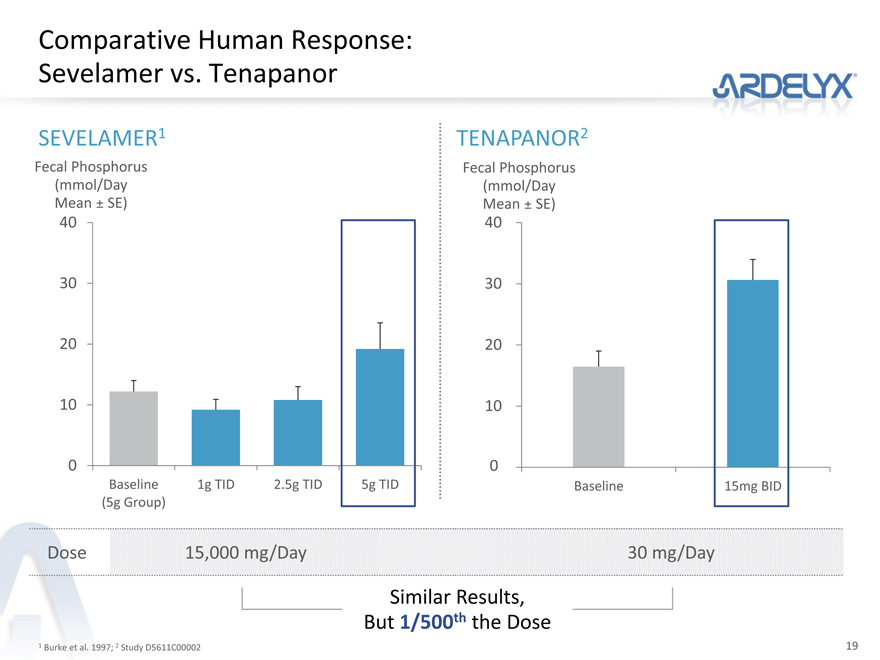

Comparative Human Response: Sevelamer vs. Tenapanor

SEVELAMER1 TENAPANOR2

Fecal Phosphorus Fecal Phosphorus

(mmol/Day (mmol/Day

Mean ± SE) Mean ± SE)

40 40

30 30

20 20

10 10

0 0

Baseline 1g TID 2.5g TID 5g TID Baseline 15mg BID

(5g Group)

Dose 15,000 mg/Day 30 mg/Day

Similar Results,

But 1/500th the Dose

| 1 |

|

Burke et al. 1997; 2 Study D5611C00002 |

19

|

|

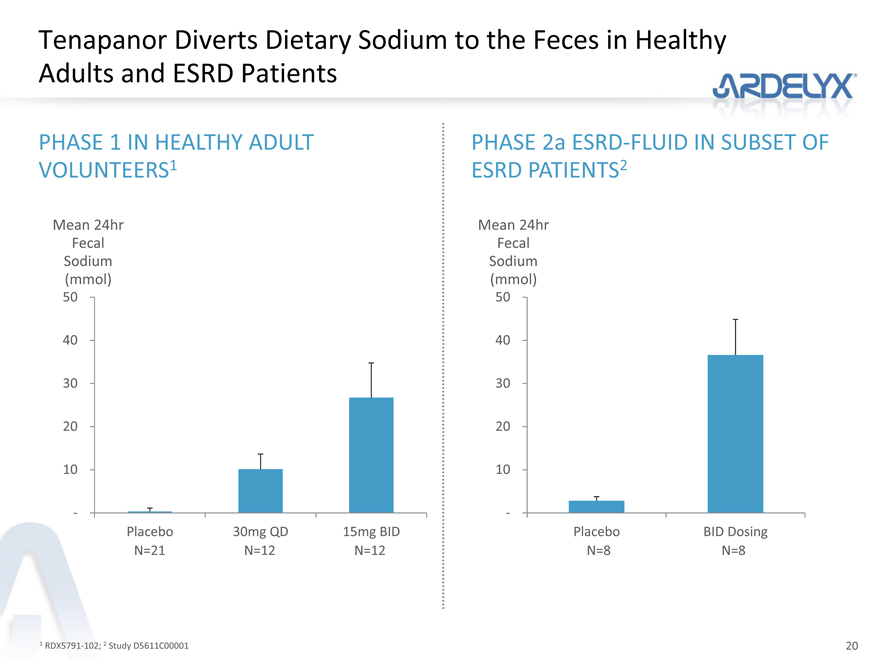

Tenapanor Diverts Dietary Sodium to the Feces in Healthy Adults and ESRD Patients

PHASE 1 IN HEALTHY ADULT

VOLUNTEERS1

Mean 24hr

Fecal

Sodium

(mmol)

50

40

30

20

10

-

Placebo 30mg QD 15mg BID

N=21 N=12 N=12

| 1 |

|

RDX5791-102; 2 Study D5611C00001 |

PHASE 2a ESRD-FLUID IN SUBSET OF

ESRD PATIENTS2

Mean 24hr

Fecal

Sodium

(mmol)

50

40

30

20

10

-

Placebo BID Dosing

N=8 N=8

20

|

|

ESRD Clinical Trials

ESRD FLUID

PHASE 2a

ESRD-

HYPERPHOSPHATEMIA

PHASE 2b

Design: Double-Blind; 4 Weeks of Treatment, n=88 (45 Active/43 Placebo)

Objective: Safety, Tolerability, and Pharmacodynamics of Tenapanor in ESRD-HD Patients with Fluid Overload

Status: Completed

Design: Double Blind; 4 Weeks Of Treatment, n=150 (125 Active/25 Placebo)

Objective: Efficacy and Safety of Tenapanor for the Treatment of Hyperphosphatemia in ESRD-HD Patients; Determination of Phase 3 Dose(s)

Status: Enrolling; Data Expected 1H 2015

21

|

|

Tenapanor for Treating CKD

Sodium and Fluid Overload

LIMITATIONS OF CURRENT TREATMENTS TO DELAY CKD PROGRESSION

Poor Compliance with Low Sodium Diets

Diuretics Lose Efficacy and Cause Electrolyte Disorders

ACE Inhibitors Reduce Blood Pressure but Hyperkalemia Limits Widespread Use in CKD Patients

22

|

|

CKD Clinical Trials

CKD

PHASE 2a

Design: Double-Blind, 12 Weeks of Treatment, n=140 (70 Active/70 Placebo)

Objective: Safety, Tolerability, and Pharmacodynamics of Tenapanor in CKD Patients with Type 2 Diabetes Mellitus and Albuminuria

Status: Enrolling, Data Expected 2H 2015

23

|

|

Tenapanor for IBS-C

GI Disorder: Constipation and Abdominal Pain

LIMITATIONS OF CURRENT TREATMENTS

OTC Drugs Inexpensive but Not Very Effective in Moderate to Severe Cases

Amitiza® and Linzess® Fall Short:

– Achieve Endpoint in Only 7% to 20% of Patients

– Side Effects (e.g., Diarrhea)

Medical Need for Improved Therapies with Better Efficacy, Excellent Safety and Tolerability

24

|

|

Phase 2a Demonstrates Consistent Effects of Tenapanor in Multiple Endpoints and Supports Ongoing Phase 2b Study

DUAL ENDPOINT: >30% DECREASE IN WEEKLY ABDOMINAL PAIN SCORE AND >1 INCREASE IN CSBM FREQUENCY AS COMPARED TO BASELINE

End of Treatment

40% Placebo (n=47)

| * |

|

100mg QD (n=46) |

30%

Percent

Responders 20%

10%

0%

Week 1 Week 2 Week 3 Week 4 Follow-Up Follow-Up

Week 1 Week 2

Although the Primary Endpoint, Change in CSBM from Baseline to Week 4, Was Not Met, We Did Note Improvements in Degree of Bloating and Abdominal Pain, as Well as Relief of IBS Symptoms, Severity and QOL Measurements

These Data Were the Basis for Our Decision to Take Tenapanor into a Phase 2b Clinical Study

| * |

|

p<0.05 versus placebo |

25

|

|

IBS-C Clinical Trials

IBS-C

PHASE 2a

IBS-C

PHASE 2b

Design: Double-Blind, 4 Weeks of Treatment, n=186 (139 Active/47 Placebo)

Objective: Safety, Tolerability, and Pharmacodynamics of Tenapanor for the Treatment of IBS-C

Status: Completed

Design: Double-Blind, 12 Weeks of Treatment, n=371 (3:1 Active: Placebo)

Objective: Efficacy and Safety of Tenapanor for the Treatment of IBS-C; Determination of Phase 3 Dose(s)

Status: Enrollment Completed, Data Expected 4Q 2014

26

|

|

The AstraZeneca/Tenapanor Collaboration

PAYMENTS

Additional

Upfront Development Launch and Sales

Up to

Milestones $35M $237.5M $597.5M $870M

Total

$50M 2H 2015

$20M 1H 2015

$25M Received May 2014

$15M Received December 2013

Royalties Incremental, Tiered (High Single Digit – High Teen Percentages)

Co-Funding Option at 1st P3 Trial: Buy Up to 1%, 2% or 3% of

Royalties with $20M, $30M or $40M* Respectively

OTHER TERMS

AstraZeneca

Responsibilities: All R&D and Commercialization Expenses**

Ardelyx Rights: Right to Co-Promote in the US

*Exercisable Within 60 Days After Decision to Proceed to P3 Clinical for the First Indication for Tenapanor **Subject to cap on obligation for IBS-C reimbursement

27

|

|

RDX002: NaP2b and Our Collaboration with Sanofi

PROPRIETARY PLATFORM

2 VALIDATED PROGRAMS

WHOLLY-OWNED PIPELINE

CAPITAL EFFICIENCY

PROVEN MANAGEMENT TEAM

Discovery and Design of Non-Systemic, Small Molecule Therapeutics

Tenapanor: AstraZeneca Collaboration; Phase 2 in Three Indications

RDX002 NaP2b Inhibition: Sanofi Collaboration

Multiple Near-Term Catalysts

Pipeline Provides Additional Opportunity Strong History Deep Domain Expertise

28

|

|

Phosphate Binder vs. Phosphate Transport Inhibitor

Binder Phosphate Transport Inhibitor

Phosphate Binder Phosphate Phosphate

Transport

Inhibitor

NaP2b

Transporter

Enterocyte

Capillary

GI-Upset/Pill-Burden

Increased Calcium Load with Calcium Based Binders

Concerns of Metal Accumulation with Metal Based Binders

Potential for Dramatically Reduced Pill-Burden

Potential for Use in Combination with Phosphate Binders

29

|

|

RDX002: NTX1942 Reduces Urine Phosphorus Levels in Normal Rats and Is Additive to Sevelamer

0

Reduction -10

(%)

-20

-30 ** *** ***

Vehicle Sevelamer NTX1942 Combo

500 mg/kg 50 mg/kg

Combination of

Sevelamer and

NTX1942 Is Additive

NTX1942 Response Is Superior to Sevelamer at 1/10 of the Dose

Data Shown is the Mean ± SEM; ** = p<0.01; *** =p<0.001, by one-way ANOVA, n= 12

30

|

|

The Sanofi/NaP2b Collaboration

Milestones

Royalties

Licensed Technology

Other Terms

PAYMENTS

Upfront Potential Additional Devt./Reg Milestones

Up to

$198M

Total

$1.25M

Incremental, Tiered (Mid-Single Digit – Low Teen Percentages)

NaP2b Patent Portfolio and Related Know-how for Research to

Complete Activities under Preclinical Development Plan

Option to Obtain Exclusive License to Develop, Manufacture and

Commercialize NaP2b Inhibitors

Sanofi Responsible for Completing Pre-Clinical Development Plan,

and if It Exercises the Option, for All Development and

Commercialization at Its Expense

Ardelyx Has the Right to Co-Promote in the US

31

|

|

Ardelyx-Owned Pipeline

PROPRIETARY PLATFORM

2 VALIDATED PROGRAMS

WHOLLY-OWNED PIPELINE

CAPITAL EFFICIENCY

PROVEN MANAGEMENT TEAM

Discovery and Design of Non-Systemic, Small Molecule Therapeutics

Tenapanor: AstraZeneca Collaboration; Phase 2 in Three Indications

NaP2b Inhibition: Sanofi Collaboration

Multiple Near-Term Catalysts

Pipeline Provides Additional Opportunity Strong History Deep Domain Expertise

32

|

|

RDX009: TGR5 Agonists for Inflammatory Bowel Disease (IBD)

TGR5 STIMULATION

Enhances GLP1 and GLP2 (Incretins) Secretion Directly to the GI Mucosa

Anti-Inflammation and Mucosal Healing Effects

Gattex® = GLP2 approved for Short Bowel Syndrome – Studied in Crohn’s

– Daily Injections

Intercept and Exelixis/BMS Both Have Systemic TGR5 Agonists

– Gallbladder Emptying Issues

– Short Lasting Incretin Secretion

ARDELYX TGR5 AGONISTS + DPP4 INHIBITOR

No Gallbladder Issues

Long Lasting Incretin Secretion

Significantly Improves Mucosal Damage In Mouse Model of IBD

33

|

|

RDX013: Hyperkalemia (Elevated Serum Potassium)

THE CHALLENGE

All Potassium Binders (e.g. Patiromer) Have Limited Efficacy on per Gram Basis

Therapeutic Dose for Kayexelate, Patiromer or ZS-9 Substantially the Same (15-30 g/day)

The Limiting Factor in Efficacy is Not Binder Capacity but Availability of Potassium in the Colon

ARDELYX POTASSIUM “SECRETAGOGUE”

To Move Potassium into Colon and Increase Fecal Excretion

Used as a Stand Alone or in Combination with Potassium Binder

Augment Patient Compliance

Maintain Normal Serum Potassium with Optimal Dosing of Antihypertensives (RAAS Blockade Drugs)

34

|

|

Near-Term Catalysts to Drive Value

Tenapanor

IBS-C ESRD-Pi CKD

DATA Phase 2b Phase 2b Phase 2a

Data Data Data

Q4 1H 2H

2014 2015

35

|

|

Financial Overview

$ MILLIONS

$33.2M (as of 3/31/14)

Cash and Cash Equivalents $25M Additional Received May 2014

$61M received from IPO in July 2014

Operating Expenses* $12.5M (12 Months Ended 3/31/14)

Debt $0

Capital Raised

Series A $26M Series B $30M IPO $69M

Nasdaq:

Ventures ARDX

2008 2011

*Excludes amounts reimbursed by AZN or associated with AZN agreement

36

|

|

Summary

PROPRIETARY PLATFORM

2 VALIDATED PROGRAMS

WHOLLY-OWNED PIPELINE

CAPITAL EFFICIENCY

PROVEN MANAGEMENT TEAM

Discovery and Design of Non-Systemic, Small Molecule Therapeutics

Tenapanor: AstraZeneca Collaboration; Phase 2 in Three Indications

NaP2b Inhibition: Sanofi Collaboration

Multiple Near-Term Catalysts

Pipeline Provides Additional Opportunity Strong History Deep Domain Expertise

37