Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Northern Power Systems Corp. | d767375dex991.htm |

| 8-K - FORM 8-K - Northern Power Systems Corp. | d767375d8k.htm |

Q2

2014 Earnings Presentation August 5, 2014

Exhibit 99.2 |

All

statements and other information contained in this document related to anticipated future events or results

constitute forward-looking statements. Forward-looking statements often,

but not always, are identified by the use of words such as “seek”,

“anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “forecast”, “project”, “likely”,

“potential”,

“targeted”

and

“possible”

and

statements

that

an

event

or

result

“may”,

“will”,

“would”,

“should”,

“could”

or “might”

occur or be achieve and other similar expressions. Forward-looking

statements are subject to known and unknown business and economic risks and

uncertainties and other factors that could cause actual results of operations to

differ materially from those expressed or implied by the forward-looking statements. Forward-

looking statements are based on estimates and opinions of management at the date the

statements are made. Northern Power Systems does not undertake any obligation to

update forward-looking statements even if circumstances or management’s

estimates or opinions should change, except as required by law. For the

reasons set forth above, investors should not place undue reliance on

forward-looking statements. This presentation references non-GAAP

financial measures with the required reconciliation referenced in the

table

captioned

“Non-GAAP

Reconciliations”

to

the

most

comparable

GAAP

financial

measures.

2

FORWARD

LOOKING

STATEMENT

AND

NON-GAAP

DISCLOSURES |

Presentation Organization and Call Details

3

Troy Patton

President and CEO

Ciel Caldwell

CFO

Q&A Session:

Presentation Organization:

Basis of Presentation:

Q2 2014 business update

Q2 2014 operational and

financial results review

GAAP to Non-GAAP

reconciliations

Q2 2014 = Northern Power Systems Corp.

YTD 2014 = Q1 Wind Power Holdings, Inc.

+ Q2 Northern Power Systems Corp.

2013 periods = Wind Power Holdings, Inc.

Immediately following this call

Link from IR webpage at

http://www.ir.northernpower.com/

events-and-presentations.aspx

Hosted by: |

NPS’

Business Lines

Distributed turbine

sales expanding

NPS 100kW

NPS 60kW

BRIC+ strategy

Fully developed Licensing and

Royalty Model

Successfully deployed in China

and Brazil to date

Global Growth

High-margin Engineering

Project work

Expansion of IP portfolio

Technology Licensing

Product Sales & Service

NPS 2MW

turbine

platform

Converter and

Controls Systems

4

Technology Development |

Business Expansion Trends

5

Q1 ‘13

Q2 ‘14

Q1 ‘13

Q2 ‘14

Bridge to Net Loss

Non-GAAP EBITDA Loss

(3.4)

(2.2)

(3.1)

(4.8)

(3.2)

Q1 ‘13

Q2 ‘14

Revenue

Backlog

(2.8)

13.8

13.8

9.0

5.6

4.3

1.7

41

48

45

36

34

21

$14

$12

$10

$8

$6

$4

$2

$0

$50

$40

$30

$20

$10

$0

(2.9)

(3.0)

(2.3)

(3.0)

(2.5)

(1.3)

$0

($1)

($2)

($3)

($4)

($5) |

Q2

2014: Product Sales and Service Update Production

of

initial

unit

of

3

rd

-

generation 60kW turbine in VT factory.

Continued strong European

momentum; evolving market

conditions

First 4 units shipped to Korea

Staffing expansion plan for Sales and

Marketing to expand regions and re-

focus efforts in North America

Exploring further Power Converter

supply agreements

6

Distributed turbine

sales expanding

Product Sales & Service

NPS 2MW

turbine

platform

NPS 100kW

NPS 60kW

Converter and

Controls Systems |

Next

Generation Distributed Turbine 7

Next gen

turbine in testing

Installation at

customer site

Power generation

Second

generation

turbine

Third generation turbine |

Q2

2014: Technology Licensing Update WEG 2.1MW turbine deliveries

begin in Brazil

Initial 2.1MW units expected to

commission in 4Q14

3Q14 expecting partial WEG

license revenue recognition and

commenced royalty payments

Other smaller technology

licensing transactions underway

8

BRIC+ strategy

Fully developed Licensing and

Royalty Model

Successfully deployed in China

and Brazil to date

Technology Licensing |

WEG

Manufactured 2.1MW Turbines 9 |

Q2

2014: Technology Development WEG 3.3MW license agreement

commenced:

Expecting to scale development in Q3

into Q4; anticipated completion in 2015

Backbone of planned development

activity for next twelve months

Patented FlexPhase Power

Converters currently under

development for other

applications in the power sector

NPS expertise in complex power

grid connections currently utilized

for work with a regulated utility in

the US Northeast

10

Broad scale expansion

High-margin Engineering

Project work

Expansion of IP portfolio

Technology Development |

Q2

2014: Key Financial Metrics Q2 2014

YTD 2014

Revenue

•

$13.8M

•

220% y/y growth

•

$27.5M

•

360% y/y growth

Backlog

•

$41M

•

21% y/y growth

Gross Margin

•

16%

•

PY at (1%)

•

12%

•

PY at (4%)

Net Loss

•

($2.2M)

•

22% y/y loss reduction

•

($0.10/share)

•

($5.3M)

•

14% y/y loss reduction

•

($0.31/share)

Non-GAAP EBITDA

Loss

•

($1.3M)

•

58% y/y loss reduction

•

($0.06/share)

•

($3.8M)

•

36% y/y loss reduction

•

($0.22/share)

11 |

Revenue and Gross Margin Trends

12

Q1 ‘13

Q2 ‘13

Q4 ‘13

Q2 ‘14

Q1 ‘14

Q3 ‘13

High-wind Regimes

Non-turbine Revenue

Low-wind Regimes

$0

$2

$4

$6

$8

$10

$12

$14

-

9.9%

-1.3%

16.2%

6.1%

8.6%

15.9%

-

10.0%

0.0%

10.0%

20.0% |

Q2

2014: Other Financial Metrics Cash Flow Statement

Q2 2014

YTD 2014

Cash used in operations

($6.9M)

($9.2M)

Cash provided by investing

activities

$.9M

$.7M

Cash provided by financing

activities

$19.3M

$19.2M

13

Balance Sheet Metrics

June 30, 2014

December 31, 2013

Cash and cash equivalents

$15.4M

$4.5M

Debt

$0*

$12.5M

* Comerica working capital line of credit available through 6/30/15 for up to

$6M Change in

operating assets /

liab. ($5.6M)

•

•

Cap-Ex ($.4M)

Facility Sale $1.3M

•

•

Change in

operating assets /

liab. ($5.1M)

•

Cap-Ex ($.6M)

Facility Sale $1.3M

• |

14

Non-GAAP Reconciliations |

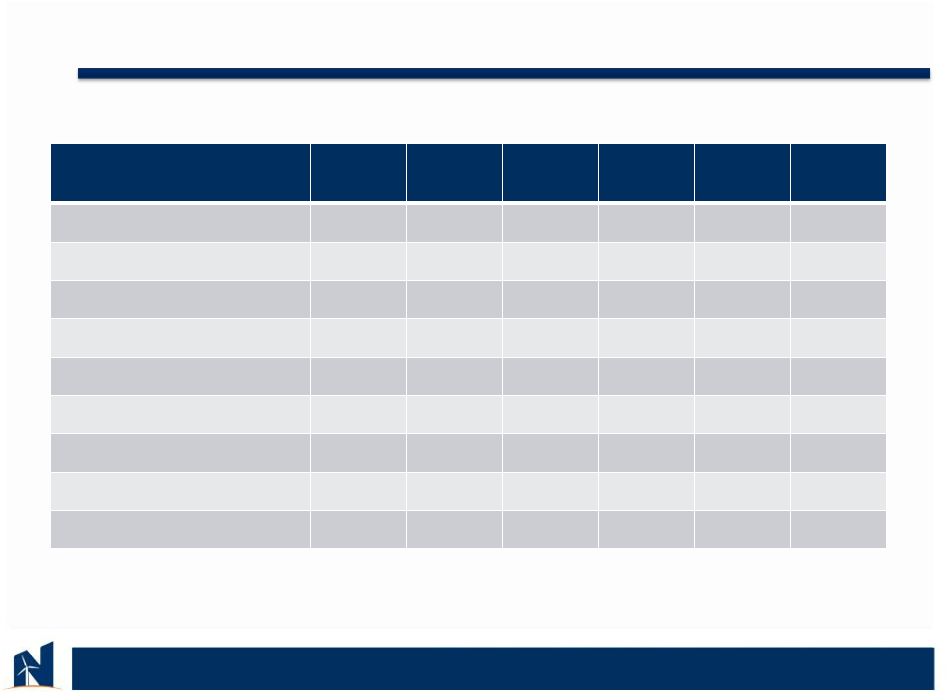

Non-GAAP Reconciliations –

Non-GAAP adjusted EBITDA

(All amounts in thousand)

15

Q1

2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Net Loss

$(3,384)

$(2,753)

$(3,163)

$(4,828)

$(3,124)

$(2,152)

Interest

18

111

99

286

240

37

Taxes

26

3

(16)

22

14

15

Depreciation

227

310

234

214

178

391

Stock compensation

122

57

85

437

148

454

Fair value warrants

63

(724)

489

-

-

-

Non-cash restructuring

-

-

-

70

-

-

Loss on asset held for sale

-

-

-

768

-

-

Adjusted EBITDA

$(2,928)

$(2,996)

$(2,272)

$(3,031)

$(2,544)

$(1,255) |

Non-GAAP Reconciliations –

Earnings Per Share

16

Q2

2014

Year to Date

2014

Net

Loss

per

common

share

–

Basic

and

Diluted

$(0.10)

$(0.31)

Interest

-

0.02

Depreciation

0.02

0.03

Stock compensation

0.02

0.04

Adjusted

EBITDA

per

common

share

–

Basic

and

Diluted

$(0.06)

$(0.22)

Weighted

average

number

of

common

shares

outstanding

–

Basic

and

Diluted

21,088,589

16,964,388 |