Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - U.S. CONCRETE, INC. | d765113d8k.htm |

Investor Presentation

July 29, 2014

Exhibit 99.1 |

Certain

statements

and

information

provided

in

this

presentation

are

“forward-looking

statements”

within

the

meaning

of

the

Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, without limitation, statements concerning plans,

objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other

statements, which are not statements of historical facts. These forward-looking

statements are based on our current expectations and beliefs concerning

future developments and their potential effect on us and do not include the impact of future acquisitions.

While

management

believes

that

these

forward-looking

statements

are

reasonable

as

and

when

made,

there

can

be

no

assurance

that future developments affecting us will be those that we anticipate. Our

forward-looking statements involve significant risks and uncertainties

(some of which are beyond our control) and assumptions that could cause actual results to differ materially. The

forward-looking statements speak only as of the date of this

presentation. Investors are cautioned not to rely unduly upon these

forward-looking statements. The Company undertakes no obligation to

update these forward-looking statements, except as required by

law. Important factors that could cause actual results to differ

materially from those in the forward-looking statements include, but are

not limited to, general economic and business conditions, which will, among other

things, affect demand for new residential and commercial construction; our

ability to successfully identify, manage, and integrate acquisitions; the cyclical nature of, and

changes in, the real estate and construction markets, including pricing changes by

our competitors; governmental requirements and initiatives, including those

related to mortgage lending or mortgage financing, funding for public or infrastructure construction,

land usage, and environmental, health, and safety matters; disruptions,

uncertainties or volatility in the credit markets that may limit our, our

suppliers' and our customers' access to capital; our ability to successfully implement our operating strategy; weather

conditions; our substantial indebtedness and the restrictions imposed on us by the

terms of our indebtedness; our ability to maintain favorable relationships

with third parties who supply us with equipment and essential supplies; our ability to retain key

personnel

and

maintain

satisfactory

labor

relations;

and

product

liability,

property

damage,

and

other

claims

and

insurance

coverage issues.

For

additional

information

regarding

known

material

factors

that

could

cause

our

actual

results

to

differ

from

our

projected

results,

please see “Risk Factors”

in our Form 10-K and our Quarterly Reports on Form 10-Q filed with the

Securities and Exchange Commission. All written and oral

forward-looking statements in this presentation are expressly qualified by these “Risk Factors.”

Page 2

Forward-Looking Statements |

Company Overview |

Business Overview

U.S. Concrete is one of the largest non-integrated concrete producers in the

U.S. National producer of ready-mixed concrete

Headquartered in Euless, TX

Trades on NASDAQ under ticker “USCR”

Market

capitalization

of

$362.9

million

Total

Enterprise

Value

of

$481.2

million

Financial Overview

LTM

3/31/14

Revenue:

$619.0

million

(91.1%

ready-mixed;

3.7%

aggregates)

3

LTM

3/31/14

Adjusted

EBITDA:

$53.8

million

4

U.S. Concrete Overview

¹

Based on USCR stock price of $25.95 as of 7/24/14 and basic shares outstanding of

13.985 million as of 7/24/14 2

Enterprise value is defined as market capitalization plus debt less cash and cash

equivalents 3

Excludes $16.8 million of internal aggregates sales that are eliminated in

consolidation. 4

Adjusted EBITDA is a non-GAAP financial measure, see page 28 for more

information Page 4

1

2 |

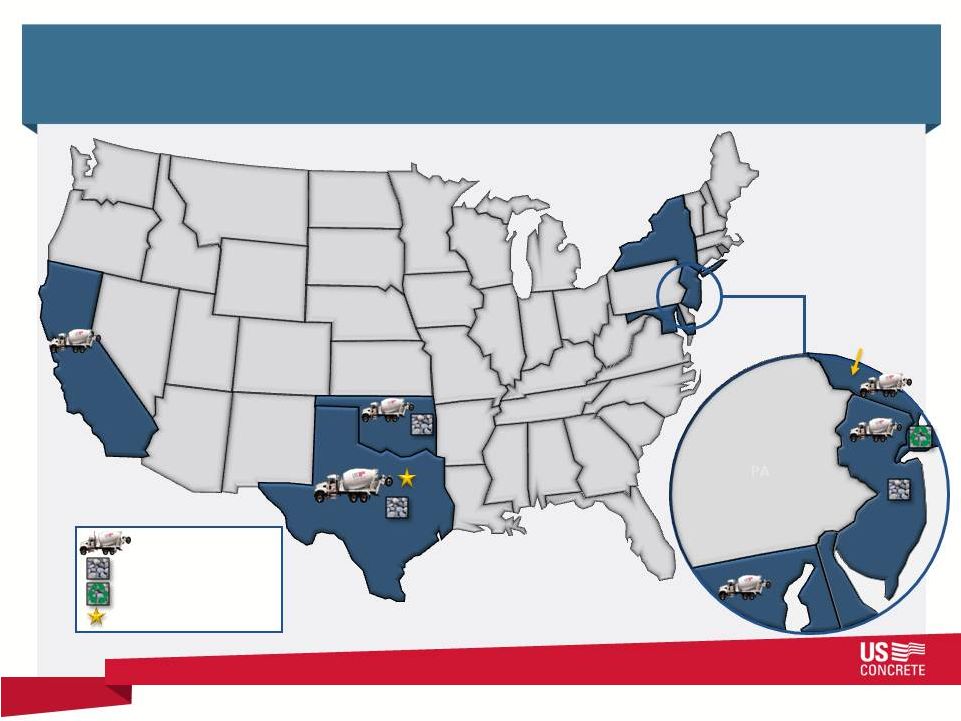

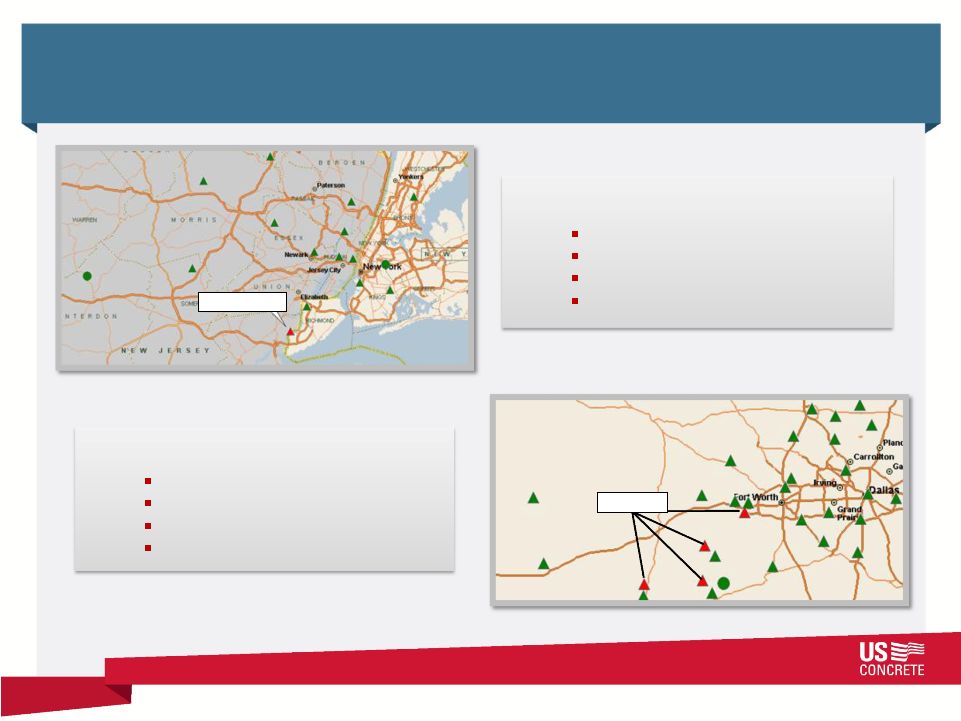

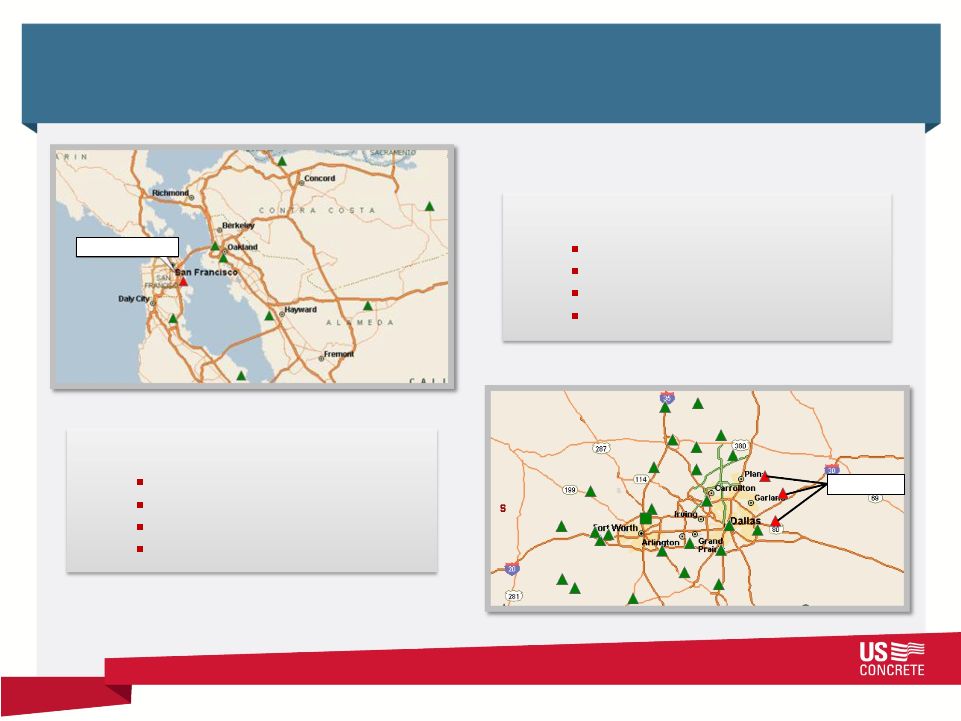

SAN

FRANCISCO Strong Positions in Attractive Markets

Page 5

17 Ready-

Mixed

67 Ready-Mixed

5 Aggregates

9 Ready-Mixed

1 Aggregate

DC

NJ

DE

PA

PA

2 Ready-

Mixed

14 Ready-

Mixed

3 Aggs.

5 Ready-Mixed

1 Recycled

Aggregates

NY

READY-MIXED PLANTS

AGGREGATES FACILITIES

RECYCLED AGGREGATES

CORPORATE HEADQUARTERS |

Growth Driven by Key Sectors

Texas/Oklahoma

Northern California

New York/New Jersey

Washington, D.C.

Page 6

Energy

Technology

Financial Services

Government |

-

Over 80 million tons of owned and leased reserves

Significant Quality Asset Base

Page 7

5.2 million cubic yards of concrete sold in 2013

940+ ready-mixed concrete trucks

Aggregates’

primary focus is supply of USCR ready-mixed operations

-

9 aggregate facilities and 1 aggregate recycle operation

114 ready-mixed concrete plants

-

3.6 million tons of aggregates produced in 2013

Leading market position in four regions with attractive fundamentals

Ready-Mixed Concrete

Aggregates |

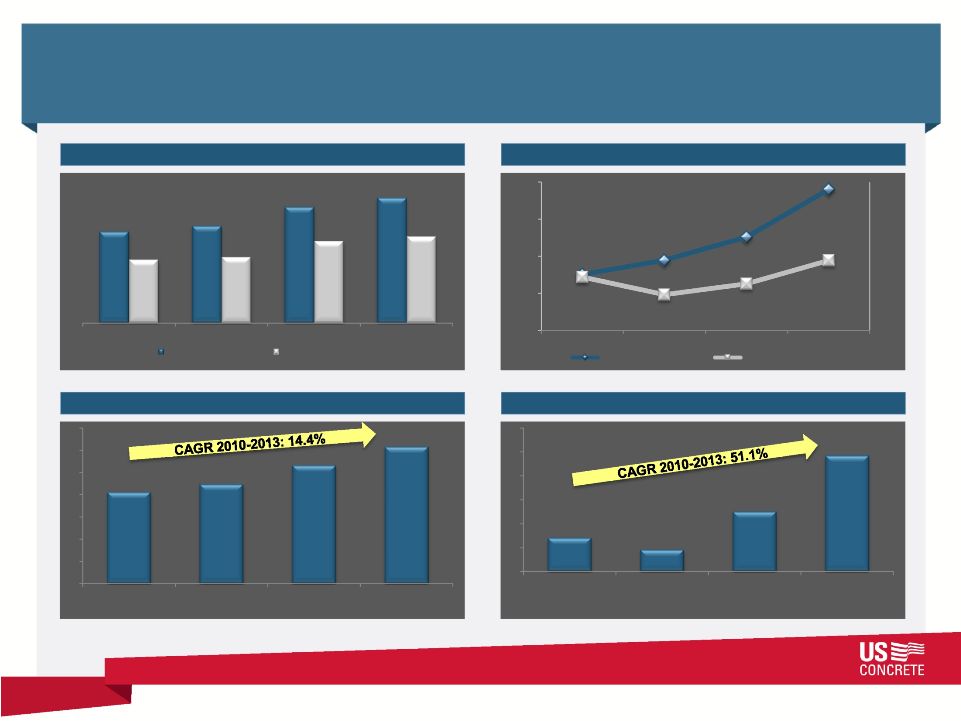

Strong Historical Performance Trend

Page 8

Volume (‘000)

Average Selling Price

Revenue ($mm)

Adjusted EBITDA ($mm)

3,805

2,624

4,047

2,741

4,839

3,407

5,225

3,597

2010

2011

2012

2013

Ready Mix (CYDs)

Ready Mix ($/CYD)

Aggregate (Tons)

Aggregate ($/ton)

2010

2011

2012

2013

2010

2011

2012

2013

2010

2011

2012

2013

$411

$446

$531

$615

$14

$9

$25

$48

$92.54

$94.48

$97.59

$104.03

$8.16

$7.46

$7.89

$8.84

$105

$100

$95

$90

$85

$12

$11

$10

$9

$8

$7

$6 |

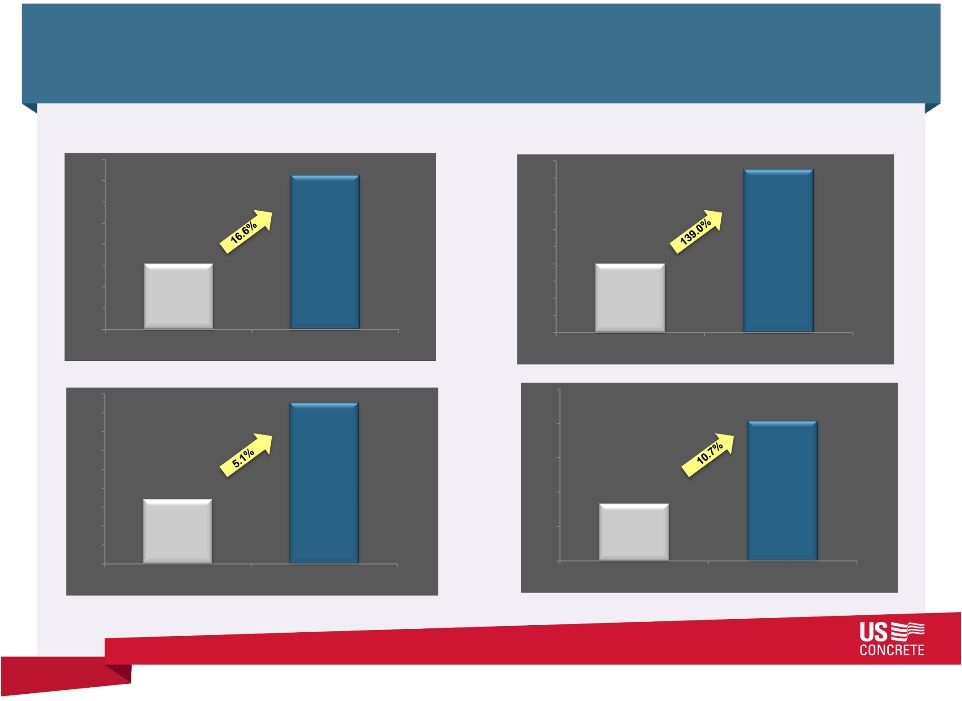

Improved Year-over-Year Performance

Page 9

(in millions, except ASP)

$110

$115

$120

$125

$130

$135

$140

$145

$150

$125.4

$146.3

Q1 '13

Q1 '14

Revenue

$-

$1

$2

$3

$4

$5

$6

$7

$8

$9

$10

$4.0

$9.5

Q1 '13

Q1 '14

Adj. EBITDA

$98

$99

$100

$101

$102

$103

$104

$105

$106

$107

$106.53

Q1 '13

Q1 '14

ASP (per cyd)

1.05

1.10

1.15

1.20

1.25

1.30

Q1 '13

Q1 '14

Ready

-Mixed Volume

(cyds)

$101.40

1.133

1.254 |

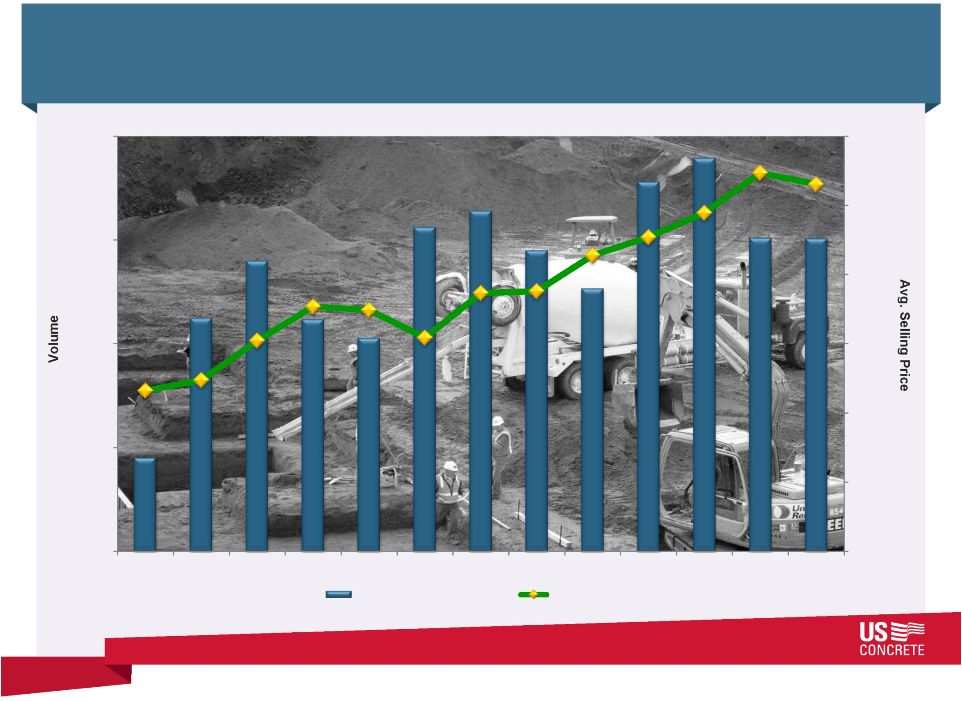

Ready-Mixed Top Line Drivers

Page 10

726

1,062

1,200

1,059

1,014

1,281

1,320

1,225

1,133

1,390

1,447

1,255

1,254

$91.61

$92.37

$95.23

$97.70

$97.44

$95.44

$98.67

$98.81

$101.40

$102.71

$104.47

$107.36

$106.53

$80

$85

$90

$95

$100

$105

$110

500

750

1,000

1,250

1,500

Q1 '11

Q2 '11

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Q3 '12

Q4 '12

Q1 '13

Q2 '13

Q3 '13

Q4 '13

Q1 '14

Volume (cyds in 000's)

ASP (per cyd) |

Solid Capital Structure

As of March 31, 2014

8.5% Senior Secured Notes due December 1, 2018

$ 200.0

$125mm ABL Revolver expiring October 2, 2018

0.0

Other Debt

14.5

Total Debt

214.5

1

Based on stock price of $25.95 as of 7/24/14

Cash

$ 96.2

Net Debt

118.3

362.9

Enterprise Value

481.2

LTM Adjusted EBITDA

$ 53.8

Total Debt/LTM Adjusted EBITDA

4.0x

Net Debt/LTM Adjusted EBITDA

2.2x

Page 11

($ millions)

1

Equity

Value |

Industry Overview |

Increasing vertical integration among

cement, aggregates and concrete

producers

Source: National Ready-Mixed Concrete Association

Annual Revenue

$30.0 B

Ready-Mixed

Concrete Producers

2,000

Ready-Mixed Concrete Market Size

Large, Fragmented Market

Page 13

Ready-Mixed

Concrete Plants

5,500 |

Focused on Key End Use Markets

Page 14

Source: McGraw-Hill Construction market outlook for 2013 as of Q4

2013 Total U.S. Market

Commercial and industrial sectors generate higher margins

Streets and highways often self-performed by construction companies

U.S. Concrete, Inc.

Residential

19%

Commercial & Industrial

16%

Street, Highway, &

Other Public Works

65%

Residential

21%

Commercial &

Industrial

62%

Street, Highway, &

Other Public Works

17%

Source: U.S. Concrete, Inc.

2013 Ready-Mixed Concrete Volume |

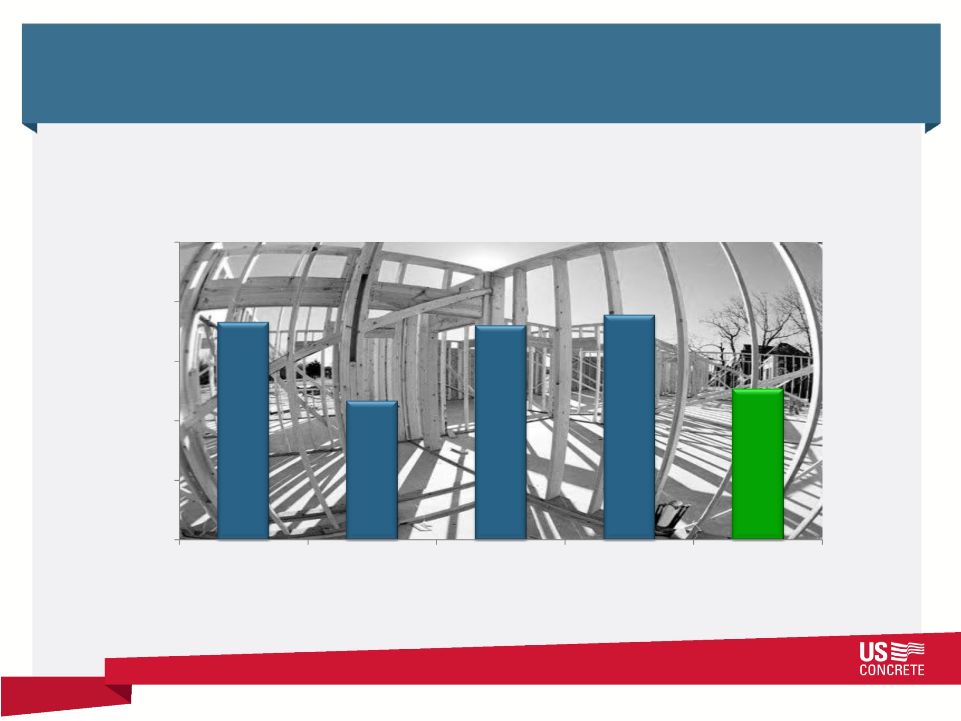

Evidence of Strength in our Regional Markets

Page 15

Housing starts in U.S. Concrete served regional markets

2-Year Compound Annual Growth Rate, 2011-2013

Source: United States Census Bureau –

Building Permits Survey

0%

10%

20%

30%

40%

50%

New York -

New

Jersey

Dallas -

Fort Worth

West Texas

San Francisco

National

Average |

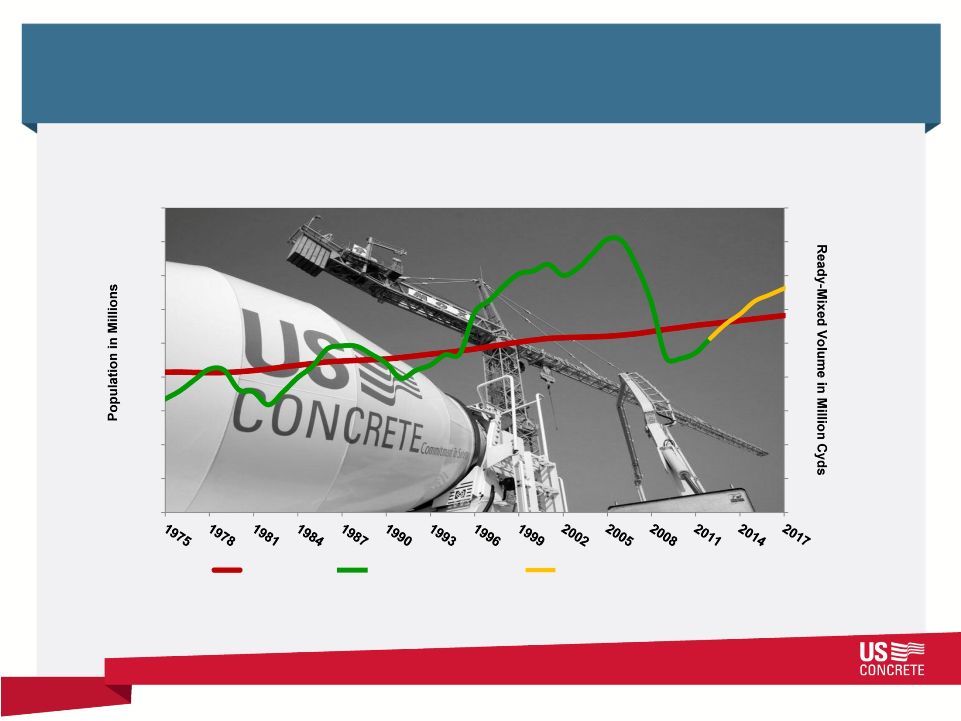

Growth Trend for U.S. Concrete Served Markets

Page 16

Source: Company estimates of ready-mixed concrete demand using market

population data from Woods & Poole. U.S.

Concrete’

s

Regional

Markets

Leveraged

to

Favorable

Growth

Prospects

0

5

10

15

20

25

30

35

40

45

0

5

10

15

20

25

30

35

40

45

Population

Concrete Production

Forecasted Concrete Demand |

Company Strategy and Focus |

U.S. Concrete’s Focus Today to Continue to Improve

Performance

Page 18

Pursue strategic development opportunities

Focus on ready-mixed concrete and aggregates

Evaluate assets, business units and opportunities

Continue to aggressively manage cost structure |

Acquisition Strategy and Historical Acquisitions

Acquisition Strategy

Continue

to

expand

within

and

concentrically

around

our

existing

regional

markets

through

bolt-ons and vertical integration

Focus on ready-mixed in all regions and aggregates, particularly in Northern

California and Dallas / Forth Worth

Also considering selected larger-scale opportunities in new geographies

Recent Transactions

Choice Ready-Mix (March 2014)

Red River Sand & Gravel Greenfield (March 2014)

Young Ready-Mix (Feb 2014)

Bodin Concrete (July 2013)

Bode Concrete (Oct 2012)

Colorado River Concrete (Sept 2012)

Granite/Scara Mix (July 2012)

Page 19 |

Acquisition Activity

Page 20

Granite/Scara Mix: Staten Island, NY

Lease Agreement (July 2012)

Single Facility –

One Plant

Volume –

80K cyds/year

16 Mixer Trucks

Scara Mix

Colorado River Concrete: West Texas

Asset Deal (closed Sept 2012)

Four Facilities –

Four Plants

Volume –

80K cyds/year

16 Mixer Trucks

CRC Plants |

Acquisition Activity (contd.)

Page 21

Bode Companies: San Francisco, CA

Stock Deal (closed Oct 2012)

Single Facility –

Three Plants

Volume -

260K cyds/year

41 Mixer Trucks

Bode Concrete

Bodin Concrete: Dallas,TX

Asset Deal (closed July 2013)

Acquired out of bankruptcy

Three Facilities –

Three Plants

Volume –

100K cyds/year

Bodin Plants |

Acquisition Activity (contd.)

Page 22

Red River Sand & Gravel:

Thackerville, OK

Greenfield (announced March

2014)

Single facility

Addresses DFW’s sand shortage

Red River Sand & Gravel

Young Ready-Mix: Brady, TX

Asset Deal (closed Feb 2014)

Single plant facility

Expands footprint in West

Texas

Young Ready-Mix |

Page 23

Choice Ready-Mix: Tye, TX

Asset Deal (closed March 2014)

Single plant facility

Strengthens position in greater

Abilene market of West Texas

Choice Ready-Mix

Acquisition Activity (contd.) |

USCR Competitive Advantage

Strong

Leadership

Operating

excellence

Group-wide

sourcing

Central IT &

support

Focused R&D

Page 24

Healthy regional

economies

Vertically

integrated

synergies

Best practice

execution

Concentrated

Purchasing

Power

Deep market

knowledge

Fast & flexible

delivery

Customer

relationships

High end product

offering

Superior

returns

Excellent

reputation

Supplier of

choice

Accelerated

growth

potential

National Support

Selected

Regional

Franchises

Local

Presence

Success

Large

company

resources

–

local

company

entrepreneurship |

Sustainability Leadership

Page 25

Leader in low CO

2

concrete

Charter member of Carbon Leadership Forum

First ready-mix company in North America to adopt and

receive verified Environmental Product Declarations (EPDs)

for its concrete mixes

Pledged to Architecture 2030

Employ extensive sustainable operational practices across

the enterprise |

Benefits of Our Sustainable Strategy

Page 26

Sustainable demand to grow

at a higher rate

Increase product demand

Higher priced value-added

products drive margins

Increase revenue and

profit per yard

Lower cost of cement

alternatives

Reduce raw material cost

per yard

Cement companies remain

focused on core cement

Differentiate USCR from

competition

First mover offering solution to

owners

Create competitive

advantage |

Investment Highlights

Page 27

Experienced management team

Strong financial performance and conservative balance sheet

Focus on sustainable leadership and strategy

Long-term diversified customer base

Well positioned to benefit from rebound in construction market

High quality asset base in attractive markets

Favorable exposure to commercial projects with higher margins and barriers to

entry |

Disclosure of Non-GAAP Financial Measures

U.S. CONCRETE, INC.

ADDITIONAL STATISTICS

(In thousands, unless otherwise noted; unaudited)

We report our financial results in accordance with generally accepted accounting

principles in the United States (“GAAP”). However, our management

believes that certain non-GAAP performance measures and ratios, which our management uses in

managing our business, may provide users of this financial information additional

meaningful comparisons between current results and results in prior operating

periods. See the following table for presentations of our adjusted EBITDA and adjusted EBITDA margin

for the years 2012 and 2013 and the first three months of 2013 and 2014.

We define adjusted EBITDA as our net income (loss) from continuing operations plus

the provision (benefit) for income taxes, net interest expense, depreciation,

depletion and amortization, reorganization costs, noncash impairments, derivative (income) loss,

expenses related to the departure of our former CEO, expenses related to the

relocation of our corporate headquarters, gain (loss) on extinguishment of

debt and non-cash stock compensation expense. We define adjusted EBITDA margin as the amount determined by

dividing adjusted EBITDA by total revenue. We have included adjusted EBITDA and

adjusted EBITDA margin in the accompanying tables because they are often used

by investors for valuation and for comparing our financial performance with the performance of

other building material companies. We also use adjusted EBITDA to monitor and compare

the financial performance of our operations. Adjusted EBITDA does not give

effect to the cash we must use to service our debt or pay our income taxes and thus does

not reflect the funds actually available for capital expenditures. In addition,

our presentation of adjusted EBITDA may not be comparable to similarly titled

measures other companies report. Non-GAAP

financial

measures

should

be

viewed

in

addition

to,

and

not

as

an

alternative

for,

our

reported

operating

results

or

cash flow from operations or any other measure of performance prepared in accordance

with GAAP. Page 28 |

Reconciliation of Non-GAAP Financial Measures

Page 29

¹

Adjusted EBITDA is defined as income (loss) from continuing operations, plus income

tax provision (benefit), net interest expense, derivative (income) loss related to our

Convertible

Notes

and

Warrants,

depreciation,

depletion

and

amortization,

loss

on

early

extinguishment

of

debt,

expenses

related

to

our

corporate

headquarters

relocation,

officer severance, and non-cash stock compensation expense.

(in thousands, except per share amounts)

2012

2013

2013

2014

Adjusted EBITDA¹

reconciliation:

Net Loss from Continuing Operations

(25,749)

$

(18,390)

$

(13,560)

$

(1,626)

$

Income tax (benefit) expense

(3,760)

1,155

(5,197)

22

Interest expense, net

11,344

11,332

2,772

5,010

Derivative loss (income)

19,725

29,964

18,446

623

Depreciation, depletion and amortization

15,676

18,984

4,825

4,898

Loss (gain) on extinguishment of debt

2,630

(985)

(4,310)

-

Expenses related to corporate headquarters relocation

2,484

550

224

-

Officer severance

275

245

-

-

Non-cash stock compensation expense

2,512

5,429

758

530

Adjusted EBITDA

25,137

$

48,284

$

3,958

$

9,457

$

Adjusted EBITDA margin

4.7%

7.9%

3.2%

6.5%

Quarter Ended March 31,

Year Ended December 31, |

Investor Presentation

July 29, 2014 |