Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARK NATIONAL CORP /OH/ | prk-201407288xk.htm |

1 July 29 – 30, 2014 Keefe, Bruyette & Woods Community Bank Investor Conference

Safe Harbor Statement Park cautions that any forward-looking statements contained in this presentation or made by management of Park are provided to assist in the understanding of anticipated future financial performance. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future performance. The forward-looking statements are based on management’s expectations and are subject to a number of risks and uncertainties. Although management believes that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause actual results to differ materially include, without limitation: Park's ability to execute its business plan successfully and within the expected timeframe; general economic and financial market conditions, and the uneven spread of positive impacts of the recovery on the economy, specifically in the real estate markets and the credit markets, either nationally or in the states in which Park and its subsidiaries do business, may be worse or slower than expected which could adversely impact the demand for loan, deposit and other financial services as well as loan delinquencies and defaults; changes in interest rates and prices may adversely impact the value of securities, loans, deposits and other financial instruments and the interest rate sensitivity of our consolidated balance sheet; changes in consumer spending, borrowing and saving habits; changes in unemployment; asset/liability repricing risks and liquidity risks; our liquidity requirements could be adversely affected by changes to regulations governing bank capital and liquidity standards as well as by changes in our assets and liabilities; competitive factors among financial services organizations could increase significantly, including product and pricing pressures and our ability to attract, develop and retain qualified bank professionals; the nature, timing and effect of changes in banking regulations or other regulatory or legislative requirements affecting the respective businesses of Park and its subsidiaries, including changes in laws and regulations concerning taxes, accounting, banking, securities and other aspects of the financial services industry, specifically the Dodd- Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), as well as future regulations which will be adopted by the relevant regulatory agencies, including the Consumer Financial Protection Bureau, to implement the Dodd-Frank Act's provisions, the Budget Control Act of 2011, the American Taxpayer Relief Act of 2012 and the Basel III regulatory capital reforms; the effect of changes in accounting policies and practices, as may be adopted by the Financial Accounting Standards Board, the SEC, the Public Company Accounting Oversight Board and other regulatory agencies, and the accuracy of our assumptions and estimates used to prepare our financial statements; the effect of fiscal and governmental policies of the United States federal government; the adequacy of our risk management program; a failure in or breach of our operational or security systems or infrastructure, or those of our third-party vendors and other service providers, including as a result of cyber attacks; demand for loans in the respective market areas served by Park and its subsidiaries; and other risk factors relating to the banking industry as detailed from time to time in Park's reports filed with the Securities and Exchange Commission including those described in "Item 1A. Risk Factors" of Part I of Park's Annual Report on Form 10-K for the fiscal year ended December 31, 2013. Park does not undertake, and specifically disclaims any obligation, to publicly release the results of any revisions that may be made to update any forward-looking statement to reflect the events or circumstances after the date on which the forward-looking statement was made, or reflect the occurrence of unanticipated events, except to the extent required by law. 2

3 Park National Corporation (PRK) Profile (as of June 30, 2014) • 11 Community Bank Divisions • 2 Specialty Finance Companies • One non-bank workout subsidiary • 29 Ohio & 1 Kentucky counties • 120 bank branches • 7 specialty finance offices • 1,839 FTEs

Park Executive Management David L. Trautman – President and CEO– Age: 53 President , CEO and Board Member of The Park National Bank and Park National Corporation (Park) headquartered in Newark, Ohio. He served as President of First-Knox National Bank, a division of The Park National Bank, from May 1997 through January 2002, and as its Chairman from 2001 to 2006. In addition, he served on the Board of the United Bank of Bucyrus, a division of The Park National bank, from 2000 to 2006. Mr. Trautman received his BA from Duke University and joined Park immediately following graduation. He holds an MBA, with honors, from The Ohio State University. He is a graduate of The Stonier Graduate School of Banking at The University of Delaware and the Ohio Bankers Association Leadership Institute. Mr. Trautman is past Chairman of the Ohio Bankers League, member of Newark Rotary Club, past campaign chair for United Way of Licking County, and serves as a Trustee of the Licking County Foundation and Dawes Arboretum. C. Daniel DeLawder – Chairman – Age: 64 Chairman and Board Member of The Park National Bank and Park National Corporation headquartered in Newark, Ohio. He served previously as President and CEO of The Park National Bank and Park. He served as President of the Fairfield National Bank, a division of The Park National Bank, from 1985 through 1991. He also currently serves on the Boards of MedBen, Truck One, Inc. and Fleet Service, Inc. Mr. DeLawder received his B.S.Ed., cum laude from Ohio University in Athens and joined Park immediately following graduation. He is a graduate of numerous bank industry educational programs. Mr. DeLawder is a past member of the Board of Directors of the Federal Reserve Bank of Cleveland. He is the past chairman of the Board of Trustees of Ohio University. He served as a member of the American Bankers Association (ABA) BankPac Committee as well as a member of the Government Relations Council of the ABA. He is past Chairman of the Ohio Bankers Association and a past Director-at-Large of the Community Bankers Association of Ohio. 4 Leadership Team

Park Executive Management (continued) Brady T. Burt – Chief Financial Officer – Age: 42 Chief Financial Officer of Park since 2012. Formally served as the Chief Accounting Officer with Park since April 2007. Prior to joining Park, Mr. Burt served Vail Banks, Inc. in various capacities, including EVP-Chief Financial Officer from June 2005 to November 2006, SVP-Director of Internal Audit from September 2003 to June 2005, and VP-Assistant Audit Director from April 2002 to September 2003. Mr. Burt was also employed by Bank One from August 2001 to March 2002 and PricewaterhouseCoopers from September 1994 to August 2001, working in various accounting roles, both in Ohio and London, England. Mr. Burt received his B.S. Degree in Accounting from Miami University in 1994. In addition, he currently serves on the Finance Committee of the Licking County United Way, is a member of the Granville Rotary Club, and is an Audit Committee member of the Licking County Foundation. He is a board member of Habitat MidOhio. Matthew R. Miller – Chief Accounting Officer – Age: 36 Chief Accounting Officer of Park since 2012. He served previously as an Accounting Vice President with Park beginning in April 2009. Prior to joining Park, Mr. Miller worked eight years at Deloitte & Touche, where his experience was primarily focused on financial service industry clients. Mr. Miller holds a bachelor’s degree in accounting, graduating summa cum laude from the University of Akron. He is a board member of both the YMCA of Licking County and Big Brothers Big Sisters of Licking and Perry Counties. He is also a member of the Development Council at The Works and the Granville Rotary Club. 5

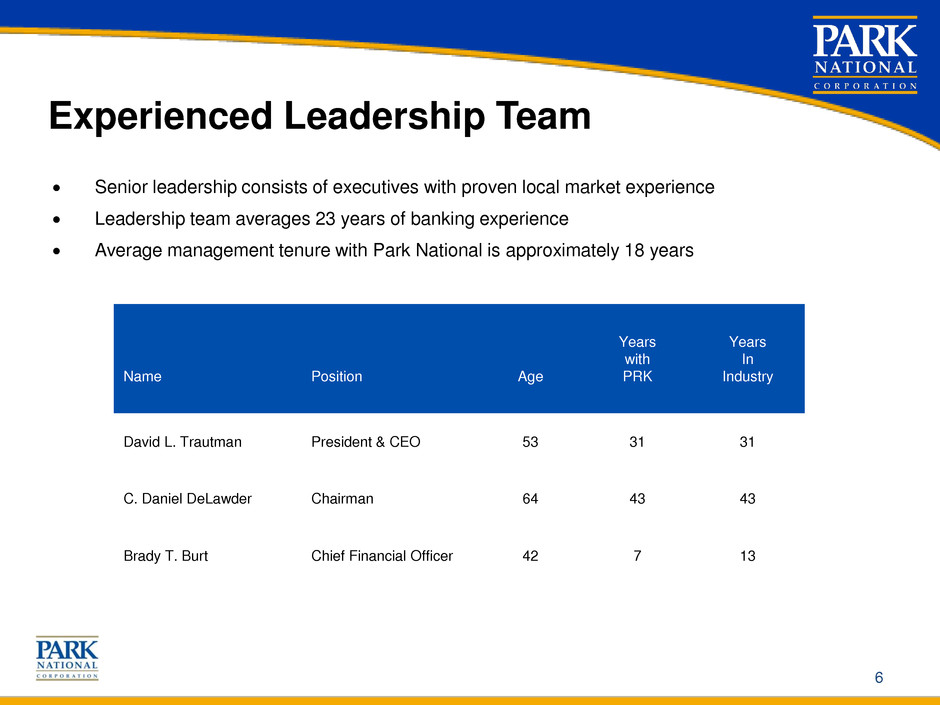

6 Experienced Leadership Team Name Position Age Years with PRK Years In Industry David L. Trautman President & CEO 53 31 31 C. Daniel DeLawder Chairman 64 43 43 Brady T. Burt Chief Financial Officer 42 7 13 Senior leadership consists of executives with proven local market experience Leadership team averages 23 years of banking experience Average management tenure with Park National is approximately 18 years

7 Leadership Team – continued Name Position Age Years with PRK Years In Industry Adrienne M. Brokaw SVP – Director of Internal Audit 46 1 15 Thomas J. Button SVP – Chief Credit Officer 54 17 28 Thomas M. Cummiskey SVP – Trust 44 14 16 Robert N. Kent, Jr. President – Scope Aircraft Finance 56 11 31 Timothy J. Lehman SVP and Chief Operating Officer 49 19 19 Laura B. Lewis SVP – Human Resources & Marketing 54 29 29 Matthew R. Miller SVP – Chief Accounting Officer 36 5 11 Cheryl L. Snyder SVP – Consumer Banking 57 34 36 Paul E. Turner SVP - Treasury 46 24 24 Jeffrey A. Wilson SVP – Chief Administrative Officer 47 9 17 Jason L. Painley VP – Chief Risk Officer 37 2 13

8 Affiliate Leadership Name Position Age Years with PRK/Affiliate Years In Industry John A. Brown President – Richland Bank 45 23 23 Brett A. Baumeister President – Unity National Bank 48 10 24 William C. Fralick President – Security National Bank 59 38 38 David J. Gooch President – Park National Bank of Southwest Ohio & Northern Kentucky 45 17 23 Brian R. Hinkle President – Farmers & Savings Bank 37 9 13 Thomas M. Lyall Chairman – Century National Bank 68 43 43 Patrick L. Nash President – Century National Bank 49 27 27 Earl W. Osborne Chairman – Guardian Finance Company 60 15 24 Matthew R. Marsh President – Guardian Finance Company 48 14 26 Vickie A. Sant President – First-Knox National Bank 59 36 36 Donald R. Stone President – United Bank 57 18 30 John E. Swallow President – Second National Bank 57 29 39 Stephen G. Wells President – Fairfield National Bank 53 30 30

9 Highlights of the First Six Months of 2014 • Loan growth of $120 million year to date, or 5.3% annualized, at Park’s Ohio subsidiary, The Park National Bank. • Credit quality remains strong: Park National Corporation experienced annualized net (recoveries) charge-offs for the first six months of (8) basis points, and 13 basis points for Park’s Ohio operations. • Continued reduction of SEPH (formerly Vision) nonperforming assets. At June 30, 2014, the carrying value of SEPH’s nonperforming assets were approximately $45.9 million.

10 PRK and PRK, excluding Vision & Southeast Property Holdings, LLC (SEPH) ROA and ROE History 1 Calculated using average common equity for Park National Corporation. 2 Calculated using average common equity for Park National Corporation, excluding Vision Bank and SE Property Holdings, LLC. 3 Adjusted for goodwill impairment charges of $55 million in 2008 and $54 million in 2007. Including the goodwill impairment charges, Park’s ROAA for 2008 and 2007 was 0.20% and 0.37%,respectively, and Park’s ROAE for 2008 and 2007 was 2.40% and 3.67% respectively. 4 Due to unavailability of 2Q 2014 peer median financial metrics, data utilized herein reflects 1Q 2014 peer results. Source: BHC Performance Report and Company Filings Peers include all bank holding companies nationwide with total assets between $3.0 and $10.0 billion Park ROAA Park ROAA, excluding VB & SEPH Peer median ROAA Park ROAE 1 Park ROAE, excluding VB & SEPH 2 Peer median ROAE 2Q 2014 YTD (annualized) 1.23% 1.22% 0.91% 4 12.44% 12.42% 7.99% 4 2013 1.15% 1.15% 1.04% 11.96% 12.13% 8.89% 2012 1.11% 1.33% 0.98% 11.41% 13.94% 8.57% 2011 1.06% 1.59% 0.80% 11.81% 19.46% 7.26% 2010 0.74% 1.58% 0.29% 8.05% 18.27% 1.59% 2009 0.97% 1.61% (0.16)% 11.81% 20.80% (2.22)% 2008 1.02% 3 1.63% (0.04)% 12.12% 3 21.57% (1.80)% 2007 1.24% 3 1.52% 0.87% 12.40% 3 17.88% 9.45% 2006 1.75% 1.75% 1.11% 17.26% 17.26% 12.23% 2005 1.71% 1.71% 1.14% 17.03% 17.03% 12.96% 2004 1.81% 1.81% 1.15% 17.00% 17.00% 13.15% Average 2004 – 2013 1.26% 1.57% 0.72% 13.09% 17.53% 7.01%

11 Total Return Performance Park National Corporation 50 75 100 125 150 175 200 225 250 12/31/08 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 Ind ex Va lue Total Return Performance Park National Corporation NYSE MKT Composite Index NASDAQ Bank SNL Bank and Thrift Index The total return stock performance graph depicts the yearly percentage change in Park’s cumulative total shareholder return over the latest 5-year fiscal periods. Calculations include the reinvestment of dividends and are indexed to the base year’s measurement point (closing price on last trading day before the beginning of the registrant’s fifth preceding fiscal year). Source: SNL

12 Bank Division Year Joined Park Hdqtr. Co. Deposits Total County Deposits Park % of 2013 Market Share Headquarter County Market Share Rank Park National 1908 $ 1,213,870 $ 2,083,268 58.3% 1 Fairfield National 1985 372,869 1,816,712 20.5% 1 Richland Bank 1987 451,558 1,705,766 26.5% 1 Century National 1990 380,177 1,215,818 31.3% 1 First-Knox National 1997 418,394 736,557 56.8% 1 Second National 2000 240,424 1,023,295 23.5% 2 Security National 2001 474,866 1,488,926 31.9% 1 Seven largest OH divisions $ 3,552,158 $ 10,070,342 35.3% Other OH divisions – headquarter counties 532,503 4,618,727 11.5% Total OH divisions – headquarter counties $ 4,084,661 $ 14,689,069 27.8% Remaining Ohio bank deposits $ 839,951 Total Ohio bank deposits $ 4,924,612 The Park National Bank – The bank of choice Headquarter Counties – Deposits (in thousands) Source: FDIC, June 30, 2013

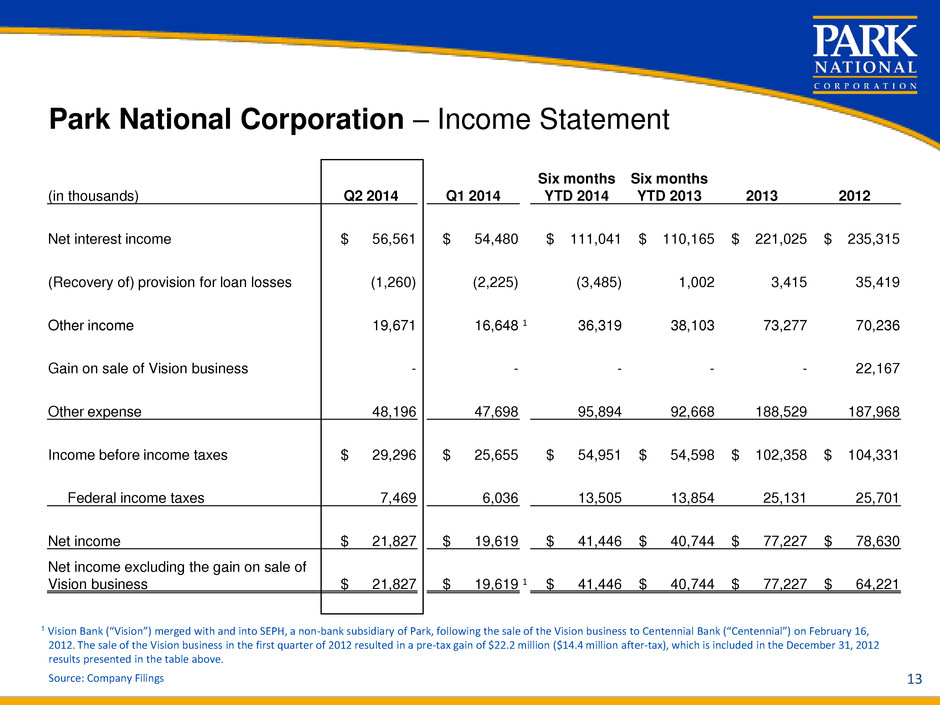

13 Park National Corporation – Income Statement Source: Company Filings 1 Vision Bank (“Vision”) merged with and into SEPH, a non-bank subsidiary of Park, following the sale of the Vision business to Centennial Bank (“Centennial”) on February 16, 2012. The sale of the Vision business in the first quarter of 2012 resulted in a pre-tax gain of $22.2 million ($14.4 million after-tax), which is included in the December 31, 2012 results presented in the table above. (in thousands) Q2 2014 Q1 2014 Six months YTD 2014 Six months YTD 2013 2013 2012 Net interest income $ 56,561 $ 54,480 $ 111,041 $ 110,165 $ 221,025 $ 235,315 (Recovery of) provision for loan losses (1,260) (2,225) (3,485) 1,002 3,415 35,419 Other income 19,671 16,648 1 36,319 38,103 73,277 70,236 Gain on sale of Vision business - - - - - 22,167 Other expense 48,196 47,698 95,894 92,668 188,529 187,968 Income before income taxes $ 29,296 $ 25,655 $ 54,951 $ 54,598 $ 102,358 $ 104,331 Federal income taxes 7,469 6,036 13,505 13,854 25,131 25,701 Net income $ 21,827 $ 19,619 $ 41,446 $ 40,744 $ 77,227 $ 78,630 Net income excluding the gain on sale of Vision business $ 21,827 $ 19,619 1 $ 41,446 $ 40,744 $ 77,227 $ 64,221

PARK NATIONAL CORPORATION Statement of Condition 14 Source: Company Filings (in millions) June 30, 2014 Dec. 31, 2013 Dec. 31, 2012 Investment securities $ 1,418 $ 1,424 $ 1,582 Loans 4,735 4,621 4,450 Allowance for loan losses (58) (59) (56) Other assets 694 652 667 Total assets $ 6,789 $ 6,638 $ 6,643 Non-interest bearing deposits $ 1,163 $ 1,194 $ 1,137 Interest bearing deposits 3,764 3,596 3,579 Total deposits $ 4,927 $ 4,790 $ 4,716 Total borrowings 1,118 1,133 1,206 Other liabilities 57 64 71 Stockholders’ equity 687 651 650 Total liabilities & shareholders’ equity $ 6,789 $ 6,638 $ 6,643

Quarterly Net Income by Operating Segment 15 Source: Company Filings (In thousands) Q2 2014 Q1 2014 Six months YTD 2014 Six months YTD 2013 2013 2012 PNB $ 22,189 $ 19,607 $ 41,796 $ 40,262 $ 75,794 $ 87,106 GFSC 478 604 1,082 1,530 2,888 3,550 Park Parent Company 1 (1,245) (904) (2,149) 323 (1,397) 195 Ongoing operations $ 21,422 $ 19,307 $ 40,729 $ 42,115 $ 77,085 $ 90,851 SEPH 405 312 717 (1,371) 142 (12,221) Total Park $ 21,827 $ 19,619 $ 41,446 $ 40,744 $ 77,227 $ 78,630 Preferred dividends and accretion - - - - - 3,425 Net income available to common shareholders $ 21,827 $ 19,619 $ 41,446 $ 40,744 $ 77,227 $ 75,205 1 The “Park Parent Company” above excludes the results for SEPH, an entity which is winding down commensurate with the disposition of its problem assets. Management considers the “Ongoing operations” results to be reflective of the business of Park and its subsidiaries on a going forward basis. The discussion below provides some additional information regarding the segments that make up the “Ongoing operations”, followed by additional information on SEPH.

16 Source: Company Filings The Park National Bank Income Statement (In thousands) Q2 2014 Q1 2014 Six months YTD 2014 Six months YTD 2013 2013 2012 Net interest income $ 55,290 $ 53,099 $ 108,389 $ 104,471 $ 210,781 $ 221,758 Provision for (recovery of) loan losses 1,683 (140) 1,543 5,252 14,039 16,678 Fee income 18,909 15,703 34,612 36,408 70,841 70,739 Total other expense 41,979 42,311 84,290 80,732 165,665 156,516 Income before income taxes $ 30,537 $ 26,631 $ 57,168 $ 54,895 $ 101,918 $ 119,303 Federal income taxes 8,348 7,024 15,372 14,633 26,324 32,197 Net income $ 22,189 $ 19,607 $ 41,796 $ 40,262 $ 75,594 $ 87,106

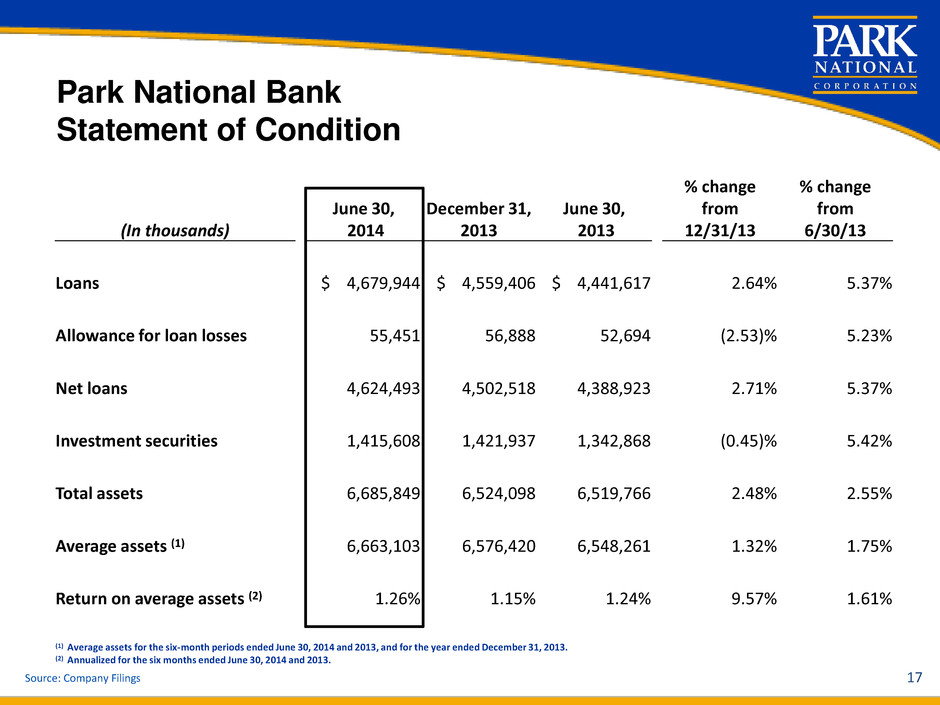

Park National Bank Statement of Condition 17 Source: Company Filings (In thousands) June 30, 2014 December 31, 2013 June 30, 2013 % change from 12/31/13 % change from 6/30/13 Loans $ 4,679,944 $ 4,559,406 $ 4,441,617 2.64% 5.37% Allowance for loan losses 55,451 56,888 52,694 (2.53)% 5.23% Net loans 4,624,493 4,502,518 4,388,923 2.71% 5.37% Investment securities 1,415,608 1,421,937 1,342,868 (0.45)% 5.42% Total assets 6,685,849 6,524,098 6,519,766 2.48% 2.55% Average assets (1) 6,663,103 6,576,420 6,548,261 1.32% 1.75% Return on average assets (2) 1.26% 1.15% 1.24% 9.57% 1.61% (1) Average assets for the six-month periods ended June 30, 2014 and 2013, and for the year ended December 31, 2013. (2) Annualized for the six months ended June 30, 2014 and 2013.

18 Park National Bank Loans by Type Source: Company Filings as of June 30, 2014 • Commercial lending focus is on small, closely-held businesses within our markets. • Consumer mortgage and home equity portfolios are originated by Park within our footprint and have been consistently underwritten for decades. • PNB experienced solid growth in residential real estate and consumer loans in the first six months of 2014. 6/31/2013 12/31/2013 6/30/2014 % Change from Amount Amount Amount 6/30/2013 12/31/2013 Commercial Real Estate Owner Occupied $ 523,752 $ 517,230 $ 502,759 (4.2)% (2.9)% Non-Owner Occupied 473,783 473,044 477,482 0.8% 0.9% Residential Real Estate 1,720,017 1,781,536 1,813,045 5.1% 1.7% Construction Real Estate 145,651 150,269 149,788 2.8% (0.3)% Commercial & Industrial 793,897 812,630 806,927 1.6% (0.7)% Consumer 648,224 684,647 795,019 18.5% 13.9% Farmland 105,553 112,503 112,818 6.4% 0.3% Leases 3,234 3,404 3,222 (0.4)% (5.6)% Total Loans $ 4,414,111 $ 4,535,263 $ 4,661,060 5.3% 2.7% Annualized growth rate in 2014 of 5.3%

19 Park National Corporation Nonperforming Loans by Type At June 30, 2014 Source: Company Filings as of June 30, 2014 PNB Guardian SEPH LLC PRK Amount Percentage Amount Percentage Amount Percentage Amount Percentage Commercial Real Estate Owner Occupied $ 18,515 16.76% $ - 0.00% $ 3,937 13.23% $ 22,452 15.71% Non-Owner Occupied 8,235 7.46% - 0.00% 2,689 9.04% 10,924 7.64% Residential Real Estate 51,685 46.79% - 0.00% 14,362 48.26% 66,047 46.22% Construction Real Estate 10,345 9.37% - 0.00% 4,378 14.71% 14,723 10.30% Commercial & Industrial 17,062 15.45% 115 4.28% 4,395 14.77% 21,572 15.10% Consumer 2,809 2.54% 2,575 95.72% - 0.00% 5,384 3.77% Farmland 1,800 1.63% - 0.00% - 0.00% 1,800 1.26% Leases - 0.00% - 0.00% - 0.00% - 0.00% Total Loans $ 110,451 100.00% $ 2,690 100.00% $ 29,761 100.00% $ 142,902 100.00%

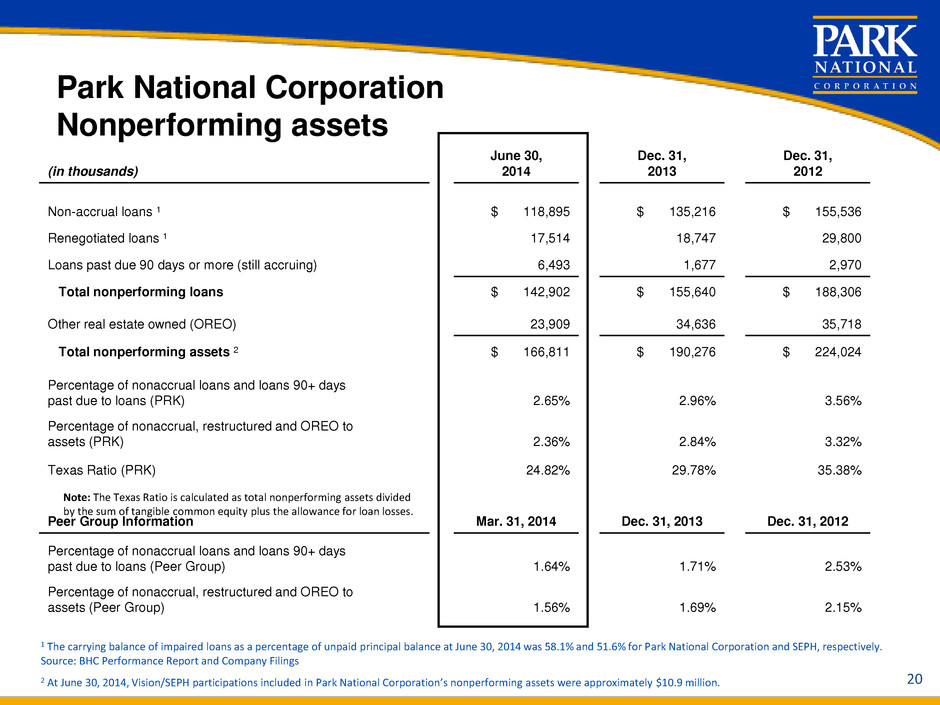

20 Park National Corporation Nonperforming assets 1 The carrying balance of impaired loans as a percentage of unpaid principal balance at June 30, 2014 was 58.1% and 51.6% for Park National Corporation and SEPH, respectively. Source: BHC Performance Report and Company Filings 2 At June 30, 2014, Vision/SEPH participations included in Park National Corporation’s nonperforming assets were approximately $10.9 million. (in thousands) June 30, 2014 Dec. 31, 2013 Dec. 31, 2012 Non-accrual loans 1 $ 118,895 $ 135,216 $ 155,536 Renegotiated loans 1 17,514 18,747 29,800 Loans past due 90 days or more (still accruing) 6,493 1,677 2,970 Total nonperforming loans $ 142,902 $ 155,640 $ 188,306 Other real estate owned (OREO) 23,909 34,636 35,718 Total nonperforming assets 2 $ 166,811 $ 190,276 $ 224,024 Percentage of nonaccrual loans and loans 90+ days past due to loans (PRK) 2.65% 2.96% 3.56% Percentage of nonaccrual, restructured and OREO to assets (PRK) 2.36% 2.84% 3.32% Texas Ratio (PRK) 24.82% 29.78% 35.38% Peer Group Information Mar. 31, 2014 Dec. 31, 2013 Dec. 31, 2012 Percentage of nonaccrual loans and loans 90+ days past due to loans (Peer Group) 1.64% 1.71% 2.53% Percentage of nonaccrual, restructured and OREO to assets (Peer Group) 1.56% 1.69% 2.15% Note: The Texas Ratio is calculated as total nonperforming assets divided by the sum of tangible common equity plus the allowance for loan losses.

21 Source: BHC Performance Report and Company Filings (in thousands) June 30, 2014 Dec. 31, 2013 Dec. 31, 2012 Non-accrual loans $ 89,231 $ 99,108 $ 100,244 Renegotiated loans 17,417 18,747 29,800 Loans past due 90 days or more (still accruing) 6,493 1,677 2,970 Total nonperforming loans $ 113,141 $ 119,532 $ 133,014 Other real estate owned (OREO) – PNB 7,727 11,413 14,715 Total nonperforming assets $ 120,868 $ 130,945 $ 147,729 Percentage of nonaccrual loans and loans 90+ days past due to loans (PNB and Guardian) 2.03% 2.20% 2.35% Percentage of nonaccrual, restructured and OREO to assets (PNB and Guardian) 1.71% 1.98% 2.22% Texas Ratio 18.29% 20.85% 23.73% Peer Group Information Mar. 31, 2014 Dec. 31, 2013 Dec. 31, 2012 Percentage of nonaccrual loans and loans 90+ days past due to loans (PRK Peer Group) 1.64% 1.71% 2.53% Percentage of nonaccrual, restructured and OREO to assets (PRK Peer Group) 1.56% 1.69% 2.15% Park National Corporation less Vision Bank/SEPH Nonperforming Assets Note: The Texas Ratio is calculated as total nonperforming assets divided by the sum of tangible common equity plus the allowance for loan losses.

Park National Bank Commercial Loan Portfolio Trends 22 1 Commercial loans include: (1) Commercial, financial and agricultural loans, (2) Commercial real estate loans, (3) Commercial related loans in the construction real estate portfolio and (4) Commercial related loans in the residential real estate portfolio. *Included within Park National Bank’s impaired loan totals, participations related to Vision Bank were $10.9million, $12.3million, and $14.1million at June 30, 2014, December 31, 2013, and December 31, 2012, respectively. Source: Company Filings $2,000,000 $2,070,000 $2,140,000 $2,210,000 $2,280,000 $2,350,000 $2,420,000 December 31, 2012 December 31, 2013 June 30, 2014 (Data in 000s ) Impaired* Substandard Special Mention Pass rated $25.7 MM $67.0 MM $77.0 MM $29.0MM $89.4MM $66.1MM 1

23 PRK comparison to peers 1 Calculated for the six months ended June 30, 2014. 2 Annualized based on dividends and stock price through June 30, 2014. 3 Due to unavailability of 2Q 2014 peer median financial metrics, data utilized herein reflects 1Q 2014 peer results. Source: Company Filings and SNL data of $3 to $10 billion bank holding companies PRK Price to Book % Peer Group Price to Book % PRK Price to tangible book Peer Group Price to Tangible Book % PRK Price to Earnings Peer Group Price to Earnings PRK Dividend Yield Peer Group Dividend Yield 2Q 2014 173% %174 3 193% %196 3 14.2 1 22.1 3 4.9 2 2.1 3 2013 201% %170 226% %192 17.0 19.9 4.4 2.1 2012 153% 117% 172% 145% 13.2 13.4 5.8 2.8 2011 156% 109% 176% 135% 13.1 14.7 5.8 2.4 2010 177% 127% 202% 155% 21.1 17.8 5.2 2.1 2009 141% 105% 163% 140% 12.2 16.9 6.4 2.5 2008 183% 135% 217% 211% 14.6 15.7 5.3 2.9 2007 155% 138% 207% 206% 11.9 13.2 5.8 3.3 2006 242% 206% 280% 291% 14.7 17.1 3.8 2.3 2005 259% 204% 296% 268% 15.5 15.5 3.6 2.3 2004 345% 238% 372% 307% 21.4 18.1 2.7 2.1 2003 301% 219% 309% 283% 18.9 16.9 3.1 2.1

A Successful History of Disciplined Strategic Growth in Ohio (11 acquisitions; 2 De Novos) 24 1908 1908 The Park National Bank is established 1985 1985 Acquisition of Fairfield National Bank 1987 1987 Park National Corporation holding company is established Acquisition of Richland Trust Company 1990 1990 Acquisition of Century National Bank 1994 1994 Acquisition of Scope Aircraft Finance 1997 1999 2000 2001 2005 2006 1997 Acquisition of First-Knox National Bank Farmers Savings Bank 1999 Guardian Finance Company established 2000 Acquisition of United Bank Acquisition of Second National Bank 2001 Acquisition of Security National Bank Citizens National Bank Unity National Bank 2005 Acquisition of First Federal Savings Bank of Eastern Ohio (merged with Century National Bank) Acquisition of First Clermont Bank (became the Park National Bank of Southwest Ohio & Northern Kentucky division) 2006 Acquisition of Anderson Bank (merged with The Park National Bank of Southwest Ohio & Northern Kentucky division)

M&A Opportunities PRK successfully completed 11 Ohio- based financial institution mergers from 1985 through 2006. Each bank operates within PRK in an autonomous fashion; each bank retains its local community bank identity, leadership team, and advisory board of directors. Future Merger Objectives: Dilution to tangible book value (if any) per share should be earned back in four years or less. Earnings and integration considerations. 25

26 July 29 – 30, 2014 Community Bank Investor Conference