Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACI WORLDWIDE, INC. | d762481d8k.htm |

| EX-99.1 - EX-99.1 - ACI WORLDWIDE, INC. | d762481dex991.htm |

| EX-10.1 - EX-10.1 - ACI WORLDWIDE, INC. | d762481dex101.htm |

Exhibit 99.2

|

|

ACI Worldwide to Acquire ReD

July 21, 2014

|

|

Private Securities Litigation Reform Act of 1995 Safe Harbor for Forward-Looking Statements

This presentation contains forward-looking statements based on current expectations that involve a number of risks and uncertainties. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. A discussion of these forward-looking statements and risk factors that may affect them is set forth at the end of this presentation. The Company assumes no obligation to update any forward-looking statement in this presentation, except as required by law.

MEETS THE CHALLENGE OF CHANGE

2

|

|

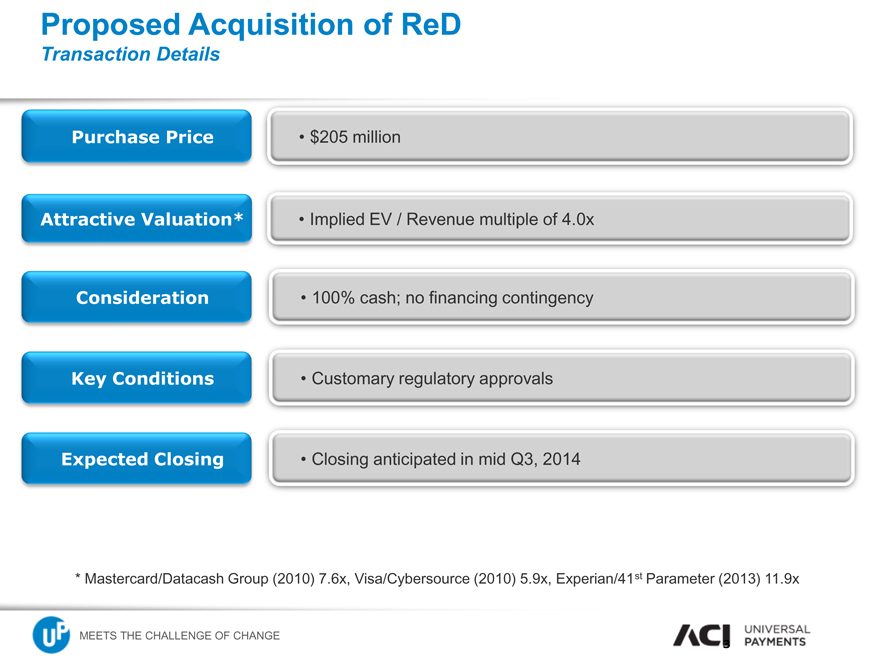

Proposed Acquisition of ReD

Transaction Details

Purchase Price

$205 million

Attractive Valuation* • Implied EV / Revenue multiple of 4.0x

Consideration 100% cash; no financing contingency

Key Conditions • Customary regulatory approvals

Expected Closing • Closing anticipated in mid Q3, 2014

* Mastercard/Datacash Group (2010) 7.6x, Visa/Cybersource (2010) 5.9x, Experian/41st Parameter (2013) 11.9x

MEETS THE CHALLENGE OF CHANGE

|

|

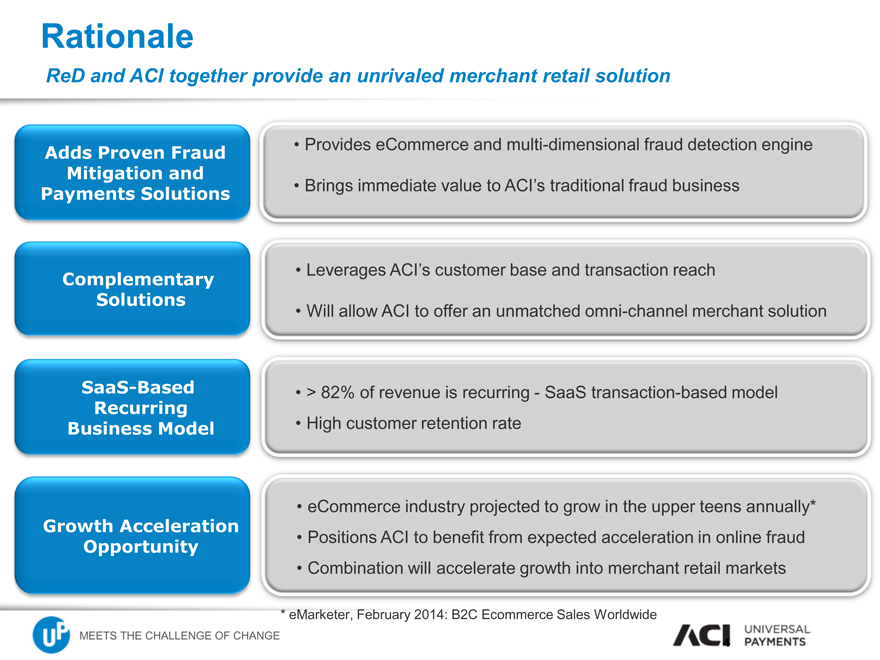

Rationale

ReD and ACI together provide an unrivaled merchant retail solution

Adds Proven Fraud Mitigation and Payments Solutions

Provides eCommerce and multi-dimensional fraud detection engine

Brings immediate value to ACI’s traditional fraud business

Complementary Solutions

Leverages ACI’s customer base and transaction reach

Will allow ACI to offer an unmatched omni-channel merchant solution

SaaS-Based Recurring Business Model

> 82% of revenue is recurring—SaaS transaction-based model

High customer retention rate

Growth Acceleration Opportunity

eCommerce industry projected to grow in the upper teens annually*

Positions ACI to benefit from expected acceleration in online fraud

Combination will accelerate growth into merchant retail markets

* eMarketer, February 2014: B2C Ecommerce Sales Worldwide

MEETS THE CHALLENGE OF CHAN

|

|

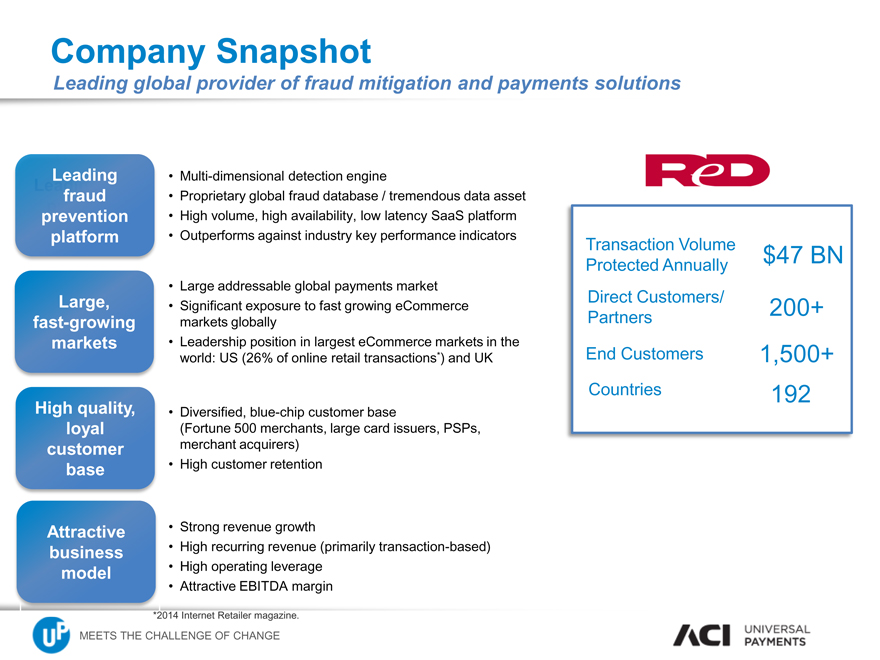

Company Snapshot

Leading global provider of fraud mitigation and payments solutions

Leading fraud prevention platform

Multi-dimensional detection engine

Proprietary global fraud database / tremendous data asset

High volume, high availability, low latency SaaS platform

Outperforms against industry key performance indicators

Large, fast-growing markets

Large addressable global payments market

Significant exposure to fast growing eCommerce markets globally

Leadership position in largest eCommerce markets in the world: US (26% of online retail transactions*) and UK

High quality, loyal customer base

Diversified, blue-chip customer base

(Fortune 500 merchants, large card issuers, PSPs, merchant acquirers)

High customer retention

Attractive business model

Strong revenue growth

High recurring revenue (primarily transaction-based)

High operating leverage

Attractive EBITDA margin

*2014 Internet Retailer magazine.

MEETS THE CHALLENGE OF CHANGE

Transaction Volume $47 BN

Protected Annually

Direct Customers/ 200+

Partners

End Customers 1,500+

Countries 192

|

|

Forward-Looking Statements

This presentation contains forward-looking statements based on current expectations that involve a number of risks and uncertainties. Generally, forward-looking statements do not relate strictly to historical or current facts and may include words or phrases such as “believes,” “ will,” “expects,” “anticipates,” “intends,” and words and phrases of similar impact. The forward-looking statements are made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements in this presentation include, but are not limited to, statements regarding expectations of certain continued recurring revenue of ReD, expectations of growth in the eCommerce industry and online fraud, and expectations of the combined company’s accelerated growth into merchant retail markets.

MEETS THE CHALLENGE OF CHANGE

6

|

|

Forward-Looking Statements

All of the foregoing forward-looking statements are expressly qualified by the risk factors discussed in our filings with the Securities and Exchange Commission. Such factors include but are not limited to, increased competition, the performance of our strategic product, BASE24-eps, demand for our products, restrictions and other financial covenants in our credit facility, consolidations and failures in the financial services industry, customer reluctance to switch to a new vendor, the accuracy of management’s backlog estimates, the maturity of certain products, our strategy to migrate customers to our next generation products, ratable or deferred recognition of certain revenue associated with customer migrations and the maturity of certain of our products, failure to obtain renewals of customer contracts or to obtain such renewals on favorable terms, delay or cancellation of customer projects or inaccurate project completion estimates, volatility and disruption of the capital and credit markets and adverse changes in the global economy, our existing levels of debt, impairment of our goodwill or intangible assets, litigation, future acquisitions, strategic partnerships and investments, risks related to the expected benefits to be achieved in the transaction with Online Resources, the complexity of our products and services and the risk that they may contain hidden defects or be subjected to security breaches or viruses, compliance of our products with applicable legislation, governmental regulations and industry standards, our compliance with privacy regulations, the protection of our intellectual property in intellectual property litigation, the cyclical nature of our revenue and earnings and the accuracy of forecasts due to the concentration of revenue generating activity during the final weeks of each quarter, business interruptions or failure of our information technology and communication systems, our offshore software development activities, risks from operating internationally, including fluctuations in currency exchange rates, exposure to unknown tax liabilities, and volatility in our stock price. For a detailed discussion of these risk factors, parties that are relying on the forward-looking statements should review our filings with the Securities and Exchange Commission, including our most recently filed Annual Report on Form 10-K, Registration Statement on Form S-4, and subsequent reports on Forms 10-Q and 8-K.

MEETS THE CHALLENGE OF CHANGE

7