Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Inland Diversified Real Estate Trust, Inc. | firstquarterflashreport.htm |

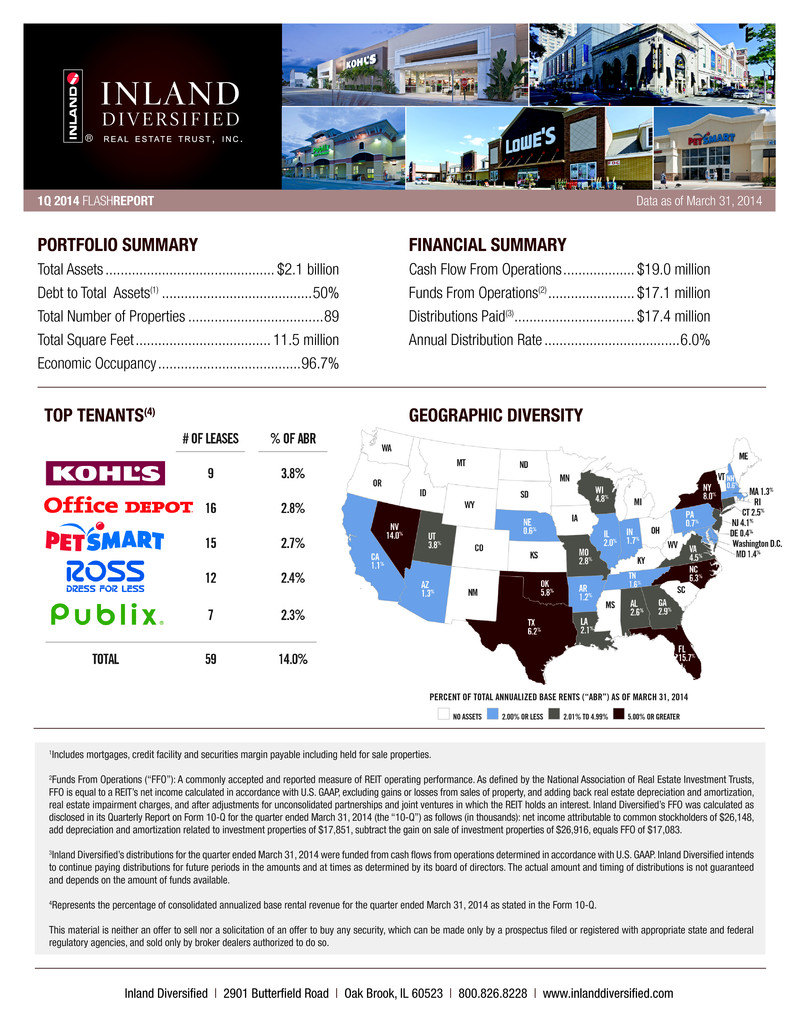

1Q 2014 FLASHREPORT Data as of March 31, 2014 1Includes mortgages, credit facility and securities margin payable including held for sale properties. 2Funds From Operations (“FFO”): A commonly accepted and reported measure of REIT operating performance. As defined by the National Association of Real Estate Investment Trusts, FFO is equal to a REIT’s net income calculated in accordance with U.S. GAAP, excluding gains or losses from sales of property, and adding back real estate depreciation and amortization, real estate impairment charges, and after adjustments for unconsolidated partnerships and joint ventures in which the REIT holds an interest. Inland Diversified’s FFO was calculated as disclosed in its Quarterly Report on Form 10-Q for the quarter ended March 31, 2014 (the “10-Q”) as follows (in thousands): net income attributable to common stockholders of $26,148, add depreciation and amortization related to investment properties of $17,851, subtract the gain on sale of investment properties of $26,916, equals FFO of $17,083. 3Inland Diversified’s distributions for the quarter ended March 31, 2014 were funded from cash flows from operations determined in accordance with U.S. GAAP. Inland Diversified intends to continue paying distributions for future periods in the amounts and at times as determined by its board of directors. The actual amount and timing of distributions is not guaranteed and depends on the amount of funds available. 4Represents the percentage of consolidated annualized base rental revenue for the quarter ended March 31, 2014 as stated in the Form 10-Q. This material is neither an offer to sell nor a solicitation of an offer to buy any security, which can be made only by a prospectus filed or registered with appropriate state and federal regulatory agencies, and sold only by broker dealers authorized to do so. Inland Diversified | 2901 Butterfield Road | Oak Brook, IL 60523 | 800.826.8228 | www.inlanddiversified.com PERCENT OF TOTAL ANNUALIZED BASE RENTS (“ABR”) AS OF MARCH 31, 2014 NO ASSETS 2.00% OR LESS 2.01% TO 4.99% 5.00% OR GREATER GEOGRAPHIC DIVERSITY PORTFOLIO SUMMARY Total Assets ............................................. $2.1 billion Debt to Total Assets(1) ........................................50% Total Number of Properties ....................................89 Total Square Feet .................................... 11.5 million Economic Occupancy ......................................96.7% FINANCIAL SUMMARY Cash Flow From Operations ................... $19.0 million Funds From Operations(2) ....................... $17.1 million Distributions Paid(3) ................................ $17.4 million Annual Distribution Rate ....................................6.0% TOP TENANTS(4)

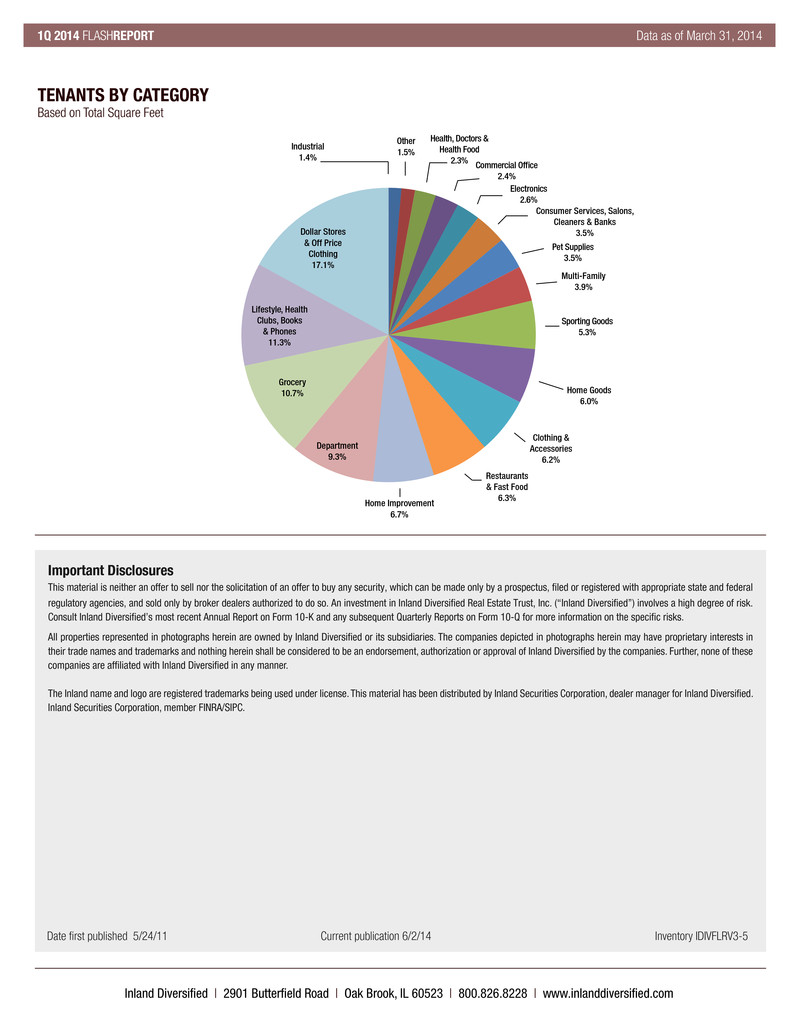

TENANTS BY CATEGORY Based on Total Square Feet Grocery 10.7% Dollar Stores & Off Price Clothing 17.1% Lifestyle, Health Clubs, Books & Phones 11.3% Department 9.3% Home Goods 6.0% Commercial Office 2.4% Sporting Goods 5.3% Home Improvement 6.7% Multi-Family 3.9% Clothing & Accessories 6.2% Electronics 2.6% Health, Doctors & Health Food 2.3% Other 1.5%Industrial1.4% Consumer Services, Salons, Cleaners & Banks 3.5% Important Disclosures This material is neither an offer to sell nor the solicitation of an offer to buy any security, which can be made only by a prospectus, filed or registered with appropriate state and federal regulatory agencies, and sold only by broker dealers authorized to do so. An investment in Inland Diversified Real Estate Trust, Inc. (“Inland Diversified”) involves a high degree of risk. Consult Inland Diversified’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q for more information on the specific risks. All properties represented in photographs herein are owned by Inland Diversified or its subsidiaries. The companies depicted in photographs herein may have proprietary interests in their trade names and trademarks and nothing herein shall be considered to be an endorsement, authorization or approval of Inland Diversified by the companies. Further, none of these companies are affiliated with Inland Diversified in any manner. The Inland name and logo are registered trademarks being used under license. This material has been distributed by Inland Securities Corporation, dealer manager for Inland Diversified. Inland Securities Corporation, member FINRA/SIPC. 1Q 2014 FLASHREPORT Data as of March 31, 2014 Date first published 5/24/11 Current publication 6/2/14 Inventory IDIVFLRV3-5 Inland Diversified | 2901 Butterfield Road | Oak Brook, IL 60523 | 800.826.8228 | www.inlanddiversified.com Restaurants & Fast Food 6.3% Pet Supplies 3.5%