Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OPKO HEALTH, INC. | d736771d8k.htm |

Jefferies 2014 Global Healthcare Conference

June 3, 2014

Exhibit 99.1 |

2 |

OPKO

Important Products Available or Coming to Market Near Term

3

Diagnostics

–

4Kscore™

Test blood test for personalized risk of high-grade

prostate cancer

–

CLIA-certified urological specialty laboratory

–

Pharmaceuticals

–

Vitamin

D

therapeutics

for

SHPT

*

–

Platform technology to make peptides and proteins long acting to

treat growth hormone deficiency, hemophilia, obesity, etc.

–

Calcium-free, magnesium-based phosphate binder

–

Approved third generation hepatitis B vaccine

*Secondary Hyperparathyroidism

Claros

®

1

immunoassay

system

for

rapid,

lab

quality

in-office

testing

(PSA,

Testosterone,

Vitamin

D) |

OPKO

Diagnostics – Addressing Large Dx Markets

4

4Kscore™

Test

Initially targeting pre-prostate biopsy market

PSA market 60 million tests globally

Recently launched in US at $395

Highly significant clinical data on 1,012 patients presented at AUA

plenary session May 18, 2014

Launch in Europe: September 2014

Claros

®

1 Analyzer and Sangia

™

Microfluidic Test Card

In office finger-stick blood analysis

Initial target assays in US:

PSA: 30 million tests, $750 M

Testosterone: 15 million tests, $525 M

Vitamin D: 70 million tests, $3.5 B |

5

DELIVERING BETTER

HEALTHCARE

CONVENIENT

LAB QUALITY

ACCURACY |

Finger stick blood

sample

Convenience

1-2

mins

10

mins

6 |

| Claros

1 Update •

Testosterone

–

FDA: Pre-submission comments received from FDA

–

On track to file 510(k) in 2014

–

CE Mark: 4Q2014

•

PSA

–

FDA: Pre-submission response expected in August

–

Timing of 510k submission based on longitudinal trial requirements

–

CE Mark Update (Formulation and Chemistry): 4Q2014

•

Vitamin D

–

On track to support launch of Rayaldee 1Q2016

7 |

Challenges in Prostate Cancer Screening

High false positive rate of PSA

Patient Anxiety

1M Prostate biopsies in US

75% Negative or Low-Grade

Pain, bleeding, infection,

hospitalization

Recommendations to stop PSA

screening

8 |

4Kscore Test –

Avoiding Unnecessary Prostate

Biopsies

The only

test to identify men with high-grade prostate

cancer from a blood sample

Combines results of multiple biomarkers to create a

patient’s personal risk score

Based on 10 years of clinical research by scientists at

Memorial Sloan-Kettering Cancer Center and leading

European cancer centers

Tested in over 10,000 men in 9 separate clinical studies

demonstrating a 27% -

82% biopsy reduction

Validated by OPKO in a prospective, blinded study of

1,012 men

9 |

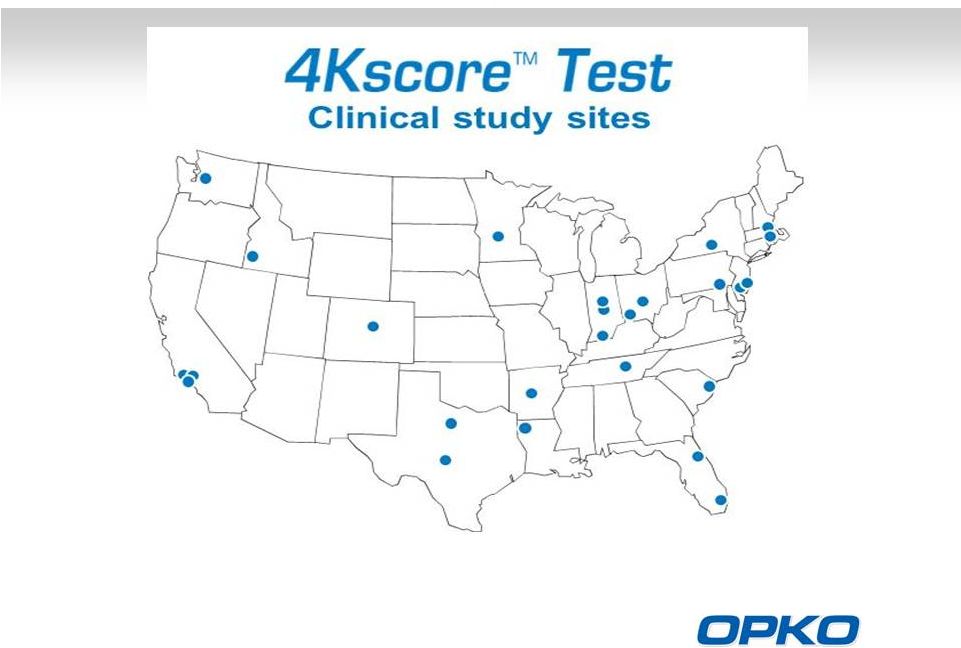

4Kscore Test US Clinical Study

10

1,012 Patients Enrolled –

Prospective Clinical Trial |

11

4Kscore Test Clinical Study Results in 1,012 Men

•

Discrimination: AUC = 0.82

•

Risk Calibration

•

Decision Curve Analysis

•

Biopsy reduction of 30% to 58% |

The

4Kscore Patient Counseling Report for a Result of 5%

12 |

The

4Kscore Test Conclusions Validated test based on a decade of clinical

research and a prospective, multi-institutional,

contemporary US clinical trial

Convenient blood test, cost $395

Excellent discrimination for high-grade cancer

(AUC = 0.82) and high net benefit for clinical use

Reduces 30 –

58% of biopsies

Provides a calibrated score for informed, shared

decision-making between urologist and patient

13 |

OPKO

Pharmaceuticals — Advanced, Deep Pipeline

Product

Indication

Preclinical

Phase 1

Phase 2

Phase 3

Milestone

Market Size

Rayaldee™

(CTAP101)

SHPT

(CKD Stage 3-4 Patients)

Phase 3 results

expected mid-

2014

$12.0 BN

hGH-CTP

hGH deficiency

$3.5 BN

Alpharen™

(Fermagate)

Hyperphosphatemia

(CKD Stage 5 Patients)

$1.2 BN

Rolapitant

CINV

NDA submission

targeted mid-2014

$1.5 BN

Sci-B-Vac™

Hepatitis B

(CKD Stage 5 Patients)

$0.2BN

Lunacalcipol™

(CTA018)

Moderate to severe SHPT

(CKD Stage 5 Patients) &

Psoriasis

$1.5 BN

CTAP201

Mild to moderate SHPT

(CKD Stage 5 Patients)

$1.1 BN

Factor VIIa-CTP

Hemophilia

$1.7 BN

AntagoNAT

Platform

Cancer, CV, metabolic

and orphan disease

$1.0 BN

Oxyntomodulin

Diabetes, Obesity

$15 BN

Outlicensed to TESARO

14 |

15

Rayaldee (CTAP101) –

A Late-Stage Investigational Drug

Product Overview

•

Oral formulation of 25D3*

addresses significant unmet need

•

Safe and effective treatment for

elevated PTH (SHPT) associated

with low 25D levels in Stage 3-4

CKD

•

Achieves reliable increases in

serum 25D and reductions in

plasma PTH

•

Lower risk of side effects

compared to active 1,25D

**

products

•

Potential for additional

indications including elderly,

osteoporosis & cancer

Clinical Status

Intellectual Property

* 25-Hydroxyvitamin D

** 1,25-Dihydroxyvitamin D

•

Clinical development guided by

prominent Scientific Advisory

Board

•

Top line phase 3 data available

in mid-2014

•

NDA filing in 1Q 2015

•

Rayaldee US patents issued,

protected through 2028

•

Additional global patents

allowed or pending

3 |

16

Rayaldee -

Commercial Opportunity

Source: BioTrends Research Group, Inc. December 2010

Untreated

26-44%

Vitamin D

Hormone

20-36%

Nutritional

Vitamin D

36-38%

Untreated

26-44%

Safety

concerns;

exacerbates

vitamin D

insufficiency

Efficacy

Concerns

Stage 3 & 4 CKD Treatment

•

Low

serum

25D

and

elevated

plasma

PTH

are

prevalent

in

CKD

Stage

3-4

patients

–

8 million CKD Stage 3-4 patients in the US

–

4 million patients with low serum 25D and high plasma PTH

Rayaldee is expected to take significant market share in Stage 3 and 4 CKD

patients suffering from SHPT – a potential $12 billion revenue

opportunity |

Rayaldee is expected to raise serum total 25-hydroxyvitamin D (25D) and

lower

plasma

iPTH

more

effectively

than

any

currently

marketed

over-the-

counter (OTC) or prescription (Rx) product without the risk of

hypercalcemia.

Comparison of Vitamin D Therapies for Stage 3-4 CKD

*And generics

**25-hydroxyvitamin D

17 |

•

CTP increases protein circulation time

•

Merck’s long acting FSH-CTP (Elonva

™

):

o

Received EU marketing authorization in 2010; NDA filed Q3 2013

o

Single FSH-CTP injection replaces 7 daily FSH injections in fertility

treatment

•

Two licensees of CTP technology for human therapeutics:

o

Merck (holds license for 4 fertility-focused proteins )

o

OPKO’s Biologics (holds license for all other rights)

18

CTP Technology: Clinically Validated Proprietary Platform

CTP –

a natural sequence

created during evolution

to enhance the longevity

of peptides and proteins

without increasing toxicity

Any Short Acting

Protein

CTP

Long Acting

Protein |

| •

$3.5 billion market, growing 5% annually

•

Once-a-week injection (current products require daily injections)

•

Small needle size (31 gauge) due to low viscosity

–

Competitive long acting formulations have high viscosity

•

Superb clinical, safety and immunogenicity profile

•

Human growth hormone is used for:

–

Growth hormone deficient children

–

Growth hormone deficient adults

–

Short stature

–

Off label

•

Orphan drug designation in the US & EU for children & adults

19

hGH-CTP Opportunity |

| hGH-CTP Clinical Development

•

Adult Pivotal Phase 3 trial (ongoing)

–

189 patients

–

Primary

efficacy

endpoint:

reduction

in

truncal

fat

mass

after

6

months

vs.

placebo

–

Secondary efficacy endpoints include:

•

Reduction in total body fat

•

Increase in lean body mass

–

Single pivotal trial required by FDA for BLA submission in 2016

•

Pediatric GHD Phase 2 trial (advanced stage)

–

Enrollment completed March 2014

–

4 cohorts:

•

3 dose levels of once-weekly hGH-CTP

•

Commercially available standard daily rhGH treatment

–

Key outcome: height velocity

–

Positive clinical data to be presented at ENDO meeting June 21-24,

2014 –

Phase 3 to commence by 1H2015

20 |

| FVIIa –CTP: Long Acting for Treating Hemophilic Patients

21

•

$1.7 billion market

•

Growing 7% annually

•

Only 25% of patients are treated

•

Current product (NovoSeven®) requires frequent IV doses

•

3-4 times a day during bleeding episodes

•

1-2 times a day for prophylactic treatment

•

Pharmacological studies in hemophilic mice and dogs FVIIa-

CTP demonstrated:

•

Potential for substantial improvement in the quality of life of patients via

subcutaneous administration

•

Reduce frequency of injection during on-demand therapy

•

Enable prophylactic treatment while reducing the frequency of injections to

2-3 times a week

•

Phase 2a study in hemophilic patients: initiated H2 2014

•

Orphan drug designation in the US |

| MOD-6031: Long Acting Oxyntomodulin for Obesity

22

•

>$15 billion market

•

Growing rapidly

•

Oxyntomodulin

–

Nature’s Appetite Control Mechanism

•

Natural appetite suppressor

•

Secreted by the digestive system following food intake and induces satiety in

the brain

•

Increases glucose tolerance

•

Short acting –

requires 3 injections per day

•

MOD-6031 Long Acting Oxyntomodulin-

weekly injection

studies in mutant obese mice and diet induced obese mice

demonstrated:

•

Significantly inhibited food intake and reduced body weight by reducing fat

•

Reduced cholesterol levels

•

Improved glycemic control

•

Phase 1 study to be initiated 1H2015

•

MOD-6031 is expected to provide superior long-term therapy

for obesity and diabetes type II patients |

Rolapitant –

Potential Near-term Revenue Driver

•

Rolapitant out-licensed to Tesaro in December 2010

–

Payments of up to $121 million

–

Double-digit tiered royalties

•

Differentiated cancer supportive care product with $1.5B US Market

Opportunity

–

Potent neurokinin-1(NK-1) receptor antagonist for

chemotherapy-induced nausea and vomiting (CINV)

–

Opportunity to differentiate on convenience, market access and safety

•

Single dose

•

Lack of CYP 3A4 drug-drug interactions

Long acting

•

Oral and

IV formulations allow full market access

•

NDA submission targeted for mid-2014

–

All three Phase 3 trials (MEC

*

and HEC

**

) achieved primary endpoint

–

Primary endpoint: complete response (no emesis and no use of rescue

medication) –

Third

Phase

3

trial

(HEC)

also

achieved

all

secondary

endpoints,

including:

•

Complete response in acute (0-24 hrs) and overall (0-120 hrs) phase of

CINV •

No significant nausea

23

*Moderately emetogenic chemotherapy **Highly emetogenic

chemotherapy |

| Strategic Investments

•

ARNO Therapeutics,

Inc. (OTC: ARNI) (~5% equity interest)

–

Anti-progestins for breast (phase 2) , endometrial and prostate

cancers •

Zebra Biologics,

Inc. (~19% equity interest)

–

Combinatorial antibody libraries based on function in human cell

screens

•

OAO Pharmsynthez

(MICE: LIFE) (~17% equity interest)

–

Russian developer and marketer of new drugs

•

RXi Pharmaceuticals

Corporation (NASDAQ: RXII)

(~17% equity interest)

–

sRNA to prevent hypertrophic scars (phase 2)

•

Cocrystal Pharma,

Inc. (OTC: COCP) (~16% equity interest)

–

New anti-virals (Hepatitis C, flu, dengue fever)

•

Fabrus,

Inc.

(~12% equity interest*)

–

Antibodies against difficult targets (e.g., G protein-coupled receptor, ion

channels) •

Neovasc,

Inc. (NASDAQ: NVCN) (~ 6% equity interest)

–

Cardiology devices

•

ChromaDex,

Inc.

(OTC: CDXC) (~2% equity interest)

–

New nutritional supplement APIs

24

Proprietary Technologies with Significant Upside Potential

(As of March 31, 2014)

*

Merger with Senesco Technologies, Inc. (OTC: SNTI) completed May 19, 2014

|