Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Tri Pointe Homes, Inc. | d738048d8k.htm |

Exhibit 99.1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This offering memorandum contains statements concerning future results and performance and other matters that are “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

These statements:

| • | use forward-looking terminology; |

| • | are based on various assumptions that TRI Pointe and WRECO make; and |

| • | may not be accurate because of risks and uncertainties surrounding the assumptions that TRI Pointe and WRECO make. |

Factors listed in this section—as well as other factors not included—may cause actual results to differ significantly from the forward-looking statements contained in this offering memorandum. There is no guarantee that any of the events anticipated by the forward-looking statements in this offering memorandum will occur, or if any of the events occurs, there is no guarantee what effect it will have on the operations or financial condition of WRECO, TRI Pointe, or the combined company.

Unless required by law, WRECO and TRI Pointe will not update forward-looking statements contained in any document after the date of such document.

Statements

TRI Pointe and WRECO make forward-looking statements in this offering memorandum, including with respect to dividends, estimated tax rates, expected results of litigation and the sufficiency of litigation reserves, expected capital expenditures, the Transactions, financing, expectations regarding synergies, cost savings and other benefits resulting from the Transactions and recognition of certain tax benefits.

WRECO and TRI Pointe base forward-looking statements on a number of factors, including the expected effect of:

| • | the economy; |

| • | laws and regulations; |

| • | adverse litigation outcomes and the adequacy of reserves; |

| • | changes in accounting principles; |

| • | projected benefit payments; |

| • | projected tax rates and credits; and |

| • | other related matters. |

Risks, Uncertainties and Assumptions

The major risks and uncertainties—and assumptions that WRECO and TRI Pointe make—that affect their businesses and may cause actual results to differ from these forward-looking statements include, but are not limited to:

| • | the effect of general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages and strength of the U.S. dollar; |

| • | market demand for products, which is related to the strength of the various U.S. business segments and U.S. and international economic conditions; |

| • | levels of competition; |

| • | the successful execution of internal performance plans, including restructurings and cost reduction initiatives; |

| • | global economic conditions; |

| • | raw material prices; |

| • | energy prices; |

| • | the effect of weather; |

| • | the risk of loss from earthquakes, volcanoes, fires, floods, droughts, windstorms, hurricanes, pest infestations and other natural disasters; |

| • | transportation costs; |

| • | federal and state tax policies; |

| • | the effect of forestry, land use, environmental and other governmental regulations; |

| • | legal proceedings; |

| • | risks relating to any unforeseen changes to or effects on liabilities, future capital expenditures, revenues, expenses, earnings, synergies, indebtedness, financial condition, losses and future prospects; |

| • | the satisfaction of the conditions to the consummation of the Transactions and other risks related to the consummation of the Transactions and actions related thereto; |

| • | the risk that disruptions from the Transactions will harm WRECO’s or TRI Pointe’s businesses; |

| • | WRECO’s and TRI Pointe’s ability to complete the Transactions on the anticipated terms and schedule, including the ability to obtain stockholder and regulatory approvals; |

| • | WRECO’s and TRI Pointe’s ability to achieve the benefits of the Transactions in the estimated amount and anticipated timeframe, if at all; |

| • | TRI Pointe’s ability to integrate WRECO successfully after the consummation of the Transactions and to achieve anticipated synergies; and |

| • | changes in accounting principles. |

2

Summary Unaudited Condensed Combined Pro Forma Financial Information of TRI Pointe and WRECO

The following summary unaudited condensed combined pro forma financial information of TRI Pointe and WRECO are being presented for illustrative purposes only. The data assume that WRECO had been owned by TRI Pointe for all periods and at the dates presented, and reflect the changes that WRECO expects to experience as a result of the Transactions, including the REB Transfers. TRI Pointe and WRECO may have performed differently had they actually been combined for all periods or on the dates presented. You should not rely on the following data as being indicative of the results or financial condition that would have been achieved or existed had TRI Pointe and WRECO been combined other than during the periods or on the dates presented or of the actual future results or financial condition of TRI Pointe and its consolidated subsidiaries to be achieved following the consummation of the Transactions. This information is only a summary and should be read in conjunction with “Unaudited Pro Forma Condensed Combined Financial Information of TRI Pointe and WRECO.”

| As of and for the Three Months Ended March 31, 2014 |

For the Year Ended December 31,2013 |

|||||||

| (Dollar amounts in thousands) | ||||||||

| Statement of Operations Data |

||||||||

| Home sales |

$ | 314,714 | $ | 1,465,521 | ||||

| Cost of home sales |

(252,911 | ) | (1,172,659 | ) | ||||

| Impairments and related charges |

(429 | ) | (1,719 | ) | ||||

|

|

|

|

|

|||||

| Homebuilding gross margin |

61,374 | 291,143 | ||||||

| Non-single-family gross margin |

2,435 | 17,353 | ||||||

| Fee building gross margin |

— | 1,082 | ||||||

| Sales and marketing |

(23,714 | ) | (104,297 | ) | ||||

| General and administrative |

(24,813 | ) | (94,720 | ) | ||||

| Restructuring charges |

(411 | ) | (8,538 | ) | ||||

| Other income, net |

974 | 6,475 | ||||||

|

|

|

|

|

|||||

| Earnings before income taxes |

15,845 | 108,498 | ||||||

| Provision for income taxes |

(6,169 | ) | (42,039 | ) | ||||

|

|

|

|

|

|||||

| Earnings from continuing operations |

$ | 9,676 | $ | 66,459 | ||||

|

|

|

|

|

|||||

| Operating Data |

||||||||

| Net new home orders |

805 | 3,532 | ||||||

| New homes delivered |

600 | 3,335 | ||||||

| Average sales price of homes delivered |

$ | 525 | $ | 439 | ||||

| Cancellation rate |

14 | % | 15 | % | ||||

| Average selling communities |

101 | 93 | ||||||

| Selling communities at end of period |

103 | 99 | ||||||

| Backlog at end of period, number of homes |

1,251 | 1,046 | ||||||

| Backlog at end of period, aggregate sales value |

$ | 752,242 | $ | 618,630 | ||||

| Other Pro Forma Financial Data |

||||||||

| EBITDA(1) |

$ | 24,827 | $ | 171,362 | ||||

| Adjusted EBITDA(1) |

$ | 27,794 | $ | 191,257 | ||||

| Further Adjusted EBITDA(1) |

$ | 30,797 | $ | 206,723 | ||||

| Ratio of debt to capitalization |

0.42 | x | N/A | |||||

| Balance Sheet Data |

||||||||

| Cash, cash equivalents and marketable securities |

$ | 39,351 | ||||||

| Inventory |

$ | 1,971,953 | ||||||

| Total assets |

$ | 2,531,925 | ||||||

| Debt payable |

$ | 976,933 | ||||||

| Total liabilities |

$ | 1,169,873 | ||||||

| Stockholders’ equity |

$ | 1,331,833 | ||||||

| (1) | Cash interest expense related to the notes assumes that $800 million aggregate principal amount of notes is issued hereby at a blended interest rate per annum of 6.25%. A 0.125% increase or decrease in the blended interest rate per annum would increase (decrease) such cash interest expense related to the notes by $1 million per annum. |

The following table reconciles pro forma earnings (loss) from continuing operations, to EBITDA, Adjusted EBITDA and Further Adjusted EBITDA:

| As of and for the Three Months Ended March 31, 2014 |

For the Year Ended December 31, 2013 |

|||||||

| (Dollar amounts in thousands) | ||||||||

| Earnings from continuing operations |

$ | 9,676 | $ | 66,459 | ||||

| Plus: Interest Incurred |

14,302 | 60,888 | ||||||

| Less: Interest Capitalized |

(14,302 | ) | (60,888 | ) | ||||

| Plus: Amortization of Interest in Cost of Sales |

5,706 | 47,219 | ||||||

| Plus: Provision for Income Taxes |

6,169 | 42,039 | ||||||

| Plus: Depreciation and Amortization |

3,276 | 15,645 | ||||||

|

|

|

|

|

|||||

| EBITDA |

$ | 24,827 | $ | 171,362 | ||||

| Adjustments: |

||||||||

| Plus: Restructuring Expense |

411 | 8,538 | ||||||

| Plus: Amortization of stock-based compensation |

2,556 | 11,357 | ||||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 27,794 | $ | 191,257 | ||||

| Further Adjustments(1): |

||||||||

| Plus: Cost of Sales related to Inventory fair value |

4,418 | 22,616 | ||||||

| Less: Transaction Expenses |

(548 | ) | (4,087 | ) | ||||

| Less: Excluded Operations |

(787 | ) | (2,964 | ) | ||||

| Less: Amortization of deferred financing fees |

(80 | ) | (99 | ) | ||||

|

|

|

|

|

|||||

| Further Adjusted EBITDA |

$ | 30,797 | $ | 206,723 | ||||

|

|

|

|

|

|||||

| (1) | Further Adjusted EBITDA is a non-GAAP financial measure that management of TRI Pointe believes is a useful measure of the combined company’s cash flow and operations. Further Adjusted EBITDA means Adjusted EBITDA, adjusted for (a) the increase to cost of home sales that was included for pro forma purposes due to the increase in the fair value of inventory acquired in the Transactions, (b) transaction expenses that were excluded for pro forma purposes related to underwriting, legal and other advisory fees associated with the Transactions, (c) certain costs that were excluded for pro forma purposes because they are expected to be retained by Weyerhaeuser in the Transaction Agreement and (d) amortization of deferred financing fees which were excluded for pro forma purposes because they are removed in purchase accounting in connection with the Transactions. |

The following table sets forth the calculation of pro forma Ratio of debt to capitalization:

| As of and for the Three Months Ended March 31, 2014 |

||||

| (Dollar amounts in thousands) |

||||

| Debt |

$ | 976,933 | ||

| Equity |

1,331,833 | |||

| Total capital |

2,308,766 | |||

| Ratio of debt to capitalization |

0.42 | x | ||

COMBINED COMPANY BUSINESS

As used in “Combined Company Business”, unless stated otherwise or the context otherwise requires:

| • | references to the “combined company” refer to the combined businesses of WRECO and its subsidiaries and TRI Pointe and its subsidiaries with regard to periods following consummation of the Transactions. |

| • | references to “TRI Pointe” refer to TRI Pointe Homes, Inc., a Delaware corporation, with regard to periods before and after the Transactions, as applicable, and |

| • | references to “WRECO” refer to Weyerhaeuser Real Estate Company and its direct and indirect subsidiaries. |

The Combined Company

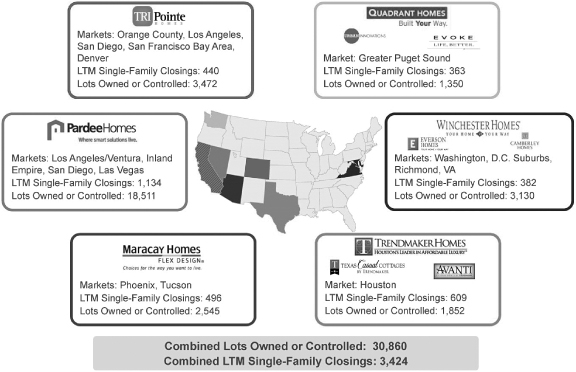

After the consummation of the Merger, TRI Pointe will own and operate WRECO as a fully integrated homebuilding business. The combination of TRI Pointe and WRECO is expected to create an industry-leading national homebuilding company which, on a pro forma combined basis after giving effect to the Transactions, would have had over 3,300 home deliveries in 2013 and an estimated combined equity market value of approximately $2.6 billion, based on an assumed 161.3 million shares of TRI Pointe common stock outstanding immediately after the consummation of the Merger and the closing price of TRI Pointe’s common stock on May 15, 2014. On a pro forma basis after giving effect to the Merger, the combined company would rank in the top ten public homebuilders in terms of estimated combined equity market value and as the 12th largest public homebuilder by 2013 homebuilding revenue according to Hanley Wood market data. The combined company will initially operate six distinct regional homebuilding companies with local growth strategies targeting some of the most attractive markets in the United States.

With approximately 31,000 lots owned or controlled on a combined basis as of March 31, 2014, including over 19,000 in entitlement-constrained California markets, the combined company will have a significant supply of lots to fuel future growth. On a pro forma combined basis after giving effect to the Transactions, for the twelve months ended December 31, 2013 and the three months ended March 31, 2014, the combined company would have generated total revenues of approximately $1.5 billion and $321 million, respectively, and Further Adjusted EBITDA of approximately $207 million and $31 million, respectively. For a reconciliation of net income to Further Adjusted EBITDA, see “Summary—Summary Unaudited Condensed Combined Pro Forma Financial Information of TRI Pointe and WRECO.”

| (1) | All lots owned and controlled as well as LTM data as of March 31, 2014 or the twelve months ended March 31, 2014. Lots controlled include lots under purchase agreements or options. There can be no assurance that these lots will be acquired or that homes will be built and sold. |

TRI Pointe and WRECO’s Combined Competitive Strengths

Leading National Homebuilder with Significant Scale and Operating Efficiency

The Merger is expected to create an industry-leading national homebuilding company with a strong portfolio of regional homebuilding companies and over $1.5 billion in total revenues and 3,335 new homes delivered on a pro forma combined basis for the year ended December 31, 2013. The combined company would rank among the top 12 largest U.S. homebuilder in terms of deliveries, based on data compiled by Hanley Wood for 2013. The combined company’s six distinct regional homebuilding companies operate twelve brands in 13 core markets across eight states, primarily in the western United States. The significantly enhanced scale of the combined company is expected to enable incremental purchasing savings and operating efficiencies.

Strong Portfolio of Regional Homebuilding Companies with Leading Positions in High Growth Markets

TRI Pointe and WRECO build homes and develop communities under six distinct regional homebuilding companies in some of the most attractive housing markets in the country:

| • | Maracay Homes in Phoenix and Tucson, Arizona |

| • | Pardee Homes in Southern California, and Las Vegas, Nevada |

| • | Quadrant Homes in the Puget Sound area of Washington State |

| • | Trendmaker Homes in Houston, Texas |

| • | TRI Pointe Homes in Southern and Northern California and Denver, Colorado; and |

| • | Winchester Homes in the Washington, D.C. suburbs and Richmond, Virginia. |

Pardee, Quadrant, Trendmaker and Winchester have operated within their respective geographic markets for over 25 years and have developed strong reputations among homebuyers for building high quality homes and delivering exceptional customer service. Their reputations have positioned these companies as preferred local brands that offer an extensive collection of home designs for a variety of market segments ranging from entry level to move-up to luxury homes. As a result, most of TRI Pointe and WRECO’s brands hold a top ten market position both in the total market as well as target segments defined by price point, based on home delivery data from Hanley Wood for 2013.

Each regional homebuilding company has a management team with significant operating and local market experience, helping to drive growth strategies tailored for each local market. TRI Pointe and WRECO believe these markets represent some of the most attractive housing markets in the United States based on favorable housing demand drivers including high population and job growth, positive migration patterns, housing affordability and desirable lifestyle and weather characteristics.

In recent years, several of WRECO’s regional homebuilding companies have developed complementary brands targeting adjacent, underserved segments within existing, as well as new, geographic markets. For example, Evoke in the Puget Sound area of Washington State and Avanti Custom Homes in Houston are each targeting a higher price point than the core WRECO brands in those markets (Quadrant and Trendmaker, respectively). TRI Pointe and WRECO believe that these complementary brands will enhance the combined company’s leading share in these markets and allow the combined company to capture additional pockets of homebuyer demand at different price points to maximize revenue potential.

WRECO’s regional homebuilding companies are focused on many of the most attractive housing markets in the United States, characterized by favorable long-term economic and demographic fundamentals, including expected home value, employment, housing permit and population growth. Moreover, housing permits issued in 2013 as a percentage of peak issuance in the last housing cycle in many of these markets are significantly lower than the national average, implying continued potential for growth.

Attractive Land Position to Support Future Growth

As of March 31, 2014, on a pro forma combined basis, TRI Pointe and WRECO owned or controlled approximately 31,000 lots, providing a robust land pipeline for future growth. The combined company’s land position implies approximately nine years of supply, based on deliveries for the twelve months ended March 31, 2014, near the high end of its public homebuilding peers. A long land supply, especially in entitlement-constrained markets, reduces dependence upon the competitive land acquisition market to fulfill near-term forecasts.

Furthermore, as of March 31, 2014, TRI Pointe and WRECO owned or controlled, on a pro forma combined basis, over 19,000 lots in entitlement-constrained markets in California, primarily through Pardee Homes. Most of these lots are strategically located in key Southern California counties, including Los Angeles, Orange, San Diego and Riverside, in which the land entitlement and development environment is complex and typically lengthy, requiring significant expertise and capital. TRI Pointe and WRECO believe this robust supply of land also provides optionality for future lot sales to other homebuilders to optimize returns on capital and prudently manage risk.

| Market |

TRI Pointe | WRECO | Combined Company |

|||||||||||||||||||||||||

| Owned | Controlled | Total | Owned | Controlled | Total | |||||||||||||||||||||||

| Southern California |

1,210 | 558 | 1,768 | 15,054 | 74 | 15,128 | 16,896 | |||||||||||||||||||||

| Northern California |

930 | 203 | 1,133 | 1,372 | — | 1,372 | 2,505 | |||||||||||||||||||||

| Colorado |

369 | 202 | 571 | — | — | — | 571 | |||||||||||||||||||||

| Washington, D.C.(1) |

— | — | — | 2,100 | 1,030 | 3,130 | 3,130 | |||||||||||||||||||||

| Arizona |

— | — | — | 1,313 | 1,232 | 2,545 | 2,545 | |||||||||||||||||||||

| Nevada |

— | — | — | 1,499 | 512 | 2,011 | 2,011 | |||||||||||||||||||||

| Texas |

— | — | — | 669 | 1,183 | 1,852 | 1,852 | |||||||||||||||||||||

| Washington |

— | — | — | 1,034 | 316 | 1,350 | 1,350 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total |

2,509 | 963 | 3,472 | 23,041 | 4,347 | 27,388 | 30,860 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (1) | Includes lots in the Washington, D.C. suburbs as well as lots acquired for expansion into the Richmond, VA market. |

Proven Executive Leadership Supported by Strong Operational Management

The executive management team of the combined company, which is expected to include Douglas Bauer, Chief Executive Officer, Thomas Mitchell, President and Chief Operating Officer, and Michael Grubbs, Chief Financial Officer and Treasurer, has worked together for over 20 years and possesses a successful track record of managing a large, geographically-diverse, growth-oriented public homebuilding company. Their combined real estate industry experience includes land acquisition, financing, entitlement, development, construction, marketing and sales of single-family detached and attached homes in communities in a variety of markets. Prior to forming TRI Pointe in 2009, Messrs. Bauer, Mitchell and Grubbs worked together for 17 years at William Lyon Homes from its formation in 1992, ultimately serving as its President and Chief Operating Officer, Executive Vice President, and Senior Vice President and Chief Financial Officer, respectively.

The combined company’s executive leadership team will be supported by a strong operational management team at each regional homebuilding company. The talented and experienced presidents leading these management teams have an average of over 20 years of experience, many of which in their core operating markets and will facilitate growth strategies tailored to the unique characteristics of each market in which they operate. TRI Pointe and WRECO believe that their executive and operational management teams’ prior experience, extensive relationships and strong local reputation will provide the combined company with a competitive advantage in being able to acquire land and lots, obtain entitlements, design and build quality homes, and complete projects on schedule.

Construction and Marketing Expertise Across A Wide Range of Products

The combined company will offer a wide range of products, including single-family detached and attached homes, from entry level to move-up to luxury, both within and across its regional homebuilding companies. With a consolidated average selling price of over $400,000, both TRI Pointe and WRECO have historically focused on a move-up homebuyer, offering high quality and compelling value at a premium price point. However, WRECO’s regional homebuilding companies have historically built, and TRI Pointe and WRECO expect the combined company will continue to build, across a variety of price points ranging from $165,000 to more than $2 million, with home sizes ranging from approximately 1,000 to 8,500 square feet.

TRI Pointe and WRECO expect their combined expertise in building across a wide range of products and price points will allow the combined company the flexibility to pursue a wide range of land acquisition opportunities in support of its homebuilding strategies in each of its markets. This flexibility to target specific segments of a sub-market where demand exceeds supply translates into better return potential with a greater ability to manage risk and TRI Pointe and WRECO expect that this will allow the combined company to be more patient and disciplined in its land acquisition efforts. Lastly, TRI Pointe and WRECO expect the breadth of their

product construction and marketing expertise to allow the combined company to quickly adapt to changing market conditions and consumer preferences.

Extensive Entitlement and Land Development Expertise

TRI Pointe and WRECO’s key senior land acquisition and development professionals have significant industry experience, providing the combined company with the necessary expertise to progress land successfully through the entire development cycle, including the entitlement process. Some of TRI Pointe and WRECO’s combined land holdings, primarily in Southern California through Pardee Homes, represent multi-phase, master planned communities, which will provide the combined company with the opportunity to add value to its undeveloped land through re-entitlement or repositioning, particularly in those markets with highly fragmented land ownership or those lacking market participants capable of assembling and developing large land parcels. Further, TRI Pointe and WRECO expect their expertise in land development to afford the combined company the opportunity to pursue opportunistic bulk land sales when such sales translate into attractive returns for the combined company.

Strong Relationships with Land Owners and Master Plan Developers

TRI Pointe and WRECO believe their ability to identify, acquire and develop land in desirable locations and on favorable terms will be key to the success of the combined company. The long tenure of TRI Pointe and WRECO’s management teams contributes to their acquisition and development capabilities and strong relationships with local and regional land sellers. TRI Pointe and WRECO have purchased land and built and sold homes in highly desirable master planned communities and developments such as The Irvine Ranch, Rancho Mission Viejo, Eastmark and Riverstone. TRI Pointe and WRECO believe these longstanding relationships will provide the combined company with a significant competitive advantage in their combined markets, where relationships are frequently just as important as, or more important than, price in the sourcing of land acquisitions.

TRI Pointe and WRECO’s Combined Business Strategy

Expand Leading Position in Core and Target Markets

TRI Pointe and WRECO expect the combined company to pursue growth within their current markets to the extent that the combined company believes such growth is consistent with its disciplined operating strategy, balanced land policies and overall commitment to superior product quality. TRI Pointe and WRECO believe their longstanding reputations for quality and customer service have helped achieve market-leading positions in many of their markets, which they expect the combined company to continue to defend and extend with the execution of its strategy. TRI Pointe and WRECO believe that there are significant opportunities to profitably expand in their existing markets due to favorable long-term supply and demand characteristics including increased job growth and household formations. Furthermore, TRI Pointe and WRECO’s land position in select markets underpins the combined company’s ability to meet rising demand in the future. While the combined company’s primary growth strategy will focus on increasing its market position in its existing markets, the combined company may, on an opportunistic basis, explore expansion into additional markets through organic growth or opportunistic acquisitions.

Acquire Attractive Land Positions While Prudently Managing Risk

TRI Pointe and WRECO believe that their reputations and extensive relationships with land sellers, master plan developers, financial institutions, brokers and other builders, their highly experienced land acquisition teams as well as TRI Pointe’s relationship with Starwood Capital Group, will enable the combined company to continue to source and acquire well-positioned land parcels in its existing markets and provide the combined company access to a greater number of acquisition opportunities. TRI Pointe and WRECO believe their expertise in land development and planning will enable the combined company to create desirable communities that meet or exceed its target homebuyers’ expectations, while further expanding the universe of potential acquisition opportunities. TRI Pointe and WRECO also believe that the contribution of WRECO’s land supply beyond two

to three years will provides the combined company with a competitive advantage at the current expansionary phase of the housing market cycle. TRI Pointe and WRECO also expect the combined company to seek to minimize its exposure to land risk through disciplined management of entitlements, as well as the use of land options and other flexible land acquisition arrangements. TRI Pointe and WRECO’s combined expertise in developing large master planned communities and selling lots to other builders affords the combined company the flexibility to optimize its returns while prudently managing risk.

Provide Superior Design, Homebuyer Experience and Customer Service

The combined company’s strategy will be to continue to strive to be a best-in-class, “progressive” homebuilder driven by exemplary customer experience, cutting-edge product development and exceptional execution. The combined company’s core operating philosophy will be to provide a positive, memorable experience to its homeowners through active engagement in the building process, tailoring its product to the homebuyer’s lifestyle needs and enhancing communication, knowledge and satisfaction. TRI Pointe and WRECO believe that the new generation of home buying families has different ideas about the kind of home buying experience it wants. As a result, TRI Pointe and WRECO expect the combined company to focus its selling process on the homes’ features, benefits, quality and design in addition to the traditional metrics of price and square footage. In addition, TRI Pointe and WRECO expect to the combined company to continue to devote significant resources to the research and design of its homes to better meet the needs of its homebuyers. Through TRI Pointe’s “TRI-e 3 Green” platform and WRECO’s “LivingSmart®” brand, TRI Pointe and WRECO provide homes that they believe are earth-friendly, enhance homeowners’ comfort, promote a healthier lifestyle and deliver tangible operating cost savings versus less efficient resale homes. Collectively, TRI Pointe and WRECO believe these features and benefits enhance the selling process, lead to a more satisfied homeowner and increase the number of homebuyers referred to their communities.

Offer a Wide Range of Products

TRI Pointe and WRECO expect the combined company to be a builder with a wide range of product lines that enable the combined company to meet or exceed the specific needs of each homebuyer within its target market segments, which TRI Pointe and WRECO believe will provide the combined company with a balanced portfolio and an opportunity to increase market share. While TRI Pointe and WRECO’s regional homebuilding company target segments can vary from market to market, they typically offer more premium or move-up products relative to their market competition. However, historically TRI Pointe and WRECO have demonstrated expertise in effectively building homes from entry-level to move-up to luxury homes. TRI Pointe and WRECO spend extensive time studying and designing their products through the use of architects, consultants and homeowner focus groups for all levels and price points in their target markets. TRI Pointe and WRECO believe their diversified product strategy will enable the combined company to best serve a wide range of homebuyers, adapt quickly to changing market conditions and optimize performance and returns while strategically reducing portfolio risk.

Focus on Efficient Cost and Organization Structure

TRI Pointe and WRECO believe the members of the expected management team of the combined company have been vigilant in controlling costs. TRI Pointe and WRECO expect the combined company to competitively bid its developments while maintaining strong relationships with its trade partners by managing production schedules closely and paying its vendors on time.

TRI Pointe and WRECO expect the combined company to combine decentralized management in those aspects of its business where it believes detailed knowledge of local market conditions is critical (such as governmental processing, construction, land development and sales and marketing) with centralized management in those functions where the combined company believes central control is required (such as approval of land acquisitions, financial, treasury, human resources, legal matters and information technology). TRI Pointe and WRECO have each made significant investments in systems and infrastructure to operate the combined company’s business efficiently and to support the planned future growth of the combined company as a result of executing its expansion strategy.

Maintain Balance Sheet Strength and Flexibility

TRI Pointe and WRECO expect the combined company to employ both debt and equity as part of its ongoing financing strategy, coupled with redeployment of cash flows from continuing operations, to provide the combined company with the financial flexibility to access capital on the best terms available. In that regard, TRI Pointe and WRECO expect the combined company to employ prudent levels of leverage to finance the acquisition and development of its lots and construction of its homes. On or before the closing of the Merger, TRI Pointe expects to enter into a new revolving credit facility providing for up to $425 million of total borrowing capacity, subject to ongoing negotiations with lenders. The prospective facility would provide meaningful liquidity in executing the combined company’s business strategy. However, there can be no assurance that this revolving credit facility will be completed. At March 31, 2014, on a pro forma basis and after giving effect to the Transactions, including the issuance of the notes, TRI Pointe and WRECO expect the combined company to have a total debt to total capitalization ratio of approximately 0.42x, below its long-term target of approximately 0.50x.

Leverage Land Development Expertise to Maximize Returns and Manage Risk

TRI Pointe and WRECO believe the combined company will have significant entitlement and development expertise, which they expect the combined company to leverage to improve returns and expand the universe of acquisition opportunities while prudently managing risk. Unlike many of their competitors, TRI Pointe and WRECO believe the combined company will be able to increase the value of its land portfolio through the zoning and engineering process by creating attractive land use plans and optimizing its use of land. Pardee Homes holds the majority of the combined company’s land currently under development, in Southern California markets where land and entitlement constraints limit the available supply of, and increase the competition for, finished lots. TRI Pointe and WRECO expect the combined company to advance these parcels through the entitlement process, to add value through community development, consistent with its strategy and to provide significant supply to meet future rising homebuyer demand.

DESCRIPTION OF OTHER INDEBTEDNESS

New Revolving Credit Facility

TRI Pointe anticipates entering into a New Revolving Credit Facility, providing for up to $425 million of total borrowing capacity, which would replace the Existing Secured Credit Agreements. The New Revolving Credit Facility is anticipated to have a four-year term and is not anticipated to be secured. The interest rate on borrowings is expected to be at a rate based on LIBOR plus an applicable margin, ranging from 215 to 285 basis points depending on TRI Pointe’s leverage ratio. Borrowings under the New Revolving Credit Facility are expected to be subject to, among other things, a borrowing base formula. The New Revolving Credit Facility is expected to contain customary representations and warranties, affirmative and negative covenants and events of default, including certain financial covenants. The New Revolving Credit Facility is expected to require that TRI Pointe’s wholly-owned domestic homebuilding subsidiaries guarantee TRI Pointe’s obligations thereunder, other than (1) subsidiaries whose net worth is less than $3,000,000 individually and 3% of consolidated tangible net worth of TRI Pointe in the aggregate, and (2) certain special purpose subsidiaries. Additionally, it is anticipated that such subsidiaries will not be required to become guarantors under the New Revolving Credit Facility for a certain period of time following consummation of the Merger.

The New Revolving Credit Facility is subject to ongoing negotiations with lenders and there can be no assurance that the parties will reach a definitive agreement with respect to the New Revolving Credit Facility on the terms described above or at all.

U.S. Bank Secured Revolving Credit Facility

TRI Pointe currently has a secured, non-guaranteed three-year revolving credit facility with U.S. Bank National Association d/b/a Housing Capital Company (the “U.S. Bank Facility”). The U.S. Bank Facility provides for a maximum loan commitment of $125 million and matures on July 18, 2016 with the potential for a one-year extension of the term of the loan, subject to specified conditions and payment of an extension fee.

Borrowings under the U.S. Bank Facility are secured by a first priority lien on borrowing base properties and are subject to, among other things, a borrowing base formula. In addition to customary representations and warranties, affirmative and negative covenants and events of default, the U.S. Bank Facility contains specific financial covenants requiring TRI Pointe to maintain on a quarterly basis: (a) a minimum tangible net worth (as defined) requirement of $200 million (which amount is subject to increase over time based on earnings from and after December 31, 2012 and proceeds from equity capital investments in TRI Pointe), (b) liquid assets (as defined) equal to or greater than $10 million, (c) a fixed charge coverage ratio (EBITDA to interest paid, as defined) of at least 1.60 to 1.00 (determined at the end of each fiscal quarter on a rolling four-quarters basis), (d) a leverage ratio (as defined) of less than 1.50 to 1.00, and (e) a ratio of land assets (as defined) to tangible net worth of less than 1.50 to 1.00. The foregoing covenants, as well as the borrowing base provisions, limit the amount TRI Pointe can borrow or keep outstanding under the U.S. Bank Facility. The interest rate on borrowings is at a rate based on LIBOR plus an applicable margin, ranging from 250 to 370 basis points depending on TRI Pointe’s leverage ratio.

As of March 31, 2014, the outstanding balance was $120.2 million with an interest rate of 2.69% per annum and $44.2 million of availability after considering the borrowing base provisions and outstanding letters of credit.

TRI Pointe expects to replace this facility with borrowings under the New Revolving Credit Facility.

California Bank & Trust Secured Revolving Credit Facility

TRI Pointe currently has a secured, non-guaranteed revolving credit facility with California Bank & Trust (the “California Bank & Trust Facility”). The California Bank & Trust Facility provides for a maximum loan commitment of $50 million and matures in April 2016.

Interest rates charged under the California Bank & Trust Facility include applicable LIBOR and prime rate pricing options, subject to a minimum interest rate floor.

As of March 31, 2014, the outstanding balance under the California Bank & Trust Facility was $30.4 million with an interest rate of 3.75% per annum and $10.1 million of availability after considering the borrowing base provisions and outstanding letters of credit.

TRI Pointe expects to replace this facility with borrowings under the New Revolving Credit Facility.

Secured Acquisition and Development Loans and Construction Loans

As of March 31, 2014, TRI Pointe was party to two secured acquisition and development loan agreements (the “Acquisition and Development Loan Agreements”) to purchase and develop land parcels. In addition, TRI Pointe was party to five secured construction loan agreements (the “Construction Loan Agreements”, and together with the U.S. Bank Facility, the California Bank & Trust Facility and the Acquisition and Development Loan Agreements”, the “Existing Secured Credit Agreements”) for the construction of TRI Pointe’s model and production homes. As of December 31, 2013, TRI Pointe was party to several secured acquisition and development loan agreements to purchase and develop land parcels. In addition, TRI Pointe was party to several secured construction loan agreements for the construction of TRI Pointe’s model and production homes. As of March 31, 2014 and December 31, 2013, the total aggregate commitment of TRI Pointe’s acquisition and development loans and TRI Pointe’s construction loans was $59.1 million and $65.6 million, respectively, of which $26.4 million and $47.4 million, respectively, was outstanding. The acquisition and development loans will be repaid as lots are released from the loans based upon a specific release price, as defined in each respective loan agreement. TRI Pointe’s construction loans will be repaid with proceeds from home sales based upon a specific release price, as defined in each respective loan agreement. These loans range in maturity between December 2014 and August 2016, including the six month extensions which are at TRI Pointe’s election (subject to certain conditions) and bear interest at a rate based on applicable LIBOR or Prime Rate pricing options plus an applicable margin. As of March 31, 2014 and December 31, 2013, the weighted average interest rate was 3.6% and 3.5%, respectively, per annum.

TRI Pointe expects to replace these facilities with borrowings under the New Revolving Credit Facility.

Definitions

“TRI Pointe” means TRI Pointe Homes, Inc.

“WRECO” means Weyerhaeuser Real Estate Company.

“Weyerhaeuser” refers to the parent entities of WRECO, which may be either Weyerhaeuser Company, Weyerhaeuser NR Company, or both.

“Transaction Agreement” refers to the Transaction Agreement (as such agreement may be amended from time to time) dated November 4, 2013 among Weyerhaeuser, WRECO, TRI Pointe and Topaz Acquisition, Inc., a Washington corporation.

References to the “Transactions” refer collectively to the transactions contemplated by the Transaction Agreement and related documents.

The “Merger” means the merger between WRECO and Topaz Acquisition, Inc., a subsidiary of TRI Pointe, with WRECO as the surviving entity becoming a wholly owned subsidiary of TRI Pointe.

“REB Transfers” refers to certain transfers of assets and transfers and assumptions of liabilities, as described as follows. Under the terms of the Transaction Agreement, Weyerhaeuser and its subsidiaries will transfer to WRECO and its subsidiaries certain assets and liabilities relating to WRECO’s real estate business, and WRECO and its subsidiaries will transfer to Weyerhaeuser and its subsidiaries (other than WRECO and its subsidiaries) certain assets and liabilities of WRECO and its subsidiaries that the parties have agreed will be excluded from the Transactions and retained and, as applicable, assumed, by Weyerhaeuser and its subsidiaries (other than WRECO and its subsidiaries) following the closing date of the Transactions.