Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ENDURANCE SPECIALTY HOLDINGS LTD | d728803d8k.htm |

| EX-99.1 - EX-99.1 - ENDURANCE SPECIALTY HOLDINGS LTD | d728803dex991.htm |

Increased

Proposal to Aspen Shareholders: Creating a Global Leader in Specialty Insurance and

Reinsurance June 2, 2014

Exhibit 99.2 |

Cautionary

Note

Regarding

Forward

Looking

Statements

Some of the statements in this presentation may include forward-looking statements which

reflect our current views with respect to future events and financial performance. Such statements may include forward-looking

statements both with respect to us in general and the insurance and reinsurance sectors

specifically, both as to underwriting and investment matters. These statements may also include assumptions about our proposed acquisition

of

Aspen

(including

its

benefits,

results,

effects

and

timing).

Statements

which

include

the

words

"should,"

"would,"

"expect,"

"intend,"

"plan,"

"believe,"

"project,"

"anticipate,"

"seek,"

"will,"

and

similar

statements

of

a

future

or

forward-looking

nature

identify

forward-looking

statements

in

this

presentation

for

purposes

of

the

U.S.

federal

securities

laws

or

otherwise.

We

intend

these

forward-looking

statements

to

be

covered

by

the

safe

harbor

provisions for forward-looking statements in the Private Securities Litigation Reform Act

of 1995. All forward-looking statements address matters that involve risks and

uncertainties. Accordingly, there are or may be important factors that could cause actual results to differ materially from those indicated in the forward-

looking

statements.

These

factors

include,

but

are

not

limited

to,

the

effects

of

competitors’

pricing

policies,

greater

frequency

or

severity

of

claims

and

loss

activity,

changes

in

market

conditions

in

the

agriculture

insurance

industry, termination of or changes in the terms of the U.S. multiple peril crop insurance

program, a decreased demand for property and casualty insurance or reinsurance, changes in the availability, cost or quality of reinsurance

or retrocessional coverage, our inability to renew business previously underwritten or

acquired, our inability to maintain our applicable financial strength ratings, our inability to effectively integrate acquired operations,

uncertainties in our reserving process, changes to our tax status, changes in insurance

regulations, reduced acceptance of our existing or new products and services, a loss of business from and credit risk related to our broker

counterparties,

assessments

for

high

risk

or

otherwise

uninsured

individuals,

possible

terrorism

or

the

outbreak

of

war,

a

loss

of

key

personnel,

political

conditions,

changes

in

accounting

policies,

our

investment

performance,

the

valuation of our invested assets, a breach of our investment guidelines, the unavailability of

capital in the future, developments in the world’s financial and capital markets and our access to such markets, government intervention

in the insurance and reinsurance industry, illiquidity in the credit markets, changes in

general economic conditions and other factors described in our Annual Report on Form 10-K for the year ended December 31, 2013 and our

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

March

31,

2014.

Additional

risks

and

uncertainties

related

to

the

proposed

transaction

include,

among

others,

uncertainty

as

to

whether

Endurance

will

be

able

to

enter

into

or

consummate

the

transaction

on

the

terms

set

forth

in

the

proposal,

the

risk

that

our

or

Aspen’s

shareholders

do

not

approve

the

transaction,

potential

adverse

reactions

or

changes

to

business

relationships

resulting

from

the

announcement or completion of the transaction, uncertainties as to the timing of the

transaction, uncertainty as to the actual premium of the Endurance share component of the proposal that will be realized by Aspen

shareholders in connection with the transaction, competitive responses to the transaction, the

risk that regulatory or other approvals required for the transaction are not obtained or are obtained subject to conditions that are not

anticipated,

the

risk

that

the

conditions

to

the

closing

of

the

transaction

are

not

satisfied,

costs

and

difficulties

related

to

the

integration

of

Aspen’s

businesses

and

operations

with

Endurance’s

businesses

and

operations,

the

inability to obtain, or delays in obtaining, cost savings and synergies from the transaction,

unexpected costs, charges or expenses resulting from the transaction, litigation relating to the transaction, the inability to retain key

personnel, and any changes in general economic and/or industry specific conditions.

Forward-looking

statements

speak

only

as

of

the

date

on

which

they

are

made,

and

we

undertake

no

obligation

publicly

to

update

or

revise

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

developments or otherwise.

The

foregoing

review

of

important

factors

should

not

be

construed

as

exhaustive

and

should

be

read

in

conjunction

with

the

other

cautionary

statements

that

are

included

herein

and

elsewhere,

including

the

risk

factors

included

in our most recent reports on Form 10-K and Form 10-Q and the risk factors included in

Aspen's most recent reports on Form 10-K and Form 10-Q and other documents of Endurance and Aspen on file with the U.S. Securities and

Exchange

Commission

(the

“SEC”).

Any

forward-looking

statements

made

in

this

presentation

are

qualified

by

these

cautionary

statements,

and

there

can

be

no

assurance

that

the

actual

results

or

developments

anticipated

by

Endurance will be realized or, even if substantially realized, that they will have the expected

consequences to, or effects on, us or our business or operations. Additional

Information

and

Where

to

Find

It

This

presentation

relates

to

the

offer

to

be

commenced

by

Endurance

to

exchange

each

issued

and

outstanding

common

share

of

Aspen

(together

with

associated

preferred

share

purchase

rights)

for

$49.50

in

cash,

0.9197

Endurance

common

shares,

or

a

combination

of

cash

and

Endurance

common

shares,

subject

to

a

customary

proration

mechanism.

This

presentation

is

for

informational

purposes

only

and

does

not

constitute

an

offer

to

exchange, or a solicitation of an offer to exchange, Aspen common shares, nor is it a

substitute for the Tender Offer Statement on Schedule TO or the preliminary Prospectus/Offer to Exchange to be included in the Registration

Statement on Form S-4 (including the Letter of Transmittal and Election and related

documents and as amended from time to time, the “Exchange Offer Documents”) that Endurance intends to file with the SEC. The Endurance

exchange offer will be made only through the Exchange Offer Documents.

This presentation is not a substitute for any other relevant documents that Endurance may file

with the SEC or any other documents that Endurance may send to its or Aspen’s shareholders in connection with the proposed

transaction. Today, Endurance will file with the SEC a preliminary solicitation statement

with respect to the solicitation of (i) written requisitions that the board of directors of Aspen convene a special general meeting of Aspen’s

shareholders to vote on an increase in the size of Aspen’s board of directors from 12 to

19 directors and (ii) Aspen shareholder support for the proposal of a scheme of arrangement by Endurance which will entail the holding of a

court-ordered meeting of Aspen shareholders at which Aspen’s shareholders would vote

to approve a scheme of arrangement under Bermuda law pursuant to which Endurance would acquire all of Aspen’s outstanding common

shares

on

financial

terms

no

less

favorable

than

those

contained

in

its

acquisition

proposal

announced

on

June

2,

2014

(the

“Solicitation

Statement”).

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE EXCHANGE OFFER DOCUMENTS AND THE

SOLICITATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ENDURANCE HAS FILED OR MAY FILE WITH THE

SEC

IF

AND

WHEN

THEY

BECOME

AVAILABLE

BECAUSE

THEY

CONTAIN

OR

WILL

CONTAIN

IMPORTANT

INFORMATION

ABOUT

THE

PROPOSED

TRANSACTION.

All

such

documents,

when

filed,

are

available

free

of

charge

at

the

SEC’s

website (www.sec.gov) or by directing a request to Endurance at the Investor , +1 441 278 0988

(phone), investorrelations@endurance.bm (email). Participants

in

the

Solicitation

Endurance and its directors and certain of its executive officers and employees may be deemed

to be participants in any solicitation of shareholders in connection with the proposed transaction. Information about Endurance’s

directors,

executive

officers

and

employees

who

may

be

deemed

to

be

participants

in

the

solicitation,

including

a

description

of

their

direct

and

indirect

interests,

by

security

holdings

or

otherwise,

is

set

forth

in

the

Solicitation

Statement and Endurance’s proxy statement, dated April 9, 2014, for its 2014 annual

general meeting of shareholders. Forward looking statements & other information

2 |

Regulation

G

Disclaimer

In this presentation, management has included and discussed certain non-GAAP

measures. Management believes that these non-GAAP measures, which may be defined differently by other companies, better explain the proposed

transaction in a manner that allows for a more complete understanding. However, these

measures should not be viewed as a substitute for those determined in accordance with GAAP. For a complete description of non-GAAP

measures

and

reconciliations,

please

review

the

Investor

Financial

Supplement

on

our

web

site

at

www.endurance.bm.

The

combined

ratio

is

the

sum

of

the

loss,

acquisition

expense

and

general

and

administrative

expense

ratios.

Endurance

presents

the

combined

ratio

as

a

measure

that

is

commonly

recognized

as

a

standard

of

performance

by

investors,

analysts,

rating

agencies

and

other

users

of

its

financial

information.

The

combined

ratio,

excluding

prior

year

net

loss

reserve

development,

enables

investors,

analysts,

rating

agencies

and

other

users

of

its

financial

information to more easily analyze Endurance’s results of underwriting activities in a

manner similar to how management analyzes Endurance’s underlying business performance. The combined ratio, excluding prior year net loss

reserve development, should not be viewed as a substitute for the combined ratio.

Net premiums written is a non-GAAP internal performance measure used by Endurance in the

management of its operations. Net premiums written represents net premiums written and deposit premiums, which are premiums on

contracts

that

are

deemed

as

either

transferring

only

significant

timing

risk

or

transferring

only

significant

underwriting

risk

and

thus

are

required

to

be

accounted

for

under

GAAP

as

deposits.

Endurance

believes

these

amounts

are

significant to its business and underwriting process and excluding them distorts the analysis

of its premium trends. In addition to presenting gross premiums written determined in accordance with GAAP, Endurance believes that

net premiums written enables investors, analysts, rating agencies and other users of its

financial information to more easily analyze Endurance’s results of underwriting activities in a manner similar to how management analyzes

Endurance’s underlying business performance. Net premiums written should not be

viewed as a substitute for gross premiums written determined in accordance with GAAP.

Return on Equity (ROE) is comprised using the average common equity calculated as the

arithmetic average of the beginning and ending common equity balances for stated periods. Endurance presents various measures of Return

on Equity that are commonly recognized as a standard of performance by investors, analysts,

rating agencies and other users of its financial information. Certain information

included in this presentation has been sourced from third parties. Endurance does not make any representations regarding the accuracy, completeness or timeliness of such third party information. Permission

to cite such information has neither been sought nor obtained.

All information in this presentation regarding Aspen, including its businesses, operations and

financial results, was obtained from public sources. While Endurance has no knowledge that any such information is inaccurate or

incomplete, Endurance has not had the opportunity to verify any of that information.

Additional

Information

All

references

in

this

presentation

to

“$”

refer

to

United

States

dollars.

The

contents

of

any

website

referenced

in

this

presentation

are

not

incorporated

by

reference

herein.

Forward looking statements & other information (continued)

3

Third

Party-Sourced

Information |

•

Improved proposed transaction offers enhanced upfront premium and opportunity for

long-term value for Aspen’s shareholders –

Increased price of $49.50

(1)

–

a substantial premium valuation

–

Opportunity to receive cash and/or Endurance shares

–

Simplified and improved financing plan

•

The combination of Endurance and Aspen is a unique opportunity to create a global leader in

the specialty insurance and reinsurance sector

–

Over $5 billion of combined annual gross premiums written, diversified across products and

geographies –

$5.9 billion of pro forma shareholders’

equity

(2)

and $7.3 billion in total capital

(2)

, yielding a sizable and strong capital base to

compete in the increasingly competitive global market

•

The transaction will create a company with a superior financial profile

–

Increased scale, diversification, market presence and relevance

–

Enhanced profitability driven by:

•

Proven management team comprised of industry-leading talent

•

World-class underwriting expertise from both companies

•

Over $100 million of anticipated annual synergies from the transaction

•

Actions being taken to provide Aspen shareholders the means to expedite transaction:

–

Pursuing special general meeting of Aspen’s shareholders to increase size of Aspen’s

board, allowing Aspen's shareholders the ability to replace the majority of Aspen's

board at the 2015 general meeting

–

Seeking Aspen shareholder support for the proposal for a Scheme of Arrangement which will

entail the holding of a court- ordered meeting of Aspen shareholders to approve a

Scheme of Arrangement in order to vote upon completing the transaction with Endurance

without Aspen board support if necessary –

Commencing an exchange offer for all Aspen common shares in the near future reflecting the

same economic terms as Endurance's increased proposal

Endurance and Aspen –

A Compelling Combination

Improved Proposed Transaction will yield significant value for shareholders and create a

company with greater scale, market presence, diversification and profit potential

4

Notes

1.

Based on Endurance’s unaffected closing share price of $53.82 as of 4/11/2014

2.

Figures as of 3/31/2014, pro forma for transaction and reflects permanent financing plan,

assuming no exercise of CVC’s option to purchase $250MM of Endurance ordinary shares post-closing.

Shareholders’

equity excludes non-controlling interest |

Improved

Transaction Terms Compelling value for Aspen shareholders while generating significant

earnings and ROE accretion for Endurance shareholders

5

Notes

1.

Based on 66.3MM fully-diluted Aspen shares as of 4/25/2014 and Endurance’s unaffected

closing share price of $53.82 as of 4/11/2014 2.

Based on pro rata consideration mix of 40% cash and 60% stock

3.

Reflects permanent financing plan and assumes repayment of Endurance’s $200MM senior debt

maturing in October 2015 4.

Assumes $0.5Bn of common equity issued to new investors at 3% discount to Endurance’s

closing share price of $51.72 as of 5/30/2014; assumes no exercise of option by CVC to purchase $250MM of

Endurance ordinary shares post-closing

Transaction Proposal

•

Endurance to acquire all of the common shares of Aspen

Value

•

Revised

proposal

values

Aspen

at

$49.50

per

share

or

$3.2

billion

(1)

–

1.16x Aspen’s diluted book value per share at 3/31/2014 and 11.8x 2014 consensus Street

earnings estimates –

25.7% premium to Aspen’s unaffected closing share price on 4/11/2014 and 19.5% premium

to (pre-announcement) all- time high

–

The consideration is based on Endurance’s unaffected closing share price on 4/11/2014.

Based on Endurance’s closing share

price

on

5/30/2014,

Endurance’s

proposal

would

value

Aspen

at

$48.34

per

share

(2)

Consideration

•

Aggregate consideration mix of 40% cash and 60% stock

•

Aspen

shareholders

can

elect

to

receive

(i)

$49.50

in

cash

per

Aspen

share,

(ii)

0.9197

(1)

Endurance

common

shares

for

each

Aspen

share,

or

(iii)

a

combination

of

0.5518

(1)

Endurance

common

shares

and

$19.80

in

cash

for

each

Aspen

share,

subject

to a customary proration mechanism

•

Proposal structured to be tax-free to Aspen common shareholders with respect to the

Endurance common shares received in the transaction

Financing

•

$1.3 billion of cash consideration to be funded through Endurance’s cash on hand and

$1.0Bn committed bridge financing –

Financing

to

replace

bridge

facility

currently

anticipated

to

be

generated

from

Aspen

cash

on

hand

of

$0.2Bn,

public

investment grade debt financing of ~$0.3Bn and common equity financing of ~$0.5Bn

–

Pro forma debt to total capital of 19% at 3/31/2014, expected to

be approximately 15% by end of 2015

(3)

Endurance CEO

Investment

•

John Charman, Endurance’s Chairman and Chief Executive Officer, remains committed to

purchase $25 million of Endurance common shares in connection with the transaction,

bringing his total purchases of Endurance shares to $55 million Pro Forma Ownership

•

49% by Endurance shareholders (including John Charman)

•

40% by Aspen shareholders

•

11% by New Investors

(4)

Financial Benefits

•

Relative to Endurance’s initial proposal, improved EPS and ROE accretion for

Endurance shareholders, lower initial book value

per

share

dilution,

assuming

permanent

financing

as

contemplated

above

•

Over $100 million of annual synergies anticipated |

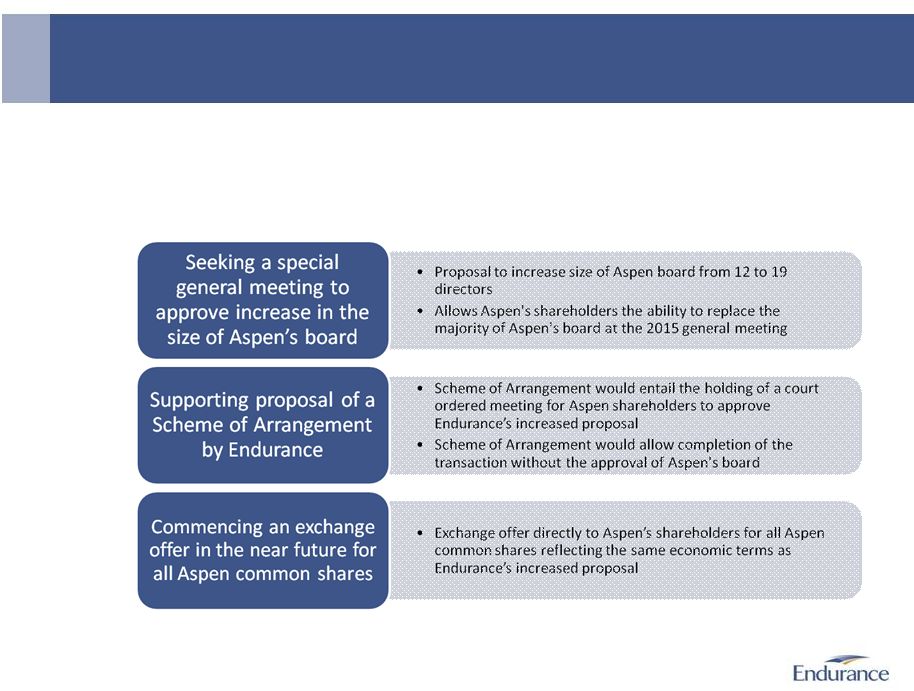

Actions to

expedite transaction further demonstrate Endurance’s commitment to pursuing this

transaction

while

providing

Aspen

shareholders

multiple

means

to

voice

support

and

complete

transaction in spite of Aspen’s refusal to engage.

Endurance and Aspen –

A Compelling Combination

Actions to expedite transaction give Aspen shareholders opportunity to voice support for the

transaction while providing a path forward to a successful transaction

6

Increased

Proposal to

$49.50

(1)

and

updated

financing

plan

Notes

1.

Calculated based on Endurance’s unaffected closing share price of $53.82 as of 4/11/2014,

the last trading day prior to Endurance’s announcement of its initial proposal to acquire Aspen for $47.50 per share |

Creating a

Global Leader in Specialty Insurance and Reinsurance |

Transaction

Creates Company With Improved Market Presence and Diversification, Stronger Capitalization

and Enhanced Profitability 8

Diversified Platform

Across Products and

Geographies

Increased Scale and

Market Presence

•

Combination creates an enterprise with over $5 billion of annual

gross premiums written

•

Expanded leadership and underwriting expertise

•

Increased size allows organization to better capitalize on distribution relationships

•

Greater scale better positions combined company to compete with largest players as

competition intensifies

•

Endurance and Aspen share certain common businesses; however, the relative weighting of each

is quite complementary

•

Aspen’s strength in the Lloyd’s market and Endurance’s market-leading U.S.

agriculture business are examples of uncorrelated and diversified businesses

•

The global breadth and diversity of the combined business will be more relevant for brokers

and customers

•

Aspen’s Lloyd’s platform complements global insurance and reinsurance footprint and

is highly attractive to Endurance

Enhanced

Profitability

•

With shareholders’

equity

(1)

of $5.9 billion and total capital of $7.3 billion

(1)

, the combined

company will have scale comparable to many of its key competitors

•

Larger, stronger balance sheet will be better positioned to pursue growth and withstand

volatility •

Additional capital efficiencies due to improved business diversification anticipated

•

Meaningful transaction synergies through cost savings, underwriting improvements, capital

efficiencies and enhanced capital management opportunities anticipated

•

Combined company will be well positioned to produce an improved ROE

•

Larger asset base will enable the combined company to capitalize

on investment opportunities as

they arise

Notes

1.

Figures as of 3/31/2014, pro forma for transaction and reflects permanent financing plan,

assuming no exercise of CVC’s option to purchase $250MM of Endurance ordinary shares post-closing.

Shareholders’

equity excludes non-controlling interest

Strong Balance

Sheet and Capital

Position |

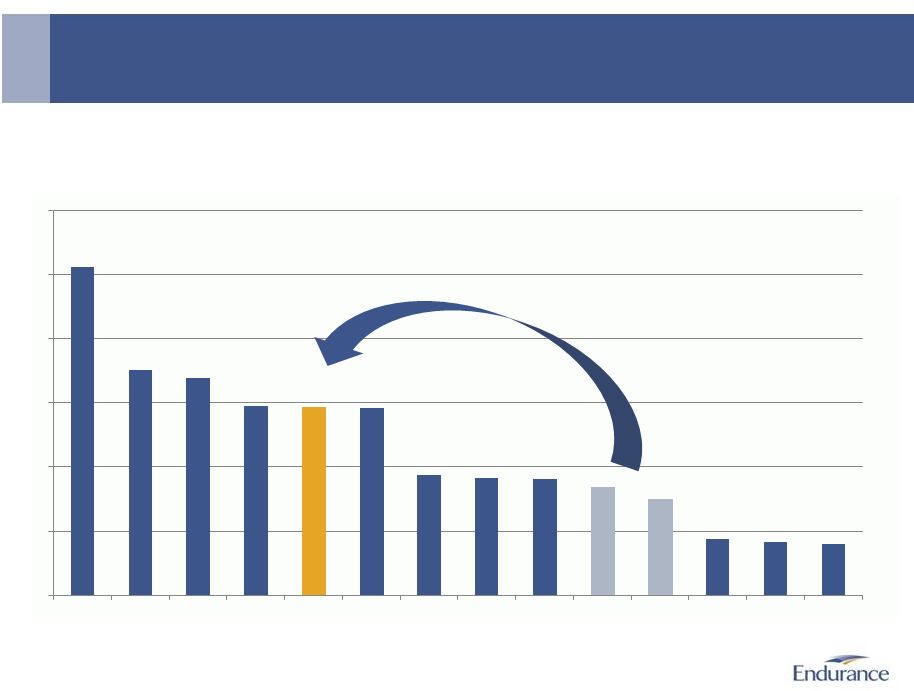

Combined Company

Will Have Scale to Compete With Market Leaders

9

Notes

1.

Excluding non-controlling interest

2.

As of 3/31/2014, pro forma for transaction and reflects permanent financing plan, assuming no

exercise of CVC’s option to purchase $250MM of Endurance ordinary shares post-closing

Shareholders’

Equity of Peer Companies

(1)

As of 3/31/2014

$Bn

(2)

10.2

7.0

6.8

5.9

5.9

5.8

3.8

3.6

3.6

3.4

3.0

1.8

1.7

1.6

0.0

2.0

4.0

6.0

8.0

10.0

12.0

XL

RE

PRE

ACGL

ENH+AHL

AXS

RNR

VR

AWH

AHL

ENH

PTP

MRH

AGII |

Combined

Business Well Diversified Across Business Lines and Sectors Geographic and distribution

diversification benefits are also achieved 10

Endurance

Aspen

Combined

Property

2%

Agriculture

36%

Professional

Lines

6%

Casualty &

Other Specialty

12%

Property

9%

Casualty &

Other

Specialty

(2)

16%

Financial &

Professional

Lines

13%

Marine, Energy

& Transportation

20%

Catastrophe

13%

Property

11%

Casualty &

Specialty

(1)

20%

+

=

Property

Catastrophe

10%

Other

Property

11%

Casualty &

Specialty

21%

GPW: $2.7Bn

GPW: $2.6Bn

GPW: $5.3Bn

Insurance 55%

Reinsurance 45%

Insurance 57%

Reinsurance 43%

Catastrophe

12%

Insurance 56%

Reinsurance 44%

Agriculture

18%

Property

5%

Casualty &

Other

Specialty

(2)

14%

Professional

Lines

9%

Marine, Energy

& Transportation

10%

Property

11%

Casualty &

Specialty

(1)

21%

Notes

1.

Includes Professional Lines reinsurance segment for Endurance

2.

Includes Programs insurance segment for Aspen

Full Year 2013 Gross Written Premiums |

Analysts See

Logic in Combination and Support Engagement 11

Equity Research #4

-

April 30, 2014

“[W]ith P&C pricing decelerating, and an outright soft market in

reinsurance, we see cost-driven consolidation among the Bermuda

group as strategically logical and shareholder friendly …

[A] combined

entity would be a solid mid-cap name with a capital base towards the

larger end of its peer group …

The companies also have complementary

strengths, as Endurance is underweight in London and does not have a

Lloyd's syndicate –

one of the strongest aspects of Aspen's business.

Further, ENH's crop insurance business, while currently over-weight

relative to its size, would provide a more balanced contribution

to the

combined underwriting portfolio, and deliver a revenue stream that is

not correlated to the P&C pricing cycle”

Equity Research #5

-

April 17, 2014

“Given softening market conditions (especially in reinsurance), the

entry of 3rd party capital (pension/hedge fund), excess capital

(everywhere), shrinking loss reserve redundancies, low interest rates,

the competitive advantages of “size,”

…

we’ve discussed the increasing

attractiveness of combinations in Bermuda …

From Endurance’s

perspective the move “in line”

with management’s stated strategy of

developing market “relevance”

(with both clients and brokers) through

increased sophistication, diversification and scale”

Equity Research #3

-

April 24, 2014

“Thoughts on ROE Outlook: AHL’s ROE in this quarter was 14.9%,

however if we normalize for cat losses and reserve releases in excess of

our forecast we get ROE closer to 9%. We continue to have difficulty

finding the levers in our model to get to an ROE close to management’s

targets for 2014.”

Equity Research #2

-

April 14, 2014

“Aspen has a strong Lloyd's franchise, while Endurance is known for its

substantial agriculture insurance operation. While there would be some

overlap, the deal would likely result in a company double the size of

each individual company with an increased presence across the globe

across more products …

Reinsurance rates continue to soften with

capital pouring in from hedge funds and alternative vehicles. In

such an

environment, growth by acquisition rather than undercutting the

competition makes sense”

Equity Research #1

-

April 15, 2014

“We suspect that current AHL shareholders will ask the AHL board to

reconsider this transaction and/or look for competitive offers. Looking

over the landscape we do not see too many competitors that would

be

willing to pay a similar premium to book value for AHL”

Note: Permission to use quoted material neither sought nor obtained

|

Endurance’s Actions to Expedite

the Transaction |

Actions to

Expedite the Transaction 13

In addition to significantly increasing its highly attractive premium proposal, Endurance is

taking the following actions: Action

1:

Special

General

Meeting

of

Aspen

Shareholders

–

Calling

special

general

meeting

requires

support

of

at

least

10%

of

Aspen’s

outstanding

common

shares

–

If the special general meeting is held, and the proposal is approved, a majority of

Aspen’s directors would stand for election at Aspen’s 2015 annual general

meeting, and Aspen’s shareholders would have the ability to hold the board

directly accountable for failing to comply with the will of the true owners of the company

Action

2:

Supporting

Proposal

of

Scheme

of

Arrangement

by

Endurance

–

Aspen’s poison pill is not anticipated to be an impediment to completing a Scheme of

Arrangement Action

3:

Exchange

Offer

Preliminary solicitation statement being filed with SEC seeking the support of Aspen’s

common shareholders to convene

a

special

general

meeting

of

Aspen

shareholders

at

which

they

would

consider

a

proposal

to

increase

the

size of Aspen’s board from 12 to 19 directors

Preliminary solicitation statement also seeks the support of Aspen’s shareholders for the

proposal of a Scheme of Arrangement by Endurance which will entail the holding of a

court-ordered meeting at which Aspen’s shareholders would

vote

on

a

Scheme

of

Arrangement

on

financial

terms

no

less

favorable

than

those

contained

in

Endurance’s

increased proposal

The

Scheme

of

Arrangement

can

be

accomplished

–

without

the

approval

of

the

Aspen

board

–

if

approved

by

Aspen

shareholders at two shareholder meetings and sanctioned by the Supreme Court of Bermuda

Commencing

an

exchange

offer

in

the

near

future

made

directly

to

Aspen’s

shareholders

for

all

Aspen

common

shares

on the same economic terms as Endurance’s increased proposal

|

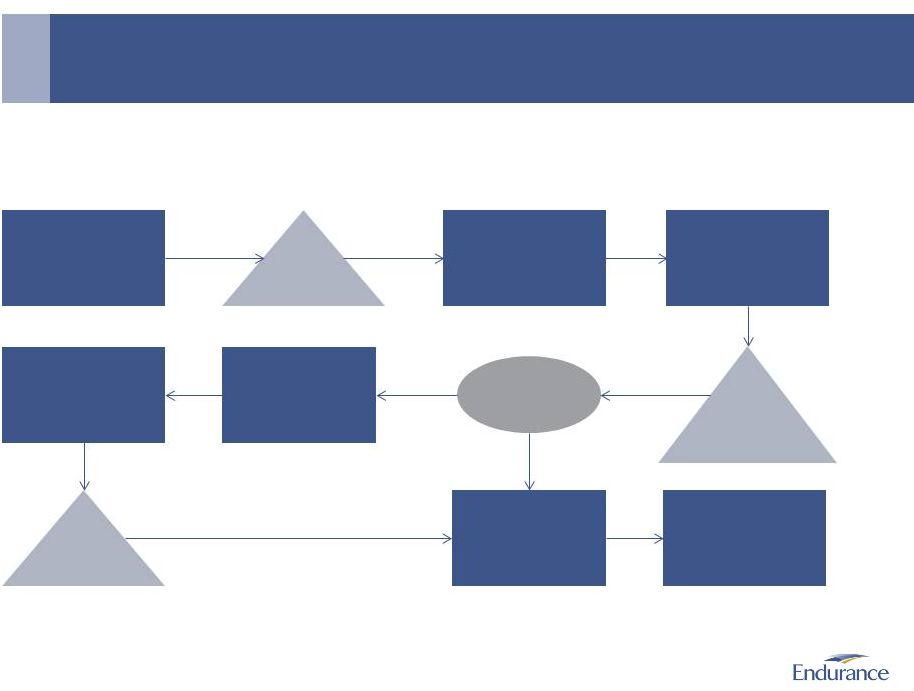

Actions to

Expedite the Transaction (continued) 14

•

A Scheme of Arrangement is a court approved arrangement between a company and its shareholders

that would allow Endurance to simultaneously acquire all of the outstanding Aspen

common shares

No

Yes

Support

from at least

15% of Aspen’s

outstanding common

shares

Solicitation seeking support of

Aspen’s shareholders for a

proposal for a Scheme of

Arrangement

Application to the Supreme

Court of Bermuda for court-

ordered meeting

If granted, hold court-ordered

special general meeting to

consider Scheme of

Arrangement

Hold Aspen special general

meeting to allow Aspen

shareholders to approve

Scheme of Arrangement on

behalf of Aspen

Requisition Aspen special

general meeting to approve

Scheme of Arrangement

Aspen’s board approves

Scheme of Arrangement?

Support

from majority

of Aspen’s holders

present at the meeting

representing at least 75%

in value of votes cast

Support

from majority of

votes cast at Aspen

special general meeting

Apply to Supreme Court of

Bermuda to sanction the

Scheme of Arrangement

Deliver a copy of the order of

the Supreme Court of

Bermuda sanctioning the

Scheme of Arrangement to

the Bermuda Registrar of

Companies |

Simplified and

Improved Financing Plan 15

Notes

1.

Reflects permanent financing plan and assumes repayment of Endurance’s $200MM senior debt

maturing in October 2015 2.

Based on 66.3MM fully-diluted Aspen shares as of 4/25/2014 and an exchange ratio of 0.9197

based on Endurance’s unaffected closing share price of $53.82 as of 4/11/2014

3.

For illustrative purposes only; assumes no exercise of CVC’s option to purchase $250MM of

Endurance ordinary shares post-closing •

$1.0Bn committed bridge loan facility from Morgan Stanley to fund, together with cash on hand

at Endurance, the cash portion of the consideration payable to Aspen’s

shareholders –

Endurance’s increased proposal is not subject to a financing condition

•

Permanent financing expected to include common equity and investment grade debt on customary

terms –

Pro

forma

leverage

of

19%

at

3/31/2014,

expected

to

be

approximately

15%

by

end

of

2015

(1)

•

Endurance believes that, pro forma for the transaction, its financial position will be well

within the ratings criteria to maintain its current ratings

Permanent

Financing

Plan

($Bn)

(3)

Common Equity

$0.5

Debt

$0.3

Aspen available cash (est.)

$0.2

Total

$1.0

Total Consideration ($Bn)

Stock

$1.9

Cash

$1.3

Total consideration

$3.2

Initial

“Committed

/

Available”

Cash

Bridge

$1.0

Cash on Hand

$0.4

Total Sources of Cash

$1.4

(2) |

Increased

Proposal is a Compelling Value Proposition for Aspen

Shareholders |

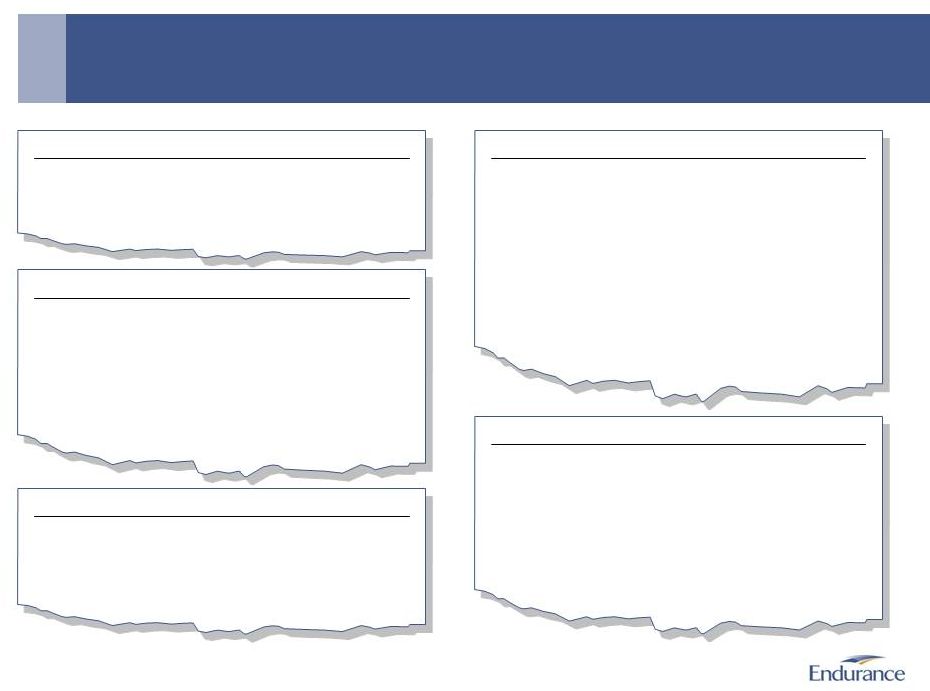

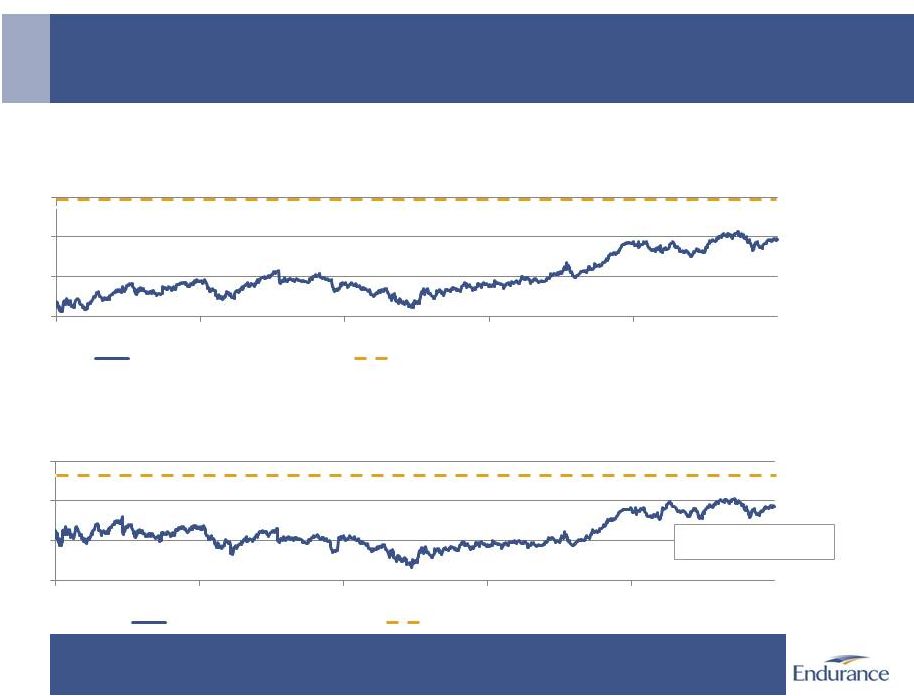

Proposed

Valuation Well Above Aspen’s Historical Trading Prices 17

1.16x

0.96x

$49.50

$39.37

Aspen Share Price –

Last 5 Years

4/11/2009 –

4/11/2014

Aspen P/BV –

Last 5 Years

4/11/2009 –

4/11/2014

5-Yr Average: 0.79x

Performance

illustrated

through

April

11,

2014

–

the

trading

day

prior to initial transaction announcement

$20

$30

$40

$50

Apr-09

Apr-10

Apr-11

Apr-12

Apr-13

Historical Share Price

Endurance Purchase Price

0.50x

0.75x

1.00x

1.25x

Apr-09

Apr-10

Apr-11

Apr-12

Apr-13

Historical P/BV

Endurance Purchase Price |

Proposal

Provides Compelling Value for Aspen Shareholders 18

Notes

1.

For the 30 calendar days ending 4/11/2014

2.

All time high and 5-year average P/BV prior to announcement of Endurance’s initial

proposal on 4/11/2014 3.

Based on consensus Street estimates for 2014 and 2015 EPS as of 5/30/2014

Substantial Premium to Trading Prices

Attractive Valuation Multiples

Proposal Price Per Share

$49.50

vs. Price

as of 4/11/2014

$39.37

+25.7%

vs. 1-month VWAP

(1)

$39.27

+26.1%

vs. All Time High

(2)

$41.43

+19.5%

Proposal Price Per Share

$49.50

vs.

Diluted

BVPS

at

12/31/13

$40.90

1.21x

vs.

Diluted

BVPS

at

3/31/14

$42.72

1.16x

vs. 5-year Average P/BV

(2)

0.79x

+46.7%

vs. 2014E Earnings

(3)

$4.20

11.8x

vs. 2015E Earnings

(3)

$4.15

11.9x |

•

Over $100 million of annual synergies

anticipated, including:

–

Cost savings

–

Underwriting improvements

–

Capital efficiencies

–

Enhanced capital management opportunities

Financially Compelling Transaction

Transaction economics are highly attractive for ongoing Endurance shareholders

19

Notes

1.

As of 3/31/2014, pro forma for transaction and reflects entering

into bridge loan facility commitment and takeout through permanent financing plan, assuming no

exercise of CVC’s option to purchase $250MM of Endurance ordinary shares

post-closing 2.

Excluding non-controlling interests

3.

Excluding integration charges

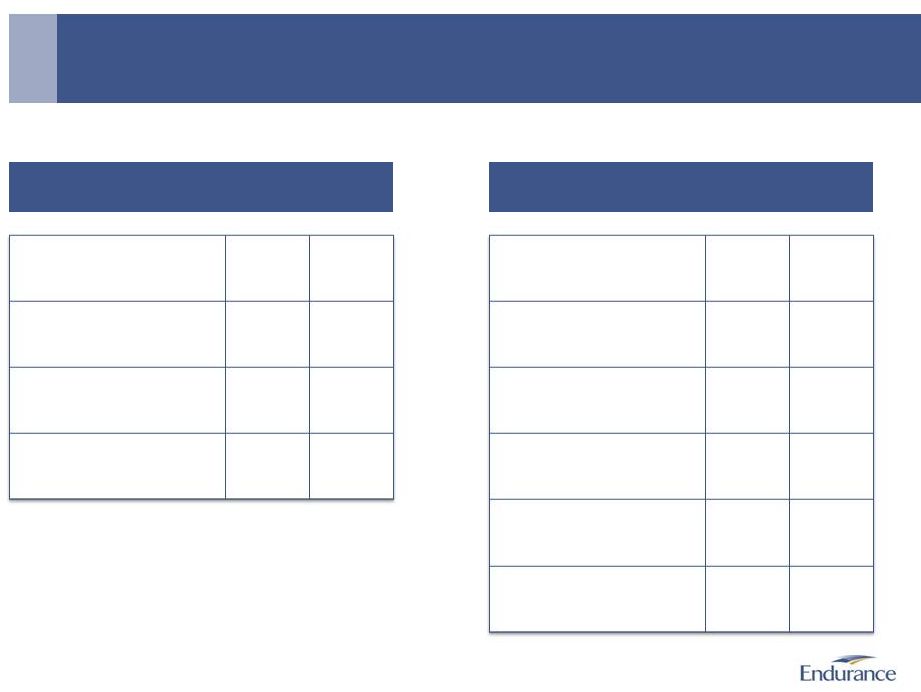

Key Financial Drivers

Combined Balance Sheet Strength

(1)

Summary of Financial Impact to Endurance

EPS

(3)

•

>15% accretion anticipated in 2015

ROE

(3)

•

12 –

14% pro forma ROE anticipated in 2015; >200bps

increase vs. standalone Endurance ROE

Book Value Per Share

•

Modest initial dilution to book value per share anticipated

Endurance

Pro Forma at

3/31/2014

Shareholders’

Equity

(2)

$3.0Bn

$5.9Bn

Cash and Invested Assets

$6.7Bn

$14.4Bn

Total Capital

$3.5Bn

$7.3Bn |

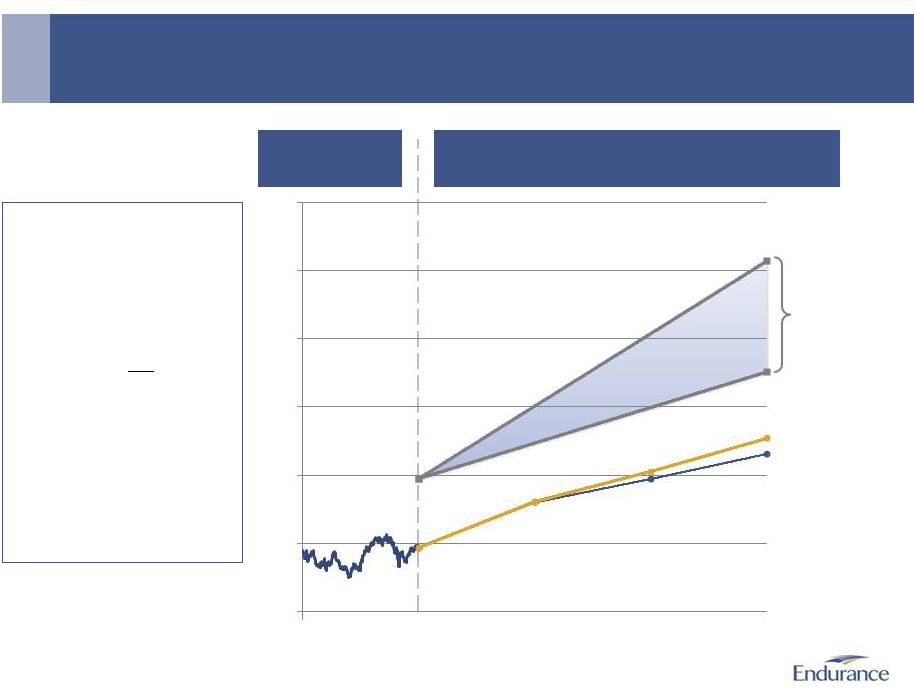

Illustrative

Future Value of Aspen Shares (1)(2)

•

The transaction provides

Aspen shareholders the

ability to achieve values

meaningfully higher than

Aspen’s future value

implied by consensus

Street estimates for

Aspen’s ROE and

recent

Aspen management ROE

guidance

•

It will take Aspen over 2

years to surpass the $49.50

proposed acquisition price

based on consensus Street

estimates for Aspen’s ROE

Transaction Provides Substantial Premium and Significant

Upside Potential

20

Notes

1.

Assumes Aspen shareholders receive 0.9197 shares of Endurance for each share of Aspen

2.

Assumes Aspen and pro forma dividend yield maintained at current

level as of 4/11/2014 in all scenarios; dividend yield based on

trailing 12-months dividends per share divided by current share price

3.

Assumes P/BV of 1.0x-1.2x for 12-14% ROE

4.

Assumes P/BV of 1.0x; Aspen’s management guidance of 10% ROE in 2014 and 11% ROE for 2015

and 2016 per first quarter 2014 investor presentation dated 5/20/2014 5.

Assumes P/BV of 1.0x; consensus Street estimates for Aspen’s ROE based on median 2014 ROE

estimate of 9.8% for +1 year and median 2015 ROE estimate of 9.1% for +2 years and +3 years; estimates as of 5/30/2014

Historical Aspen

Share Price

Pro forma at

12-14% ROE

(3)

Pre-Announcement

+1 Year

+2 Years

+3 Years

-1 Year

Aspen standalone at

consensus Street

estimates

Aspen standalone at

management

guidance

$39.37

$46

$49

$53

$65

$49.50

$81

$46

$51

$55

$30

$40

$50

$60

$70

$80

$90

(4)

(5) |

Conclusion

21

Aspen's shareholders should vote in FAVOR of the two

shareholder authorizations Endurance is seeking

•

Increased proposal provides enhanced upfront premium and opportunity for long-term value

for Aspen’s shareholders

–

Also creates improved EPS and ROE accretion for Endurance shareholders

•

Formal mechanisms in place for Aspen shareholders to voice support for the transaction

•

Committed bridge loan facility provides increased flexibility and greater certainty of

financing •

The combination of Endurance and Aspen is a unique opportunity to create a global leader in

the specialty insurance and reinsurance sector

–

Increased scale, diversification, market presence and relevance

–

Enhanced profitability driven by industry-leading talent, world-class underwriting

expertise, and meaningful synergies anticipated from the transaction

•

The transaction will create a company with a superior financial profile

|

Appendix

|

Continued

Support from Equity Investor 23

•

Endurance and CVC have terminated the previously announced equity commitment letter,

which had been developed under the context of a friendly, negotiated transaction

•

Since Aspen's board and management have refused to engage with Endurance, Endurance is

compelled to take the additional actions being announced today

•

Given

CVC's

continued

support

for

the

merits

of

a

combination

of

Endurance

and

Aspen,

Endurance has granted CVC:

–

Option to invest $250 million

(1)

in the combined company, exercisable for 60 days

following the closing of Endurance’s acquisition of Aspen

–

Right of first refusal to provide any privately raised equity capital in connection with

Endurance’s permanent financing plans for the transaction subject to certain

exceptions •

Endurance does not intend to privately raise equity capital in connection with such

permanent financing, but reserves the right to do so

Notes

1.

CVC may invest $250MM at a price of $50.03 per Endurance ordinary share (6.5% discount to the

20 trading day volume-weighted average NYSE stock price of Endurance on 4/11/2014 of $53.51). If

the option is exercised, CVC will receive warrants to purchase Endurance ordinary shares equal

to 38.5% of the number of Endurance ordinary shares purchased at an exercise price of $58.86 |

Summary of

Bridge Term Loan Facility Material Terms 24

Facility

•

$1.0Bn 364-Day Senior Unsecured Bridge Term Loan Facility

Commitment

Termination Date

•

December 31, 2014, or if an acquisition agreement is entered into on or prior to December 31,

2014, the earliest to occur of (i)

the

termination

date

specified

in

the

acquisition

agreement,

(ii)

6

months

from

the

execution

of

the

acquisition

agreement

plus

up

to

an

additional

3

months

to

obtain

regulatory

approvals

to

the

extent

deemed

advisable

by

Endurance

to

effect

the

acquisition (and to the extent the termination date under the acquisition agreement is

similarly extended) and (iii) 15 months from the date of the commitment letter for the

Bridge Term Loan Facility Maturity

•

364 days following any funding of the Bridge Term Loan Facility

Pricing

•

Customary structuring, upfront and funding fees

•

Draws

on

the

facility

will

be

priced

on

a

ratings

based

grid.

At

Endurance’s

current

ratings:

–

Days 1-89: L+ 150 bps

–

Days 90-179: L + 175 bps

–

Days 180-269: L + 200 bps

–

Days 270-364: L + 250 bps

•

Ticking / commitment fees: After 60 days, 20.0 bps per annum, increasing to 30.0 bps per

annum on December 31, 2014 and ending on the closing date on the undrawn commitments

outstanding under the Bridge Term Loan Facility •

Duration fees (on bridge loans outstanding):

–

50 bps payable 90 days after funding

–

75 bps payable 180 days after funding

–

100 bps payable 270 days after funding

Prepayments

•

Prepayable at any time at par

•

Mandatory prepayments/commitment reductions: net cash proceeds from debt, equity and

convertible issuances and non- ordinary course asset sales (subject to certain

exceptions) Financial Covenants

•

Minimum Consolidated Tangible Net Worth of $1.8Bn

•

Maximum Debt / Capitalization of 35%, increasing to 40% to the extent a corresponding change

is made to Endurance’s existing credit agreement

Conditions

•

Customary,

including

(i)

minimum

credit

ratings

of

Baa3

(with

stable

outlook)

from

Moody’s

and

BBB-

(with

stable

outlook)

from

S&P,

(ii)

minimum

financial

strength

ratings

of

A-

(with

stable

outlook)

from

S&P

and

A-

(with

stable

outlook)

from

A.M.

Best, and (iii) except in the case of a negotiated transaction, consolidated tangible net

worth, pro forma for the acquisition, of not less than $3.9 billion

|