Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTLAKE CHEMICAL CORP | d733884d8k.htm |

| EX-99.1 - EX-99.1 - WESTLAKE CHEMICAL CORP | d733884dex991.htm |

Exhibit 99.2

Westlake Chemical Corporation

Acquisition of Vinnolit Holdings GmbH

Transaction Overview

| • | Westlake is acquiring Vinnolit Holdings GmbH (“Vinnolit”), a leading European chlor-vinyls producer and a global leader in specialty PVC. |

| – | Vinnolit generated 2013 sales of €917 million. |

| • | Acquisition price of €490 million. |

| • | Transaction multiple of approximately 6x 2013 Vinnolit EBITDA and is expected to be immediately accretive to EPS. |

| • | Subject to regulatory reviews and customary closing conditions, the transaction is expected to close in 3rd Qtr, 2014. |

| • | The acquisition provides superior: |

| • | Technology |

| • | Products |

| • | Operational excellence |

2

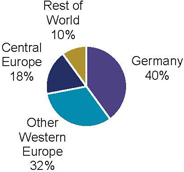

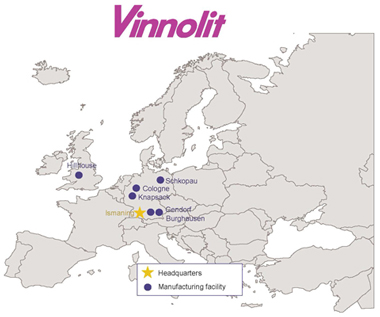

Vinnolit Company Overview

3

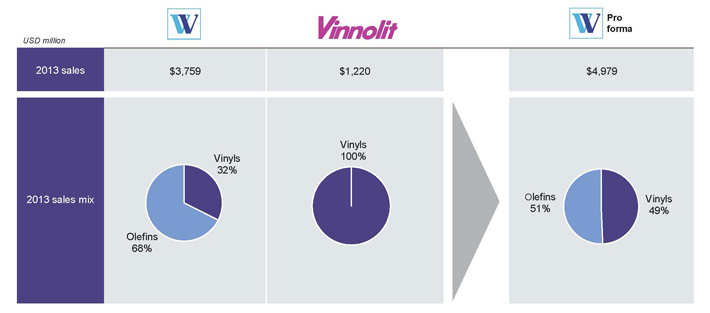

Westlake Combination with Vinnolit

| Combined revenue of nearly $5 billion |

Note: Pro forma financials exclude synergies. Vinnolit financials based on 2013 average USD/EUR exchange rate of 1.33.

4

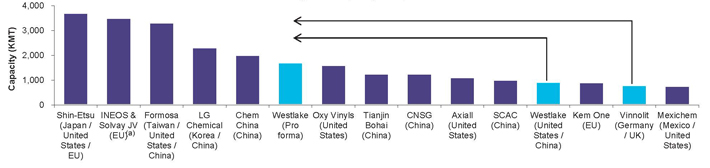

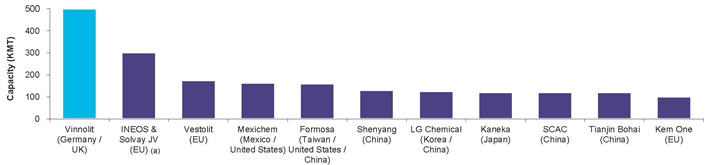

PVC Global Landscape

| Select PVC producers worldwide |

| PVC global capacity: ~46,000 KMT |

| Vinnolit is a leading specialty PVC producer |

| Specialty PVC global capacity: ~3,000 KMT |

| (a) | Represents combined company, pre-asset sale Source: IHS Chemical |

5

Acquisition Advances Westlake Mission

| Profitable growth… |

• Specialty PVC provides better margins and reduces volatility.

• European PVC market well-positioned to benefit from economic recovery.

| |

| …in businesses we understand |

• Enhances Westlake’s product suite.

• Leverage best practices across regions.

| |

| …globally in areas we can gain an edge |

• Diversifies geographic and end market mix.

• Improves distribution capabilities, especially to emerging markets.

• Optimizes product mix and cost positions across business.

| |

| …in a disciplined and opportunistic manner |

• Transaction expected to be immediately accretive to EPS.

• No expected change to credit profile.

|

6

Safe Harbor Language

This presentation contains certain forward-looking statements. Actual results may differ materially depending on factors such as general economic and business conditions; the cyclical nature of the chemical industry; the availability, cost and volatility of raw materials and energy, uncertainties associated with the United States and worldwide economies, including those due to political tensions in the Middle East and elsewhere; current and potential governmental regulatory actions in the United States and regulatory actions and political unrest in other countries; industry production capacity and operating rates; the supply/demand balance for our products; competitive products and pricing pressures; instability in the credit and financial markets; access to capital markets; terrorist acts; operating interruptions (including leaks, explosions, fires, weather-related incidents, mechanical failure, unscheduled downtime, labor difficulties, transportation interruptions, spills and releases and other environmental risks); changes in laws or regulations; technological developments; our ability to implement our business strategies; creditworthiness of our customers; and other factors described in our reports filed with the Securities and Exchange Commission. Many of these factors are beyond our ability to control or predict. Any of the factors, or a combination of these factors, could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. These forward-looking statements are not guarantees of our future performance, and our actual results and future developments may differ materially from those projected in the forward-looking statements. Management cautions against putting undue reliance on forward-looking statements. Every forward-looking statement speaks only as of the date of the particular statement, and we undertake no obligation to publicly update or revise any forward-looking statements.

Investor Relations Contact

Steve Bender

Sr. Vice President & Chief Financial Officer

Westlake Chemical Corporation

2801 Post Oak Boulevard, Suite 600

Houston, Texas 77056

713-960-9111

7