Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST FINANCIAL SERVICE CORP | v379409_8k.htm |

Shareholder Meeting May 21, 2014 1

This presentation contains forward - looking statements, including statements about beliefs and expectations based on the information available to, and assumptions and estimates made by, management as of the date made. These forward - looking statements cover, among other things, anticipated future revenue, expenses, capital ratios, and the future plans and prospects of First Financial Service Corporation. For a discussion of the risks and uncertainties that may cause actual results to differ from these expectations and our other forward - looking statements, refer to First Financial Service Corporation’s 2013 Annual Report on Form 10 - K, including the “Risk Factors” section, and other periodic reports filed with the Securities and Exchange Commission. Forward - looking statements speak only as of the date they are made, and First Financial Service Corporation undertakes no obligation to update them in light of new information or future events. 2

Primary Objectives and Progress through 2013 Business Combination Question and Answer 3

Our associates are key to everything we do. ◦ Take care of our associates. Best place to work Nine Years in a Row. ◦ Take care of our customers. ◦ Take care of our community. ◦ Take care of our shareholders. 4 Our Heart Is In Everything we Do ! For Associates with the Passion to Serve. Helping Every Customer Succeed!

Asset quality remediation. ◦ Lower the overall risk profile of the Company. Financial Improvement. Place the Company in the best position to attract outside capital. 5

The Company’s problem assets had to be resolved before it could address the need for more capital. Problem asset charges resulted in significant losses to earnings and created the need for additional common equity. As long as the problem assets remained elevated, uncertainty existed as to the extent of future losses. Resolving problem assets: ◦ Lowers the overall risk profile of the Company. ◦ Minimizes the additional expected equity losses from problem assets . ◦ Reduces the drag on earnings from problem asset cost. 6

7 In Thousands $5,000 $20,000 $35,000 $50,000 $65,000 $80,000 • $55 million reduction • 86 % improvement from the peak. • Four Properties make up 65% of total.

8 In Thousands $15,000 $35,000 $55,000 $75,000 $95,000 • $66 million reduction. • 74 % improvement from the peak. • One property is 50% of total OREO.

9 In Thousands $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 • $72 million reduction • 68 % improvement from the peak

NPA’s projected decline to $12 million. Improvement beyond quarter end. Sales contracts executed on other real estate owned properties and various work out arrangements are in place. $10 million book value to close during the second and third quarter 2014. Projected 44% decline. 10 $- $20,000 $40,000 $60,000 $80,000 $100,000 March 2011 June 2011 September 2011 December 2011 March 2012 June 2012 September 2012 December 2012 March 2013 June 2013 September 2013 December 2013 March 2014 Q2 and Q3 Non - performing assets (In Thousands)

Asset quality remediation. Financial Improvement. ◦ Increase the visibility and certainty of viability going forward. Place the Company in the best position to attract outside capital. 11

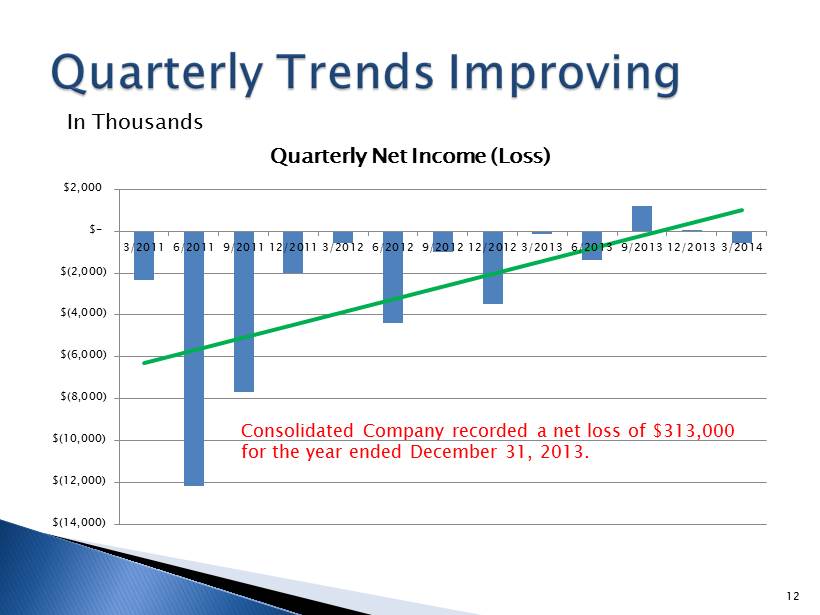

12 In Thousands $(14,000) $(12,000) $(10,000) $(8,000) $(6,000) $(4,000) $(2,000) $- $2,000 3/2011 6/2011 9/2011 12/2011 3/2012 6/2012 9/2012 12/2012 3/2013 6/2013 9/2013 12/2013 3/2014 Quarterly Net Income (Loss) Consolidated Company recorded a net loss of $313,000 for the year ended December 31, 2013.

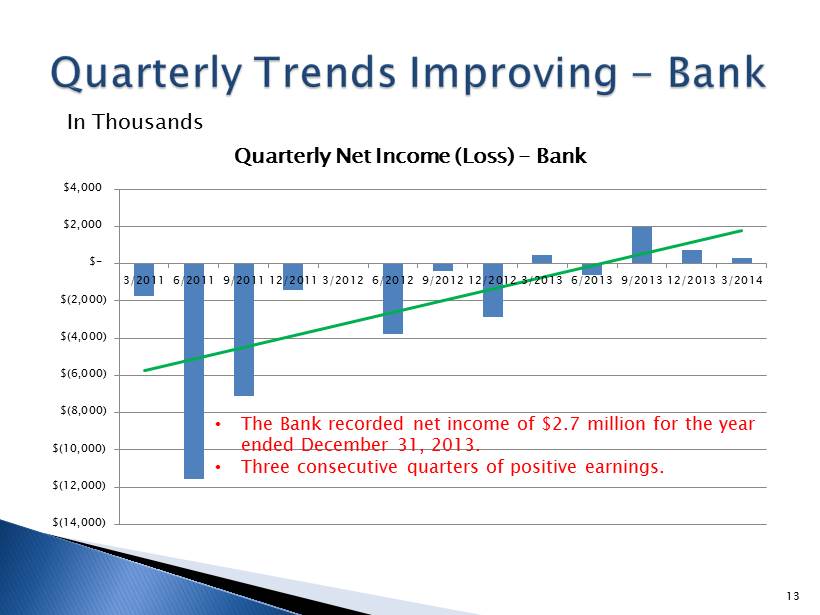

13 In Thousands $(14,000) $(12,000) $(10,000) $(8,000) $(6,000) $(4,000) $(2,000) $- $2,000 $4,000 3/2011 6/2011 9/2011 12/2011 3/2012 6/2012 9/2012 12/2012 3/2013 6/2013 9/2013 12/2013 3/2014 Quarterly Net Income (Loss) - Bank • The Bank recorded net income of $2.7 million for the year ended December 31, 2013. • Three consecutive quarters of positive earnings.

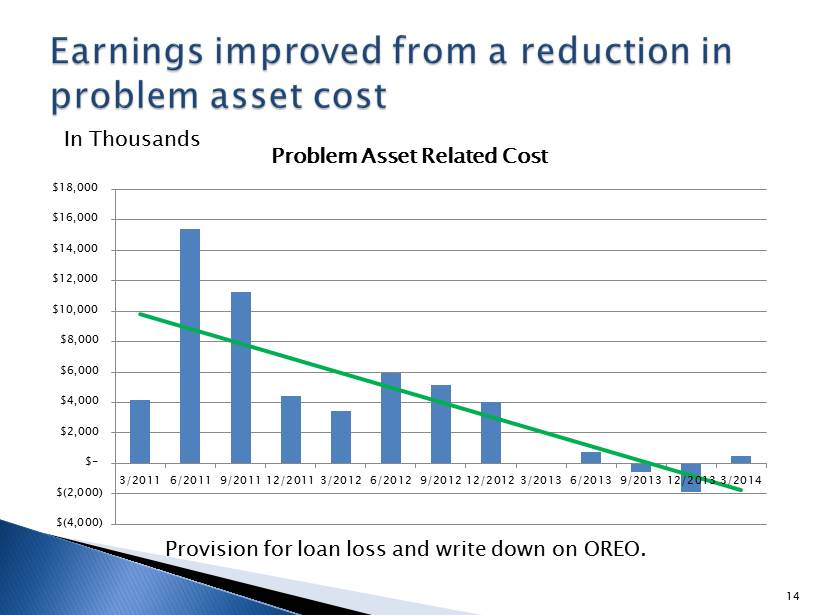

14 In Thousands Provision for loan loss and write down on OREO. $(4,000) $(2,000) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 3/2011 6/2011 9/2011 12/2011 3/2012 6/2012 9/2012 12/2012 3/2013 6/2013 9/2013 12/2013 3/2014 Problem Asset Related Cost

2.00 2.20 2.40 2.60 2.80 3.00 3.20 3.40 Net Interest Margin (%) 15

0.40 0.60 0.80 1.00 1.20 1.40 1.60 Interest Bearing Deposits (%) 16

Production improving. Experienced Lending and Credit Team. Focus on growth markets of Louisville, Hardin, and Bullitt Counties. E xperienced “in - market” commercial lenders. Focus on loan diversification. 17 $- $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 New Loans Produced (In Thousands)

Core earnings will improve with net loan growth and substantial cost cutting austerity measures. ◦ Earning asset levels too low to support the current infrastructure. Problem loan roll off decreased the size of the loan portfolio. High liquidity levels pressure top line interest income. Future growth in earnings will be slow and challenging. While challenges persist, the improvement in earnings to date has been significant. 18

Asset quality remediation. Financial Improvement. Place the Company in the best position to attract outside capital. 19

Enhance the Bank’s capital ratios to meet the consent order capital ratio requirements. Holding Company Equity Resolution. ◦ Need for more common equity. ◦ Pay back $20 million of TARP funds plus dividends in arrears. Dividend rate increased from 5% to 9% in January 2014. ◦ Pay deferred interest on $18 million of Trust Preferred Securities. Fourth quarter 2015 deadline looming. 20

To Place the Company in the position to attract outside capital 21

Reduce the size of the Company to lessen the amount of equity needed to support total assets and improve the Bank’s capital ratios. ◦ Enhanced the Bank’s capital position through asset reduction. Sold our four Southern Indiana branches July 2012. Asset reductions of approximately $150 million in 2013. ◦ The Bank produced positive earnings of $2.7 million for 2013. 22

7.08% 6.31% 5.95% 5.86% 5.90% 5.72% 6.50% 6.68% 6.84% 7.27% 7.80% 7.96% 8.15% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 7.00% 7.50% 8.00% 8.50% Tier I Leverage Ratio 23

11.43% 10.48% 9.94% 10.18% 10.70% 10.66% 11.88% 12.21% 12.33% 12.36% 13.14% 13.48% 14.13% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% Total Risk Based Capital Ratio In Compliance with Order 24

Worked with Private investors to purchase our TARP Securities from the U.S. Treasury on 4/19/2013. Structured exit agreement with primary investor. Redeem $20 million of preferred stock for $12 million during the second year or a change of control. Allows for the capture of the $8 million gain on redemption. Very attractive to outside capital. 25

Recapture Deferred Tax Asset (DTA) ◦ Results in $23 million of net income at the Bank and Holding Company upon recapture. Minimum of six consecutive quarterly core earnings needed. Equity increases by $23 million. ◦ Very attractive to outside capital. Future increase in value of investment. 26

Financial trends. ◦ Improving risk profile. Reduced asset size lowered the capital need. Realize $8 million gain if preferred stock can be redeemed. Recapture DTA of $23 million upon sustained profitability. ◦ Restores $23 million of capital. 27

Capital solution time frame. Most immediate challenge is to repay deferred interest on our Trust Preferred Securities ( TruPS ) . ◦ Avoid default risk in fourth quarter of 2015. ◦ Deferral of $4.3 million at 3/31/2014. Increasing $327,250 per quarter of deferral. Avoid default on TRuPS . ◦ Holding Company triggers default on TRUPs. Possible sale of Bank to pay Holding Company debt. ◦ Eliminates the DTA. Eliminates ability to capture the $23 million in capital. 28

IRS limitations on $23 million DTA recapture ◦ Issuing new stock resulting in over a 50% change in ownership limits the full DTA recapture. Limits amount of capital that can be raised through a stock sale to new investors. ◦ May not raise sufficient funds for all capital needs. 29

Business as usual – not feasible. ◦ Earnings will be insufficient to get the TruPS current prior to the default date. Raise capital from institutional investors and current shareholders. Business Combination. 30

Substantial capital raise needed to address all needs. Significant dilution to current shareholders . Amount of capital limited by IRS rules. ◦ Capital raise may not be enough to resolve all capital challenges. Short - term investment horizon for institutional investors. ◦ Managing with a goal to sell in three to five years. Pressure to maximize profits. ◦ Require branch rationalization and closings. ◦ Immediate downsizing of personnel. ◦ Culture and community secondary to shareholder return. 31

Business combination was the superior strategic alternative. ◦ Superior returns for current FFKY shareholders. ◦ Retains the focus on customer service. ◦ Retains the focus on the community. 32

Material Terms of the Agreement Highlights Overview of Community Bank Shares of Indiana, Inc. and Your Community Bank Combined Company Profile Time Line 33

On April 22, 2014 we announced a business combination with Community Bank Shares of Indiana, Inc . (Nasdaq CBIN) CBIN will acquire all of the outstanding shares of First Financial Service Corporation through a share exchange. First Federal Savings Bank will merge into Your Community Bank with Your Community Bank as the surviving Bank. 34

FFKY Shareholders will receive .153 shares of CBIN’s common stock for each FFKY share, subject to adjustment in certain circumstances. TARP preferred stock paid off. Trust Preferred Securities assumed, will pay past dividends. One director of FFKY appointed to CBIN Holding Company Board and another FFKY director appointed to Your Community Bank board. Details of terms of the share exchange described in the Form 8K mailed to FFKY shareholders. Also available from the SEC website http://www.sec.gov . 35

Solid footprint North and South of Ohio River along the I - 65 and I - 64 corridor expanding East to Lexington, KY. Creates a dynamic community banking franchise covering the complete Louisville MSA. ◦ Seventh largest footprint in the Louisville Metro market. ◦ Third largest locally owned bank in Louisville Metro with $862 million in total deposits. Immediate increase in FFKY tangible book value per share. Immediate earnings per share to FFKY shareholders. 36

The combined company will have $1.6 billion combined company with significant earnings power. ◦ Projected Return on Assets in excess of 1.0% after first full year of combined operations. ◦ Banks with $1.0 billion plus in total assets generally trade at a higher multiple of earnings CBIN pays a dividend of $0.48 per year (equivalent to $0.07 per FFKY share). Provides FFKY shareholders greater liquidity through a larger market capitalization. 37

Your Community Bank 38

Founded 1934 Began trading on the NASDAQ in 1995 under the symbol CBIN 24 Locations throughout Indiana and Kentucky with a significant presence in the Louisville MSA $850 million in assets, CBIN is Southeast Indiana’s largest locally - owned bank holding company 2013 Return on Assets of 1.07% 2013 Return on TCE of 14.17% 39 CBIN Branch Network

“Achieving financial goals with exceptional people and exceptional service” Focus on: ◦ Building relationships in its communities. ◦ Develop and strengthen profitable customers. Strong corporate culture drives financial success. ◦ Build culture by investing in people. 40

Up to date with technology. Strong commitment to associates. Heavy community involvement. Customer philosophy to build lasting relationships. 41

Best Places to Work in Indiana 2012 – 2014. Best Place to Work in Kentucky 2014. Among top - performing banks under $2B by the American Banker magazine. Several awards in recognition of a strong corporate culture. ◦ Indiana Bankers Association ◦ Indiana Chamber of Commerce ◦ Business First Magazine 42

43 $1.77 $1.79 $2.06 $2.32 $- $0.50 $1.00 $1.50 $2.00 $2.50 2010 2011 2012 2013 Earnings Per Share ($) 9.4% CAGR

44 1.2 0.87 0.62 0.67 0.88 0.65 0.36 0.18 - 0.20 0.40 0.60 0.80 1.00 1.20 1.40 2010 2011 2012 2013 Peer CBIN Cost of Deposits (%)

45 3.67 3.66 3.51 3.36 3.90 4.07 4.07 4.24 2.50 2.70 2.90 3.10 3.30 3.50 3.70 3.90 4.10 4.30 4.50 2010 2011 2012 2013 Peer CBIN Net Interest Margin (%)

46 0.45 0.43 0.81 0.69 0.85 0.94 0.95 1.04 - 0.20 0.40 0.60 0.80 1.00 1.20 2010 2011 2012 2013 Peer CBIN Return on Average Assets (%)

47 4.36 4.93 9.39 7.19 13.55 12.32 12.53 13.61 - 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 2010 2011 2012 2013 Peer CBIN Return on Average Common Equity (%)

48

$1.6 Billion in assets. $1.4 Billion in deposits. Contiguous franchises provides scale and expansion . 49

50

Combined footprint of 41 branches. Solid footprint North and South of Ohio River along the I - 65 and I - 64 corridor expanding East to Lexington , KY. Creates a dynamic community banking franchise covering the complete Louisville MSA. ◦ Seventh largest footprint in the Louisville Metro market. ◦ Third largest locally owned bank in Louisville Metro with $862 million in total deposits Strong focus on serving Communities in all markets. 51

52

Subject to regulatory and shareholder approval. ◦ CBIN will File for Regulatory Approval – Anticipated filing date May 2014. ◦ Regulatory approval anticipated between August and November. ◦ Proposed share exchange will be submitted for shareholder vote at a special meeting sometime in the August to November time frame. ◦ FFKY and First Federal Savings Bank will operate as independent entities until closing, which will occur promptly after regulatory and shareholder approval. 53

A great deal of effort and hard work from everyone in the organization has opened the door to a tremendous opportunity. This business combination with our neighbor, Your Community Bank, will be a new and exciting beginning of a new era for shareholders, associates, customers, and the community. 54

55