Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cytosorbents Corp | v379088_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - Cytosorbents Corp | v379088_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - Cytosorbents Corp | v379088_ex99-1.htm |

Cyto Sorbents Corporation OTCBB: CTSO An Emerging Leader in Critical Care Immunotherapy Q1 2014 Review – May 14, 2014

Safe Harbor Statement Statements in this presentation regarding CytoSorbents Corporation and its operating subsidiary CytoSorbents, Inc that are not historical facts are forward - looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ materially from such statements . Any such forward - looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . It is routine for our internal projections and expectations to change . Although these expectations may change, we are under no obligation to inform you if they do . Actual events or results may differ materially from those contained in the projections or forward - looking statements . The following factors, among others, could cause our actual results to differ materially from those described in a forward - looking statement : our history of losses ; potential fluctuations in our quarterly and annual results ; competition, inability to achieve regulatory approval for our device, technology systems beyond our control and technology - related defects that could affect the companies’ products or reputation ; risks related to adverse business conditions ; our dependence on key employees ; competition for qualified personnel ; the possible unavailability of financing as and if needed ; and risks related to protecting our intellectual property rights or potential infringement of the intellectual property rights of third parties . This list is intended to identify only certain of the principal factors that could cause actual results to differ from those discussed in the forward - looking statements . Readers are referred to a discussion of important risk factors detailed in the Company’s Form 10 - K filed with the Securities and Exchange Commission on March 31 , 2014 and other reports and documents filed from time to time by us, which are available online at www . sec . gov .

3 Conference Call Participants Dr . Phillip Chan, MD, PhD Chief Executive Officer and President Vincent Capponi , MS Chief Operating Officer Kathleen Bloch, MBA, CPA Chief Financial Officer Dr . Christian Steiner, MD Vice President of Sales and Marketing Christopher Cramer, MS, MBA Vice President of Business Development Moderator: Amy Vogel – CytoSorbents Corporation

4 Cyto Sorbents is an Emerging Leader in the $20B Critical Care Immunotherapy Space Leading the Prevention or Treatment of Life - Threatening Inflammation in the ICU

5 Cyto Sorb ® Removes the Fuel to the Fire • CytoSorb ® represents a powerful immunotherapy to control inflammation • Approved in the European Union as the only specifically approved extracorporeal cytokine filter • Clinically proven to reduce key cytokines in blood by 30 - 50% in critically ill patients • Approved for use in any situation where cytokines are elevated • Safe: More than 3,000 human treatments, with no serious device related adverse events reported

6 The Heart of the Technology The underlying blood purification technology is based on state - of - the - art biocompatible, highly porous polymer beads that act like tiny sponges to remove harmful substances from blood • Protected by 32 issued US patents and multiple applications pending • Manufactured at our ISO 13485 certified facility in New Jersey • One of the highest grade medical sorbents on the medical market today . Each bead is about the size of a grain of salt

7 Goal: To Prevent or Treat Organ Failure Sepsis ARDS Burn Injury Trauma Pancreatitis Influenza Surgical The Potential to Revolutionize Critical Care Medicine Improve Patient Outcome and Survival Decrease Costs Of ICU and Patient Care

8 Q1 2014 Operating and Financial Highlights

9 • Huge market CytoSorb ® is sold to hospitals and critical care physicians, targeting a “need to have” $ 20 billion worldwide critical care opportunity addressing organ failure • Little to no competition • Critical care physicians understand the problem • It is a plug and play high margin disposable “razorblade” Hospital’s existing hemodialysis infrastructure is the “razor”, no new hardware • Technicians already know how to use the device • CytoSorb ® is reimbursed in Germany/Austria at > $ 500 /cartridge . Depending on the application and devices used, revenue potential per patient ~ $ 1 - 5 K • Affordable yet profitable with gross margins of 60 % +, target > 80 % • Intensive care units are highly centralized easy for a small sales force to access Cyto Sorb ® An Excellent Business Model

10 Raised $10.2M in March 2014 • Fortified balance sheet with net proceeds of $9.5M cash from our financing • Enables aggressive growth strategy, focused on growing CytoSorb® sales, generating clinical data, and product development • Currently have estimated 1 - 2 years of cash to be supplemented with • CytoSorb sales • Grant income • Potential strategic partnerships • Led by Brean Capital

11 Middle East Expansion with Techno Orbits • Exclusive distribution agreement • Includes the Gulf Cooperation Council (GCC) countries of Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Oman, and Bahrain and related states of Yemen, Iraq, and Jordan • 105 million people in this territory • Many trends in our favor: • Growing population • Government sponsored universal healthcare • Strong purchasing power from government agencies due to rise in oil prices • Significant interest in innovative new medical technologies • Product registration is pending

12 E.U. Approval Opens Global Distribution Signed 18 countries including the UK, Ireland, Netherlands, Turkey, Russia, India and Middle East covering ~1.7 billion lives. Expanding to other parts of Europe and other countries outside the EU that accept the CE Mark WMC Intensiv Med LLC

13 Q1 2014 Revenue Results • Q1 2014 total revenue was ~$1.1M, compared to total Q1 2013 revenues of $371,000 • CytoSorb ® Q1 2014 product sales were ~$569,000, an increase of 223% over Q1 2013 product sales of ~$176,000 • Grant income for Q1 2014 was ~$491,000, compared to grant income of ~$195,000 for the first quarter of 2013, an increase of 152% • Q1 2014 product gross margins were in excess of 60% Q1 2014 Q1 2013 % Incr. Product revenue $ 569 ,243 $ 176,098 223% Grant and other income 492,929 195,232 152% Total revenue $ 1,062,172 $ 371,330 186%

14 Continuing Strong Product Growth $13,679 $87,960 $176,098 $127,969 $203,561 $314,159 $569,243 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 CytoSorb ® Product Sales 14 Q1 2014 Product Sales increased 81% from the prior quarter.

15 Product Sales (TTM) $151,574 $310,779 $405,706 $595,588 $821,787 $1,214,932 $- $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Trailing Twelve Month Product Sales Trend Line

16 Working Capital Capital Available to Fund Growth • Receipt of net proceeds of $9,451,000 from our March 11, 2014 preregistered offering has strengthened our balance sheet. • Receipt of approximately $458,000 from sale of our operating losses under the New Jersey Technology Business Tax Certificate Transfer Program • Increasing Product Sales with high gross product margins will help offset operating expenses. Gross margin for Q1 2014 was approximately $400,000 $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Cash and Short - Term Investments Cash and Short-Term Investments on Hand In thousands of U.S. Dollars

17 Rationale for Using CytoSorb ® for Existing and Emerging Viral Threats

18 The Influenza Emergency Seasonal influenza afflicts 60+ million Americans each year, hospitalizing 200,000 and killing 36,000 despite broad availability of vaccines and anti - virals * • Swine flu (2009 H1N1) pandemic lessons • We cannot rely on vaccination alone. 30 - 70M Americans contracted H1N1 before the vaccine became widely available in December 2009 (per CDC statistics) • Lengthy production for new outbreaks • Low yields, potency, and quality problems • Initial short supply and limited availability • Not everyone chose to get vaccinated • We cannot rely on anti - virals alone • Many miss the 24 - 48 hour window after onset of symptoms • Known resistance of highly pathogenic strains such as the deadly avian flu * Centers of Disease Control 2009 estimates

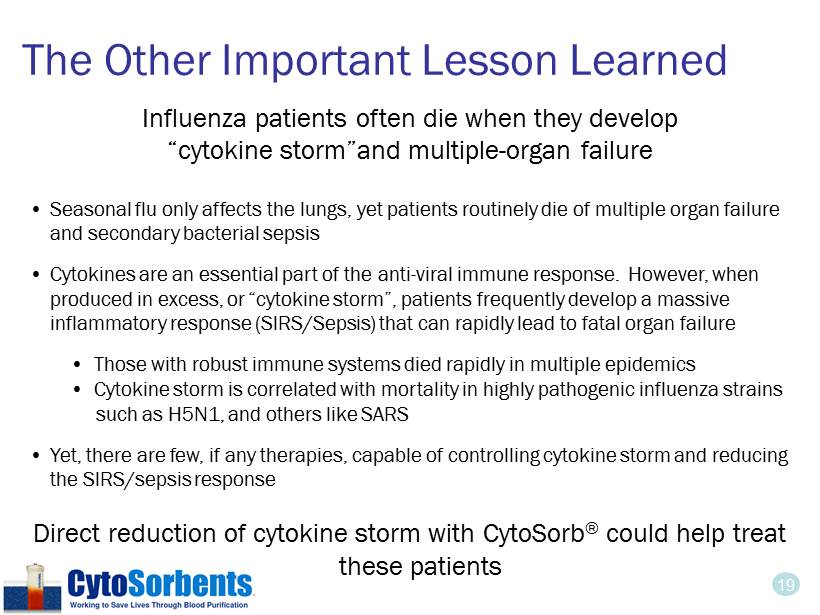

19 The Other Important Lesson Learned Influenza patients often die when they develop “cytokine storm”and multiple - organ failure • Seasonal flu only affects the lungs, y et patients routinely die of multiple organ failure and secondary bacterial sepsis • Cytokines are an essential part of the anti - viral immune response. However, when produced in excess, or “cytokine storm”, patients frequently develop a massive inflammatory response (SIRS/Sepsis) that can rapidly lead to fatal organ failure • Those with robust immune systems died rapidly in multiple epidemics • Cytokine storm is correlated with mortality in highly pathogenic influenza strains such as H5N1, and others like SARS • Yet, there are few, if any therapies, capable of controlling cytokine storm and reducing the SIRS/sepsis response Direct reduction of cytokine storm with CytoSorb ® could help treat these patients

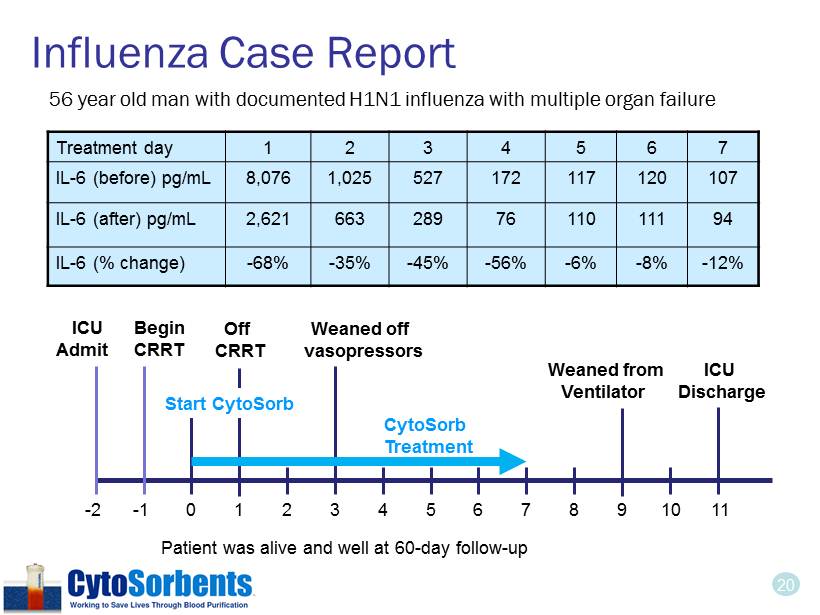

20 Influenza Case Report Treatment day 1 2 3 4 5 6 7 IL - 6 (before) pg/mL 8,076 1,025 527 172 117 120 107 IL - 6 (after) pg/mL 2,621 663 289 76 110 111 94 IL - 6 (% change) - 68% - 35% - 45% - 56% - 6% - 8% - 12% - 2 - 1 0 1 3 2 4 5 6 7 8 10 11 9 ICU Admit Start CytoSorb CytoSorb Treatment Weaned off vasopressors Weaned from Ventilator ICU Discharge Patient was alive and well at 60 - day follow - up Begin CRRT Off CRRT 56 year old man with documented H1N1 influenza with multiple organ failure

21 Lessons Learned from SARS • 2002 - 2003 Pandemic: 8,098 infected, 774 people died (~10 % mortality)* • Patients died due to pulmonary complications such as ARDS (particularly in age > 60 ), multiple organ failure, secondary bacterial pneumonias, and had other complications such as diarrhea and lymphopenia • Pathology caused by viral replication and immune system mediated events • Hyperactive immune response was characterized by high levels of inflammatory cytokines ( e.g IFN - g , IL - 1, IL - 6, IL - 12) and chemokines (e.g. IL - 8, MCP - 1, and IP - 10). IL - 8 was correlated with ARDS. No significant elevation in TNF - a , IL - 4 or IL - 10** • No specific treatment for SARS, though many patients were treated with ribavirin and corticosteroids Acute Viral Replication Hyperactive Immune Response Recovery Lung Injury (ALI/ARDS) Death * World Health Organizaton statistics ** Wong, et al. Clin Exp Immunol 2004: 136:95 - 103

22 MERS Coronavirus • The mechanism of injury is likely the same as SARS and influenza, though mortality appears significantly higher • Based on WHO reports, there have been 538 documented cases of MERS in 17 countries, with 174 deaths (~25% mortality) with an increasing number of cases since March • Majority of cases in Middle East • 2 documented cases in the U.S. • 1 in 5 infections are in healthcare workers thought due to patient exposure • Causes severe viral pneumonia with the development of acute respiratory distress syndrome, sepsis, and multiple organ failure • Treatment: No cure, no vaccine. Currently supportive care.

23 Recent Visit to Saudi Arabia Prince Mohammed Bin Abdulaziz Hospital in Riyadh, Saudi Arabia

24 Where We Stand with MERS • We have used CytoSorb® successfully in several patients with viral sepsis and multi - organ failure due to influenza, where a reduction in cytokines coincided with clinical improvement • Similarly, there is good scientific rationale to why CytoSorb® could be helpful in the treatment of patients afflicted with the MERS, and how a reduction in “cytokine storm” could be of help • CytoSorb ® is available for use in the Middle East with registration of CytoSorb® possible in the near term • We have visited Saudi Arabia recently, introduced CytoSorb ® to one of the three main hospitals treating MERS in Saudi Arabia and trained our distributor Techno Orbits • Although we have not yet treated a patient with MERS and do not know if or how CytoSorb ® may help these patients, we are well - positioned to potentially have our first treatment case soon

25 Cyto Sorbents is Leading the Way To Prevent or Treat Life Threatening Inflammation • CytoSorb ® targets deadly inflammation in the ICU that leads to organ failure and death • It is approved in the E.U. a nd is generating international revenue • Untapped $20B market opportunity and crucial unmet medical need • Validation of the company and technology from many fronts • Unique, highly profitable product and pipeline with little to no competition • Experienced and responsible management team • Potential major catalysts in the next 6 - 9 months • Revenue Growth • Strategic Partnerships • Clinical Data • Up - listing to National Market • New Product Development • Institutional Ownership

26 Phillip P. Chan, MD, PhD - CEO 7 Deer Park Drive, Suite K Monmouth Junction, NJ 08852 pchan@cytosorbents.com Cyto Sorbents Corporation OTCBB: CTSO The Rise of An Emerging Critical Care Immunotherapy Company Q&A Session