Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | ceoletterq12014form8-k.htm |

Exhibit 99.1

First Business CEO Report Q1 2014

Dear Shareholders and Friends of First Business:

Steady. Growing. Opportunistic. At First Business (the "Company"), we have built a solid reputation - and a quality track record - by remaining true to these qualities. They are the qualities that define our entrepreneurial approach to business - an approach we believe differentiates First Business from our competitors and peers. We share this entrepreneurial approach with our business clients, who recognize that disciplined and strategic execution is essential to success. It has been, and we believe will continue to be, an important factor in our ability to produce steady and growing bottom-line results.

CONSISTENT RESULTS

The merits of our model were evident in our results for this year’s first quarter. We earned $3.3 million in net income, representing a 3% increase compared to $3.2 million earned in last year’s first quarter. Even stronger, our pre-tax adjusted earnings - a non-GAAP measure which excludes the impact of credit costs and other items unrelated to our primary business activities - grew 6% to $5.3 million. This marked the third consecutive quarter in which pre-tax adjusted earnings exceeded $5.0 million.

Our solid performance resulted in the Company maintaining several additional performance trends above key thresholds that are widely viewed as barometers of success in the banking industry: at 1.06%, our first quarter annualized return on average assets (ROA) exceeded the 1% benchmark for the fifth consecutive quarter; at 12.01%, our annualized return on average equity (ROE) exceeded 12% for the seventh consecutive quarter; and at 59.84%, our efficiency ratio - a measure of the incremental expense incurred to generate each dollar of revenue we earn - remained below the benchmark 60% level for the seventh consecutive quarter. Compared to a group of 18 other business-focused banks which we consider to make up our peer group, this level of efficiency ranks third and is more than 900 basis points better than the peer average. Superior efficiency has contributed to leading profitability, ranking us among the top quartile of our peers for both ROA and ROE in the first quarter of 2014.

First Business also kicked off 2014 with several record achievements. Period-end net loans and leases grew for the eighth consecutive quarter, reaching a record $971.2 million. Likewise, fees earned from our trust and investment services offerings totaled a record $1.1 million, as continued growth in client accounts and rising equity market values drove trust assets under administration and management to a record $969.3 million at March 31, 2014, up 15% compared to just one year prior. Steady execution toward our strategic initiative to grow full-service banking relationships drove our success.

We are always focused on expanding our banking relationships, but not at the expense of asset quality. We are diligent in our evaluation of existing and potential clients’ credit profiles, and equally diligent in our efforts to resolve problems if those profiles deteriorate. Our first quarter asset quality metrics continued a trend that demonstrates our credit discipline is paying off. During the first quarter, we experienced no charge-offs while recognizing $20,000 in net recoveries on loans previously charged-off. In fact, our ratio of annualized

net charge-offs to average loans has measured at or below 0.15% for the past six quarters, consistently favorable to our peer group average.

We have produced steady results by growing our business in an opportunistic manner, and we believe we are on course to continue.

SEIZING OPPORTUNITY

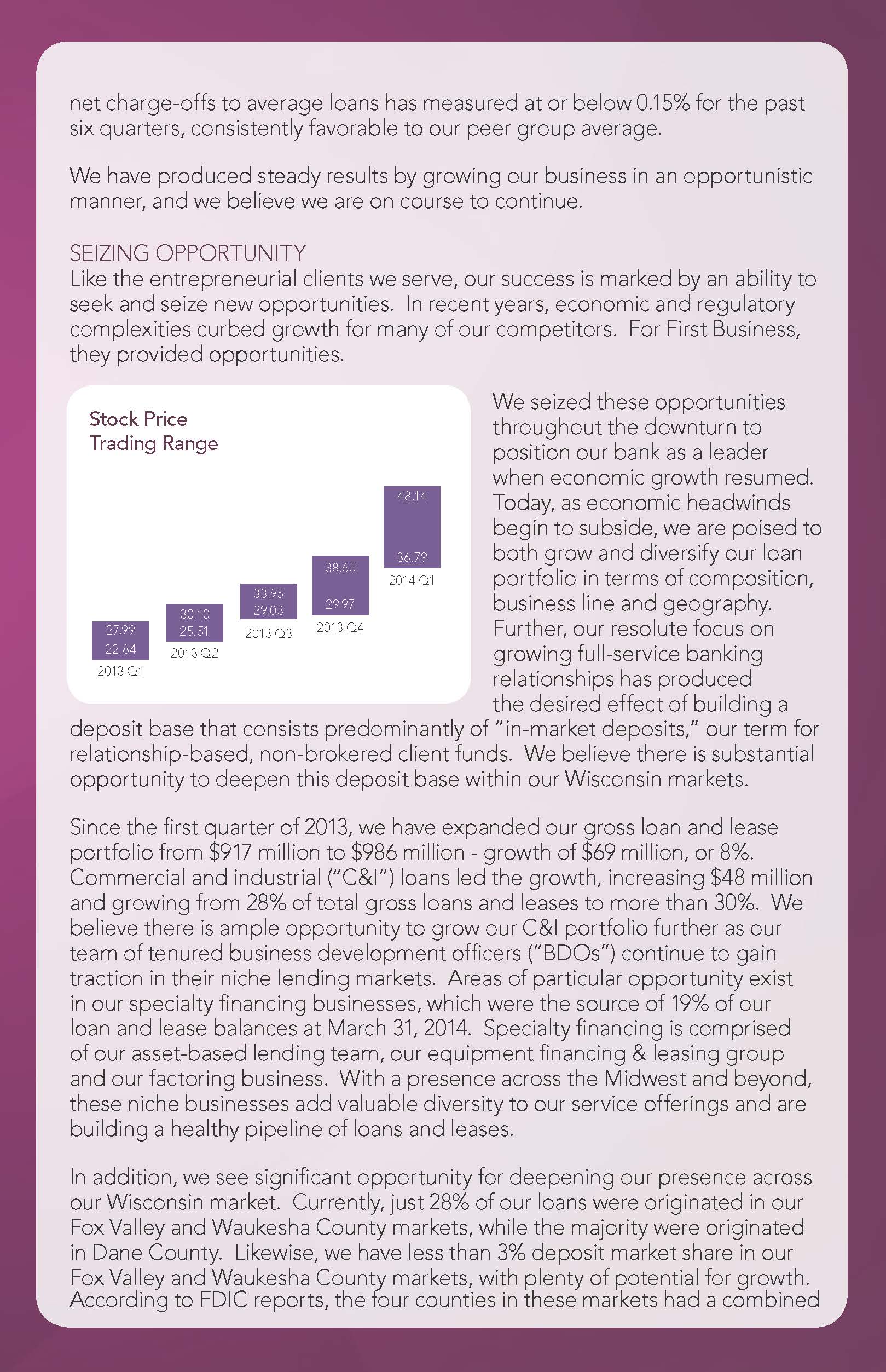

Like the entrepreneurial clients we serve, our success is marked by an ability to seek and seize new opportunities. In recent years, economic and regulatory complexities curbed growth for many of our competitors. For First Business, they provided opportunities.

We seized these opportunities throughout the downturn to position our bank as a leader when economic growth resumed. Today, as economic headwinds begin to subside, we are poised to both grow and diversify our loan portfolio in terms of composition, business line and geography. Further, our resolute focus on growing full-service banking relationships has produced the desired effect of building a deposit base that consists predominantly of “in-market deposits,” our term for relationship-based, non-brokered client funds. We believe there is substantial opportunity to deepen this deposit base within our Wisconsin markets.

Since the first quarter of 2013, we have expanded our gross loan and lease portfolio from $917 million to $986 million - growth of $69 million, or 8%. Commercial and industrial ("C&I") loans led the growth, increasing $48 million and growing from 28% of total gross loans and leases to more than 30%. We believe there is ample opportunity to grow our C&I portfolio further as our team of tenured business development officers ("BDOs") continue to gain traction in their niche lending markets. Areas of particular opportunity exist in our specialty financing businesses, which were the source of 19% of our loan and lease balances at March 31, 2014. Specialty financing is comprised of our asset-based lending team, our equipment financing & leasing group and our factoring business. With a presence across the Midwest and beyond, these niche businesses add valuable diversity to our service offerings and are building a healthy pipeline of loans and leases.

In addition, we see significant opportunity for deepening our presence across our Wisconsin market. Currently, just 28% of our loans were originated in our Fox Valley and Waukesha County markets, while the majority were originated in Dane County. Likewise, we have less than 3% deposit market share in our Fox Valley and Waukesha County markets, with plenty of potential for growth. According to FDIC reports, the four counties in these markets had a combined

$20.9 billion in deposits as of June 30, 2013 (the most recent date of which information was available). That means that capturing even just 0.5% of deposit market share would yield $105 million in deposit balances - which would equate to growth of more than 9% on our current deposit base. Gaining traction takes time, and we believe our history of growth demonstrates that we are effective at building footholds and developing momentum.

A SOLID START IN 2014 - FOUNDATION BUILT FOR CONTINUED SUCCESS

Results in this year’s first quarter demonstrate the compounding power of our disciplined growth in recent years. Our BDOs have risen to the task year-in and year-out, obtaining new business and working together with our superior client service staff to retain existing business through high touch, consistent service. Our team has expanded our commercial presence, the diversity of our business loan portfolio, the sources of our fee income and the size and quality of our in-market deposit funding base. These efforts have been aided and accelerated by company-wide investments in talent and technology.

As always, we remain committed to growing the First Business franchise. We have put the right people in place and equipped them with the tools they need to continue generating positive returns in 2014 and beyond. We believe significant opportunity exists for organic growth within our existing markets, as well as for the potential of opportunistic acquisitions of similar or complementary financial service organizations.

We believe that 2014 promises to be another great year as we continue to execute on our strategy and strive to build shareholder value. On behalf of all of us at First Business, thank you for your continued support.

Sincerely,

Corey Chambas, President and CEO

Note: “Fox Valley” represents Brown, Outagamie and Winnebago counties in Wisconsin. First Business’ peer group includes: Bank of Kentucky Financial Corporation (BKYF), Guaranty Bancorp (GBNK), Heritage Financial Corporation (HFWA), Mackinac Financial Corporation (MFNC), Mercantile Bank Corporation (MBWM), Mid Penn Bancorp, Inc. (MPB), MidSouth Bancorp, Inc. (MSL), Old Line Bancshares, Inc. (OLBK), Pacific Continental Corporation (PCBK), Peoples Financial Corporation (PFBX), QCR Holdings, Inc. (QCRH), Republic First Bancorp, Inc. (FRBK), S.Y. Bancorp, Inc. (SYBT), Southern National Bancorp of Virginia, Inc. (SONA), Southwest Bancorp, Inc. (OKSB), Univest Corporation of Pennsylvania (UVSP), WashingtonFirst Bankshares, Inc. (WFBI), West Bancorporation, Inc. (WTBA). Peer group averages reflect first quarter 2014 results of operations for all peer institutions. All peer data sourced from SNL Financial.

This letter includes "forward-looking" statements related to First Business Financial Services, Inc. (the "Company") that can generally be identified as describing the Company's future plans, objectives or goals. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company's future results, please see the Company's annual report on Form 10-K, quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission.

Financial Highlights

FBIZ Footprint