Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - ADEPTPROS INC | v378584_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - ADEPTPROS INC | v378584_ex10-1.htm |

| EX-3.1 - EXHIBIT 3.1 - ADEPTPROS INC | v378584_ex3-1.htm |

| EX-10.4 - EXHIBIT 10.4 - ADEPTPROS INC | v378584_ex10-4.htm |

| EX-23.1 - EXHIBIT 23.1 - ADEPTPROS INC | v378584_ex23-1.htm |

| EX-10.3 - EXHIBIT 10.3 - ADEPTPROS INC | v378584_ex10-3.htm |

| EX-3.2 - EXHIBIT 3.2 - ADEPTPROS INC | v378584_ex3-2.htm |

| EX-3.12 - EXHIBIT 3.12 - ADEPTPROS INC | v378584_ex3-12.htm |

As filed with the Securities and Exchange Commission on May 15, 2014

Registration No. 333-[xxxx]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM S-1 | ||

| REGISTRATION STATEMENT | ||

| UNDER | ||

THE SECURITIES ACT OF 1933

|

ADEPTPROS INC.

(Exact Name of Registrant in its Charter)

| Nevada | 7371 | 45-3793685 | ||

| (State or other Jurisdiction of Incorporation) |

(Primary Standard Industrial Classification Code) |

(IRS Employer Identification No.) |

ADEPTPROS INC.

14301 87th Street, Suite 110

Scottsdale, AZ 85260

Tel.: 1-877-664-2777

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

Copies of communications to:

Gregg E. Jaclin, Esq.

Szaferman, Lakind, Blumstein & Blader, PC

101 Grovers Mill Road, Suite 200

Lawrenceville, NJ 08648

Tel. No.: (609) 275-0400

Fax No.: (609) 275-4511

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

| Non-accelerated filer | ¨ | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

| Title of Each Class Of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Aggregate Offering Price per share |

Proposed Maximum Aggregate Offering Price |

Amount of Registration fee |

||||||||||||

| Common Stock, $0.001 par value per share | 5,874,444 | (1) | $ | 0.05 | (2) | $ | 293,722.20 | (2) | $ | 37.83 | ||||||

(1) This Registration Statement covers the resale by our selling shareholders of i) 3,155,210 shares held by the original founders of AdeptPros LLC and ii) 2,719,234 shares issued to the founders of AdeptPros Inc. (f/k/a Madison Park Acquisition Corp.).

(2) The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). Our common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined by the price of the shares that were sold to our shareholders in a private placement memorandum. The price of $0.05 is a fixed price at which the selling security holders may sell their shares until our common stock is quoted on the OTCBB at which time the shares may be sold at prevailing market prices or privately negotiated prices. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission (“SEC”) is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated May 15, 2014

ADEPTPROS INC.

5,874,444 SHARES OFCOMMON STOCK

The selling security holders named in this prospectus are offering all of the shares of common stock offered through this prospectus. The common stock to be sold by the selling shareholders as provided in the “Selling Security Holders” section is common stock that are shares that have already been issued and are currently outstanding. We will not receive any proceeds from the sale of the common stock covered by this prospectus.

Our common stock is presently not traded on any market or securities exchange. The selling security holders have not engaged any underwriter in connection with the sale of their shares of common stock. Common stock being registered in this registration statement may be sold by selling security holders at a fixed price of $0.05 per share until our common stock is quoted on the OTC Bulletin Board (“OTCBB”) and thereafter at a prevailing market prices or privately negotiated prices or in transactions that are not in the public market. There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved. We have agreed to bear the expenses relating to the registration of the shares of the selling security holders.

We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” beginning on page 3 to read about factors you should consider before buying shares of our common stock.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus is: May 15, 2014

TABLE OF CONTENTS

| 2 |

ITEM 3. Summary Information, Risk Factors and Ratio of Earnings to Fixed Charges

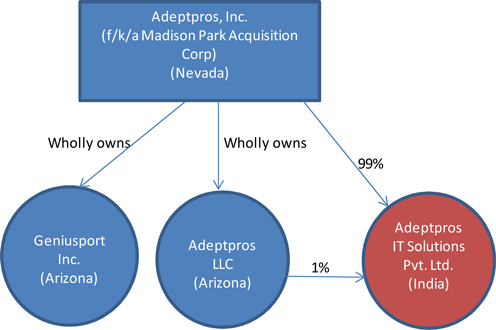

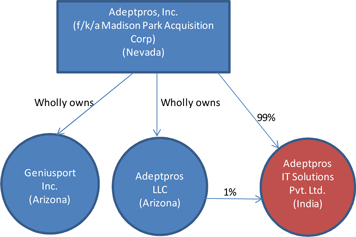

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in the common stock. You should carefully read the entire prospectus, including “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Financial Statements, before making an investment decision. In this Prospectus, the terms “AdeptPros,” the “Company,” “we,” “us” and “our” refer to AdeptPros Inc. AdeptPros LLC , an Arizona LLC, is a wholly-owned subsidiary of the Company. GeniusPort, Inc., an Arizona corporation, is a wholly-owned subsidiary of the Company. AdeptPros IT Solutions Pvt. Ltd is owned 99% by AdeptPros Inc. and 1% by AdeptPros LLC.

Overview

We were incorporated in the State of Nevada as Madison Park Acquisition Corp. on November 29, 2011. On January 27, 2014, we amended our Articles of Incorporation to change our name to AdeptPros Inc. On April 15, 2014, AdeptPros Inc. completed a share exchange agreement with AdeptPros LLC, an Arizona LLC formed in 2007 and GeniusPort Inc., an Arizona s-corporation formed in 2010. Additionally, on May 9, 2014, AdeptPros Inc. purchased 99% of AdeptPros IT Solutions Pvt. Ltd, a corporation incorporated under the Companies Act of 1956 under the laws of the nation of India. Concurrently, AdeptPros LLC purchased 1% of AdeptPros IT Solutions Pvt. Ltd. The resultant structure, hereafter referred to as “the Company” is as follows:

| 3 |

The financial statements and results of operations have been reported as if the business combinations occurred at the beginning of the period being reported on (March 1, 2011).

Equity Exchange Agreement

On April 15, 2014, we executed an equity exchange agreement with AdeptPros LLC and GeniusPort Inc. Under this exchange agreement, AdeptPros Inc. became the holding company and obtained 100% interest in each of the two consolidating entitles: AdeptPros LLC, and GeniusPort Inc. As consideration for the transfer of the equity interests of AdeptPros LLC, and GeniusPort, Inc., we agreed to issue a total of 44,375,337 shares of our common stock to the members of AdeptPros LLC and the shareholders of GeniusPort Inc. Specifically, we issued shares as follows:

| (A) | 44,262,826 shares of AdeptPros Inc. were issued to the following individual Members of Adeptros LLC: |

| Member Name | Number of Shares | |||

| Padma Kalluri | 4,291,808 | |||

| Venkat Nallapati | 15,000,000 | |||

| Jayaram Kode | 11,263,389 | |||

| Sekhar Kolla | 5,660,797 | |||

| Sandhya Paruchuri | 3,275,176 | |||

| Gowri Bokka | 2,365,404 | |||

| Nilay Kavathia | 401,042 | |||

| Jigar Shah | 401,042 | |||

| Madhavi Katta | 401,042 | |||

| Srinivasa Rao Chavadam | 401,042 | |||

| Srinaresh Kumar Nemani | 401,042 | |||

| Srivenkata Nimmagadda | 401,042 | |||

| Total | 44,262,826 | |||

| (B) | 112,511 shares of AdeptPros Inc.were issued to the following individual shareholders of GeniusPort Inc.: |

| Name of Shareholder | Number of Shares | |||

| Padma Kalluri | 78,758 | |||

| Jayaram Kode | 33,753 | |||

| Total | 112,511 | |||

Stock Purchase Agreement

On May 9, 2014, we executed 3 separate stock purchase agreements whereby AdeptPros Inc. purchased for cash 9,900 shares from the existing shareholders of AdeptPros IT Solutions Pvt. Ltd (India) and AdeptPros LLC purchased 100 shares from the existing shareholders of AdeptPros IT Solutions Pvt. Ltd (India). The 10,000 shares purchased were all the outstanding stock of AdeptPros IT Solutions Pvt. Ltd (India).

Our Business

AdeptPros, Inc. primarily has App Development and Training & Consulting business units to offer services to enterprises in Mobile Technologies such as Apple iOS, Google Android and Microsoft Windows. AdeptPros also has a road map to develop own enterprise mobile apps to cater to various industries. It creates these apps by implementing own ideas and encouraging entrepreneurs to develop apps under profit sharing model. With this unique combination, AdeptPros is generating good cash flows from two existing business units and also creating long term value by developing company owned mobile apps.

| · | AdeptPros' App development unit is carefully assembled with architects, managers, designers, developers and testers that assure the highest quality of custom application development, enterprise mobile application development and product development across a multitude of platforms and operating systems. All of these options can be fully customized by outside companies looking to develop their business apps. |

| · | AdeptPros Training & Consulting unit, GeniusPort, is designed to teach eager individuals about app development programming and then, in using our staffing service implemented within GeniusPort, find the best programmers and bring them on to the App development at AdeptPros. Individuals who are not chosen for AdeptPros still leave GeniusPort with the absolute best mobile development training available in the world. We do not leave our students short of job opportunities upon completion of GeniusPort training. This unit consists of trainers, solution architects, business analysts and designers, which works with our clients to augment their team with skilled resources. This enables the enterprises to complete their projects cheaper and faster. This model also creates a sales pipeline for Apps development projects and produces skilled resources to work on our projects. |

Enterprise mobility is a company's ability to manage and adapt mobile computing in a business context. The global business world is constantly evolving and is evolving in the digital direction with an emphasis on mobility. Applications and mobile websites are the future of our work place and AdeptPros goal is to equip all companies with the right set of tools to fully adapt and succeed in the digital workplace. We have an expanding assortment of Fortune 500 customers that request a variety of mobile services from our team. Our largest customers include Honeywell, Intel, SAP, IBM, Fidelity, Citrix, AOL and several other companies including a major U.S. university.

Our ability to successfully operate our business and achieve our goals and strategies is subject to numerous risks as discussed in the section titled “Risk Factors,” beginning on page 3.

| 4 |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As such, we are eligible to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We have decided to take advantage of these exemptions. As a result, some investors may find our common stock less attractive as a result. The result may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We intend to take advantage of the benefits of this extended transition period.

We could remain an “emerging growth company” for up to five years, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

Where You Can Find Us

Our principal executive office is located at 14301 N. 87th Street, Suite 110, Scottsdale, AZ 85260 and our telephone number is 1-877-664-2777.

The Offering

| Common stock offered by selling security holders | 5,874,444 shares of common stock. This number represents 11.74% of our current outstanding common stock (1). | |

| Common stock outstanding before the offering | 50,000,000 | |

| Common stock outstanding after the offering | 50,000,000 shares of common stock as of May 15, 2014. | |

| Terms of the Offering | The selling security holders will determine when and how they will sell the common stock offered in this prospectus. | |

| Termination of the Offering | The offering will conclude upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) such time as all of the common stock becomes eligible for resale without volume limitations pursuant to Rule 144 under the Securities Act, or any other rule of similar effect. | |

| Use of proceeds | We are not selling any shares of the common stock covered by this prospectus. | |

| Risk Factors | The Common Stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 3. |

(1) Based on 50,000,000 shares of common stock outstanding as of May 15, 2014.

| 5 |

Risk Factors

Risks Related to our Business

OUR BUSINESS DEPENDS ON EXPERIENCED AND SKILLED PERSONNEL, AND IF WE ARE UNABLE TO ATTRACT AND INTEGRATE SKILLED PERSONNEL, IT WILL BE MORE DIFFICULT FOR US TO MANAGE OUR BUSINESS AND COMPLETE CONTRACTS.

The success of our business depends on the experienced and skilled personnel. It is critical that we maintain, and continue to build, a highly experienced management team and team of skilled professionals. Competition for personnel, particularly those with expertise in mobile technologies and identifying candidates with the appropriate qualifications can be costly. We may not be able to hire the necessary personnel to implement our business strategy given our anticipated hiring needs, or we may need to provide higher compensation or more training to our personnel than we currently anticipate.

The increase in demand for mobile technologies and managed services has further increased the need for employees with specialized skills or significant experience in these areas. Our ability to expand our operations will be highly dependent on our ability to attract a sufficient number of highly skilled employees and to retain our employees. We may not be successful in attracting and retaining enough employees to achieve our desired expansion or staffing plans. Furthermore, the industry turnover rates for these types of employees are very high and we may not be successful in retaining, training or motivating our employees. Any inability to attract, retain, train and motivate employees could impair our ability to adequately manage and complete existing projects and to accept new client engagements. Such inability may also force us to increase our hiring, which may increase our costs and reduce our profitability on client engagements. We must also devote substantial managerial and financial resources to monitoring and managing our workforce. Our future success will depend on our ability to manage the levels and related costs of our workforce.

In the event we are unable to attract, hire and retain the requisite skilled personnel, we may experience delays in completing contracts in accordance with project schedules and budgets, which may have an adverse effect on our financial results, harm our reputation and cause us to curtail our pursuit of new contracts. Further, any increase in demand for personnel may result in higher costs, causing us to exceed the budget on a contract, which in turn may have an adverse effect on our business, financial condition and operating results and harm our relationships with our customers.

| 6 |

CUSTOMER APPLICATION FAILURES COULD DAMAGE OUR REPUTATION AND ADVERSELY AFFECT OUR REVENUES AND PROFITABILITY.

Many of the applications we develop, install and maintain for our customers involve managing and protecting personal information. While we have programs designed to comply with relevant privacy and security laws and restrictions, if an application we develop or maintain were to fail or experience a security breach or service interruption, whether caused by us, third-party service providers, cyber security threats or other events, we may experience loss of revenue, remediation costs or face claims for damages or contract termination. Any such event could cause serious harm to our reputation and prevent us from having access to or being eligible for further work on such applications. Our errors and omissions liability insurance may be inadequate to compensate us for all of the damages that we may incur and, as a result, our future results could be adversely affected.

WE ARE A HOLDING COMPANY WITH NO REVENUE GENERATING OPERATIONS OF OUR OWN. WE DEPEND ON THE PERFORMANCE OF OUR SUBSIDIARIES AND THEIR ABILITY TO MAKE DISTRIBUTIONS TO US.

AdeptPros, Inc. is a holding company with no business operations, sources of income or assets of our own other than our ownership interests in our subsidiaries. Because all of our operations are conducted by our subsidiaries, our cash flow and our ability to repay debt that we currently have and that we may incur after this offering and our ability to pay dividends to our stockholders are dependent upon cash dividends and distributions or other transfers from our subsidiaries.

Our subsidiaries are separate and distinct legal entities. Any right that we have to receive any assets of or distributions from any of our subsidiaries upon the bankruptcy, dissolution, liquidation or reorganization of any such subsidiary, or to realize proceeds from the sale of their assets, will be junior to the claims of that subsidiary’s creditors, including trade creditors and holders of debt issued by that subsidiary.

WE RELY UPON SEVERAL MAJOR CUSTOMERS; THE LOSS OF ANY OF THE MAIN CUSTOMERS WILL ADVERSELY AFFECT OUR BUSINESS PERFORMANCE.

We rely upon our major customers for a substantial portion of our sales. For the fiscal year ended March 31, 2013, our) largest customer accounted for approximately 26% of the sales of AdeptPros. Loss of any of this customer or other major customers could adversely affect our business performance and profitability

OUR PRODUCTS AND SERVICES ARE BASED ON NEW AND UNPROVED TECHNOLOGIES AND ARE SUBJECT TO THE RISKS OF FAILURE INHERENT IN THE DEVELOPMENT OF NEW PRODUCTS AND SERVICES.

Because our products and services are and will be based on new technologies, they are subject to risks of failure that are particular to new technologies, including the possibility that:

| · | our new approaches will not result in any products or services that gain market acceptance; |

| · | our mobile applications and the technology powering our custom development services may unfavorably interact with other types of commonly used applications and services, thus restricting the circumstances in which they may be used; |

| · | our mobile products may source hardware to provide mobility solutions for enterprises and dependencies on third party suppliers for hardware can present a risk of solution failure; |

| · | proprietary rights of third parties may preclude us from marketing a new product or service; or |

| · | third parties may market superior or more cost-effective products or services. |

As a result, our activities may not result in a broad enough base of commercially viable products or services, which would harm our sales, revenue and financial condition.

| 7 |

Onsite / offshore model for the mobile products development and mobile application services can have an adverse effect on our business, financial condition and operational efficiency

We rely on onsite / offshore model for the mobile application services and mobile apps development. Our services leverage the low cost development model by off-shoring the non-strategic development work to India. The onsite / offshore model can be subject to issues including, but not limited to:

| · | the currency risk, appreciation of Indian rupees against U.S. dollar can have an adverse effect on increase in our costs and can reduce our profitability for internal product development or client engagements |

| · | the political risk can be high in doing business in India due to tackling regulatory uncertainty and anti-social elements that can lead to high cost of doing business and can have adverse effect on our business |

| · | the inflationary risk, Indian economy experiences high inflation and quick rise in many cost associated with the business along with the salaries for mobile technology professionals. The rapidly increasing service delivery costs can lead to diminishing cost savings from off-shoring and reduce the profitability for our business. |

| · | the onsite / offshore model has occasionally experienced political push in U.S. too and has demanded revisiting of policies that can have adverse impact on our business. |

As a result, onsite / offshore model for the mobile products development and mobile application services can have an adverse effect on our business, financial condition and operational efficiency.

MAJOR NETWORK FAILURES COULD HAVE AN ADVERSE EFFECT ON OUR BUSINESS.

Our technology infrastructure is critical to the performance of our products and customer satisfaction. Our Apps run on a complex distributed system, or what is commonly known as cloud computing. We own, operate and maintain the primary elements of this system, however, some elements of this system are operated by third parties which we do not control and would require significant time to replace. We expect this dependence on third parties to continue. Major equipment failures, natural disasters, including severe weather, terrorist acts, acts of war, cyber-attacks or other breaches of network or information technology security that affect third-party networks, communications switches, routers, microwave links, cell sites or other third-party equipment on which we rely, could cause major network failures and/or unusually high network traffic demands that could have a material adverse effect on our operations or our ability to provide service to our customers. These events could disrupt our operations, require significant resources to resolve, result in a loss of customers or impair our ability to attract new customers, which in turn could have a material adverse effect on our business, prospects, results of operations and financial condition.

In addition, with the growth of wireless data services, enterprise data interfaces and Internet-based or Internet Protocol-enabled applications, wireless networks and devices are exposed to a greater degree to third-party data or applications over which we have less direct control. As a result, the network infrastructure and information systems on which we rely, as well as our customers’ wireless devices, may be subject to a wider array of potential security risks, including viruses and other types of computer-based attacks, which could cause lapses in our service or adversely affect the ability of our customers to access our service. Such lapses could have a material adverse effect on our business, prospects, results of operations and financial condition.

OUR PRODUCTS AND THE TECHNOLOGY POWERING OUR CUSTOM DEVELOPMENT SERVICES ARE COMPLEX AND MAY CONTAIN UNKNOWN DEFECTS THAT COULD RESULT IN NUMEROUS ADVERSE CONSEQUENCES, RESULTING IN COSTLY MANAGEMENT’S ATTENTION AND RESOURCES.

Complex software products such as those associated with our products and custom developed products often contain latent errors or defects, particularly when first introduced, or when new versions or enhancements are released. We have experienced and addressed errors and defects in the software associated with our products or custom developed products, but do not believe these errors will have a material negative effect in the future on their functionality. However, there can be no assurance that, despite testing, additional defects and errors will not be found in the current version, or in any new versions or enhancements of our custom developed products, any of which could result in damage to our reputation, the loss of sales, a diversion of our product development resources, and/or a delay in market acceptance, and thereby materially adversely affecting our business, operating results and financial condition.

| 8 |

IF THIRD PARTIES CLAIM THAT WE INFRINGE ON THEIR INTELLECTUAL PROPERTY, IT MAY RESULT IN COSTLY LITIGATION.

We cannot assure you that third parties will not claim our current or future products or services infringe their intellectual property rights. Any such claims, with or without merit, could cause costly litigation that could consume significant management time. As the number of product and services offerings in the mobile application market increases and functionalities increasingly overlap, companies such as ours may become increasingly subject to infringement claims. Such claims also might require us to enter into royalty or license agreements. If required, we may not be able to obtain such royalty or license agreements, or obtain them on terms acceptable to us.

OUR FUTURE GROWTH MAY REQUIRE RECRUITMENT OF ADDITIONAL QUALIFIED EMPLOYEES.

In the event of our future growth in administration, marketing, and customer service, we may have to increase the depth and experience of our management team by adding new members. Our future success will depend to a large degree upon the active participation of our key officers and employees. There is no assurance that we will be able to employ qualified persons on acceptable terms. Lack of qualified employees may adversely affect our business development.

Risks Related To This Offering

WE MAY INCUR SIGNIFICANT COSTS TO BE A PUBLIC COMPANY TO ENSURE COMPLIANCE WITH U.S. CORPORATE GOVERNANCE AND ACCOUNTING REQUIREMENTS AND WE MAY NOT BE ABLE TO ABSORB SUCH COSTS.

We may incur significant costs associated with our public company reporting requirements, costs associated with newly applicable corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002 and other rules implemented by the Securities and Exchange Commission. We expect all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some activities more time consuming and costly. We also expect that these applicable rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors or as executive officers. We are currently evaluating and monitoring developments with respect to these newly applicable rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs. In addition, we may not be able to absorb these costs of being a public company which will negatively affect our business operations.

THE LACK OF PUBLIC COMPANY EXPERIENCE OF OUR MANAGEMENT TEAM COULD ADVERSELY IMPACT OUR ABILITY TO COMPLY WITH THE REPORTING REQUIREMENTS OF U.S. SECURITIES LAWS.

Our Chief Executive Officer (“CEO”) lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Our CEO has never been responsible for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934 which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

| 9 |

OUR FUTURE SUCCESS IS DEPENDENT, IN PART, ON THE PERFORMANCE AND CONTINUED SERVICE OF VENKAT NALLAPTI, OUR PRESIDENT AND CEO.

We are presently dependent to a great extent upon the experience, abilities and continued services of Venkat Nallapati, our Chief Executive Officer. The loss of services of any of the CEO could have a material adverse effect on our business, financial condition or results of operation.

UPON THE COMPLETION OF THIS OFFERING, THE CONCENTRATION OF OUR CAPITAL STOCK OWNERSHIP WITH OUR FOUNDERS AND EXECUTIVE OFFICERS WILL LIKELY LIMIT AN INVESTOR’S ABILITY TO INFLUENCE CORPORATE MATTERS.

Upon completion of this offering, the executive officers, Venkat Nallapati and his wife, Padma Kalluri will own approximately 38.74% of our outstanding common stock. And other founders, Jayaram Kode and Sekhar Kolla will own 23.04% and 11.32% respectively. As a result, these stockholders, acting individually or together, can exercise significant influence over our business policies and affairs, including the power to nominate a majority of the members of our board of directors. Because of such power and because our board of directors is responsible for appointing the members of our senior management team, our founders and key employees could affect any attempt by independent stockholders to replace current members of our management team. In addition, our founders and key employees and the Nallapati family in general can control any action requiring the general approval of our stockholders, including the adoption of amendments to our certificate of incorporation and bylaws and the approval of mergers or sales of substantially all of our assets. It is possible that the interests of certain of our founders and other key employees may, in certain circumstances, conflict with our interests, the interests of our other founders, key employees or minority stockholders, including you. For example, the concentration of ownership and voting power of our founders and key employees may delay, defer or even prevent an acquisition by a third party or other change of control involving us and may make some transactions more difficult or impossible without their support, even if such events are in the best interests of our minority stockholders. As a result, our founders and key employees could pursue transactions that may not be in our best interests which could have a material adverse effect on our business, financial condition or results of operations.

Risk Related To Our Capital Stock

WE MAY NEVER PAY ANY DIVIDENDS TO SHAREHOLDERS.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings, if any, to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

The declaration, payment and amount of any future dividends will be made at the discretion of the board of directors, and will depend upon, among other things, the results of our operations, cash flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend.

THE OFFERING PRICE OF THE COMMON STOCK WAS DETERMINED BASED ON THE PRICE OF OUR PRIVATE OFFERING, AND THEREFORE SHOULD NOT BE USED AS AN INDICATOR OF THE FUTURE MARKET PRICE OF THE SECURITIES. THEREFORE, THE OFFERING PRICE BEARS NO RELATIONSHIP TO OUR ACTUAL VALUE, AND MAY MAKE OUR SHARES DIFFICULT TO SELL.

Since our shares are not listed or quoted on any exchange or quotation system, the offering price of $0.05 per share for the shares of common stock was determined based on the price of our private offering. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market. The offering price bears no relationship to the book value, assets or earnings of our company or any other recognized criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities.

| 10 |

YOU WILL EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST BECAUSE OF THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK AND OUR PREFERRED STOCK.

In the future, we may issue our authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our present stockholders. We are currently authorized to issue 190,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share. We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares of our common stock or other securities may create downward pressure on the trading price of our common stock. There can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with hiring or retaining employees or consultants, future acquisitions, future sales of our securities for capital raising purposes or for other business purposes, including at a price (or exercise prices) below the price at which shares of our common stock will be quoted on the OTCBB.

IN THE EVENT THAT THE COMPANY’S SHARES ARE TRADED, THEY WILL MOST LIKELY TRADE UNDER $5.00 PER SHARE AND THUS WILL BE A PENNY STOCK. TRADING IN PENNY STOCKS HAS MANY RESTRICTIONS AND THESE RESTRICTIONS COULD SEVERLY AFFECT THE PRICE AND LIQUIDITY OF THE COMPANY’S SHARES.

In the event that our shares are traded, and our stock will most likely trade below $5.00 per share, and our stock will therefore be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission (the “SEC”) has adopted regulations which generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Our common stock will probably be considered to be a “penny stock” and will subject to the additional regulations and risks of such a security. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and accredited investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities, and may negatively affect the ability of holders of shares of our common stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to.

INVESTING IN THE COMPANY IS A HIGHLY SPECULATIVE INVESTMENT AND COULD RESULT IN THE LOSS OF YOUR ENTIRE INVESTMENT.

A purchase of the offered shares is significantly speculative and involves significant risks. The offered shares should not be purchased by any person who cannot afford the loss of his or her entire purchase price. The business objectives of the Company are also speculative, and we may be unable to satisfy those objectives. The shareholders of the Company may be unable to realize a substantial return on their purchase of the offered shares, or any return whatsoever, and may lose their entire investment in the Company. For this reason, each prospective purchaser of the offered shares should read this prospectus and all of its exhibits carefully and consult with their attorney, business advisor and/or investment advisor.

THERE IS NO ASSURANCE OF A PUBLIC MARKET OR THAT OUR COMMON STOCK WILL EVER TRADE ON A RECOGNIZED EXCHANGE. THEREFORE, YOU MAY BE UNABLE TO LIQUIDATE YOUR INVESTMENT IN OUR STOCK.

There is no established public trading market for our common stock. Our shares have not been listed or quoted on any exchange or quotation system. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTCBB, nor can there be any assurance that such an application for quotation will be approved or that a regular trading market will develop or that if developed, will be sustained. In the absence of a trading market, an investor may be unable to liquidate their investment.

| 11 |

WE ARE AN “EMERGING GROWTH COMPANY,” AND ANY DECISION ON OUR PART TO COMPLY ONLY WITH CERTAIN REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO “EMERGING GROWTH COMPANIES” COULD MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS.

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to opt in to the extended transition period for complying with the revised accounting standards.

OUR STATUS AS AN “EMERGING GROWTH COMPANY” UNDER THE JOBS ACT OF 2012 MAY MAKE IT MORE DIFFICULT TO RAISE CAPITAL AS AND WHEN WE NEED IT.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

WE MAY BE EXEMPT FROM THE REPORTING OBLIGATIONS PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT AND THEREFORE MAY NOT HAVE TO PROVIDE INVESTORS WITH PERIODIC REPORTS AS MAY BE REQUIRED PURSUANT TO SECTION 13 OF THE SECURITIES EXCHANGE ACT, FOLLOWING THE FORM 10K REQUIRED FOR THE FISCAL YEAR IN WHICH OUR REGISTRATION STATEMENT IS EFFECTIVE.

The requirement for an issuer that has filed a registration statement to file pursuant to Section 15(d) of the Securities Exchange Act is suspended for any fiscal year, except for the fiscal year in which such registration statement becomes effective, if, at the beginning of the fiscal year, the issuer has fewer than 300 shareholders. We currently have fewer than 300 shareholders and expect to maintain a fewer than 300 shareholder base. If we do continue to have fewer than 300 shareholders, we will be exempt from the filing requirements as required pursuant to Section 13 of the Securities Exchange Act and will not be required to file any periodic reports, including Form 10Q and 10K filings, with the SEC subsequent to the Form 10K required for the fiscal year in which our registration statement is effective. Further, disclosures in our Form 10K that we will be required to file for the fiscal year in which our registration statement is effective, is less extensive than the disclosures required of fully reporting companies. Specifically, we are not subject to disclose in our Form 10K risk factors, unresolved staff comments, or selected financial data, pursuant to Items 1A, 1B, 6, respectively.

| 12 |

UNTIL WE REGISTER A CLASS OF OUR SECURITIES UNDER SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 (“EXCHANGE ACT”), WE WILL ONLY BE SUBJECT TO THE PERIODIC REPORTING OBLIGATIONS IMPOSED BY SECTION 15(D) OF THE EXCHANGE ACT.

Until such time as we register a class of our securities under Section 12 of the Securities Exchange Act of 1934, we will only be subject to the periodic reporting obligations imposed by Section 15(d) of the Exchange Act. Accordingly, we will not be subject to the proxy rules, Section 16 short-swing profit provisions, beneficial ownership reporting, the bulk of the tender offer rules and the reporting requirements of Section 13 of the Exchange Act.

s own ideas and encouraging entrepreneurs to develop apps under a profit sharing model.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information contained in this report, including in the documents incorporated by reference into this report, includes some statement that are not purely historical and that are “forward-looking statements.” Such forward-looking statements include, but are not limited to, statements regarding our and their management’s expectations, hopes, beliefs, intentions or strategies regarding the future, including our financial condition, results of operations. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipates, ” “believes, ” “continue, ” “could, ” “estimates, ” “expects, ” “intends, ” “may, ” “might, ” “plans, ” “possible, ” “potential, ” “predicts, ” “projects, ” “seeks, ” “should, ” “would ” and similar expressions, or the negatives of such terms, may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements contained in this report are based on current expectations and beliefs concerning future developments and the potential effects on the parties and the transaction. There can be no assurance that future developments actually affecting us will be those anticipated. These that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements, including the following forward-looking statements involve a number of risks, uncertainties (some of which are beyond the parties ’ control) or other assumptions.

We will not receive any proceeds from the sale of common stock by the selling security holders. All of the net proceeds from the sale of our common stock will go to the selling security holders as described below in the sections entitled “Selling Security Holders ” and “Plan of Distribution .” We have agreed to bear the expenses relating to the registration of the common stock for the selling security holders.

| 13 |

Determination of Offering Price

Since our common stock is not listed or quoted on any exchange or quotation system, the offering price of the shares of common stock was determined by the price of the common stock that was sold to our security holders pursuant to an exemption under Section 4(2) of the Securities Act of 1933 and Rule 506 of Regulation D promulgated under the Securities Act of 1933.

The offering price of the shares of our common stock does not necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria of value. The facts considered in determining the offering price were our financial condition and prospects, our limited operating history and the general condition of the securities market.

Although our common stock is not listed on a public exchange, we will be filing to obtain a quotation on the OTCBB concurrently with the filing of this prospectus. In order to be quoted on the OTCBB, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved.

In addition, there is no assurance that our common stock will trade at market prices in excess of the initial offering price as prices for the common stock in any public market which may develop will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity.

The common stock to be sold by the selling shareholders as provided in the “Selling Security Holders” section is common stock that is currently issued. Accordingly, there will be no dilution to our existing shareholders.

The common shares being offered for resale by the selling security holders consist of 5,874,444 shares of our common stock held by 38 shareholders, which consist of i) 3,155,210 shares held by the original founders of AdeptPros LLC ii) 2,719,234 shares issued to the founders of AdeptPros Inc. (f/k/a Madison Park Acquisition Corp.).

The following table sets forth the names of the selling security holders, the number of shares of common stock beneficially owned by each of the selling stockholders as of May 15, 2014 and the number of shares of common stock being offered by the selling stockholders. The shares being offered hereby are being registered to permit public secondary trading, and the selling stockholders may offer all or part of the shares for resale from time to time. However, the selling stockholders are under no obligation to sell all or any portion of such shares nor are the selling stockholders obligated to sell any shares immediately upon effectiveness of this prospectus. All information with respect to share ownership has been furnished by the selling stockholders.

| 14 |

| Name | Shares Beneficially Owned Prior to Offering |

Shares to be Offered |

Amount Beneficially Owned After Offering |

Percent Beneficially Owned After Offering |

||||||||||||

| Padma Kalluri | 4,370,566 | 250,000 | 4,120,566 | 8.24 | % | |||||||||||

| Venkat Nallapati | 15,000,000 | 250,000 | 14,750,000 | 29.50 | % | |||||||||||

| Jayaram Kode | 11,521,939 | 250,000 | 11,271,939 | 22.54 | % | |||||||||||

| Gautam Mandewalker | 999,550 | 100,000 | 899,550 | 1.80 | % | |||||||||||

| Sekhar Kolla | 5,660,797 | 250,000 | 5,410,797 | 10.82 | % | |||||||||||

| Sandhya Paruchuri | 3,275,176 | 250,000 | 3,025,176 | 6.05 | % | |||||||||||

| Gowri Bokka | 2,365,404 | 150,000 | 2,215,404 | 4.43 | % | |||||||||||

| Nilay Kavathia | 401,042 | 401,042 | 0 | * | ||||||||||||

| Jigar Shah | 401,042 | 401,042 | 0 | * | ||||||||||||

| Madhavi Katta | 401,042 | 401,042 | 0 | * | ||||||||||||

| Srinivasa Rao Chavadam | 401,042 | 401,042 | 0 | * | ||||||||||||

| Srinaresh Kumar Nemani | 401,042 | 401,042 | 0 | * | ||||||||||||

| Srivenkata Nimmagadda | 401,042 | 401,042 | 0 | |||||||||||||

| John J. Chichester | 500 | 500 | 0 | |||||||||||||

| Chichester Associates Inc. | 500 | 500 | 0 | |||||||||||||

| Rafael Veloz | 500 | 500 | 0 | |||||||||||||

| Bennett Weber | 500 | 500 | 0 | |||||||||||||

| The David Weber Oil Company | 500 | 500 | 0 | |||||||||||||

| Segal Gebski PLLC | 500 | 500 | 0 | |||||||||||||

| Martin Smietanksi | 500 | 500 | 0 | |||||||||||||

| Wendy Elie | 500 | 500 | 0 | |||||||||||||

| Darren DeRosa | 500 | 500 | 0 | |||||||||||||

| Q5 Ventures LLC | 500 | 500 | 0 | |||||||||||||

| Integrity Cargo Freight Corporation | 500 | 500 | 0 | |||||||||||||

| Sterling Seal & Supply Inc. | 500 | 500 | 0 | |||||||||||||

| Charles DeRosa | 500 | 500 | 0 | |||||||||||||

| ADDR Properties LLC | 500 | 500 | 0 | |||||||||||||

| Anthony DiGiovanni | 500 | 500 | 0 | |||||||||||||

| Lawrence D’Angelo | 500 | 500 | 0 | |||||||||||||

| David Ciambrone | 500 | 500 | 0 | |||||||||||||

| Gregory Russo | 500 | 500 | 0 | |||||||||||||

| Theodore Hanley | 500 | 500 | 0 | |||||||||||||

| Angleo DeRosa | 500 | 500 | 0 | |||||||||||||

| Vishal Baijal | 1,250,000 | 200,000 | 1,050,000 | 2.10 | % | |||||||||||

| Scott Chichester | 1,232,124 | 100,000 | 1,132,124 | 2.26 | % | |||||||||||

| Larry Adams | 1,008,102 | 1,008,102 | 0 | * | ||||||||||||

| Elisse Porter | 900,090 | 650,090 | 250,000 | * | ||||||||||||

| 0 | * | |||||||||||||||

| TOTAL: | 50,000,000 | 5,874,444 | 44,125,556 | 88.24 | % | |||||||||||

| 15 |

There are no agreements between the company and any selling shareholder pursuant to which the shares subject to this registration statement were issued.

None of the selling shareholders or their beneficial owners:

| - | has had a material relationship with us other than as a shareholder at any time within the past three years; or |

| - | are broker-dealers or affiliated with broker-dealers. |

| 16 |

The selling security holders may sell some or all of their shares at a fixed price of $0.05 per share until our shares are quoted on the OTCBB and thereafter at prevailing market prices or privately negotiated prices. Prior to being quoted on the OTC Bulletin Board, shareholders may sell their shares in private transactions to other individuals. Although our common stock is not listed on a public exchange, we will be filing to obtain a quotation on the OTCBB concurrently with the filing of this prospectus. In order to be quoted on the OTC Bulletin Board, a market maker must file an application on our behalf in order to make a market for our common stock. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, which operates the OTC Bulletin Board, nor can there be any assurance that such an application for quotation will be approved. However, sales by selling security holder must be made at the fixed price of $0.05 until a market develops for the stock.

Once a market has developed for our common stock, the shares may be sold or distributed from time to time by the selling stockholders, who may be deemed to be underwriters, directly to one or more purchasers or through brokers or dealers who act solely as agents, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at negotiated prices or at fixed prices, which may be changed. The distribution of the shares may be effected in one or more of the following methods:

| ● | ordinary brokers transactions, which may include long or short sales, |

| ● | transactions involving cross or block trades on any securities or market where our common stock is trading, market where our common stock is trading, |

| ● | through direct sales to purchasers or sales effected through agents, |

| ● | through transactions in options, swaps or other derivatives (whether exchange listed of otherwise), or exchange listed or otherwise), or |

| ● | any combination of the foregoing. |

In addition, the selling stockholders may enter into hedging transactions with broker-dealers who may engage in short sales, if short sales were permitted, of shares in the course of hedging the positions they assume with the selling stockholders. The selling stockholders may also enter into option or other transactions with broker-dealers that require the delivery by such broker-dealers of the shares, which shares may be resold thereafter pursuant to this prospectus. To our best knowledge, none of the selling security holders are broker-dealers or affiliates of broker dealers.

We will advise the selling security holders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling security holders and their affiliates. In addition, we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling security holders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling security holders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

Brokers, dealers, or agents participating in the distribution of the shares may receive compensation in the form of discounts, concessions or commissions from the selling stockholders and/or the purchasers of shares for whom such broker-dealers may act as agent or to whom they may sell as principal, or both (which compensation as to a particular broker-dealer may be in excess of customary commissions). Neither the selling stockholders nor we can presently estimate the amount of such compensation. We know of no existing arrangements between the selling stockholders and any other stockholder, broker, dealer or agent relating to the sale or distribution of the shares. We will not receive any proceeds from the sale of the shares of the selling security holders pursuant to this prospectus. We have agreed to bear the expenses of the registration of the shares, including legal and accounting fees, and such expenses are estimated to be approximately $70,000.

Notwithstanding anything set forth herein, no FINRA member will charge commissions that exceed 8% of the total proceeds of the offering.

Description of Securities to be Registered

General

We are currently authorized to issue 190,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share.

| 17 |

Common Stock

We are currently authorized to issue 190,000,000 shares of common stock, par value $0.001 per share. Currently we have 50,000,000 shares of common stock issued and outstanding.

Each share of common stock shall have one (1) vote per share for all purpose. Our common stock does not provide a preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights. Our common stock holders are not entitled to cumulative voting for election of Board of Directors.

Preferred Stock

We are authorized to issue 10,000,000 shares of preferred stock, par value $0.001 per share. Currently, no shares of our preferred stock have been designated any rights and we have no shares of preferred stock issued and outstanding.

Dividends

We have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our board of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions, and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest earnings, if any, in our business operations.

Warrants

There are no outstanding warrants to purchase our securities.

Options

There are no outstanding options to purchase our securities.

Transfer Agent and Registrar

We do not currently have a transfer agent and registrar.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Szaferman, Lakind, Blumstein & Blader, P.C. located at 101 Grovers Mill Road, Suite 200, Lawrenceville, New Jersey 08648 will pass on the validity of the common stock being offered pursuant to this registration statement.

The financial statements as of March 31, 2013 included in this prospectus and the registration statement have been audited by SadlerGibb, an independent registered public accounting firm, to the extent and for the periods set forth in their report appearing elsewhere herein and in the registration statement, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

| 18 |

Information about the Registrant

Overview

We were incorporated in the State of Nevada as Madison Park Acquisition Corp. on November 29, 2011. On January 27, 2014, we amended our Articles of Incorporation to change our name to AdeptPros Inc. On April 15, 2014, AdeptPros Inc. completed a share exchange agreement with AdeptPros LLC, an Arizona LLC formed in 2007 and GeniusPort Inc., an Arizona s-corporation formed in 2010. Additionally, on May 9, 2014, AdeptPros Inc. purchased 99% of AdeptPros IT Solutions Pvt. Ltd, a corporation incorporated under the Companies Act of 1956 under the laws of the nation of India. Concurrently, AdeptPros LLC purchased 1% of AdeptPros IT Solutions Pvt. Ltd. The resultant structure, hereafter referred to as “the Company” is as follows:

The financial statements and results of operations have been reported as if the business combinations occurred at the beginning of the period being reported on (March 1, 2011).

| 19 |

Equity Exchange Agreement

On April 15 2014, we executed an equity exchange agreement with AdeptPros LLC and GeniusPort Inc. Under this exchange agreement, AdeptPros Inc. became the holding company and obtained 100% interest in each of the two consolidating entitles: AdeptPros LLC, and GeniusPort Inc. As consideration for the transfer of the equity interests of AdeptPros LLC, and GeniusPort, Inc., we agreed to issue a total of 44,375,337 shares of our common stock to the members of AdeptPros LLC and the shareholders of GeniusPort Inc. Specifically, we issued shares as follows:

| (C) | 44,262,826 shares of AdeptPros Inc. were issued to the following individual Members of Adeptros LLC: |

| Member Name | Number of Shares | |||

| Padma Kalluri | 4,291,808 | |||

| Venkat Nallapati | 15,000,000 | |||

| Jayaram Kode | 11,263,389 | |||

| Sekhar Kolla | 5,660,797 | |||

| Sandhya Paruchuri | 3,275,176 | |||

| Gowri Bokka | 2,365,404 | |||

| Nilay Kavathia | 401,042 | |||

| Jigar Shah | 401,042 | |||

| Madhavi Katta | 401,042 | |||

| Srinivasa Rao Chavadam | 401,042 | |||

| Srinaresh Kumar Nemani | 401,042 | |||

| Srivenkata Nimmagadda | 401,042 | |||

| Total | 44,262,826 | |||

| (D) | 112,511 shares of AdeptPros Inc.were issued to the following individual shareholders of GeniusPort Inc.: |

| Name of Shareholder | Number of Shares | |||

| Padma Kalluri | 78,758 | |||

| Jayaram Kode | 33,753 | |||

| Total | 112,511 | |||

Stock Purchase Agreement

On May 9, 2014, we executed 3 separate stock purchase agreements whereby AdeptPros Inc. purchased for cash 9,900 shares from the existing shareholders of AdeptPros IT Solutions Pvt. Ltd (India) and AdeptPros LLC purchased 100 shares from the existing shareholders of AdeptPros IT Solutions Pvt. Ltd (India). The 10,000 shares purchased were all the outstanding stock of AdeptPros IT Solutions Pvt. Ltd (India).

Corporate History

AdeptPros, Inc. primarily has App Development and Training & Consulting business units to offer services to enterprises in Mobile Technologies such as Apple iOS, Google Android and Microsoft Windows. AdeptPros also has a road map to develop own enterprise mobile apps to cater to various industries. It creates these apps by implementing own ideas and encouraging entrepreneurs to develop apps under profit sharing model. With this unique combination, AdeptPros is generating good cash flows from two existing business units and also creating long term value by developing company owned mobile apps.

| · | AdeptPros' App development unit is carefully assembled with architects, managers, designers, developers and testers that assure the highest quality of custom application development, enterprise mobile application development and product development across a multitude of platforms and operating systems. All of these options can be fully customized by outside companies looking to develop their business apps. |

| 20 |

| · | AdeptPros Training & Consulting unit, GeniusPort, is designed to teach eager individuals about app development programming and then, in using our staffing service implemented within GeniusPort, find the best programmers and bring them on to the App development at AdeptPros. Individuals who are not chosen for AdeptPros still leave GeniusPort with the absolute best mobile development training available in the world. We do not leave our students short of job opportunities upon completion of GeniusPort training. This unit consists of trainers, solution architects, business analysts and designers, which works with our clients to augment their team with skilled resources. This enables the enterprises to complete their projects cheaper and faster. This model also creates a sales pipeline for Apps development projects and produces skilled resources to work on our projects. |

Enterprise mobility is a company's ability to manage and adapt mobile computing in a business context. The global business world is constantly evolving and is evolving in the digital direction with an emphasis on mobility. Applications and mobile websites are the future of our work place and AdeptPros goal is to equip all companies with the right set of tools to fully adapt and succeed in the digital workplace. We have an expanding assortment of Fortune 500 customers that request a variety of mobile services from our team. Our largest customers include Honeywell, Intel, SAP, IBM, Fidelity, Citrix, AOL and several other companies including a major U.S. university.

The Industry

In total, smartphones, such as iPhone, Android and Windows phone sales in the United States are growing at a year to year rate of 40%, and many studies suggest that this growth may continue at this pace for the next 3 years. Apple recently reported that it had $10 billion in revenue in 2013 from application downloads alone. The mobile applications market will be $54 billion industry by 2015 (source: Gartner). Many enterprises are adopting mobile tablets to run their day-to-day enterprise applications on them. This creates a variety of business opportunities for AdeptPros in this enterprise mobile applications domain. The specifics and statistics of mobile phone and tablet users today has exceeded any consumer expectations. Some of these astounding statistics include:

| · | By the end of 2013, there will be more mobile devices on Earth than people. |

| · | 27% of companies worldwide planned to implement location-based marketing in coming years. |

| · | 25% of international media and marketing executives see mobile as the most disruptive force in their industry. |

| · | 80% of smartphone owners want more mobile-optimized product information while they’re shopping in stores. |

| · | Time spent with mobile apps starting to challenge television: consumers are spending 127 minutes per day in mobile apps – up 35% from 94 minutes a day in the same time last year – and spend 168 minutes watching television per day. |

| · | 73% of consumers say they have used their mobile phone in a store. |

| · | 64% of affluent app users say they view brands with mobile apps more favorably. |

| · | 85% of merchants say mobile commerce is a focus in 2012, up from 68 percent in 2011 |

These statistics are a compilation of mobile enterprise stats taken from the website digby.com from a collection of sources eMarketer and Cisco. The most astounding and inspiring statistic from an enterprise mobility standpoint is that nearly 65% of affluent app users want their favorites brands to have an app, therefore leading brands and companies to necessitate app development. While these numbers are impressive and the opportunities are unquestionably there, AdeptPros has several target markets to be successful.

| 21 |

Our Expertise, Business Units and Services

Expertise: AdeptPros is an early adopter and has strong technical and integration expertise in Mobile, Social, Cloud, Analytics and Web 2.0 domains. Our technical competence is mentioned below:

| · | Mobile: App development expertise for Apple iOS, Google Android and Microsoft Windows Mobile devices |

| · | Social: Integrating Facebook, Twitter, LinkedIn, Pinterest, Google+ etc., platforms within enterprise applications |

| · | Cloud: Hosting enterprise application on Amazon AWS, Rackspace and private cloud systems |

| · | Analytics: Generating business intelligence reports and insights for enterprises using various data tools |

| · | Web: App development expertise in Java, .Net, HTML5, Java Script, mySQL, Php, CSS, JQuery etc., |

Business Units: AdeptPros, Inc. primarily has App Development and Training & Consulting business units to offer services to enterprises in these mentioned technologies. A headquarters in the United States allows us to easily and regularly meet with our clients while saving the same clients huge costs with our experienced and tested development team in Bengaluru, India.

Services:

App Development unit includes the following services:

Enterprise Mobile Apps development (aka Enterprise Mobility): Our team helps many companies to develop enterprise mobile apps in order to improve their productivity, profitability and customer loyalty. For several years we have been assisting our clients from strategy to execution of their projects. Our advanced enterprise mobile application development services helped clients transform their businesses in a company that exceeds expectations. We build and deploy mobile apps that keep customers connected and engaged.

IT Systems Integration: In a rapidly shifting business environment, we are required to quickly integrate complex technologies. Be it a large or a small organization, AdeptPros ensures that the IT systems integration services are aligned with business requirements. Our services are spread on a global scale. We know how challenging it is for an enterprise to integrate multiple IT systems for different departments. We use the right tools and methodologies to ensure that a company’s needs are streamlined through proper hardware and software integration. Some systems we have integrated are: Microsoft Office, Oracle, Sybase, SAP, SQL server, Google App engine, ASP.NET MVC apps etc.,

Product Development: Some enterprises require us to develop end-to-end product development to perform multiple business functions. Typically it requires most of our services in Mobile, Social, Cloud, Analytics and Web technologies.

Games Development: AdeptPros has required knowledge in developing games for Mobile and Web platforms by using Unity framework.

Quality Assurance: Every application or product or game where AdeptPros is engaged with is tested efficiently by using our expert team, tools, framework and methodologies. The testing team is comprised of security experts and UI/UX experts who check for the performance, scalability and design of the application from all perspectives. They make sure that the testing is a full-fledged verification, done in terms of planning, architecture, execution, automation and measurement. We perform various testing such as System testing, Regression testing, User interface and usability testing, Compatibility and interoperability testing, Security testing, Functional automation testing, Performance testing and White box testing (code coverage and unit testing).

Strategy: The process of determining ideal enterprise mobility involves three basic components of a business: business process, customer interaction process and employees' work. We create an accurate strategy that compiles all these basic factors and renders mobile enablement for the optimal benefit of the enterprise. This enhances employees’ productivity, empowers the customer base and minimizes company cost while delivering higher revenue.

Solution Architecture: Through our technical expertise, we simplify the large and complex decision making processes, therefore delivering the best guidance in planning the execution of your idea and conception as well as upgrading several progressive technologies. Our solution architecture framework is designed to develop and support the mobile strategy across all facets of an enterprise development. Regardless of the industry or platform, we create mobile application technology map architecture for all enterprises.

| 22 |

Training & Consulting unit offers the following services:

Training: AdeptPros runs "GeniusPort", a training company to train software developers. It has a proven track record in improving institutional knowledge for major corporations in mobile technologies such as iPhone/iPad, Android and Windows. It has trained more than 3,500 IT professionals at our client companies including Intel, SAP, Honeywell, IBM, Fidelity, Citrix, Philips, McAfee, Akamai, AOL, Infosys, HCL, Zensar, Alcatel-Lucent etc.

Mobile Tech Support: AdeptPros has a dedicated support team to educate the organizations’ employees on how to use the applications and products delivered through the Smartphone.

Consulting: In few occasions, AdeptPros supply skilled resources such as trainers, developers, solution architects, business analysts and designers, to augment our client teams. This enables the enterprises to complete their projects cheaper and faster. This model also creates a sales pipeline for Apps development projects and produces skilled resources to work on these projects.

Our Work

AdeptPros has developed and launched mobile applications in several industries including travel and hospitality, education, healthcare, mCommerce, sports, entertainment, gaming and marketing. These applications include:

REAL is an education and developmental milestone marking application important for school readiness and an easily administered monitoring system for parents and teachers alike.

Social Sizzle is a social party application allowing users to communicate real time experiences inside bars and restaurants.

ADH is a healthcare application helping Arizona patients prepare for upcoming procedures and appointments. Data sharing with in the app also allows for healthcare service providers to easily access patient information.

SeeT is a photo sharing social media application that allows its users to take, post, share and describe pictures of their vantage point at a live event (concert, sporting event, live performance etc.) and proceed to buy tickets from the app for future occasions and events via a StubHub link.