Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SI Financial Group, Inc. | d727694d8k.htm |

Annual

Meeting May 14, 2014

Exhibit 99.1 |

Forward Looking

Statements 2

This presentation contains forward-looking statements, which can be identified by the use

of words such as “believes,” “expects,”

“anticipates,”

“estimates”

or similar expressions. These forward-looking statements include, but are not limited

to: statements of our goals, intentions and expectations;

statements regarding our business plans, prospects, growth and operating strategies;

statements regarding the asset quality of our loan and investment portfolios; and

estimates of our risks and future costs and benefits.

These forward-looking statements are subject to significant risks and uncertainties.

Actual results may differ materially from those contemplated by the forward-looking

statements due to, among others, the following factors: general economic conditions,

either nationally or in our market areas, that are different than expected; changes in

the interest rate environment that reduce our margins or reduce the fair value of

financial instruments; increased competitive pressures among financial services

companies; Difficulties in integrating Newport Federal Savings Bank or failing to

achieve the expected cost savings or revenue synergies; changes in consumer spending,

borrowing and savings habits; legislative or regulatory changes that adversely affect

our business; adverse changes in the securities and credit markets; and

changes in accounting policies and practices, as may be adopted by bank regulatory agencies or

the Financial Accounting Standards Board.

Any of the forward-looking statements that we make in this presentation and in other

public statements we make may later prove incorrect because of inaccurate assumptions,

the factors illustrated above or other factors that we cannot foresee. Consequently, no

forward-looking statement can be guaranteed.

Because of these and other uncertainties, our actual future results may be materially

different from the results indicated by these forward-looking statements. We

do not undertake, and specifically disclaim any obligation, to revise any forward-looking statements

contained in this presentation. |

3

(1)

Close price on April 30, 2014

(2)

See Appendix –

Non-GAAP Financial Measures

Market Summary as of April 30, 2014

Issuer:

SI Financial Group, Inc.

Listing / Ticker Symbol:

Nasdaq Global Market / “SIFI”

Market Price Per Share:

(1)

$11.80

Shares Outstanding:

12,828,406

Market Capitalization:

$151.4 million

Tangible Book Value Per Share:

(2)

$10.52

Price to Tangible Book Value:

112.17%

Dividend Yield:

1.04% |

Company

Overview |

5

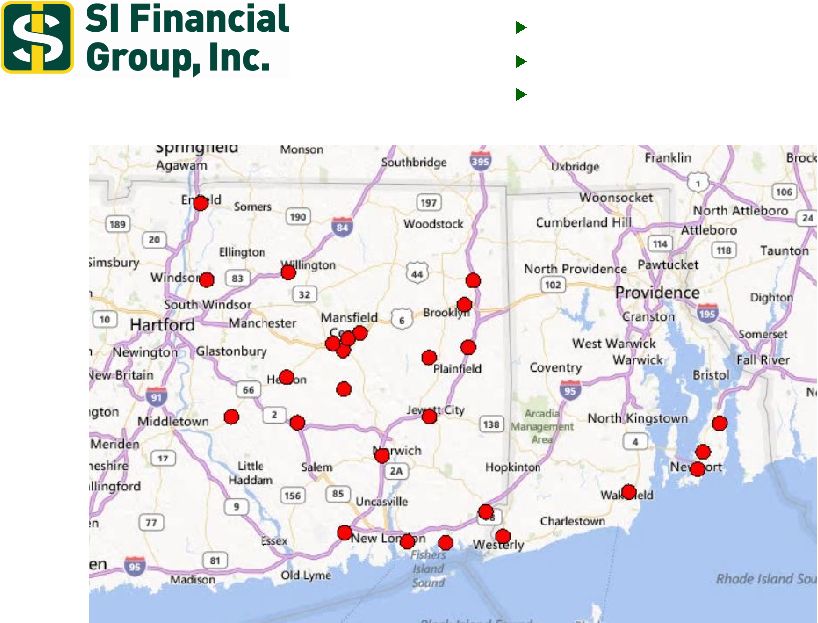

Headquartered in Willimantic, CT

Established in 1842

Total assets in 1995: $252 million |

Business

Strategy 6

Continue community oriented focus by offering a full range of financial products

and services to its customers

Optimize future growth opportunities by executing a proven business model and

by opportunistically seeking branch or whole bank acquisitions in areas in or

adjacent to existing market area

Prudently diversify the asset mix and geographic concentration by selectively

increasing the percentage of commercial business loans, multi-family and

commercial real estate loans locally and in the New England region and by

expanding the existing portfolio of time share and homeowner association loans

Continue conservative underwriting practices and maintain a high

quality loan

portfolio

Increase core deposits by emphasizing exceptional customer service, cross-selling

our full range of financial products and increasing our commercial deposits

Supplement noninterest income through expanded mortgage banking operations

and wealth management operations |

Financial

Highlights |

Franchise

Growth 8

Savings Institute has grown organically and through acquisitions, resulting in an

asset CAGR from 2009 to 2013 of 11.5%

Total Assets

(In Thousands) |

Deposits

- Trend

Total deposits exclude mortgagors’

and investors’

escrow

accounts

From December 2009 to March 2014, total

deposits have grown at CAGR of 8.8% $65,407

$66,845

$85,958

$89,836

$139,428

$136,297

$282,071

$304,306

$343,331

$338,076

$494,765

$505,652

$311,309

$289,563

$272,637

$277,236

$350,556

$362,334

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

$1,000,000

2009

2010

2011

2012

2013

Mar 2014

Demand

NOW/Savings/MMDA

Time

Average

Interest Rate

2.25%

1.55%

1.18%

0.97%

0.75%

0.62%

9 |

Loan Portfolio

- Trend

10

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

$1,000,000

$1,100,000

2009

2010

2011

2012

2013

Mar 2014

Com'l RE

Com'l Bus

Construction

1-4 Family

Consumer

(In Thousands) |

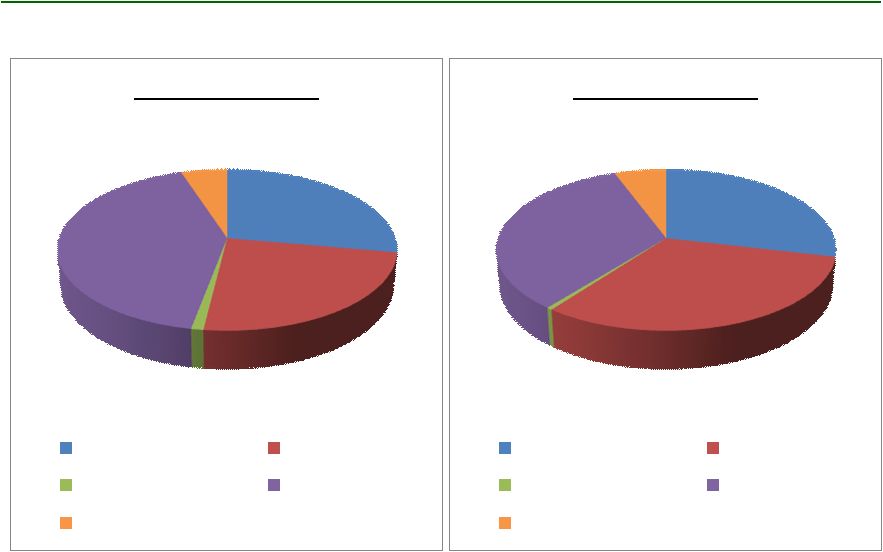

Loan Portfolio

– Comparison

27.80%

24.13%

1.01%

41.99%

5.06%

March 31, 2014

Com'l RE

Com'l Bus

Construction

1-4 Family

Consumer

28.66%

31.62%

0.48%

33.55%

5.69%

March 31, 2013

Com'l RE

Com'l Bus

Construction

1-4 Family

Consumer

11 |

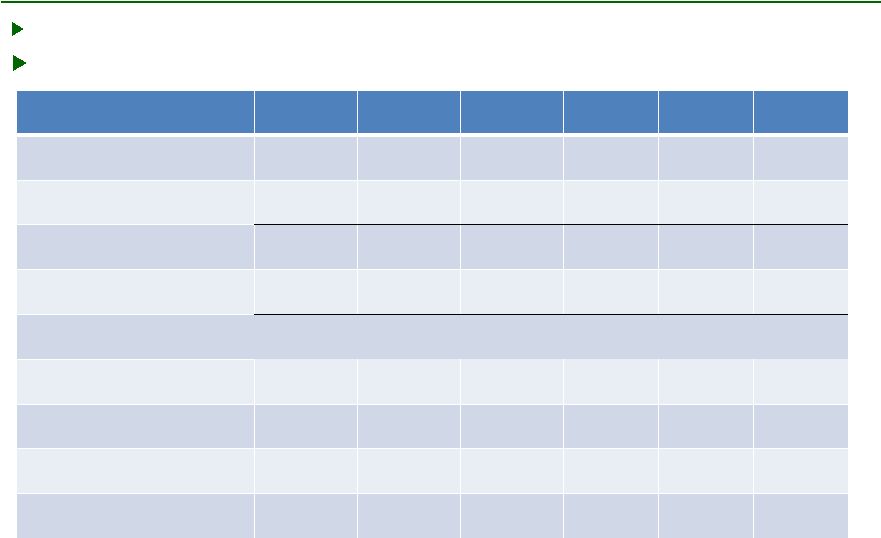

Asset Quality

– Trend

12

Savings

Institute has maintained high asset quality with solid reserve coverage

Aggressive with early recognition of nonperforming loans

2009

2010

2011

2012

2013

Mar 2014

Nonperforming loans

$ 3,007

$ 4,925

$ 10,591

$ 7,654

$ 6,993

$ 5,983

Other real estate owned

3,680

1,285

976

1,293

2,429

2,037

Nonperforming assets

6,687

6,210

11,567

8,947

9,422

8,020

Accruing TDRs

67

5,261

4,620

3,826

2,192

3,178

Total NPAs and TDRs

6,754

11,471

16,187

12,773

11,614

11,198

NPLs/Loans

0.49%

0.81%

1.70%

1.11%

0.66%

0.57%

NPAs and TDRs /Assets

0.77%

1.24%

1.69%

1.34%

0.86%

0.82%

Reserves/Loans

0.80%

0.79%

0.80%

0.93%

0.66%

0.69%

Reserves/NPLs

162.65%

97.44%

46.93%

83.45%

98.90%

121.21% |

Securities

Portfolio – March 31, 2014

13

Savings Institute maintains a diversified securities portfolio totaling $170.0

million at March 31, 2014

Savings Institute performs impairment analyses on its securities

portfolio

quarterly. As of March 31, 2014, all securities were of investment grade.

|

Noninterest

Income - Trend

14

$10,181

$10,685

$11,127

$8,717

$8,305

$7,000

$8,000

$9,000

$10,000

$11,000

$12,000

2009

2010

2011

2012

2013

(In Thousands) |

Electronic

Banking 15

2012

2013

Transaction at SIBT ATMs

870,399

914,204

Debit Signature Transactions

2,473,993

3,274,051

Debit POS/ATM Transactions

2,611,065

2,912,075

On-line Bill Pay Transactions

329,014

367,446

eStatement Accounts

13,906

22,506

EBills

1,180

1,762

Mobile Browser Sessions

243,671

367,446 |

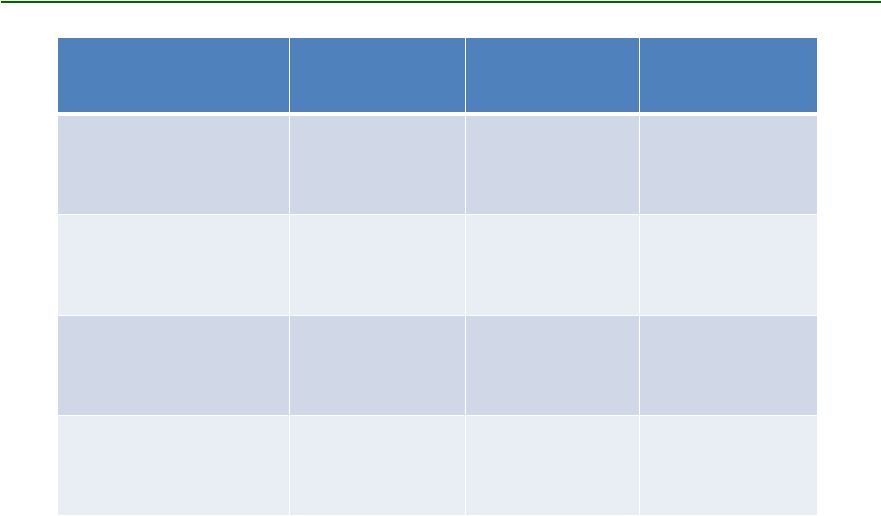

Financial

Strength – March 31, 2014

* Represents regulatory capital ratios for Savings Institute.

16

Ratio *

Minimum

Required

Well

Capitalized

Risk-Based Capital

15.76%

8.00%

10.00%

Tier 1 Risk-Based

Capital

14.80%

4.00%

6.00%

Tier 1 Capital

8.98%

4.00%

5.00%

Tangible

Equity

Ratio

8.98%

1.50%

N/A |

Earnings

17

2013 –

Net Loss of $855,000

$2.6 million of Pre-tax Merger-related Expenses for Newport Acquisition

$1.2 million in Losses on the Sale of Securities

$659,000 in Federal Home Loan Bank Prepayment Penalties for the Early

Extinguishment of Debt

Includes Operations of Newport effective September 6, 2013

4 Quarter of 2013 –

Net Income of $1.0 million

1 Quarter of 2014 –

Net Income of $906,000

th

st |

Appendix

– Non-GAAP Financial Measures |

Non-GAAP

Financial

Measures

–

March

31,

2014

19

Tangible Book Value Per Share:

Book value per share

$12.03

Effect of intangible assets per share

( 1.51)

Tangible book value per share

$10.52

Tangible Common Equity:

Equity

$154,298

Less: Intangible assets

(19,402)

Tangible equity

$134,896

Dollars in thousands, except per share amounts |