Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Essex Rental Corp. | a20140514opcoindustrialsco.htm |

Essex Rental Corp. Oppenheimer Presentation May 14, 2014 1

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. It is an outline of matters for discussion only. Some of the statements in this presentation and other written and oral statements made from time to time by the Company and its representatives are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include statements regarding the intent and belief or current expectations of Essex and its management team and may be identified by the use of words like "anticipate", "believe", "estimate", "expect", "intend", "may", "plan", "will", "should", "seek", the negative of these terms or other comparable terminology. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements. Important factors that could cause actual results to differ materially from Essex’s expectations include, without limitation, the continued ability of Essex to successfully execute its business plan, the possibility of a change in demand for the products and services that Essex provides, intense competition which may require us to lower prices or offer more favorable terms of sale, our reliance on third party suppliers, our indebtedness which could limit our operational and financial flexibility, global economic factors including interest rates, general economic conditions, geopolitical events and regulatory changes, our dependence on our management team and key personnel, as well as other relevant risks detailed in our Annual Report on Form 10-K and subsequent periodic reports filed with the Securities and Exchange Commission and available on our website, www.essexrentalcorp.com. The factors listed here are not exhaustive. Many of these uncertainties and risks are difficult to predict and beyond management’s control. Forward-looking statements are not guarantees of future performance, results or events. Essex assumes no obligation to update or supplement forward-looking information in this presentation whether to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results or financial conditions, or otherwise. This presentation contains unaudited non-GAAP financial measures, including Adjusted EBITDA. Management believes that the presentation of these non-GAAP financial measures serves to enhance understanding of Essex’s individual operating and financial performance. These non-GAAP financial measures should be considered in addition to, but not as substitutes for, the most directly comparable U.S. GAAP measures. A reconciliation of Adjusted EBITDA to net loss for the three month period ended March 31, 2014 can be found in Essex’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May 8, 2014. We believe the non-Company information provided herein is reliable, as of the date hereof, but do not warrant its accuracy or completeness. In preparing these materials, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. Except as required by law, the Company, Essex and their respective directors, officers, employees, agents and consultants make no representation or warranty as to the accuracy or completeness of the non- Company information contained in this document, and take no responsibility under any circumstances for any loss or damage suffered as a result of any omission, inadequacy, or inaccuracy in this document. The Company does not guaranty the performance or return of capital from investments. ©2011 Essex Rental Corp. 2

Company Overview 3

Introduction 4 Nicholas Matthews, President and Chief Executive Officer – President & CEO of Essex Rental since March 2014 – Previously served as Chief Operating Officer for Essex Rental since June 2013 – Served as Vice President and Group Executive for Railcar Operations at GATX, a global leader in railcar leasing, responsible for GATX's North American railcar maintenance operations, engineering group, railcar service centers, field service activities and contract shop operations – Previously with FreightCar America and Trinity Industries Kory Glen, Chief Financial Officer – CFO of Essex Rental since June 2013 – Previously served as Director of Finance for Essex Rental since 2009 – 5 years as Director of Financial Reporting of Equity Residential, a publicly traded real estate investment trust, responsible for Securities and Exchange Commission financial reporting, Sarbanes-Oxley Act of 2002 compliance and other accounting related responsibilities – Previously with Ernst & Young LLP (Certified Public Accountant) Management and Directors represent ownership in excess of 20% of the Company

5 Essex Rental Corp. Acquired Essex Crane Rental Corp. in October 2008 and conducted substantially all operations through this subsidiary until acquisition of Coast Crane Company Acquisition of Coast Crane Company in November 2010 increased the Company’s geographic footprint, product offerings and lines of business, and diversified its earnings stream Leading national rental equipment company with a fleet consisting primarily of heavy lift cranes including crawler cranes, tower cranes, and rough terrain cranes. Fleet portfolio also includes boom trucks, industrial cranes, and elevator lifts, which are used in a variety of construction applications Focused on bare rental of construction and lifting equipment with approximately 700 pieces of equipment and attachments Highly diversified end markets served across a national footprint. Markets served include: • Power Generation • Water Treatment & Purification • Industrial Plants • Petro Chemicals • Bridges/Highway • Commercial/Residential Construction • Refineries • Shipbuilding/Offshore Oil Fabrication • Fabrication

Integrated Business Model — Rental — New and Used Sales — Parts and Service — Multi–faceted offering of diverse lifting needs — Multiple lines of business driving growth — Cyclical “earnings smoothing” Geographic & End Market Diversity — 22 locations in 12 states and Canada — Serve a broad array of end markets, with no exposure to a single industry or geography — Significant focus on infrastructure and energy-related end markets Significant Asset Value — Appraised fleet Orderly Liquidation Value (“OLV”) of approximately $350 million ($5.72 per share, net of debt) as of 3/31/2014 as determined by independent third party appraiser — Rental fleet book value of approximately $282 million as of 3/31/2014 — Replacement value of approximately $600 million Return on Capital Business Model — Focus on long economic lived assets — High residual value relative to original cost — Attractive ROIC business model due to efficient conversion of EBITDA to free cash flow 3 Primary Growth Drivers — Rental equipment — New and used equipment sales — Parts and services support Investment Highlights 6

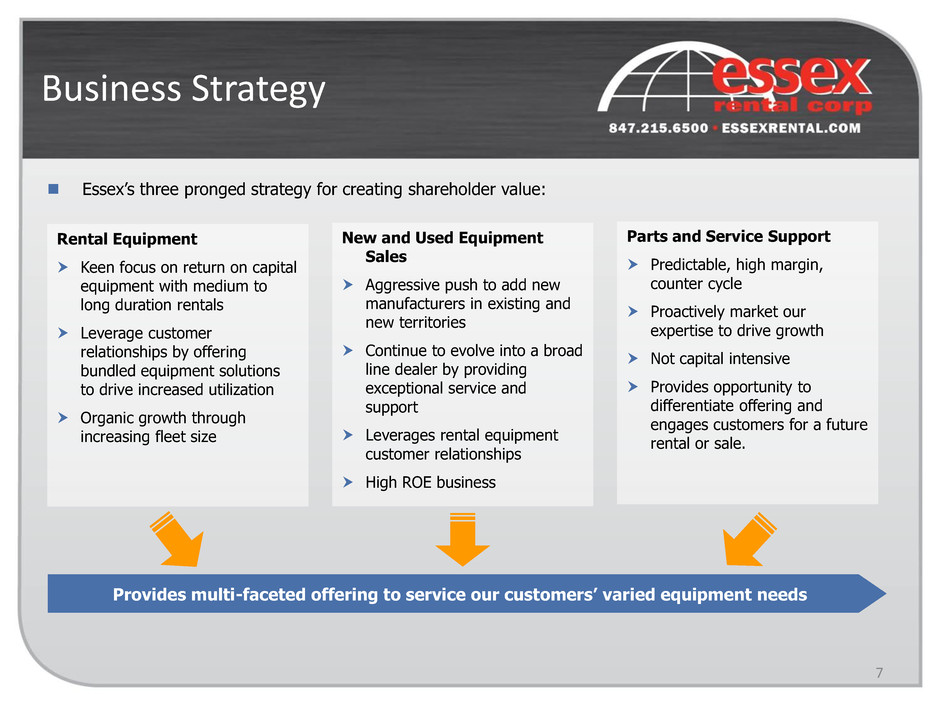

Essex’s three pronged strategy for creating shareholder value: Rental Equipment Keen focus on return on capital equipment with medium to long duration rentals Leverage customer relationships by offering bundled equipment solutions to drive increased utilization Organic growth through increasing fleet size New and Used Equipment Sales Aggressive push to add new manufacturers in existing and new territories Continue to evolve into a broad line dealer by providing exceptional service and support Leverages rental equipment customer relationships High ROE business Parts and Service Support Predictable, high margin, counter cycle Proactively market our expertise to drive growth Not capital intensive Provides opportunity to differentiate offering and engages customers for a future rental or sale. Provides multi-faceted offering to service our customers’ varied equipment needs Business Strategy 7

Continue to leverage the Essex and Coast brands in the territories in which they are strongest, yet achieve the benefits of geographic and product diversity Headquarters Service Center Equipment Storage Yard Satellite Service Center National Footprint 8

Essex End Markets Essex 2008 YTD Rental Revenues by End Market Business is Dependent on Energy & Infrastructure Industrial / Marine (20%) Industrial Facilities Factories Petrochemicals (14%) Chemical Plants Petrochemical Plants General Building (22%) Hospitals Stadiums Power (13%) Power Plants Wind Power Transportation (18%) Road construction Bridge construction Sewer & Water (11%) Sewers Water Treatment Essex 2013 YTD Rental Revenues by End Market 9

New & Used Equipment Sales 10 New and used equipment sales segment provides a countercyclical balance to rental business segment New Equipment Sales Distribution agreements signed with Tadano, Manitex, Potain, Mantis, Broderson and Sany: Distribution agreements in Western United States, British Columbia, the Yukon, Guam and Republic of the Marshall Islands Rental Equipment Sales Continue to rebalance the Essex crawler crane fleet by selling $20M of older underutilized cranes Emphasize a “rent-to-sell” business model by selecting appropriate time and equipment to create a used equipment offering for customers not prepared to buy new

Market Indicators 11

Current Business Initiatives 12 Reshaping our asset portfolio and repositioning the fleet Auctions, trades and outright sales Reduce dependency on traditional crawlers Improving utilization and return on invested capital Strategic partnerships Integrate sales offering on rental packages for Essex Rental Corp Explore additional offerings & services Improving quality Enhance each segment – Rental, Parts & Service and Equipment Distribution Create a culture of continuous improvement Safety Coast Crane: SC&RA Safety Award Essex Crane: SC&RA Safety Award and Safety Improvement Award Developing a more customer centric service oriented culture throughout the company Change in business processes to facilitate better customer relations Focus on services to differentiate our offering in the marketplace Partner vs. Supplier

Summary Financial Information and Valuation 13

14 Essex Rental Fleet Crane Type Crawler Rough Terrain (RTs) Boom Truck Tower Sales Channel Rental & Distribution Rental & Distribution Rental & Distribution Rental & Distribution Max. Lift Cap. (tons) 3,000+ 150 50+ 80 Max. Reach Cap. (ft.) 700+ 250 200 350 Price New ($ ‘000) $800 - $5,000 (1) $250 - $1,500 $100 - $600 $300 - $1,000 Avg. Life (years) 50+ 20+ 15+ 30+ Rental Duration Long-term Short-medium term Short-term Long-term Key End Markets Highways, large bridges, railroads Public infrastructure (stadiums, garages) Power generation Sewer / water treatment Petrochemicals Industrial / marine Highways, large bridges, railroads Public infrastructure (stadiums, garages) Power generation Sewer / water treatment Petrochemicals Industrial / marine Commercial & Residential Petrochemical Oil & Gas Railroads Highways Public Utilities Condominiums Apartment Buildings Other Residential Nuclear power Sewer / water treatment High rise (>10 story) Office Towers Condominiums Apartment Buildings % of total OLV Fleet Value(2) 75% 12% 4% 9% Note (1): Crawler crane prices reflect models in Essex’s heavy-lift niche. Light and super heavy-lift crawler cranes can range from $0.5 million to over $35 million. Note (2): Measured as of March 31, 2014.

Essex Rental Fleet Employs Long Lived Assets Asset Depreciation (1) Benchmark: Annual Depreciation %(2) -1% -2% -3% -3% -3% -5% -6% -7% -7% -10% -11% -11% -11% -11% -12% -14% -14% -22% -25%-20%-15%-10%-5%0% Essex Crane Crawler Crane Mobile Mini storage units (steel) Tower Crane Scotsman rental equip. (N.America) Mobile Mini storage units (wood) Scotsman rental equip. (Europe) Rough Terrain All terrain cranes Boom Truck Backhoe Forklift / Boomlift crane Skidsteer Loader Tractor Loader Van Trailers Scissor Lift Excavator Roller Hospital Equipment Asset Depreciation (1) Benchmark: Residual Value vs. Lifespan Notes: 1. Asset depreciation represents equipment market value depreciation 2. Annual Depreciation % = (1 – Residual Value %) / Lifespan. 3. Source: Oliver Wyman Essex Crane Assessment and the Company Return on Capital vs. Return of Capital Rental Lifespan (years) Van trailers Boom Lift Scissor Lift Roller Backhoe Tractor Loader Forklift Crane Excavator Skidsteer Loader Hospital equipment Mobile Mini storage units (steel) Scotsman rental equipment (North America) Mobile Mini storage units (wood) Scotsman rental equipment (Europe) All terrain cranes Crawler Crane 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 0 5 10 15 20 25 30 35 Rough Terrain Crane Boom Truck Tower Crane 15 Denotes classes of equipment owned by Essex Rental

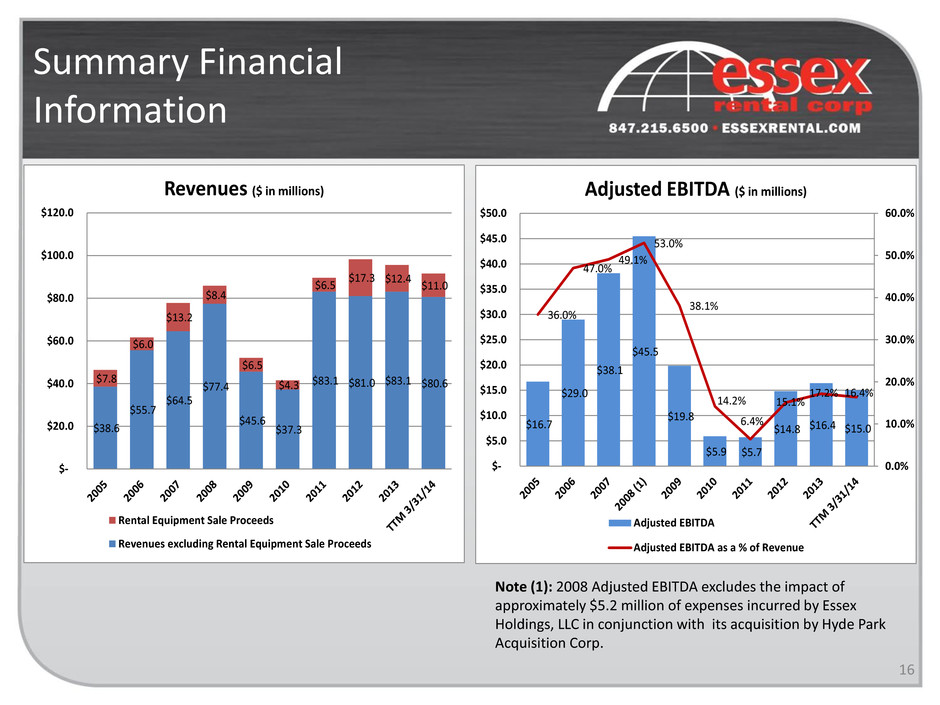

Summary Financial Information 16 Note (1): 2008 Adjusted EBITDA excludes the impact of approximately $5.2 million of expenses incurred by Essex Holdings, LLC in conjunction with its acquisition by Hyde Park Acquisition Corp. $38.6 $55.7 $64.5 $77.4 $45.6 $37.3 $83.1 $81.0 $83.1 $80.6 $7.8 $6.0 $13.2 $8.4 $6.5 $4.3 $6.5 $17.3 $12.4 $11.0 $- $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 Revenues ($ in millions) Rental Equipment Sale Proceeds Revenues excluding Rental Equipment Sale Proceeds $16.7 $29.0 $38.1 $45.5 $19.8 $5.9 $5.7 $14.8 $16.4 $15.0 36.0% 47.0% 49.1% 53.0% 38.1% 14.2% 6.4% 15.1% 17.2% 16.4% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 Adjusted EBITDA ($ in millions) Adjusted EBITDA Adjusted EBITDA as a % of Revenue

Unlevered Free Cash Flow and Capital Investment 17 Note (1): Unlevered free cash flow is defined as Adjusted EBITDA, excluding the impact of approximately $5.2 million of acquisition related expenses incurred in conjunction with Hyde Park Acquisition Corp.’s acquisition of Essex Holdings, LLC in 2008, plus the book value of rental equipment sold, less capital expenditures and cash taxes. Adjusted EBITDA is EBITDA excluding the impact of foreign currency exchange gains or losses and other income. Note (2): Net Investment is defined as the cash paid to purchase rental equipment assets and fixed assets less the proceeds received from the sale of rental equipment and fixed assets. $(10.0) $(5.0) $- $5.0 $10.0 $15.0 $20.0 $(20.0) $(15.0) $(10.0) $(5.0) $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 2005 2006 2007 2008 (1) 2009 2010 2011 2012 2013 Unl eve red Fre e Ca sh Fl ow (1) Unlevered Free Cash Flow ($ in millions) Net Inv estm ent (2) $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 $5.4 $5.5 $13.2 $8.4 $6.5 $- $4.6 $9.5 $8.2 $- $- $4.9 $12.2 $9.7 $18.8 $- $- Gross Investment ($ in millions) Discretionary Growth Capital Expenditures Replacement Capital Expenditures Maintenance Capital Expenditures

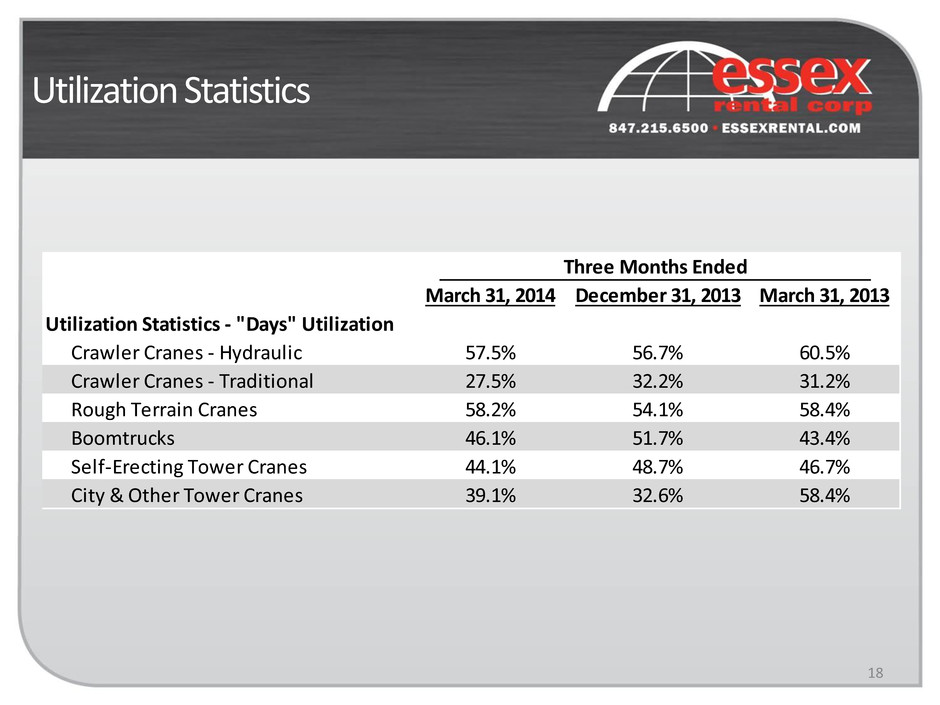

18 Utilization Statistics March 31, 2014 December 31, 2013 March 31, 2013 Utilization Statistics - "Days" Utilization Crawler Cranes - Hydraulic 57.5% 56.7% 60.5% Crawler Cranes - Traditional 27.5% 32.2% 31.2% Rough Terrain Cranes 58.2% 54.1% 58.4% Boomtrucks 46.1% 51.7% 43.4% Self-Erecting Tower Cranes 44.1% 48.7% 46.7% City & Other Tower Cranes 39.1% 32.6% 58.4% Three Months Ended

19 Average Rental Rate March 31, 2014 December 31, 2013 March 31, 2013 Average Rental Rate Per Month Crawler Cranes - Hydraulic 21,311$ 20,950$ 20,325$ Crawler Cranes - Traditional 11,405$ 11,758$ 12,156$ Rough Terrain Cranes 11,938$ 11,823$ 12,022$ Boomtrucks 8,431$ 8,963$ 8,156$ Self-Erecting Tower Cranes 8,185$ 8,183$ 7,536$ City & Other Tower Cranes 8,278$ 7,374$ 7,001$ Three Months Ended

Investment Summary 20 Market leader with significant operating leverage Utilization in certain asset classes is increasing and rental rates are also increasing Return on capital business model with high conversion rate of EBITDA to free cash flow Poised to participate in growing infrastructure & energy related markets as construction activity increases Numerous organic and strategic growth opportunities