Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMEDISYS INC | d726655d8k.htm |

Amedisys

Investor Presentation May 2014

Exhibit 99.1 |

2

Forward-looking Statements

This

presentation

may

include

forward-looking

statements

as

defined

by

the

Private

Securities

Litigation

Reform

Act

of

1995.

These

forward-looking

statements

are

based

upon

current

expectations

and

assumptions

about

our

business

that

are

subject

to

a

variety

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

described

in

this

presentation.

You

should

not

rely

on

forward-looking

statements

as

a

prediction

of

future

events.

Additional

information

regarding

factors

that

could

cause

actual

results

to

differ

materially

from

those

discussed

in

any

forward-looking

statements

are

described

in

reports

and

registration

statements

we

file

with

the

SEC,

including

our

Annual

Report

on

Form

10-K

and

subsequent

Quarterly

Reports

on

Form

10-Q

and

Current

Reports

on

Form

8-K,

copies

of

which

are

available

on

the

Amedisys

internet

website

http://www.amedisys.com

or

by

contacting

the

Amedisys

Investor

Relations

department

at

(225)

292-2031.

We disclaim any obligation to update any forward-looking statements or any changes in

events, conditions or circumstances upon which any forward-looking statement may be

based except as required by law.

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we have

posted additional important

information such as press releases,

profiles concerning our business and

clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-critical

information regarding the Company in

advance of or in lieu of distributing a

press release or a filing with the SEC

disclosing the same information. |

3

Amedisys Snapshot

Overview

•

Founded in 1982,

publicly listed 1994

•

396 care centers in 34

states

•

Over 13,500 employees

•

Over 60,000 patients

cared for on a daily basis

•

2013 revenue of

approximately $1.25

billion

Amedisys Home Health Care Centers (316 locations)

Amedisys Hospice Care Centers (80 locations) |

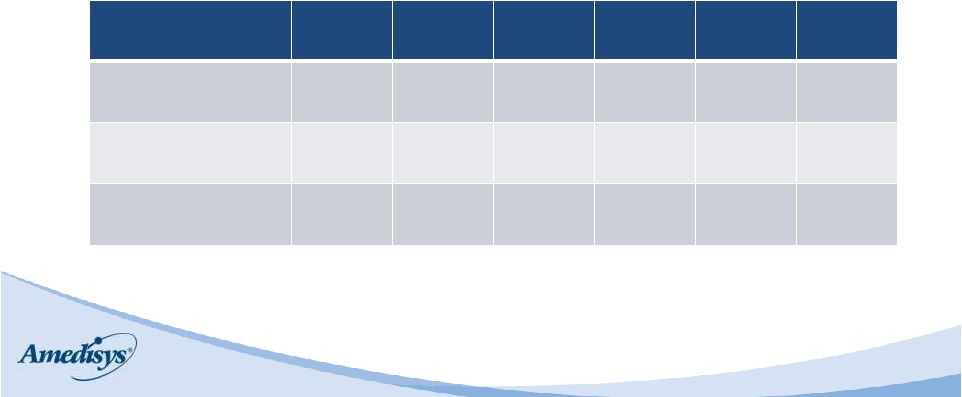

4

Business Overview

Business

$ (in millions) /

% of Revenue

Revenue per

Visit / Revenue

per Day

Gross Margin %

Reimbursement

Type

Home Health

Medicare

$189 / 63%

$157

42.4%

60-day episode of care

Non-Medicare Episodic

$20 / 7%

$154

41.5%

60-day episode of care

Non-Medicare Per Visit

$28 / 9%

$108

16.5%

Per visit

Total Home Health

$237 / 79%

Hospice

$62 / 21%

$146

46.7%

99% routine care; daily rate

Total

$299 / 100%

Based

on

1Q14

financials.

Gross

margin

computed

by

subtracting

cost

per

visit

from

revenue

per

visit

in

home

health

and

cost

per

day

from

hospice

revenue

per

day |

5

Favorable Long Term Trends

•

Compelling demographics

•

Patient preference

•

Increased payer and hospital focus

•

Low cost of care delivery

Inpatient

Hospital

LTAC

IRF

SNF

Hospice

Home

Health

Average cost of stay

$12,000

$39,493

$17,995

$10,392

$11,852

$5,294

Average length of stay

5 days

26 days

13 days

27 days

88 days

120 days

Average per diem cost

$2,448

$1,507

$1,395

$399

$135

$44

Source:

MedPAC

March

2014

report

and

Amedisys

estimates;

hospital

information

is

for

inpatient

facilities

only

and

is

estimated

based

on

patient

discharges |

6

($ in millions, except per share data)

2012

(1)

2013

(1)

Net Revenue

$1,441

$ 1,249

Gross Margin %

43.7%

42.5%

Adjusted EBITDA

$106

$ 54

Adjusted EBITDA Margin

7.3%

4.4%

Adjusted EPS

$1.15

$0.27

1.

The

financial

results

for

2012

and

2013

are

adjusted

for

certain

items

incurred

in

both

years

and

should

be

considered

non-GAAP

financial

measures.

A

reconciliation

of

these

non-GAAP

financial

measures

is

included

as

Exhibit

99.2

to

our

Form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

March

12,

2014.

Summary Financials |

7

Summary Financials –

Quarterly

($ in millions, except per share data)

1Q13

(1)

4Q13

(2)

1Q14

(1)

Net Revenue

$329

$304

$299

Adj. Gross Margin %

43.5%

40.9%

41.0%

Adjusted EBITDA

$18

$8

$6

Adjusted EBITDA Margin

5.6%

2.5%

1.8%

Adjusted EPS

$0.15

($0.05)

($0.07)

1.

The

financial

results

for

the

three-month

period

ended

March

31,

2013

and

March

31,

2014

are

adjusted

for

certain

items

and

should

be

considered

a

non-

GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial

measure

is

included

as

Exhibit

99.2

to

our

Form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

May

8,

2014

2.

The

financial

results

for

the

three-month

period

ended

December

31,

2013

are

adjusted

for

certain

items

and

should

be

considered

a

non-GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial

measure

is

included

as

Exhibit

99.2

to

our

Form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

March

12,

2014 |

8

($ in millions)

1Q13

(1)

4Q13

(2)

1Q14

(1)

Net Revenue

$262

$238

$237

Adj. Gross Margin %

42.6%

39.4%

39.5%

Key Operating Statistics

Medicare admissions

50,007

45,405

46,527

Revenue per episode

$2,778

$2,840

$2,778

Medicare recert rate

37.8%

37.1%

38.2%

Cost per visit

$83.89

$90.21

$90.28

Home Health Segment

1.

The

financial

results

for

the

three-month

period

ended

March

31,

2013

and

March

31,

2014

are

adjusted

for

certain

items

and

should

be

considered

a

non-

GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial

measure

is

included

as

Exhibit

99.2

to

our

Form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

May

8,

2014

2.

The

financial

results

for

the

three-month

period

ended

December

31,

2013

are

adjusted

for

certain

items

and

should

be

considered

a

non-GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial

measure

is

included

as

Exhibit

99.2

to

our

Form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

March

12,

2014 |

9

($ in millions)

1Q13

(1)

4Q13

(2)

1Q14

(1)

Net Revenue

$67

$65

$62

Adj. Gross Margin %

47.1%

46.5%

46.8%

Key Operating Statistics

Average daily census

5,071

4,866

4,721

Admissions

4,957

4,371

4,595

Revenue per day

$145.98

$145.60

$145.95

Cost per day

$77.04

$77.63

$77.47

Hospice Segment

1.

The

financial

results

for

the

three-month

period

ended

March

31,

2013

and

March

31,

2014

are

adjusted

for

certain

items

and

should

be

considered

a

non-

GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial

measure

is

included

as

Exhibit

99.2

to

our

Form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

May

8,

2014

2.

The

financial

results

for

the

three-month

period

ended

December

31,

2013

are

adjusted

for

certain

items

and

should

be

considered

a

non-GAAP

financial

measure.

A

reconciliation

of

this

non-GAAP

financial

measure

is

included

as

Exhibit

99.2

to

our

Form

8-K

filed

with

the

Securities

and

Exchange

Commission

on

March

12,

2014 |

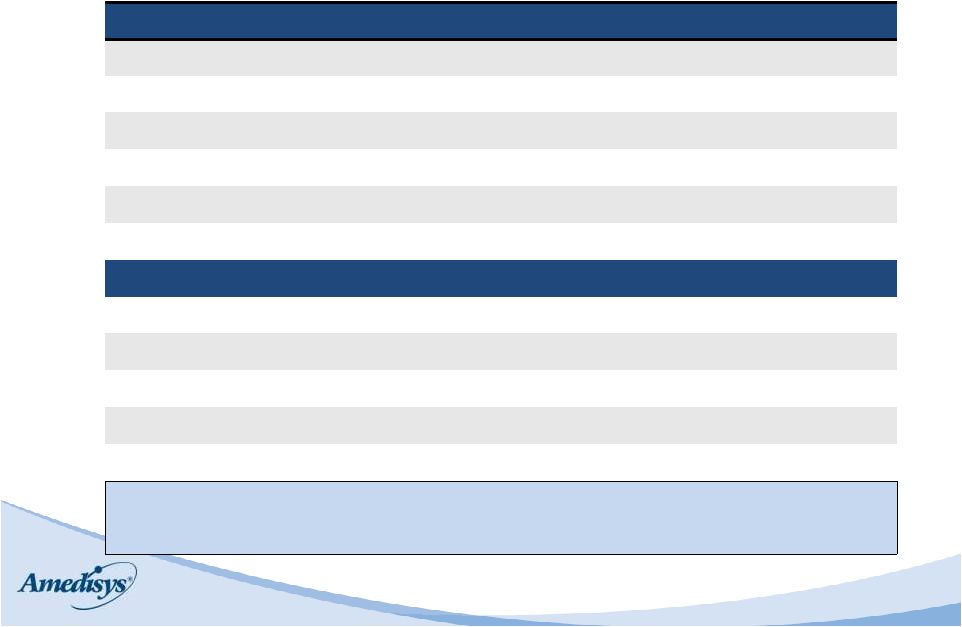

10

Summary Balance Sheet

Assets ($ in MM)

12/31/12

12/31/13

3/31/14

Cash

$15

$17

$3

Accounts Receivable, net

169

111

115

Property and Equipment

157

159

157

Goodwill

210

209

209

Other

180

230

243

Total Assets

731

726

727

Liabilities and Equity

Other Liabilities

$176

$157

$171

Debt

103

47

43

DOJ Settlement Reserve

--

150

150

Equity

452

372

363

Total Liabilities and Equity

731

726

727

Leverage Ratio

1.1x

2.9x

3.2x

Days Sales Outstanding

42

32

34 |

11

1Q14 Restructuring –

Impact on Results

Portfolio Rationalization

•

54 care centers closed or consolidated

•

This group, in addition to previous closures, reduced EBITDA by $4 million in 1Q14

•

10 care centers sold in April

•

16 lower volume care centers retained

•

396 core care centers generate ~$3M in average annual revenue

G&A Expense Reduction

•

Reduced G&A levels appropriate for reduced size and geographic footprint

•

G&A review is ongoing

•

Full run rate of reductions ($2.5 million/quarter) beginning in 3Q14

•

Full run rate of EBITDA improvement in 3Q14 |

12

Amedisys Turnaround –

Focus Areas

Continuing to deliver clinical excellence

•

Trend of clinical outcomes improving

Driving consistent organic growth

•

Seeing positive volume trends from core group of care centers

Getting “back to basics”

on core operations

•

Focus on managing direct costs

Capital allocation strategy

•

Clear ROI for shareholders |

13

Contact Information

Dale Redman

Interim Chief Financial Officer

dale.redman@amedisys.com

David Castille

Director, Treasury/Finance

david.castille@amedisys.com

Amedisys, Inc.

5959 S. Sherwood Forest Blvd.

Baton Rouge, LA 70816

Office: 225.292.2031 |