Attached files

| file | filename |

|---|---|

| 8-K - SBT BANCORP, INC. 8-K - SBT Bancorp, Inc. | a50863779.htm |

Exhibit 99.1

April 11, 2014

Dear Fellow Shareholders,

Simsbury Bank is a growth company. We have been and continue to be focused on long-term strategies to enhance shareholder value. At times, however, these strategies may result in short-term disappointments. Our 2013 earnings were lower than last year’s due principally to a decline in residential mortgage gain on sale revenue during the second half of the year as higher market interest rates reduced mortgage refinance demand. While we cannot control interest rates, we are pleased that the Bank’s overall performance reflects strong management of what we can control.

We remain committed to the residential mortgage business as a key element of our growth strategy. The competitive market changes over the past several years have created new opportunities for us to differentiate ourselves from other banks based in Hartford County. We developed our growth strategy to take advantage of our strengths and these market changes.

The goal of our strategy remains to produce strong earnings for the benefit of shareholders. The key elements of our strategy are as follows:

|

·

|

Broaden and deepen consumer and commercial customer relationships in our branch market area. Success here will further bolster the revenues we earn from deposit related, lending and investment services activities.

|

|

·

|

Increase the proportion of commercial loans in our loan portfolio. Success here will improve our net interest margin as higher yielding commercial loans replace lower yielding investments and residential mortgages.

|

|

·

|

Extend the geographic reach of our commercial banking and residential mortgage lending businesses beyond our branch market area. Thanks to technology, these businesses are not branch dependent.

|

We believe that the full implementation of these strategies will result in consistent earnings growth and shareholder value creation.

Market Changes

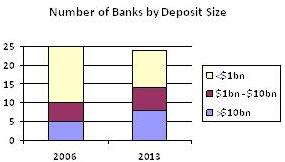

According to the FDIC’s annual deposit market survey, there were 24 full-service banks serving Hartford County in June 2013, only one fewer than June 2006, the year before the latest round of consolidation began. However, the composition of the competitors has changed dramatically. In 2006, only five banks with total deposits over $10 billion served Hartford County and their deposit market share was 73%. By 2013, there were eight banks with over $10 billion in total deposits serving Hartford County and their market share was 86%. Meanwhile, in 2006, fifteen banks with less than $1 billion in deposits served Hartford County and enjoyed a 13% market share. By 2013, that number of banks had fallen to ten and their market share had declined to 4%. The decline in the number of banks under $1 billion in deposits was the result of the growth of some banks and sale of others.

1

|

|

We believe that the contraction of the Hartford County market served by banks with less than $1 billion in deposits represents an outstanding growth opportunity. Banks under $1 billion in deposits have advantages that smaller size brings. The customer experience is demonstrably different than that of larger banks. Smaller banks have flatter organization structures resulting in more authority in the hands of people dealing directly with customers and quicker turnaround in dealing with exception situations. They tend to have a deeper understanding of their local markets and greater local involvement. With $324 million in deposits at June 30, 2013, Simsbury Bank sees a great opportunity to grow in Hartford County and beyond by offering a customer experience those larger banks cannot.

Commercial Banking

We are very pleased with the performance of our Commercial Banking unit in 2013. With loan balances growing $23.1 million to $83.5 million, a 38% increase, our Commercial team is executing on our strategic goal of building our commercial relationships and commercial loan portfolio. All categories of commercial loans showed healthy increases in 2013. Commercial mortgage loans outstanding increased $13.2 million (31%) to $55.2 million; commercial and industrial loans increased $4.4 million (32%) to $18.4 million; and municipal loans increased $0.7 million (45%) to $2.1 million. With the emerging recovery of demand for newly constructed residential properties, we returned to financing successful homebuilders in our market area which resulted in a $4.8 million (161%) increase in construction and land development loans to $7.8 million. We added 40 new customers during 2013 and now serve commercial banking customers in 41 different Connecticut towns.

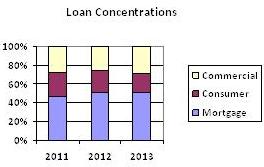

At year end, commercial loans comprised 29% of our loan portfolio.

|

|

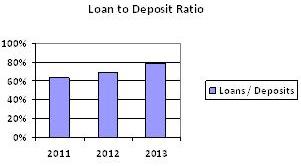

The growth in our commercial loan portfolio is contributing to improvement in our loan to deposit ratio and net interest margin as we deploy more of our low-cost deposits to fund higher margin assets. Asset quality remains strong. During 2014, we prioritize floating rate loan opportunities which will improve our ability to navigate a rising interest rate environment. Additionally, we will be adding to our commercial banking capacity to strengthen our cash management and commercial real estate capabilities.

Mortgage and Consumer Lending

Our mortgage business demonstrated strength throughout the year with number one market share in our four town branch and nine town CRA markets. In Hartford County, we finished the year as the third highest ranked Hartford County based bank and 12th overall. In 2013, we closed mortgages in 78 different Connecticut towns and 8 towns out of state. The Bank’s third party mortgage servicing portfolio grew by approximately $59 million (67%) to approximately $148 million. Mortgage servicing fee revenue contributes approximately $360,000 on an annualized basis.

2

The big news in the mortgage business in 2013, however, was the rapid and dramatic contraction of demand for refinance mortgages in the second half of the year. Beginning immediately subsequent to Fed Chairman Bernanke’s May 22nd comments that led the bond market to anticipate an earlier than anticipated wind down of the Fed’s bond purchase program, the benchmark 10 year Treasury rose dramatically. By early September, the 10 year Treasury bond rate had risen from approximately 2% to 3%. This resulted in an approximately 1% rise in 30-year mortgage rates. With the rise in rates, demand for refinance mortgages dropped dramatically.

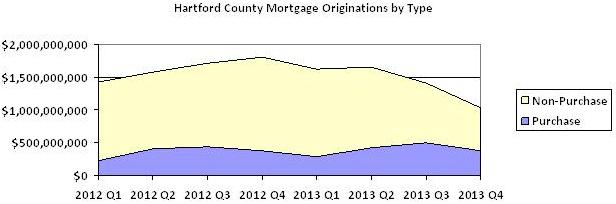

The following chart shows the dollar volume of closed mortgages in Hartford County in 2012 and 2013 by type.

As this chart illustrates, the Purchase Mortgage market has fluctuated seasonally, but was relatively unaffected by the rise in interest rates in the second half of 2013. However, in the fourth quarter of 2013, the Non-Purchase closings, predominantly mortgage refinancings and home equity loans, were 54% lower than their level during the year earlier quarter. Total originations in the fourth quarter were 43% lower than the fourth quarter of 2012.

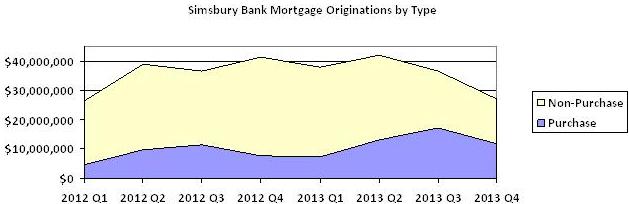

The following chart illustrates Simsbury Bank’s originations in 2012 and 2013 by type.

Similar to the decline in Hartford County, Simsbury Bank’s Non-Purchase Mortgage originations in the fourth quarter of 2013 were 54% lower than in the fourth quarter of 2012. However, thanks to improved purchase mortgage market penetration, Simsbury Bank’s total mortgage originations in the fourth quarter of 2013 were only 35% lower than in the fourth quarter of 2012.

We made a conscious business decision subsequent to the interest rate jump to maintain the highly efficient and successful residential mortgage lending infrastructure that we put in place over the past several years. As we continue to build our origination capacity, however, we have instituted cost-cutting measures to improve short-term earnings by better aligning our infrastructure with the current mortgage market opportunity and our origination capacity.

3

Retail Banking

According to the FDIC’s annual deposit market survey, since 2006 Hartford County’s total deposit market served by full-service banks has grown by 47%. Simsbury Bank’s deposits have grown by 66%, significantly faster than the market and entirely through organic growth. From 2012 to 2013, the County deposit market served by full-service banks grew by 3.0% while Simsbury Bank’s deposits grew by 5.5%. Simsbury Bank continues to have the largest deposit market share of a Connecticut-based bank in our four town branch market area. We continue to enjoy a favorable deposit mix with noninterest bearing deposits comprising 32% of our deposits at 2013 year-end which contributes to our having the second lowest cost of deposits among Connecticut banks.

During 2014, we plan to implement a significant enhancement to our electronic delivery with the introduction of mobile banking, mobile check deposit, and online deposit account opening. We intend to leverage these capabilities to not only deepen our market position in our branch market, but also extend our Retail Banking reach geographically. With mortgage customers in 105 Connecticut towns and health savings account customers in 149 towns, we will have new ways to serve customers not requiring branch services.

Investment Services

Our investment services business continued to perform well during 2013. Commission revenue increased 26% to over $230,000. Assets under management increased $12.2 million (19%) during the year to $76.3 million. We continue to seek ways to grow our investment services capabilities.

Recognition

During 2013, we had two changes to our Board of Directors. Rodney Reynolds retired as a member of the Bank and holding company’s boards of directors. Rod brought extraordinary business and investment experience to our board. We will miss his wise counsel and humor. Ann Taylor joined the board late in the year. Ann brings a wealth of banking, healthcare industry, and management experience to the board. We are delighted to have Ann’s breadth of knowledge and her perspectives on the rapidly changing healthcare industry on our board.

With sadness, we observe the recent passing of Evan Woollacott, one of our original directors. Evan was invaluable in all that was required to open the Bank and he served with distinction as a director until he retired in 2005.

Finally, we recognize and thank Anthony Bisceglio for his contributions to the Bank since 1995. As the company’s Chief Financial Officer, Tony ensured that we had the financial capacity to grow and the control environment to operate in a safe and sound manner. We will miss Tony’s steady hand and thoughtful insights.

In conclusion, our strategic plan remains sound. We will continue to broaden and deepen our relationships across all business lines in our franchise market area. We will continue to extend our non-branch-dependent businesses – commercial banking and residential mortgage banking – well beyond our market area. We have the talented and experienced team at all levels of the Bank to successfully achieve our goals.

We thank you for your support and look forward to a strong year for Simsbury Bank, its shareholders, customers, employees and the communities it serves.

| Sincerely, | ||

| /s/ Martin J. Geitz | /s/ Robert J. Bogino | |

| Martin J. Geitz | Robert J. Bogino | |

| President & Chief Executive Officer | Chairman of the Board of Directors |

4

Recognition of

Rodney R. Reynolds

Member, Board of Directors

2007 to 2013

Rodney R. Reynolds retired from the Boards of SBT Bancorp, Inc. and Simsbury Bank in September 2013 after over six years of devoted service. The Board of Directors wishes to express its heartfelt gratitude to Mr. Reynolds for his many contributions that benefited our shareholders, customers, employees and community.

Rod agreed to join the Boards because he believed strongly in the mission of the Bank and in the difference that a locally controlled bank can make in the wellbeing of the communities it serves. Rod’s earlier role as a founder and board member of the Trust Company of Connecticut had provided him with first-hand experience on how local financial institutions can leverage their advantages and compete successfully with much larger banks.

Rod’s perspectives as a successful entrepreneur and innovative creator of a not-for-profit therapeutic riding program provided invaluable insights to the Boards as the Bank navigated a very challenging economic environment. Rod generously introduced the Bank to many businesses and consumers who became Simsbury Bank customers. We will miss Rod’s humor, stories, and his collegiality and thank him for his commitment to the Bank.

5

Recognition of

Anthony F. Bisceglio

Chief Financial Officer and Treasurer

1995 to 2014

Anthony F. Bisceglio, Executive Vice President and Chief Financial Officer, retired from SBT Bancorp, Inc. and Simsbury Bank in March 2014. The Board of Directors wishes to express its warm gratitude to Mr. Bisceglio for his 19 years of faithful service to our shareholders, customers, employees and community.

Tony joined the Bank just a few months after the Bank opened for business in 1995. He brought with him the experience and strength of a career in banking and shepherded us from our first annual report through our growth to the leading bank in the Farmington Valley.

We have benefited greatly from his depth and breadth of experience. Being a Chief Financial Officer at Simsbury Bank during our early days required a variety of abilities ranging from the steady management of the Bank’s finances and financial reporting, to overseeing the operations, technology and facilities areas for several years.

Tony’s quiet manner belies the number and variety of responsibilities that he was charged with leading, managing and executing. For the employees who worked with him and for him, Tony’s absolute devotion to the success of our mission, as well as to the strong long-term growth of the Bank, is without question. We thank Tony for the legacy of financial stability that he helped guide and wish him the very best for a long and happy retirement.

6